- Home

- »

- Consumer F&B

- »

-

Flavor Compounds Market Size, Share, Growth Report, 2030GVR Report cover

![Flavor Compounds Market Size, Share & Trends Report]()

Flavor Compounds Market (2023 - 2030) Size, Share & Trends Analysis Report By Flavor (Salty, Fruity, Savory, Spicy, Sweet), By Application (Protein Bars & Snacks, Meat Alternatives), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-131-1

- Number of Report Pages: 134

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Flavor Compounds Market Summary

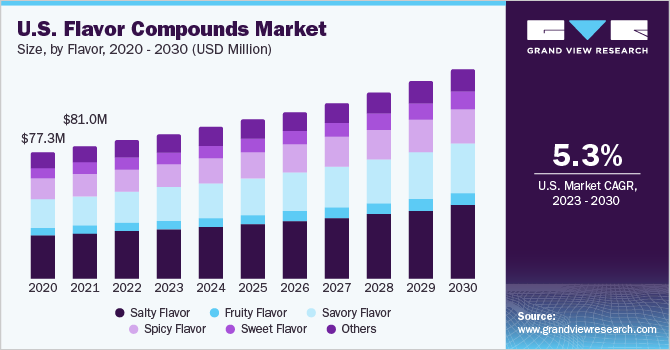

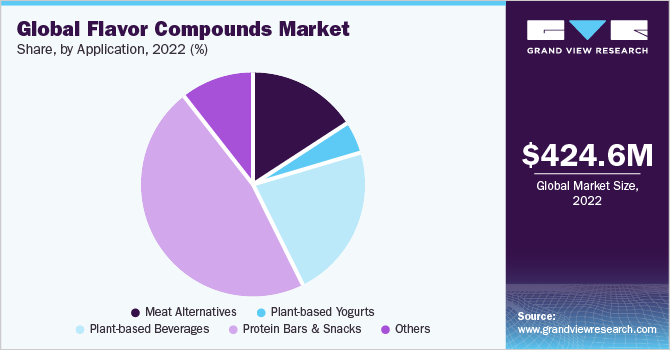

The global flavor compounds market size was estimated at USD 424.61 million in 2022 and is projected to reach USD 660.4 million by 2030, growing at a compound annual growth rate (CAGR) of 5.7% from 2023 to 2030. The market is experiencing significant growth, driven by a confluence of factors that cater to diverse consumer preferences and industry demands.

Key Market Trends & Insights

- Asia Pacific dominated the market with a share of 44.2% in 2022.

- The market in Europe is expected to grow at a CAGR of 5.6% from 2023 to 2030.

- Based on flavor, the salty flavor segment held the largest market share of 35.0% in 2022 in terms of revenue.

- Based on application, the protein bars & snacks segment held a revenue share of 46.9% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 424.61 Million

- 2030 Projected Market Size: USD 660.4 Million

- CAGR (2023-2030): 5.7%

- Asia Pacific: Largest market in 2022

With the increasing popularity of processed and convenience foods in today's fast-paced lifestyles, flavor compounds are instrumental in enhancing the taste and aroma of these products, making them more enticing to consumers. Consumer palates have become increasingly sophisticated and varied, leading to a demand for a wide range of flavors, from sweet to savory and exotic. The preference for natural and clean-label ingredients has also fueled the market, with flavor compounds derived from natural sources aligning perfectly with consumers' desires for healthier and more transparent food choices.

Furthermore, as functional foods and beverages gain prominence for their added health benefits, flavor compounds find use in masking the taste of functional ingredients or improving overall palatability. The market is further shaped by globalization, rapid innovation, cost-effective solutions in the food industry, and the need for flavor masking in pharmaceuticals, creating a broad spectrum of applications. The demand for natural and clean-label flavors is witnessing a significant uptick among consumers. This prevailing trend has heightened interest in flavor compounds from botanical origins, including herbs, spices, and fruits.

Manufacturers are making substantial investments in natural flavor extraction methods to cater to this evolving preference for transparent ingredient lists. Moreover, consumers' appetite for exotic and unique flavor profiles is growing. This shift toward culinary exploration has inspired flavor compound producers to embark on innovative endeavors, crafting distinctive and globally-inspired flavors. These novel tastes encompass a wide range, from tropical fruits to international spices and unique herbal blends designed to captivate consumers seeking distinctive gastronomic experiences. Artificial intelligence (AI) and machine learning (ML) are also making their mark in the flavor industry.

These advanced technologies are harnessed to analyze consumer preferences and meticulously predict flavor trends. By adopting this data-driven approach, the industry can create flavors that resonate with specific target demographics, enhancing product launch success and elevating overall consumer satisfaction. Furthermore, flavor compounds have assumed a pivotal role in the context of the growing plant-based and alternative protein movement. They are instrumental in crafting palatable meat substitutes and dairy alternatives that mirror the flavors of conventional animal-derived products. This development caters to the preferences of health-conscious and environmentally-aware consumers.

Flavor Insights

In terms of revenue, the salty flavor segment held the largest market share of 35.0% in 2022. Saltiness is one of the five primary taste sensations, and it can enhance the overall flavor profile of plant-based dishes. Salt can enhance other flavors, making plant-based foods more savory and appetizing. Salt is a natural flavor enhancer that can make plant-based foods more palatable. Many people have a natural craving for savory and salty flavors. Plant-based snacks that offer a satisfying salty taste are gaining widespread popularity, making them a preferred choice for those who enjoy savory snacks. According to a survey from Mintel in 2023, 42% of snackers admitted to eating more salty snacks than they did in 2021, while 34% are experimenting with new, intriguing flavors.

The savory flavor segment is expected to grow at the fastest CAGR of 6.3% from 2023 to 2030. Savory flavor compounds, also known as umami compounds, contribute to the savory and meaty taste perception in foods. Umami is considered one of the five basic taste sensations, alongside sweet, sour, bitter, and salty. Savory flavor compounds can be found naturally in a variety of foods, and they are also used in the food industry to enhance the taste of various products. For example, tomatoes are naturally rich in glutamate, and tomato paste or concentrated tomato products are used in various savory dishes to enhance their umami flavor.

Application Insights

In terms of revenue, the protein bars & snacks segment held a revenue share of 46.9% in 2022. Plant-based flavor compounds from fruits and berries, such as strawberry, blueberry, or banana extracts, can create fruity and refreshing taste profiles in snacks and bars. Manufacturers can customize flavor profiles by using clean-label ingredients to create unique and proprietary taste experiences that cater to specific consumer preferences. In July 2021, Barebells, a protein bar producer in the U.S., launched a duo of vegan protein bars, Salty Peanut and Hazelnut Nougat. These protein bars are meticulously crafted with a focus on clean-label components and have been thoughtfully designed to promote the health and well-being of their customers.

Moreover, consumers are increasingly focused on health and wellness, leading to a growing demand for natural and nutritious snack options. Plant-based protein bars align with these trends, as they often contain ingredients like fruits, nuts, seeds, and whole grains and are healthier alternatives to processed ingredients. The meat alternatives segment is expected to grow at a CAGR of 5.8% from 2023 to 2030. Flavor compounds play a crucial role in developing meat alternatives, which aim to replicate the sensory experience that closely mimics the flavors of real meat. Plant-based meat alternatives often rely on natural flavor compounds found in various plant sources to recreate the taste of meat.

For example, compounds like glutamic acid, responsible for umami flavor, can be derived from sources like mushrooms, tomatoes, or soy. Flavor companies play a crucial role in the development and success of meat alternatives by creating appealing products. SucculencePB, Kerry's solution for plant-based meat alternatives, recreates meat's exquisite, juicy flavor. The SucculencePB patent-pending technology was launched in March 2023 by Kerry Group plc. It provides plant-based burger and sausage manufacturers with a vegan-friendly solution to lock in moisture and flavor while improving flavor and nutritional characteristics to meet consumer expectations.

Regional Insights

Asia Pacific dominated the market with a share of 44.2% in 2022. Compounds with natural flavors are those that are derived from plants, herbs, spices, fruits, vegetables, or microbial fermentation. The demand for natural flavor compounds in the market has been boosted by consumers' growing interest in naturally nutrient-rich and delicious products. Chinese consumers are increasingly seeking functional and nutraceutical products, and manufacturers are launching new products to meet the consumer demand. For instance, in April 2021, Tonino Lamborghini formed a licensing agreement with NEW AWAKEN LIMITED to launch Tonino Lamborghini Energy Drink in the Chinese market.

The Tonino Lamborghini Energy Drink Sugar-Free was the first product launched in China, with a 330ml version. Subsequent releases will include the regular canned version and a non-carbonated variant. In addition, the product was launched with a unique design that can be tailored to align with Chinese preferences and consumption habits. As a result, manufacturers increasingly use flavor compounds to provide consumers with functional and nutraceutical beverages with unique, innovative, and creative flavors. The market in Europe is expected to grow at a CAGR of 5.6% from 2023 to 2030.

The vegan and plant-based food market is experiencing significant growth across Europe, with the increasing use of natural flavor compounds in manufacturing plant-based alternatives to meat and dairy products. The growing vegan population in the region is a key factor driving the demand for vegan products. Rapid urbanization drives the demand for processed and packaged foods in various European countries. To maintain freshness, taste, safety, and texture, flavor compounds are used in convenience and processed food products. With a rise in consumer awareness, the demand for high-end food products has also increased, thus driving the demand for flavor compounds.

Key Companies & Market Share Insights

The market includes both international and domestic participants. Brand share analysis indicates that key market players are focusing on strategies such as new flavor launches, partnerships, mergers & acquisitions, global expansion, and others. Some of the initiatives include:

-

In March 2023, the "Orange NextGen replacers and extenders" product line was introduced by FirmenichSA as a natural substitute for FTNF (From The Named Fruit) orange oils. It offers cost-effective and sustainable solutions to its customers while maintaining the desired flavor profile

-

In January 2023, Symrise, a global leader in flavors and fragrances, invested by acquiring a minority stake in EvodiaBio, a Danish aroma company. This strategic move allows Symrise to strengthen its position in the aroma and fragrance industry and potentially collaborate with EvodiaBio on various projects and product developments

-

In December 2022, MANE India established its first Flavour Innovation Centre in Hyderabad, India. The Flavour Innovation Centre is 13,901 square feet and is projected to be highly efficient in meeting customers' needs nationwide. The center is expected to serve as a hub for creativity and experimentation in various categories of flavors

Some of the key players operating in the global flavor compounds market include:

-

Givuadan

-

Firmenich SA

-

Symrise AG

-

Sensient Technologies Corporation

-

International Flavors & Fragrances Inc.

-

Takasago International Corporation

-

Kerry Group plc

-

MANE

-

Robertet Group

-

Huabao Flavours & Fragrances Co., Ltd.

-

Others

Flavor Compounds Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 444.9 million

Revenue forecast in 2030

USD 660.4 million

Growth rate

CAGR of 5.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Flavor, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia, South Korea; Brazil; South Africa

Key companies profiled

Givuadan; Firmenich SA; Symrise AG; Sensient Technologies Corp.; International Flavors & Fragrances Inc.; Takasago International Corp.; Kerry Group plc; MANE; Robertet Group; Huabao Flavours & Fragrances Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Flavor Compounds Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global flavor compounds market report on the basis of flavor, application, and region:

-

Flavor Outlook (Revenue, USD Million, 2017 - 2030)

-

Salty Flavor

-

Fruity Flavor

-

Savory Flavor

-

Spicy Flavor

-

Sweet Flavor

-

Others

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Meat Alternatives

-

Plant-based Yogurts

-

Plant-based Beverages

-

Protein Bars & Snacks

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global flavor compounds market size was estimated at USD 424.61 million in 2022 and is expected to reach USD 444.9 million in 2023.

b. The global flavor compounds market is expected to grow at a compounded growth rate of 5.7% from 2023 to 2030 to reach USD 660.4 million by 2030.

b. Salty flavor dominated the global flavor compounds market with a share of 35.0% in 2022. Salty flavors are versatile and can be used in various food products, including snacks, processed meats, sauces, and soups. This versatility makes salty-flavored compounds valuable to food manufacturers looking to enhance the taste of their products.

b. Some key players operating in flavor compounds market include Givuadan, Firmenich SA, Symrise AG, Sensient Technologies Corporation, International Flavors & Fragrances Inc., Takasago International Corporation, Kerry Group plc, MANE, Robertet Group, Huabao Flavours & Fragrances Co., Ltd., Others.

b. Key factors that are driving the market growth include rising demand for plant based foods and growing preference for natural ingredients

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.