- Home

- »

- Next Generation Technologies

- »

-

Disaster Preparedness System Market Size Report, 2030GVR Report cover

![Disaster Preparedness System Market Size, Share & Trends Report]()

Disaster Preparedness System Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Surveillance System, Safety Management System), By Solution, By Services, By Communication Technology, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-462-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Disaster Preparedness System Market Summary

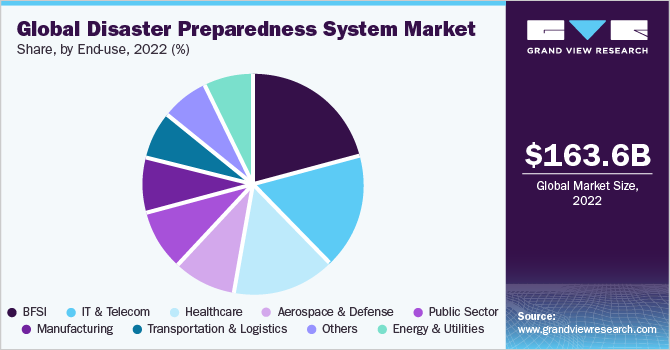

The global disaster preparedness system market size was estimated at USD 163.60 billion in 2022 and is projected to reach USD 308.01 billion by 2030, growing at a CAGR of 8.5% from 2023 to 2030. The growth can be attributed to the increasing frequency and intensity of natural disasters, such as hurricanes, floods, wildfires, and earthquakes, globally.

Key Market Trends & Insights

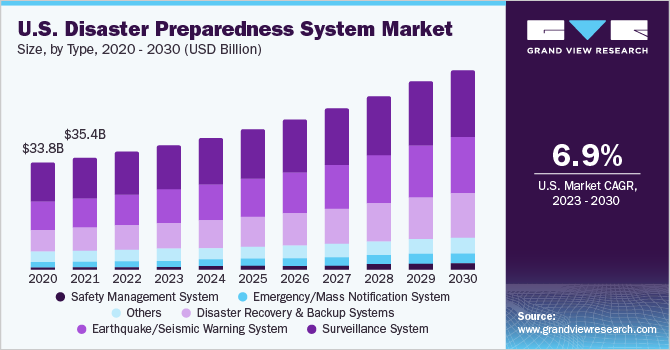

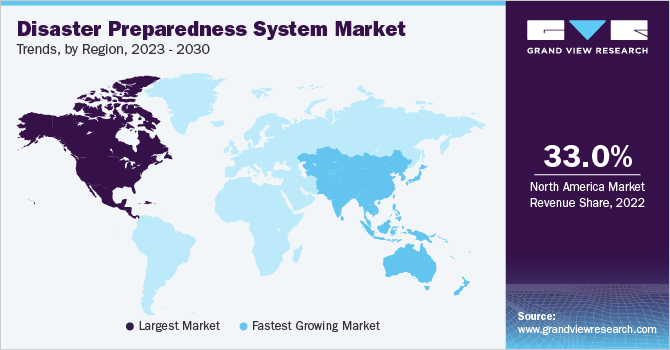

- The North America region dominated the market in 2022 with a revenue share of over 33.0%.

- By type, the surveillance system segment dominated the market with a revenue share of more than 35.0% in 2022.

- By solution, the disaster recovery solutions segment dominated the disaster preparedness system market in 2022.

- By service, the consulting services segment dominated the market with a revenue share of more than 39.0% in 2022.

- By end use, the BFSI segment dominated the market in 2022 with a revenue share of more than 20.0%.

Market Size & Forecast

- 2022 Market Size: USD 163.60 Billion

- 2030 Projected Market Size: USD 308.01 Billion

- CAGR (2023-2030): 8.5%

- North America: Largest market in 2022

These events have indicated the critical need for effective disaster preparedness and response mechanisms. Therefore, governments, organizations, and communities are increasingly investing in advanced technologies and systems to enhance their disaster preparedness capabilities.

Concurrently, the growing recognition of the importance of early warning systems and real-time situational awareness is also contributing to the market growth. Advancements in sensor technologies, satellite imagery, and data analytics have resulted in the development of sophisticated early warning systems that can provide timely alerts and insights, allowing for proactive disaster management.

Organizations worldwide are progressively researching, developing, and procuring safety management systems to cultivate a culture of security and minimize dangers for their representatives. A safety management system could be a comprehensive program that enables organizations to prioritize security and relieve dangers within the work environment. By utilizing such a system, organizations can successfully distinguish, assess, and oversee potential dangers, in this manner guaranteeing the security of both their workforce and the general population across all operations.

With the evolving safety standards for improving workplace safety, companies are coordinating towards executing safety management systems. Therefore, the request for these systems is anticipated to rise in the predictable future. The demand for these systems is expected to increase over the forecast period owing to capabilities such as the prevention of process failure and improvement of the long-term profitability of organizations.

The world is witnessing an alarming increase in the frequency of natural disasters. The frequency and intensity of events such as hurricanes, floods, wildfires, and earthquakes have increased in recent years. For instance, Swiss Re's latest Sigma report reveals that 2022 is the second consecutive year in which insured losses from natural catastrophes surpassed USD 100 billion.

This was evident in various significant events worldwide, including Hurricane Ian hitting Florida, unprecedented hailstorm losses in France, devastating floods in Australia and South Africa, severe winter storms in Europe and the U.S., and prolonged droughts impacting Europe, China, and the Americas. These occurrences reaffirm the ongoing trend of a consistent 5% - 7% average annual increase in insured losses over the past three decades.

Climate change is considered a significant contributing factor, as it results in shifts in weather patterns and amplifies the impact of natural hazards. The rising global temperatures have been linked to the intensification of storms and the melting of polar ice, resulting in higher sea levels and increased coastal flooding. The changes in precipitation patterns have caused prolonged droughts in some regions while causing heavy rainfall and flash floods in others.

In addition, deforestation and human activities in vulnerable areas have exacerbated the risk and consequences of natural disasters. The increasing occurrence of these events signifies the urgent need for comprehensive disaster preparedness and mitigation strategies at both the local and global levels.

The adoption of cloud-based solutions by enterprises has been on the rise, driven by the need to protect critical data and ensure its availability in the event of potential disasters. Cloud-based solutions offer numerous advantages over traditional on-premises infrastructure, including enhanced scalability, flexibility, and cost-effectiveness.

A key benefit of cloud computing is its inherent disaster recovery capabilities. By leveraging cloud services, enterprises can establish robust disaster recovery and backup systems that provide data redundancy and protection against various threats. Cloud-based disaster recovery solutions enable organizations to replicate and store their data and applications in geographically diverse data centers.

COVID-19 Impact Analysis

The disaster preparedness system has been positively impacted by the COVID-19 situation. The COVID-19 pandemic has brought into focus the criticality of resilient infrastructure and supply chains. Ensuring access to essential resources, such as medical supplies, personal protective equipment, and vaccines, has become a key component of disaster preparedness. The pandemic has underscored the importance of maintaining adequate stockpiles and establishing resilient supply chains to mitigate disruptions and respond effectively to public health crises.

Type Insights

The surveillance system segment dominated the market with a revenue share of more than 35.0% in 2022. Various factors, including the escalating occurrence of natural disasters, unpredictable climatic conditions, the prevalence of domestic violence, and government emphasis on safety policies, have prompted emergency management agencies to adopt and enhance surveillance systems in urban areas.

Deploying surveillance systems enables organizations to effectively identify potential risks and formulate appropriate action plans. In addition, IP-based video surveillance systems empower municipalities and organizations to remotely detect incidents such as flooding, fires, theft, or even acts of terrorism. These favorable circumstances collectively contribute to the growth of this segment.

The earthquake/seismic warning system segment is anticipated to register significant growth over the forecast period. The earthquake/seismic warning system is a monitoring system designed to detect seismic waves generated by earthquakes and issue alerts to the public regarding potential tremors. Researchers are also focusing on developing earthquake early warning systems to enhance their seismic warning capabilities.

For instance, in February 2023, Researchers at Dokuz Eylül University (DEÜ) developed earthquake early warning systems that would issue alerts before the earthquake hits. The Earthquake Early Warning Systems (DEUSİS) is currently undergoing testing, having been developed through extensive research conducted at Dokuz Eylül University’s Earthquake Research and Application Center (DAUM).

According to DAUM Director Hasan Sözbilir, the system is designed to provide early notifications before the actual perception of an earthquake, detecting the movement of fault lines. Depending on the proximity to the seismic source, the warning can be issued 10, 15, or 20 seconds in advance of the tremor's impact on the surface.

Solution Insights

The disaster recovery solutions segment dominated the disaster preparedness system market in 2022 with a revenue share of more than 40.0%. Organizations, regardless of their size, adopt disaster recovery solutions to swiftly recover their crucial data, hardware, and applications, essential for uninterrupted business operations.

Through the implementation of disaster recovery solutions, organizations and municipal authorities can effectively strategize and prepare for disruptive events such as floods, fires, power outages, and human-caused disasters. Cloud-based data recovery offerings have gained popularity among numerous organizations worldwide as they significantly reduce the substantial capital investment needed for infrastructure and the expenses associated with environmental management. These factors are anticipated to propel the growth of this segment.

The situational awareness solutions segment is anticipated to register the fastest CAGR of 8.7% over the forecast period. The increasing demand for surveillance and security systems to promptly identify issues, government prioritization of public safety during disasters, and the advancement of smart infrastructure are motivating organizations and emergency management agencies to embrace situational awareness solutions.

These solutions facilitate the real-time delivery of critical data to first responders, enabling faster and more efficient emergency responses. In addition, the growing recognition of situational awareness solutions for cybersecurity purposes is anticipated to further propel the growth of this segment throughout the forecast period.

Service Insights

The consulting services segment dominated the market with a revenue share of more than 39.0% in 2022. Consulting firms are moving away from traditional siloed approaches and adopting a broader perspective that considers multiple hazards, vulnerabilities, and interdependencies. This shift enables organizations to develop more robust and integrated disaster preparedness strategies that address a wide range of potential risks.

In addition, there is a growing emphasis on leveraging advanced technologies such as Artificial Intelligence (AI), Machine Learning (ML), and big data analytics in consulting services, further contributing to the growth of the segment. These technologies enable the analysis of vast amounts of data, the identification of patterns, and the generation of valuable insights for proactive decision-making.

The training & education services segment is anticipated to register a significant CAGR over the forecast period. The widespread adoption of disaster preparedness systems in organizations and municipalities has sparked a demand for professional services, specifically training and education services, catering to first responders, disaster response teams, and disaster management volunteers. These services involve immersive training scenarios that simulate real-time emergencies, enabling disaster response teams to enhance their preparedness and response capabilities.

In addition, organizations provide training for the utilization of simulation tools, such as hazard propagation simulation tools and incident and evacuation simulation tools. The implementation of these simulation tools within the training modules contributes to improving the response capabilities, preparedness levels, and property damage mitigation during emergencies. Therefore, these factors are projected to generate growth opportunities for the training and education services segment throughout the forecast period.

Communication Technology Insights

The emergency response radars segment held the largest revenue share of more than 29.0% in 2o022. Emergency response radars play a crucial role in detecting natural disasters and unfavorable weather conditions, enabling early warnings and aiding the preparedness of first responders and government organizations. These radars are instrumental in managing traffic during emergencies by providing real-time simulations of the current traffic situation and assisting in identifying evacuation routes to ensure smooth traffic flow.

In addition, radar technology detects surface displacements during earthquakes, facilitating the assessment of seismic activity. Furthermore, these radars have become indispensable tools for short-term weather forecasting, particularly in the case of natural disasters and severe weather events such as windstorms, thunderstorms, and tornadoes. The significance of these applications is anticipated to drive the growth of the emergency response radar segment.

The first responder tools segment is anticipated to register the fastest CAGR of 9.8% over the forecast period. The growth of the segment is being driven by increased utilization of first responder tools among various emergency response teams, such as fire departments, security personnel, medical teams, and police personnel. These tools encompass a range of technology devices that assist these teams and departments in providing prompt aid during emergencies. Specifically designed communication devices are used by first responders in disaster-stricken situations.

These devices include wearable technologies such as smartwatches, smart glasses, and wearable cameras, as well as GIS-based tools, Ultra High Frequency (UHF), Very High Frequency (VHF) radios, and land mobile radios. While radios remain the most commonly employed first responder tools during emergencies, smartphones, and smart devices are also witnessing growing adoption. Smartphones offer enhanced access to mapping, navigation, street views, and satellite views, providing valuable support to first responders.

End-use Insights

The BFSI segment dominated the market in 2022 with a revenue share of more than 20.0%. The increasing focus on business continuity and disaster recovery planning within the BFSI sector is a major factor contributing to the segment growth. With the criticality of their operations and the potential financial and reputational risks involved, banks, financial institutions, and insurance companies are investing in robust disaster preparedness systems to ensure uninterrupted service delivery during crises.

In addition, the increasing adoption of cloud-based solutions in the BFSI sector is also driving segment growth. Cloud-based disaster recovery and backup systems offer scalability, flexibility, and cost-efficiency, allowing BFSI organizations to store and retrieve critical data and applications seamlessly.

The healthcare segment is anticipated to register the fastest CAGR of 9.9% over the forecast period. Increasing recognition of the importance of healthcare infrastructure resilience and emergency response capabilities is contributing to the growth of the segment. Healthcare facilities, including hospitals, clinics, and medical centers, are focusing on implementing robust disaster preparedness systems to ensure the continuity of critical healthcare services during emergencies.

Moreover, the rising adoption of advanced technologies, such as telemedicine and remote patient monitoring, to enhance disaster response and patient care is also driving the segment’s growth. These technologies help healthcare providers to remotely assess and monitor patients, deliver virtual consultations, and manage healthcare services even amid a crisis.

Regional Insights

The North America region dominated the market in 2022 with a revenue share of over 33.0%. The U.S. holds a significant market share due to the government's heightened emphasis on developing and implementing intelligent emergency management and mitigation plans. These initiatives aim to minimize response time and mitigate damages resulting from both natural and man-made disasters. A comprehensive disaster preparedness system is vital in expediting emergency planning and facilitating the recovery process. The region's increasing frequency and cost of disasters, attributed to climate change, further underscores the necessity for robust disaster preparedness systems.

Asia Pacific is anticipated to witness the fastest CAGR of 9.9% over the forecast period. Increasing awareness and recognition of the vulnerability of the region to natural disasters such as earthquakes, typhoons, floods, and tsunamis are the major reason contributing to regional growth. Therefore, governments and organizations in the Asia Pacific region are investing in comprehensive disaster preparedness systems to enhance their resilience and response capabilities. In addition, the growing adoption of innovative technologies, including remote sensing, satellite imagery, and geospatial data analysis, to improve disaster risk assessment and early warning systems is further contributing to the growth of the segment.

Key Companies & Market Share Insights

The market exhibits a highly fragmented competitive landscape, with major players adopting diverse organic and inorganic strategies to enhance their market positions. These strategies include partnerships, product innovation, geographical expansion, and research and development efforts. Market leaders are actively engaged in forming strategic alliances, developing new and improved products, expanding their presence in different regions, and investing in research and development activities. Disaster recovery solutions providers are also focusing on launching disaster recovery portfolios for organizations to ensure continuity among business enterprises.

For instance, in March 2023, Huawei Technologies Co., Ltd., at the Mobile World Congress (MWC) 2023, launched a unified disaster recovery portfolio solution, leveraging the Storage & Optical Connection Coordination (SOCC) technology. This innovative solution integrates storage and optical transmission products, ensuring uninterrupted connectivity for critical enterprise operations. Its primary objective is to minimize data loss and prevent business disruptions during catastrophic events such as fires or earthquakes.

Numerous businesses operating in the market are actively forging alliances and collaborations with other industry participants. This collaborative approach enables them to leverage each other's expertise, capabilities, and resources, thereby offering more comprehensive and integrated solutions to their clients. Moreover, companies are increasingly expanding their regional presence to enter new markets and broaden their customer base. Through partnerships with local entities, investments in infrastructure, and targeted marketing efforts, these businesses aim to enhance their market reach and effectively address the specific disaster preparedness needs of different regions. Some prominent players in the global disaster preparedness system market include:

-

Honeywell International Inc.

-

Lockheed Martin

-

Motorola Solutions, Inc.

-

Siemens

-

NEC Corporation

-

IBM

-

Alertus Technologies LLC

-

OnSolve

-

Juvare, LLC

-

Singlewire Software, LLC.

Disaster Preparedness System Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 173.99 billion

Revenue forecast in 2030

USD 308.01 billion

Growth rate

CAGR of 8.5 % from 2023 to 2030

Base year of estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

August 2023

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share analysis, competitive landscape, growth factors, and trends

Segments covered

Type, solution, services, communication technology, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; China; India; Japan; Brazil

Key companies profiled

Honeywell International Inc.; Lockheed Martin; Motorola Solutions, Inc.; Siemens; NEC Corporation; IBM; Alertus Technologies LLC; OnSolve; Juvare, LLC; Singlewire Software, LLC.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Disaster Preparedness System Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global disaster preparedness system market report based on type, solution, services, communication technology, end-use, and region:

-

Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Emergency/Mass Notification System

-

Surveillance System

-

Safety Management System

-

Earthquake/Seismic Warning System

-

Disaster Recovery and Backup Systems

-

Others

-

-

Solution Outlook (Revenue, USD Billion, 2017 - 2030)

-

Geospatial Solutions

-

Disaster Recovery Solutions

-

Situational Awareness Solutions

-

-

Services Outlook (Revenue, USD Billion, 2017 - 2030)

-

Training & Education Services

-

Consulting Services

-

Design & Integration Services

-

Support & Maintenance Services

-

-

Communication Technology Outlook (Revenue, USD Billion, 2017 - 2030)

-

First Responder Tools

-

Satellite Phones

-

Emergency Response Radars

-

Vehicle-Ready Gateways

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2017 - 2030)

-

BFSI

-

Energy and Utilities

-

Aerospace and Defense

-

Manufacturing

-

IT and Telecom

-

Public Sector

-

Transportation and Logistics

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The disaster recovery solutions segment dominated the disaster preparedness systems market in 2022 and accounted for more than 39.0% share of the global revenue.

b. The consulting services segment dominated the disaster preparedness system market in 2022 and accounted for more than 39.0% share of the global revenue.

b. The emergency response radars segment dominated the disaster preparedness system market in 2022 and accounted for more than 29.0% share of the global revenue.

b. The BFSI segment dominated the disaster preparedness systems market in 2022 and accounted for more than a 20.0% share of the global revenue.

b. North America dominated the disaster preparedness system market in 2022 and accounted for over 33.0% share of global revenue.

b. The global disaster preparedness system market size was estimated at USD 163.60 billion in 2022 and is expected to reach USD 173.99 billion in 2023.

b. The global disaster preparedness system market is expected to grow at a compound annual growth rate of 8.5% from 2023 to 2030 to reach USD 308.01 billion by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.