- Home

- »

- Biotechnology

- »

-

Fluorescent In Situ Hybridization Probe Market Report, 2030GVR Report cover

![Fluorescent In Situ Hybridization Probe Market Size, Share & Trends Report]()

Fluorescent In Situ Hybridization Probe Market (2025 - 2030) Size, Share & Trends Analysis Report By Technology (Flow FISH, Q FISH), By Type (DNA, RNA), By Application, By End-use (Research, Clinical use), By Region, And Segment Forecasts

- Report ID: 978-1-68038-596-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Fluorescent In Situ Hybridization Probe Market Summary

The global fluorescent in situ hybridization probe market size was estimated at USD 951.77 million in 2024 and is projected to reach USD 1,485.88 million by 2030, growing at a CAGR of 7.78% from 2025 to 2030. The market is driven by the rising incidence of genetic disorders and cancer, technological advancements in molecular diagnostics, and the expansion of clinical research and drug development.

Key Market Trends & Insights

- North America dominated the fluorescent in situ hybridization probe market and accounted for a 44.33% share in 2024.

- The U.S. leads the fluorescent in situ hybridization probe market, driven by rising cancer incidences and a focus on research and development.

- By technology, FLOW-FISH segment held the largest share of 35.81% of the fluorescent in situ hybridization probe industry in 2024 and is reported to be the fastest segment over the forecast period.

- By type, DNA probes segment represent the largest segment of the market, accounting for 55.85% of revenue share.

- By application, cancer diagnostics is the largest segment of the market, with a revenue share of 43.85% in 2024.

Market Size & Forecast

- 2024 Revenue: USD 951.77 Million

- 2030 Projected Market Size: USD 1,485.88 Million

- CAGR (2025-2030):7.78%

- North America: Largest market in 2024

- Asia-Pacific: Fastest growing market

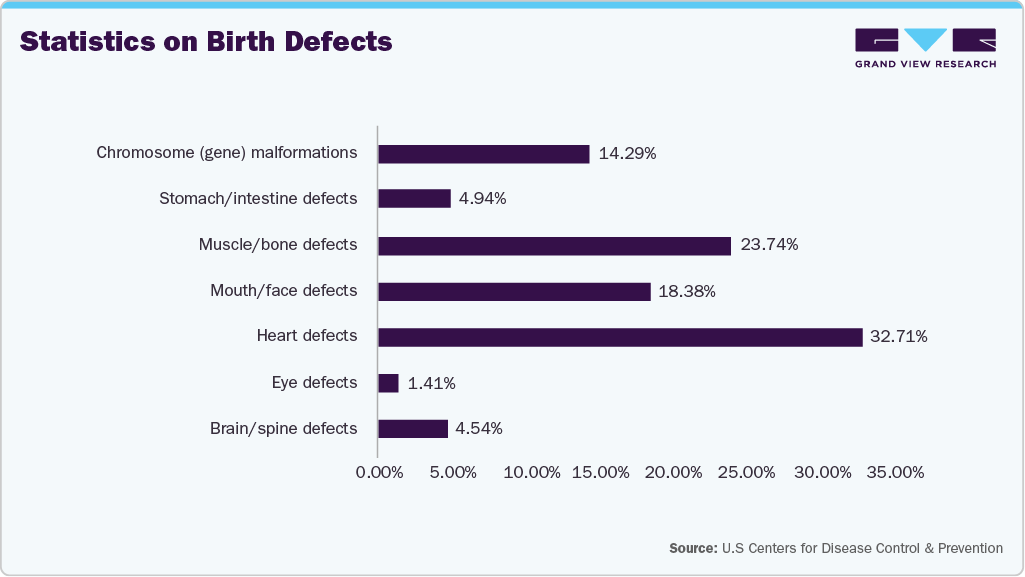

According to the American Association for Cancer Research, approximately 2.53 million cancer cases are estimated by 2050, with 0.97 million deaths. The growing prevalence of genetic diseases, congenital abnormalities, and various cancers significantly fuels the demand for FISH probes. Prenatal diagnosis using FISH probes enables rapid detection of chromosomal abnormalities in developing fetuses. FISH identifies conditions like Down syndrome, Turner syndrome, and other aneuploidies by targeting specific DNA sequences. It provides accurate, early results, helping expectant parents make informed decisions during high-risk pregnancies. The chart below illustrates specific birth defects and the percentage of babies affected each year:

Early detection of mutations or structural chromosome changes using FISH enables clinicians to provide targeted therapies and prognostic insights. With increasing awareness and routine screening, healthcare systems are integrating FISH testing more broadly, creating sustained demand for FISH probes in research and clinical diagnostics.

Technological advancements are fueling the market growth. Rapid innovations in molecular diagnostics have enhanced the sensitivity, specificity, and efficiency of FISH techniques. Automation of FISH workflows, multiplexing capabilities, and integration with digital imaging systems have significantly reduced turnaround times and improved reproducibility. Advanced probe designs enable more accurate detection of subtle chromosomal changes, even in complex samples. Such advancements allow broader clinical and research applications, from personalized medicine to prenatal diagnostics. The continuous development of high-throughput and AI-powered analysis tools has made FISH a more powerful diagnostic tool, driving adoption across hospitals, reference labs, and academic research centers. The map below highlights the evolution of FISH from 1980 to the present.

FISH probes are vital in drug discovery and clinical trials, especially in oncology and cytogenetics. Pharmaceutical and biotechnology companies rely on FISH to validate genetic biomarkers, monitor chromosomal integrity in engineered cells, and evaluate treatment responses. Rising cancer research and novel drug pipelines have boosted the demand for FISH-based companion diagnostics, and efficacy monitoring tools are accelerating. Regulatory bodies increasingly require molecular-level evidence for drug approval, prompting more frequent use of FISH in research. The supportive landscape for R&D investment in life sciences continues to drive robust demand for these probes.

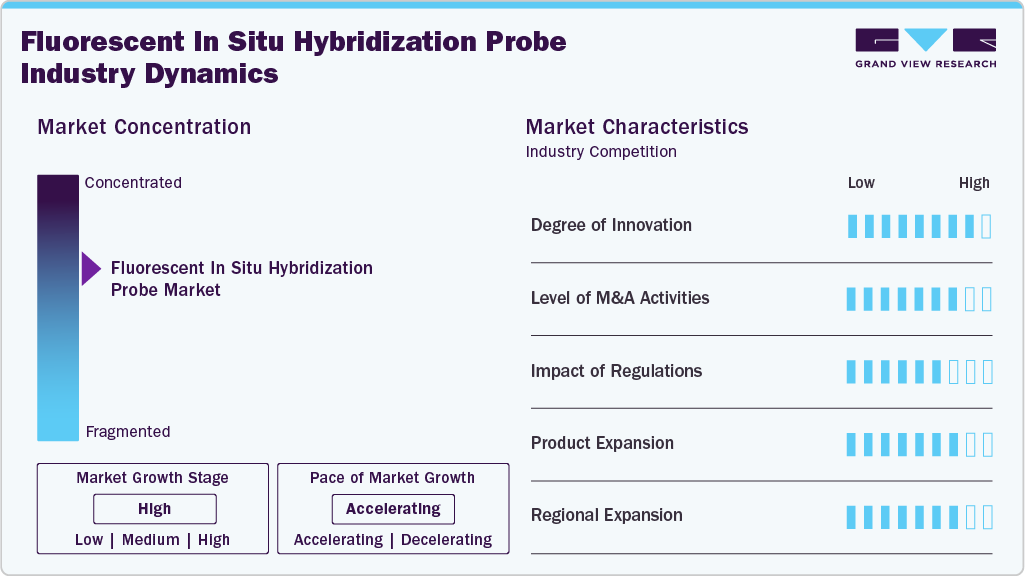

Market Concentration & Characteristics

The FISH probe industry demonstrates consistent innovation, especially in probe specificity, multiplexing capabilities, and automation. Innovations such as digital FISH and rapid hybridization protocols have improved diagnostic accuracy and speed. For instance, in January 2025, Molecular Instruments (MI) announced the launch of its HCR Gold and HCR Pro product lines. The foundational HCR imaging platform has redefined the state-of-the-art for multiplexed, quantitative, high-resolution RNA fluorescence in situ hybridization (RNA-FISH) in thick, autofluorescent samples. Moreover, integration with other genomic platforms like NGS and PCR has expanded its diagnostic relevance. Custom probe development for rare and complex disorders exemplifies the market’s innovative nature, driving adoption in clinical diagnostics, oncology, and prenatal testing.

The market has witnessed high mergers and acquisitions, primarily driven by strategic consolidation among diagnostics companies. Major players acquire smaller firms to access proprietary probe technologies, expand product portfolios, and enter new markets. For example, in January 2025, Leica Biosystems announced a partnership with Molecular Instruments as the HCR Pro RNA-FISH technology was released on the BOND RX and BOND RXm research staining instruments.

Regulatory frameworks significantly shape the market, particularly due to its clinical diagnostic applications. Probes used for medical diagnosis must comply with stringent standards set by agencies like the FDA (USA) and CE marking (Europe). These regulations ensure safety, accuracy, and efficacy, but also increase development costs and approval timelines. However, regulatory clarity supports trust in clinical use and encourages investment. Harmonized international regulations are gradually easing market entry for new players and products.

Product expansion in the FISH probe industry has been driven by rising demand for precision diagnostics. Manufacturers are developing various probes targeting cancer biomarkers, genetic syndromes, and chromosomal abnormalities. The rise of personalized medicine has fueled demand for companion diagnostics using FISH. These multiplex probe kits and probes for rare diseases are being developed to cater to niche diagnostic needs. This diversification helps companies tap into both clinical and research segments.

Regional expansion is a key growth strategy in the market, with emerging economies in Asia-Pacific, Latin America, and the Middle East showing increasing adoption. Improved healthcare infrastructure, rising awareness, and government investments in diagnostics have boosted demand in these regions. For instance, in March 2025, Vitro announced the appointment of Biocare Medical as the exclusive distributor for its new NeoPATH Pro instrument in the United States. The NeoPATH Pro is a high-throughput platform with a 42-slide capacity, supporting advanced immunohistochemistry (IHC), in situ hybridization (ISH), and fluorescence in situ hybridization (FISH).

Technology Insights

FLOW-FISH held the largest share of 35.81% of the fluorescent in situ hybridization probe industry in 2024 and is reported to be the fastest segment over the forecast period, due to its unique combination of flow cytometry and fluorescence in situ hybridization, enabling high-throughput, quantitative analysis of nucleic acids at the single-cell level. This method is widely used in telomere length measurement, hematologic malignancy diagnosis, and stem cell research. Its ability to analyze thousands of cells rapidly with precise fluorescent labeling makes it highly valuable in clinical and research settings. Increasing demand for personalized medicine and early cancer detection further drives FLOW-FISH adoption, reinforcing its dominance in the market across multiple applications.

There is a vast number of research studies that are ongoing using FLOW FISH for genetic disorders as well as cancer. One such example of a study published in April 2025 revealed the clinical significance of telomere length and genetic profiling via Flow-FISH as potential biomarkers for early diagnosis, prognosis, and personalized management of acquired pediatric aplastic anemia. Its advantages, such as speed, scalability, and precision, make it a preferred choice over conventional FISH techniques.

Type Insights

DNA probes represent the largest segment of the market, accounting for 55.85% of revenue share, owing to their critical role in detecting specific gene sequences, chromosomal abnormalities, and structural rearrangements. These probes are widely used in clinical diagnostics, particularly oncology, prenatal screening, and genetic disorder identification. DNA-based FISH probes offer high specificity and stability, enabling accurate visualization of target DNA within cells or tissues. Their versatility allows for single-locus, centromeric, and whole-chromosome applications. With growing demand for precise genetic analysis, the use of DNA probes has expanded significantly, reinforcing their dominance in both clinical and research settings within the global FISH probe industry.

RNA probes represent the fastest-growing segment of the market, driven by rising interest in gene expression analysis, single-cell transcriptomics, and spatial biology. RNA FISH enables direct visualization of RNA molecules within cells, offering insights into transcriptional activity, cellular heterogeneity, and disease mechanisms. Advanced RNA FISH technologies, such as single-molecule and multiplexed RNA FISH, have gained popularity in cancer research, neuroscience, and infectious disease studies. The growing demand for high-resolution, real-time RNA detection in clinical diagnostics and academic research has accelerated the adoption of RNA probes, positioning this segment as the most rapidly expanding area in the market.

Application Insights

Cancer diagnostics is the largest segment of the market, with a revenue share of 43.85% in 2024, driven by the technique’s ability to detect high precision gene rearrangements, amplifications, and deletions. Its utility in guiding targeted therapies and monitoring disease progression has made it a cornerstone in personalized oncology. For example, Amoy Diagnostics Co., Ltd. (AmoyDx) announced in September 2024 the approval of AmoyDx FGFR2 Break-Apart FISH Probe Kit as a companion diagnostic (CDx). The growing global cancer burden, coupled with increased adoption of companion diagnostics, continues to fuel demand for FISH probes in cancer diagnostics, solidifying this segment’s dominant position in the overall market.

The use of FISH probes in diagnosing genetic diseases to accurately detect chromosomal abnormalities such as deletions, duplications, translocations, and aneuploidies is appreciable. FISH is widely employed in identifying genetic syndromes like Down syndrome and DiGeorge syndrome. Its ability to provide rapid and accurate results makes it particularly valuable in prenatal diagnostics and neonatal screening. FISH also aids in confirming results from other molecular techniques and uncovering mosaicism or submicroscopic alterations. As awareness and screening for inherited genetic conditions increase, the demand for FISH in genetic disease diagnostics continues to expand.

End-use Insights

Clinical use represents the largest segment of the market, accounting for 41.33% in 2024, driven by its widespread application in diagnosing genetic disorders, cancers, and infectious diseases. With high sensitivity and specificity, FISH probes are routinely used in hospitals and diagnostic laboratories to detect chromosomal abnormalities, gene fusions, and copy number variations. The technique supports critical clinical decisions, especially in oncology and prenatal testing, by enabling precise molecular profiling. Growing awareness of personalized medicine, increasing availability of companion diagnostics, and regulatory approvals for FISH-based assays continue to boost clinical adoption. As a result, clinical applications remain the primary driver of market demand and growth.

These probes are used in research due to FISH’s vast applications in molecular biology, genetics, and cellular studies. Researchers use FISH probes to study gene expression, chromosomal organization, and spatial-temporal dynamics of nucleic acids at the single-cell level. Advanced FISH techniques, such as multiplexed and single-molecule RNA FISH, have become essential tools in developmental biology, neuroscience, cancer research, and microbiology. Academic institutions and research labs increasingly adopt FISH to gain deeper insights into complex biological processes. As funding for life sciences research grows globally, the demand for FISH probes in research continues to rise.

Regional Insights

North America dominated the fluorescent in situ hybridization probe market and accounted for a 44.33% share in 2024, driven by the high adoption of molecular diagnostics and the strong presence of key market players. Rising cancer prevalence, increased funding for genetic research, and favorable regulatory support further contributed to the region’s market dominance and sustained growth.

U.S. Fluorescent In Situ Hybridization Probe Market Trends

The U.S. leads the fluorescent in situ hybridization probe market, driven by rising cancer incidences and a focus on research and development. Strong research funding, regulatory approvals, and collaborations propel the market growth. For example, in April 2025, Genomics partnered with BioDot to launch the first pre-optimized hematology FISH probe panels that accelerate FISH testing for hematologic malignancies, offering enhanced efficiency, consistency, and ease of use in clinical and research laboratory workflows.

Europe Fluorescent In situ Hybridization Probe Market Trends

Europe holds a significant share of the FISH probe market, driven by strong government support for genomic research, advanced diagnostic infrastructure, and increasing prevalence of genetic disorders and cancer. Widespread adoption of personalized medicine and active participation in clinical trials further boost market growth across major European countries.

UK Fluorescent In situ Hybridization Probe Market Trends

The UK holds a leading share in the European FISH probe market, driven by its advanced healthcare system, strong focus on genetic research, and increasing adoption of precision diagnostics. Government initiatives, such as the Genomics England project, and collaborations between academia and industry further support market expansion in the country.

Germany Fluorescent In situ Hybridization Probe Market Trends

Germany holds a substantial share of the FISH probe market in Europe, supported by its advanced biomedical research infrastructure and growing funding for technological development. Resolve Biosciences secured USD 71 million to accelerate commercial expansion and meet the growing global demand for its Molecular Cartography workflow. This workflow features a proprietary, highly multiplexed single-molecule fluorescence in situ hybridization (smFISH) technology, providing three-dimensional spatial context at subcellular resolution through a fully automated process.

Asia Pacific Fluorescent In Situ Hybridization Probe Market Trends

Asia-Pacific is rapidly emerging with a CAGR of 9.5% in the FISH probe market, driven by rising awareness of genetic diseases and increasing cancer prevalence. In 2022, approximately 2.37 million new cancer cases and 1.53 million cancer-related deaths were reported in the WHO South-East Asia Region, highlighting the region’s growing cancer burden. Government investments in molecular diagnostics and the growing adoption of advanced technologies in countries like China, India, and Japan fuel significant market growth.

China Fluorescent In situ Hybridization Probe Market Trends

China held a dominant share in the Asia-Pacific FISH probe market, driven by its expanding research and development and strong government support for molecular diagnostics. For instance, in April 2023, a research study on UroVysion fluorescence in situ hybridization (FISH) exhibited a high positive rate in detecting carcinomas of non-urothelial lineages. Rapid adoption of advanced technologies, growing investments in biotech research, and the presence of local manufacturers are fueling market growth across the country.

Japan Fluorescent In Situ Hybridization Probe Market Trends

Japan’s fluorescent in situ hybridization probe market is progressing steadily, driven by cutting-edge research in molecular biology. The country's high adoption of precision medicine and government initiatives promoting genomic testing contribute to the growing demand for FISH technology.

Latin America Fluorescent In situ Hybridization Probe Market Trends

Latin America is emerging as a growing market for FISH probes, driven by increasing expansion in diagnostic solutions and research funding. Countries like Brazil and Mexico are leading adoption, supported by expanding diagnostic capabilities, government health initiatives, and growing investment in molecular diagnostic technologies.

Brazil Fluorescent In Situ Hybridization Probe Market Trends

Brazil holds the largest share of the FISH probe market in Latin America, driven by its expanding healthcare sector. For instance, in September 2024, Hospitex and BIO BRASIL BIOTECNOLOGIA announced plans to strengthen their partnership to expand cytology services across Brazil. This collaboration aims to enhance diagnostic capabilities by increasing access to advanced cytological technologies and services, supporting early disease detection, and improving patient outcomes nationwide. Government support for advanced diagnostic technologies and a strong network of public and private laboratories fuel market growth.

Middle East & Africa Fluorescent in situ Hybridization Probe Market Trends

The Middle East and Africa are experiencing growing adoption of FISH probe technology, driven by increasing cancer prevalence, rising awareness of genetic disorders, and improving healthcare infrastructure. Countries like the UAE and South Africa are investing in advanced diagnostics, fostering market growth through public-private partnerships and expanding molecular testing capabilities.

Saudi Arabia Fluorescent in situ Hybridization Probe Market Trends

Saudi Arabia holds a leading share of the FISH probe market in the Middle East, supported by significant investment in healthcare modernization, rising cancer diagnostics demand, and expansion of genetic testing services. Government initiatives like Vision 2030 and increased adoption of advanced molecular technologies drive sustained market growth.

Key Fluorescent in situ Hybridization Probe Company Insights

The FISH probe market is highly competitive, with companies like Thermo Fisher Scientific Inc. and Agilent Technologies Inc. holding a significant share due to their broad product offerings. Companies are pursuing strategies such as product innovation, regional expansion, and strategic partnerships to strengthen their market position. For example, in March 2023, KromaTiD launched the dGH in-Site CAR-T Kit, which features a distinctive dGH technology unlike any other FISH method. This kit provides researchers with a valuable tool for monitoring the effects of T cell engineering.

Key Fluorescent In Situ Hybridization Probe Companies:

The following are the leading companies in the fluorescent in situ hybridization probe market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific Inc.

- PerkinElmer Inc.

- BioDot

- Horizon Diagnostics

- Agilent Technologies, Inc.

- Abnova Corporation

- LGC Biosearch Technologies

- Genemed Biotechnologies, Inc.

- Oxford Gene Technology IP Limited

- Biocare Medical, LLC.

- QIAGEN (Exiqon A/S)

- GSP Research Institute, Inc

Recent Developments

-

In April 2025, Empire Genomics, a Biocare Medical company, partnered with BioDot to launch the first pre-optimized hematology FISH probe panels and controls for the CellWriter S platform.

-

In April 2023, researchers at the University of Montpellier launched high-throughput smFISH (HT-smFISH), a streamlined and cost-effective technique for imaging hundreds to thousands of single endogenous RNA molecules in 96-well plates. This technique enables large-scale RNA analysis with high precision and efficiency.

Fluorescent In Situ Hybridization Probe Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,021.63 million

Revenue forecast in 2030

USD 1,485.88 million

Growth rate

CAGR of 7.78% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

technology, type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; Sweden; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Thermo Fisher Scientific, Inc; Perkinelmer Inc.; BioDot; Horizon Diagnostics; Agilent Technologies, Inc.; Abnova Corporation; LGC Biosearch Technologie; Genemed Biotechnologies, Inc.; Oxford Gene Technology IP Limited; Biocare Medical, LLC.; QIAGEN (Exiqon A/S); GSP Research Institute, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fluorescent In Situ Hybridization Probe Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global fluorescent in situ hybridization probe market report based on technology, type, application, end-use and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Q FISH

-

FLOW FISH

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

DNA

-

RNA

-

mRNA

-

miRNA

-

Other

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cancer Diagnostics

-

Lung

-

Breast

-

Bladder

-

Hematological

-

Gastric

-

Prostrate

-

Cervical

-

Other

-

-

Genetic diseases

-

Other

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Research

-

Clinical use

-

Companion diagnostics

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

Italy

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global fluorescent in situ hybridization probe market size was estimated at USD 951.77 million in 2024 and is expected to reach USD 1,021.63 million in 2025.

b. The global fluorescent in situ hybridization probe market is expected to grow at a compound annual growth rate of 7.8% from 2025 to 2030 to reach USD 1,485.88 million by 2030.

b. FLOW-FISH segment held the largest revenue share of 35.80% in 2024 and is anticipated to grow at the fastest growth rate over the forecast period in the fluorescent in situ hybridization (FISH) probe market owing to the growing demand for genomic profiling by healthcare professionals.

b. Some key players operating in the fluorescent in situ hybridization probee market include Oxford Gene Technologies; Life Science Technologies; PerkinElmer Inc.; Abnova Corporation; Biosearch Technologies Inc.; Genemed Biotechnologies, Inc.; and F. Hoffmann-La Roche AG.

b. Key factors that are driving market growth include increasing demand for In-vitro Diagnostics (IVD) testing for the diagnosis of various chronic diseases that provide a high level of reliability, rapidity, and sensitivity for FISH probe techniques,

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.