- Home

- »

- Biotechnology

- »

-

Fragment Analysis Market Size, Share, Industry Report, 2033GVR Report cover

![Fragment Report]()

Fragment Analysis Market (2025 - 2033) Size, Share & Trends Analysis Report By Product & Service (Instruments, Reagents & Consumables), By Technology, By Application, (Genotyping & Polymorphism Analysis, Molecular Diagnostics), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-824-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Fragment Analysis Market Summary

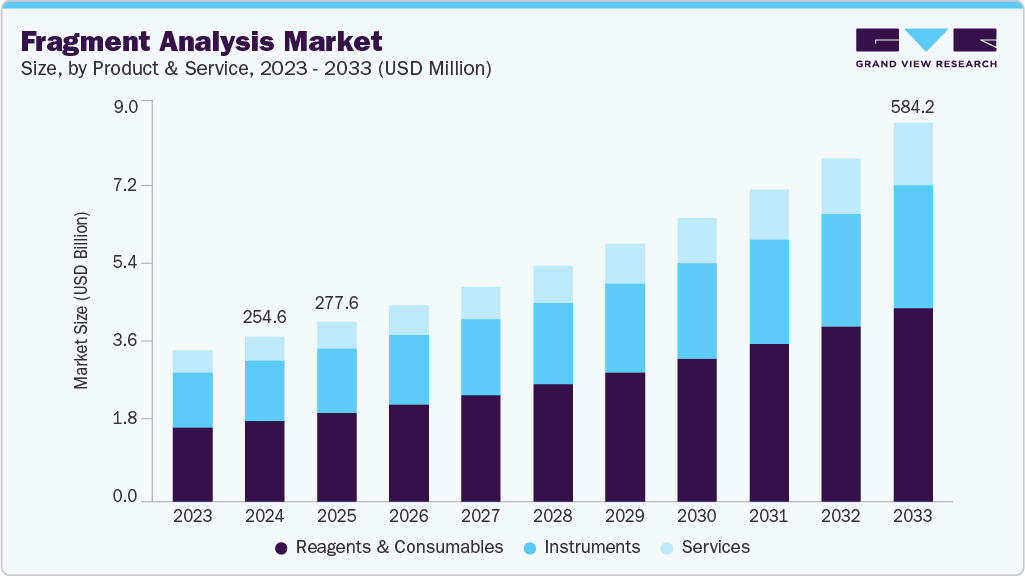

The global fragment analysis market size was estimated at USD 254.6 million in 2024 and is projected to reach USD 584.2 million by 2033, growing at a CAGR of 9.75% from 2025 to 2033. The market growth is primarily driven by factors such as increasing adoption of advanced analytical techniques, rising demand for high-precision molecular and protein analysis, expansion of research and development activities in the pharmaceutical and biotechnology sectors, and growing applications in genomics, proteomics, and diagnostics.

Key Market Trends & Insights

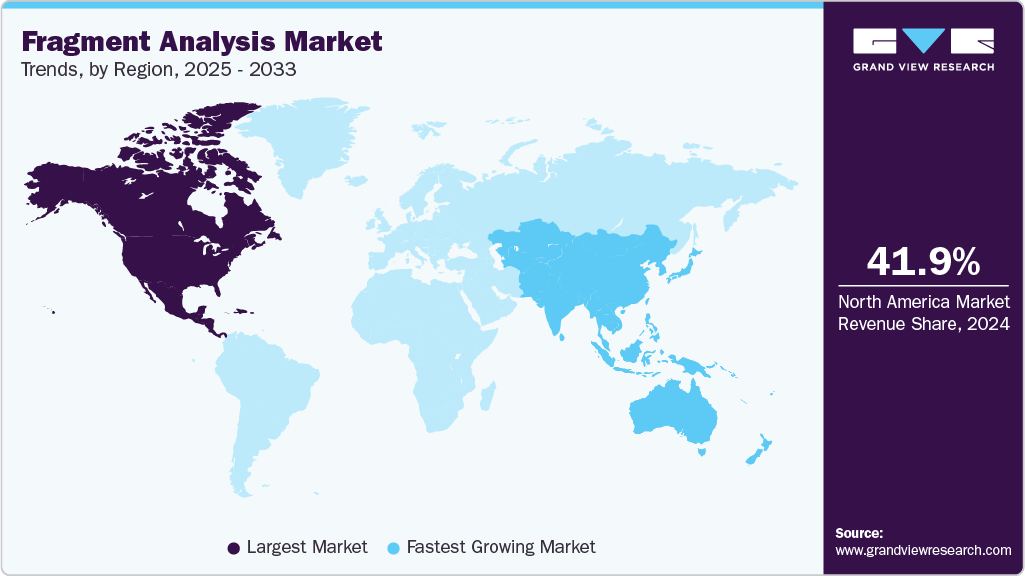

- The North America fragment analysis market held the largest global revenue share of 41.91% in 2024.

- The fragment analysis industry in the U.S. is expected to grow significantly from 2025 to 2033.

- By product & service, the instruments segment held the largest market share of 48.94% in 2024.

- By technology, the capillary electrophoresis segment held the largest market share in 2024.

- By application, the genotyping & polymorphism analysis segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 254.6 Million

- 2033 Projected Market Size: USD 584.2 Million

- CAGR (2025-2033): 9.75%

- North America: Largest Market in 2024

- Asia Pacific: Fastest Growing Market

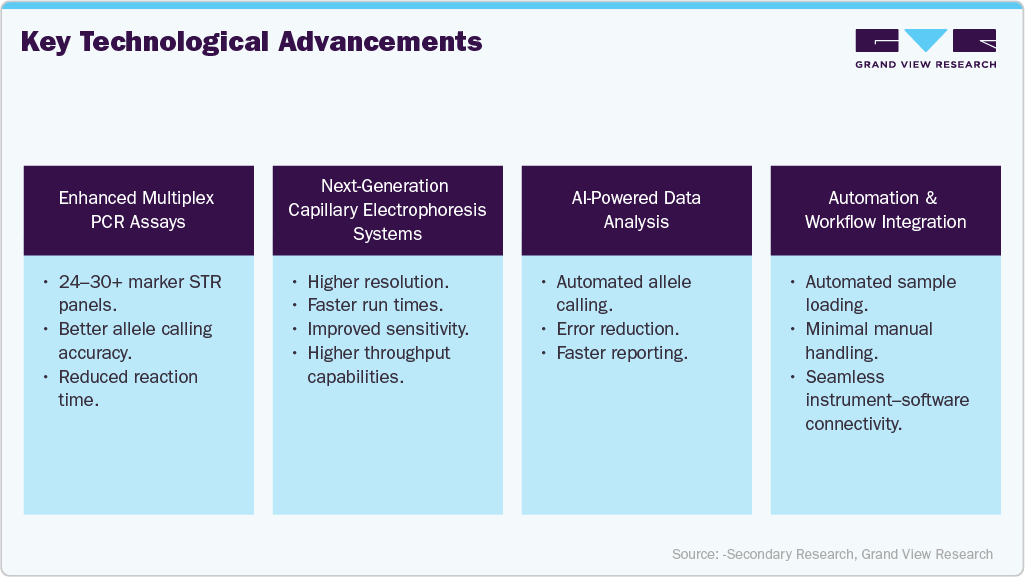

Key Technology Advancements

Advancements in Technology have emerged as a major demand driver for the fragment analysis market, primarily due to continuous improvements in capillary electrophoresis (CE) platforms and assay chemistry. Higher resolution, quicker run times, enhanced sensitivity, and the ability to analyze multiple fragments simultaneously via sophisticated multiplexing are all features of new-generation CE instruments. These improvements significantly enhance laboratory workflow efficiency, enabling the detection of microsatellites, STRs, SNPs, and other genetic markers with greater accuracy.

The accuracy and repeatability of fragment analysis have also been reinforced by advancements in fluorescent labeling chemistry, sample preparation kits, and precision detection technologies. Compared to alternative genomic techniques, such as NGS, these technological developments enable researchers and clinicians to obtain reliable results at a lower cost per sample. Clinical genetics, forensics, oncology, agriculture, and academic research are all experiencing an increase in adoption, which is fueling steady market growth.

Expanding IVF, Preimplantation, and Prenatal Testing

The rapid rise in IVF procedures and preimplantation genetic testing (PGT) is driving strong demand for fragment analysis technologies. Growing infertility rates, delayed pregnancies, and greater adoption of assisted reproductive technologies have increased the number of IVF cycles globally. Fragment analysis is essential for PGT-M, providing accurate and cost-effective STR-based linkage analysis to identify inherited mutations in embryos.

Prenatal diagnostic programs are expanding, further increasing demand for fragment analysis as it is widely used for aneuploidy detection, fetal genotyping, and maternal-fetal contamination testing. As regulatory bodies promote comprehensive prenatal screening and counseling, reliance on accurate fragment-based assays continues to grow, supporting sustained demand for related instruments and reagents.

Market Concentration & Characteristics

The fragment analysis industry exhibits a consistent level of innovation, propelled by developments in automated data analysis tools, multiplex PCR, and capillary electrophoresis systems. Workflows are streamlined by advancements in fluorescent dyes and sample prep kits, and newer platforms offer greater resolution, faster throughput, and enhanced sensitivity. Despite technology’s relative maturity, its adoption in clinical, forensic, and research settings is still supported by continuous improvements in accuracy, automation, and usability.

The level of M&A activity in the fragment analysis industry is moderate, driven mainly by larger life science and genomics companies acquiring smaller firms to expand their assay portfolios, strengthen CE-based workflows, and enhance forensic or clinical genetics capabilities. The market is characterized by consistent strategic acquisitions aimed at integrating complementary technologies, expanding reagent and software offerings, and enhancing global distribution networks. Still, it is not as heavily consolidated as high-growth industries like NGS or single-cell analysis. These focused agreements support end-to-end workflow solutions for research, clinical, and forensic applications and help established players stay competitive.

Regulations strongly influence the fragment analysis industry by enforcing strict standards for accuracy, validation, and compliance across both clinical and forensic applications. Guidelines from agencies such as the FDA, EMA, and CLIA drive demand for reliable, validated instruments and STR kits, particularly in genetic diagnostics and forensic applications. While regulatory requirements increase development costs, they enhance market trust, standardization, and overall quality of fragment analysis workflows.

The fragment analysis industry is largely driven by product expansion, as businesses continue to add cutting-edge CE instruments, high-multiplex STR kits, improved fluorescent dyes, and optimized sample preparation reagents to their portfolios. The use cases for fragment analysis have expanded in both the clinical and research domains with the introduction of application-specific panels for reproductive genetics, oncology, hereditary disease testing, and forensics. In addition to enhancing end users' performance and flexibility, the consistent rollout of new kits and workflow improvements also motivates labs to expand or upgrade their current systems, thereby supporting long-term market growth.

Manufacturers are expanding into high-potential regions by establishing new distributors, service networks, and localized support, which is driving the growth of the fragment analysis market. Asian, Latin American, and Middle Eastern emerging markets are investing heavily in molecular diagnostics and forensics, driving demand for CE instruments and assay kits. These efforts expand market access and facilitate the adoption of analysis technology worldwide.

Product & Service Insights

The reagents & consumables segment accounted for the largest market share of 48.94% in 2024 in the fragment analysis market, primarily due to the continuous need for high-volume supplies such as PCR primers, fluorescent dyes, buffers, enzymes, size standards, and electrophoresis consumables for every workflow. The adoption of high-throughput fragment analysis for STR typing, MSI assessment, microbial strain typing, and mutation screening further increases per-sample reagent usage, reinforcing the segment’s leadership.

The services segment is expected to grow at the fastest CAGR over the forecast period, as more genotyping, STR profiling, and DNA fragment sizing are outsourced to specialized labs to lower turnaround times, costs, and reliance on in-house expertise. Biopharma firms, forensics departments, and CROs that need high-throughput analytics, regulatory-grade reporting, and effective workflow management all contribute to the demand.

Technology Insights

The capillary electrophoresis segment led the fragment analysis industry, accounting for the largest share of 42.54% in 2024, because of its exceptional accuracy, repeatability, and sensitivity in sizing DNA fragments for STR genotyping, MSI detection, mutation analysis, and microbial typing. Standardized CE-based kits, strong regulatory acceptance, and seamless compatibility with downstream sequencing workflows further reinforce its dominant position over emerging alternatives.

DNA sequencing is the fastest-growing segment of the fragment analysis market, driven by the rising use of sequencing platforms to validate and enhance insights beyond traditional CE-based fragment sizing. NGS-enabled workflows are gaining traction in oncology mutation profiling, hereditary disease testing, microbial strain differentiation, and population genetics due to their higher resolution and variant detection depth. The increasing demand for multiplexed data output, scalable throughput, and cost-efficient sequencing protocols is driving the integration of these protocols with fragment analysis pipelines.

Application Insights

The genotyping & polymorphism analysis segment accounted for the largest fragment analysis industry share of 36.26% in 2024, due to the widespread use of fragment analysis to identify STRs, SNPs, VNTRs, and microsatellites in research, clinical, and forensic applications. Adoption has been further accelerated by the growing need for high-throughput genotyping to support large-scale disease association studies, biorepository screening, and personalized medicine. The segment's dominance is maintained by validated assays, workflows that are ready for automation, and compatibility with CE and sequencing platforms.

The molecular diagnostics segment is the fastest-growing in the fragment analysis market, driven by the increasing use of DNA fragment sizing and STR/MSI detection for early disease diagnosis, cancer profiling, infectious disease screening, and genetic testing. Adoption in routine diagnostics is increasing rapidly due to the rise in cancer and rare disease cases, the shift toward precision medicine, and the growing availability of regulatory-approved kits and automated CE/NGS workflows.

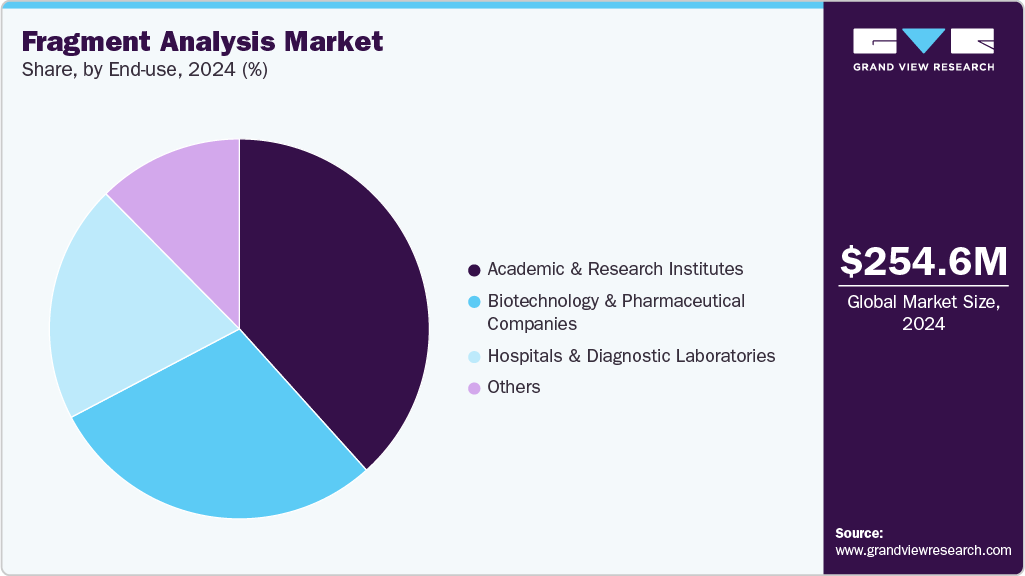

End Use Insights

The academic & research institutes segment led the market in 2024 with a revenue share of 38.34%. High precision, cost efficiency, and compatibility with high-throughput workflows make CE- and sequencing-based fragment analysis a preferred choice in universities and government labs. Growing funding for genomics and cancer research, along with collaborations between academia and biotech, continues to strengthen the segment’s dominance.

The hospitals & diagnostic laboratories segment is projected to grow at the fastest CAGR from 2025 to 2033, driven by increasing use of fragment analysis for cancer diagnostics, hereditary disease testing, infectious disease genotyping, and prenatal screening. The rising focus on precision medicine and early detection, along with the wider adoption of automated CE- and sequencing-based workflows and regulatory-approved kits, is accelerating the routine clinical use. Improving reimbursement and expanding molecular diagnostics in developing regions will further support rapid growth.

Regional Insights

North America dominated the fragment analysis market in 2024, accounting for the largest revenue share of 41.91%, primarily due to the strong adoption of this technology across clinical genetics, forensics, and academic research. The region boasts advanced healthcare systems, high awareness of genetic testing, and substantial investments in precision medicine. Early adoption of CE systems and advanced STR/microsatellite analysis workflows accelerated market penetration. Collaboration between biotech, forensic, and genomic research institutes drives market innovation and technology upgrades.

U.S Fragment Analysis Market Trends

The U.S. fragment analysis industry has experienced steady growth, driven by rising demand for genetic diagnostics, forensics, and reproductive genetics applications. The increased use of STR profiling in criminal investigations, combined with the expansion of newborn screening and hereditary disease testing programs, is fueling its adoption.

Europe Fragment Analysis Market Trends

The Europe fragment analysis industry is set for steady growth driven by strong regulatory frameworks, robust forensic networks, and rising EU funding for genomics. National forensic programs, biobanking efforts, and clinical genetics centers further support adoption.

The UK fragment analysis market is set to grow due to the implementation of robust genetic testing programs and major initiatives, such as Genomics England and UK Biobank. Government support for molecular diagnostics and forensic modernization is boosting demand in the country's market.

The fragment analysis market in Germany benefits from government programs promoting biotechnology and advanced molecular testing, which are driving adoption. For cancer genetics, reproductive testing, and forensic science, laboratories are upgrading CE systems and using high-multiplex PCR kits.

Asia Pacific Fragment Analysis Market Trends

The Asia Pacific fragment analysis industry is expected to witness the fastest CAGR of 11.15% from 2025 to 2033, driven by rising demand for genetic diagnostics, expanding forensics infrastructure, and increasing investments in genomics research. Growing awareness of hereditary disorders, the high prevalence of genetic diseases, and the rapid expansion of IVF and prenatal testing centers are further enabling market growth.

The China fragment analysis market is becoming a major market, driven by heavy investments in genomics, forensics, and precision medicine, under initiatives such as “Healthy China 2030.” The country is rapidly expanding STR profiling, prenatal testing, and oncology genotyping, which supports market growth.

The fragment analysis market in Japan is expected to experience strong growth, driven by advanced healthcare infrastructure, high adoption of precision medicine, and increasing application of fragment analysis in reproductive genetics. Aging population dynamics and rising cancer incidence are driving demand for accurate fragment analysis.

MEA Fragment Analysis Market Trends

The fragment analysis industry in the Middle East & Africa is projected to grow steadily, driven by rising demand for genetic diagnostics, modernization in forensic science, and the strengthening of biotechnology capabilities. The increasing incidence of hereditary diseases and government-led healthcare modernization programs are boosting adoption.

The Kuwait fragment analysis market is still in the early stages of adopting advanced genomic technologies, but it shows strong potential due to growing investment in healthcare modernization and research.

Key Fragment Analysis Company Insights

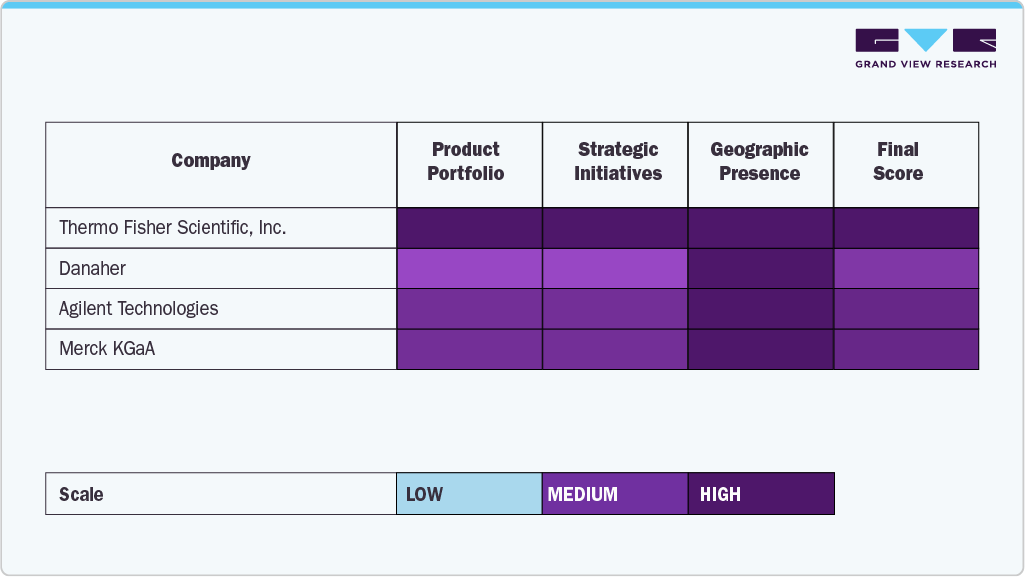

The fragment analysis market is dominated by several established players leveraging robust product portfolios, strategic collaborations, and ongoing investments in research and development. Companies such as Thermo Fisher Scientific, Danaher, and Agilent Technologies maintain significant market share through advanced capillary electrophoresis systems, Sanger sequencing platforms, and comprehensive fragment analysis solutions.

Emerging and specialized firms, including NimaGen, Genetika Science, Promega Corporation, LGC, Eurofins Genomics, MCLAB, and SoftGenetics, are expanding their footprint by providing innovative reagents, software tools, and customized services for genotyping, STR analysis, and next-generation sequencing-assisted fragment workflows. Companies that successfully combine scientific innovation with customer-focused solutions are well-positioned to drive sustained value and maintain leadership in this rapidly evolving market.

Key Fragment Analysis Companies:

The following are the leading companies in the fragment analysis market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific, Inc.

- Danaher

- Agilent Technologies

- NimaGen

- Genetika Science

- Promega Corporation

- LGC

- Eurofins Genomics

- MCLAB

- SoftGenetics

Recent Developments

-

In December 2024, in the UK, LGC acquired DiaMex to strengthen its diagnostics and genomics portfolio, expanding access to Optitrol quality controls and enhancing product choice for global core laboratory customers.

-

In September 2024, in the USA, Promega Corporation developed a novel reduced-stutter polymerase for forensic DNA analysis, enhancing accuracy in STR fragment analysis and enabling integration into upcoming 8-color STR kits.

-

In September 2023, NimaGen partnered with NicheVision to provide forensic laboratories with a combined wet-to-dry DNA sequencing and fragment-analysis workflow, enhancing complex mixture interpretation.

-

In March 2022, in India, Thermo Fisher Scientific launched the SeqStudio Flex Series Genetic Analyzer, enhancing Sanger sequencing and fragment-analysis capabilities with improved throughput, workflow efficiency, and remote connectivity for genomic research.

Fragment Analysis Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 277.6 million

Revenue forecast in 2033

USD 584.2 million

Growth rate

CAGR of 9.75% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product & service, technology, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Thermo Fisher Scientific, Inc.; Danaher; Agilent Technologies; NimaGen; Genetika Science; Promega Corporation; LGC; Eurofins Genomics; MCLAB; SoftGenetics

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Fragment Analysis Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global fragment analysis market report based on product & service, technology, application, end use, and region:

-

Product & Service Scope Outlook (Revenue, USD Million, 2021 - 2033)

-

Instruments

-

Reagents & Consumables

-

PCR master mixes

-

Fluorescent dyes and labels

-

DNA size standards & ladders

-

Capillary arrays

-

Others

-

-

Services

-

-

Technology Scope Outlook (Revenue, USD Million, 2021 - 2033)

-

Capillary Electrophoresis

-

Polymerase Chain Reaction

-

DNA Sequencing

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Genotyping & Polymorphism Analysis

-

SNP and Indel Genotyping

-

Microsatellite / STR / VNTR Analysis

-

Others

-

-

Molecular Diagnostics

-

Forensic & Paternity Testing

-

Agricultural & Animal Genomics

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Academic & Research Institutes

-

Hospitals & Diagnostic Laboratories

-

Biotechnology & Pharmaceutical Companies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global fragment analysis market size was estimated at USD 254.6 million in 2024 and is expected to reach USD 277.6 million in 2025.

b. The global fragment analysis market is expected to grow at a compound annual growth rate of 9.75% from 2025 to 2033 to reach USD 584.2 million by 2033.

b. North America dominated the fragment analysis market with a share of 41.91% in 2024. This is attributable to the well-developed healthcare infrastructure and the increasing number of research and development initiatives in the region.

b. Some key players operating in the fragment analysis market include Thermo Fisher Scientific, Inc.; Danaher’; Agilent Technologies; NimaGen; Genetika Science; Promega Corporation; LGC; Eurofins Genomics; MCLAB; SoftGenetics

b. The market growth is primarily driven by factors such as increasing adoption of advanced analytical techniques, rising demand for high-precision molecular and protein analysis, expansion of research and development activities in the pharmaceutical and biotechnology sectors, and growing applications in genomics, proteomics, and diagnostics.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.