- Home

- »

- Agrochemicals & Fertilizers

- »

-

Fertilizers Market Size, Share, Growth, Industry Report, 2033GVR Report cover

![Fertilizers Market Size, Share & Trends Report]()

Fertilizers Market (2026 - 2033) Size, Share & Trends Analysis Report By Type (Nitrogenous, Phosphate, Potash, Secondary, Micronutrients), By Application (Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-850-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Fertilizers Market Summary

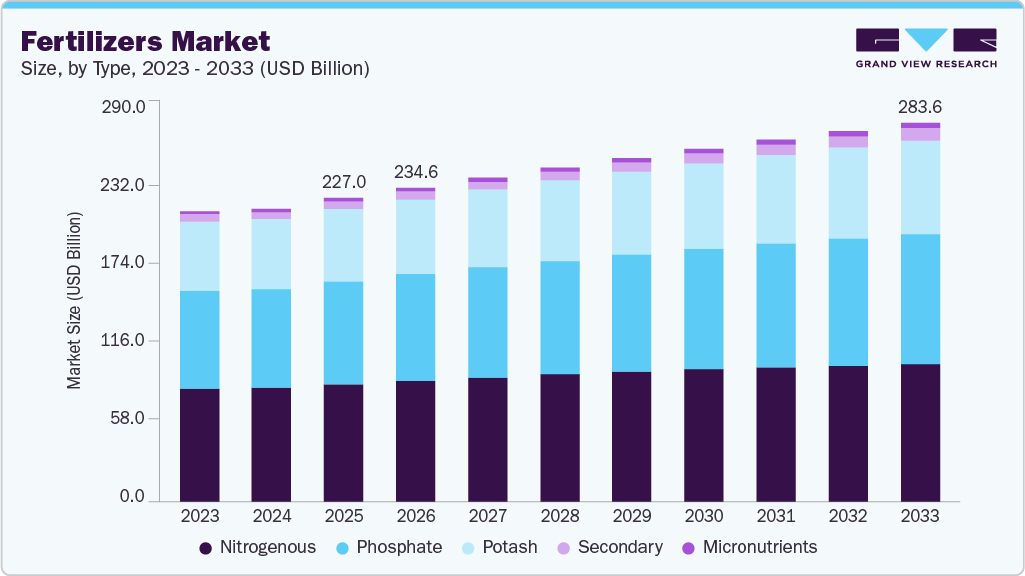

The global fertilizers market size was estimated at USD 227.0 billion in 2025 and is projected to reach USD 283.6 billion by 2033, growing at a CAGR of 2.7% from 2026 to 2033. Global population growth and rising protein consumption are intensifying the need for higher agricultural output.

Key Market Trends & Insights

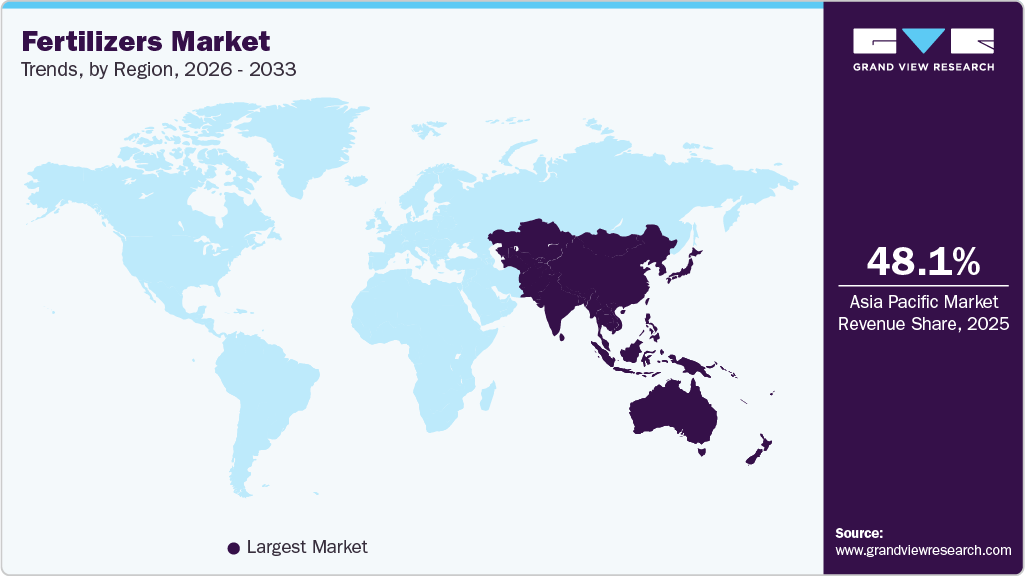

- Asia Pacific dominated the fertilizers market with the largest revenue share of 48.1% in 2025.

- China remains the top global fertilizer consumer, driven by intensive cereal farming and high food demand from its vast population.

- Based on type, the micronutrients segment is expected to grow at the fastest CAGR of 6.6% from 2026 to 2033.

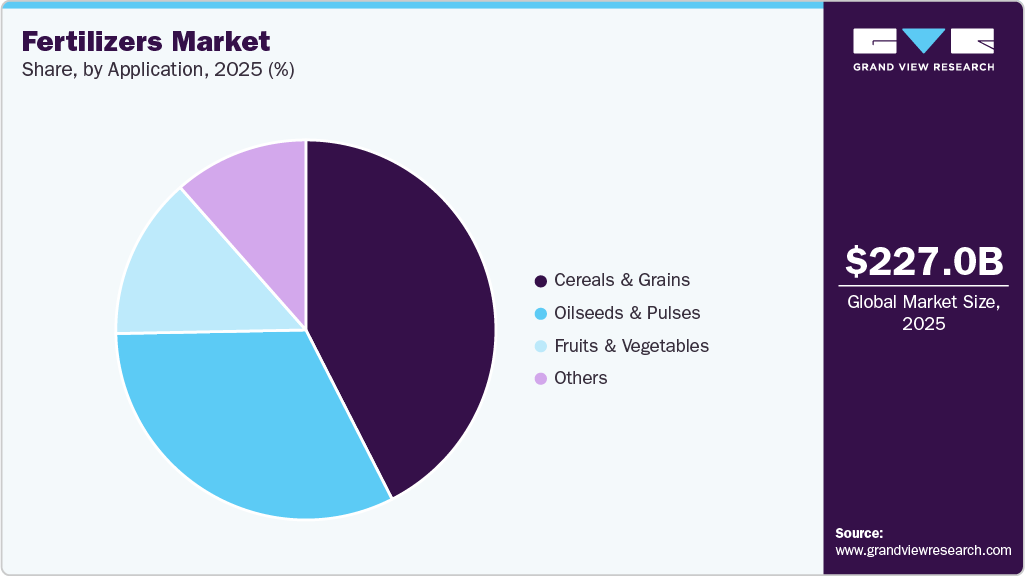

- Based on application, cereals & grains held the largest revenue share of 42.5% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 227.0 Billion

- 2033 Projected Market Size: USD 283.6 Billion

- CAGR (2026-2033): 2.7%

- Asia Pacific: Largest Market in 2025

Fertilizers play a key role in maximizing crop yields from limited arable land. This structural demand ensures consistent growth for the global fertilizers industry. Large-scale commercial farming is expanding rapidly, especially in Asia, Latin America, and Africa. Farmers are increasing fertilizer use to secure predictable yields, improve crop quality, and shorten production cycles. Government support and better access to farm credit further boost fertilizer consumption.

Environmental concerns and efficiency requirements are driving demand for controlled-release, water-soluble, and bio-based fertilizers. These products reduce nutrient losses, enhance crop uptake, and comply with stricter regulations. As sustainability becomes a key focus, premium fertilizers offer significant growth potential.

Market Concentration & Characteristics

The global fertilizers industry is moderately concentrated, dominated by a few multinational players with integrated operations across production, distribution, and retail. Companies such as Nutrien, Yara leverage scale, technology, and strong distribution networks to maintain a competitive advantage and influence pricing dynamics.

Market characteristics include high capital intensity, dependence on raw materials like natural gas and phosphate rock, and sensitivity to global agricultural cycles. Innovation in specialty and sustainable fertilizers, along with regulatory compliance, increasingly differentiates market players and drives strategic partnerships across regions.

Type Insights

Nitrogenous fertilizers dominated the global market with the highest revenue share of more than 38% in 2025. Rising global food demand and the need for high-yield crops continue to drive strong consumption of nitrogen-based fertilizers. Their cost-effectiveness and critical role in enhancing staple crop productivity keep this segment as the largest contributor to the global market.

Micronutrients are the fastest-growing segment with a projected CAGR of 6.6% from 2026 to 2033. Increasing focus on soil health, crop quality, and precision farming is accelerating demand for micronutrient fertilizers. These high-value products address specific nutrient deficiencies, supporting premium yields and sustainable farming practices, fueling rapid market growth.

Application Insights

Cereals and grains dominated the market with the highest revenue share of 42.5% in 2025. High global consumption of cereals and grains drives consistent fertilizer demand, particularly nitrogen and phosphorus-based products. Their critical role in staple crop productivity ensures this segment remains the largest contributor to the global fertilizers market.

Oilseeds & pulses are growing significantly with a projected CAGR of 2.7% 2026 to 2033. Rising demand for plant-based oils and protein-rich pulses is boosting fertilizer consumption in this segment. Targeted nutrient application and increased cultivation in emerging markets are fueling rapid growth and higher adoption of specialty fertilizers.

Regional Insights

Asia Pacific fertilizers market dominated with the highest revenue share of 48.1% in 2025, driven by rising population, expanding commercial agriculture, and high crop intensity in major markets like India and China. Growing adoption of precision farming and modern nutrient management practices is enhancing yield efficiency and fertilizer uptake.

China Fertilizers Market Trends

China continues to lead global fertilizer consumption due to its intensive cereal cultivation and population-driven food demand. Government initiatives focused on food security and promotion of high-efficiency fertilizers are enhancing productivity and market stability. Adoption of modern farming techniques and specialty fertilizers is increasingly driving yield optimization and supporting sustainable agriculture practices.

North America Fertilizers Market Trends

The fertilizers market in North America is primarily supported by large-scale commercial farms and highly mechanized agricultural operations. The United States, as the largest contributor in the region, relies heavily on fertilizers to maintain high crop productivity and support high-value crops such as corn and soybeans. Rising focus on sustainability, environmental compliance, and specialty fertilizers is also shaping market trends, encouraging investment in innovative nutrient solutions.

The fertilizers market in the U.S. is primarily driven by large-scale commercial agriculture and the need to maintain high productivity for crops such as corn, soybeans, and wheat. The adoption of precision agriculture, nutrient management technologies, and sustainable farming practices supports the demand for specialty and high-efficiency fertilizers. Government incentives and ongoing R&D are strengthening the market’s innovation pipeline and competitive positioning.

Europe Fertilizers Market Trends

The fertilizers market in Europe is shaped by stringent environmental regulations and sustainability initiatives that govern nutrient usage. Countries such as Germany rely on mechanized, high-yield farming, while the adoption of bio-based and micronutrient fertilizers allows farmers to meet productivity targets while complying with regulatory requirements. Innovation in precision farming and specialty fertilizers further differentiates market players and supports steady growth across the region.

Germany fertilizers market is heavily influenced by strict environmental regulations and strong sustainability mandates. High-value crop cultivation combined with advanced mechanization necessitates precise nutrient management. The adoption of bio-based fertilizers and precision nutrient solutions is helping farmers achieve regulatory compliance while optimizing yields, positioning Germany as a leader in sustainable fertilizer practices.

Central & South America Fertilizers Market Trends

The fertilizers market in Central & South America is witnessing robust growth, driven by the expansion of arable land and large-scale commercial agriculture in countries such as Brazil and Argentina. Increased cultivation of soybean, maize, and sugarcane, combined with government support programs and modernization of farming techniques, is driving higher fertilizer adoption. The market is also benefiting from investments in nutrient-efficient practices and sustainable farming solutions to enhance yield per hectare.

Middle East & Africa Fertilizers Market Trends

The fertilizers market in the Middle East & Africa is fueled by rising food security priorities, low soil fertility, and the need to increase agricultural productivity. Countries in the region are investing in modern agricultural practices and nutrient-efficient solutions to maximize crop yields. Growing awareness of sustainable farming and precision nutrient application is also contributing to the expansion of the market.

Key Fertilizers Companies Insights

The fertilizers market is highly competitive, with the big international brands focusing on the development of long-term relationships with the end users. Increasing demand for the product has led to increased competition in the market. To sustain in the competitive environment, manufacturers are engaged in adopting several strategic initiatives, including product capacity expansion, acquisition, and broadening geographical reach.

-

Nutrien Ltd. is a leading global player in crop nutrition, offering nitrogen, phosphate, and potash-based fertilizers. The company integrates production, distribution, and agronomic services to support high-yield commercial farming. Its emphasis on precision agriculture and sustainable solutions strengthens productivity and efficiency in the global market.

-

Yara International specializes in crop nutrition and sustainable fertilizer solutions, including nitrogen-based and specialty products. The company leverages digital farming tools and advanced nutrient management to improve crop yields and environmental compliance. Yara’s focus on innovation and precision agriculture reinforces its leadership in the global market.

Key Fertilizers Companies:

The following key companies have been profiled for this study on the fertilizers market.

- Nutrien Ltd.

- Yara

- ICL

- OMEX

- Haifa Negev Technologies Ltd.

- EuroChem Group

- SQM S.A.

- URALCHEM JSC

- Mosiac

- CF Industries Holdings Inc.

- American Plant Food

- AdvanSix

- Anuvia

Fertilizers Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 234.6 billion

Revenue forecast in 2033

USD 283.6 billion

Growth rate

CAGR of 2.7% from 2026 to 2033

Base year for estimation

2025

Historical data

2018 - 2024

Forecast period

2026 - 2033

Quantitative units

Volume in kilotons; revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Nutrien Ltd.; Yara; ICL; OMEX; Haifa Negev Technologies Ltd.; EuroChem Group; SQM S.A.; URALCHEM JSC; Mosiac; CF Industries Holdings Inc.; American Plant Food; AdvanSix; Anuvia

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fertilizers Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global fertilizers market report based on type, application, and region:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Nitrogenous Fertilizers

-

Urea

-

Methylene Urea

-

Ammonium Nitrate

-

Ammonium Sulfate

-

Ammonia

-

Calcium Ammonium Nitrate

-

Others

-

-

Phosphate Fertilizers

-

Monoammonium Phosphate (MAP)

-

Diammonium Phosphate (DAP)

-

Single Superphosphate (SSP)

-

Triple Superphosphate (TSP)

-

Others

-

-

Potash Fertilizers

-

Muriate of Potash (MOP)

-

Sulfate of Potash (SOP)

-

Others

-

-

Secondary Fertilizers

-

Micronutrients Fertilizers

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Cereals & Grains

-

Oilseeds & Pulses

-

Fruits & Vegetables

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global fertilizers market size was estimated at USD 227.0 billion in 2025 and is expected to reach USD 234.6 billion in 2026.

b. The global fertilizers market is expected to grow at a compound annual growth rate of 2.7% from 2026 to 2033 to reach USD 283.6 billion by 2033.

b. Asia Pacific dominated the global fertilizers market with the highest revenue share of 48.1% in 2025, driven by rising population, expanding commercial agriculture, and high crop intensity in major markets like India and China. Growing adoption of precision farming and modern nutrient management practices is enhancing yield efficiency and fertilizer uptake.

b. Some key players operating in the fertilizer market include Nutrien Ltd., Yara, ICL, OMEX, Haifa Negev Technologies Ltd., EuroChem Group, SQM S.A., URALCHEM JSC, Mosiac, CF Industries Holdings Inc., American Plant Food, AdvanSix, Anuvia.

b. Global population growth and rising protein consumption are intensifying the need for higher agricultural output. Fertilizers play a key role in maximizing crop yields from limited arable land. This structural demand ensures consistent growth for the global fertilizers market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.