- Home

- »

- Specialty Polymers

- »

-

Fluoropolymer Films Market Size, Industry Report, 2030GVR Report cover

![Fluoropolymer Films Market Size, Share & Trends Report]()

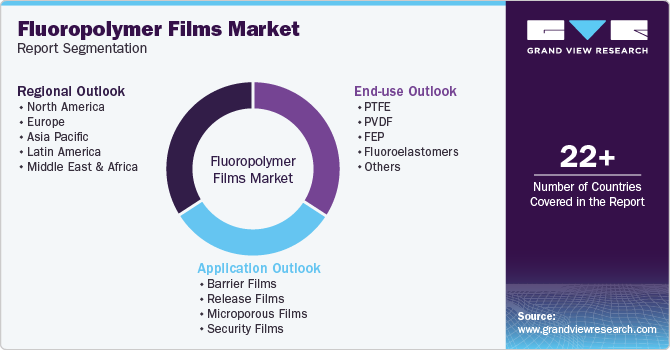

Fluoropolymer Films Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Barrier Films, Release Films, Microporous Films, Security Films), By End Use (Automotive, Construction, Aerospace & Defence), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-479-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Fluoropolymer Films Market Size & Trends

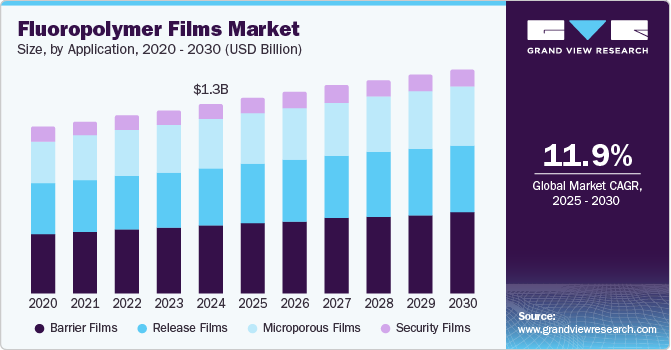

The global fluoropolymer films marketsize was valued at USD 1.33 billion in 2024 and is projected to grow at a CAGR of 11.9 % from 2025 to 2030. The increasing demand for high-performance electronic devices and semiconductors is driving the growth of fluoropolymer films market. These films are used in electronic devices for semiconductor packaging, capacitors, and PCBs. It is commonly employed in high temperatures and harsh chemical conditions to fulfil performance requirements.

The increasing demand for fluoropolymer films made of fluorine and carbon is leading to market expansion. This is attributed to their exceptional durability against chemicals and moisture. The rising demand for fluoropolymer tapes due to their thermal and chemical resistance, strong dielectric properties, and low friction coefficient is driving the market growth. The significant advancements in the refining of fluoropolymer films are commonly used in a variety of manufacturing processes. These advancements have resulted in a significant increase in the importance and market sales of fluoropolymer films.

The growing demand from different end uses segments owing to its superior properties is propelling the market growth. Fluoropolymer tapes are widely used in solar photovoltaic modules, offering strong resistance to chemicals and weathering. The growing automotive sector is boosting the demand for fluoropolymer films to protect vehicles inside and out. The rising utilization of fluoropolymer films in sectors such as pharmaceuticals, aerospace, and food processing is leading to the market growth.

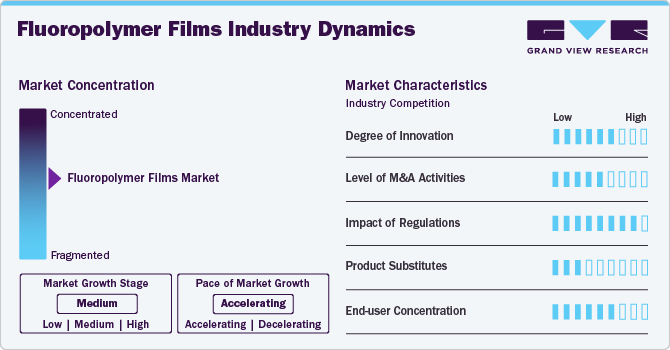

Market Concentration & Characteristics

The market is moderately fragmented, with key participants involved in R&D and technological innovations. Notable companies include 3M; DAIKIN INDUSTRIES, Ltd.; The Chemours Company; Saint-Gobain ; Solvay; DuPont; NOWOFOL; and Guarniflon India PVT., LTD. Several players are engaged in framework development to improve their market share.

The fluoropolymer films market is projected to experience consistent growth, fueled by significant demand in industries such as electronics, solar power, aerospace, and pharmaceutical packaging. This increase is mainly attributed to the advanced innovations in film processing techniques and material formulations that provide exceptional UV resistance, non-stick characteristics, chemical stability, and high performance in extreme temperature conditions.

Developments in ultra-thin and multi-layer fluoropolymer films-particularly in areas like flexible electronics, photovoltaic backsheet applications, and high-barrier packaging-are expected to enhance market penetration.

Additionally, the market is likely to see a moderate amount of mergers and acquisitions, as companies aim to merge with specialty film converters and broaden their portfolios in advanced materials. These consolidations are intended to accelerate research and development efforts and explore high-growth niche areas such as green hydrogen infrastructure and films for medical devices. In summary, the combination of technological advancements and strategic corporate maneuvers is set to significantly propel growth in the fluoropolymer films market.

Application Insights

The barrier films segment dominated the market and accounted for the largest revenue share of 45.32% in 2024. Fluoropolymer barrier films are highly effective in shielding products from different environmental elements such as oxygen, moisture, and UV radiation. This results in preserving product quality and prolonging shelf life, especially in sectors such as food and pharmaceuticals. Fluoropolymer barrier films efficiently address concerns related to contamination and spoilage of food products by effectively preventing them.

The release films segment is expected to grow at a significant CAGR of 12.0% over the forecast years. The low surface energy of fluoropolymers makes them extremely non-adhesive. It offers resilience against various chemicals, providing longevity and reliability in challenging situations. They can endure extreme temperatures without affecting their ability, making them ideal for a range of industrial applications. The release films serve as a shield for fragile electronic parts, safeguarding them from harm during processing and assembly.

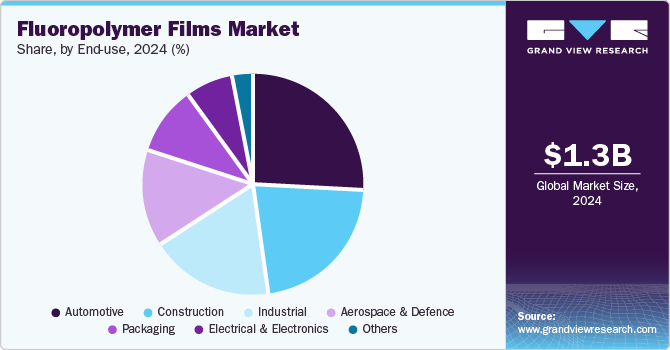

End Use Insights

The automotive segment dominated the market and accounted for the largest revenue share of 26.10% in 2024. The growing automotive industry is generating the demand for fluoropolymer films. Its use in fuel lines, gaskets, and hoses due to their chemical resistance is driving the segment's growth. Fluoropolymer films are employed to shield sensors and electronic components in advanced driver assistance systems (ADAS) systems against severe environmental conditions and electromagnetic interference.

The construction segment is expected to grow at a significant CAGR over the forecast years. The robust performance of fluoropolymer films in harsh weather conditions such as exposure to UV radiation, moisture, and extreme temperatures is driving the demand for films in the construction sector. It requires minimal maintenance, lowering building upkeep costs and improving their aesthetics. The films are available in a variety of colours and finishes, enhancing the architectural design of buildings.

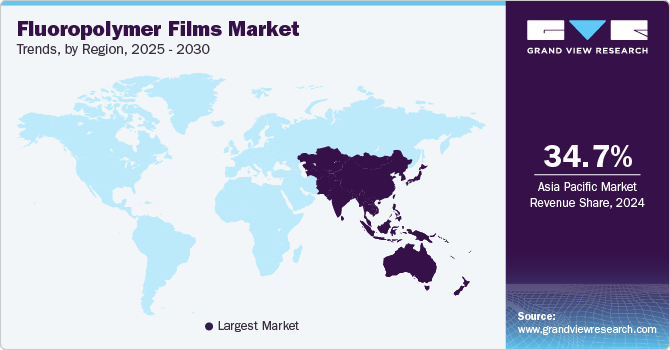

Regional Insights

The North America fluoropolymer films market held a market share of 24.49% in 2024. The region has a robust automotive and aerospace manufacturing foundation. Fluoropolymer films are widely utilized in these sectors for various parts such as seals, fuel lines, gaskets, and wire coatings owing to their exceptional chemical resistance, high heat resistance, and low friction characteristics.

U.S. Fluoropolymer Films Market Trends

The fluoropolymer films market in the U.S. experienced significant growth in 2024. The country is at the forefront of electronics and semiconductor technology. The increasing demand for high-performance electronic devices is driving the demand for fluoropolymer films with excellent dielectric properties and thermal stability. Furthermore, the need for sterile packaging options for pharmaceuticals and medical devices is leading to an increase in the use of fluoropolymer films.

Asia Pacific Fluoropolymer Films Market Trends

Asia Pacific fluoropolymer films market dominated the global market with a market share of 34.66% in 2024 due to the rising industrialization and expansion in the manufacturing industry in the region. Industries such as automotive, electronics, and chemical processing require materials with excellent thermal stability, chemical resistance, and durability. The increasing focus on sustainability and strict environmental laws are driving the need for fluoropolymers.

The fluoropolymer films market in China is expected to grow significantly in the coming years due to the strong presence of the manufacturing industry across various sectors including electronics, automotive, and others. The automotive sector in China is boosting the need for fluoropolymer films in parts such as fuel lines, gaskets, and coatings as they offer strong chemical resistance and long-lasting qualities.

Europe Fluoropolymer Films Market Trends

Europe fluoropolymer films market is expected to grow at a CAGR of 12.0% over the forecast period. The chemical sector in Europe is well established and vast, which requires fluoropolymer films to withstand harsh chemicals and extreme heat. It is also used in wind turbines, solar panels, and other renewable energy technologies. The continuous infrastructure development in Europe is leading to a rise in demand for construction materials, such as fluoropolymer films used in facades, roofing, and insulation.

The fluoropolymer films market in the UK is expected to grow significantly due to a rapid increase in the need for fluoropolymer tapes for a range of uses including photovoltaic cells, insulators, microphone membranes, adhesives, airbags, and others. Infrastructure projects such as HS2 require durable materials that resist harsh weather conditions, making fluoropolymer films suitable for cladding, roofing, and insulation.

Key Fluoropolymer Films Company Insights

Some of the key participants in the global fluoropolymer films market are 3M, Saint-Gobain, DAIKIN INDUSTRIES, Ltd., PolymerFilms, and others.

-

3M provides products and services to clients in a range of sectors including automotive, electronics, health care, safety, energy, consumer goods, and others. The company has variety of fluoropolymer films such as Dyneon, Dynamar, and others.

Key Fluoropolymer Films Companies:

The following are the leading companies in the fluoropolymer films market. These companies collectively hold the largest market share and dictate industry trends.

- 3M

- DAIKIN INDUSTRIES, Ltd.

- The Chemours Company

- Saint-Gobain

- Solvay

- DuPont

- NOWOFOL

- Guarniflon India PVT., LTD.

- PolymerFilms

- Asahi Kasei Corporation

Recent Developments

-

In April 2024, Rostec State Corporation announced the launch of Russia’s first fluoropolymer film production line, NEVAFLON. It substitutes polycarbonate & other polymer materials and glass and has wide applications ranging from architecture industry to aerospace industry.

Fluoropolymer Films Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.56 billion

Revenue forecast in 2030

USD 2.74 billion

Growth rate

CAGR of 11.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in Kilotons, Revenue in Million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Russia; Denmark; Sweden; Norway; China; India; Japan; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

3M; DAIKIN INDUSTRIES, Ltd. ; The Chemours Company; Saint-Gobain ; Solvay; DuPont; NOWOFOL; Guarniflon India PVT., LTD.; PolymerFilms; Asahi Kasei Corporation

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fluoropolymer Films Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyses the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global fluoropolymer films market report based on application, end use, and region.

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Barrier Films

-

Release Films

-

Microporous Films

-

Security Films

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Construction

-

Aerospace & Defence

-

Packaging

-

Industrial

-

Electrical & Electronics

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global fluoropolymer films market size was estimated at USD 1,326.50 million in 2024 and is expected to reach USD 1,562.78 million in 2025.

b. The global fluoropolymer films market is expected to grow at a compound annual growth rate of 11.9% from 2025 to 2030, reaching USD 2,744.18 million by 2025.

b. The barrier films segment dominated the market and accounted for the largest revenue share of 45.32% in 2024. Fluoropolymer barrier films are highly effective in shielding products from different environmental elements such as oxygen, moisture, and UV radiation.

b. Some key players operating in the fluoropolymer films market include Chemours Company, DAIKIN Industries Ltd, DUNMORE Corp., DuPont, Polyflon Technology Limited, Saint-Gobain S.A., Arkema Group, Solvay SA, Evonik Industries, and Asahi Glass Co., Ltd.

b. Key factors that are driving the market growth include rising demand from various application in construction, and increasing number of deployment and rapid expansion of solar photovoltaic (PV) modules across the globe.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.