- Home

- »

- Electronic & Electrical

- »

-

Smoke Detector Market Size & Share, Industry Report, 2033GVR Report cover

![Smoke Detector Market Size, Share & Trend Report]()

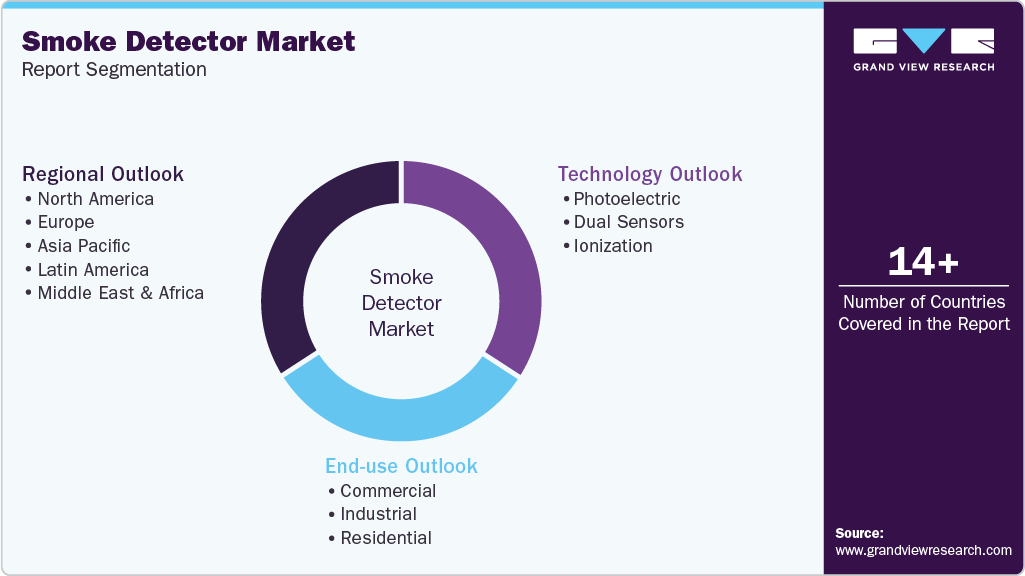

Smoke Detector Market (2025 - 2033) Size, Share & Trend Analysis Report By Technology (Photoelectric, Dual Sensors), By End Use (Commercial, Industrial), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-099-6

- Number of Report Pages: 97

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Smoke Detector Market Summary

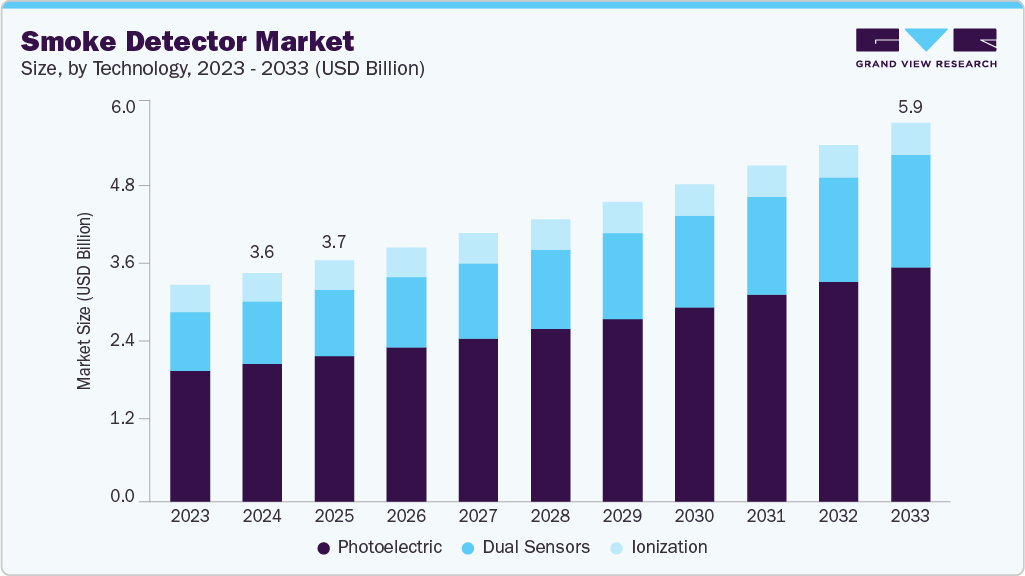

The global smoke detector market size was estimated at USD 3.55 billion in 2024 and is projected to reach USD 5.88 billion by 2033, growing at a CAGR of 5.8% from 2025 to 2033. The smoke detector industry is driven by increasing safety awareness and strict government regulations on fire prevention. Advancements in smart home technologies also fuel market growth.

Key Market Trends & Insights

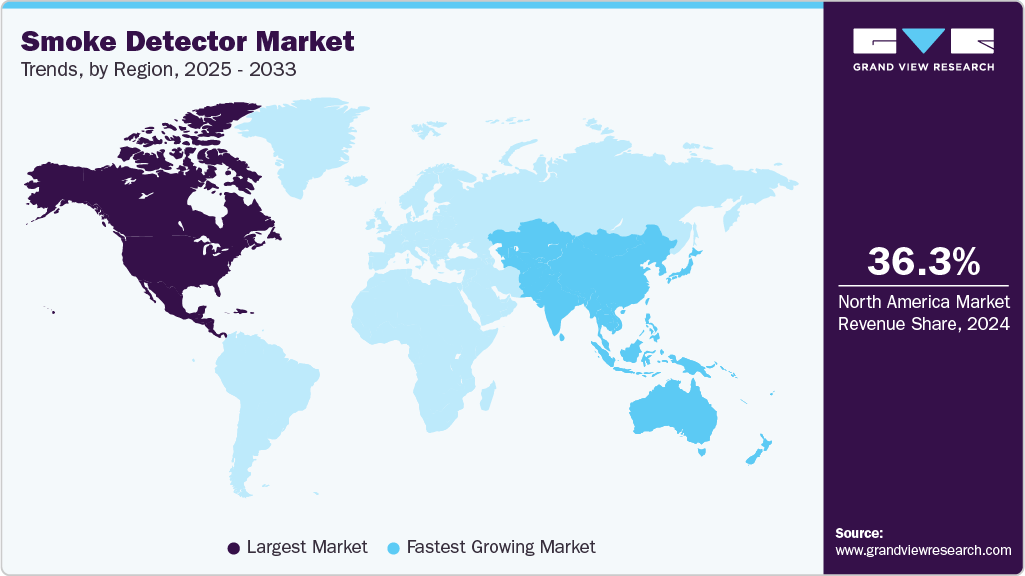

- North America dominated the global smoke detector market with the largest revenue share of 36.3% in 2024.

- The smoke detector market in Asia Pacific is anticipated to grow at a significant CAGR of 6.9% during the forecast period.

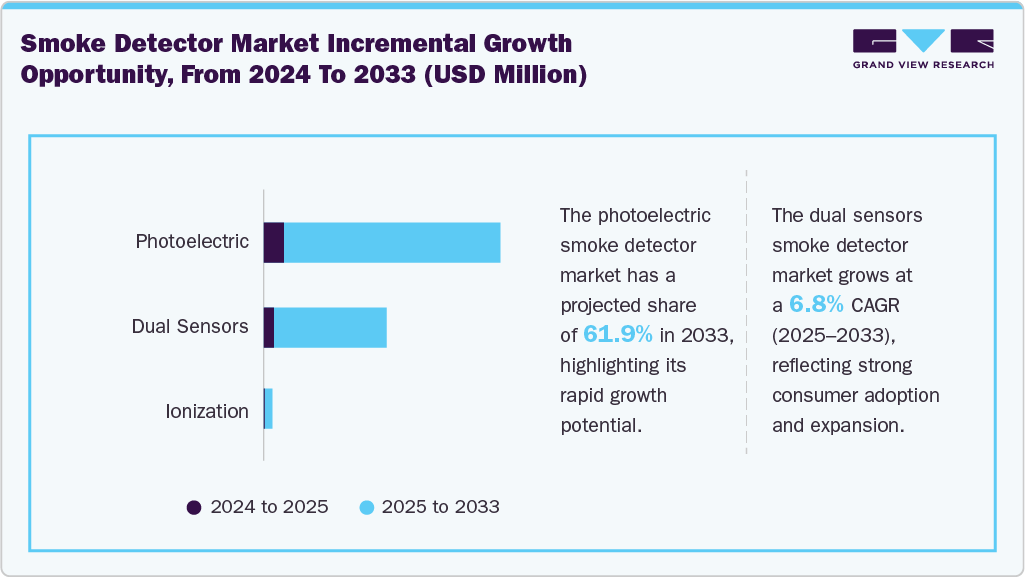

- By technology, the photoelectric segment with the largest revenue share of 60.3% in 2024.

- By technology, the dual sensors segment is anticipated to grow at a significant CAGR of 6.8% during the forecast period.

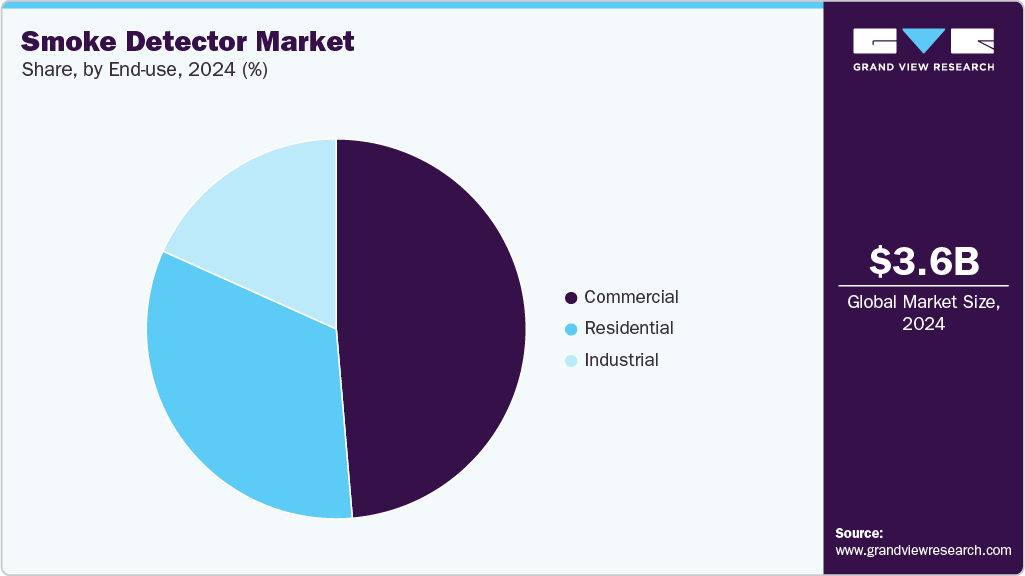

- By end use, the commercial segment led the market with the largest revenue share of 48.7% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.55 Billion

- 2033 Projected Market Size: USD 5.88 Billion

- CAGR (2025-2033): 5.8%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The smoke detector industry is experiencing growth due to rising concerns over fire safety and stricter regulations by governments worldwide. As people become more aware of the importance of early fire detection, demand for reliable and advanced smoke detection systems increases. The integration of smart technology in these devices, allowing for remote monitoring and alerts, further boosts adoption. In addition, the expansion of residential and commercial construction projects contributes to the growing need for fire safety solutions. According to the SafeHome.org data published in February 2025, about 33% of Americans have adopted smart smoke detectors.

The smoke detector industry is expanding as people become more focused on safety, especially with the growing number of fire-related incidents. As smart home technology continues to advance, more consumers are choosing modern detectors that provide real-time alerts and remote monitoring capabilities. The growing emphasis on building safety and the need to meet fire regulations are driving demand across both residential and commercial spaces. In addition, urban development and the rise in property insurance policies are further encouraging the widespread adoption of fire safety systems.

The smoke detector industry is being fueled by an increasing focus on fire safety and growing concerns about property protection. As more people seek to protect their homes and businesses, demand for reliable fire detection systems continues to rise. Technological advancements, such as the integration of AI and voice alerts, are making these systems more efficient and user-friendly. At the same time, stricter local and international safety regulations are prompting greater adoption across various sectors, from residential homes to large commercial complexes.

Forinstance, effective from 1st January 2022, new regulations were enforced in England for smoke alarms and carbon monoxide detectors in all residential accommodations and will require landlords to provide and install smoke alarms on every floor of their property and carbon monoxide detectors in rooms with a solid fuel appliance. These new regulations are applied to all new tenancies starting on or after 1st January 2022, and to all existing tenancies from 1st April 2022.

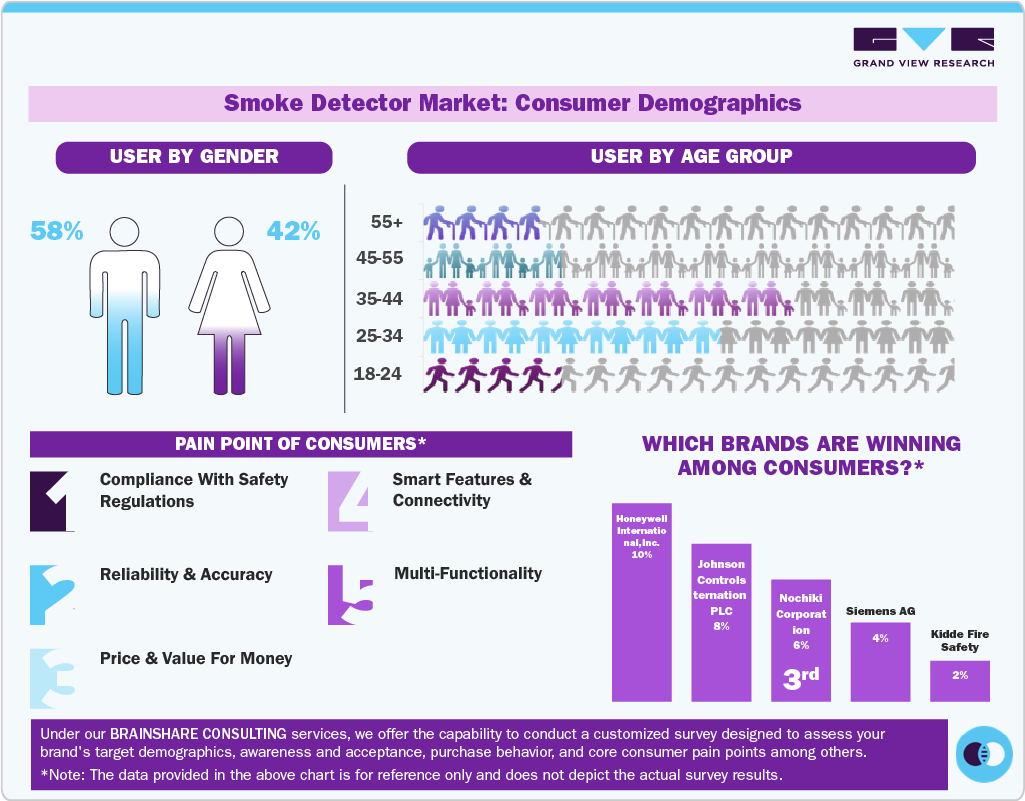

Consumer Insights for Smoke Detector

Technology Insights

The photoelectric segment led the market with the largest revenue share of 60.3% in 2024. Photoelectric smoke detectors are driven by the principle of light scattering. When smoke enters the sensing chamber, it disrupts the light beam, causing it to scatter onto a sensor. This disruption triggers the alarm. Key factors influencing their effectiveness include the size of smoke particles, environmental conditions like dust or humidity, and the sensitivity of the detector. These detectors are especially responsive to smoldering fires, offering early warning in such scenarios. For instance, in July 2024, Hikvision India introduced a new range of standalone photoelectric smoke and gas detectors. It enhanced its safety product portfolio with advanced sensing technologies designed to deliver early warnings and ensure improved fire and gas leak detection.

The dual sensors segment is projected to grow at the fastest CAGR of 6.8% from 2025 to 2033. Dual-sensor smoke detectors combine both ionization and photoelectric technologies to offer more reliable fire detection. The ionization sensor detects fast, flaming fires, while the photoelectric sensor is better for smoldering fires. By using both, these detectors reduce false alarms and improve response time. Factors like air quality, smoke particle size, and sensitivity settings impact their performance. This combination makes dual-sensor alarms highly effective in a variety of fire scenarios.

End Use Insights

The commercial segment led the market with the largest revenue share of 48.7% in 2024. The commercial segment is expanding due to increasing safety regulations and stricter building codes that require fire detection systems in workplaces and public spaces. As businesses prioritize employee safety and property protection, demand for reliable and advanced smoke detectors continues to rise. The growth of smart building technology is also driving the market, with businesses opting for systems that offer real-time monitoring and remote alerts. Insurance companies are offering discounts to properties with fire safety systems, encouraging adoption. In addition, rising awareness of fire hazards and the need for compliance with local safety standards are pushing more commercial establishments to invest in smoke detection solutions.

The residential segment is projected to grow at the fastest CAGR of 5.6% from 2025 to 2033. The residential smoke detector industry is growing as homeowners become more aware of fire risks and the importance of safety in their homes. Stricter building codes and fire safety regulations are also contributing to higher adoption rates. With the rise in smart home devices, many consumers are opting for connected smoke detectors that can send alerts directly to their phones. The increasing affordability and energy efficiency of these systems are making them more accessible to a wider range of homeowners.

In additional, insurance incentives for homes equipped with advanced fire detection systems are further driving demand. In July 2024, HFI, Halma Safety’s new business unit in India, launched Veiga, a locally designed, EN‑54 and IS‑standard fire alarm and smoke detection solution tailored for residential, commercial, and industrial applications, reinforcing Halma’s strategic shift toward solution‑driven fire safety delivery in India.

Regional Insights

North America dominated the global smoke detector market with the largest revenue share of 36.3% in 2024. In North America, the market is largely driven by stringent safety regulations and fire safety codes, especially in residential and commercial buildings. Growing awareness around fire hazards and the importance of early detection is encouraging consumers to invest in advanced smoke detection systems. In addition, the increasing adoption of smart home technologies, along with government initiatives to improve fire safety, is further boosting the demand. Insurance discounts for properties with fire safety systems also play a role in encouraging wider adoption. Furthermore, the market benefits from the region's focus on infrastructure development and modernization.

U.S. Smoke Detector Market Trends

The smoke detector market in the U.S. accounted for the largest market revenue share of 85.9% in North America in 2024. In the U.S., the market is seeing significant growth due to the implementation of nationwide building codes that require smoke alarms in every home. Rising public awareness about the dangers of fires and the push for better home safety is driving consumer demand for reliable smoke detection systems. According to the Consumer Product Safety Commission (CPSC) data published in September 2024, about 99% of the households in the U.S. have smoke detectors installed in their homes. The increasing popularity of smart home products, which can integrate smoke detectors with other smart devices, is expanding the market. In addition, government incentives and local policies are making fire safety systems more accessible. With frequent fire-related incidents, both residential and commercial sectors are prioritizing smoke detection solutions.

Europe Smoke Detector Market Trends

The smoke detector market in Europe held the significant market share of 26.2% in the global market. The European market is being fueled by strict fire safety regulations across the region, requiring the installation of smoke alarms in both new and existing buildings. Growing urbanization, combined with an emphasis on improving residential and commercial building safety, is driving demand for advanced smoke detectors. Technological innovations, including the rise of smart smoke detectors, are gaining traction as consumers seek more efficient and connected safety solutions. Furthermore, increased awareness about fire safety and the ongoing efforts to meet energy-efficient standards are encouraging wider adoption of modern smoke detection systems.

The Germany smoke detector market accounted for the largest market revenue share of 24.1% in Europe in 2024. Germany's market is experiencing growth due to stringent regulations that mandate the installation of smoke detectors in all residential buildings. The country has been proactive in enforcing fire safety laws, pushing consumers and businesses to invest in reliable fire detection systems. As one of the leaders in the adoption of smart home technology, Germany sees increasing demand for connected smoke detectors that can integrate with other smart systems. Rising concerns over fire safety in both urban and rural areas, combined with a robust insurance sector offering discounts for equipped properties, are further driving market growth.

Asia Pacific Smoke Detector Market Trends

The smoke detector market in Asia Pacific is projected to grow at the fastest CAGR of 6.9% from 2025 to 2033. In the Asia Pacific region, rapid urbanization and infrastructure development are major factors driving the smoke detector industry. As cities grow and new buildings are constructed, there is a rising demand for fire safety solutions to comply with increasingly stringent regulations. The adoption of smart home technology is gaining momentum, with consumers in countries such as China and India becoming more interested in smart smoke detectors that offer enhanced features like remote monitoring. The region's growing middle class and heightened awareness about fire hazards are further pushing the need for reliable smoke detection systems in both residential and commercial properties.

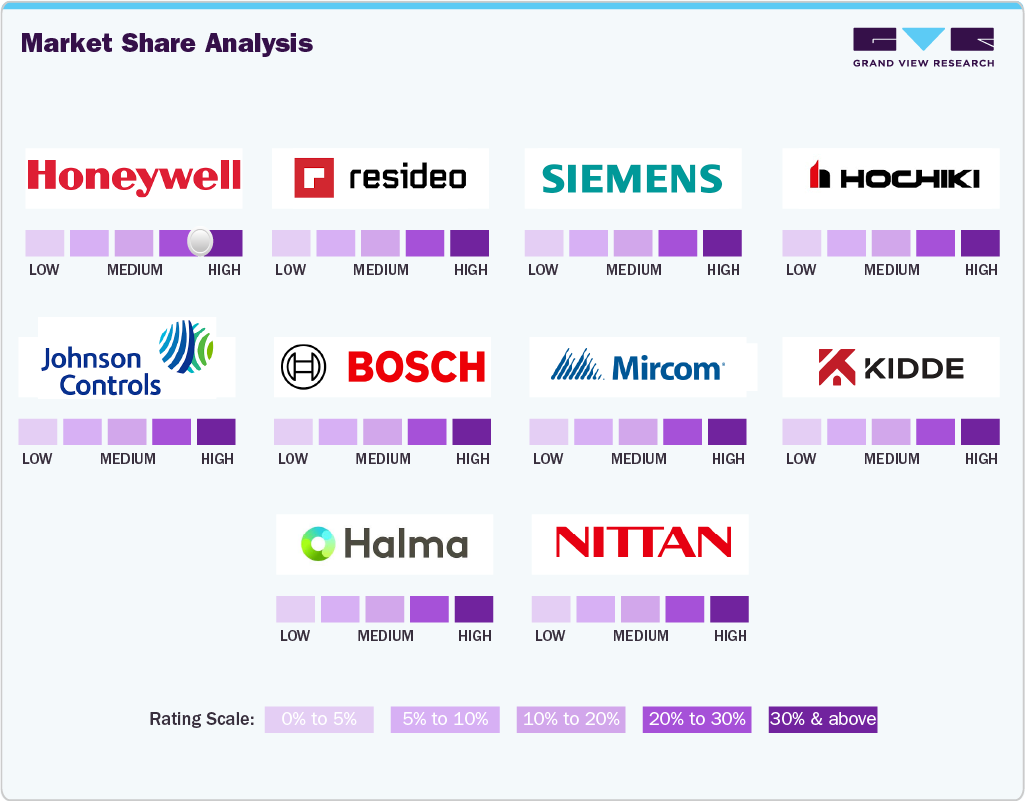

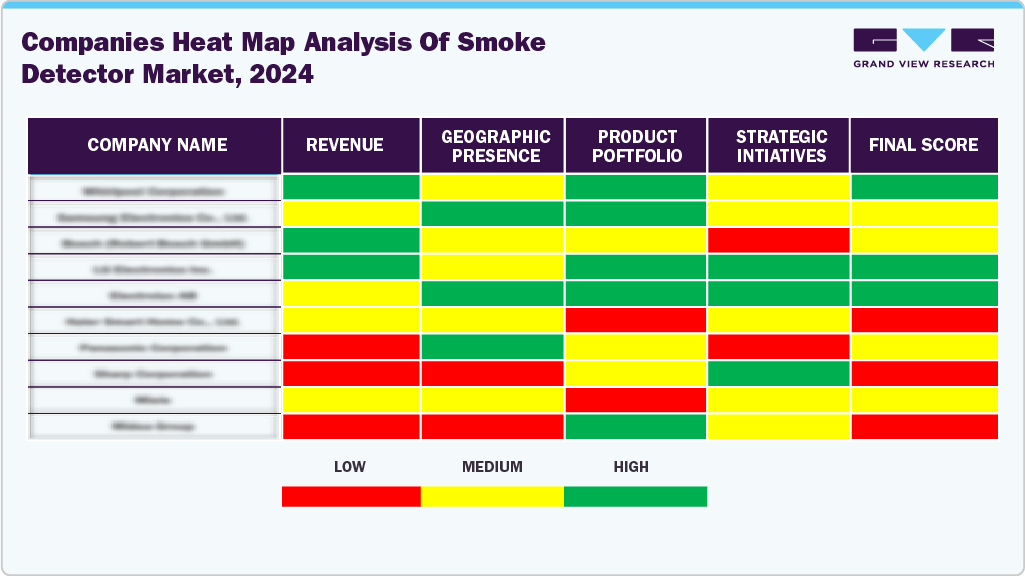

Key Smoke Detectors Company Insights

Many brands in the smoke detector industry have recognized untapped opportunities within their end use portfolios and are actively working to capitalize on these gaps. This includes launching innovative designs, expanding customization options, and tailoring marketing strategies to align with evolving consumer tastes and cultural trends. By addressing niche segments and emerging preferences, these brands aim to increase their market share and strengthen their competitive positioning worldwide.

Key Smoke Detectors Companies:

The following are the leading companies in the smoke detector market. These companies collectively hold the largest market share and dictate industry trends.

- Honeywell International Inc.

- Resideo Technologies Inc. (BRK Brands, Inc. and First Alart)

- Siemens AG

- Hochiki Corporation

- Johnson Controls International PLC

- Robert Bosch GmbH

- Mircom Group

- Kidde Fire Safety

- Halma plc (Apollo Fire Detectors Ltd.)

- Nittan Co., Ltd.

Recent Developments

-

In July 2025, Honeywell acquired Nexceris’s Li‑ion Tamer business, enhancing its Building Automation fire‑safety portfolio. The technology enabled early detection of lithium‑ion battery off‑gassing and smoke detection.

-

In March 2025, Kidde Commercial launched its EXCELLENCE Series smoke detectors featuring patented optical sensing technology. The devices applied multi‑wave,multi‑angle detection using MIE light scattering theory and a dual detection mode to distinguish nuisance particles from real fire threats.

-

In October 2024, Siterwell launched the A8612B smoke and carbon monoxide detector in the US, offering detection up to 15 seconds faster than conventional models. The device incorporated dual‑sensor technology and smart algorithms to enhance life‑saving responsiveness and reliability.

Smoke Detector Market Report Scope

Report Attribute

Details

Market value size in 2025

USD 3.74 billion

Revenue Forecast in 2033

USD 5.88 billion

Growth rate

CAGR of 5.8% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, end use, region

Regional Scope

North America; Europe; Asia-Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; South Africa

Key companies profiled

Honeywell International Inc.; Resideo Technologies Inc.; Siemens AG; Hochiki Corporation; Johnson Controls International PLC; Robert Bosch GmbH. Mircom Group.; Kidde Fire Safety; Halma plc (Apollo Fire Detectors Ltd.); Nittan Co., Ltd

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smoke Detector Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global smoke detector market report based on the technology, end use, and region.

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Photoelectric

-

Dual Sensors

-

Ionization

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Commercial

-

Industrial

-

Residential

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global smoke detector industry was valued at USD 3.55 billion in 2024 and is expected to grow at a compound annual growth rate (CAGR) of 5.8% from 2025 to 2033.

b. The global smoke detector market is expected to grow at a compound annual growth rate of 8.8% from 2019 to 2025 to reach USD 5.88 billion by 2033.

b. North America accounted for the market share of 36.3% in 2024. In North America, the smoke detector market is largely driven by stringent safety regulations and fire safety codes, especially in residential and commercial buildings

b. Some key players operating in the smoke detector market include Honeywell International Inc, Resideo Technologies Inc., Siemens AG, Hochiki Corporation, Johnson Controls International PLC, Robert Bosch GmbH. Mircom Group., Kidde Fire Safety, Halma plc (Apollo Fire Detectors Ltd.), Nittan Co., Ltd

b. Key factors that are driving the market growth include rising awareness regarding fire safety of buildings and increasing sustainable development in the construction industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.