- Home

- »

- Biotechnology

- »

-

Flow Cytometry Market Size, Share & Growth Report, 2030GVR Report cover

![Flow Cytometry Market Size, Share & Trends Report]()

Flow Cytometry Market Size, Share & Trends Analysis Report By Product (Instruments, Software), By Technology (Bead-based, Cell-based), By Application (Industrial, Clinical), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-412-3

- Number of Report Pages: 166

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Flow Cytometry Market Size & Trends

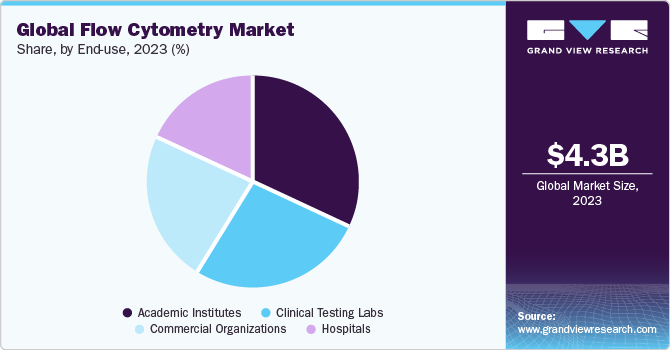

The global flow cytometry market size was estimated at USD 4.32 billion in 2023 and is projected to grow at a CAGR of 6.96% from 2024 to 2030.The increasing incidence of cancer, immunodeficiency disorders, and infectious diseases is a key factor propelling market growth. Additionally, extensive research and development investments in biotechnology, life science, and biopharmaceutical research have contributed to a leveraged demand for flow cytometry instruments. For instance, in February 2023, Cytek Biosciences announced its plan to acquire the imaging and flow cytometry business from DiaSorin to expand its market share.

Flow cytometry is commonly used for the diagnosis of cancer and immunodeficiency diseases. The increasing prevalence of these diseases is one of the factors expected to drive the market over the forecast period. In addition, the adverse effects of chemotherapy & radiation therapy in cancer treatment have increased physicians' preference for autologous and allogeneic stem cell therapies, thereby positively impacting the growth of this market. According to data published by the American Cancer Society, in 2022, an estimated 1.9 million cancer cases were newly diagnosed in the U.S. Moreover, it also stated that around 0.60 million people died because of cancer.

Furthermore, key players are undertaking extensive strategic initiatives to new and advanced product developments. For instance, in January 2024, IDEX Health & Science introduced the new Semrock Nanopede Optical Filters tailored for flow cytometry applications. These filters cover the near UV and visible spectrum in 20 nm Full-Width, Half-Max (FWHM) increments, with the FWHM increasing to 30 nm in the near-infrared range. The Nanopede family includes 26 filters designed to meet specific application needs. This launch marks the initial step in expanding its product line to align with the dynamic market.

In addition, BD Biosciences has unveiled a significant technological advancement in Fluorescent Activated Cell Sorting (FACS), with the upcoming 50th anniversary of FACS in 2024. The BD FACSDiscover S8 Cell Sorter represents a milestone as the first spectral flow cytometer with sort-capable image analysis, offering the Canadian research community unprecedented insights and the ability to tackle previously unanswerable questions. Microfluidic miniature flow cytometry is expected to aid of adopting point-of-care diagnostics products, which is likely to be a key factor augmenting market growth. The introduction of multiplex reagents and probes for specific applications in drug discovery & diagnostics is expected to further create growth opportunities by catering to users in research laboratories and small peripheral laboratories. Moreover, digital signal processing has revolutionized the field of flow cytometry.

Market Concentration & Characteristics

The market growth stage is medium, and the pace is accelerating. The flow cytometry market is characterized by a high degree of innovation due to rapid technological advancements. In addition, the incorporation of automation and multi-processing technologies is expected to have a positive impact on its adoption during the forecast period.

The market is also characterized by industrial developments such as mergers and acquisitions. The companies are focusing on acquisitions of start-up companies with patented technologies. Such activities are allowing the companies to consolidate their market share in the global landscape.

The market is witnessing a considerable number of partnerships and collaborations to extend & consolidate supply chain channels and technology sharing. Implementation of such strategies is enabling companies to bridge the demand-supply gap worldwide.

End-user concentration is a significant factor in the market. Since there are a substantial number of end-users, a considerable number of opportunities are likely to arise to boost the adoption of this technology by 2030.

Product Insights

The instrument segment dominated the market with a revenue share of 35.40% in 2023 owing to higher penetration driven by technological developments. For instance, in June 2023, BD announced the launch of an automated instrument that is designed to prepare samples for clinical diagnostics through flow cytometry, enabling smoother processing and workflow. The progress in technology, leading to cost-effectiveness, improved accuracy, and portability, is expected to pave the way for future growth opportunities. In addition, the focus of companies on the development and manufacturing of instruments with rapid turnaround time is also estimated to have a positive impact on the segment’s growth during the forecast period.

The software segment is expected to witness significant CAGR from 2024 to 2030. Software plays a crucial role in controlling and acquiring data from cytometers, analyzing information, and offering statistical insights. In research applications, the software is employed for cell acquisition and data analysis, while in clinical diagnosis, it aids in disease diagnosis through the analysis of patients' samples. The broad spectrum of applications is anticipated to propel the market in coming years. Additionally, the introduction of new products by key companies is identified as a significant factor that is expected to fuel the growth of this segment. For instance, in February 2023, Agilent announced the launch of NovoCyte Flow Cytometer System Software which encompasses updated regulatory compliances for biopharmaceutical and pharmaceutical manufacturing.

Technology Insights

Cell-based flow cytometry held the largest revenue share in 2023 and is expected to grow at a CAGR of 6.41% from 2024 to 2030. The cell-based assays are used in drug discovery for assessing the physiological characteristics of cells and studying the information obtained. In addition, technological advancements, such as multi-parameter flow cytometry used in rare cell analysis, are expected to impel segment demand over the coming years. This technology is used in clinical studies of various cells, tumor cells in peripheral blood, endothelial cells in the blood, tumor stem cells, and hematopoietic progenitor cells. It is also used in the study of disease mechanisms and target identification.

The bead-based assays segment is predicted to grow at an exponential CAGR from 2024 to 2030. . This growth can be attributed to advancements in molecular engineering and monoclonal antibody production, coupled with associated benefits such as cost-efficiency, minimal sample requirements, and rapid turnaround times. These assays, employing indirect or sandwich immunoassay formats, are specifically designed for assessing antibody levels in biological fluids. Moreover, these assays have been developed for the study of infectious diseases, and their demand is anticipated to experience substantial growth during the forecast period.

Application Insights

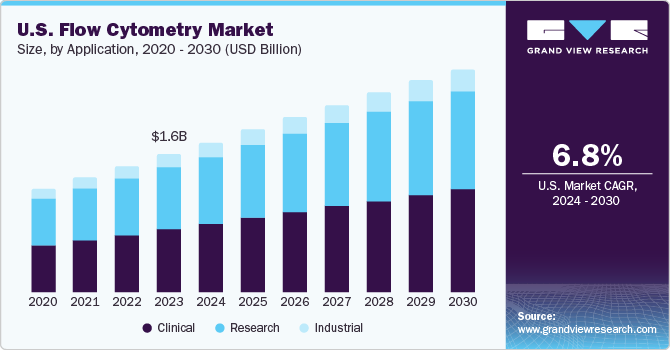

The clinical segment accounted for a major revenue share of 45.44% in 2023. This can be attributed to the growing research and development activities focused on cancer and infectious diseases, including the ongoing efforts related to COVID-19. Moreover, the increasing research and development investments in the biotechnology and pharmaceutical industry are expected to offer a favorable environment for market expansion. Additionally, the continuous growth strategies implemented by key market players and the introduction of innovative solutions for clinical applications are anticipated to play a significant role in supporting the growth of this segment. For instance, in July 2023, Discovery Life Sciences announced the launch of novel flow cytometry clinical trial services. The new instrument is expected to provide services in genomics, proteomics, and molecular pathology.

The industrial segment is expected to be the fastest-growing segment from 2024 to 2030 due to the increasing applications in activities such as microbiology, tissue culturing, the food industry, and plant tissue culture. In food microbiology, flow cytometry is used to check food safety. It also has applications in cellular measurements in food microbiology, viability assessment & cell counting, detection of food-borne pathogens, antimicrobial susceptibility testing, and biopreservation. Thus, the growth of the food industry in developed and developing economies is anticipated to create lucrative opportunities for flow cytometry solutions.

End-use Insights

The academic institutes segment captured the highest revenue share in 2023. Flow cytometry is employed in studies related to cell biology and molecular diagnostics to assess various cell parameters, including the physical properties of cells and the identification of biomarkers using specific antibodies. It is utilized for determining cell type, cell lineage, and maturation stage. The technology finds applications across various educational fields such as molecular biology, immunology, pathology, plant biology, and marine biology. In January 2024, the Columbia Stem Cell Initiative (CSCI) at Columbia University used flow cytometry technology in its trailblazing stem cell research. This facility provides access to the technology for stem cell research and other research activities in various fields of life sciences.

The clinical testing labs segment is anticipated to be the fastest-growing segment from 2024 to 2030 due to the growing need for cost-effective diagnosis of target diseases such as cancer.It is a widely used tool in the diagnosis and treatment of cancers and immunodeficiency diseases. Furthermore, a growing number of industrial developments such as partnerships and collaborations are also projected to have a positive impact on the segment growth. For instance, in May 2023, BD India entered into a strategic partnership with Sehgal Path Lab to launch a clinical flow cytometry center in Mumbai.

Regional Insights

North America dominated the overall market with a revenue share of 41.20% in 2023. This large share can be attributed to the presence of well-established healthcare system and pharmaceutical industry in the U.S., which has created a significant demand for flow cytometry solutions for clinical and research purposes. Extensive R&D initiatives being undertaken for developing therapeutics and increasing public-private investments in the field of cancer research have also fueled the need for instruments or products in the country, thus leading to high market growth. For instance, in December 2023, AlleSense was commissioned to enhance cancer diagnostics with the help of advanced technologies. The initial investment for the company was around USD 2.5 million.

U.S. Flow Cytometry Market Trends

The U.S. flow cytometry market is expected to grow from 2024 to 2030 attributed to the high prevalence of cancer and extensive R&D activities by regional players to develop novel therapies Government support and funding to facilitate the development of novel solutions in the country is anticipated to create lucrative growth opportunities

Europe Flow Cytometry Market Trends

The flow cytometry market in Europe can primarily be attributed to the increasing demand for products in countries with well-established biotechnology industries such as Germany, the UK, and Italy.Furthermore, a large number of COVID-19 cases in countries such as Italy, France, the UK, & Germany and extensive R&D initiatives by European pharmaceutical players to develop vaccines for the disease are anticipated to create high demand for various solutions.

The UK flow cytometry market is growing primarily due to collaborations between key market players and the launch of novel products. Commercial partnerships between the government and key players for the use of these products in the country are propelling the market growth.

The flow cytometry in France is expected to grow from 2024 to 2040 attributed to increased acceptance rate of these technologies in research & academia and increasing use of Artificial Intelligence (AI) technologies in flow cytometry workflows.

The Germany flow cytometry market in is expected to witness substantial growth owing to strong presence of key players and continuous strategic initiatives being undertaken by them. Furthermore, a high number of COVID-19 cases and extensive R&D activities by regional players to develop novel vaccines for the disease are anticipated to create significant demand for flow cytometry solutions for research and clinical applications.

Asia Pacific Flow Cytometry Market Trends

The Asia Pacific flow cytometry market is anticipated to witness a significant CAGR from 2024 to 2030 as a result of the growing pharmaceutical and biotechnology industries in emerging economies, such as China and India. The market growth is propelled by the rising prevalence of chronic diseases and the increasing utilization of cytometry devices across various applications in the region. Furthermore, continuous innovations in fields of cancer and infectious diseases are anticipated to contribute significantly to the market growth in the region. Additionally, extensive research activities conducted by regional players aiming to enhance or create innovative flow cytometry solutions are expected to bolster market growth in Asia Pacific throughout the projected timeframe.

The flow cytometry market in China is expected to grow from 2024 to 2030, owing to key players are undertaking both organic and inorganic growth strategies to gain a competitive edge. Increasing R&D initiatives are anticipated to significantly boost the demand for products in the country, thus supporting market growth.

The Japan flow cytometry market dominated the Asia Pacific market attributed to increased focus on R&D or introduction of new technologies for flow cytometry solutions for research purposes.

Latin America Flow Cytometry Market Trends

Latin America flow cytometry market is estimated to grow at a significant CAGR from 2024 to 2030. The rise in private-public partnerships to promote research on effective diagnostics is expected to drive the regional market. In addition, the demographic phenomenon of population aging is a significant trend driving market growth in the region.

The flow cytometry market in Brazil is influenced by the public-private investments in pharmaceutical & biotechnology sectors.

Middle East And Africa Flow Cytometry Market Trends

MEA flow cytometry market is anticipated to exhibit steady growth from 2024 to 2030. This steady growth can be attributed to various factors such as limited investments in the biotechnology sector, low affordability of expensive systems, and fewer R&D activities in pharmaceutical & biotechnology sectors.

The flow cytometry market in Saudi Arabia is expected to grow over the forecast period attributed to increase in consumer demand due to the growing prevalence of chronic illnesses, a higher need for localized testing, and decreasing sequencing prices.

Key Flow Cytometry Company Insights

The established players in the market such as Thermo Fisher Scientific, Inc., BD, and Danaher are strategically positioning themselves for sustained growth. Their activities include continuous research and development initiatives, strategic partnerships and acquisitions, and a focus on expanding their product portfolios. By leveraging their experience and market presence, these players aim to maintain leadership positions and adapt to evolving industry trends in the competitive landscape of flow cytometry.

Emerging players are actively engaging in strategic activities to establish their presence. These activities include innovative product development, strategic collaborations, and market expansions. By focusing on such strategies, these players aim to capitalize on the growing demand for flow cytometry solutions.

Key Flow Cytometry Companies:

The following are the leading companies in the flow cytometry market. These companies collectively hold the largest market share and dictate industry trends.

- Danaher

- BD

- Sysmex Corporation

- Agilent Technologies, Inc.

- Apogee Flow Systems Ltd.

- Bio-Rad Laboratories, Inc.

- Thermo Fisher Scientific, Inc.

- Stratedigm, Inc.

- Miltenyi Biotec

- Cytek Biosciences

- Sony Group Corporation (Sony Biotechnology Inc.)

Recent Developments

-

In March 2024, Beckman Coulter Life Sciences received 510(k) clearance from the FDA to distribute its DxFLEX Clinical Flow Cytometer in the U.S. This advancement makes high-complexity flow cytometry testing more accessible to laboratories without the need for additional expense.

-

In January 2024, Cytek Biosciences, Inc. agreed with the Centre for Genomic Regulation (CRG) and Pompeu Fabra University (UPF) to foster technological innovation and accelerate discoveries in the scientific community. The collaboration underscores the significant impact of Cytek's spectral flow cytometry technology, paving the way for expansion into new applications.

-

In December 2023, Cytek Biosciences introduced the Cytek Orion Reagent Cocktail Preparation System, a groundbreaking automated instrument designed for flow cytometry.

-

In October 2023, Sony Corporation launched the FP7000 spectral cell sorter, designed to facilitate high-speed, high-parameter sorting with over 44 colors and streamlined workflows. This innovative system integrates patented spectral technology-based optics, advanced electronics, and fluidics.

Flow Cytometry Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.68 billion

Revenue forecast in 2030

USD 7.01 billion

Growth rate

CAGR of 6.96% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Norway; Sweden; Denmark; China; Japan; India; South Korea; Australia; Thailand; Singapore; Brazil; Mexico; Argentina; UAE; South Africa; Saudi Arabia; Kuwait

Key companies profiled

Danaher; BD; Sysmex Corp.; Agilent Technologies, Inc.; Apogee Flow Systems Ltd.; Bio-Rad Laboratories, Inc.; Thermo Fisher Scientific, Inc.; Stratedigm, Inc.; Miltenyi Biotec; Cytek Biosciences; Sony Group Corporation (Sony Biotechnology Inc.)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Flow Cytometry Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global flow cytometry market report based on product, technology, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Cell Analyzers

-

Cell Sorters

-

-

Reagents & Consumables

-

Software

-

Accessories

-

Services

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Cell-based

-

Bead-based

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Research

-

Pharmaceutical

-

Drug Discovery

-

Stem Cell

-

In Vitro Toxicity

-

-

Apoptosis

-

Cell Sorting

-

Cell Cycle Analysis

-

Immunology

-

Cell Viability

-

Others

-

-

Industrial

-

Clinical

-

Cancer

-

Organ Transplantation

-

Immunodeficiency

-

Hematology

-

Autoimmune Disorders

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial Organizations

-

Biotechnology Companies

-

Pharmaceutical Companies

-

CROs

-

-

Hospitals

-

Academic Institutes

-

Clinical Testing Labs

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

Singapore

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global flow cytometry market size was estimated at USD 4.32 billion in 2023 and is expected to reach USD 4.68 billion in 2024.

b. The global flow cytometry market is expected to grow at a compound annual growth rate of 6.96% from 2024 to 2030 to reach USD 7.01 billion by 2030.

b. North America dominated the flow cytometry market with a share of 41.20% in 2023. This is attributable to an established healthcare sector and supportive government policies for developing advanced technologies for molecular diagnostics in the region.

b. Some key players operating in the flow cytometry market include Danaher Corporation; Becton, Dickinson and Company; DiaSorin S.p.A.; Agilent Technologies, Inc.; Bio-Rad Laboratories, Inc.; Miltenyi Biotec; Sysmex Corporation; Stratedigm, Inc.; Apogee Flow Systems Ltd.; Sony Biotechnology, Inc.; and Thermo Fisher Scientific, Inc.

b. Key factors driving the flow cytometry market growth include the rising R&D investments in the biotechnology sector and technological advancements in the field of flow cytometry for introducing new and improved analytical tools, such as microfluidic flow cytometry, for point-of-care testing.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."