- Home

- »

- Homecare & Decor

- »

-

Furniture Rental Market Size, Share & Growth Report, 2030GVR Report cover

![Furniture Rental Market Size, Share & Trends Report]()

Furniture Rental Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Wardrobes & Dressers, Beds), By Material (Wood, Plastic), By Application (Residential, Commercial), By Region (Europe, Asia Pacific), And Segment Forecasts

- Report ID: GVR-4-68040-046-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Furniture Rental Market Summary

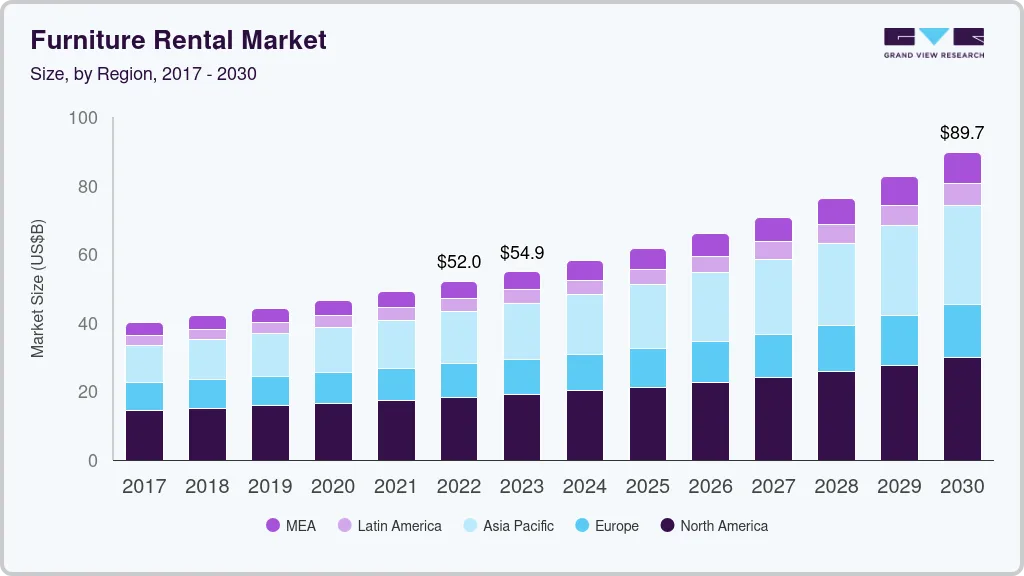

The global furniture rental market size was estimated at USD 52.05 billion in 2022 and is projected to reach USD 89.68 billion by 2030, growing at a CAGR of 7.0% from 2023 to 2030. The upsurge in the rental economy is attributed to culture and ideology.

Key Market Trends & Insights

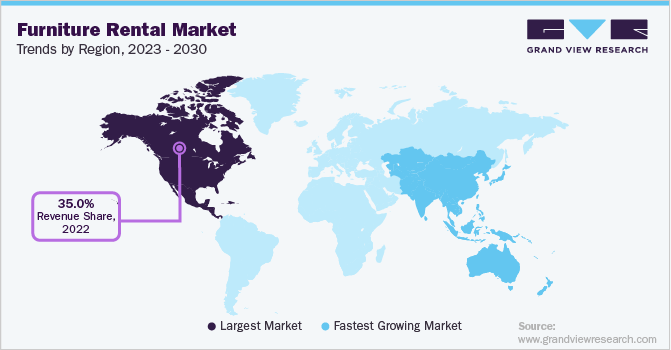

- The North American region dominated the global industry in 2022 and accounted for the maximum share of more than 35.00% of the overall revenue.

- By product, the bed product segment dominated the global industry in 2022 and accounted for the highest share of more than 31.25% of the total revenue.

- By material, the wood material segment dominated the global industry in 2022 and accounted for the maximum share of more than 38.65% of the overall revenue.

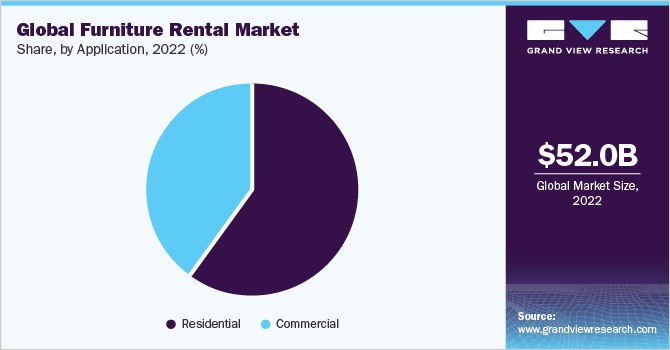

- By application, the commercial application segment dominated the industry in 2022 and accounted for the maximum share of more than 60.45% of the overall revenue.

Market Size & Forecast

- 2022 Market Size: USD 52.05 Billion

- 2030 Projected Market Size: USD 89.68 Billion

- CAGR (2023-2030): 7.0%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

According to the online rental industry report 2019-2023, economic factors are responsible for the rental industry’s expansion, as customers prefer the variety, value, and affordability offered by rental service providers. During the COVID-19 pandemic, over 60% of the world’s population was required to work from home, which led to people making house remodeling and renovation a key priority, likely driving the demand for furniture rental products.

Moreover, there was an increase in demand for rental furniture, such as office tables and chairs, from working professionals due to work-from-home orders, according to key providers. Due to hybrid work schedules, it is anticipated to continue as a long-term purchasing behavior. Moreover, according to Fabrento, an Indian furniture rental company, businesses as well as independent individuals are renting ergonomically designed products to increase the efficiency of working from home, particularly in urban areas. In addition, the furniture rental concept is majorly preferred among consumers owing to its monthly and yearly payment options. Key players, such as Furlenco, Rentomojo, and Feather, introduced a new category owing to the rising demand for work-from-home furniture.

There is the easy availability of a wide range of tables and chairs, which has led to a boom in furniture rentals demand. In addition, the growing trend of rental furniture has provided a solution for one of the major concerns among millennials about lowering carbon footprints. As individuals do not utilize several products, sharing those products is considered sustainable and advantageous for the environment as well as cost-effective, likely favoring the growth of the market. Furthermore, event managers, hotels, and various commercial places organize multiple events, including birthday parties, wedding anniversaries, wedding ceremonies, corporate gatherings, and much more. According to their themes, these events demand various ambiances and furnishings, as they are unique from one another, propelling the market growth.

Thus, rental furniture is considered a good option for furnishing an event space. Saving money and readily customizing the rental furnishings to match the particular environment, theme, & event type are a few factors that drive the growth of the market. Key players are expanding their business by increasing their physical presence through mergers and acquisitions. For instance, in March 2022, David Phillips, a London-based property furnishing company, announced its merger with Monty Space. It is a subscription-based rental furniture service provider specifically for residential spaces. The merger’s main goal is to expand the furniture offerings into the trending build-to-rent market.

Product Insights

The bed product segment dominated the global industry in 2022 and accounted for the highest share of more than 31.25% of the total revenue. A substantial shift in the trend can be attributed to how millennials view or live their life, increasing the demand for furniture rentals including beds. Since they prefer to live in the now, rather than being tied down to a specific place or activity, millennials are more pragmatic. As a result of their constant exploration, movement, and search for new opportunities, they avoid investing in things like furniture.

This has caused an increased demand for comfortable, high-quality, and cost-effective beds, thereby supporting the industry’s growth. On the other hand, the wardrobes & dressers segment is projected to register the fastest growth rate from 2023 to 2030. A variety of sizes, designs, and finishes are available for wardrobes, which can improve the appearance and ambiance of the space. Customers prefer dressers with mirrors or door-mounted mirrors that enhance the room’s overall look. These dressers can also be used as a television cabinet, a centerpiece, or a nightstand.

Material Insights

The wood material segment dominated the global industry in 2022 and accounted for the maximum share of more than 38.65% of the overall revenue. Wood adds natural charm to furniture while still being easy to handle and provides a solid foundation for tables, desks, benches, chairs, beds, and other furnishings. However, many softwoods, such as pressure-treated oak, cedar, and fir, are affordable and commonly used for indoor furnishings. Hardwoods, on the other hand, are much tougher, withstand all weather, and can last for decades if properly cared for, and are often used in rental furniture for long-term use with less maintenance.

The plastic material segment is estimated to register the fastest growth rate over the forecast period. Furniture made of plastic is typically more lightweight than furniture made of metal or wood. This makes transportation to and from various areas relatively simple. Moving plastic furniture and setting up the space does not require a lot of assistance. As rental companies tend to move furniture frequently based on the requirements, the furniture must be durable and easy to move without any damage. All these factors will drive the plastic material segment over the forecast period.

Application Insights

On the basis of applications, the global industry has been further bifurcated into commercial and residential. The commercial application segment dominated the industry in 2022 and accounted for the maximum share of more than 60.45% of the overall revenue. Several events are organized all over the globe on a daily basis. It is convenient and simple to add elegance and luxury to any event by renting furniture. Since the furniture rental companies take care of all the requirements for the furniture, it saves expense, time, and energy for event organizers. In addition, renting furniture allows people to decorate an area for an event without having to spend money on items that will only be used once.

On the other hand, the residential application segment is estimated to register the fastest growth rate over the forecast period. With the ongoing trend of work-from-home and classes being conducted online, it has become important to set up a comfortable space to facilitate flexibility and comfortability during tuition or work hours. This has been challenging, especially for those who live in comparatively smaller homes. This allows furniture rental service providers to expand their product offerings to the residential sector.

Regional Insights

The North American region dominated the global industry in 2022 and accounted for the maximum share of more than 35.00% of the overall revenue. The regional market's growth is driven by the presence of key service providers, increasing consumer preference for rental furniture owing to the flexibility, and the concept of a shared economy. Recent years have seen a huge increase in the popularity of rental furniture, particularly among younger generations that value convenience, independence, and flexibility. However, even well-known companies like Ikea can lease furniture and switch to a circular economic model.

Asia Pacific is expected to witness the fastest CAGR from 2023 to 2030. The regional market of Asia Pacific is developing rapidly and offers tremendous potential for expansion. The Gen-Z and millennial demographics are responsible for driving the demand for rental furniture in the region since it gives them a hassle-free way to often move, change places, and change careers, in addition to giving them access to fashionable designs. This depicts that consumers view furniture rentals and subscriptions as a more sustainable choice to keep flexibility and engage in responsible consumption.

Key Companies & Market Share Insights

The global industry is highly competitive with a range of companies offering various products for renting. Many big players are increasing their focus on new product launches, partnerships, and expansion into new markets to gain higher industry share. For instance,

-

In July 2021, Furlenco, an online furniture rental company, introduced “UNLMTD”, a yearly subscription service that provides clients with the furniture and appliances they want all at once and at a single price

-

In February 2021, Rent-A-Center, Inc. acquired Acima Holdings. This acquisition allowed customers to take advantage of the company’s flexible Lease-To-Own (LTO) solutions through e-commerce, digital, and mobile channels due to the combined business

Some of the key players operating in the global furniture rental market include:

-

Furlenco

-

Feather

-

Rentomojo

-

Brook Furniture Rental

-

Rent-A-Center

-

Luxe Modern Rentals

-

The Everest

-

Fernished Inc.

-

Athoor

-

Fashion Furniture Rental

Furniture Rental Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 54.91 billion

Revenue forecast in 2030

USD 89.68 billion

Growth rate

CAGR of 7.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; China; India; Japan; Brazil; South Africa

Key companies profiled

Furlenco; Feather; Rentomojo; Brook Furniture Rental; Rent-A-Center; Luxe Modern Rentals; The Everest; Fernished Inc.; Athoor; Fashion Furniture Rental

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

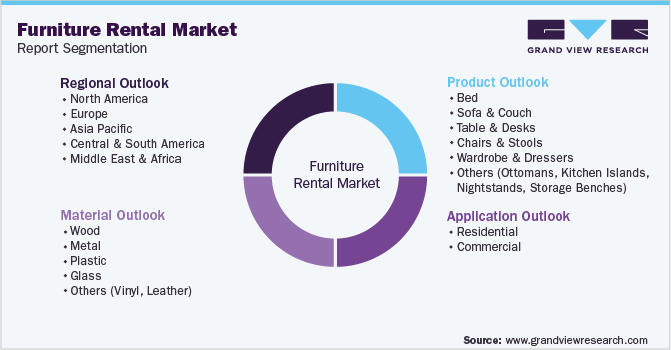

Global Furniture Rental Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global furniture rental market report on the basis of product, material, application, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Bed

-

Sofa & Couch

-

Table & Desks

-

Chairs & Stools

-

Wardrobe & Dressers

-

Others (Ottomans, Kitchen Islands, Nightstands, Storage Benches)

-

-

Material Outlook (Revenue, USD Million, 2017 - 2030)

-

Wood

-

Metal

-

Plastic

-

Glass

-

Others (Vinyl, Leather)

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Residential

-

Commercial

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America (CSA)

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global furniture rental market was estimated at USD 52.05 billion in 2022 and is expected to reach USD 54.91 billion in 2023.

b. The global furniture rental market is expected to grow at a compound annual growth rate of 7.0% from 2022 to 2030 to reach USD 89.68 million by 2030.

b. North America dominated the furniture rental market with a share of around 35.3% in 2022. The growth of the regional market is driven on account of the presence of key service providers.

b. Some of the key players operating in the furniture rental market include Furlenco; Feather; Rentomojo; Brook Furniture Rental; Rent-A-Center; Luxe Modern Rentals; The Everest; Fernished Inc.; Athoor; Fashion Furniture Rental

b. Key factors that are driving the furniture rental market growth include the increasing consumer spending on home remodeling and growing consumer preference for aesthetic and utility-based furniture.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.