- Home

- »

- Next Generation Technologies

- »

-

Firefighting Drone Market Size & Share, Industry Report 2033GVR Report cover

![Firefighting Drone Market Size, Share & Trends Report]()

Firefighting Drone Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Fixed Wing Drones, Rotary Wing Drones, Hybrid Drones), By Size (Micro, Macro), By Payload Capacity, By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-723-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Firefighting Drone Market Summary

The global firefighting drone market size was estimated at USD 1,206.9 million in 2024 and is projected to reach USD 2,783.8 million by 2033, growing at a CAGR of 9.8% from 2025 to 2033. The rising need for enhanced situational awareness and real-time data during firefighting operations primarily drives the market growth.

Key Market Trends & Insights

- North America dominated the global firefighting drone market with the largest revenue share of over 37% in 2024.

- The firefighting drone market in the U.S led the North America market and held the largest revenue share in 2024.

- By type, the rotary wing drones segment led the market and held the largest revenue share of over 63% in 2024.

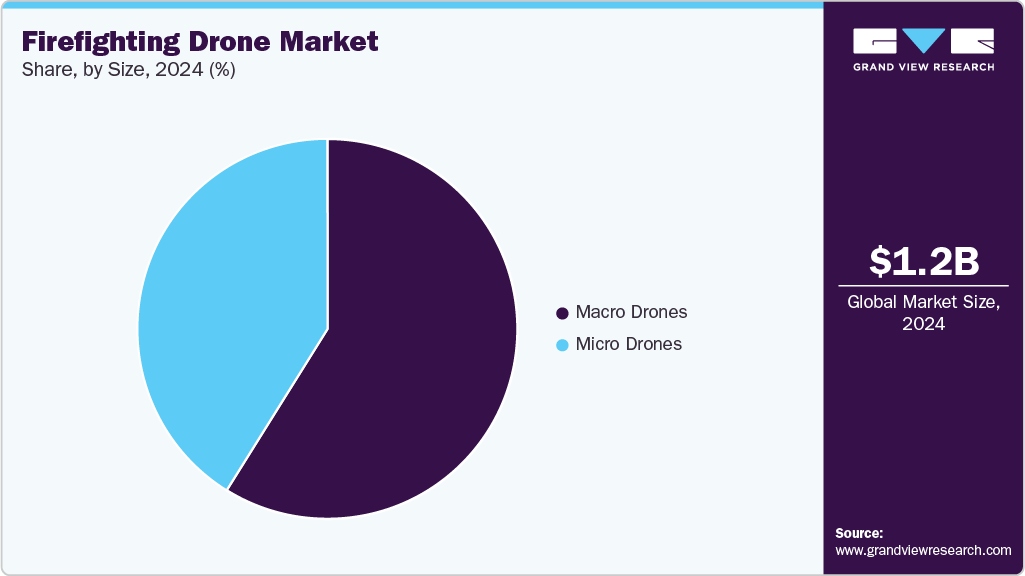

- By size, the macro drones segment led the market and held the largest revenue share of over 58% in 2024.

- By payload capacity, the 10-20 kg segment dominates the market and holds the largest revenue share of over 46% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1,206.9 Million

- 2033 Projected Market Size: USD 2,783.8 Million

- CAGR (2025-2033): 9.8%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The market growth is primarily driven by the increasing demand for advanced aerial firefighting solutions capable of accessing hazardous or hard-to-reach areas. The rising frequency of wildfires, industrial fires, and urban fire incidents is prompting government agencies to adopt drone-based firefighting systems. The emphasis on minimizing firefighter risk and reducing operational costs encourages using unmanned aerial vehicles equipped with thermal imaging, real-time video streaming, and payload delivery systems for extinguishing agents. Ongoing innovations in heavy-lift drones, extended battery life, and modular payload systems are improving operational versatility and cost-effectiveness, which is expected to drive the firefighting drone industry expansion.

The rising need for rapid emergency response and enhanced operational safety is significantly fueling the growth of the firefighting drone industry. Drones offer real-time situational awareness, high-resolution imaging, and thermal sensing capabilities, enabling firefighters to assess fire intensity, map spread patterns, and identify trapped victims before committing ground crews. This capability reduces response time, minimizes human risk, and enhances firefighting efficiency, accelerating market adoption.

In addition, the growing incidence of wildfires worldwide is becoming a major growth driver for the market. Climate change has led to longer fire seasons and increased frequency of large-scale forest fires, prompting government agencies and environmental organizations to invest in advanced aerial firefighting solutions. Firefighting drones equipped with infrared cameras, smoke-penetrating sensors, and autonomous navigation systems can operate in hazardous conditions where manned aircraft may be too risky. The ability to deliver fire retardants with precise mapping data positions drones as an indispensable tool in combating wildfires and preserving natural ecosystems.

Furthermore, advancements in payload capacity and firefighting technology are creating robust demand for firefighting drones. Integrating AI-powered target recognition allows drones to identify hotspots and deploy extinguishing agents with pinpoint accuracy automatically. These capabilities are particularly valuable for high-rise fires, oil refinery incidents, and hazardous chemical facility emergencies, where direct human intervention is dangerous and time sensitive.

Moreover, rising investments in smart city infrastructure and disaster management systems enhance the adoption of firefighting drones. Companies increasingly incorporate drone-based emergency response units into their urban safety plans, enabling rapid aerial assessment during building fires, traffic accidents, or hazardous material spills. Integrating cloud-based data platforms and AI-driven predictive fire risk mapping allows drones to work seamlessly. These technological and infrastructural advancements improve firefighting outcomes and ensure long-term cost efficiency and scalability, further propelling market growth.

Type Insights

The rotary wing drones segment dominated the market with a market share of over 63% in 2024, driven by their superior maneuverability and ability to hover in place. Their vertical take-off and landing (VTOL) capability allows deployment from narrow spaces, enabling rapid response in high-rise building fires and industrial accidents. The growing adoption of rotary wing drones in wildfire management, where they assist in perimeter mapping, hotspot detection, and guiding ground crews, continues to expand their application scope and reinforces the segment’s momentum in the firefighting drone industry.

The fixed wing Drones segment is expected to witness the highest CAGR of over 11% from 2025 to 2033. This growth is attributed to the increasing need for long-endurance aerial surveillance, particularly in wildfire-prone regions. The segment is further driven by the rising adoption of advanced fire detection systems in national parks, forest reserves, and rural-urban interface zones where extended flight time and range are critical. Innovations such as hybrid propulsion for longer missions and real-time high-resolution mapping enhance operational efficiency and accuracy, contributing to the segment’s rapid adoption in the market.

Payload Capacity Insights

The 10-20 kg segment accounted for the largest market share in 2024, owing to the rising demand for mid-capacity firefighting drones that offer an optimal balance between payload capability and operational agility. The segment’s growth is further supported by advancements in lightweight composite materials, high-efficiency propulsion systems, and modular payload bays that allow quick swapping between firefighting tools and thermal imaging equipment. This combination of performance and cost-effectiveness continues to dominate this segment in the firefighting drone industry.

The >20 kg segment is expected to witness a significant CAGR from 2025 to 2033. This growth is driven by the rising demand for heavy-payload firefighting drones capable of carrying substantial volumes of fire suppressant materials. The ability of >20 kg drones to transport thermal imaging systems and multi-sensor payloads simultaneously enhances situational awareness. These high-capacity systems are gaining traction in hazardous material firefighting, where robust payload capabilities enable the transport of rescue kits and communication tools, further propelling the segment’s expansion in the market.

Application Insights

The scene monitoring segment accounted for the largest market share in 2024, driven by the increasing emphasis on real-time situational awareness and incident assessment. This growth is also driven by the rising adoption of drones equipped with high-resolution optical cameras and LiDAR systems, which enable first responders to accurately map fire perimeters and assess structural integrity from a safe distance. The growing frequency of large-scale wildfires, industrial accidents, and urban high-rise fires reinforces the dominance of scene monitoring in the market.

The post-fire/disaster assessment segment is expected to witness the highest CAGR from 2025 to 2033. The increasing frequency of industrial accidents and urban fires drives this growth. Emergency response agencies prioritize drones equipped with high-resolution imaging, LiDAR mapping, and thermal sensing capabilities to quickly assess structural integrity and detect residual hotspots for recovery planning. Integrating AI-powered image analysis enhances the speed, accuracy, and accessibility of assessment data, reinforcing the segment’s leadership in the firefighting drone industry.

End Use Insights

The fire departments segment accounted for the largest market share in 2024, primarily driven by their critical role in emergency response, established operational networks, and specialized expertise in fire suppression. Equipped with advanced high-resolution video systems and AI-powered analytics, firefighting drones used by fire departments provide unmatched situational awareness. The combination of mission-critical reliability, rapid deployment capabilities, and integration with established firefighting protocols reinforces the dominance of the fire departments segment in the firefighting drone industry.

The emergency services segment is expected to witness the highest CAGR from 2025 to 2033. The growth is fueled by the increasing frequency of fire incidents and the growing complexity of industrial and infrastructure environments that require rapid and specialized response. Advancements in firefighting equipment technology have significantly improved operational efficiency and responder safety. Rising investments in modernizing fire stations, expanding rapid intervention units, and integrating smart communication networks into emergency operations further accelerate the segment’s expansion.

Size Insights

The macro drones segment accounted for the largest market share in 2024, owing to the rising preference for high-payload and long-endurance aerial platforms capable of carrying substantial firefighting equipment. These macro drones offer enhanced operational range, stability in adverse weather conditions, and the ability to operate in large-scale incidents. Government investments in upgrading emergency response infrastructure and integrating swarm coordination technologies are prompting end-users to prioritize macro drone solutions, reinforcing the segment’s dominance in the market.

The micro drones segment is expected to witness a significant CAGR from 2025 to 2033. The increasing need for rapid situational assessment and access to confined or hazardous spaces during firefighting operations drives this growth. With high-resolution cameras and real-time data transmission capabilities, micro drones can navigate tight indoor environments, high-rise structures, and collapsed buildings where larger UAVs cannot operate effectively. Integrating autonomous navigation, obstacle avoidance, and live video analytics enhances safety, enables faster decision-making, and reduces risks for frontline firefighters, thereby solidifying the micro drones' leadership in the firefighting drone industry.

Regional Insights

The North America firefighting drone market accounted for the largest market share of over 37% in 2024, primarily driven by the increasing frequency of wildfires, which is prompting extensive adoption of advanced aerial firefighting technologies. The presence of leading drone manufacturers and early adoption of AI-driven imaging, thermal sensing, and autonomous navigation systems enhances operational efficiency. The growing use of firefighting drones in industrial safety applications, such as oil refineries, chemical plants, and high-rise building inspections, further supports market growth in North America.

U.S. Firefighting Drone Market Trends

The firefighting drone market in the U.S. is expected to grow at a CAGR of over 8% from 2025 to 2033. The increasing frequency and severity of wildfires in states like California, Arizona, and Colorado, fueled by prolonged droughts, rising temperatures, and changing climate patterns, is significantly driving demand for advanced aerial firefighting solutions. This growing integration of drone technology into wildfire management strategies is enhancing response times, improving safety for firefighting personnel, and strengthening the overall growth of the firefighting drone industry in the country.

Europe Firefighting Drone Market Trends

The firefighting drone market in Europe is expected to grow at a CAGR of over 9% from 2025 to 2033. In Europe, the market is driven by increasing investment in advanced emergency response systems and the EU’s emphasis on integrating unmanned aerial vehicles into public safety frameworks. Government initiatives to modernize firefighting fleets and enhance disaster preparedness encourage the adoption of drones equipped with thermal imaging, high-definition cameras, and autonomous navigation systems. With strong governmental support for technological innovation and sustainable public safety solutions, the firefighting drone industry in Europe continues to gain momentum.

The UK firefighting drone market is expected to grow significantly in the coming years. The country’s dense urban landscapes and a high concentration of high-rise buildings drive the need for advanced firefighting drone solutions. Increasing concerns over wildfire risks in rural and forested regions, particularly during prolonged dry spells linked to climate change, are prompting government agencies and local fire brigades to invest in drone-based fire detection and suppression systems. The rising demand for cost-efficient, quick-response firefighting tools is creating a favorable environment for market expansion in the UK.

The firefighting drone market in Germany is fueled by the country’s advanced emergency response infrastructure and growing emphasis on integrating innovative technologies into disaster management. Germany’s commitment to modernizing fire services through digitalization and automation has accelerated the adoption of drones equipped with thermal imaging and AI-assisted navigation for rapid incident assessment. Rising concerns over industrial fire hazards in manufacturing, chemical processing, and logistics sectors have further boosted demand for the firefighting drone industry.

Asia Pacific Firefighting Drone Market Trends

The firefighting drone market in the Asia Pacific is expected to grow at the highest CAGR of over 12% from 2025 to 2033, fueled by rapid urbanization, rising high-rise infrastructure, and increasing fire safety concerns across densely populated cities. Countries in the region are witnessing a surge in industrial facilities and urban residential projects, driving demand for advanced aerial firefighting solutions. Increasing collaborations between global drone manufacturers and regional technology firms and supportive policies for integrating UAVs into emergency services reinforce the region’s leadership in the firefighting drone industry.

Japan firefighting drone marketis gaining traction, fueled by the country’s advanced disaster management infrastructure and strong government emphasis on public safety. Japan’s high population density and high prevalence of high-rise buildings have created a strong need for agile and precise aerial firefighting solutions. The government’s proactive stance on integrating robotics and automation into emergency services, supported by national initiatives for smart city development, is accelerating drone adoption and strengthening the market’s growth trajectory across the country.

The firefighting drone market in China is rapidly expanding. China's rising urban density and increased high-rise residential and commercial buildings are driving demand for advanced firefighting drone solutions. Frequent industrial accidents and warehouse fires in China’s manufacturing hubs are prompting authorities to adopt drones equipped with thermal imaging and real-time data transmission to improve emergency response efficiency. Rapid advancements in domestic drone manufacturing, competitive pricing, and localized innovation enable Chinese companies to produce specialized firefighting drones tailored to industrial needs, propelling the market’s growth.

Key Firefighting Drone Company Insights

Some key players operating in the market include DJI and Lockheed Martin Corporation.

-

DJI is a top player in the market, leveraging its advanced drone engineering capabilities and global manufacturing dominance. DJI’s firefighting drones are equipped with thermal imaging and payload systems for fire suppression. DJI has solidified its leadership in the firefighting drone industry through strong R&D investments, strategic partnerships, and advancements in real-time data streaming and incident command system integration.

-

Lockheed Martin Corporation is a top player specializing in defense and aerospace solutions. Through its rugged and mission-ready UAV platforms, it has a significant footprint in the firefighting drone segment. Lockheed Martin’s expertise in advanced sensors, AI-enabled situational awareness, and interoperability with ground and air assets makes it a trusted provider for government, military, and emergency service agencies tackling large-scale fire incidents.

EHang and Draganfly Innovations Inc. are some of the emerging market participants.

-

EHang is an emerging player gaining recognition for its autonomous electric vertical takeoff and landing firefighting drones. Models like the EHang 216F are specifically engineered for high-rise urban firefighting, capable of carrying fire suppressant payloads, breaking windows, and delivering extinguishing agents directly to fire sources. EHang is rapidly deploying its technology in municipal firefighting fleets, carving out a leader in the urban market.

-

Draganfly Innovations Inc. is an emerging player focused on versatile UAV solutions for firefighting, search and rescue, and disaster response. Its platforms have LiDAR and modular payload systems for delivering fire retardants or emergency equipment to critical locations. Draganfly is expanding its presence among municipal fire departments, industrial safety units, and international emergency services, solidifying its position as a fast-growing force in the global firefighting drone industry.

Key Firefighting Drone Companies:

The following are the leading companies in the firefighting drone market. These companies collectively hold the largest market share and dictate industry trends.

- DJI

- Lockheed Martin Corporation.

- AeroVironment, Inc.

- EHang

- Draganfly Innovations Inc.

- Skydio, Inc.

- Parrot Drones SAS.

- Elbit Systems Ltd.

- Yuneec International

- FLIR Systems, Inc.

- Microdrones GmbH

- L3Harris Technologies, Inc.

Recent Developments

-

In May 2025, DJI drones deployed the Firefighters drone to enhance wildfire response efforts, utilizing advanced thermal imaging and real-time mapping technology. This strategic adoption strengthens emergency response efficiency and safety, reinforcing DJI’s competitive position in the global market.

-

In May 2025, Lockheed Martin Corporation conducted California's first-ever live-fire autonomous wildfire suppression tests. Using an optionally piloted Black Hawk controlled via a Rain tablet, they demonstrated real-time flight path adjustments and autonomous water drops even under wind conditions up to 30 knots, marking a major leap in the firefighting drone industry.

-

In February 2025, L3Harris Technologies, Inc. unveiled Amorphous, a software platform designed to command and coordinate large autonomous drones across multiple domains. In the market, this technology could enable the simultaneous deployment of dozens of drones for wildfire suppression, hotspot detection, and targeted suppressant delivery. Multiple unmanned systems to operate collaboratively with minimal human intervention, Amorphous has the potential to significantly enhance the speed and efficiency of large-scale aerial firefighting operations.

Firefighting Drone Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,315.2 million

Revenue forecast in 2033

USD 2,783.8 million

Growth rate

CAGR of 9.8% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, size, payload capacity, application, end use, region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; Saudi Arabia; UAE; South Africa

Key companies profiled

DJI; Lockheed Martin Corporation; AeroVironment, Inc.; Ehang; Draganfly Innovations Inc.; Skydio, Inc.; Parrot Drones SAS.; Elbit Systems Ltd.; Yuneec International; FLIR Systems, Inc.; Microdrones GmbH; L3Harris Technologies, Inc.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Firefighting Drone Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technological trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the firefighting drone market report based on type, size, payload capacity, application, end use, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Fixed Wing Drones

-

Rotary Wing Drones

-

Hybrid Drones

-

-

Size Outlook (Revenue, USD Million, 2021 - 2033)

-

Micro Drones

-

Macro Drones

-

-

Payload Capacity Outlook (Revenue, USD Million, 2021 - 2033)

-

Less than 10 kg

-

10-20 kg

-

More than 20 kg

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Scene Monitoring

-

Search and Rescue

-

Post Fire or Disaster Assessment

-

Firefighting

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Fire Departments

-

Emergency Services

-

Industrial Enterprises

-

Forestry Departments

-

Military and Defense

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global firefighting drone market was estimated at USD 1,206.9 million in 2024 and is expected to reach USD 1,315.2 million in 2025.

b. The global firefighting drone market is expected to grow at a compound annual growth rate of 9.8% from 2025 to 2033 to reach USD 2,783.8 million by 2033.

b. The North America firefighting drone market accounted for the largest market share of over 37% in 2024, primarily driven by the increasing frequency of wildfires, which is prompting extensive adoption of advanced aerial firefighting technologies. The presence of leading drone manufacturers and early adoption of AI-driven imaging, thermal sensing, and autonomous navigation systems enhances operational efficiency. The growing use of firefighting drones in industrial safety applications, such as oil refineries, chemical plants, and high-rise building inspections, further supports market growth in North America.

b. The key players in the firefighting drone market are DJI, Lockheed Martin Corporation, AeroVironment, Inc., EHang, Draganfly Innovations Inc., Skydio, Inc., Parrot Drones SAS., Elbit Systems Ltd., Yuneec International, FLIR Systems, Inc., Microdrones GmbH, L3Harris Technologies, Inc.

b. Key drivers of the firefighting drone market include the rising need for enhanced situational awareness and real-time data during firefighting operations. The growing preference for unmanned aerial systems to monitor wildfire spread and assess structural damage is expected to drive the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.