- Home

- »

- Semiconductors

- »

-

Fiber Optics Market Size, Share And Growth Report, 2030GVR Report cover

![Fiber Optics Market Size, Share & Trends Report]()

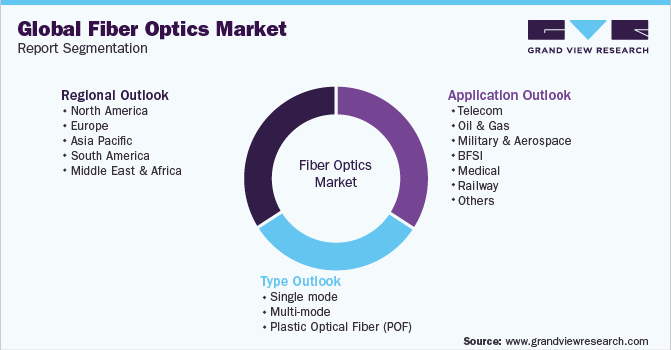

Fiber Optics Market Size, Share & Trends Analysis Report By Type (Single Mode, Multi-mode, Plastic Optical Fiber (POF)), By Application (Telecom, Medical, Oil & Gas), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-860-2

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Semiconductors & Electronics

Fiber Optics Market Size & Trends

The global fiber optics market size was valued at USD 8.76 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.9% from 2023 to 2030. Fiber optics technology is modern-day innovation that has evolved owing to rigorous studies conducted by researchers and scientists worldwide through extensive R&D. Several connector manufacturers are expanding their product lines to connect fiber optic channels that are highly protected and precisely aligned. For instance, in for instance, in December 2022, Microsoft acquired Lumenisity Limited, a fiber optic products supplier in England. This acquisition aims to strengthen Microsoft's ability to enhance its global cloud infrastructure and meet the strict latency and security requirements of Microsoft's Cloud Platform and Services customers.

The combined efforts of businesses to innovate fiber networks to reduce operations and maintenance (O&M) and optical distribution network (ODN) construction and costs will have a significant impact on market during projected period. Moreover, increased government initiatives for fiber optic cable deployment are contributed to market growth.

For instance, in July 2022, Government of India announced a merger of Bharat Sanchar Nigam Ltd, a telecommunications company, and Bharat Broadband Network Ltd, a broadband company to construct country’s largest optic fiber cable (OFC) network. Through this merger, BSNL will gain complete control of BBNL's 5.67 lakh km of optical fiber spread across the country.

Significant adoption of fiber optic cables under the sea contributed towards growth of market due to increased utilization of deployed fiber, improved network capacity, and enhancement in spectral efficiency. Moreover, major benefit of fiber optic cables under sea is that large amounts of data are transmitted rapidly and evolve to enable development of new technologies.

For instance, in August 2020, the Indian government launched a submarine optical fiber cable connecting Andaman and Nicobar Islands to mainland, to provide cheaper and better telecom connectivity to Union Territory. This initiative will facilitate Andaman and Nicobar Islands in improving online education, telemedicine, banking, online trading, and tourism.

A few major applications of fiber optic technology across healthcare & medical industry include ophthalmic lasers, X-ray imaging, laboratory & clinical diagnostics, surgical endoscopy & microscopy, surgical instrumentation, and light therapy. The demand for fiber optic technology in medical industry can be attributed to `growing demand for minimally invasive surgeries, preferred by patients.

Patients are also demanding advanced medical treatments, which is paving the way for advanced and skilled medical practices. Increasing application of fiber optics technology in healthcare sector propels the market’s growth.

Market Dynamics

Fiber optic systems can easily carry data, sound, and pictures over several kilometers to a few meters. Two industries with most significant applications are telecommunication and information technology. The development of fiber-rich infrastructure has greatly increased need for fiber optic cables. The telecommunication industry has been experiencing continuous advancements leading to a variety of upgrades and technological improvisations. Several innovations are being made across telecom industry, paving way for bandwidth-intensive communication. The growing demand for fiber optic cables can be accredited to rising bandwidth needs across carrier and enterprise networks. Broadband network topologies are being deployed at an exponentially rising rate as technology advances in telecom industry. Fiber to the home (FTTH), fiber to the building (FTTB), fiber to the cabinet (FTTC), and fiber to the premise (FTTP) are some of the well-known broadband networking architectures that call for extensive installation of fiber optic networks and consequently increase demand for fiber optic cables. The demand for fiber optic cables is being driven by expanding demand for high-speed wired internet and demand emerging through broadband network infrastructures. More data is used by specialized programs like gaming, media, and video because they demand a very fast internet connection to function properly. Due to growing interest in entertainment and communication needs, consumers worldwide are drawn to gadgets that enable high data consumption. As a result, the market for fiber optics as a whole is able to grow quickly over projection period. Additionally, the advantages of fiber optic cables influencing the migration from copper cables to optical fibers are low costs, high data-carrying capacities at faster rates, suitability for digital data transmission, low-power requirements, flexibility, and durability. Moreover, the risk of signal degradation is extremely negligible in fiber optic cables, which allows the technology to be adopted at an extensive pace.

Type Insights

multi-mode fiber optic segment held largest revenue share of 53.6% in 2022 due to its low cost and widespread use in illumination and surgical lighting in the healthcare sector. Moreover, the multi-mode fiber optic is used in medical instruments and diagnostics, operating rooms, telemedicine, and medical imaging to achieve higher quality, efficiency, and resolution.

Multi-mode segment also provides a solution for communication, lighting, and sensing requirements in automotive applications. Moreover, multi-mode segment is increasingly being used as communication medium of choice for mission-critical applications due to its high bandwidth, and low cost.

Revenue from signal segment in fiber optics industry is expected to grow during the forecast period. The increased demand for long-distance transmission applications is responsible for rising demand for single-mode fiber optics segment. Single-mode fibers are frequently used by telecom companies for high-bandwidth and long-distance requirements.

Plastic optic fiber (POF) is expected to grow rapidly during the forecast period due to rising population, changing lifestyles, increased disposable income, and its robustness under bending and stretching. The core materials used in POF cable construction differentiate it from its single and multimode counterparts.

Application Insights

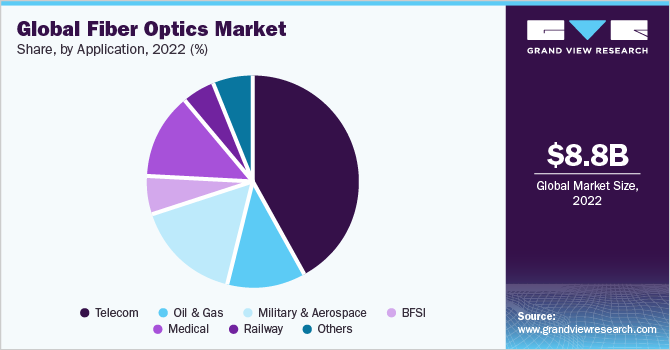

Telecom segment dominated the market, with a revenue share of 41.7% in 2022. The growth prospects for fiber optics technology in telecom segment appear promising, owing to technology's increasing adoption in communication and data transmission services.

Fiber optics enables high-speed data transfer services in short and long-distance communications. The growing popularity of cloud-based applications, Video-on-Demand (VoD) services, and audio-video services drive up demand for fiber optic installations. Moreover, optical communications enabled the construction of telecommunications links over much greater distances and with much lower levels of transmission medium loss.

The medical segment is expected to grow rapidly, owing to rising adoption of optic technology devices in these markets. Stringent regulations enforced by medical associations and government regulating authorities are further assisting the fiber optics industry to flourish in medical sector, ultimately driving the global market to grow at a significant pace over the estimated time.

The railway track maintenance achieved by fiber optics enables enhanced track repair with ease and at a much cheaper cost, which is attributed to the growth of Railway segment. Military and aerospace markets are moderately penetrated, and it is expected to grow rapidly in the future, with their market share witnessing a rise during the forecast period.

Regional Insights

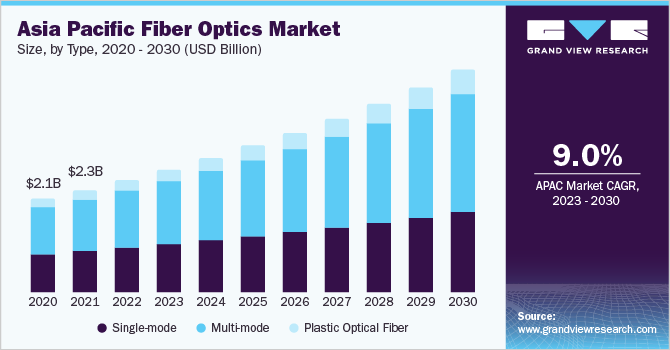

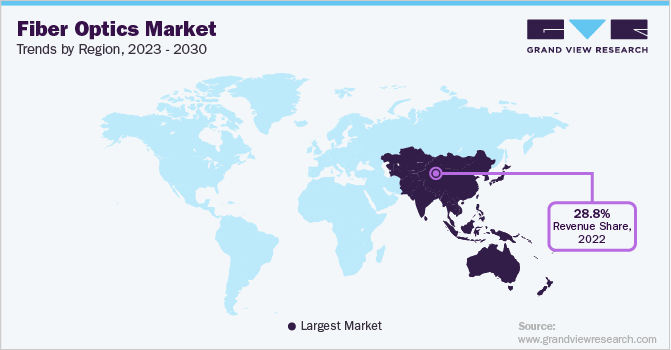

Asia Pacific region dominated global market at a revenue share of 28.8% in 2022. Increased technological advancements, widespread adoption in IT & telecommunications, administrative sectors, and development of fiber-integrated infrastructure are attributed to the growth.

In 2022, U.S. had around 91.9 million km of fiber optic cable laid throughout the country. Rising demand for Internet of Things (IoT) and connected devices along with growing deployment of broadband network platforms including Fiber to the Premise, Fiber to the Building, Fiber to the Home, and Fiber to the Cabinet also drives fiber optics' positive growth in this region.

Moreover, growing demand for connected wearables, smartphones, and tablets in North America has significantly increased demand for fiber optic networks, which drives demand for fiber optic cables.

The high penetration rate of expanding IT & telecommunications sector manufacturing sector across the Asia Pacific region is strengthening market's hold in this region. Moreover, growing use of fiber optics in medical sector is catapulting growth in countries such as Japan, China, and India, propelling overall market growth rapidly.

Governments in developed countries such as U.S., U.K., Germany, China, Japan, and others are making significant investments in improving national security infrastructures. Rapidly developing economies seeking to strengthen their control on the international scene and this leads to increased funding for technologies, particularly fiber optics.

One of the primary drivers for growth in demand for dark fiber in New Zealand is rising investments in FTTx infrastructure. High-speed services are delivered to residential, commercial, and industrial premises using optical fiber cables rather than coaxial cables, telephone, or cable wires.

Key Companies & Market Share Insights

The market is characterized by strong competition, with a few major worldwide competitors owning a significant market share. Major focus is on developing new products and collaboration among key players. For instance, in December 2021, Amphenol Corporation, a U.S.-based Electronic connector manufacturing company, announced the acquisition of Halo Technology Limited, a manufacturer of fiber optic interconnects devices, for approximately $715 million. The initiative aims to enhance Amphenol Corporation's fiber optic offering to IT and data communications, mobile networks, and broadband customers by using Halos's high-technology products. Some prominent players in global fiber optics market include:

-

AFL

-

Birla Furukawa Fiber Optics Limited

-

Corning Incorporated

-

Finolex Cables Limited

-

Molex, LLC

-

OFS Fitel, LLC

-

Optical Cable Corporation (OCC)

-

Prysmian Group

-

Sterlite Technologies Limited

-

Yangtze Optical Fiber and Cable Joint Stock Limited Company (YOFC)

Fiber Optics Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 9.39 billion

Revenue forecast in 2030

USD 14.93 billion

Growth rate

CAGR 6.9% of from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million & CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; South America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Brazil

Key companies profiled

AFL; Birla Furukawa Fiber Optics Limited; Corning Incorporated; Finolex Cables Limited; OFS Fitel, LLC; Optical Cable Corporation (OCC); Prysmian Group; Sterlite Technologies Limited; Yangtze Optical Fiber; Cable Joint Stock Limited Company(YOFC)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fiber Optics Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global fiber optics market report based on type, application, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Single mode

-

Multi-mode

-

Plastic Optical Fiber (POF)

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Telecom

-

Oil & Gas

-

Military & Aerospace

-

BFSI

-

Medical

-

Railway

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

South America

-

Brazil

-

-

Middle East and Africa

-

Frequently Asked Questions About This Report

b. The global fiber optics market is expected to grow at a compound annual growth rate of 6.9% from 2023 to 2030 to reach USD 14.93 billion by 2030.

b. Asia Pacific dominated the fiber optics market with a share of 28.8% in 2022. This is attributable to technological advancements and large-scale adoption of the technology in IT and telecommunication.

b. Key factors that are driving the market growth include growing demand for high bandwidth communication and growth opportunities in the healthcare sector.

b. The global fiber optics market size was estimated at USD 8.76 billion in 2022 and is expected to reach USD 9.39 billion in 2023.

b. Some key players operating in the fiber optics market include Corning Incorporated; Optical Cable Corporation (OCC); Sterlite Technologies Limited; OFS Fitel, LLC; Prysmian Group; AFL; Birla Furukawa Fiber Optics Limited; and Finolex Cables Limited.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."