- Home

- »

- Communication Services

- »

-

Telecom Services Market Size, Share, Industry Report, 2030GVR Report cover

![Telecom Services Market Size, Share & Trends Report]()

Telecom Services Market (2025 - 2030) Size, Share & Trends Analysis Report By Service Type (Fixed Voice Services, Fixed Internet Access Services), By Transmission (Wireline, Wireless), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-518-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Telecom Services Market Summary

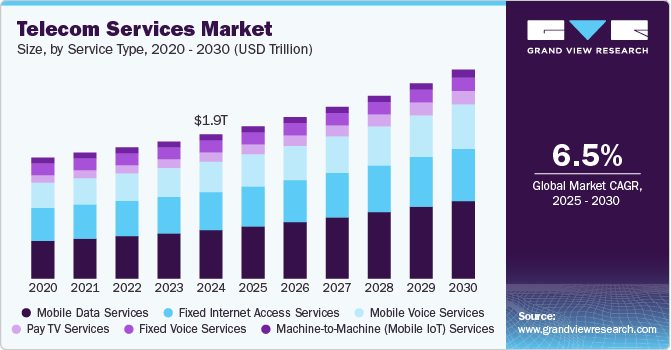

The global telecom services market size was estimated at USD 1,983.08 billion in 2024 and is projected to reach USD 2,874.76 billion by 2030, growing at a CAGR of 6.5% from 2025 to 2030. Rising spending on the deployment of 5G infrastructures due to the shift in customer inclination toward next-generation technologies and smartphone devices is one of the key factors driving this industry.

Key Market Trends & Insights

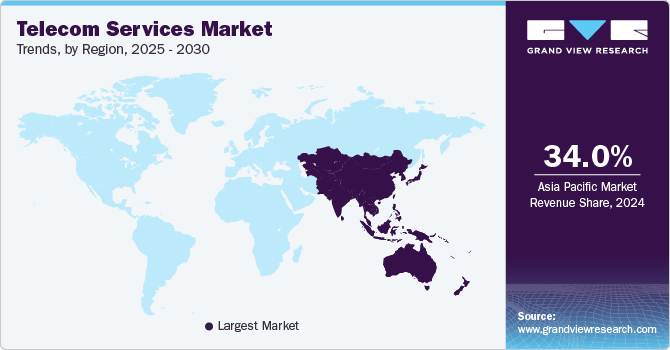

- Asia Pacific dominated the telecom services market with the largest revenue share of 34.0% in 2024.

- The telecom services market in the U.S. held a dominant position in North America in 2024.

- Based on service type, the mobile data services segment led the market with a share of 40.0% in 2024.

- Based on transmission, the wireless segment led the market with a share of 22.1% in 2024.

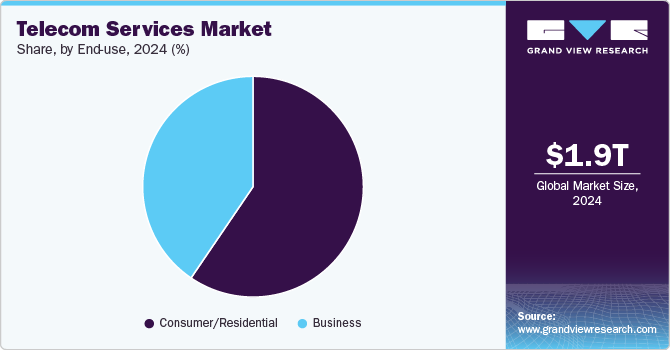

- Based on end use, the consumer/residential segment led the market a share of 59.5% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1,983.08 Billion

- 2030 Projected Market Size: USD 2,874.76 Billion

- CAGR (2025-2030): 6.5%

- Asia Pacific: Largest market in 2024

An increasing number of mobile subscribers, soaring demand for high-speed data connectivity, and the growing demand for value-added managed services are the other potential factors fueling the market growth. The global communication network has undoubtedly been one of the prominent areas for continued technological advancements over the past few decades.The industry’s product offering evolved in the late 19th century from only voice and visual signals in terms of facsimile or telegraphs over wired infrastructure to the current scenario of exchanging audio, video, and text content over numerous wireless infrastructures. The market for telecom services has also witnessed significant improvements in data speeds, from Global System for Mobile communications (GSM) and Code Division Multiple Access (CDMA) to Third Generation (3G), Fourth Generation (4G), and now the commercialization of Fifth Generation (5G) networks. The advent of data connectivity has made possible the reduction in the duration of transferring large chunks of data from days to hours and now to a few seconds.

In today’s digital age, customers favor Over-The-Top (OTT) channels for a variety of reasons, among which the number of viewing options, and the pricing offered are the most prominent ones. The OTT solution providers offer video, audio, and other media content over the Internet. Usually, they are not bound to price agreements with limited viewing choices to pick from. Common instances of OTT applications are Netflix, Amazon Video, Roku, Hotstar, HBO, and others. Consumers and marketers alike are getting more acquainted with OTT applications and content. Furthermore, smartphone display and sound quality, open-source platforms, and super-fast Internet Protocol (IP) networks, among other innovative services, act as mobilizing factors to draw more consumers to the OTT providers 'freemium-based' business models, thus witnessing an ever-growing adoption rate and boosting the market growth.

As people worldwide struggle with the realities of the COVID-19 pandemic, digital entertainment platforms as well as the global telecom service providers, have benefitted from the current scenario due to their industry type and business model. In a current worldwide lockdown scenario, a shift among the masses to remote working will fuel the demand for network connectivity and infrastructure. Similarly, the temporary shutdown of multiplexes and other outdoor entertainment avenues due to strict social distancing has shot up the usage of various digital platforms, including social media, gaming, and OTT applications. The mobile voice traffic has also witnessed an upsurge during this period with prominent communication operators reporting an enormous escalation in their voice traffic since the outbreak of the pandemic.

The escalating consumption of digital media platforms by global customers has resulted in the sudden demand for higher bandwidths with high-speed connectivity. With the upsurge in the consumption of these platforms, telecom service companies are urging OTT providers to reduce the streaming resolution of their media content. In fact, the Cellular Operators Association of India (COAI) has requested video streaming providers to reduce their content quality from High Definition (HD) to Standard Definition (SD). To avoid the congestion in internet traffic, especially when most people are working from home and require high bandwidth, some governments are also helping the market for telecom services to ensure the smooth functioning of their data and voice carriers.

Service Type Insights

Based on service type, the mobile data services segment led the market with the largest revenue share of 40.0% in 2024. This is attributed to the significantly growing usage of smartphones among consumers. Rapidly rising demand for high-speed broadband services for corporate and residential applications is further expected to bolster the segment growth over the forecast period. Moreover, a massive demand for accessing online 4K UHD videos and playing online cloud gaming is estimated to spur the data services market growth.

The evolution of the Internet of Things (IoT) devices has raised its proliferation across several industry verticals, including healthcare, manufacturing, energy and utilities, and the public sector, among others. The number of IoT-connected devices is expected to exceed 50 billion by 2030. The rapidly growing IoT devices would require high-speed data connectivity to operate and communicate seamlessly. Therefore, the demand for telecom services is expected to witness significant growth in the machine-to-machine services segment over the forecast period.

Transmission Insights

Based on transmission, the wireless segment led the market with the largest revenue share of 22.1% in 2024. The advent of cloud-computing technologies, artificial intelligence, and IoT is presumed to majorly contribute to the growth of wireless communication channels worldwide. Over the years, there has been a rapid deployment of systems for Wireless Local Area Networks (WLANs) that have enabled internet access to cellular devices in private homes, public spaces, airports, office buildings, cafeterias, and other areas. Such wireless densification to simplify work processes and automate routine test actions is presumed to prove beneficial, hence registering a robust CAGR in the forthcoming years.

The wireline segment is expected to grow at a significant CAGR over the forecast period. Wireline communication involves the transfer of information via twisted pair, coaxial, and optical fiber cables. The wireless method transmits information Over-The-Air (OTA) using transmitters, receivers, and Radio Frequency (RF) waves. The moderate growth of the wireline segment is attributed to a rising number of SMEs and MNCs in countries, including the UK, the U.S., and China, that utilize an extensive network of Public Switched Telephone Network (PSTN) and Integrated Services Digital Network (ISDN).

End Use Insights

Based on end use, the consumer/residential segment led the market with the largest revenue share of 59.5% in 2024. The significant growth is ascribed to the proliferation of smartphones worldwide. The private telecom operators account for a larger subscriber base as compared to government-owned companies. In addition, the growing demand for OTT applications is contemplating the users to subscribe to wireless internet offerings, thereby significantly contributing to the deployment of communication networks at a broader level. In addition, the growing trend of using ultra-high-definition videos and online gaming is expected to boost the segment growth over the forecast period.

The business segment is expected to grow at a significant CAGR over the forecast period. The demand for telecom services is increasing in business applications with the deployment of next-generation high-speed networks. Businesses are installing 5G small cell networks and private LTE and 5G networks to access faster data bandwidth in order to avoid latency in their network. The enhanced bandwidth connectivity would help businesses cater to their client's requirements with minimum waiting time and improve the overall customer experience. Moreover, the key business application areas include VoIP services, fixed and mobile data connectivity, unified communication, and other services. To handle a rapidly increasing chunk of customers’ datasets, would require unified and fast network connectivity across businesses globally. This, in turn, is estimated to fuel the segment growth from 2023 to 2030.

Regional Insights

The telecom services market in North America is expected to grow at a significant CAGR during the forecast period. The North America market is poised for significant growth over the forecast period, as a result of the presence of prominent players, such as AT&T Inc.; Verizon Communications Inc.; and T-Mobile US, Inc.; among others, and the growing adoption of mobile services in the region. For instance, according to the Mobile Economy North America 2022 report by GSMA, nearly 329 million people, or 84% of the population in North America, subscribed to mobile services in 2021.

U.S. Telecom Services Market Trends

The telecom services market in the U.S. held a dominant position in North America in 2024. In the U.S., the launch of 5G services has opened access for people to high-speed internet. The growing adoption of 5G technology in the manufacturing industry is particularly anticipated to contribute to the market growth over the forecast period.

Asia Pacific Telecom Services Market Trends

Asia Pacific dominated the telecom services market with the largest revenue share of 34.0% in 2024. The region is likely to attract more than half of the new mobile subscribers by 2030. The regional market is primarily driven by e-commerce and retailer buy-in platforms, smartphone ubiquity, and investments in 5G networks. China, Japan, and India have emerged as significant contributors to regional market growth. According to industry expert analysis, in February 2022, China recorded 1.02 billion internet users, which is more than three times the number of the third-placed United States, which had just over 307 million. India recorded the second highest internet users in February 2022.

The telecom services market in China is expected to grow at a rapid CAGR during the forecast period. The increasing number of 5G connections across China is a major factor driving the market growth. According to the GSMA’s The Mobile Economy China 2023 report, by the end of 2022, the number of 5G base stations in China surpassed 2.3 million, with around 887,000 installed during the year.

The India telecom services market is experiencing rapid growth. Rapid advancements in 5G network deployment are at the forefront, enabling faster connectivity and fostering innovations in sectors such as IoT, smart cities, and industrial automation.

Europe Telecom Services Market Trends

The telecom services market in Europe was identified as a lucrative region in 2024. The telecommunications industry is one of Europe’s growing, technology-based industries. The infrastructures the incumbents of the industry are rolling out are laying the foundation for green and digital transformation by accelerating the adoption of edge computing, 5G, cloud computing, and mobile IoT, among other latest technologies. The increasing adoption of these advanced technologies by businesses and consumers is driving the demand for telecom services in the region.

The UK telecom services market is characterized by technology-driven changes, delivering new, innovative services to both consumers and businesses. According to the Office of Communications (Ofcom), as of Q2/2023, there were 28.2 million fixed broadband lines in the U.K., an increase of 139,000, or 0.5%, over the year

The telecom services market in Germany held a substantial market share in 2024 .The rapid growth in the number of internet users is a major factor driving the growth of the telecom services industry in Germany. For instance, according to the data published by the World Bank, in 2022, 92% of the total population in Germany used the internet, up from 82% in 2010.

Key Telecom Services Company Insights

Some of the key companies in the telecom services industry include Verizon Communications Inc., Deutsche Telekom AG, China Mobile Limited, and others. All these market players are investing aggressively to introduce innovative and application-specific services as part of their efforts to strengthen their foothold in the market.

-

Verizon Communications Inc., has been at the forefront of the telecom services market, delivering cutting-edge solutions across wireless, wireline, and enterprise segments. By leveraging its 5G Ultra Wideband network, Verizon continues to enhance connectivity, supporting innovations such as private networks, edge computing, and IoT solutions.

-

Deutsche Telekom AG offers mobile and fixed network solutions to its business customers and individual consumers worldwide. Deutsche Telekom AG is one of the prominent players in the telecom services industry, providing a comprehensive portfolio that includes high-speed internet, cloud services, and IoT integration. With its robust presence in Europe and expanding operations globally, the company emphasizes digital transformation and innovation in its services.

Key Telecom Services Companies:

The following are the leading companies in the telecom services market. These companies collectively hold the largest market share and dictate industry trends.

- AT&T Inc.

- China Mobile Limited

- China Telecom Corporation Limited

- Deutsche Telekom AG

- Nippon Telegraph and Telephone Corporation

- SoftBank Corp.

- Orange S.A.

- Telefonica S.A.

- Verizon Communications Inc.

- Vodafone Group Plc

- KDDI Corporation

Recent Developments

-

In May 2023, Verizon Communications Inc. announced plans to deploy 5G Ultra Wideband in multiple markets across the U.S. states of Wisconsin, Illinois, Ohio, Arizona, Pennsylvania, and West Virginia by utilizing up to 100 MHz of the C-Band spectrum it acquired recently. Plans envisaged the company adding more bandwidth once the licensed spectrum is available in its entirety. The additional bandwidth would be available by the end of 2023 and would aid in providing exceptional capacity and speed.

-

In February 2023, AT&T Inc. and ServiceNow, a software company, announced a telecom product that can assist Communication Service Providers (CSPs) in managing their inventory of 5G and fiber networks. The ServiceNow Telecom Network Inventory has been developed with AT&T Inc.'s valuable input on strategic design and technical aspects. The product has been built on the ServiceNow Platform and is accessible to telecom companies worldwide.

Telecom Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2,095.72 billion

Revenue forecast in 2030

USD 2,874.76 billion

Growth rate

CAGR of 6.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD mission/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

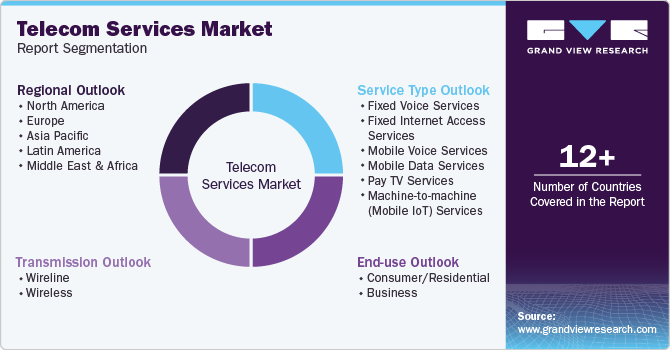

Service type, transmission, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; China; Japan; India; South Korea; Australia; Brazil; Columbia; Peru; Chile

Key companies profiled

AT&T Inc.; China Mobile Limited; China Telecom Corporation Limited; Deutsche Telekom AG; Nippon Telegraph and Telephone Corporation; SoftBank Corp.; Orange S.A.; Telefonica S.A.; Verizon Communications Inc.; Vodafone Group Plc; KDDI Corporation.

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Telecom Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global telecom services market report based on service type, transmission, end use, and region:

-

Service Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Fixed Voice Services

-

Fixed Internet Access Services

-

Mobile Voice Services

-

Mobile Data Services

-

Pay TV Services

-

Machine-to-machine (Mobile IoT) Services

-

-

Transmission Outlook (Revenue, USD Billion, 2018 - 2030)

-

Wireline

-

Wireless

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Consumer/Residential

-

Business

-

IT & Telecom

-

Manufacturing

-

Healthcare

-

Retail

-

Media & Entertainment

-

Government & Defense

-

Education

-

BFSI

-

Energy and utilities

-

Transportation & Logistics

-

Travel & Hospitality

-

O&G and Mining

-

Others

-

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Columbia

-

Peru

-

Chile

-

-

MEA

-

Frequently Asked Questions About This Report

b. The global telecom services market size was estimated at USD 1,983.08 billion in 2024 and is expected to reach USD 2,095.72 billion in 2025.

b. The global telecom services market is expected to grow at a compound annual growth rate of 6.5% from 2025 to 2030 to reach USD 2,874.76 billion by 2030.

b. In 2024, the mobile data services segment held the largest share of nearly 40.0% in the telecom services market, and is expected to exhibit a significant CAGR from 2025 to 2030. This is attributed to the significantly growing usage of smartphones among consumers.

b. The consumer/residential end-use segment accounted for the largest revenue share of more than 59.0% in the telecom services market in 2024, and is projected to maintain its lead over the forecast period. The significant growth is ascribed to the proliferation of smartphones worldwide.

b. Asia Pacific captured the largest share of 34.0% in the telecom services market in 2024, and is expected to witness significant growth from 2025 to 2030. The region is likely to attract more than half of the new mobile subscribers by 2030.

b. The wireless segment accounted for the largest share of over 77.0% in 2024 in the telecom services market, and is expected to exhibit a significant CAGR from 2025 to 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.