- Home

- »

- Green Building Materials

- »

-

Fire Stopping Materials Market Size, Industry Report, 2030GVR Report cover

![Fire Stopping Materials Market Size, Share & Trends Report]()

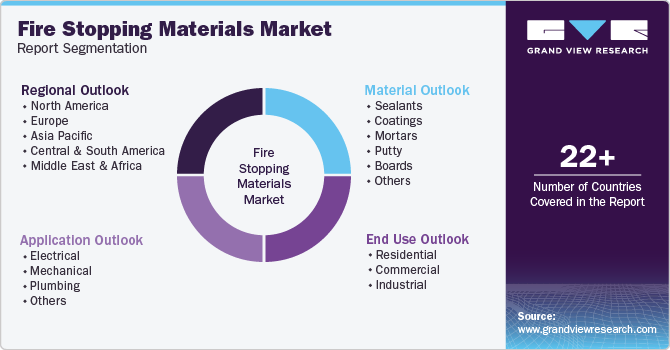

Fire Stopping Materials Market (2025 - 2030) Size, Share & Trends Analysis Report By Materials (Sealants, Coatings, Mortars, Putty, Boards), By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-502-0

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Fire Stopping Materials Market Summary

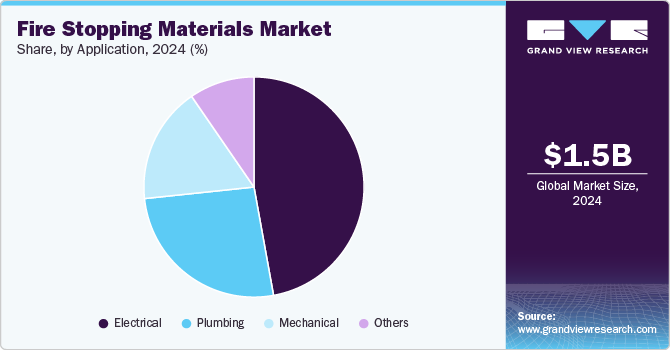

The global fire stopping materials market size was estimated at USD 1.5 billion in 2024 and is projected to reach USD 2.35 billion by 2030, growing at a CAGR of 8.1% from 2025 to 2030. The demand for fire stopping materials is growing in the global market due to the increasing emphasis on fire safety regulations and building codes worldwide.

Key Market Trends & Insights

- North America dominated the global fire stopping materials market with the largest revenue share of 31.2% in 2024.

- The fire stopping materials market in the U.S. accounted for the largest revenue share in North America in 2024.

- Based on materials, the sealants segment led the market with the largest revenue share of 31.3% in 2024.

- Based on application, the electrical segment led the market with the largest revenue share of 47.2% in 2024..

- Based on end use, the commercial segment led the market with the largest revenue share of 51.1% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.5 Billion

- 2030 Projected Market Size: USD 2.35 Billion

- CAGR (2025-2030): 8.1%

- North America: Largest market in 2024

Governments and regulatory authorities are continually tightening safety standards in response to rising fire incidents, particularly in densely populated urban areas. These materials, designed to prevent the spread of flames, smoke, and toxic gases through openings and penetrations in walls, floors, and ceilings, are essential for ensuring the integrity of fire-resistance-rated structures. This regulatory push has heightened the adoption of fire-stopping solutions in both new construction and retrofit projects, driving market growth.

Another significant factor contributing to the growing demand is the rapid pace of urbanization and infrastructure development. As global populations shift toward urban centers, the construction of residential buildings, commercial complexes, and industrial facilities has surged. With this growth comes the need for stringent fire safety measures to protect lives and assets. In addition, the rise in green building initiatives and the construction of high-rise buildings necessitate the use of advanced fire-stopping technologies, as these structures are particularly vulnerable to fire spread due to their design complexities.

The increasing awareness of fire hazards among industries and property owners has also played a key role in driving demand. Organizations across sectors such as oil and gas, manufacturing, and healthcare are recognizing the critical importance of fire-stopping materials in mitigating risks and ensuring business continuity. The growing emphasis on liability management and risk reduction has led businesses to invest heavily in fire-resistant systems, further boosting the market.

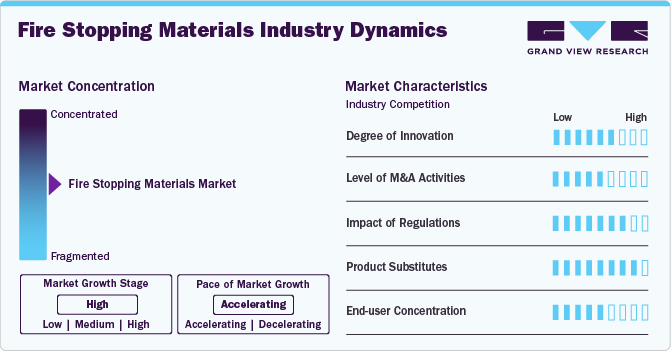

Market Concentration & Characteristics

Market growth stage is high, and pace is accelerating. The fire-stopping materials industry is characterized by its dynamic growth trajectory, driven by diverse end-user applications and increasing global demand for enhanced fire safety measures. It is a fragmented yet highly competitive industry with a mix of global and regional players offering specialized products.

Products are developed to meet stringent fire safety standards such as ASTM, UL, and EN, making certification and testing a critical part of the competitive landscape. The industry is also seeing an increase in demand for sustainable and non-toxic fire-stopping solutions, aligning with the global push toward environmentally friendly construction practices.

The fire-stopping materials industry is marked by intense competition among established players, mid-sized companies, and niche manufacturers. Major players dominate the global market due to their extensive product portfolios, global distribution networks, and strong R&D capabilities. These companies leverage advanced technology and economies of scale to maintain their competitive edge, offering comprehensive solutions for both new constructions and retrofitting projects.

Furhermore, advancements in fire-stopping materials, such as the development of eco-friendly, cost-effective, and high-performance solutions, are fueling their adoption. Innovations in materials, including intumescent coatings, fire-resistant sealants, and firestop collars, have enhanced the efficiency and versatility of these products. With ongoing research and development efforts, manufacturers are introducing solutions tailored to meet the diverse needs of end-users, ensuring sustained growth in the global market.

Material Insights

Based on materials, the sealants segment led the market with the largest revenue share of 31.3% in 2024. Fire stopping sealants are specialized materials, which are used to seal joints, gaps, and penetrations in buildings to prevent the spread of fire, smoke, and toxic gases. These are mainly made from fire-resistant materials, such as silicone, acrylic, or intumescent compounds. These sealants are applied to openings in fire-rated walls, floors, and ceilings to maintain the integrity of fire barriers and compartments.

Fire stopping putty is a pliable material, which is used to seal small openings and gaps in fire-rated walls, floors, and ceilings. It is designed to provide a flexible barrier against the spread of fire, smoke, and toxic gases. Fire stopping putty remains flexible even after application, allowing it to conform to irregular shapes and surfaces. This flexibility helps ensure a tight seal around penetrations, such as cables, pipes, and conduits, preventing the passage of flames and hot gases.

Application Insights

Based on application, the electrical segment led the market with the largest revenue share of 47.2% in 2024 and is expected to grow at a rapid CAGR from 2025 to 2030. Fire stopping materials play a critical role in electrical applications by providing passive fire protection to electrical installations, equipment, and wiring. One of the primary advantages of fire stopping materials in electrical applications is their ability to prevent the spread of fire. Electrical fires can start due to various factors, such as short circuits, overloaded circuits, or faulty equipment. Materials, such as sealants, putties, and wraps, create a barrier around electrical penetrants, preventing the spread of flames, smoke, and heat to other areas of the building.

Mechanical systems, including HVAC (heating, ventilation, and air conditioning) duct systems, are critical for maintaining occupant comfort and safety in buildings. Fire-stopping materials create a barrier around mechanical penetrations, such as ducts and vents, preventing the spread of fire and smoke to other parts of the building. Fire-stopping materials provide an additional layer of fire protection against mechanical penetrations, complementing other fire safety measures, such as fire-rated walls, doors, and dampers. By sealing gaps and voids around penetrations, these materials help maintain the fire resistance rating of building assemblies and prevent the spread of fire through concealed spaces.

End Use Insights

Based on end use, the commercial segment led the market with the largest revenue share of 51.1% in 2024, and is expected to grow at a rapid CAGR from 2025 to 2030. Commercial buildings often house a diverse range of occupants, including employees, customers, and visitors, making fire safety a paramount concern. The potential for fire hazards in commercial settings, such as electrical faults, combustible materials, and heating systems, is higher compared to residential buildings, due to the larger scale and complexity of commercial operations. As a result, there is a growing recognition among building developers and regulatory authorities regarding the need to implement robust fire protection measures in commercial buildings.

On the other hand, industrial buildings often house high-risk activities and processes that increase the likelihood of fire incidents. These activities may include manufacturing, storage of flammable materials, chemical processing, and machinery operation. As a result, industrial buildings are particularly susceptible to fire hazards, making fire safety a top priority for facility managers and operators.

Regional Insights

North America dominated the global fire stopping materials market with the largest revenue share of 31.2% in 2024. This is attributed to the increasing number of large-scale infrastructure projects, including data centers, commercial complexes, and public facilities. The region’s advanced construction sector is placing greater emphasis on fire-resistant solutions to meet stringent safety requirements. Furthermore, the push toward retrofitting older buildings to align with modern fire safety codes is creating a sustained demand for innovative and compliant fire-stopping materials.

U.S. Fire Stopping Materials Market Trends

The fire stopping materials market in the U.S. accounted for the largest revenue share in North America in 2024. The USA stands out as the primary driver of demand within North America, fueled by urbanization and a surge in multi-family housing and mixed-use developments. In addition, rising awareness of wildfire hazards in regions like California has led to the adoption of advanced fire-resistant technologies in residential and commercial buildings. Federal and state-level incentives for disaster-resilient infrastructure have further propelled the market for fire-stopping solutions.

Asia Pacific Fire Stopping Materials Market Trends

The fire stopping materials market in Asia-Pacific is experiencing a surge in demand for fire-stopping materials due to rapid urbanization and infrastructure development across emerging economies. The region’s booming construction industry, particularly in high-rise residential and commercial buildings, is a key driver. In addition, governments in countries like India and Vietnam are increasingly adopting stricter fire safety regulations, further accelerating market growth.

The China fire stopping materials market is anticipated to grow at the fastest CAGR during the forecast period. China’s construction boom, driven by its massive urbanization initiatives and industrial expansion, has created substantial demand for fire-stopping materials. The country’s growing focus on fire safety in megaprojects, such as smart cities and transportation hubs, has further intensified this trend. In addition, stricter enforcement of local fire safety standards is pushing builders to adopt advanced fire-stopping solutions.

Europe Fire Stopping Materials Market Trends

The fire stopping materials market in Europe is anticipated to grow at the fastest CAGR during the forecast period. The growing adoption of fire-stopping materials is linked to the region's commitment to achieving net-zero emissions and sustainability goals. Green building certifications, such as BREEAM and LEED, require the use of fire-resistant materials, driving the market growth. In addition, the refurbishment of heritage buildings to meet updated fire safety codes is fueling the demand for adaptable fire-stopping solutions.

The Germany fire stopping materials market accounted for the largest revenue share in Europe in 2024. The focus on industrial fire safety in sectors such as automotive, manufacturing, and logistics is a significant growth driver. The stringent enforcement of national fire safety standards, coupled with the country’s high adoption of prefabricated building techniques, has increased the use of specialized fire-stopping materials. Moreover, Germany’s leadership in research and development is encouraging innovation in fire protection technologies.

Central & South America Fire Stopping Materials Market Trends

The fire stopping materials market in Central and South America is anticipated to grow at a significant CAGR during the forecast period. The growing demand for fire-stopping materials is driven by expanding urban infrastructure projects and a rising middle class investing in safer residential buildings. Countries like Brazil and Mexico are witnessing increased adoption due to government initiatives to improve fire safety in public spaces, including schools and hospitals. In addition, a growing awareness of fire hazards is driving private sector investment in fire-resistant technologies.

Middle East & Africa Fire Stopping Materials Market Trends

The fire stopping materials market in the Middle East and Africa is experiencing growth in fire-stopping materials due to the rapid development of high-rise buildings, luxury hotels, and large-scale infrastructure projects, particularly in countries like the UAE and Saudi Arabia. The rising focus on ensuring fire safety in oil and gas facilities is also a major driver. In Africa, the growth of urban centers and the increasing enforcement of fire safety regulations are pushing developers to incorporate fire-stopping materials into new construction projects

Key Fire Stopping Materials Company Insights

Some key companies in the global market include Hilti Corporation, 3M, BASF SE, RectorSeal, Sika AG, Specified Technologies, Inc., Etex Group, Morgan Advanced Materials, Knauf Insulation, and RPM International Inc. Vendors in the market are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

-

Hilti Corporation was founded in 1941 and is headquartered in Liechtenstein. This company operates through its fourteen divisions, including, Anchor systems, Construction chemicals, Cordless systems, Cutting, sawing and grinding, Diamond corning and cutting, Direct fastening, Drilling and demolition, Firestop, Accessories, Modular support systems, Measuring systems, Screw fastening and Façade systems.

-

Knauf Insulation was founded in 1978, and is headquartered in Indiana, U.S. It operates as a subsidiary of Gebr. Knauf KG. It is engaged in the production and distribution of building & construction materials for customers in Australia, Africa, Asia, the Russian Federation, South America, the U.S., and European countries. The company operates in over 40 countries across the globe, with 28 production facilities in 15 different countries.

Key Fire Stopping Materials Companies:

The following are the leading companies in the fire stopping materials market. These companies collectively hold the largest market share and dictate industry trends.

- Hilti Corporation

- 3M

- BASF SE

- RECTORSEAL CORPORATION

- Sika AG

- Specified Technologies, Inc

- Etex Group

- Morgan Advanced Materials

- Knauf Insulation

- RPM International Inc.

Recent Developments

-

In July 2022, BASF and THOR GmbH announced their collaboration by combining their expertise in non-halogenated flame retardant additives to bring solutions that are expected to enhance the sustainability and performance of specific plastic compounds, as well as meet stringent fire safety requirements.

-

In September 2020, Etex Group announced the acquisition of FSi Limited, a British company that specializes in passive fire protection solutions to strengthen its position in the market.

Fire Stopping Materials Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.59 billion

Revenue forecast in 2030

USD 2.35 billion

Growth rate

CAGR of 8.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan

Key companies profiled

Hilti Corporation; 3M; BASF SE; RectorSeal ; Sika AG; Specified Technologies, Inc.; Etex Group; Morgan Advanced Materials; Knauf Insulation and RPM International Inc..

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fire Stopping Materials Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global fire stopping materials market report based on material, application, end use and region:

-

Material Outlook (USD Million, 2018 - 2030)

-

Sealants

-

Coatings

-

Mortars

-

Putty

-

Boards

-

Others

-

-

Application Outlook (USD Million, 2018 - 2030)

-

Electrical

-

Mechanical

-

Plumbing

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global fire stopping materials market size was estimated at USD 1.48 billion in 2024 and is expected to reach USD 1.59 billion in 2025.

b. The global fire stopping materials market is expected to grow at a compound annual growth rate of 8.1% from 2025 to 2030 to reach USD 2.35 billion by 2030.

b. Based on application type, electrical segment dominated the global fire stopping materials market in 2024 by accounting for a revenue share of 47.2% of the market in the same year. Electrical equipment and wiring can be sources of ignition owing to short circuits, overloads, or equipment malfunctions that can result in fire hazards. Hence, fire stopping materials are largely used in electrical applications type to reduce the risk of fire, thereby ensuring the safety of buildings and their occupants.

b. Key players operating in the market are Hilti Corporation, 3M, Etex Group, and BASF SE.

b. The key factors that are driving the fire stopping materials include the flourishing construction industry in emerging economies across the world. Moreover, the rising awareness regarding fire stopping materials among the end-users and the increasing fire safety regulations worldwide are further driving the growth of the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.