- Home

- »

- Advanced Interior Materials

- »

-

Flame & Detonation Arrestors Market, Industry Report, 2030GVR Report cover

![Flame And Detonation Arrestors Market Size, Share & Trends Report]()

Flame And Detonation Arrestors Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (In Line, End Of Line), By End-use (Oil & Gas, Chemicals, Power Generation, Mining, Pharmaceutical), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-375-3

- Number of Report Pages: 152

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

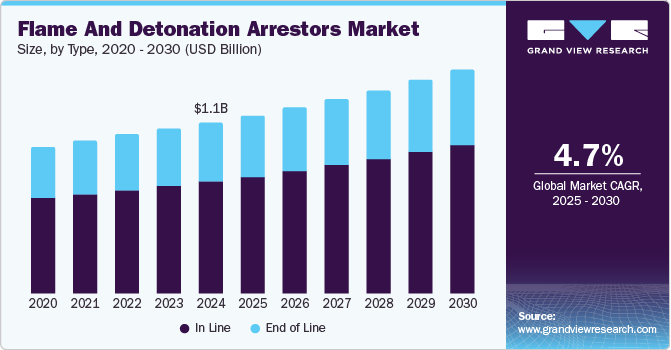

The global flame and detonation arrestors market size was estimated at USD 1.05 billion in 2024 and is expected to grow at a CAGR of 4.7% from 2025 to 2030. The increasing demand for safety devices to prevent explosions and ensure safe operational environments in various industries such as oil & gas, chemicals, and power generation is driving the growth of the market for flame and detonation arrestors.

These devices are crucial for preventing the propagation of flames and detonations in pipelines, storage tanks, and other equipment, thus protecting assets and personnel. The market growth is further expected to be fueled by stringent safety regulations and standards across industries, which mandate the installation of flame and detonation arrestors to mitigate risks associated with hazardous environments. Technological advancements in arrestor design and the development of advanced materials are also contributing to market expansion. Additionally, the rising focus on industrial safety and the need to comply with regulatory requirements are driving the adoption of flame and detonation arrestors globally.

The flame and detonation arrestors market is driven by the increasing emphasis on industrial safety and the prevention of explosions in hazardous environments. The adoption of stringent safety regulations across industries such as oil & gas, chemicals, and power generation is significantly contributing to market growth. Additionally, technological advancements in arrestor design, including the use of advanced materials and innovative engineering solutions, are enhancing the performance and reliability of these devices, further driving market demand.

The market faces challenges such as the high cost of advanced flame and detonation arrestors and the complexity of installation and maintenance. These factors can act as barriers to adoption, particularly for small and medium-sized enterprises. Additionally, the availability of alternative safety technologies may limit the growth potential of the flame and detonation arrestor market in certain applications.

The market for flame and detonation arrestors has abundant growth opportunities, particularly with the rising focus on industrial safety and the expansion of industries in emerging markets. The continuous development of innovative arrestor designs aimed at improving safety and reducing operational costs is expected to drive market growth further. Additionally, the increasing adoption of these devices in industries such as pharmaceuticals and mining, driven by the need to comply with stringent safety standards, presents significant growth opportunities.

Type Insights

The in-line flame and detonation arrestors market dominated and accounted for the largest revenue share of 65.5% in 2024. These arrestors are widely utilized in pipelines and other closed systems to prevent the spread of flames and detonations. They are essential for ensuring safety in continuous processing operations where the risk of flame propagation is high. The demand for in-line arrestors is driven by their efficiency and reliability in preventing explosions within industrial processes. According to ISO 16852, section 3.22, an in-line detonation and flame arrester must be installed with pipe connections on both sides of the device.

The end of line flame and detonation arrestors market is expected to grow significantly at a CAGR of 4.3% over the forecast period. According to ISO 16852, section 3.21, an end of line detonation and flame arrester needs to be fitted with a single pipe connection. They are used at the end of pipelines or at venting points to prevent external flames from entering the system. These arrestors are critical in applications where exhaust gases are vented into the atmosphere, ensuring that external ignition sources do not cause internal explosions. The demand for end-of-line arrestors is driven by their effectiveness in protecting storage tanks and other equipment from potential explosion hazards.

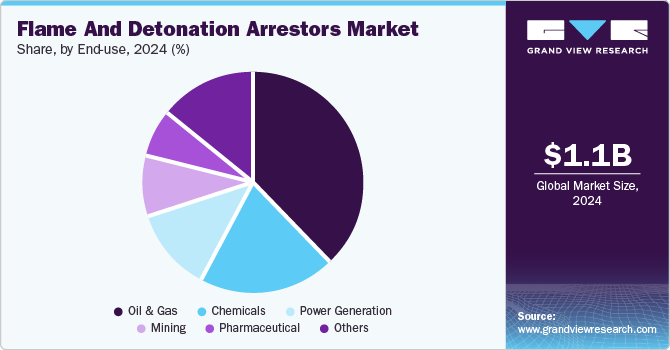

End-use Insights

The oil and gas segment dominated the flame and detonation arrestors market, with the largest revenue share of 38.0% in 2024. These arrestors are critical for preventing explosions and ensuring safety in oil & gas operations, particularly in upstream, midstream, and downstream activities. The stringent safety regulations in the oil & gas industry are a major driver for the adoption of flame and detonation arrestors. In 2023, a total of 20 oil and gas fields were approved for extraction, totaling 8 billion barrels of oil equivalent. By 2030, the industry plans to sanction 31 bn barrels across 64 new fields. The U.S. has been leading global oil production for six consecutive years and spearheaded new projects in 2022 and 2023, which further contributed to the demand for flame and detonation arrestors.

The demand for flame and detonation arrestors market in the chemicals industry is expected to grow at the fastest CAGR of 5.2% over the forecast period owing to their ability to prevent the spread of flames in chemical processing plants. The need for high safety standards and the prevention of hazardous incidents in chemical manufacturing and processing are driving the demand for these devices.

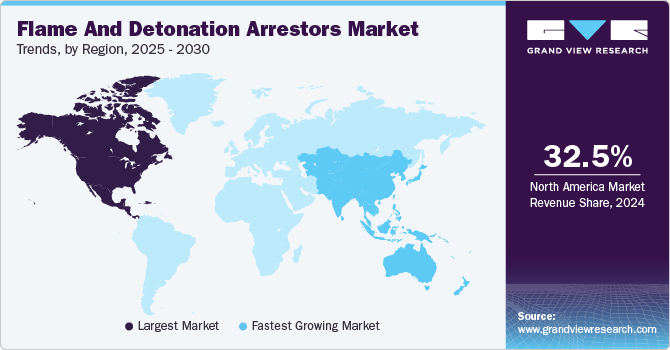

Regional Insights

North America flame and detonation arrestors market dominated the global market, with the largest revenue share of 32.5% in 2024. Stringent safety regulations and a strong focus on technological advancements characterize the North American flame and detonation arrestors industry. The region's well-established industries, particularly in the oil & gas and chemical sectors, are driving the demand for high-performance safety devices. The increasing emphasis on industrial safety and compliance with regulatory standards is further propelling market growth. Ongoing investments in research and development are leading to the introduction of innovative arrestor designs, enhancing the market's growth prospects in the region.

U.S. Flame And Denotation Arrestors Market Trends

The U.S. dominated the flame and detonation arrestors market in North America and accounted for the largest revenue share in 2024. The implementation of stringent safety regulations by agencies such as the Occupational Safety and Health Administration (OSHA) and the Environmental Protection Agency (EPA) is driving the adoption of advanced safety devices. Furthermore, the U.S. chemical industry is one of the largest manufacturing sectors, catering to both a strong domestic and growing global market. In 2022, the U.S. exported chemicals worth over USD 494 billion, producing 13% of the world’s chemicals. With 14,000 establishments and over 70,000 products, the industry employed over 902,300 workers by mid-2024.

Asia Pacific Flame And Denotation Arrestors Market Trends

Asia Pacific flame and detonation arrestors market is expected to grow at the fastest CAGR of 5.5% over the forecast period. The growth is driven by rapid industrialization, increasing investments in industrial safety, and stringent regulatory standards. Countries such as China, India, and Japan are witnessing substantial growth in their industrial sectors, including oil & gas, chemicals, and power generation, which is boosting the demand for safety devices. The region's focus on enhancing industrial safety and compliance with international safety standards is expected to favor the growth of flame and detonation arrestors industry over the coming years.

The flame and detonation arrestors market in China led the Asia Pacific regional market with the largest revenue share in 2024. The government of China has implemented numerous regulations and technical guidelines to improve chemical safety, driving the demand for flame and detonation arrestors in the chemical sector.

Europe Flame And Denotation Arrestors Market Trends

Europe flame and detonation arrestors market accounted for a substantial market share in 2024. The growth is driven by stringent environmental regulations and a strong emphasis on industrial safety. Countries such as Germany, France, and the UK are at the forefront of adopting advanced safety technologies to prevent explosions and ensure safe operational environments. The region's focus on sustainability and energy efficiency is also contributing to the increased adoption of flame and detonation arrestors.

Key Flame And Detonation Arrestors Company Insights

Some of the major flame and detonation arrestors industry players are Emerson Electric Co., The Protectoseal Company, PROTEGO, and L&J Technologies. These companies stay competitive globally by investing in advanced technology, adhering to strict safety standards, and expanding their product offerings.

-

Emerson Electric Co. provide innovative solutions for industrial automation, climate technologies, and safety equipment, including flame and detonation arrestors. Emerson’s portfolio of safety devices is designed to meet the stringent requirements of industries such as oil & gas, chemicals, and power generation. The company’s focus on research and development, along with its strong commitment to quality and reliability, has solidified its position as a key market player.

-

The Protectoseal Company specializes in the design and manufacture of high-quality safety and flame control equipment, including flame and detonation arrestors. With a rich history of innovation and a strong emphasis on safety and performance, Protectoseal has established itself as a trusted name in the industry. The company's products are widely used in various industrial applications to prevent explosions and ensure safe operational environments, particularly in the chemical and oil & gas sectors.

-

Braunschweiger Flammenfilter GmbH is renowned for its expertise in developing advanced flame and explosion protection systems. The company's flame and detonation arrestors are designed to provide reliable protection in high-risk industrial environments. Braunschweiger's commitment to quality and innovation, combined with its extensive experience, has positioned it as a leading provider of safety solutions in the global market.

-

L&J Technologies offers a diverse range of industrial safety products, including flame and detonation arrestors, catering to industries such as oil & gas, chemicals, and power generation. The company's products are known for their durability, efficiency, and compliance with international safety standards. L&J Technologies’ focus on customer satisfaction and continuous improvement has helped it maintain a strong presence in the competitive market for flame and detonation arrestors.

Key Flame And Detonation Arrestors Companies:

The following are the leading companies in the flame and detonation arrestors market. These companies collectively hold the largest market share and dictate industry trends.

- Emerson Electric Co.

- The Protectoseal Company

- PROTEGO

- L&J Technologies

- Westech Industrial Ltd.

- Cross Company

- Groth Corporation

- Essex Industries, Inc.

- Flammer GmbH

- Motherwell Tank Protection

Recent Developments

-

In November 2024, L&J Technologies announced a strategic partnership with FCX Performance as its exclusive Manufacturers Representative for Louisiana and Texas. The collaboration enhances service and support for customers in the region.

-

In December 2023, Protectoseal invested over USD 5 million to enhance its manufacturing capabilities and capacities. This investment aims to halve the lead time and meet the growing global demand for its products.

-

In July 2022, Protectoseal, a manufacturer of high-quality safety and flame control products, successfully acquired Elmac Technologies. This strategic acquisition marks a significant step towards achieving Protectoseal's objective of expanding its international business through both organic growth and strategic acquisitions.

Flame And Detonation Arrestors Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.09 billion

Revenue forecast in 2030

USD 1.37 billion

Growth rate

CAGR of 4.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Spain, Italy, China, Japan, India, South Korea, Australia, Brazil, Argentina, Saudi Arabia, UAE, and South Africa

Key companies profiled

Emerson Electric Co.; The Protectoseal Company; PROTEGO; L&J Technologies; Westech Industrial Ltd.; Cross Company; Groth Corporation; Essex Industries, Inc.; Flammer GmbH; Motherwell Tank Protection

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

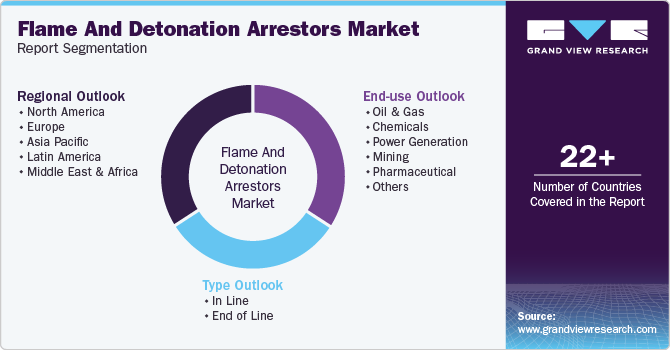

Global Flame And Detonation Arrestors Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global flame and detonation arrestors market report based on type, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

In Line

-

End of Line

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Oil & Gas

-

Chemicals

-

Power Generation

-

Mining

-

Pharmaceutical

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.