- Home

- »

- Next Generation Technologies

- »

-

Flexographic Printing Market Size And Share Report, 2030GVR Report cover

![Flexographic Printing Market Size, Share & Trends Report]()

Flexographic Printing Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Flexible Packaging, Corrugated Packaging, Labels & Tags), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-332-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Flexographic Printing Market Summary

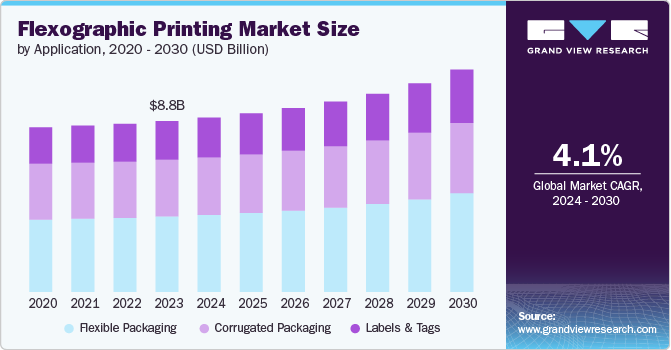

The global flexographic printing market size was estimated at USD 8.84 billion in 2023 and is projected to reach USD 11.50 billion by 2030, growing at a CAGR of 4.1% from 2024 to 2030. Flexographic printing, also known as flexo printing, is a versatile and widely used printing method that has been gaining increasing popularity due to several key advantages it offers over other printing techniques.

Key Market Trends & Insights

- The Asia Pacific accounted for the largest revenue share of 33.4% in 2023.

- By application, the flexible packaging segment was the largest with a revenue share of 44.2% in 2023.

- By application, The labels & tags segment registered the fastest CAGR of 5.0% over the forecast period.

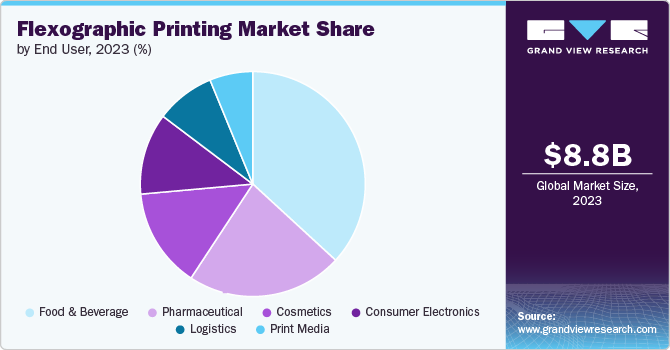

- By end use, the food and beverage segment dominated the market with a revenue share of 36.8% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 8.84 Billion

- 2030 Projected Market Size: USD 11.50 Billion

- CAGR (2024-2030): 4.1%

- Asia Pacific: Largest market in 2023

Flexographic printing presses can operate at high speeds, making them suitable for producing large quantities of printed material quickly. This is crucial for industries that require rapid turnaround times, such as packaging and labeling. Additionally, flexographic printing uses inks that are formulated for high-speed drying, which contributes to faster production times and lower energy consumption.

Additionally, the use of water-based and UV-curable inks in flexo printing reduces volatile organic compound (VOC) emissions compared to solvent-based inks used in other printing methods. Moreover, environmental considerations play a crucial role in driving the adoption of flexographic printing. The shift towards water-based and UV inks reduces volatile organic compound (VOC) emissions and improves workplace safety for operators. Additionally, the efficiency of flexographic printing in minimizing waste and energy consumption supports sustainability goals. These factors have become increasingly important as regulatory requirements tighten and consumer preferences for eco-friendly products grow stronger.

Advancements in technology have significantly enhanced the quality and versatility of flexographic printing. Modern flexo presses can achieve high-definition print quality with sharp images and vibrant colors, suitable for a wide range of applications including food packaging, pharmaceutical labels, and industrial products. The method's ability to print on various substrates-from paper and cardboard to plastics, films, and metallic foils-further expands its utility across diverse industries. This versatility extends to specialty applications such as metallic inks, varnishes, and coatings, allowing for enhanced visual appeal and product differentiation in competitive markets.

However, the initial investment in flexographic printing equipment and infrastructure can be significant, especially for smaller businesses or those entering the market. High-quality flexo presses capable of handling complex designs and substrates may require substantial capital outlay, which can deter some companies from adopting this technology. Additionally, the rise of digital printing technologies has introduced strong competition to traditional printing methods like flexography. Digital printing offers advantages such as faster turnaround times, variable data printing capabilities, and minimal setup requirements for short runs, which can attract customers looking for flexibility and cost-effectiveness.

Application Insights

The flexible packaging segment held the largest market share of 44.2% in 2023.The versatility and cost-effectiveness of flexible packaging have driven its widespread adoption across various industries. Flexible packaging, which includes materials like plastic films, foils, and laminates, offers advantages such as lightweight properties, extended shelf life for products, and reduced transportation costs. These benefits have made it increasingly popular in sectors like food and beverage, pharmaceuticals, and personal care. Additionally, the growth of e-commerce has also significantly contributed to the expansion of the flexible packaging segment. As online shopping continues to surge, there is an increased demand for packaging solutions that can protect products during shipping while remaining visually appealing. Flexographic printing on flexible materials meets these requirements effectively, offering high-quality graphics and durability.

The labels & tags segment registered the fastest CAGR of 5.0% over the forecast period. Labels and tags play a critical role across various industries, including retail, logistics, healthcare, and manufacturing. Flexographic printing is particularly well-suited for producing labels and tags due to its ability to handle a wide range of substrates and deliver high-quality printing at relatively low costs. This method allows for efficient production of labels and tags in large volumes, meeting the demands of industries requiring extensive labeling for branding, product identification, and information dissemination. One key driver of the segment's growth is the increasing demand for customized and variable data printing capabilities. Flexographic printing technology has evolved to integrate digital solutions, enabling quick setup changes and personalized printing options. This flexibility appeals to industries where rapid turnaround times and tailored labeling solutions are essential, such as in the fast-moving consumer goods (FMCG) sector and e-commerce logistics.

End User Insights

The food & beverage segment dominated the market with a revenue share of 36.8% in 2023. The food and beverages industry requires extensive and diverse packaging solutions to meet various product types, sizes, and regulatory requirements. Flexographic printing is highly versatile and capable of printing on a wide range of packaging materials, such as flexible films, paperboards, and corrugated materials. This versatility allows manufacturers to meet the specific packaging needs of different food and beverage products effectively.

The logistics segment is anticipated to register the fastest CAGR of 6.2% over the forecast period in the target market. The logistics industry relies heavily on efficient and standardized packaging and labeling solutions to streamline operations, ensure product identification, and facilitate smooth supply chain management. Flexographic printing offers cost-effective and scalable solutions for producing labels, tags, and packaging materials that meet these requirements. Additionally, flexographic printing technology has evolved to integrate digital capabilities, allowing for flexible and customizable printing solutions. This includes variable data printing, where labels and packaging can be tailored with specific information such as barcodes, QR codes, batch numbers, and shipping details. This customization capability is crucial in logistics for enhancing tracking, inventory management, and compliance with shipping regulations.

Regional Insights

The rapid expansion of e-commerce in North America has become a significant driver for the flexographic printing industry, reshaping demand patterns and influencing market dynamics. This shift in consumer behavior towards online shopping has created a substantial need for packaging solutions, particularly in the realm of corrugated boxes and flexible packaging, where flexographic printing plays a crucial role. The e-commerce sector's growth has introduced new requirements for packaging customization and branding. Online retailers are increasingly seeking to differentiate themselves through unique, visually appealing packaging that enhances brand visibility and improves the customer experience. Flexographic printing's capability to produce high-quality graphics on various substrates positions it favorably to meet these evolving needs.

U.S. Flexographic Printing Market Trends

The rising demand for flexographic printing in the U.S. can be attributed to several factors. One key factor is the increasing consumer demand for packaged products, driven by changing eating habits and lifestyles. This has led to a significant impact on the market for flexographic printing of folding cartons in food packaging. Additionally, the rise in per capita disposable income and a growing population have also contributed to the demand for printed packaging materials.

Asia Pacific Flexographic Printing Market Trends

Asia Pacific accounted for the largest revenue share of 33.4% in 2023 and is expected to continue its dominance over the forecast period. This indicates a strong presence and influence within the global market for packaging and labeling materials. The region's dominance can be attributed to several key factors. Firstly, Asia Pacific encompasses major economies like China, Japan, and India, which have experienced rapid industrialization and urbanization. These factors drive robust demand across various sectors, such as food and beverage, consumer goods, and pharmaceuticals, all of which heavily rely on efficient printing solutions for packaging. Additionally, Asia Pacific's strategic position as a global trade hub further bolsters its dominance in the flexographic printing sector. The region benefits from well-established supply chains, facilitating easy access to raw materials and efficient distribution networks. This logistical advantage not only reduces production costs but also enables timely delivery of printed materials to diverse markets worldwide.

Europe Flexographic Printing Market Trends

As European countries continue to prioritize environmental responsibility and carbon reduction goals, industries are increasingly turning to printing technologies that minimize ecological impact. Flexographic printing has made significant strides in reducing its environmental footprint. Water-based and UV-curable inks are increasingly used, minimizing volatile organic compound (VOC) emissions and meeting environmental regulations. This aligns with the growing emphasis on sustainable practices and eco-friendly packaging solutions. Additionally, modern presses often incorporate advanced technologies such as LED curing systems, which consume less energy compared to conventional drying methods. This not only lowers operational costs but also reduces the carbon footprint associated with the printing process.

Key Flexographic Printing Company Insights

Some of the key companies operating in the flexographic printing market include Asahi Kasei Corporation, Amcor Flexibles, and among others.

-

Asahi Kasei Corporation is a diversified Japanese multinational corporation with a significant presence in various industries, including chemicals, fibers, homes and construction materials, electronics, and healthcare. The company is particularly notable in the flexographic printing industry through its subsidiary, Asahi Photoproducts. Asahi Photoproducts specializes in producing flexographic photopolymer printing plates. These plates are crucial in flexographic printing processes, offering high-quality printing capabilities with environmental benefits such as reduced solvent use and improved recycling capabilities. It has a global presence with operations and subsidiaries in various countries around the world. This international footprint allows the company to serve diverse markets and customers.

Koenig & Bauer AG and Comexi are some of the emerging market companies in the target market.

-

Koenig & Bauer AG is a renowned German manufacturer of printing presses and systems. Koenig & Bauer is known for its wide range of printing press solutions, catering to various industries, including packaging, commercial printing, newspaper printing, and industrial applications. They manufacture sheetfed offset presses, web offset presses, digital presses, flexographic presses, and special-purpose presses. The company operates globally with production facilities, sales offices, and service centers strategically located around the world. This enables them to provide comprehensive support to their customers and maintain a strong presence in international markets.

Key Flexographic Printing Companies:

The following are the leading companies in the flexographic printing market. These companies collectively hold the largest market share and dictate industry trends.

- Wolverine Flexographic LLC

- Amcor PLC

- Westrock Company

- Bobst Group SA

- Comexi

- Clicheria Blumenau

- Mark Andy Inc.

- SIVA Group

- Asahi Kasei Corporation

- Koenig & Bauer AG

Recent Developments

-

In June 2024, Mark Andy Inc. announced a strategic partnership with RotoMetals, a company specializing in the manufacture of high-precision rotary tooling solutions, particularly for the flexographic printing industry. This collaboration intends to leverage Rotometal's expertise in tooling with Mark Andy's printing technology capabilities to develop innovative solutions that enhance printing quality, efficiency, and productivity for flexographic printers. The partnership aims to address industry challenges and meet the evolving needs of flexographic printers through cutting-edge tooling innovations and collaborative research and development efforts.

-

In May 2024, Amcor plc opened its European Innovation Center (AICE) in Ghent, Belgium. This center is part of Amcor's expansion of its packaging innovation hubs around the world, which already include centers in the Latin America, U.S., and Asia Pacific regions. The AICE aims to pioneer new material technologies and designs that make packaging more sustainable, performant, and visually appealing. It would collaborate with brands and retailers from across Europe to develop packaging solutions that deliver better results for consumers and the environment.

Flexographic Printing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 9.02 billion

Revenue forecast in 2030

USD 11.50 billion

Growth rate

CAGR of 4.1% from 2024 to 2030

Historical data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, end ?use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Wolverine Flexographic LLC; Amcor PLC; Westrock Company; Bobst Group SA; Comexi; Clicheria Blumenau; Mark Andy Inc.; SIVA Group; Asahi Kasei Corporation; Koenig & Bauer AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Flexographic Printing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global flexographic printing market report based on application, end use, and region.

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Flexible packaging,

-

Corrugated packaging,

-

Labels & tags

-

-

End Use Outlook (Revenue, USD Million, 2017 - 2030)

-

Pharmaceutical

-

Food & beverage

-

Cosmetics

-

Consumer electronics

-

Logistics

-

Print media

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The flexible packaging segment claimed the largest market share of 44.2% in 2023 in the flexographic printing market. This dominance can be attributed to its inherent advantages in terms of printing versatility, suitability for packaging applications, growth in consumer goods consumption, technological advancements, and alignment with sustainability goals. These factors collectively drive the adoption of flexographic printing technology across diverse industries.

b. Some of the prominent players in the flexographic printing market are Wolverine Flexographic LLC, Amcor PLC, Westrock Company, Bobst Group SA, Comexi, Clicheria Blumenau, Mark Andy Inc., SIVA Group, Asahi Kasei Corporation, Koenig & Bauer AG.

b. The flexographic printing market is driven by factors such as advancements in printing technology, a growing preference for sustainable printing solutions, rapid growth in the e-commerce industry, and Increasing consumer demand for packaged goods.

b. The global flexographic printing market size was estimated at USD 8.84 billion in 2023 and is expected to reach USD 9.02 billion in 2024.

b. The global flexographic printing market is expected to grow at a compound annual growth rate of 4.1% from 2024 to 2030 to reach USD 11.50 billion by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.