- Home

- »

- Sensors & Controls

- »

-

Fire Alarm And Detection Market Size & Share Report, 2030GVR Report cover

![Fire Alarm And Detection Market Size, Share & Trends Report]()

Fire Alarm And Detection Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Detectors, Alarm), By Detector Type (Flame, Smoke, Heat), Alarm Type (Audible, Visual, Manual Call-points), By Application, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-359-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Fire Alarm And Detection Market Summary

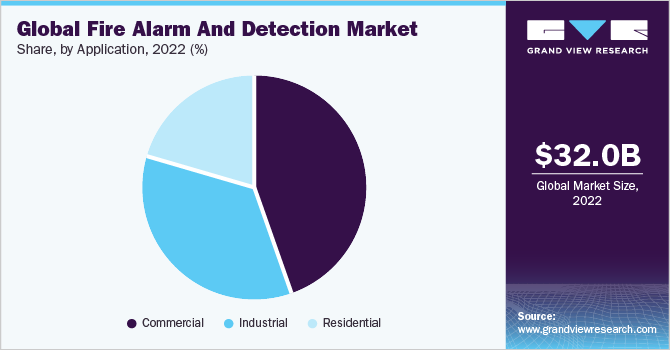

The global fire alarm and detections market size was valued at USD 32.03 billion in 2022 and is projected to reach USD 56.07 billion by 2030, growing at a CAGR of 7.2% from 2023 to 2030. Factors such as growing installation of fire safety systems in educational facilities and growing awareness of fire detection among residential and commercial sectors, the demand for fire alarms and detection will grow.

Key Market Trends & Insights

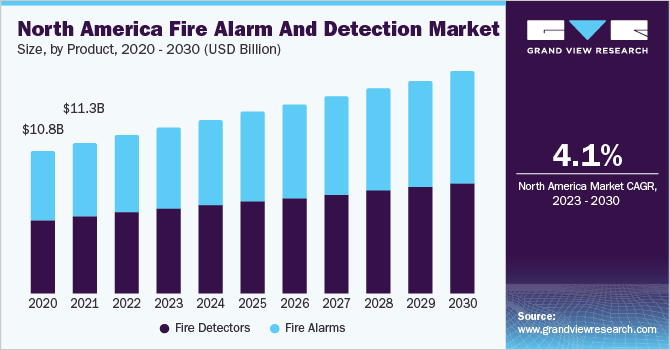

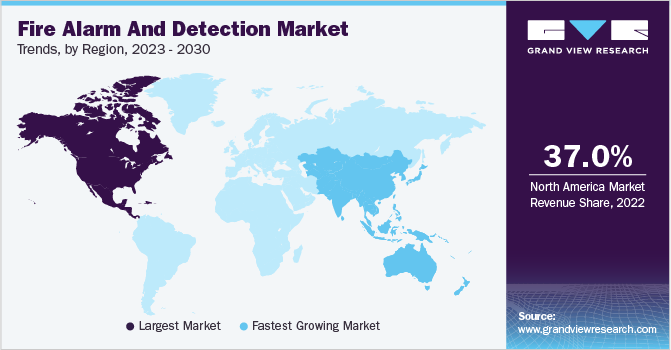

- North America emerged as the largest regional market share of nearly 37.0% in 2022.

- By detectors type, the heat detectors is expected witness the highest CAGR over the forecast period.

- By alarm type, the audible alarms segment held the largest market share of nearly 6.0% in 2022.

- By application, the commercial segment captured the highest revenue share of over 44.0% in 2022

Market Size & Forecast

- 2022 Market Size: USD 32.03 Billion

- 2030 Projected Market Size: USD 56.07 Billion

- CAGR (2023-2030): 7.2%

- North America: Largest market in 2022

Technological developments, elevated fire safety awareness, expanding urbanization, and industrialization are predicted to fuel growth of fire alarm and detection market. Furthermore, expansion of commercial and industrial sectors and increased awareness of fire safety have a positive impact on the business climate.

The market growth will be primarily driven by the need for improved fire safety systems in fire-prone industrial environments, including automotive, power & utility, mining, petrochemical, and oil & gas exploration industries. In light of the COVID-19 epidemic, fire safety has taken center stage in newly established work-from-home paradigm. Building managers or facility owners are protecting and maintaining fire safety systems as some parts of the world slowly see businesses restarting.

Over the next few years, market players will have growth prospects because of revaluation of fire safety regulations. In 2021, there was a little increase in demand for fire safety solutions. Vendors in this market, however, experienced modest difficulties in accepting and completing orders because of supply chain interruptions. The demand for kitchen fire safety, electrical fire safety, and heating fire safety will grow over the next few years. By the end of 2021, the international market will most likely have reached pre-COVID levels. With a brief setback brought on by supply chain delays, the market is already recovering.

However, as businesses reopen, importance of fire safety is likely to take center stage and will drive product sales over next few years. In addition, pandemic-induced work-from-home model will also contribute to industry recovery as fire safety gains prominence with individuals spending considerable time working from home. As industry continues to witness a modest upsurge led by a pandemic, a recovery in construction-related projects, both new and redevelopment, will also generate lucrative market conditions for fire detection and alarm OEMs.

Although many projects have taken a backseat for mid-term, opportunities still thrive in terms of anticipated new projects and ongoing projects that will resume in 2021. Fire detection & alarm is integral elements of any building project enabling safety across several structures. Hence, a rise in number of construction-related projects will come as a respite for the industry’s growth. In addition, advancements in technology enabling wireless products with improvements in response time will also pave the way for future growth.

Market Dynamics

One significant trend is increasing adoption of smart and connected technologies, which has generated a demand for suppliers offering integrated solutions. These suppliers specialize in advanced alarm systems and detection devices that seamlessly integrate with existing smart home or commercial automation systems. They also focus on eco-friendly and energy-efficient products, resulting in a rise in suppliers offering sustainable alarm and detection solutions. These suppliers prioritize incorporating renewable energy sources, employing low-power consumption technologies, and implementing recycling programs for their products. Furthermore, there is a growing preference for suppliers that provide comprehensive services, including installation, maintenance, and monitoring. This enables customers to have a convenient one-stop-shop experience for all their alarm and detection needs. As the alarm and detection industry continues to evolve, suppliers play a crucial role in meeting increasing demand for cutting-edge technologies, sustainability, and convenience.

Additionally, there has been an increasing emphasis on sustainable and environmentally friendly solutions, resulting in the adoption of recyclable and biodegradable materials in alarm and detection devices. For instance, manufacturers are actively exploring alternatives to conventional plastics by incorporating plant-based bioplastics or biodegradable polymers into their production processes. This transition toward eco-conscious materials aligns with industry's commitment to minimizing environmental impact while maintaining highest performance standards in security systems.

Product Insights

Fire detectors product segment accounted for the highest revenue share exceeding 50.0% in 2022. Fire detectors have applications in detecting leaks, such as gas, that could result in a fire accident. Regulations in several countries that encourage a adoption of fire detectors are the key factor favoring product sales, a trend expected to continue till 2030. Fire alarms segment is expected to register the highest CAGR over the forecast period. Fire regulations will continue to play a vital role in boosting product demand.

Fire alarms and detectors must be used in tandem for the best performance. While alarms send out a warning to occupants, detectors are crucial in finding leaks. Both product categories will experience significant increase during the projection period and are crucial to a building or facility. In the current situation, technology plays a significant part in product advancements and favors the accompanying market demand. For instance, incorporating cutting-edge features that facilitate voice evacuation will go a long way in boosting product sales and market's expansion.

Detectors Type Insights

In Fire detectors, heat detectors is expected witness the highest CAGR over the forecast period. Heat detectors are the best option in hot climates or in places where temperatures change quickly. These locations may include, among others, garages, mechanical rooms, storage facilities, and commercial kitchens. In 2022, market was headed by smoke detectors sector, which accounted for a revenue in 2022. Smoke detectors are frequently utilized in places where slow-burning smouldering fires could occur, including residential apartments or commercial buildings.

The development of intelligent or "smart" smoke detectors as a result of technological improvements is crucial for boosting product sales. Furthermore, introduction of novel products with a longer lifespan and more cost-efficiency has also helped to maintain sector demand over the past few years. Fire alarms section also includes manual call points, visual alerts, and audio alarms. Audible Alarms overtook the competition in 2022. Throughout the anticipated period, the sector will continue to dominate market since audible alarms are a crucial part of any fire alarm system because they can alert individuals to a dangerous situation.

Alarm Type Insights

Amongst alarm type, audible alarms held the largest market share of nearly 6.0% in 2022. Audible alarms have an innate ability to grab immediate attention. Piercing sound produced by fire alarms is designed to cut through background noise and command people's attention, even in crowded or noisy environments. This quick response time is crucial in ensuring a rapid evacuation, reducing the risk of injuries or fatalities. As a result, such factors drive the growth for the segment.

However, manual call-points alarms are expected to register highest CAGR over the forecast period. Manual call-point fire alarms provide an immediate means for occupants to raise the alarm, enabling rapid evacuation and swift emergency response. With growing awareness of the significance of early detection in minimizing property damage, protecting lives, and reducing insurance liabilities, demand for manual call-point fire alarms is likely to increase globally.

Application Insights

Fire alarm & detection systems are an integral part of industrial, commercial, and residential areas. Commercial segment captured the highest revenue share of over 44.0% in 2022 and is estimated to maintain its leading position throughout the forecast period. The growing importance of fire safety equipment in business facilities and need to follow government guidelines favor segment growth. With a growing number of business centers, the demand for new fire alarm and detection systems is also on the rise. Residential segment is expected to register the fastest CAGR over the forecast period. Installation of fire sprinkler systems in residential establishments has been gaining significant traction over the past couple of years.

The continuous increase in the application and usage of fire safety equipment in corporations and commercial entities has led to an additional emphasis on safety and security. Numerous state governments in India have made it mandatory for proper fire safety adequacy and installation, especially in commercial establishments. All such factors have led to an increase in demand for fire safety equipment in commercial sector. Moreover, rising economic growth and an increase in investments in a construction sector in emerging economies including India and China is expected to boost the growth of the commercial sector in Asia Pacific region.

Regional Insights

North America emerged as the largest regional market share of nearly 37.0% in 2022. The market, however, has reached a mature phase and will witness steady growth over the forecast period. Asia Pacific is estimated to emerge as the fastest-growing regional market over the forecast years. The area is providing expansion prospects for fire safety vendors through investments centered on infrastructure development. The regional demand is a result of the advancements made in nations such as China, Japan, India, and other Southeast Asian nations.

Absence of uniform criteria encouraging the installation of fire safety equipment, however, can be a slight barrier to the otherwise lucrative sector. Regional authorities in Europe are concentrating on putting national or state-defined fire safety standards into practice. For instance, smoke alarms are now required to be installed in about 13 states in Germany. Smoke detectors are advised to be installed in bedrooms, hallways, pipelines, and escape routes according to the state construction codes. Additionally, certain states are required by national fire regulations to retrofit existing homes with smoke detectors.

Key Companies & Market Share Insights

Tapping opportunities in emerging countries will be a key focus area for most market participants. Research & development activities will help companies develop advanced products integrating the latest technologies in a bid to beat the competition. Furthermore, regional strategy focuses on cost-effectiveness, capturing regional contracts, and having a local sales network, particularly in emerging markets. Vendors aim to offer ancillary services and new products and training & support on selecting right product for a specific application. All these initiatives from OEMs will help them be afloat amidst competitive environment. For instance, in April 2023, Johnson Controls International PLC collaborated with International WELL Building Institute (IWBI) to support healthy building solutions for its customers and employees. The company's WELL Enterprise Provider (EP) designation helped clients meet ESG reporting, human capital management, and workplace policies and strategies Some prominent players in a global fire alarm and detection market include:

-

Eaton

-

GENTEX CORPORATION

-

Halmaplc

-

HOCHIKI Corporation.

-

Honeywell International, Inc.

-

Johnson Controls

-

Napco Security Technologies, Inc.

-

NITTAN Corporation

-

Robert Bosch GmbH

-

Siemens

-

Space Age Electronics, Inc.

-

United Technologies Corp.

Fire Alarm And Detection Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 34.44 billion

Revenue forecast in 2030

USD 56.07 billion

Growth rate

CAGR of 7.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

June 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, detectors type, alarms type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

Eaton; GENTEX CORPORATION; Halmaplc; HOCHIKI Corporation.; Honeywell International, Inc.; Johnson Controls; Napco Security Technologies, Inc.; NITTAN Corporation; Robert Bosch GmbH; Siemens; Space Age Electronics, Inc.; United Technologies Corp.

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fire Alarm And Detection Market Report Segmentation

The report forecasts revenue growth at global, regional, and at country level and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global fire alarm and detections market report based on product, detectors type, alarms type, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Fire Detectors

-

Fire Alarms

-

-

Detectors Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Flame Detectors

-

Smoke Detectors

-

Heat Detectors

-

-

Alarm Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Audible Alarms

-

Visual Alarms

-

Manual Call-points Alarms

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Industrial

-

Residential

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the fire alarm and detection market include Eaton, GENTEX CORPORATION, Halma plc, HOCHIKI Corporation, Honeywell International, Inc., Johnson Controls, Napco Security Technologies, Inc.

b. Key factors that are driving the fire alarm and detection market growth include the increasing demand for advanced smoke detection systems for fire-prone industries, and the increasing stringency in the adoption of fire safety regulations within residential, commercial, and industrial applications across the world.

b. The global fire alarm and detection market size was estimated at USD 32.03 billion in 2022 and is expected to reach USD 34.44 billion in 2023.

b. The global fire alarm and detection market is expected to grow at a compound annual growth rate of 7.2% from 2022 to 2030 to reach USD 56.07 billion by 2030.

b. North America emerged as the largest regional market in 2021 accounting for a revenue share of more than 38% in the fire alarm and detection market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.