- Home

- »

- Plastics, Polymers & Resins

- »

-

Flexible Epoxy Resin Market Size, Industry Report, 2030GVR Report cover

![Flexible Epoxy Resin Market Size, Share & Trends Report]()

Flexible Epoxy Resin Market (2025 - 2030) Size, Share & Trends Analysis Report By Product Type (Urethane Modified, Rubber Modified, Dimmer Acid Modified), By Application (Composites, Adhesives & Sealants, Electrical & Electronics), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-516-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Flexible Epoxy Resin Market Size & Trends

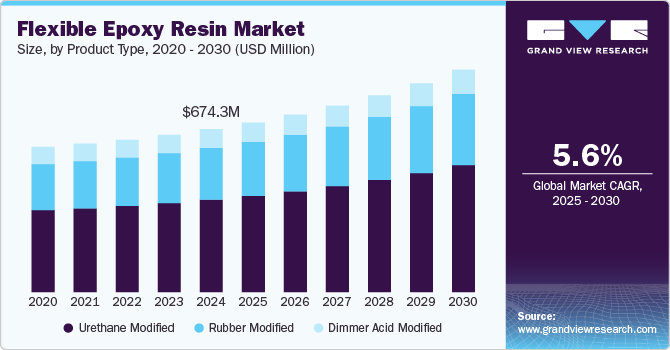

The global flexible epoxy resin market size was estimated at USD 674.3 million in 2024 and is projected to grow at a CAGR of 5.6% from 2025 to 2030. The growing need for lightweight, high-performance materials in industries such as automotive, aerospace, and flexible electronics is propelling market growth. Another significant factor is the increasing need for improved adhesive and coating solutions in various sectors. Flexible epoxy resins offer superior adhesion, chemical resistance, and impact strength, making them ideal for protective coatings in industrial applications. In the construction industry, these resins are employed in flooring systems, waterproofing, and repair materials, where they provide long-lasting protection against harsh environmental conditions. Such applications not only extend the life of infrastructure but also reduce maintenance costs, driving market demand further.

Innovation in resin formulations is also a key contributing factor to market growth. Manufacturers are continually developing new formulations that enhance the flexibility, durability, and environmental resistance of epoxy resins. For example, advancements in polymer chemistry have led to the creation of hybrid epoxy systems that offer improved performance at lower curing temperatures, making them more energy efficient. These innovations have opened new applications in sectors such as electronics and renewable energy, where precise material properties are essential for optimal performance.

Furthermore, regulatory pressures and the global push for sustainability have encouraged the development and adoption of eco-friendly flexible epoxy resins. Industries are increasingly seeking materials that not only perform well but also meet stringent environmental standards. This has led to investments in research and development aimed at reducing volatile organic compounds (VOCs) and incorporating bio-based components into epoxy formulations. As companies strive to reduce their carbon footprint, the market for sustainable, flexible epoxy resins is expected to expand significantly.

Moreover, global economic growth and increased infrastructure spending, particularly in emerging economies, are driving the demand for advanced materials such as flexible epoxy resins. Governments worldwide are investing in modernization projects that require high-performance construction materials, thereby creating a steady demand. As these economies continue to develop, the flexible epoxy resin industry is poised for long-term growth, fueled by ongoing innovation and an expanding range of applications across multiple industries.

Product Type Insights

Based on product type, the urethane modified segment led the market with the largest revenue share of 56.70% in 2024. Urethane-modified flexible epoxy resins combine the toughness of urethane with the adhesion and chemical resistance of epoxy, making them ideal for applications requiring flexibility and impact resistance. These resins are widely used in coatings, adhesives, and composite materials where enhanced durability and flexibility are critical, such as automotive, aerospace, and construction industries.

The rubber modified segment is projected to grow at the fastest CAGR of 5.7% during the forecast period. Rubber-modified epoxy resins incorporate elastomers to improve impact resistance, flexibility, and toughness while maintaining good adhesion properties. These resins are particularly used in structural adhesives, protective coatings, and high-performance composites, offering excellent crack resistance and vibration absorption in applications like electronics, marine, and industrial flooring.

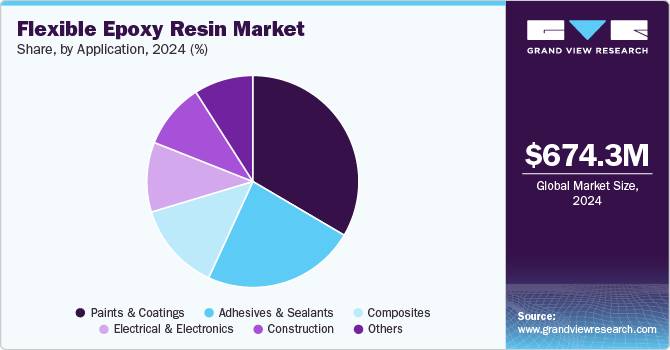

Application Insights

Based on application, the paints and coatings segment led the market with the largest revenue share of 33.46% in 2024. The demand for flexible epoxy-based paints and coatings is driven by increasing industrialization and infrastructure development. Growth in the automotive and aerospace sectors, where protective coatings are crucial, further boosts market expansion. In addition, the rising focus on environmentally friendly coatings with low VOC emissions is promoting the adoption of epoxy-based formulations.

The electrical & electronics segment is anticipated to grow at the fastest CAGR of 6.5% during the forecast period. The electrical and electronics industry extensively utilizes flexible epoxy resins in encapsulation, potting, and insulation applications. Their electrical insulating properties, along with resistance to moisture and high temperatures, make them suitable for printed circuit boards (PCBs), transformers, and semiconductor packaging. The miniaturization trend in the electronics industry and the growing demand for reliable, high-performance electronic components are key factors driving the adoption of flexible epoxy resins, thus benefiting the segment growth in the market.

Region Insights

The flexible epoxy resin market in North America is anticipated to grow at the fastest CAGR during the forecast period. The region's strong presence in aerospace and automotive manufacturing plays a crucial role in driving the market growth in the region. Companies such as Boeing, Lockheed Martin, General Motors, and Ford extensively use flexible epoxy resins in their manufacturing processes. Moreover, the construction and infrastructure sector in North America significantly contributes to market growth. With ongoing infrastructure renovation projects and the increasing adoption of green building practices, flexible epoxy resins are in high demand for applications such as floor coatings, bridge deck overlays, and concrete repair.

U.S. Flexible Epoxy Resin Market Trends

The flexible epoxy resin market in the U.S. is growing particularly due to its expansive use in aerospace, automotive, and construction sectors, backed by robust R&D and cutting-edge innovations from firms such as 3M and Hexion Inc. Automotive companies such as Tesla and Ford are incorporating flexible epoxy resins in electric vehicle battery encapsulation and lightweight body components. The shift toward electric vehicles has particularly accelerated this trend, as flexible epoxy resins provide excellent electrical insulation while maintaining the necessary mechanical properties.

Asia Pacific Flexible Epoxy Resin Market Trends

Asia Pacific dominated the flexible epoxy resin market with the largest revenue share of 39.70% in 2024 and is anticipated to grow at the fastest CAGR of 5.8% over the forecast period. The region's robust manufacturing sector, particularly in countries such as China, Japan, Southeast Asia, and India, has created substantial demand for flexible epoxy resins. For instance, major electronics manufacturers such as Samsung, Sony, and Foxconn rely heavily on flexible epoxy resins to ensure their products' durability and performance in varying environmental conditions.

The China flexible epoxy resin market is primarily driven by its massive manufacturing sector, particularly in the electronics, automotive, and construction industries, which drives substantial demand for flexible epoxy resins. Besides, the rapid expansion of a country’s renewable energy sector, especially wind power, has significantly boosted the demand for flexible epoxy resins in the country. For instance, wind turbine blade manufacturing requires large quantities of these resins due to their excellent fatigue resistance and ability to withstand extreme weather conditions. Major wind turbine manufacturers such as Goldwind and Envision have established extensive production facilities in China, creating a robust supply chain for epoxy resin applications.

Europe Flexible Epoxy Resin Market Trends

The flexible epoxy resin market in Europe growth can be attributed to the region's robust industrial infrastructure, particularly in countries such as Germany, France, and Italy. These nations have well-established automotive, aerospace, and construction sectors that extensively use flexible epoxy resins in various applications, from composite materials to protective coatings. Besides, Europe's stringent environmental regulations and sustainability initiatives are triggering the demand for flexible epoxy resin in the region. The EU's REACH regulations and emphasis on reducing volatile organic compounds (VOC) emissions have pushed manufacturers to develop and adopt more environmentally friendly flexible epoxy resins.

The Germany flexible epoxy resin market is primarily driven by its robust automotive sector, which serves as the backbone of demand for flexible epoxy resin. Germany, being home to major automotive manufacturers such as BMW, Mercedes-Benz, Volkswagen, and Audi, extensively uses flexible epoxy resins in various applications - from composite materials for lightweight vehicle components to high-performance adhesives for structural bonding. For example, these resins are crucial in manufacturing carbon fiber reinforced plastics (CFRP) used in electric vehicle battery enclosures and structural components.

Key Flexible Epoxy Resin Company Insights

The global flexible epoxy resin industry exhibits intense competition among both established manufacturers and emerging players. Key industry players dominate significant market share through their extensive product portfolios, strong R&D capabilities, and established distribution networks. These companies frequently engage in strategic initiatives such as mergers, acquisitions, and product innovations to maintain their competitive edge.

The market is experiencing increased competition from Asia Pacific manufacturers, particularly from China and India, who are leveraging cost advantages and expanding their presence in international markets. Companies are also focusing on developing eco-friendly and sustainable flexible epoxy resin formulations to address growing environmental concerns and stringent regulations, which have become a key differentiator in the competitive landscape.

Key Flexible Epoxy Resin Companies:

The following are the leading companies in the flexible epoxy resin market. These companies collectively hold the largest market share and dictate industry trends.

- Conren Limited

- DIC Corporation

- Dow

- Easy Composites

- EPOXONIC

- Hexion

- INTERTRONICS

- KUKDO Chemical (Kunshan) Co., Ltd.

- LymTal International, Inc.

- Mereco Technologies

- Nan Ya Plastic Corporation

- Olin Corporation

- Resintech Limited

- Sicomin Epoxy Systems

Recent Developments

-

In April 2024, Westlake Corporation announced the launch of several innovative lower yellowing epoxy products at the American Coatings Show 2024, Indianapolis, Indiana. Among these is the Deep Pour Lower Yellowing Epoxy System, which combines Epoxy Research Resin RSL-4710 with Research Curing Agent RSC-4731. This advanced two-component system is designed for extended set times and lower exotherm temperatures, enabling easier application with pours of up to four inches in a single use.

-

In May 2023, Huntsman announced the development of innovative materials aimed at enhancing battery performance and protection, particularly for electric vehicles (EVs). The product portfolio includes polyurethane, carbon nanotube, and epoxy materials. These are intended to create high-performance composite battery structures, offering both design flexibility and production efficiency.

Flexible Epoxy Resin Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 701.9 million

Revenue forecast in 2030

USD 920.9 million

Growth rate

CAGR of 5.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Product type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; Australia; Southeast Asia; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Conren Limited; DIC Corporation; Dow; Easy Composites; EPOXONIC; Hexion; INTERTRONICS; KUKDO Chemical (Kunshan) Co., Ltd.; LymTal International, Inc.; Mereco Technologies; Nan Ya Plastic Corporation; Olin Corporation; Resintech Limited; Sicomin Epoxy Systems

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Flexible Epoxy Resin Market Report Segmentation

This report forecasts revenue growth at a global level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global flexible epoxy resin market report based on product type, application, and region:

-

Product Type Outlook (Revenue, USD Million, Volume, Kilotons; 2018 - 2030)

-

Urethane Modified

-

Rubber Modified

-

Dimmer Acid Modified

-

-

Application Outlook (Revenue, USD Million, Volume, Kilotons; 2018 - 2030)

-

Paints and Coatings

-

Adhesives and Sealants

-

Composites

-

Electrical and Electronics

-

Construction

-

Others

-

-

Region Outlook (Revenue, USD Million, Volume, Kilotons; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

Southeast Asia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global flexible epoxy resin market size was valued at USD 674.3 million in 2024 and is expected to reach USD 702.0 million in 2025.

b. The global flexible epoxy resin market is expected to grow at a CAGR of 5.6% from 2025 to 2030, reaching USD 920.9 million by 2030.

b. Based on product, the urethane modified segment led the market with the largest revenue share of over 56.0% in 2024. Urethane-modified flexible epoxy resins combine the toughness of urethane with the adhesion and chemical resistance of epoxy, making them ideal for applications requiring flexibility and impact resistance.

b. Key players operating in the flexible epoxy resin market include Conren Limited; DIC Corporation; Dow; Easy Composites; EPOXONIC; Hexion; INTERTRONICS; KUKDO Chemical (Kunshan) Co., Ltd.; LymTal International, Inc.; Mereco Technologies, among others

b. The growing need for lightweight, high-performance materials in industries such as automotive, aerospace, and flexible electronics is propelling flexible epoxy resin market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.