- Home

- »

- Clinical Diagnostics

- »

-

Prostate Cancer Diagnostics Market Size, Share Report 2030GVR Report cover

![Prostate Cancer Diagnostics Market Size, Share & Trends Report]()

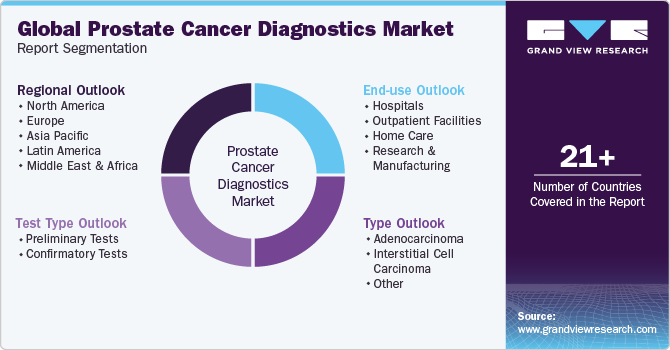

Prostate Cancer Diagnostics Market (2024 - 2030) Size, Share & Trends Analysis Report By Test Type (Preliminary Tests, Confirmatory Tests), By Type (Adenocarcinoma, Interstitial Cell Carcinoma, Other), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-548-9

- Number of Report Pages: 152

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Prostate Cancer Diagnostics Market Summary

The global prostate cancer diagnostics market size was estimated at USD 7.72 billion in 2023 and is projected to reach USD 11.90 billion by 2030, growing at a CAGR of 6.4% from 2024 to 2030. Increasing prevalence of prostate cancer is a major factor contributing to the market growth. According to the American Society of Clinical Oncology (ASCO) article published in March 2023, among men, prostate cancer is the most common cancer.

Key Market Trends & Insights

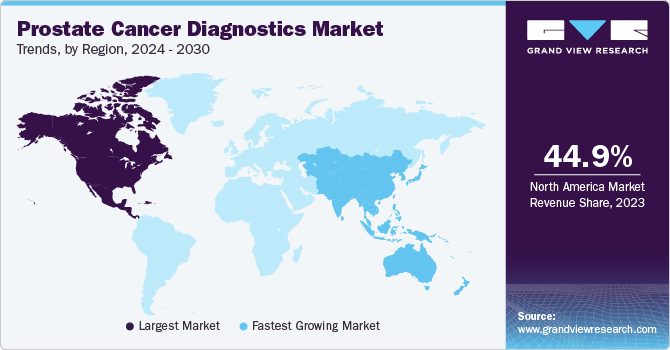

- North America dominated the market and accounted for 44.9% share in 2023.

- Asia Pacific is anticipated to witness the fastest growth in the market.

- Based on end use, outpatient Facilities segment accounted for the largest revenue share in 2023.

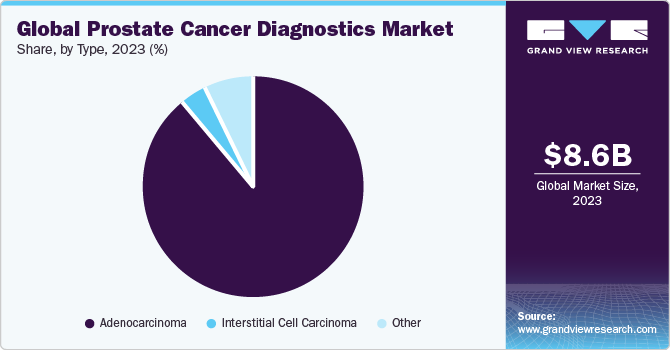

- In terms of type, adenocarcinoma segment accounted for the largest revenue share in 2023.

- Based on test type, confirmatory Tests segment led the market and accounted for the largest revenue share of 66.4% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 7.72 Billion

- 2030 Projected Market Size: USD 11.90 Billion

- CAGR (2024-2030): 6.4%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

About 288,300 men are estimated to be diagnosed with prostate cancer in 2023. Moreover, there were an estimated 1.41 million people diagnosed with prostate cancer in 2020 globally and it is the fourth most diagnosed cancer. Increasing global geriatric population and technological advancements in the field of cancer diagnostics are some of the major factors expected to drive market growth over the forecast period.

Increasing global geriatric population is expected to propel the demand for prostate cancer diagnostics, as male population over the age of 60 is comparatively more prone to develop prostate cancer. As per American Society of Clinical Oncology article published in May 2023, Prostate cancer predominantly affects older men. The median age of diagnosis is 66 years, and 60% of patients are diagnosed in men older than 65 years, with 20% being diagnosed in men older than 75 years. According to the article published by WHO in October 2023, people over 60, expected to reach 2.1 billion by 2050. As the global population ages, the number of prostate cancer cases are likely to increase thus boosting the demand for prostate cancer diagnostics.

Technological advancements in the field of cancer diagnostics is boosting the demand for the prostate cancer diagnostics industry. According to the MJH Life Sciences article published in September 2023, Oxford Biodynamics, which developed the test, has disclosed that clinical validation of EpiSwitchPSE Prostate Screening Blood Test was performed and is now available to men in the U.S. for prostate cancer screening. The blood-based test was justified as a laboratory-developed test in a consolidated high-complexity clinical laboratory improvement amendments-certified laboratory in Frederick, Maryland.

Partnerships and collaborations by the major players for development to divide expenses are increasing the demand for the market. According to the Verdict Media Limited article published in October 2023, Philips and Quilbim have joined forces to provide imaging and reporting solutions for MR prostate assessments based on artificial intelligence. The partnership allows companies to leverage each other’s technology and software to detect disorders like cancer early and improve the accurate first-time diagnosis rate. They hope to achieve this simplified diagnosis using Philips HighSpeed MR Imaging and Quibim QPProState software.

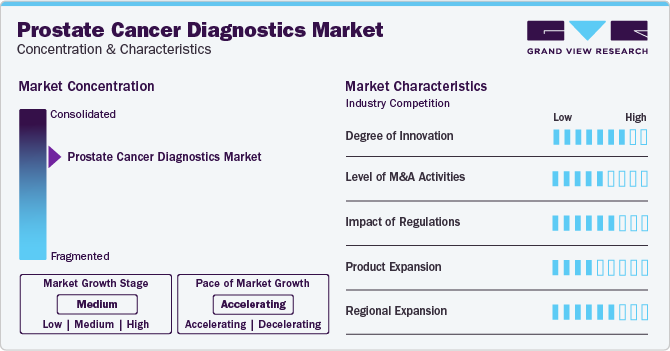

Market Concentration & Characteristics

The global prostate cancer diagnostics market has experienced a significant degree of innovation, prostate cancer research has advanced with innovations like precise imaging (multiparametric MRI), targeted therapies, and non-invasive diagnostics (liquid biopsies). These developments aim to improve accuracy in diagnosis, tailor treatments, and enhance overall outcomes for patients.

Several market players, such as MDx Health, Myriad Genetics, Inc., Abbott Laboratories, and F. Hoffman-La Roche AG, are involved in merger and acquisition activities. Through M&A activity, these companies expand their geographic reach and enter new territories.

Companies are actively investing substantial resources in clinical trials and regulatory submissions to obtain regulatory approval for pipeline Test Types. This results in increasing the cost of developing novel prostate cancer diagnostics technologies.

The market's product expansion involves introducing advanced technologies such as liquid biopsy platforms for more accurate and less invasive testing. Incorporating artificial intelligence algorithms into existing diagnostic tools enhances sensitivity and specificity, leading to improved early detection. Additionally, diversifying diagnostic options to include home-based testing kits could empower individuals to proactively monitor their health, contributing to a more comprehensive approach in the fight against prostate cancer.

Test Type Insights

Confirmatory Tests segment led the market and accounted for the largest revenue share of 66.4% in 2023. Rising incidence of the spreading of prostate cancer in the other organs (genital and urinary tract infections) in the U.S. According to the American Cancer Society article published in May 2023, if PSA and digital rectal exam (DRE) test results of post-preliminary testing are abnormal, then patients are required to undergo various confirmatory tests for diagnosis of prostate cancer. In cases where the cancer has spread to other organs, imaging tests are performed to assess the risk of metastasis. With the rising prevalence of prostate cancer, there has been an increase in the use of various confirmatory tests, which in turn is likely to boost market growth.

Preliminary Tests is anticipated to witness significant market growth over the forecast period, owing to the rise in prevalence of prostate cancer. According to the American Cancer Society article published in November 2023, the simple availability of PSA screening has facilitated early diagnosis and treatment, raising survival rates. PSA tests detect unrecognized and small tumors that may or may not develop into an advanced stage of cancer. As these tests facilitate detection before major symptoms appear, they are recommended to most men over the age of 50 and those at risk of developing the disease. These factors are boosting the market.

Type Insights

Adenocarcinoma segment accounted for the largest revenue share in 2023. Adenocarcinoma of prostate patients presents with difficulty urination, weak stream, occasionally hematuria, incomplete emptying of the bladder, and chronic back pain. On exam enlarged prostate, abnormal DRE exam, although this has low specificity and sensitivity. For instance, as per an NCBI article published in June 2023, Adenocarcinoma of the Prostate is the second most common cancer in men worldwide. It is the third leading cause of death in the U.S. Prostate cancer mortality is on a decline, especially in the U.S., which is attributed to increased screening as well as adjuvant therapies. Similarly, as per a WebMD LLC article published in May 2023, More than 95% of prostate cancers are adenocarcinomas. There are several other forms of prostate cancer that are extremely rare.

Interstitial Cell Carcinoma segment is estimated to register a significant CAGR over the forecast period. Unlike the more prevalent adenocarcinoma, ICC arises from interstitial cells and poses challenges in terms of diagnosis and management. According to the NCBI article published in August 2023, Advanced imaging techniques, such as multiparametric MRI, play an important role in accurately detecting and characterizing ICC lesions within the prostate. Treatment strategies for interstitial cell carcinoma often require a personalized approach. Targeted therapies that address specific molecular markers associated with ICC can be explored to enhance efficacy while minimizing adverse effects. As the understanding of the molecular underpinnings of ICC advances, the development of novel therapeutic interventions becomes increasingly feasible.

End Use Insights

Outpatient Facilities segment accounted for the largest revenue share in 2023. Outpatients hold a distinct advantage over other healthcare options, primarily driven by the significant reduction in hospital-related expenses, including admission costs and other hospitality-related charges. The prominent share of the outpatient segment is attributed to its cost-effectiveness, enhanced service availability, and the convenience it offers to patients. The emphasis on low costs and increased accessibility contributes to the dominance of this segment, reflecting a healthcare trend prioritizing economic efficiency and patient convenience.

Hospitals segment is estimated to register a significant CAGR over the forecast period. The hospital segment is pivotal in diagnosis, treatment, and patient care. Hospitals serve as central hubs for prostate cancer management, offering a comprehensive range of services, from initial screening to advanced treatments and supportive care. For hospitals, investing in state-of-the-art diagnostic technologies is paramount. Advanced imaging modalities, such as multiparametric MRI, can aid in accurate diagnosis and contribute to better treatment planning. Hospitals equipped with these technologies enhance their capabilities to provide precise and personalized care to prostate cancer patients. These factors are expected to boost the market.

Regional Insights

North America dominated the market and accounted for 44.9% share in 2023, driven by a rising patient awareness, rising prevalence of the prostate cancer, proactive government measures, technological advancements, and improvements in healthcare infrastructure. According to the American Cancer Society article published in January 2023, Prostate cancer exhibits a higher incidence in older men, particularly those over 65. Cases are rare in individuals under 40. About 10 out of 6 cases are typically diagnosed in men over 65. Upon diagnosis, men with prostate cancer generally have a life expectancy of around 66 years, emphasizing the impact of timely detection on prognosis. Understanding these demographic patterns is crucial for tailored screening and intervention strategies.

Asia Pacific is anticipated to witness the fastest growth in the market. According to the Informa UK Limited article published in July 2023, Prostate cancer demonstrates varying incidence rates between countries with very high Human Development Index (HDI), such as Japan and China, and those with lower HDI, like Vietnam and the Philippines. In recent times, there has been a noticeable surge in prostate cancer cases in both high and low HDI countries, including the Philippines, Japan, China, and Singapore. This rise in incidence is attributed to an increased adoption of prostate-specific antigen (PSA) screening in these regions. The higher rates in traditionally lower HDI countries indicate a changing trend in healthcare practices, emphasizing the growing awareness and implementation of early detection measures is boosting the market.

Key Companies & Market Share Insights

MDx Health, Myriad Genetics, Inc., and Abbott Laboratories are some of the dominant players operating in the prostate cancer diagnostics market.

-

MDxHealth is a global healthcare company that delivers precise diagnostics based on genetic information, to tailor cancer diagnosis and treatment

-

Myriad Genetics, Inc. is primarily involved in the R&D and commercialization of transformative molecular diagnostics. The company operates through two divisions: diagnostics and others. The diagnostics division provides testing and collaborative development of testing while the other segment provides testing products and services to the biotechnology, medical research, and pharmaceutical industries

OPKO Health, Inc., Genomic Health., and Siemens Healthcare GmbH are some of the emerging market players functioning in the prostate cancer diagnostics market.

-

OPKO Health, Inc. is a healthcare company that aims at developing, manufacturing, and marketing a varied range of products. The company operates under two reportable segments i.e., diagnostics and pharmaceuticals

-

Siemens Healthcare is a medical technology company and is a manufacturer and provider of therapeutics systems and clinical diagnostics. The company’s products include automation, integrated chemistry, routine chemistry, diabetes, hematology, urinalysis, molecular testing systems, blood gas monitoring, among others

Key Prostate Cancer Diagnostics Companies:

- MDx Health

- Myriad Genetics, Inc.

- Abbott Laboratories

- F. Hoffman-La Roche AG

- Bayer AG

- Siemens Healthcare GmbH

- OPKO Health, Inc.

- Genomic Health.

- Pfizer Inc.

Recent Developments

-

In July 2023, Quest Diagnostics through its subspecialty pathology business, has developed a new prostate cancer biomarker test, AmeriPath. The company collaborated with Envision Sciences Pty Ltd, an Australian clinical diagnostics company.

-

In August 2023, The U.S. Food and Drug Administration (FDA) approved FoundationOneCDx to serve as a companion diagnostic for Janssen's AKEEGA (abiraterone acetate Dual Action Tablet and niraparib). This approval is specifically for patients with BRCA-positive metastatic castration-resistant prostate cancer.

-

In September 2023, MDxHealth SA collaborated with the University of Oxford. The collaboration aims to explore the correlation between the Genomic Prostate Score (GPS) test and the progression of prostate cancer post-treatment for localized prostate cancer.

Prostate Cancer Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 9.05 billion

Revenue forecast in 2030

USD 11.90 billion

Growth rate

CAGR of 6.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 – 2022

Forecast period

2024 - 2030

Report updated

December 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Test type, type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

MDx Health; Myriad Genetics, Inc.; Abbott Laboratories; F. Hoffman-La Roche AG; Bayer AG; Siemens Healthcare GmbH; OPKO Health, Inc.; Genomic Health.; Pfizer Inc.

Customization scope

Free report customization (equivalent up to 8 analyst;s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Prostate Cancer Diagnostics Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global prostate cancer diagnostics market report based on test type, type, end-use, and region:

-

Test Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Preliminary Tests

-

PSA Tests

-

Free PSA Test

-

Total PSA Test

-

Other Preliminary Tests

-

-

Confirmatory Tests

-

Pca3 Test

-

Trans-Rectal Ultrasound

-

Biopsy Test

-

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Adenocarcinoma

-

Interstitial Cell Carcinoma

-

Other

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Outpatient Facilities

-

Home Care

-

Research & Manufacturing

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global prostate cancer diagnostics market size was estimated at USD 8.56 billion in 2023 and is expected to reach USD 9.05 billion in 2024.

b. The global prostate cancer diagnostics market is expected to grow at a compound annual growth rate of 6.43% from 2024 to 2030 to reach USD 13.16 billion by 2030.

b. Confirmatory tests dominated the prostate cancer diagnostics market with a share of 66.43% in 2023. This is attributable to the rising incidence of prostate cancer, high demand for confirmatory tests, and increase awareness amongst consumers.

b. Some key players operating in the prostate cancer diagnostics market include MDx Health; Myriad Genetics, Inc.; Abbott Laboratories; F. Hoffman-La Roche AG; Siemens Healthineers AG; OPKO Health, Inc.; and Genomic Health.

b. Key factors that are driving the market growth include increasing prevalence of prostate cancer, technological advancements in diagnostic tests, and the use of Artificial Intelligence (AI) to diagnose prostate cancer.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.