- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Flat Glass Coatings Market Size & Share Report, 2030GVR Report cover

![Flat Glass Coatings Market Size, Share & Trends Report]()

Flat Glass Coatings Market (2022 - 2030) Size, Share & Trends Analysis Report By Resin (PU, Acrylic), By Technology (Water-based, Nano Coatings), By Application (Solar Power, Automotive & Transportation, Mirror), And Segment Forecasts

- Report ID: GVR-2-68038-533-5

- Number of Report Pages: 155

- Format: PDF

- Historical Range: 2019 - 2020

- Forecast Period: 2022 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

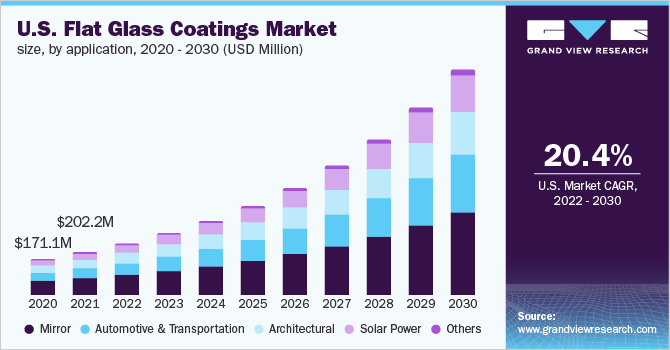

The global flat glass coatings market size was valued at USD 1.9 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 20.4% from 2022 to 2030. Flat glass is widely used in the construction of buildings in both commercials as well as residential sectors. The tremendous growth in the infrastructural developments across various emerging economies is likely to contribute to the market expansion during the forecast period.

Rising construction spending on account of rapid urbanization across the globe and infrastructural plans by various governments will continue to augment the market growth along with more focus on adopting green initiatives to become sustainable. The rapid growth in transport, renewable energy, social & commercial infrastructure, government accommodation, and defense infrastructure is further supporting the market growth. Furthermore, the rising number of green commercial building construction projects, particularly in North America, Asia Pacific, and MEA regions, is anticipated to fuel product demand during the forecast period.

Glass facades are becoming popular, particularly in the commercial building construction sector. Numerous technological innovations in glass technology have improved the overall performance in light transmission, thermal insulation, and modulating solar heat. In addition, innovations, such as double glazed, solar control, and thermal insulation, have also contributed to the increased product application in buildings.

The global demand for green buildings has grown significantly during the past few years. Green buildings serve various social, environmental, as well as economic benefits. Flat glass coatings play a vital role in reducing the operational costs of the building. Thus, a rise in the construction of green buildings will directly contribute to market growth.

Water-based coating dominates the overall market, followed by solvent-based coating. Solvent-based coatings emit higher amounts of volatile organic compounds while drying. These compounds can affect the human health of individuals who are constantly exposed to these types of products. VOCs form the ground-level ozone layer and trap the heat, which leads to global warming. These may cause eye, skin, nose, throat, and respiratory tract irritation. The VOCs emitted can lead to severe ill effects, such as cancer, leukemia, lymphoma, and various other diseases, on human health.

The construction industry has supplemented significant demand in the market. Increasing construction of amusement parks, corporate buildings, hotels, motels, hospitals, schools, and others is likely to supplement the demand for flat glass coatings in the upcoming years. Residential construction in multi-family and single-family segments is expected to rise owing to a rise in the demand for rental accommodation.

Technology Insights

The water-based technology segment led the global market and accounted for a revenue share of more than 52.0% in 2021. Water-based products contain numerous added advantages over solvent-based products. Solvent-based coatings possess harmful Volatile Organic Compounds (VOCs), which are emitted into the environment. Various regulatory authorities have laid stringent regulations with respect to the production of solvent-based flat glass coatings.

Nano-based technology is estimated to be the fastest-growing technology segment during the forecast period on account of several research & development activities and rising consumer needs. Favorable growth in the automotive and electronics manufacturing sectors is expected to boost the demand for nano-based technology over the coming years.

Solvent-based flat glass coatings comprise liquefying agents, which are designed to evaporate via a chemical reaction along with oxygen. Solvent-based coatings contain an added advantage over water-based coating such as they are susceptible to changing environmental conditions, such as humidity and temperature fluctuation. It is widely used in application areas such as mirrors, solar panels, and automotive.

Solvent-based coating technology is the most conventional technology for manufacturing flat glass coatings. Aliphatic hydrocarbons, lacquer thinner, toluene and xylene are solvents used in the process of manufacturing. The global solvent market for coatings has undergone a paradigm shift due to adverse effects on the environment because of volatile organic compounds in crude oil-based solvents.

Application Insights

Mirror application segment led the global market and accounted for a revenue share of more than 40% in 2021. Mirrors are used widely across applications in beauty, architectural, automotive, and decorative applications. Moreover, the growing demand for smart mirrors in the global market is likely to drive the market demand for flat glass coatings during the forecast period. The smart mirror acts as an effective substitute for the rear mirror in automobile applications. It offers integrated GPS navigation, a backup camera, and bluetooth connectivity which aids effectively in driving the vehicle. Smart mirrors are expanding their application areas across various non-automotive applications also such as medical consumer goods, advertising, and retail.

On the other hand, the automotive & transportation segment has reached a valuation of USD 44.6 million in 2021 and is anticipated to emerge as the fastest-growing segment in terms of CAGR during the forecast period. Flat glass coatings find numerous applications in the automotive industry owing to their durability & performance efficiency. Strengthening regulations regarding reduced CO2 emissions are further driving the market demand for flat glass coatings in automotive applications.

OEM automotive coatings and refinish coating segments are the major drivers for automotive coatings. Increasing automotive production in Brazil, India, China, Mexico & Korea along with increasing flat glass coatings consumption in major OEMs across the U.S., Japan, U.K., Germany, France & Italy is a key factor driving the market growth. APAC currently occupies the largest market share for flat glass coatings in automotive applications due to its leading position in automobile production in the world.

Demand for glass coating on solar panels has risen significantly on account of several benefits imparted by them onto the overall performance efficiency. These anti-reflective coatings specially designed for photovoltaic applications are deposited on a single side. As they are single-sided, they minimize the reflection without affecting the adhesion layer and glass. Thereby, enhancing the overall output. Solvent-based flat glass coating is mostly preferred in solar applications.

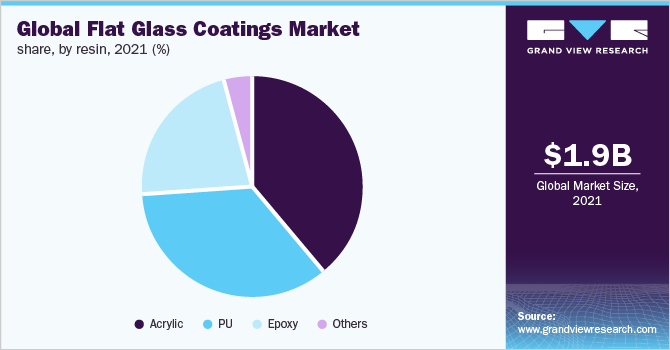

Resin Insights

The acrylic resin segment accounted for the largest revenue share of more than 39.0% in 2021 and will retain its leading position throughout the forecast period. Bio-based acrylic resins are the most widely used resins due to the high demand for eco-friendly products. Rapid urbanization and industrialization have led to a rise in construction spending in emerging nations, which, in turn, has resulted in the increased demand for acrylic resins in the architectural and industrial sectors.

On the other hand, the Polyurethane (PU) segment accounted for 34.93% of the market revenue share in 2021 and is anticipated to witness the fastest CAGR from 2022 to 2030 due to the wide usage of PU-based flat glass coatings in solar panels, greenhouses, and other architectural systems. PU resins are utilized in the coating of flat glass as finished coats and are primarily applied over the intermediate and primer coats to attain a long-term high-performance coating.

Regional Insights

The Asia Pacific was the largest regional market in 2021 and accounted for a revenue share of more than 56.0%. The region will expand further at the fastest CAGR from 2022 to 2030. Developed economies in APAC, such as China, Australia, South Korea, and Japan, are anticipated to be the major contributors to the regional market growth. Moreover, rapidly developing automobile and construction industries in the region are expected to boost product demand during the forecast period.

North America is also expected to witness significant growth in the coming years on account of the rapidly expanding construction sector, primarily in the U.S. and Mexico. Under the National Infrastructural Plan of Mexico, the government had invested USD 590 billion from 2016 to 2018, which is anticipated to promote construction activities for residential and commercial structures. Moreover, population growth, urbanization, and rising disposable income levels in Mexico are expected to play an important role to stimulate regional market growth.

Key Companies & Market Share Insights

The global flat glass coatings market is highly competitive. Product innovation is likely to open new growth opportunities over the next few years and is also expected to intensify the market competition as manufacturers are focused on increasing their production capacities while widening their product portfolios.

Certain manufacturers have also backward integrated to produce raw materials themselves. This strategy helps lower the logistic costs and procurement hassles in the long run. Rising consumer awareness about the product benefits and manufacturing technologies have compelled suppliers to ensure high-quality levels by integrating themselves into the production. Some prominent players in the global flat glass coatings market include:

-

Arkema, Inc.

-

Fenzi Spa

-

Ferro Corp.

-

Hesse Gmbh & Co. KG

-

The Sherwin-Williams Company

-

Vitro S.A.B. De C.V.

-

Nippon Paint Holdings Co., Ltd.

-

Bee Cool Glass Coatings

-

Yantai Jialong Nano Industry Co., Ltd.

-

NanoTech Coatings

-

3M

-

Gulbrandsen

-

Unelko Corporation

-

Apogee Enterprises, Inc.

-

PPG Industries Inc.

Flat Glass Coatings Market Report Scope

Attribute

Details

Market size value in 2022

USD 2.3 billion

Revenue forecast in 2030

USD 10.3 billion

Growth rate

CAGR of 20.4% from 2022 to 2030

Base year for estimation

2021

Historical data

2019 - 2020

Forecast period

2022 - 2030

Quantitative units

Volume in tons, revenue in USD million/billion, and CAGR from 2022 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Resin, application, technology, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; U.K.; Turkey; Italy; Netherlands; Belgium; Spain; China; India; Japan; Malaysia; Taiwan; South Korea; Vietnam; Brazil; Chile; Saudi Arabia; South Africa

Key companies profiled

Arkema, Inc.; Fenzi Spa; Ferro Corp.; Hesse Gmbh & Co. KG; The Sherwin-Williams Company; Vitro S.A.B. De C.V.; Nippon Paint Holdings Co., Ltd.;Bee Cool Glass Coatings; Yantai Jialong Nano Tech Coatings; 3M; Gulbrandsen; Unelko Corporation; Apogee Enterprises, Inc.; PPG Industries Inc

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2030. For this study, Grand View Research has segmented the global flat glass coatings market report based on resin, technology, application, and region:

-

Resin Outlook (Volume, Tons; Revenue, USD Million, 2019 - 2030)

-

PU

-

Acrylic

-

Epoxy

-

Others

-

-

Technology Outlook (Volume, Tons; Revenue, USD Million, 2019 - 2030)

-

Solvent-based

-

Water-based

-

Nano-based

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2019 - 2030)

-

Solar Power

-

Mirror

-

Architectural

-

Automotive & Transportation

-

Other

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2019 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

U.K.

-

Turkey

-

Italy

-

Netherlands

-

Belgium

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Malaysia

-

Taiwan

-

South Korea

-

Vietnam

-

-

CSA

-

Brazil

-

Chile

-

-

MEA

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global flat glass coatings market size was estimated at USD 1.9 billion in 2021 and is expected to reach USD 2.3 billion in 2022.

b. The global flat glass coatings market is expected to grow at a compound annual growth rate of 20.4% from 2022 to 2030 to reach USD 10.3 billion by 2030.

b. Asia Pacific dominated the flat glass coatings market with a share of more than 56% in 2021. This is attributable to the growing construction sector in emerging economies including China, Singapore, India, and Brazil.

b. Some key players operating in the flat glass coatings market include Arkema Inc.; Fenzi Spa; Ferro Corporation; Hesse Gmbh & Co. Kg; Dow Corning; and PPG Industries.

b. Key factors that are driving the flat glass coatings market growth include rising construction spending on account of growing urbanization and infrastructural plans from various governments, and rapid developments in the transport, renewable energy sector.

b. The acrylic resin segment in the flat glass coatings market accounted for the largest revenue share of over 39% in 2021 and will retain its leading position throughout the forecast period.

b. The water-based technology segment led the global market for flat glass coatings and accounted for a revenue share of more than 52% in 2021.

b. Mirror was the largest application segment in the flat glass coatings market in 2021 and accounted for a revenue share of more than 40% in the same year.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.