- Home

- »

- Healthcare IT

- »

-

Fitness App Market Size, Share And Growth Report, 2030GVR Report cover

![Fitness App Market Size, Share & Trends Report]()

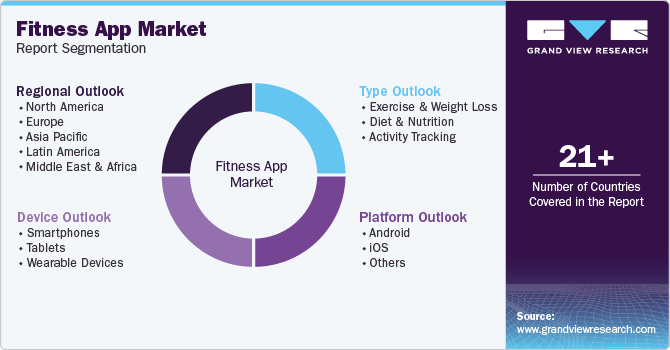

Fitness App Market Size, Share & Trends Analysis Report By Type (Exercise & Weight Loss, Diet & Nutrition, Activity Tracking), By Platform (Android, iOS, Others), By Device (Smartphones, Tablets), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-538-0

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Fitness App Market Size & Trends

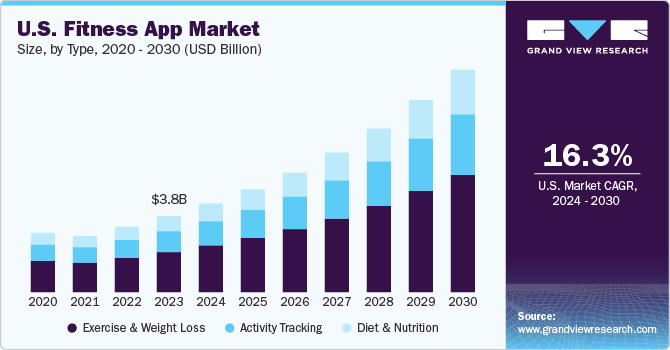

The global fitness app market size was valued at USD 9.25 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 14.08% from 2024 to 2030. COVID-19 pandemic resulted in nationwide lockdowns and subsequent adoption of social distancing measures. This shift facilitated a transition from conventional studios and gyms to virtual fitness. It has led to increased downloads and subscriptions of fitness apps. As per a report published by the American College of Sports Medicine (ACSM), it has been stated that fitness apps were ranked number 13 in the 2019 fitness trends. A tough competition has been witnessed between brick-and-mortar gyms against in-app fitness. For instance, an article published by the World Economic Forum in September 2020 stated that global downloads of health and fitness apps increased by 46.0% due to the rising trend of online fitness training, which is driving the market globally. Growing awareness of fitness and mental well-being further expands the market.

COVID-19 pandemic has led to an increase in awareness concerning health and hygiene. As per a World Economic Forum article published in September 2020, the Daily Active Users (DAUs) of fitness apps have increased by 24.0% in quarter two over quarter 1 in 2020. Moreover, expanding network of fitness studios and gyms through online platforms is further aiding the adoption of these apps. Owing to this, several consumers are investing in huge in-home fitness equipment, thus driving revenue growth. For instance, revenue from Peloton - a U.S.-based exercise equipment company, has been estimated to double in 2020.

In addition, virtual app vendors are focusing on introducing innovative solutions and expanding their geographical reach through various strategies such as product launches, partnerships, approvals, & collaborations. They offer free premium access to users amid pandemic, offering support in maintaining their health & fitness at home.

Fitness apps utilize machine learning, artificial intelligence, and other technologies to offer personalized fitness plans to their customers. They also offer personalized diet charts, no equipment workout routines, track footsteps, monitor diet, and provide personalized health and fitness coaches. Such offerings and advantages over brick-and-mortar are expected to increase the market's growth potential. For instance, HealthifyMe offers calorie tracking, nutrition guidance, and personalized diet plans to support healthy eating habits for its users. In addition, wearable technology is a growing and widely utilized technology by customers. Health and fitness apps exhibit the highest retention rates, as 96.0% of users utilize only one of these apps.

Another major factor aiding the market growth is increasing penetration of smartphones across the globe. For instance, the Mobile Economy Asia Pacific 2020, stated that the number of mobile subscribers is expected to reach 3.0 billion by 2025. Furthermore, the growing adoption of wearable devices, including Fitbit and Apple Watch, is driving market growth.

Several investment firms and capital ventures are investing in the fitness app industry. The effectiveness and adoption of these apps have led to increased investments in the fitness app sector. For instance, in March 2022, a startup established by alums of the University of York raised £250,000 through crowdfunding to develop their fitness app.

Additionally, in May 2019, Future Fitness announced that it had received USD 8.5 million in Series A funding led by Kleiner Perkins, an American venture capital firm. Other investors in company include Khosla Ventures, Caffeinated Capital, Founders Fund, and Instagram co-founder Mike Krieger. In addition, Fittr raised USD 2.0 million in April 2020. It, in turn, is expected to impact the market growth positively.

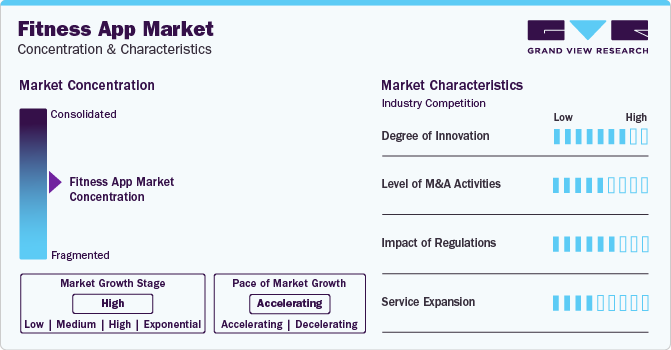

Market Concentration & Characteristics

The global fitness app market is characterized by high innovation, with new technologies and methods being developed and introduced regularly. It has become popular as individuals can track their daily activities and diet plans. As a result, market players are investing in innovative technologies and procedures to keep up with the demand.

Several market players such as MyFitnessPal, Inc., Adidas and FitnessKeeper are involved in merger and acquisition activities. Through M&A activity, these companies can expand their geographic reach and enter new territories.

Governments and companies invest in developing fitness apps. Some apps require regulatory approval from the U.S. FDA and respective government bodies. This may result in increasing the cost of developing new fitness apps.

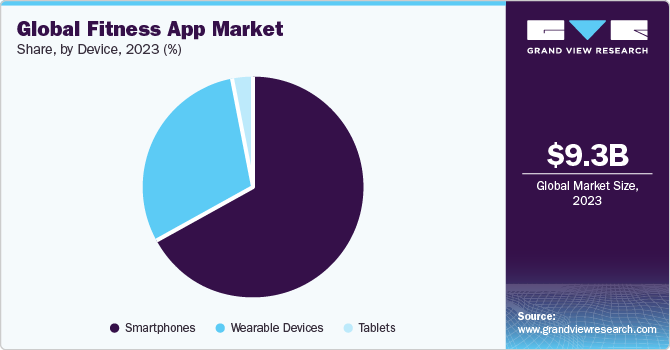

Device Insights

Smartphones accounted for the largest revenue share in 2023. An increase in penetration of smartphones globally is a key factor contributing to the segment's growth. In 2019, across the globe, adoption of smartphones was estimated at 65.0%, which is anticipated to increase to 75.0% by 2022. With the everchanging technology in fitness industry, most people are choosing to switch to their smartphones instead of going to gyms and fitness clubs to enhance their routine workouts. Accessing fitness platforms through smartphones allows them to save personal training fees and expensive fitness clubs/gyms training, thereby supporting the segment's growth.

Wearable is anticipated to register the fastest growth rate over the forecast period. For instance, according to data published by Pew Research Center in January 2020, around 21% of individuals in the U.S. use a wearable device such as fitness trackers and swartwatches in 2019. Adopting wearable devices, similar to most digital technologies, varies according to socioeconomic factors such as income, education, and occupation. The same study showed that 31% of individuals from the household income group of USD 75,000 or above per year use wearable fitness devices, which significantly drops to 12% of users from the household income group of USD 30,000 or less per year. High adoption of wearable devices by people in the U.S. is expected to drive the market over the forecast period.

Regional Insights

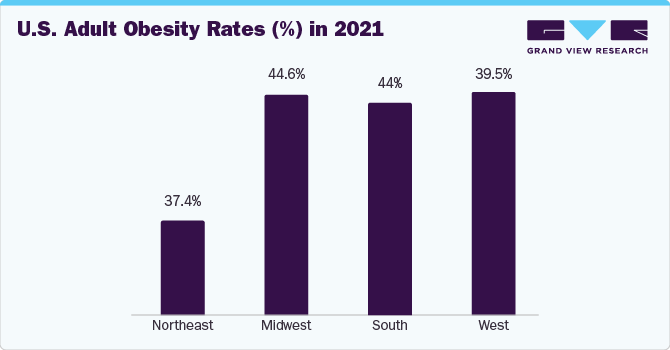

In 2023, North America accounted for the largest revenue share. Various factors, such as growth in coverage networks, rapid usage of smartphones, rise in prevalence of chronic diseases, and increase in geriatric population, are driving adoption of fitness apps in North America. The U.S. is the leading market for fitness applications across the globe. One of the major factors contributing to market growth is high adoption of mHealth in North America. Fitness app usage has been exaggerated during the COVID-19 pandemic as amid COVID-19-related lockdown, 74.0% of Americans have been witnessed using at least one fitness app, according to a survey conducted by Freeletics. Moreover, 60.0% of these consumers have planned to cancel their gym memberships.

In 2023, the U.S. accounted for North America's largest market share. Growing awareness about fitness & daily health monitoring has led to an increase in adoption of fitness apps and a significant rise in a number of new players in the region. Moreover, market is witnessing a rising number of partnerships between key players, thereby introducing superior-quality apps. For instance, in April 2019, Google partnered with Apple Inc. and launched the Google Fit app for the iOS platform. This platform offers fitness activity goals based on WHO and American Heart Association recommendations.

Asia Pacific is anticipated to be the most lucrative regional market during the forecast period owing to growing adoption of mHealth services and increasing penetration of smartphones & smart wearables. Increasing affordability is leading to the adoption of smartphones to access various fitness applications. Factors such as rising healthcare expenditure, increasing incidence of obesity, and growing number of athletes motivate governments and private organizations to develop new models for fitness regimes. For instance, in September 2020, according to an article published by the World Economic Forum, health and fitness app downloads grew by 157% in India, equaling fifty-eight million new app users.

Factors such as expansion of exercise gadgets, a substantial improvement in exercise investment, government efforts, increased health consciousness, and rise of health clubs are anticipated to propel the fitness app market in Japan. Moreover, the significant rise in smartphone penetration in Japan has played a crucial role in adopting health software among users.

Type Insights

Exercise and weight loss segment held the largest revenue share of 54.27% in 2023. Exercise and weight loss apps encourage users to exercise often with the help of scheduled notifications. These workout apps are usually equipped with video demos, fitness-tracking tools, and audio cues, which can help maintain an exercise routine. A few examples of such apps include Daily Workouts Fitness Trainer, Nike Training Club, 7 Minute Workout, Aaptiv, SworkIt, Garmin Connect, FitOn, 8fit Workouts, Adidas Training by Runtastic, and Daily Yoga. Growing adoption of exercise and weight loss apps among a large consumer group fuels segment's growth. In addition, exercise and weight loss apps ease/modify the step/process of tracking/monitoring calorie intake (daily) to a macronutrient level, such as fats and carbohydrates, and provide a customized lifestyle plan based on user feed data. Owing to the ease of use, these apps have been witnessing high demand over the past few years.

Activity tracking is anticipated to register the fastest growth rate over the forecast period. Key brands, including Jawbone, Fitbit, and Nike, lead fitness activity monitoring market. These activity-monitoring apps are followed by LG, Pebble, Samsung, and other companies that integrate activity-tracking features in their wearable devices. As per a new IDC report, demand for smartwatches is anticipated to surpass consumer interest in fitness trackers. However, as per Fitbit, fitness trackers have witnessed high demand over the last few years and are expected to register highest growth rate during the forecast period. Features such as comparing an individual's performance with other app users, sharing highlights of daily activity on social media via Instagram stories, and having friendly competition in workout regime to encourage an active lifestyle are factors driving segment growth.

Platform Insights

iOS segment accounted for the largest revenue share in 2023. High adoption of iOS devices has fueled segment growth over the past few years. For instance, according to Apple, Inc., active Apple device users raised from 1.4 billion in the first fiscal quarter of 2019 to 1.5 billion in the first fiscal quarter of 2020. Fitness apps designed for iOS devices can provide activity tracking, fitness coaching, inspiration & motivational videos for workouts, streaming workout classes, stretching, and guided meditations. Some major fitness apps designed for the iOS platform for iPhone, iPad, and Apple Watch include 7 Minute Workout, Centr, Sworkit, MyFitnessPal, Keelo, Freeletics, Strava, PEAR and JEFIT.

Android segment is expected to grow at fastest CAGR over the forecast period. Tracking health and fitness through Android smartphones has become popular in recent years. Fitness apps can be downloaded on android devices, and various functions such as gathering workout ideas, setting fitness goals, tracking calorie intake, and other activities can be performed. Owing to increasing number of android users at a rapid rate and rising adoption of smartphones globally, this segment is expected to grow fast during the forecast period. Fitness apps available on android platform include Google Fit, MyFitnessPal, Runstastic, Leap Fitness Workout Apps, and Sworkit.

Key Companies & Market Share Insights

-

Fitbit, Inc., MyFitnessPal, Inc., Adidas and FitnessKeeper are some of the dominant players operating in fitness app market.

-

Fitbit, Inc. has a wide range of solution portfolios, including Fitbit app, Stress Mangement, Health Metrics and SpO2, and many more.

-

MyFitnessPal, Inc. provides weight loss apps and fitness apps.

-

Azumio, Inc., Noom, Nike, and WillowTree, Inc. some of the emerging market players functioning in fitness app market.

Key Fitness App Companies:

- Adidas

- Appster

- FitnessKeeper

- Fitbit, Inc.

- Azumio, Inc.

- MyFitnessPal Inc.

- Noom

- Nike

- Under Armour, Inc.

- WillowTree, Inc.

- Polar Electro

- Kayla Itsines

- Fooducate

- ASICS America Corporation

Recent Developments

-

In November 2022, Headspace Health, a digital mental health platform provider, introduced a unique product that integrates Ginger's top-tier coaching, psychiatry services, and therapy with Headspace's meditation and mindfulness offerings.

-

In June 2022, Flo Health launched Flo for Business in 20 languages in more than 175 countries. It aims to educate employees on monitoring their periods, ovulation, and reproductive health.

Fitness App MarketReport Scope

Report Attribute

Details

Market size value in 2024

USD 10.59 billion

Revenue forecast in 2030

USD 23.35 billion

Growth rate

CAGR of 14.08% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

December 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, platform, device, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Spain; Italy; Norway; Denmark; Sweden; Japan; China; Australia; India; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Adidas; Appster; FitnessKeeper; Fitbit, Inc.; Azumio, Inc.; MyFitnessPal Inc.; Noom; Nike; Under Armour, Inc.; WillowTree, Inc.; Polar Electro; Kayla Itsines; Google; Fooducate; ASICS America Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fitness App Market Report Segmentation

This report forecasts revenue growth at global, regional, & country levels and provides an analysis on industry trends in each of the subsegments from 2018 to 2030. For the purpose of this study, Grand View Research, Inc. has segmented the global fitness app market report on the basis of type, platform, device, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Exercise & Weight Loss

-

Diet & Nutrition

-

Activity Tracking

-

-

Platform Outlook (Revenue, USD Million, 2018 - 2030)

-

Android

-

iOS

-

Others

-

-

Device Outlook (Revenue, USD Million, 2018 - 2030)

-

Smartphones

-

Tablets

-

Wearable Devices

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Mexico

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global fitness app market size was estimated at USD 9.25 billion in 2023 and is expected to reach USD 10.59 billion in 2024.

b. The global fitness app market is expected to grow at a compound annual growth rate of 14.08% from 2024 to 2030 to reach USD 23.35 billion by 2030.

b. Exercise & weight loss dominated the fitness app market with a share of 54.4% in 2023. This is attributable to the increasing number of people seeking a health-conscious lifestyle.

b. Some key players operating in the fitness app market include Adidas; Appster; Fitbit, Inc.; FitnessKeeper; Azumio, Inc.; MyFitnessPal Inc.; Nike; Noom; Under Armour, Inc.; Applico; Aaptiv; and Appinventiv.

b. Key factors that are driving the fitness app market growth include the presence of large pharma organizations, along with key players from multiple industries, and increasing demand for continuous health assessment.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."