- Home

- »

- Communication Services

- »

-

Fixed Voice Market Size, Share & Trends Report, 2028GVR Report cover

![Fixed Voice Market Size, Share & Trends Report]()

Fixed Voice Market (2022 - 2028) Size, Share & Trends Analysis Report By End-use (Consumer/Residential, Business), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-929-6

- Number of Report Pages: 72

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2028

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Fixed Voice Market Summary

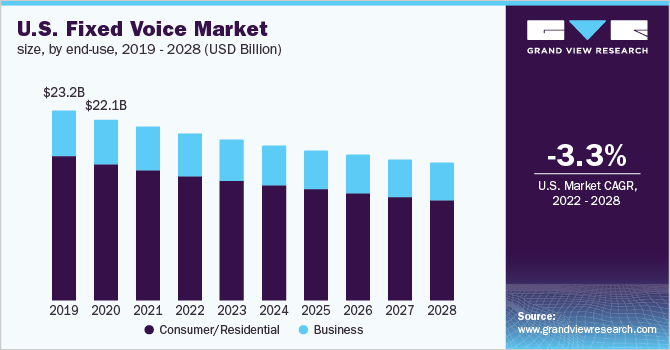

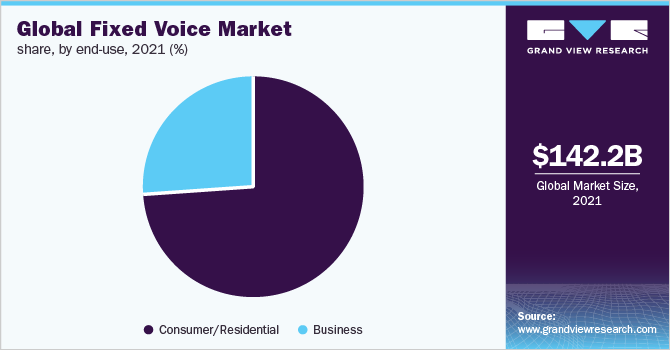

The global fixed voice market size was valued at USD 142.2 billion in 2021 and is projected to reach USD 121.2 billion by 2028, registering at a CAGR of -2.3% from 2022 to 2028. Due to decreased circuit-switched subscriptions among businesses and consumers and a drop in average revenue per user (ARPU), fixed voice service revenue is expected to shrink in the coming years.

Key Market Trends & Insights

- Asia Pacific witnessed a significant decline in fixed voice services revenues.

- North America and European countries have witnessed sluggish adoption of fixed voice services for a couple of years.

- By end use, consumer/residential segment witnessed a significant downturn in the adoption of fixed voice solutions.

Market Size & Forecast

- 2021 Market Size: USD 142.2 Billion

- 2028 Projected Market Size: USD 121.2 Billion

- CAGR (2022-2028): -2.3%

Fixed voice revenues will be dragged down in the next few years due to a high preference for mobile and OTT-based communication services. Over the recent years, consumers and businesses have made a strong shift toward the mobile voice and online voice communication channels. This has further declined the overall revenue streams for the global fixed voice services market.The rising deployment of 5G technology, an increasing number of mobile smartphones, and consumer inclination towards next-generation technologies have made a strong consumer shift towards VoIP and mobile voice communication platforms. This has hampered market growth in recent years. Additionally, governments across the globe are taking major initiatives to boost the adoption of mobile voice technologies. For instance; the Thailand government is working on the development of a fiber optic core network covering 80,000 kilometers across the country as part of the 'Thailand's Village Broadband Internet Project (Net Pracharat)'. The continuous fall in fixed voice service revenue is failing to balance the steady rise in fixed broadband service revenue, resulting in a decline in fixed communications services revenue.

Globally consumers are likely to abandon their fixed-line communication services and shift to mobile technology. Through 2024, revenue growth in the fixed broadband segment will be supported by a recovery in ARPU levels, as well as an increase in fiber-to-the-home/business (FTTH/B) subscribers as a result of the national broadband network (NBN) project. Fixed voice revenues will be dragged down in the coming years due to a high preference for mobile and OTT-based communication services.

During the COVID-19 crisis, the telecom services business has been one of the most robust sectors of the global economy. Many governments' anti-pandemic policies, which have forced people to stay at home and minimize face-to-face encounters, have boosted the use of telecom services. However, the market will be harmed by the economic impact of firm closures, rising unemployment, halted tourist activities, and lower consumer spending on non-essential goods and services.

Owing to decreased revenues from roaming costs, work-from-home scenarios, and slower net additions in the consumer sector, the mobile segment will see a minor dip in 2020. Fixed voice service spending will continue to fall and will take a further dip as a result of the pandemic, as consumers are likely to cancel fixed call services to save costs.

End-use Insights

Consumer/residential segment witnessed a significant downturn in the adoption of fixed voice solutions. Fiber-based fixed broadband services and mobile services remain the most adopted services by consumers and businesses. In the most developed markets, fiber-optic cables have largely supplanted fixed-line networks to take advantage of optical fiber’s superior performance over twisted-copper networks. Increased bandwidth demand fueled the development of fiber optics, a more advanced means of communication, as a result of the expansion of the internet and the consequent roll-out of services such as video-on-demand.

In business segment, fixed voice services have been replaced by enterprise communication solutions such as unified communications, PBX, voicemail, and telephony. This has hampered the growth of fixed voice service among businesses and enterprises. The remote work mandate created by COVID-19 has forced companies to upgrade their traditional communication platforms and opt for advanced cloud-based solutions. This is giving service providers an unparalleled chance to advertise cloud-based communications solutions while also demonstrating the flexibility of UCaaS and cloud services in terms of capacity modifications and service delivery regardless of location. This tendency is also predicted to hinder business use of fixed voice services.

Regional Insights

Asia Pacific witnessed a significant decline in fixed voice services revenues. As the region has transformed itself into a digital hub, the regional telecommunications services industry has undergone tremendous changes in recent years. Consumers and businesses in the region are turning to mobile voice services to fulfill their communication and network needs. Additionally, the loss of voice lines in the markets such as China, Japan, and India is primarily caused by fixed-mobile substitution and consolidation of multiple narrowband networks. Small and medium-sized enterprises in the region that do not require a landline or a reliable internet connection have begun to employ mobile data contracts to boost their company's potential mobility without having to deploy an expensive connection onsite. The growth of VoIP services, which use the internet to route phone calls, also eliminates the need for fixed voice connections.

North America and European countries have witnessed sluggish adoption of fixed voice services for a couple of years. Mobile phones have become the preferred form of communication since the 5G revolution, obviating the necessity for public telephone boxes and diminishing the need for enterprises to use fixed-line telephones and fixed internet connections. Customers are increasingly using mobile services and cheaper VoIP services, which have become more readily available as broadband penetration has increased. Price-capped mobile calling plans are progressively reducing the cost gap between fixed-line and mobile services, pushing people to use their phones instead of their landlines. As a result, the most immediate threat to the global fixed voice market is the shift of fixed-line voice revenues to mobile.

Key Companies & Market Share Insights

Leading industry participants are investing in R&D efforts to boost organic growth and market share. Companies are also generating new solutions and services to expand and strengthen their current portfolios as well as attract new customers. Businesses are opting for mergers and acquisitions, as well as strategic partnerships, to develop technologically advanced solutions and gain a competitive edge over their competitors. Some prominent players in the global fixed voice market include:

-

AT&T Inc.

-

Verizon Communications Inc.

-

Nippon Telegraph and Telephone Corporation (NTT)

-

China Mobile Ltd.

-

Deutsche Telekom AG

-

KT Corporation

-

Telefonica SA

-

KDDI Corporation

-

Orange SA

-

Reliance Jio Infocomm Limited

Fixed Voice Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 138.0 billion

Revenue forecast in 2028

USD 121.2 billion

Growth Rate

CAGR of -2.3% from 2022 to 2028

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2028

Quantitative units

Revenue in USD million/billion and CAGR from 2022 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

End-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; China; India; Japan; Brazil; Argentina; GCC; South Africa

Key companies profiled

AT&T Inc.; Verizon Communications Inc.; Nippon Telegraph and Telephone Corporation (NTT); China Mobile Ltd.; Deutsche Telekom AG; KT Corporation; Telefonica SA; KDDI Corporation; Orange SA; Reliance Jio Infocomm Limited

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2028. For this study, Grand View Research has segmented the global fixed voice market report based on end-use and region:

-

End-use Outlook (Revenue, USD Million, 2017 - 2028)

-

Consumer/Residential

-

Business

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2028)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

GCC

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global fixed voice market size was estimated at USD 142.2 billion in 2021 and is expected to reach USD 138.0 billion in 2022.

b. The global fixed voice market is expected to decline at a compound annual growth rate of -2.3% from 2022 to 2028 to reach USD 121.2 billion by 2028.

b. Asia Pacific witnessed significant decline in the fixed voice market with a share of 36.2% in 2021. The decline in this region attributable to the loss of voice lines and high preference for mobile and OTT-based communication services.

b. Some key players operating in the fixed voice market include AT&T Inc.; Verizon Communications Inc.; Nippon Telegraph and Telephone Corporation (NTT); China Mobile Ltd.; Deutsche Telekom AG; KT Corporation; Telefonica SA; KDDI Corporation; Orange SA; and Reliance Jio Infocomm Limited.

b. Key factors that are restraining the fixed voice market potential include an increasing number of mobile smartphones, consumer inclination towards next-generation technologies, along with increase in fiber-to-the-home/business (FTTH/B) subscribers.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.