- Home

- »

- Advanced Interior Materials

- »

-

Windows And Doors Market Size, Share, Industry Report 2033GVR Report cover

![Windows And Doors Market Size, Share & Trends Report]()

Windows And Doors Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Windows, Doors), By Material, By Mechanism, By Application (Residential, Commercial), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-837-3

- Number of Report Pages: 107

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Windows And Doors Market Summary

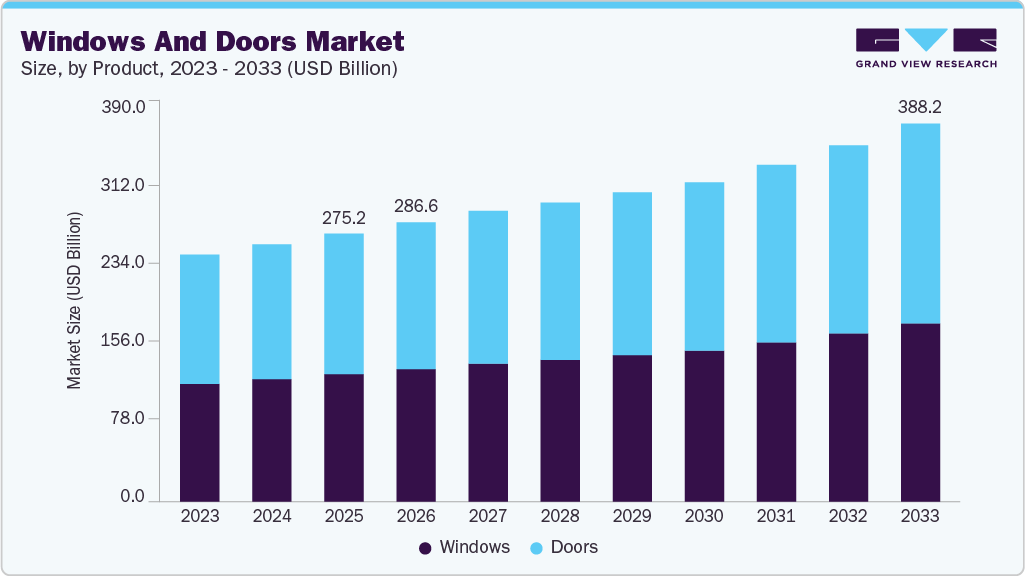

The global windows and doors market size was estimated at USD 275.16 billion in 2025 and is projected to reach USD 388.16 billion by 2033, growing at a CAGR of 4.4% from 2026 to 2033. The demand for windows and doors is rising steadily due to rapid urbanization, expansion of residential housing, and large-scale commercial construction activities worldwide.

Key Market Trends & Insights

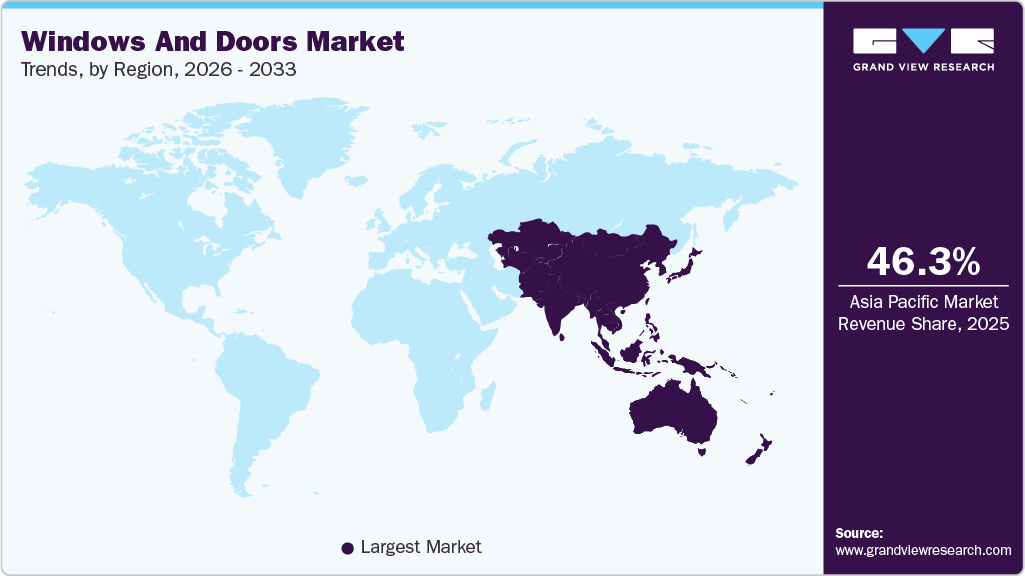

- Asia Pacific dominated the windows and doors market with the largest revenue share of 46.3% in 2025.

- China represents one of the largest markets for windows and doors, driven by extensive residential development and urban redevelopment projects.

- By product, the doors segment held the highest revenue market share of 52.5% in 2025.

- By mechanism, the sliding segment held the highest revenue market share of 41.8% in 2025 in the windows market.

- By application, the residential segment held the highest revenue market share of 66.8% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 275.16 Billion

- 2033 Projected Market Size: USD 388.16 Billion

- CAGR (2026-2033): 4.4%

- Asia Pacific: Largest market in 2025

Growing investments in smart cities, mixed-use developments, and infrastructure modernization are driving consistent replacement and new installation demand. Renovation and remodeling activities, particularly in mature markets, are further supporting market growth. Increasing awareness of energy-efficient buildings has made high-performance windows and doors a priority in both new and retrofit projects. In addition, population growth and rising homeownership rates in emerging economies continue to expand the addressable market.Key demand drivers include the growing adoption of energy-efficient, noise-insulated, and weather-resistant building components. Rising consumer preference for aesthetically appealing architectural designs is boosting demand for customized and premium windows and doors. The expansion of commercial real estate, including offices, retail spaces, and hospitality infrastructure, is significantly contributing to volume growth. Increased safety concerns are driving adoption of reinforced doors and impact-resistant window systems. Furthermore, advancements in materials such as uPVC, aluminum, and engineered wood are improving durability while lowering maintenance costs.

Technological innovation is a major trend shaping the market, with growing adoption of smart windows and automated door systems integrated with home automation platforms. Manufacturers are increasingly focusing on multi-glazed, low-emissivity glass and thermally broken frames to enhance energy efficiency. Lightweight yet strong materials such as aluminum composites and advanced polymers are gaining traction. Customization, modular designs, and prefabricated window and door systems are becoming more prevalent to reduce installation time. Sustainability-driven innovations, including recyclable materials and low-carbon manufacturing processes, are also emerging as key trends.

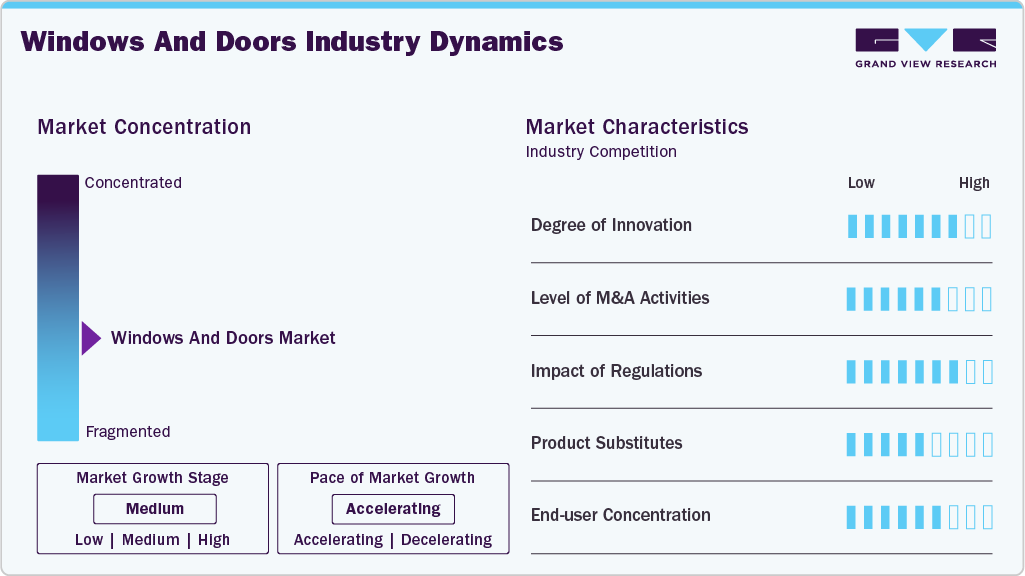

Market Concentration & Characteristics

The windows and doors market is moderately fragmented, with the presence of several global players alongside a large number of regional and local manufacturers. Established companies benefit from strong brand recognition, extensive distribution networks, and integrated manufacturing capabilities. Regional players compete by offering cost-effective and customized solutions tailored to local building practices. Strategic partnerships with construction firms and real estate developers play a crucial role in maintaining competitive advantage. Product differentiation through design, performance, and energy efficiency remains a key factor influencing market positioning.

Substitutes for windows and doors include glass fiber composites, aluminum, high-strength The threat of substitutes in the windows and doors market is moderate, as functional requirements limit replacement options. Alternatives such as curtain wall systems or open architectural designs may replace conventional windows and doors in specific commercial applications. However, safety, insulation, and regulatory compliance requirements restrict widespread substitution. Material-level substitution exists, with consumers shifting between wood, aluminum, steel, and uPVC based on cost and performance. Continuous innovation and compliance with building standards help manufacturers maintain demand stability.

Product Insights

The doors segment held the highest revenue market share of 52.5% in 2025, due to its widespread application across residential, commercial, and institutional buildings. High replacement demand driven by renovation and remodeling activities significantly contributes to segment dominance. Increasing focus on security, fire safety, and durability has accelerated the adoption of advanced door systems, including reinforced, fire-rated, and insulated doors. Commercial construction projects such as offices, hotels, healthcare facilities, and educational institutions further support demand. In addition, growing preference for aesthetically designed and customized doors enhances value growth within the segment.

The windows segment is expected to grow at a significant CAGR of 4.3% over the forecast period, driven by rising demand for energy-efficient and high-performance glazing solutions. Stringent building energy regulations are encouraging the adoption of insulated, double- and triple-glazed window systems. Increasing residential renovation activity and emphasis on natural lighting and indoor comfort are further supporting growth. Technological advancements, including smart windows and low-emissivity glass, are enhancing product adoption. Moreover, expanding urban housing projects in developing economies are expected to sustain strong demand for window installations.

Material Insights

The vinyl segment held the highest revenue market share of 42.5% in 2025 in the windows market, primarily due to its cost-effectiveness, durability, and low maintenance requirements. Vinyl windows offer strong thermal insulation and moisture resistance, making them suitable for a wide range of climatic conditions. Their ease of installation and long service life have supported widespread adoption across residential and light commercial applications. Growing preference for energy-efficient building materials has further strengthened demand for vinyl-based window systems. In addition, availability in multiple designs and finishes has improved aesthetic acceptance among homeowners and builders.

The wood segment held the highest revenue market share of 36.1% in 2025 in the doors market, driven by strong demand for premium, aesthetically appealing, and structurally robust door solutions. Wooden doors are widely preferred in residential and commercial buildings due to their natural appearance, design flexibility, and sound insulation properties. Rising demand for customized and high-end interior and exterior doors continues to support segment dominance. Wood doors are also favored in renovation and heritage construction projects where traditional architectural styles are required. Despite growing adoption of alternative materials, the premium positioning and visual appeal of wood doors sustain their strong market presence.

Mechanism Insights

The sliding segment held the highest revenue market share of 41.8% in 2025 in the windows market, driven by its space-saving design and suitability for modern residential and commercial buildings. Sliding windows are widely adopted in urban housing projects where efficient space utilization is a priority. Their ease of operation, low maintenance requirements, and compatibility with large glass panels support strong demand. The segment also benefits from growing preference for enhanced natural lighting and ventilation. Increasing adoption in apartments, offices, and high-rise developments continues to reinforce the segment’s leading position.

The swinging segment held the highest revenue market share of 28.4% in 2025 in the doors market, owing to its widespread use across residential, commercial, and institutional applications. Swinging doors offer simplicity, durability, and ease of installation, making them the preferred choice in both interior and exterior settings. Their compatibility with multiple materials, including wood, metal, and composite structures, supports broad adoption. Strong demand from housing construction and renovation activities further contributes to segment dominance. In addition, traditional design familiarity and regulatory acceptance sustain steady demand for swinging door systems.

Application Insights

The residential segment held the highest revenue market share of 66.8% in 2025, driven by robust housing construction and rising renovation and remodeling activities. Increasing urbanization and growing demand for affordable as well as premium housing are supporting sustained product adoption. Homeowners’ focus on energy efficiency, security, and aesthetic appeal has accelerated the use of advanced window and door solutions. Replacement demand from aging housing stock further contributes to segment dominance. In addition, government-backed housing projects in developing economies continue to support large-scale installations.

The commercial segment is expected to grow at a significant CAGR of 4.6% over the forecast period, supported by increasing construction of office spaces, retail complexes, hospitality facilities, and institutional buildings. Demand for high-performance, durable, and fire-rated windows and doors is rising across commercial applications. Growing emphasis on green buildings and energy-efficient infrastructure is encouraging adoption of advanced glazing and insulated door systems. Large-scale renovation of commercial properties is also contributing to market growth. Moreover, expanding urban business districts and mixed-use developments are expected to sustain strong demand over the forecast period.

Regional Insights

Asia Pacific dominated the global windows and doors market and accounted for the largest revenue share of 46.3% in 2025, due to rapid urban expansion, infrastructure development, and growing residential construction. Rising disposable income and increasing adoption of modern housing standards are supporting demand for premium and energy-efficient products. Government-backed housing projects are creating large-scale demand for standardized window and door systems. The region also benefits from cost-efficient manufacturing and strong supply chains. Continuous investments in commercial and industrial construction further reinforce regional dominance.

China Windows And Doors Market Trends

China represents one of the largest markets for windows and doors, driven by extensive residential development and urban redevelopment projects. High-rise construction and smart city initiatives are increasing demand for advanced glazing and aluminum systems. Energy efficiency regulations are encouraging adoption of insulated windows and durable door solutions. Local manufacturers dominate volume production, while international players focus on premium offerings. Renovation of aging building stock is also contributing to sustained demand.

North America Windows And Doors Market Trends

North America shows strong demand driven primarily by renovation, replacement, and remodeling activities. Stringent energy efficiency regulations are accelerating adoption of high-performance windows and doors. Residential construction remains the dominant application, supported by suburban housing expansion. Consumer preference for design, durability, and smart features is influencing purchasing decisions. The presence of established manufacturers and advanced distribution networks supports market stability.

The U.S. market is driven by replacement demand, energy-efficient home upgrades, and residential remodeling activities. Growing awareness of sustainability and energy cost reduction is boosting demand for insulated and smart window solutions. Commercial construction, including office renovations and hospitality projects, adds incremental demand. Manufacturers are focusing on customized designs and faster installation solutions. Strong regulatory enforcement continues to influence product innovation.

Europe Windows And Doors Market Trends

Europe’s windows and doors market is shaped by strict energy efficiency standards and sustainability regulations. Renovation of old residential and commercial buildings is a key growth driver across the region. Demand for triple-glazed windows and thermally efficient door systems is increasing. Architectural customization and aesthetic appeal play a significant role in purchasing decisions. Regional manufacturers emphasize sustainable materials and high-quality craftsmanship.

Germany is a key market in Europe, supported by advanced construction practices and strict environmental regulations. The demand for energy-efficient and high-insulation windows and doors remains strong. Residential renovations and green building projects drive consistent sales. Technological innovation and precision engineering give domestic manufacturers a competitive edge. Sustainability-focused policies continue to shape product development.

Central & South America Windows And Doors Market Trends

Central & South America is experiencing gradual growth in the windows and doors market due to expanding urban infrastructure and housing projects. Rising middle-class population and increasing construction activity are driving demand. Cost-effective materials such as aluminum and uPVC are widely adopted. Government-backed housing initiatives are supporting volume growth. However, market expansion is moderated by economic volatility in certain countries.

Middle East & Africa Windows And Doors Market Trends

The Middle East & Africa market is driven by large-scale infrastructure projects, commercial developments, and residential construction. Demand for durable and climate-resistant windows and doors is high due to extreme weather conditions. Rapid urbanization and tourism-driven construction support market growth in the Middle East. Africa shows emerging demand, supported by affordable housing projects and urban expansion. The market is gradually shifting toward energy-efficient and modern architectural solutions.

Key Windows And Doors Company Insights

Some of the key players operating in the market include Andersen Corporation and JELD-WEN Holding, Inc.

-

Andersen Corporation is a leading North American manufacturer of premium windows and doors, known for its broad product portfolio spanning wood, composite, and vinyl solutions. The company focuses on energy efficiency, design innovation, and sustainability, serving residential and commercial segments through extensive distribution networks.

-

JELD-WEN Holding, Inc. is a global provider of doors and windows, offering a wide range of wood, vinyl, and aluminum products. With a strong presence in both residential and commercial markets, JELD-WEN emphasizes customizable solutions and operational scale through its large manufacturing footprint.

Pella Corporation and Marvin Windows and Doors are some of the emerging market participants in the windows and doors market.

-

Pella Corporation is a U.S.-based fenestration brand recognized for high-quality windows and patio doors, combining craftsmanship with energy-efficient technologies. The company is known for customer satisfaction, design versatility, and strong dealer support across residential markets.

-

Marvin Windows and Doors is a premium manufacturer specializing in custom wood and clad-wood window and door systems. The company is distinguished by its focus on architectural design, performance, and personalized solutions for high-end residential and commercial applications.

Key Windows And Doors Companies:

The following are the leading companies in the windows and doors market. These companies collectively hold the largest market share and dictate industry trends.

- Andersen Corporation

- JELD-WEN Holding, Inc.

- Pella Corporation

- LIXIL Corporation

- YKK AP Inc.

- Masonite International Corporation

- Marvin Windows and Doors

- Atrium Windows & Doors

- Fenesta Building Systems

- Deceuninck Group

Recent Developments

-

In December 2025, Andersen Corporation announced acquisition of Bright Wood Corporation to strengthen its supply chain for lumber and components in the U.S. windows & doors industry.

Window And Doors Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 286.64 billion

Revenue forecast in 2033

USD 388.16 billion

Growth rate

CAGR of 4.4% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material, mechanism, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; China; Japan; India; Saudi Arabia; UAE; Qatar

Key companies profiled

Andersen Corporation; JELD-WEN Holding, Inc.; Pella Corporation; LIXIL Corporation; YKK AP Inc.; Masonite International Corporation; Marvin Windows and Doors; Atrium Windows & Doors; Fenesta Building Systems; Deceuninck Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Windows And Doors Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the windows and doors market on the basis of product, material, mechanism, application, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Windows

-

Doors

-

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Windows

-

Vinyl

-

Wood

-

Metal

-

Others

-

-

Doors

-

Plastic

-

Wood

-

Metal

-

Others

-

-

-

Mechanism Outlook (Revenue, USD Million, 2021 - 2033)

-

Windows

-

Swinging

-

Sliding

-

Others

-

-

Doors

-

Swinging

-

Sliding

-

Folding

-

Overhead

-

Others

-

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Residential

-

Commercial

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

Qatar

-

-

Frequently Asked Questions About This Report

b. The global windows and doors market size was estimated at USD 275.16 billion in 2025 and is expected to reach USD 286.64 billion in 2026.

b. The global windows and doors market is expected to grow at a compound annual growth rate of 4.4% from 2026 to 2033 to reach USD 388.16 billion by 2033.

b. The doors segment held the highest revenue market share of 52.5% in 2025, due to its widespread application across residential, commercial, and institutional buildings.

b. Some of the key players operating in the windows and doors market include Andersen Corporation, JELD-WEN Holding, Inc., Pella Corporation, LIXIL Corporation, YKK AP Inc., Masonite International Corporation, Marvin Windows and Doors, Atrium Windows & Doors, Carbon Composites, Inc., and Fenesta Building Systems.

b. Rapid urbanization, growth in residential and commercial construction, increasing renovation activity, and rising demand for energy-efficient and aesthetically advanced building solutions are the key factors driving the windows and doors market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.