- Home

- »

- Food Safety & Processing

- »

-

Food Packaging Equipment Market, Industry Report, 2030GVR Report cover

![Food Packaging Equipment Market Size, Share & Trends Report]()

Food Packaging Equipment Market (2025 - 2030) Size, Share & Trends Analysis Report By Equipment (Form-fill-seal, Filling & Dosing, Cartoning), By Application (Dairy, Bakery, Convenience Food), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-715-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Food Packaging Equipment Market Summary

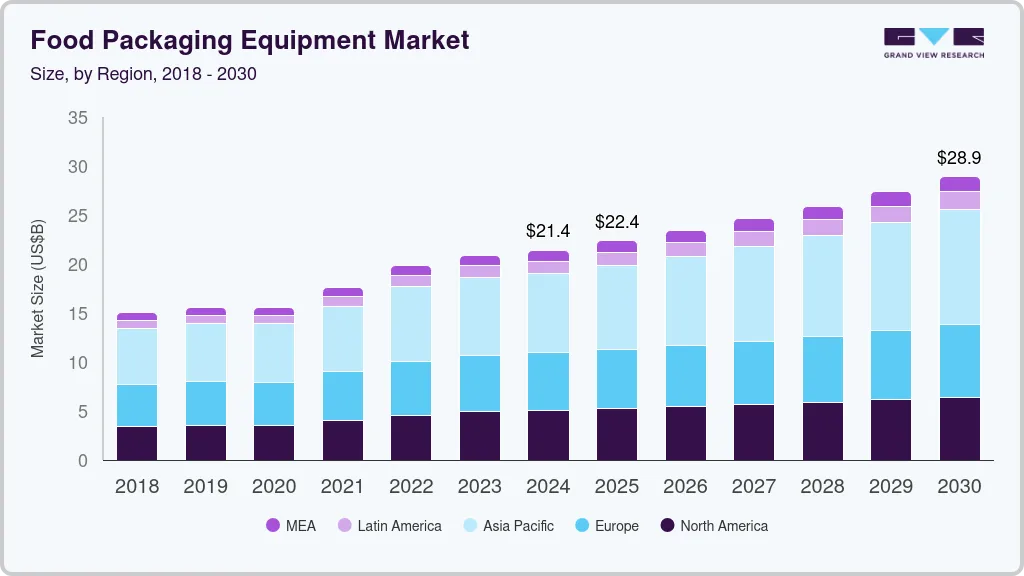

The global food packaging equipment market size was estimated at USD 21.40 billion in 2024 and is projected to reach USD 28.92 billion by 2030, growing at a CAGR of 5.3% from 2025 to 2030. This growth is attributed to the increasing health consciousness among consumers has led to a higher demand for hygienic and packaged food, prompting manufacturers to adopt advanced food packaging equipment.

Key Market Trends & Insights

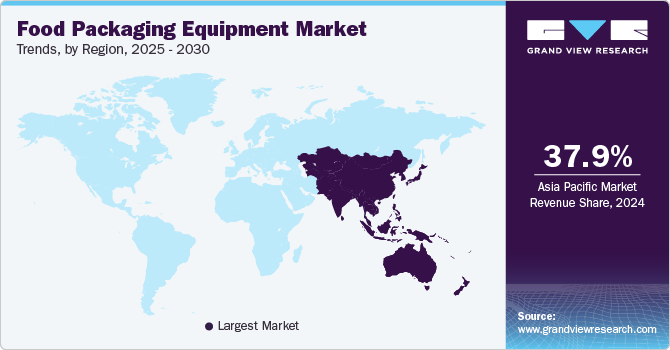

- The Asia Pacific, food packaging equipment market dominated the global market and accounted for the largest revenue share of 37.9% in 2024.

- The food packaging equipment market in China led the Asia Pacific market and accounted for the largest revenue share in 2024.

- By equipment, the form-fill-seal (FFS) machines segment dominated the market and accounted for the largest revenue share of 28.1% in 2024.

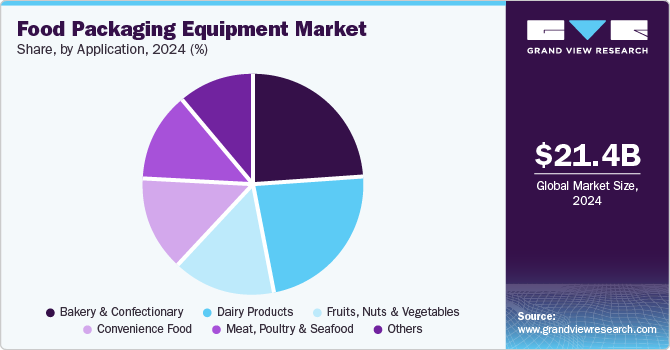

- By application, the bakery and confectionery segment led the market and accounted for the largest revenue share of 24.5% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 21.40 Billion

- 2030 Projected Market Size: USD 28.92 Billion

- CAGR (2025-2030): 5.3%

- Asia Pacific: Largest market in 2024

In addition, technological advancements, such as automation and IoT integration, enhance efficiency and safety in packaging processes. Furthermore, the rise of convenience foods and changing consumer lifestyles further stimulate the market as companies seek innovative solutions to meet evolving demands in food packaging equipment. Food packaging equipment refers to the machinery and technologies used for packaging food products to ensure their safety, quality, and longevity. The food and beverage industry's rapid expansion globally is a significant factor propelling the growth of this market. Advanced packaging and labeling machines are increasingly being adopted to meet the rising demand for efficient food packaging solutions. Innovations such as the Internet of Things (IoT) and Big Data create lucrative opportunities, enhancing food safety by enabling manufacturers to monitor products from production facilities to retail stores.In addition, the advent of Industry 4.0 and the proliferation of smart factories further increase the demand for food packaging equipment. Smart packaging technologies allow companies to incorporate sensors that monitor environmental conditions throughout the supply chain, ensuring optimal food quality and safety. Furthermore, emerging packaging technologies, particularly smart packaging, offer opportunities for differentiation and improved customer engagement. The growth of e-commerce and direct-to-consumer sales drives the need for efficient packing equipment designed for seamless shipping and handling

Moreover, as urbanization continues to rise and disposable incomes increase, particularly in developing regions, the food packaging equipment market is poised for substantial growth. The combination of these factors underscores a transformative shift in how food products are packaged, stored, and delivered, ultimately enhancing consumer satisfaction while addressing safety and sustainability concerns in the food industry.

Equipment Insights

The form-fill-seal (FFS) machines segment dominated the market and accounted for the largest revenue share of 28.1% in 2024. This growth is attributed to the increasing demand for efficient and sustainable packaging solutions. In addition, factors such as the booming food and beverage sector, rising consumer preference for convenience and single-serve products, and advancements in automation technology contribute significantly to this growth. Furthermore, FFS machines offer eco-friendly features, enabling manufacturers to meet sustainability goals while ensuring product safety and shelf life through effective packaging methods.

The filling and dosing equipment segment is expected to grow at a CAGR of 5.5% over the forecast period, primarily driven by the need for automation and precision in packaging processes across numerous industries, particularly food and beverages. In addition, the demand for consistent quality, reduced labor costs, and increased productivity are key factors driving this market. Furthermore, advancements in technology, such as AI-driven diagnostics and integration with flexible packaging materials, enhance operational efficiency and adaptability to changing consumer preferences

Application Insights

The bakery and confectionery segment led the market and accounted for the largest revenue share of 24.5% in 2024, driven by the rising demand for packaged baked goods, which are favored for their convenience and extended shelf life. In addition, manufacturers increasingly invest in advanced packaging technologies as consumer lifestyles evolve towards quick meal solutions to ensure product freshness and hygiene. Furthermore, the expansion of bakery chains and retail outlets further fuels this demand, highlighting the need for efficient packaging solutions that maintain quality and safety standards.

The dairy products segment is expected to grow at a CAGR of 5.9% from 2025 to 2030, owing to the increasing consumption of processed dairy items, such as cheese, yogurt, and milk. In addition, the demand for automated packaging solutions is rising due to the need for precision in filling and dosing, which enhances product quality and reduces waste. Furthermore, consumer preferences for convenient, ready-to-eat dairy products drive innovation in packaging technologies, ensuring that these products remain fresh while meeting stringent hygiene standards.

Regional Insights

The Asia Pacific, food packaging equipment market dominated the global market and accounted for the largest revenue share of 37.9% in 2024. This growth is attributed to economic expansion and urbanization. Increasing household incomes and a burgeoning middle-class population are fueling demand for convenience and packaged food products. Furthermore, lifestyle changes favoring on-the-go consumption have led to innovations in packaging formats, such as single-serve portions and resalable pouches, enhancing consumer convenience and driving market growth across the region.

The food packaging equipment market in China led the Asia Pacific market and accounted for the largest revenue share in 2024, owing to its vast food industry, which benefits from a large population and rising middle-class income. In addition, the growing demand for processed and packaged foods and technological advancements have led to increased investment in food packaging solutions. Furthermore, government initiatives promoting food safety and quality further support the expansion of this market, making China a key player in the Asia Pacific region.

Latin America Food Packaging Market Trends

The Latin America food packaging equipment market is expected to grow at a CAGR of 6.3% over the forecast period, driven by increasing urbanization and changing consumer preferences towards convenience foods. In addition, the rise of e-commerce and modern retail formats also contributes to this trend, as consumers seek packaged products that offer longer shelf life and ease of use. Furthermore, investments in sustainable packaging solutions are gaining traction as environmental concerns become more prevalent among consumers.

Europe Food Packaging Market Trends

The food packaging equipment market in Europe is expected to witness substantial growth over the forecast period, driven by stringent food safety and sustainability regulations. The demand for innovative packaging solutions that reduce waste and enhance product shelf life is on the rise. Furthermore, the growing trend of online grocery shopping has increased the need for efficient packaging technologies that ensure product integrity during transportation. This focus on sustainability and efficiency is shaping the future of the packaging industry in Europe

Germany food packaging equipment market dominated the European market and accounted for the largest revenue share in 2024 due to its advanced manufacturing capabilities and strong emphasis on innovation. In addition, the country's robust food processing sector drives demand for high-quality packaging solutions that meet both safety standards and consumer preferences for sustainability. Furthermore, Germany's strategic position within Europe facilitates trade and collaboration among packaging manufacturers, enhancing market growth prospects

North America Food Packaging Market Trends

The food packaging equipment market in North America is expected to grow significantly over the forecast period, driven by a high reliance on packaged food products and the strong presence of food processing companies. The increasing number of food service suppliers is digitalizing operations, enhancing consumer convenience through improved payment options and product selection. Furthermore, the rise in demand for ready-to-eat meals and convenience foods reflects changing consumer lifestyles, further fueling market expansion.

The growth of the U.S. food packaging equipment market is particularly strong due to its extensive food manufacturing base, accounting for a significant share of global dairy production. In addition, the growing popularity of plant-based products and innovations in eco-friendly packaging are key trends shaping the market. Moreover, the demand for convenience foods, including ready-to-eat meals, is driving investments in advanced packaging technologies that enhance product safety and shelf life. This dynamic environment positions the U.S. as a leader in the North American food packaging sector

Key Food Packaging Equipment Company Insights

Key companies in the global food equipment industry include MULTIVAC, ARPAC LLC., Coesia S.p.A., and others. These companies adopt various strategies to enhance their competitive edge. These include mergers and acquisitions to expand market presence, new product launches driven by innovation, and strategic partnerships to leverage technological advancements. Furthermore, companies focus on sustainability initiatives and customer-centric solutions to meet evolving consumer demands and regulatory standards, ensuring long-term growth and market relevance.

-

Krones AG specializes in manufacturing comprehensive food and beverage packaging solutions, including filling, labeling, and palletizing systems. The company operates in the beverage and liquid food segments, providing customized machinery for various container types, such as PET bottles, glass bottles, and cans.

-

Tetra Pak International S.A. manufactures innovative carton packaging systems that ensure product safety and extend shelf life while minimizing environmental impact. Operating primarily in the dairy, beverage, and food segments, the company focuses on delivering sustainable packaging solutions for various applications.

Key Food Packaging Equipment Companies:

The following are the leading companies in the food packaging equipment market. These companies collectively hold the largest market share and dictate industry trends.

- MULTIVAC

- I.M.A. INDUSTRIA MACCHINE AUTOMATICHE S.P.A.

- Krones AG

- Tetra Pak International S.A.

- Robert Bosch Packaging Technology GmbH

- GEA Group Aktiengesellschaft

- Illinois Tool Works Inc.

- ARPAC LLC.

- Coesia S.p.A.

- OPTIMA Packaging Group GmbH

Recent Developments

-

In December 2024, Tetra Pak announced a partnership with Yellow Dreams to enhance carton recycling capabilities in the European Union. This collaboration focuses on improving the recycling infrastructure for food packaging equipment, particularly beverage cartons. The initiative aims to boost recycling rates and support the circular economy by leveraging Tetra Pak's expertise. The partnership underscores a commitment to sustainability and innovation in the food packaging sector, ensuring that more cartons are recycled and reused, leading to reduced environmental impact.

Food Packaging Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 22.37 billion

Revenue forecast in 2030

USD 28.92 billion

Growth rate

CAGR of 5.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Equipment, application, region

Regional scope

North America, Asia Pacific, Europe, Latin America, Middle East and Africa.

Country scope

U.S., Canada, Mexico, China, India, Japan, South Korea, Australia, Germany, UK, France, Italy, Spain, Brazil, Argentina, Saudi Arabia, and UAE.

Key companies profiled

MULTIVAC; I.M.A. INDUSTRIA MACCHINE AUTOMATICHE S.P.A.; Krones AG; Tetra Pak International S.A.; Robert Bosch Packaging Technology GmbH; GEA Group Aktiengesellschaft; Illinois Tool Works Inc.; ARPAC LLC.; Coesia S.p.A.; OPTIMA Packaging Group GmbH.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Food Packaging Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the food packaging equipment market report based on equipment, application, and region:

-

Equipment Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Form-Fill-Seal

-

Filling & Dosing

-

Cartoning

-

Case Packing

-

Wrapping & Bundling

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Bakery & Confectionary

-

Dairy Products

-

Fruits, Nuts & Vegetables

-

Meat, Poultry & Seafood

-

Convenience Food

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Russia

-

Germany

-

UK

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Australia

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.