- Home

- »

- Medical Devices

- »

-

Flow Diverters Market Size, Share And Growth Report, 2030GVR Report cover

![Flow Diverters Market Size, Share & Trends Report]()

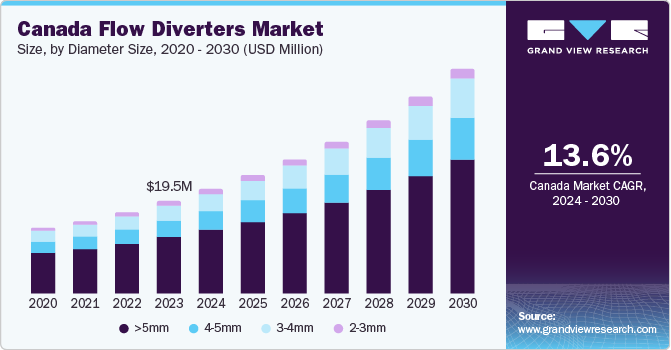

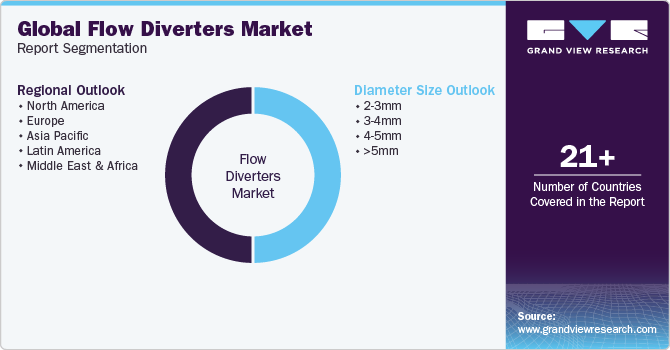

Flow Diverters Market (2024 - 2030) Size, Share & Trends Analysis Report By Diameter Size (2-3 mm, 3-4 mm, 4-5 mm, >5 mm), By Region (North America, Europe), And Segment Forecasts

- Report ID: GVR-4-68039-184-2

- Number of Report Pages: 300

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Flow Diverters Market Size & Trends

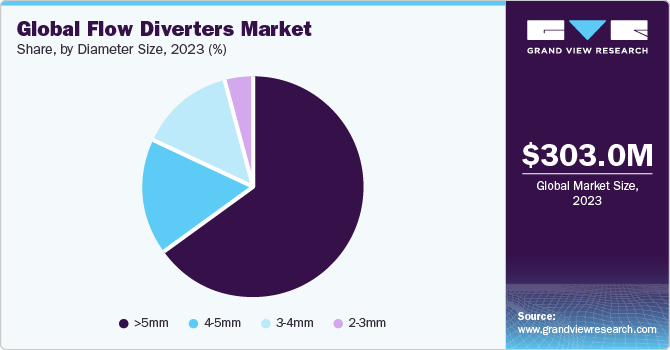

The global flow diverters market sizewas estimated at USD 303.01 million in 2023 and is projected to grow at a CAGR of 13.29% from 2024 to 2030. The market is driven by numerous factors such as the increasing prevalence of brain aneurysms, and technological advancements coupled with acquisition and merger among industry key players. Additionally, increasing the number of clinical trials boosts market growth. For instance, as per the Brain Aneurysm Foundation 6.8 million individuals in the U.S., approximately 1 in 50 people, suffer from an unruptured brain aneurysm. In the country, cases of aneurysms in the brain burst in approximately 30,000 people every year, accounting for approximately 1 rupture every 18 minutes. As more people develop brain aneurysms, there is an increased demand for effective treatments such as flow diverters. With the growing awareness about brain aneurysms and advancements in medical technology, more patients and healthcare providers are opting for flow diverters as a reliable treatment option. Consequently, this surge in demand is propelling the market to expand in the near future.

Surgical clipping, flow diverters, and endovascular coiling are notable modalities for treating intracranial aneurysms. Some key players operating in this market are Stryker Corporation, Medtronic, MicroPort Corporation, and Johnson & Johnson. Key players constantly try to introduce technologically advanced flow diverters to gain a competitive advantage. The creation of flow diverters that are more durable and efficient in controlling blood flow within blood vessels is a result of the integration of innovative materials and manufacturing processes.

Furthermore, advancements in imaging technologies have improved the placement of flow diverters with greater precision and accuracy, which lowers the possibility of complications during treatments. For instance, in July 2023, MicroVention, Inc., collaborated with U.S. physicians, and over 1,000 patients were effectively treated using the FRED X flow diverter. Specifically designed for redirecting blood flow in small vessels, FRED X is the only FDA PMA-approved option featuring a 0.021" delivery system for smaller sizes and without a distal lead wire. Enhanced with X Tech, the FRED device maintains precise and predictable placement characteristics. Such initiatives boost market growth in the near future.

Moreover, acquisition and merger among industry key players is anticipated to propel market growth over the forecast period. For instance, in May 2023, Stryker acquired Cerus Endovascular Ltd., a company specializing in developing and producing medical devices for treating intracranial aneurysms. Cerus Endovascular's products, including the Neqstent coil-assisted flow diverter and Contour neurovascular system, which are CE Marked, will complement Stryker's current product line of treatments for brain aneurysms. With the merger and acquisition, the market key players integrate their assets, expertise, and technological abilities. The act of merger often leads to improved capacities for research and development, which makes it easier to develop flow diverters that are more advanced and effective thus propelling market growth in the near future.

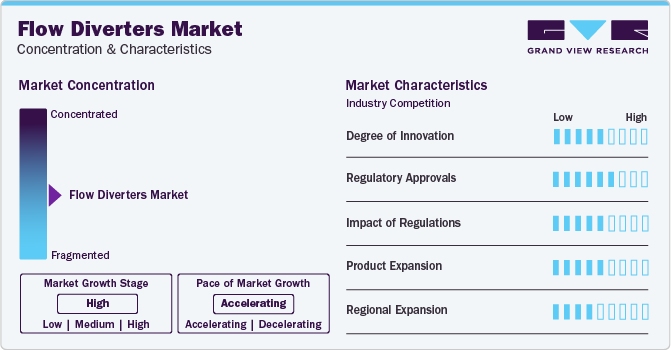

Market Concentration & Characteristics

The market growth stage is high, and the pace is accelerating. The global flow diverters market is characterized by increasing cases of brain aneurysms, technological advancements coupled with increasing regulatory approval for novel product launches.

Key strategies implemented by players and government entities in the flow diverters market are increasing clinical studies for assessments for intracranial aneurysms, expansion, acquisitions, partnerships, collaboration, and other strategies. For instance, in June 2022, Stryker and Carmeda announced a partnership that will combine their respective companies’ well-established flow diverter technologies with active heparin coatings to treat brain aneurysms. Stryker’s flow diverter uses the Carmeda covering to effectively decrease thrombin, a very effective platelet agonist & coagulation factor, at the device surface, displaying a marked decrease in clot formation in difficult bench models.

Advancements in R&D of novel materials and designs enhancing the efficacy and safety of flow diverters, technological advancements over the years, leading to more effective and minimally invasive treatment options. Innovations include improved materials, enhanced delivery systems, and better imaging techniques for precise placement enhance the degree of innovation. For instance, in July 2023, MicroVention, Inc., collaborated with U.S. physicians, over 1,000 patients were effectively treated using the FRED X flow diverter. Specifically designed for redirecting blood flow in small vessels, FRED X is the only FDA PMA-approved option featuring a 0.021" delivery system for smaller sizes and without a distal lead wire. Enhanced with X Tech, the FRED device maintains precise and predictable placement characteristics.

Major regulatory authority overseeing medical devices in the U.S. FDA, European Union (EU), Pharmaceuticals and Medical Devices Agency (PMDA) Japan, among others. Before a flow diverter can be marketed and sold, it must undergo a thorough review process to demonstrate its safety and effectiveness. This process typically involves preclinical testing, clinical trials, and submission of extensive documentation to the regulatory authorities for review. For instance, In October 2022, Medtronic received approval from the U.S. FDA to expand the labeling of a cardiac lead that works with the heart’s natural electrical system. This helps patients get the therapy they need without some of the complications linked to traditional pacing methods, such as cardiomyopathy.

Regulations often set standards for safety and efficacy, driving manufacturers to invest in R&D to meet these requirements. Companies focus on developing innovative features or improving existing technologies to comply with regulations while enhancing patient outcomes. Compliance with regulatory standards increases the time and cost of bringing flow diverters to market which also increases the treatment cost. As a result, smaller companies may face barriers to entry, limiting competition and innovation. According to the American Journal of Neuroradiology, the treatment cost in hospitals for endovascular coiling for an unruptured intracranial aneurysm is considerably higher than Medicare reimbursements in the U.S. The treatment cost in hospitals for surgical clipping is around USD 23,574 and for endovascular coiling, it is around USD 25,734, which is almost USD 12,599 higher than the average Medicare payment.

Market players are focusing on expanding their product portfolios to cater to a broader range of patient needs. Companies operating in the flow diverters market may invest in research and development to create new and innovative products. These could include advanced flow diverters with improved efficacy, safety features, or compatibility with various medical devices. This could involve offering flow diverters in different sizes, configurations, or materials to cater to a wider range of clinical needs. For instance, creating flow diverters optimized for treating aneurysms in different locations of the body, such as intracranial or peripheral vessels, can address specific clinical needs more effectively.

Within the market, many companies focus on addressing several patient demographics or meeting specific therapeutic requirements. Due to an emphasis of companies in developing customized solutions for certain specializations in the market, this specialization contributes to market fragmentation. For example, developing smaller, more flexible flow diverters and advanced delivery systems can improve navigability through distorted vessels and facilitate easier deployment, potentially expanding the patient population eligible for treatment.

Forming strategic partnerships or collaborations with local distributors, healthcare providers, and key opinion leaders can facilitate market entry and accelerate adoption. Collaborating with established entities can provide valuable insights into regional market nuances, regulatory requirements, and customer preferences. For instance, in April 2022, Medtronic and GE Healthcare announced a collaboration concentrating on the special requirements & requests for care at ambulatory surgery centers and office-based laboratories. Their partnership aims to address the increasing demand for outpatient care.

Diameter Size Insights

The >5 mm segment dominated the market in 2023. Flow diverters larger than 5 mm in diameter have the capability to effectively treat intracranial aneurysms exceeding 10 mm in size. Consequently, these >5 mm flow diverters are commonly used for placing the devices in large blood arteries that exhibit elevated rates of blockage. Their extensive range of applications includes the management of large-neck and wide-applied intracranial aneurysms, particularly as most ruptured aneurysms are larger than 10.0 mm in diameter. Therefore, flow diverters larger than 5 mm are best suited for big arterial placement, resulting in a higher rate of stable aneurysm closure thus driving the growth of the segment in near future.

Moreover, 3-4 mm diameter size segment is expected to register the fastest CAGR of 14.23% during the forecast period. The 3 mm to 4 mm devices has 72 braided wires, offering more pore density. Several products of 3 mm to 4 mm diameter are available in the market, such as SURPASS, p64, and FRED Pipeline flow diverters. The flow diverter with a diameter of 3-4 mm is more suitable for smaller vessels and has an increased chance of effectively redirecting blood flow in the desired location. This implies that a larger variety of aneurysms and deformities can be treated with it. Moreover, the smaller metal covering area of 3-4 mm flow diverters lower the risk of thrombotic events and need for antiplatelet therapy, resulting in a safer and more efficient procedure for therapy.

Regional Insights

North America accounted for 35.98% of revenue share in the global market in 2023 and is expected to continue its dominance from 2024 to 2030 owing to the presence of major manufacturers, increased spending on R&D, and an increase in government initiatives. Besides, a robust reimbursement network and strong government funding are expected to contribute to the market growth. Moreover, demand for flow diverters may be positively impacted by greater patient and healthcare public awareness of the importance of early detection and treatment for chronic illnesses.

Increased awareness within the healthcare community and the patients regarding the importance of early diagnosis & treatment for chronic disorders may positively influence the demand for flow diverters. For instance, according to the Centers for Medicare & Medicaid Services (CMS), 7.5% of U.S. health expenditures was anticipated to be spent in 2022. It was expected to reach $1 trillion for the first time in 2023. Moreover, a substantial portion of the nation's economy was accounted for by both skilled employees and high private sector earnings in developed economies. As a result, it is expected that flow diverter market in North America will increase due to improved healthcare facilities and developing infrastructure.

U.S. Flow Diverters Market Trends

The flow diverters market in the U.S. is expected to grow over the forecast period. The main factors propelling the expansion of the flow diverters market in the U.S. are the rising rates of hospitalization, traffic accidents, and the prevalence of chronic illnesses. For instance, according to the annual report released by America's Health Rankings 2023, 133 million people, approximately 43% of the U.S. population, suffered from one or more chronic illnesses in 2022. Moreover, a significant driver of market expansion in this area is the growing elderly population.

Europe Flow Diverters Market Trends

The Europe flow diverters market is expected to grow from 2024 to 2030 owing to the shorter hospital stays and faster recovery coupled with increasing demand for minimal invasive procedures to treat brain aneurysms.

The flow diverters market in the UK is expected to grow over the forecast period due to technological advancements in flow diverters with enhanced safety features.

The France flow diverters market is expected to grow over the forecast period owing to increasing incidence of neurological disorder in this region propelling the market growth.

The flow diverters market in Germany is witnessing a steady growth owing to the increasing demand for better healthcare facilities and equipment. Additionally, the aging population and growing prevalence of chronic diseases are driving the demand for flow diverters.

Asia Pacific Flow Diverters Market Trends

Asia Pacific region is anticipated to grow at the fastest CAGR from 2024 to 2030 owing to the availability of lucrative growth opportunities in the region, especially in China, India, and Japan. Mandatory healthcare insurance in some countries, rapid technological advancements, an increase in the number of road accidents, a rise in government initiatives, and growth in healthcare expenditure are expected to drive the regional market. For instance, as per the data reported by Department for Transport (2023) Great Britain, a total of 1,766 individuals lost their lives in road accidents, with 1,711 fatalities occurring in Britain and 55 in Northern Ireland. Additionally, 28,941 people sustained serious injuries, with 28,031 in Britain and 910 in Northern Ireland, as a result of these incidents. Road accident victims need instant medical attention and hospital services. Thus, rising incidence of road accidents is likely to drive the market growth over the forecast period. In addition, evolving healthcare infrastructure, supportive government initiatives, and increasing awareness regarding early diagnosis and treatment have the market in Asia Pacific to grow at a substantial rate.

The flow diverters market in China is expected to grow over the forecast period owing to need for advanced medical equipment and the increasing number of hospitals and healthcare centers in the country. Additionally, the government's initiatives to improve healthcare infrastructure and provide better medical facilities to the citizens are also contributing to the growth of the flow diverters market in China.

The India flow diverters market has been making significant investments in healthcare infrastructure. The expansion and development of hospitals and healthcare facilities will likely contribute to the growing demand for modern and advanced flow diverters. Government initiatives and schemes aimed at improving healthcare access and quality, such as the Ayushman Bharat program, may lead to increased demand for hospital equipment, including stretchers.

The flow diverters market in Japan is expected to grow over the forecast period owing to the increasing demand for minimally invasive procedures to treat neurological disorders.

Middle East And Africa Flow Diverters Market Trends

The Middle East and Africa flow diverters market is expected to witness significant growth in the coming years due to a rise in the prevalence of chronic illness, growing expenditure on healthcare infrastructure, and rising demand for cutting-edge medical technology. The market is anticipated to be propelled by adopting innovative and cutting-edge flow diverters that provide improved patient comfort and safety.

The flow diverters market in Saudi Arabia is expected to grow over the forecast period. Saudi Arabia's flow diverters market is expected to witness steady growth in the coming years due to increasing investments in healthcare infrastructure, a growing number of hospitals and clinics, and rising demand for advanced medical equipment.

The Kuwait flow diverters market is expected to grow from 2024 to 2030 due to escalating prevalence of chronic conditions and the rising geriatric population.

Key Flow Diverters Company Insights

Acandis GmbH and Rapid Medical are some of the emerging players in flow diverters market owing to the rising demand for innovative devices that offer improved efficacy, safety, and patient outcomes. Manufacturers are investing in research and development to introduce next-generation flow diverters with enhanced features such as better navigability, optimized flow diversion capacity, and compatibility with various anatomical configurations. This trend is driven by the need to address the limitations of existing devices and meet the evolving clinical requirements of healthcare professionals.

Moreover, the increasing adoption of flow diverters as a preferred treatment option for cerebral aneurysms is influencing the dynamics of the market. Healthcare providers are recognizing the benefits of flow diversion therapy, including reduced risk of aneurysm rupture, lower rates of retreatment, and improved long-term patient outcomes compared to traditional surgical approaches. This growing acceptance of flow diverters is expanding the addressable patient population and driving market expansion.

Effectiveness of Flow Diverters for the Treatment of Intracranial Aneurysm: Research Study Findings of January 2024

Research Study: Flow Diverter Performance Comparison of Different Wire Materials for Effective Intracranial Aneurysm Treatment

Three different types of flow diverters (FDs) that changed the wire's composition were set up inside the same structure used in this study. Physical property differences were evaluated, including radiopacity, radial force, and loading stent size before and after delivery. Using these flow diverters, the placement and traceability force performances were evaluated in a simulation model.

Flow diverter performance comparison of different wire materials for effective intracranial aneurysm treatment:

(Nitinol + Pt/W - Combination of Nitinol and platinum/tungsten wire)

Material and Method

Wire Material

Nitinol

Nitinol + Pt/W

Pt core Nitinol

Results

Low--------------------------------------------------------High

Size Recovery

Nitinol + Pt/W

Pt core Nitinol

Nitinol

Metal Coverage

Nitinol + Pt/W

Pt core Nitinol

Nitinol

Radiopacity

Nitinol

Pt core Nitinol

Nitinol + Pt/W

Compression force

Pt core Nitinol

Nitinol + Pt/W

Expansion force

Pt core Nitinol

Nitinol + Pt/W

Trackability force

Nitinol + Pt/W

Results and Conclusion: Wide neck aneurysms that are challenging to treat with coil embolization can be successfully treated with a flow diverter that was designed for intravascular treatment of the aneurysms by causing hemodynamic changes within the aneurysms. This comparative analysis advances the overall understanding of the ways in which various wire materials affect Flow Diverters (FD) performance. To optimize the selection and creation of FDs for the successful treatment of intracranial aneurysms, physicians and researchers might gain insight from the findings of the investigation.

Competitive Insights: MicroVention, Inc. Celebrated One Year Anniversary of FRED X Flow Diverter (July 2023)

In September 2022, MicroVention's study and testing of X Technology was published in JNIS (Journal of NeuroInterventional Surgery).

Insight from Industry expert:

“We are excited to celebrate the anniversary of our FRED X flow Diverter technology since its commercial launch last year, and we also look forward to sharing U.S. clinical data on FRED X in the near future. We are thankful for our remarkable partnerships with a large number of physicians across the United States who have helped with the advancement of this innovative yet critical technology while we continue our mission of helping to save patient lives.”

- Carsten Schroeder, President and CEO, MicroVention, Inc.

Advancements in Tubridge Flow Diverter for Treatment of Intracranial Aneurysms

Article published by Springer Nature in March 2024 for-

“Title - Use of the Tubridge flow diverter in the treatment of intracranial aneurysms: a single center experience”

The research study stated that, use of the Tubridge diverter could significantly reduce the flow of blood from entering the ruptured aneurysm, with a relatively low periprocedural complication rate (3.5%), a significant aneurysm occlusion degree, and a lower in-stent stenosis rate at follow-up, according to this study that investigated the safety and effectiveness of Tubridge flow diverter.

Following table shows the baseline data of the patients:

Variables

Data

Patients

Number of Patients

85

Male/Female

35/50

Age (yrs)

17-77 (56.7 ± 11.1)

With single aneurysms

65 (76.5%)

With multiple aneurysms

20 (23.5%)

Small aneurysms < 10 mm

50 (58.8%)

Large aneurysms > 10 mm

35 (41.2%)

Past History

Hypertension

53(62.4%)

Diabetes mellitus

9(10.6%)

Hyperlipidemia

15(17.6%)

Smoking

23(27.1%)

Alcohol abuse

19(22.4%)

Results and Conclusion: Based on the findings it could be evaluated that Tubridge flow diverter provides excellent therapeutic and diagnostic occlusion outcomes when used safely and effectively to treat cerebral aneurysms despite the fact that large aneurysms may require a longer surgical time and extra coiling, with a low rate of periprocedural complications, a high degree of aneurysm occlusion, and a low rate of in-stent stenosis during follow-up.

Key Flow Diverters Companies

The following are the leading companies in the flow diverters market. These companies collectively hold the largest market share and dictate industry trends.

- Stryker

- Medtronic

- MicroVention, Inc. (Terumo Corporation)

- Balt

- MicroPort Scientific Corporation

- CERENOVUS (Johnson & Johnson Services, Inc.)

- phenox GmbH

- Acandis GmbH

- InspireMD, Inc.

Recent Developments

-

In August 2023, Mentice, a healthcare tech firm, introduced the newest version of Ankyras in the European Union (EU). This app helps interventional neuroradiologists choose the best flow diverters for treating brain aneurysms.

-

In July 2023, MicroVention, Inc., collaborated with U.S. physicians, over 1,000 patients have been effectively treated using FRED X flow diverter. Specifically designed for redirecting blood flow in small vessels, FRED X is the only FDA PMA-approved option featuring a 0.021" delivery system for smaller sizes and without a distal lead wire. Enhanced with X Tech, the FRED device maintains precise and predictable placement characteristics.

-

In February 2022, Medtronic announced that the Freezor and Freezor Xtra Cardiac Cryoablation Focal Catheters received U.S. FDA approval to treat the growing prevalence of pediatric atrioventricular nodal reentrant tachycardia.

-

In August 2022, Medtronic plc partnered with BioIntelliSense, a company that monitors health continuously, to gain exclusive rights to distribute the BioButton wearable device in U.S. hospitals and for 30 days after patients leave the hospital. This device helps in keeping track of different health aspects all the time and stays connected.

Flow Diverters Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 341.70 million

Revenue forecast in 2030

USD 722.59 million

Growth rate

CAGR of 13.29% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends, and volume analysis

Segments covered

Diameter size, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country Scope

U.S.; Canada; Mexico; UK; Germany; Italy; France; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Stryker, Medtronic; MicroVention, Inc. (Terumo Corporation); Balt; MicroPort Scientific Corporation; CERENOVUS (Johnson & Johnson Services, Inc.); phenox GmbH; Acandis GmbH; InspireMD, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Flow Diverters Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global flow diverters market report based on diameter size and region.

-

Diameter Size Outlook (Revenue, USD Million, 2018 - 2030)

-

2-3 mm

-

3-4 mm

-

4-5 mm

-

>5 mm

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global flow diverters market size was estimated at USD 303.01 million in 2023 and is expected to reach USD 341.70 million in 2024.

b. The global flow diverters market is expected to grow at a compound annual growth rate of 13.29% from 2024 to 2030 to reach USD 722.59 million by 2030.

b. North America dominated the flow diverters market with the highest share of 35.98% in 2023. This is attributable to rising healthcare awareness coupled with the introduction of technologically advanced products and constant research and development initiatives.

b. Some key players operating in the flow diverters market include Medtronic plc, Stryker Corporation, MicroVention, Inc. (Terumo Corporation), Balt, MicroPort, Scientific Corporation, phenox GmbH, Acandis GmbH, Cerus Endovascular Inc., CERENOVUS (Johnson & Johnson Services, Inc.), InspireMD, Inc., and others.

b. Key factors driving the flow diverters market growth include rising demand for minimally invasive surgeries; increasing government initiative, favorable government policies, and rising incidence of intracranial aneurysms.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.