France Kombucha Market Summary

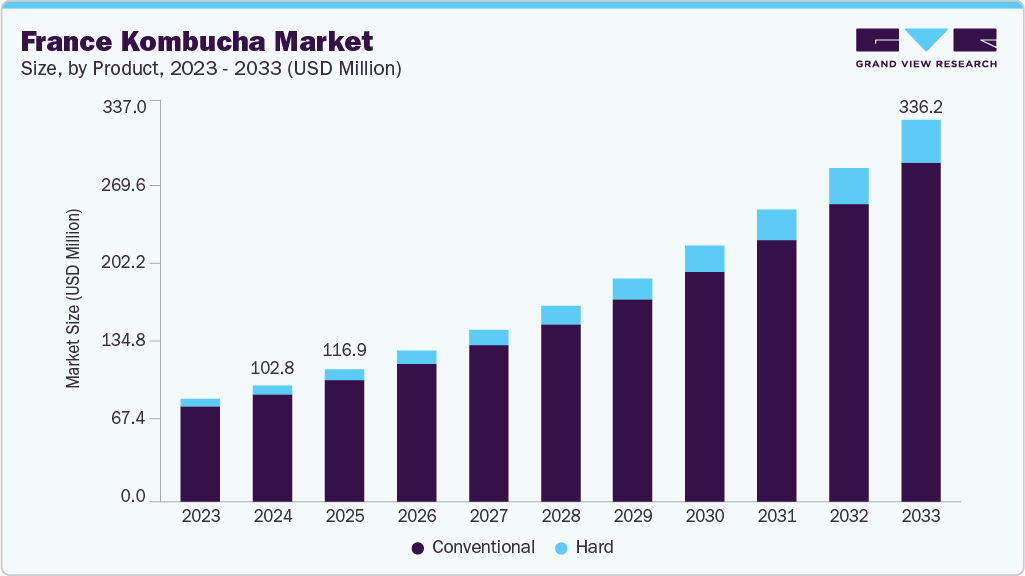

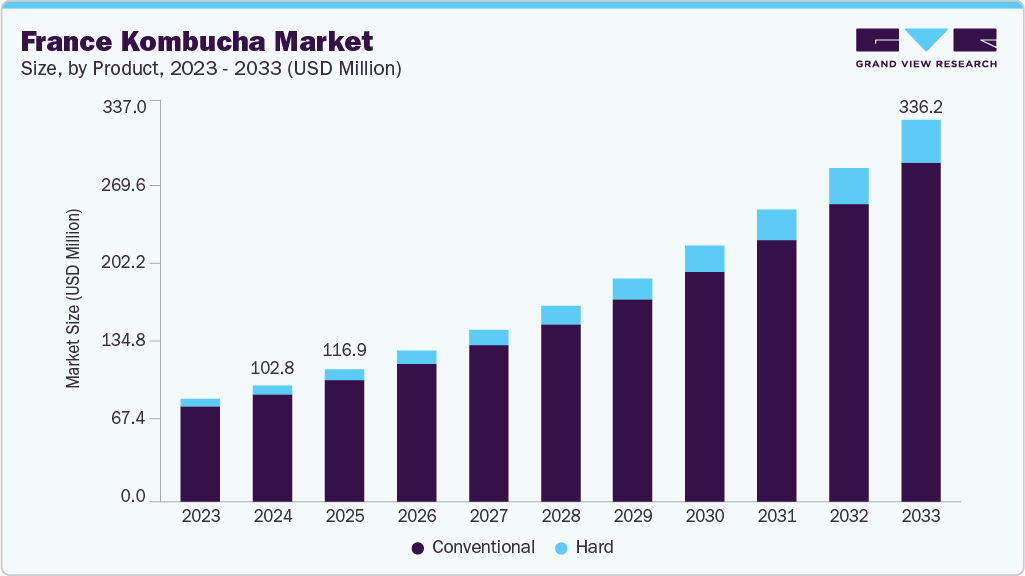

The France kombucha market size was estimated at USD 102.8 million in 2024 and is projected to reach USD 336.2 million by 2033, growing at a CAGR of 14.1% from 2025 to 2033. This market thrives as more consumers seek natural, probiotic-rich beverages supporting gut health and overall wellness.

Key Market Trends & Insights

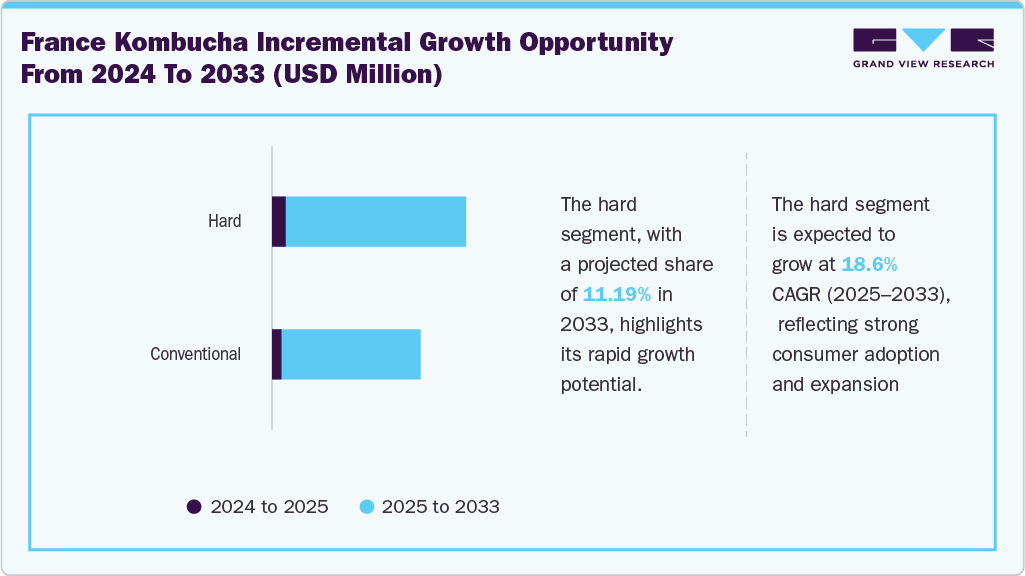

- By product, the conventional segment held the highest market share of 92.2% in 2024.

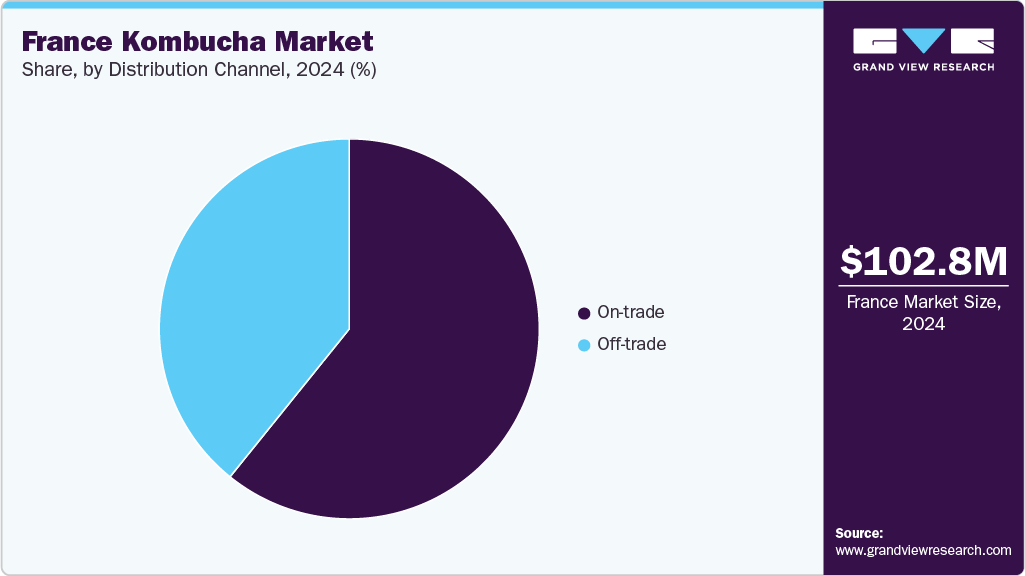

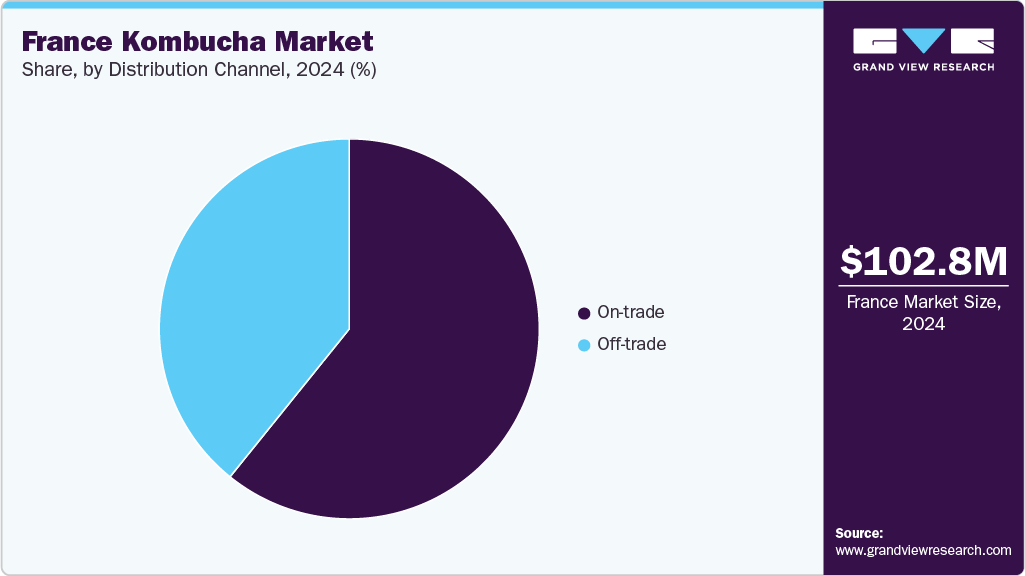

- By distribution channel, the on-trade segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 102.8 Million

- 2033 Projected Market Size: USD 336.2 Million

- CAGR (2025-2033): 14.1%

The shift in consumer preferences aligns with the broader national trend toward healthier, low-sugar alternatives to soda and alcohol. In urban areas like Paris, kombucha is increasingly seen as a sophisticated midday drink, replacing wine at lunch by health-conscious professionals. French consumers favoring beverages made with organic, raw, and locally sourced ingredients are increasingly attracted to kombucha due to its clean-label appeal. In response, brands are crafting innovative blends that incorporate fruits, herbs, and spices, resulting in bold, gourmet flavor profiles. These creative offerings resonate particularly well with millennials and Gen Zs, who prioritize sustainability, ingredient transparency, and diverse taste experiences alongside functional health benefits.

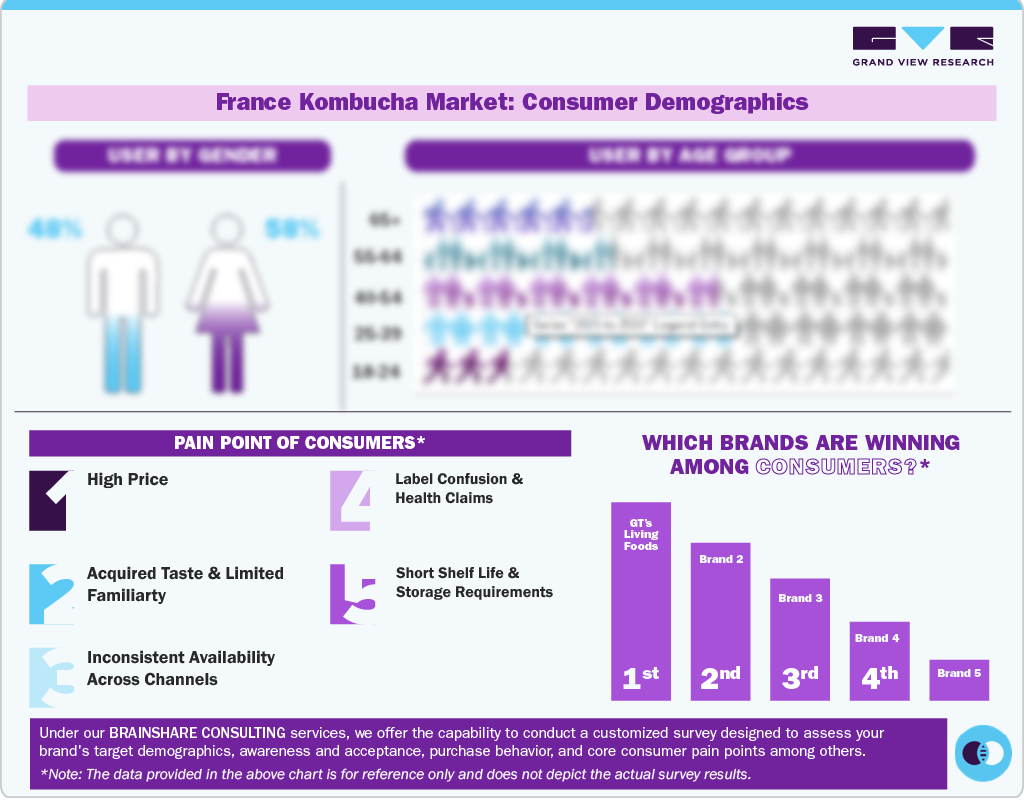

Consumer Insights

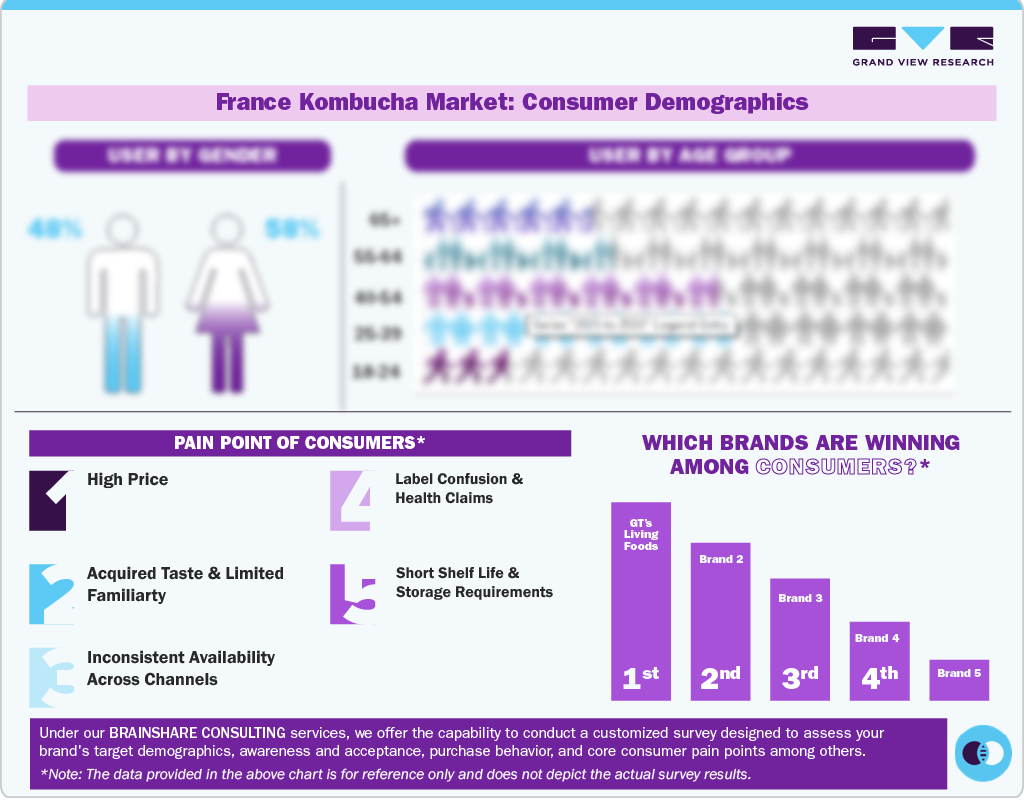

In France, kombucha is gaining popularity among urban, health-conscious consumers, particularly millennials and adults aged 30 to 50. These individuals are typically educated, affluent, and focused on wellness, gut health, and clean eating. Kombucha’s natural, probiotic-rich profile and its role as a low-sugar, non-alcoholic alternative to sodas or wine enhance its popularity. With more people embracing sober-curious and flexi-drinking lifestyles, kombucha fits perfectly into social settings.

Flavor preferences lean toward fruity and floral blends like raspberry, lemon-ginger, and hibiscus, with around 37% of purchases reflecting this trend. Consumers are also drawn to clean-label ingredients, organic sourcing, and elegant packaging, especially when kombucha is served in upscale cafés or restaurants. While supermarkets and organic stores remain key sales channels, online and direct-to-consumer platforms are preferred, particularly by younger buyers looking for convenience and variety.

Product Insights

On the basis of product, the conventional segment dominated the market with a revenue share of 92.2% in 2024. The conventional segment has a dominant share as more consumers seek healthier alternatives to sugary soft drinks. Easy availability in mainstream supermarkets like Carrefour and Monoprix has made it convenient for everyday shoppers to try it out. Pasteurized and often more affordable, conventional kombucha appeals to a wider audience with its milder taste and familiar flavors like lemon, ginger, or berries. It is also considered a convenient, functional beverage that fits into daily routines without being too niche or experimental. As major beverage brands step into the market with competitive pricing, kombucha is rapidly transitioning from a niche health-store item to a widely accepted household staple across France.

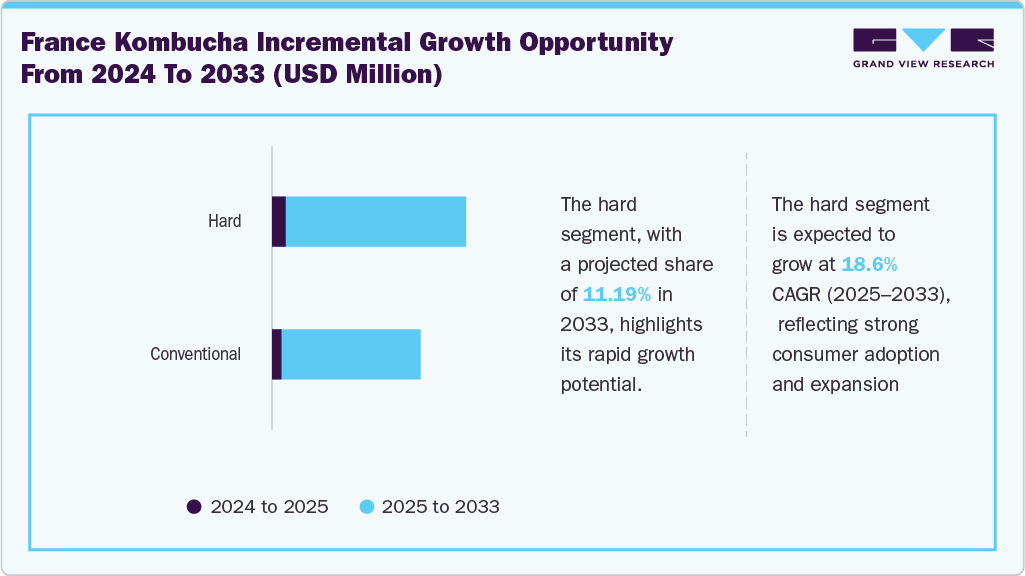

The hard segment is expected to register the highest CAGR during the forecast period. Hard kombucha is gaining popularity in France as consumers look for light, healthier alternatives to traditional alcoholic drinks. With its blend of probiotics, natural ingredients, and moderate alcohol content, it is especially appealing to millennials and Gen-Zs who value wellness but still enjoy social drinking. The rise of flexi-drinking and sober-curious trends has also opened doors for beverages that balance health and indulgence. Though still niche, hard kombucha is available in urban bars, organic stores, and festivals. The increasing presence is signaling growing curiosity and potential for this category to expand in the coming years.

Distribution Channel Insights

The on-trade segment dominated the market with a revenue share of 59.7% in 2024. The on-trade kombucha segment, which includes sales through cafés, restaurants, bars, and hotels, is witnessing notable growth, driven by rising demand for sophisticated non-alcoholic options in social settings. As more French consumers reduce alcohol intake or explore “sober-curious” lifestyles, venues are expanding their menus to include kombucha as a trendy and functional alternative. Its light fizz, complex flavors, and gut-health appeal make it an ideal lunch or dinner substitute for wine or cocktails. L’Oiseau blanc, a high-end restaurant atop Paris's Peninsula Hotel, has started serving specialized kombucha varieties. One notable version featured kombucha infused with clementine leaf presented in wine glassware.

The off-trade distribution segment is expected to grow over the forecast period. The off-trade kombucha segment, comprising retail channels like supermarkets, organic stores, convenience shops, and e-commerce, is witnessing strong momentum, driven by rising consumer interest in functional beverages and healthier lifestyle choices. As kombucha moves into the mainstream, its presence on the shelves of major retailers such as Carrefour, Monoprix, and Biocoop has significantly boosted accessibility and visibility.

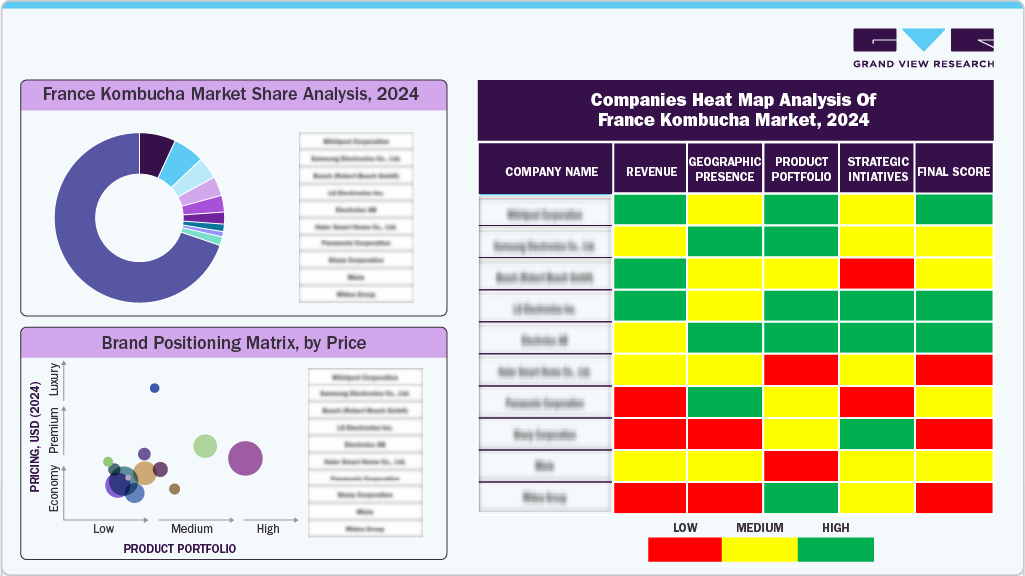

Key France Kombucha Company Insights

Some of the key players in the France kombucha market include Biogroupe SAS Production, SO KOMBUCHA, and BB Kombucha.

Key France Kombucha Companies:

- Biogroupe SAS Production

- SO KOMBUCHA

- BB Kombucha

France Kombucha Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 116.9 million

|

|

Revenue forecast in 2033

|

USD 336.2 million

|

|

Growth rate

|

CAGR of 14.1% from 2025 to 2033

|

|

Actuals

|

2021 - 2024

|

|

Forecast period

|

2025 - 2033

|

|

Quantitative units

|

Revenue in USD million and CAGR from 2025 to 2033

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, trends

|

|

Segments covered

|

Product, distribution channel

|

|

Key companies profiled

|

Biogroupe SAS Production, SO KOMBUCHA, BB Kombucha

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

France Kombucha Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the France kombucha market report based on product, and distribution channel:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)