- Home

- »

- Advanced Interior Materials

- »

-

Flat Steel Market Size, Share, Growth, Industry Report, 2030GVR Report cover

![Flat Steel Market Size, Share & Trends Report]()

Flat Steel Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Sheets & Coils, Plates), By End-use (Buildings & Construction, Railways & Highways, Automotive & Aerospace), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-988-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Flat Steel Market Summary

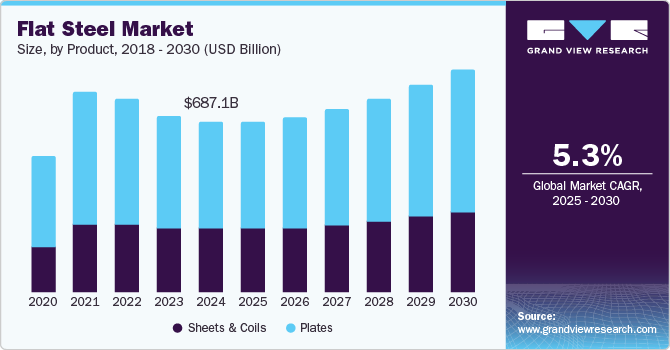

The global flat steel market was estimated at USD 687.1 billion in 2024 and is projected to reach USD 897.4 billion by 2030, growing at a CAGR of 5.3% from 2025 to 2030.Innovations in steel production, such as advanced manufacturing techniques and improved rolling processes, have enhanced the efficiency, quality, and variety of flat steel products. These innovations support the demand for steel in diverse industries by making it more cost-effective and adaptable.

Key Market Trends & Insights

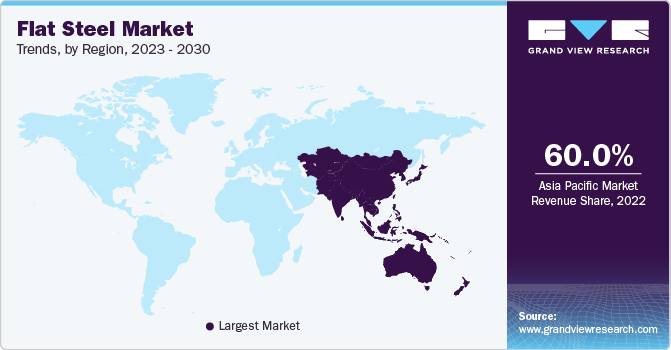

- Asia Pacific flat steel market held the largest global market share of 61% in 2024.

- North America is projected to be the fastest-growing regional market, expanding at a CAGR of 4.5% over the forecast period.

- By product, the plates segment dominated the market in 2024, accounting for 63.5% of the share.

- By end use, the automotive & aerospace segment is expected to be the fastest-growing end use segment, with a CAGR of 5.2% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 687.1 billion

- 2030 Projected Market Size: USD 897.4 billion

- CAGR (2025-2030): 5.3%

- Asia Pacific: Largest market in 2024

Additionally, shifts in consumer preferences for lighter, stronger, and more aesthetically pleasing materials-especially in sectors like automotive, construction, and appliances-drive the flat steel market. Consumers seek durable, visually appealing, lightweight products, prompting industries to prioritize flat steel's performance and design features.

Moreover, the rising emphasis on infrastructure development and increased demand from key industries, such as construction, automotive, and manufacturing, is expected to propel the market size significantly. Infrastructure projects, including bridges, roads, and buildings, require high-quality steel, boosting demand for flat steel products. In addition, the automotive industry's shift toward lightweight and fuel-efficient vehicles further fuels the demand for flat steel. As these industries expand globally, the need for flat steel, with its versatility and strength, will continue to rise, contributing to the market's growth.

Product Insights

The plates segment dominated the market by capturing the largest share of 63.5% in 2024, propelled by their widespread use in heavy industries such as construction, shipbuilding, and energy. Steel plates are essential for producing large structures like bridges, tanks, and machinery, where strength and durability are critical. Their versatility and ability to withstand extreme conditions have driven high demand in sectors requiring heavy-duty materials. Furthermore, the growing need for infrastructure development and industrial expansion continues to bolster the prominence of the plates segment in the flat steel market.

Moreover, the sheets & coils segment is projected to emerge as the fastest-growing segment and grow at a CAGR of 5.0% over the forecast period, attributed to their widespread applications across various industries, including automotive, construction, and appliances. These products are crucial for manufacturing lightweight, high-strength components that meet evolving consumer and industry demands. The automotive sector’s focus on reducing vehicle weight for fuel efficiency and emissions standards drives increased demand for steel sheets and coils. Besides, their adaptability in producing consumer goods and infrastructure components positions this segment for significant growth in the coming years.

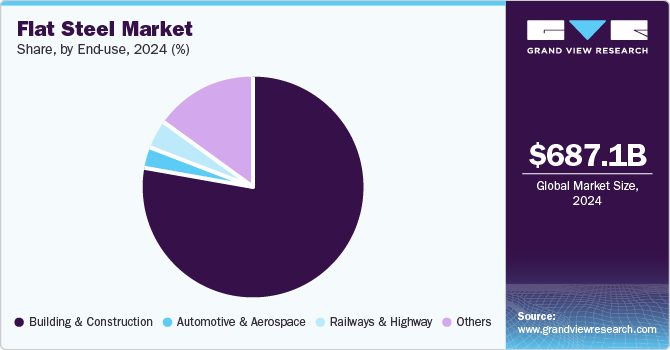

End-use Insights

The building and construction segment captured the largest revenue share of 78.9% in 2024, owing to its widespread use in structural applications such as bridges, buildings, and infrastructure projects. Flat steel offers high strength, durability, and versatility, making it ideal for constructing frameworks, roofing, cladding, and reinforced structures. With rapid urbanization, rising infrastructure investments, and an increasing focus on sustainable building materials, demand for flat steel in the construction sector continues to increase. Its supporting modern, large-scale projects solidify its foothold in the market.

The automotive and aerospace segment is expected to emerge as the fastest growing segment and is poised to capture a CAGR of 5.2% over the forecast period, fueled by escalating demand for lightweight, high-strength materials. In the automotive industry, flat steel is crucial for producing vehicle bodies, where innovations in material design aim to reduce weight for improved fuel efficiency and performance. Moreover, in aerospace, flat steel plays a vital role in manufacturing structural components for aircraft. As both industries prioritize sustainability, safety, and advanced engineering, flat steel's versatility and performance characteristics are set to drive substantial growth in these sectors.

Regional Insights

Asia Pacific Flat Steel Market Trends

Asia Pacific flat steel market secured the largest market share of 61% in 2024, attributed to the region’s robust industrial base, rapid economic growth, and surging demand from various sectors. Countries such as China, India, and Japan are major consumers and producers of flat steel due to their expanding infrastructure projects and rising automotive industries. In addition, the region's competitive pricing, large-scale production capabilities, and government initiatives promoting industrial growth further contribute to its dominance. The availability of raw materials and a well-established steel manufacturing base solidify Asia Pacific’s leading position in the global market.

Asia Pacific is projected to grow at a notable CAGR from 2025 to 2030, spurred by fast-paced industrialization, strong demand from key sectors, and the region’s substantial steel production capacity. Countries such as China, Japan, and India are major contributors, with China being the world's largest steel producer. The region's growing infrastructure projects and expanding automotive industry fuel the demand for high-quality flat steel. Moreover, the availability of affordable labor and robust supply chains make Asia Pacific a pivotal contributor to the global market.

China flat steel market captured a remarkable share in 2024 due to its rapid industrialization, massive infrastructure projects, and booming automotive sector. As the world's largest steel producer and consumer, China's demand for flat steel is fueled by its continued growth in construction, manufacturing, and transportation. The government's focus on expanding infrastructure and upgrading manufacturing capabilities further accelerates steel consumption. With investments in advanced steel production technologies and sustainable practices, China’s prominence in the flat steel market is set to strengthen shortly.

India flat steel market is anticipated to grow at a noteworthy CAGR over the forecast period,driven by a surge in industrial growth and extensive infrastructure development. The demand for flat steel products like sheets and coils is escalating as the country focuses on urbanization, smart cities, and transportation networks. The automotive sector’s shift towards lightweight and fuel-efficient vehicles further boosts the need for high-quality steel. Moreover, government initiatives such as "Make in India" and increased foreign investment in manufacturing are set to propel the growth of the market in the forecast period.

North America Flat Steel Market Trends

North America flat steel market is anticipated to emerge as the fastest growing region and expand at a CAGR of 4.5% over the forecast period, driven by strong demand from key industries such as automotive, construction, and manufacturing. The region's ongoing infrastructure development projects and the increasing adoption of advanced manufacturing technologies will fuel the need for high-quality flat steel products. Moreover, the automotive industry's shift toward lightweight, fuel-efficient vehicles is poised to boost the demand for steel sheets and coils. Besides, North America's focus on reshoring manufacturing activities further enhances the market growth prospects for flat steel in the region.

U.S. Flat Steel Market Trends

The U.S. flat steel market held a considerable position in the flat steel market in 2024, spurred bysurging demand across various industries, such as automotive, construction, and energy. The growing shift toward electric vehicles and infrastructure development drives the need for high-strength, lightweight steel solutions. Furthermore, the U.S. government’s focus on boosting domestic manufacturing and reducing steel imports is likely to strengthen the local steel industry. With technological breakthroughs and an emphasis on sustainable practices, the U.S. is well-positioned for significant growth in the flat steel market.

Mexico is projected to achieve a substantial CAGR over the forecast period, owing to its burgeoning manufacturing sector, particularly in the automotive and construction industries. As major automotive manufacturers expand operations in the country, the demand for high-quality flat steel is expected to surge. Mexico’s strategic location, trade agreements like the USMCA, and favorable labor costs further enhance its appeal as a manufacturing hub. Besides, increasing infrastructure development and government initiatives to boost industrial output are anticipated to drive ample growth in Mexico flat steel market in the years ahead.

Europe Flat Steel Market Trends

Europe flat steel market achieved sizable share in 2024, attributed to the region’s well-established industrial base, strong manufacturing sectors, and advanced technological capabilities. The region's automotive, construction, and machinery industries are major consumers of flat steel products, driving consistent demand. Additionally, Europe's focus on innovation, sustainability, and high-quality steel production further supports its presence. The presence of key steel-producing countries like Germany, Italy, and France, coupled with the European Union's trade policies and economic integration, has solidified Europe’s position as a leading contributor to the global market.

Germany is anticipated to accumulate remarkable gains by 2030, propelled by the country’s strong industrial base, particularly in the automotive, machinery, and construction sectors. As Europe's largest steel producer, Germany benefits from advanced manufacturing technologies and a robust demand for high-quality steel products. The push toward sustainable production, green steel technologies, and Germany’s focus on infrastructure and innovation will further fuel market growth. The country’s strategic position within the European Union also enhances its trade opportunities, reinforcing Germany's key role in the flat steel market expansion.

France is poised to establish a considerable foothold during the forecast period, fueled by its strong industrial base and escalating demand from sectors like automotive, construction, and energy. France automotive industry’s focus on producing lightweight, fuel-efficient vehicles is driving the demand for high-quality flat steel products such as sheets and coils. Furthermore, ongoing infrastructure projects and the push for renewable energy infrastructure are anticipated to boost steel consumption further.

Key Flat Steel Company Insights

Some of the key companies in the flat steel market include ArcelorMittal, Baosteel Group, Ezz Steel, HBIS Group, JFE Steel Corporation, Nippon Steel Corporation, Nucor, Outokumpu, POSCO, Tata Steel Limited, ThyssenKrupp AG, United States Steel Corporation, Voestalpine Group, and others.

-

ArcelorMittal provides a comprehensive range of steel products, including flat and long steel and advanced materials for the automotive, construction, and energy sectors. The company also offers mining services, supplying essential raw materials like iron ore and coal, focusing on sustainability and innovation.

-

Tata Steel Limited provides high-quality steel solutions for various sectors, such as automotive, construction, and engineering. Its product offerings focus on sustainability and innovation.

Key Flat Steel Companies:

The following are the leading companies in the flat steel market. These companies collectively hold the largest market share and dictate industry trends.

- ArcelorMittal

- Baosteel Group

- Ezz Steel

- HBIS Group

- JFE Steel Corporation

- Nippon Steel Corporation

- Nucor

- Outokumpu

- POSCO

- Tata Steel Limited

- ThyssenKrupp AG

- United States Steel Corporation

- Voestalpine Group

Recent Developments

-

In January 2025, India initiated a safeguard investigation into non-alloy and alloy steel flat products to assess potential harm from increased imports.

-

In January 2024, Fastmarkets introduced a new pricing index for European flat steel, reflecting products with reduced carbon emissions to promote sustainability.

Flat Steel Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 691.9 billion

Revenue forecast in 2030

USD 897.4 billion

Growth rate

CAGR of 5.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in Kilotons, USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East , Africa

Country scope

U.S., Mexico, Canada, Germany, France, Italy, Russia, China, India, Japan, Indonesia, Philippines, Singapore, Thailand, Malaysia, Brazil, Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, UAE, Ethiopia, Tanzania, Mozambique, Rwanda, Zimbabwe, Kenya

Key companies profiled

ArcelorMittal, Baosteel Group, Ezz Steel, HBIS Group, JFE Steel Corporation, Nippon Steel Corporation, Nucor, Outokumpu, POSCO, Tata Steel Limited, ThyssenKrupp AG, United States Steel Corporation, Voestalpine Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

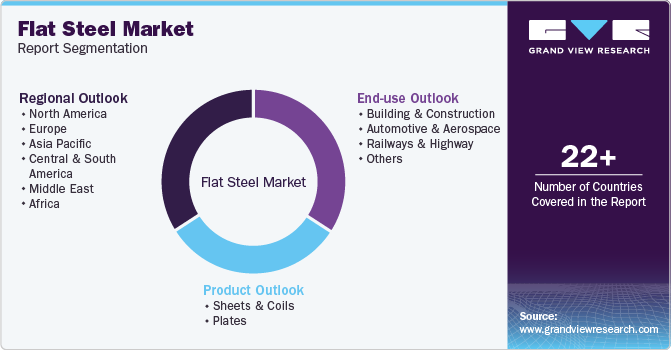

Global Flat Steel Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global flat steel market report on the basis of product, end-use, and region:

-

Product Outlook (Revenue, Kilotons, USD Million, 2018 - 2030)

-

Sheets & Coils

-

Plates

-

-

End-use Outlook (Revenue, Kilotons, USD Million, 2018 - 2030)

-

Building & Construction

-

Automotive & Aerospace

-

Railways & Highway

-

Others

-

-

Regional Outlook (Revenue, Kilotons, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Mexico

-

Canada

-

-

Europe

-

Germany

-

France

-

Italy

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Indonesia

-

Philippines

-

Singapore

-

Thailand

-

Malaysia

-

-

Central and South America

-

Brazil

-

-

Middle East

-

Bahrain

-

Kuwait

-

Oman

-

Qatar

-

Saudi Arabia

-

UAE

-

-

Africa

-

Ethiopia

-

Tanzania

-

Mozambique

-

Rwanda

-

Zimbabwe

-

Kenya

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.