- Home

- »

- Conventional Energy

- »

-

Gas Turbine Market Size, Share And Growth Report 2030GVR Report cover

![Gas Turbine Market Size, Share & Trends Report]()

Gas Turbine Market Size, Share & Trends Analysis Report By Capacity (<=200 MW, >200 MW), By End-use (Industrial, Power & Utility), By Technology (Combined Cycle, Open Cycle), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-225-9

- Number of Report Pages: 132

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

Gas Turbine Market Size & Trends

The global gas turbine market size was estimated at USD 10.19 billion in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 4.0% from 2024 to 2030. A gas turbine is an engine, which heats a mixture of fuel and outside air at a very high temperature to generate mechanical energy through the spinning of turbine blades. The mechanical energy further drives a generator, which produces electrical energy. Rapid technological advancements in the energy industry, combined with a shift in focus toward distributed power production technologies, are propelling the market forward. The market is predicted to expand rapidly over the forecast period owing to increased government backing for power production technologies that minimize Carbon Dioxide (CO2) emissions globally.

Gas turbines are primarily used for power generation. Operating a simple cycle turbine power plant for supplying electricity to the industry is much costlier than purchasing it from outside. Thus, combined cycle power plants are mostly employed, which have better efficiency. CHP plant is an example of a combined cycle power plant, which can be employed for electricity production as well as for obtaining mechanical drive. The paradigm shift to gas-based power generation from coal-based in developed and developing economies such as the United States, Japan, India, and China, as well as supportive government policies for gas-based power plant construction, are major factors enabling market growth.

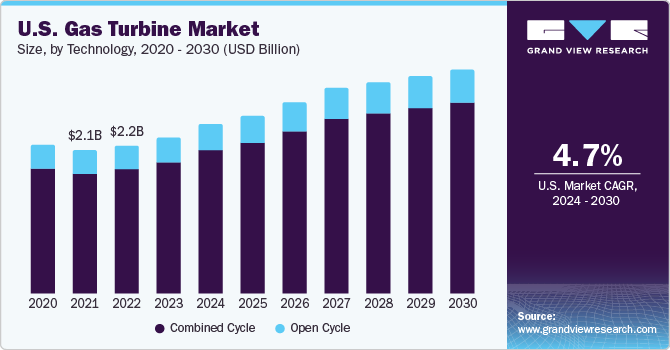

The U.S. market for gas turbines is projected to witness substantial growth, aided by increasing government support for power generation technologies that focus on the reduction of carbon dioxide emissions. Major factors leading to the move from coal-based to gas-based power generation are convenient economics and supporting regulations & policies to set up gas-based power plants in the nation. Moreover, an assurance of long-term availability of fuel supply in the United States is another vital factor enabling market expansion. Gas turbines play a leading role in reducing greenhouse gas (GHG) emissions. As compared to other combustion-based electricity generation applications, gas turbines are very proficient and also result in decreasing carbon emissions.

Execution of numerous climate change initiatives along with regulations to cut down GHG emissions are expected to lead to a surge in the potential for gas turbines over the forecast period. Lockdowns in major cities and economies have caused most industries around the world to shut down, effectively halting production. As a result, the demand for oil and gas decreased around the world. Furthermore, as a result of the global pandemic, electricity consumption from industrial and commercial end-users decreased significantly. Thus, the demand for gas turbines was impacted during that period.

Market Dynamics

Growing demand for power generation through clean energy sources is expected to drive the gas turbine industry. As per the United Nations, in 2022, the global population reached 8 billion, of which around 775 million people were deprived of electricity. Also, according to the UN, the world population is expected to climb to 8.5 billion by 2030, pushing energy requirements even further. Natural gas is considered widely to be a transitional power source between fossil fuels such as oil and coal and renewable sources such as wind and solar. This is because natural gas greatly reduces the level of carbon emissions, in comparison to other conventional power sources such as oil and coal. The market is poised to expand during the assessment period due to rising awareness regarding sustainable energy sources.

On the other hand, renewable energy sources, such as wind and solar, are increasingly becoming cost-competitive with traditional fossil fuel-based energy sources. This trend can result in a reduced demand for gas turbines, especially in the power generation segment. Additionally, several gas turbines are reaching the end of their operational lives, highlighting the need for their replacement or refurbishment. This can prove to be costly and time-consuming, reducing the demand for new gas turbines in the short term.

Capacity Insights

The >200 MW segment emerged as a significant capacity segment in this market with a revenue share of more than 73.0% in 2023. It is further projected to be the fastest-growing segment during the assessment period. The increasing pace of power generation operations globally due to high energy demands on account of population growth & rapid urbanization, along with a move from coal to gas-based power plants in some of the world’s major economies, are driving segment demand. The expansion of the power generation space, coupled with a higher focus on using renewable energy sources for electricity generation, is a primary driver for gas turbines, especially those with capacities higher than 200 MW.

The reduced turbine size allows for easier operation and maintenance, which is a crucial factor in the expansion of the 200 MW-capacity turbine segment. A smaller size leads to a lighter product, making it well-suited for offshore locations where the power-to-weight ratio is vital in deciding whether or not to build a turbine unit. The oil & gas industry is expected to restore its impetus in the coming years. On account of their compliance with operational and environmental circumstances, small turbines are frequently used in this industry.

Technology Insights

The combined cycle turbines segment accounted for the largest revenue share of more than 88.0% in 2023 and is anticipated to continue its dominance during the forecast period. This category is also expected to grow at a faster rate in the coming years. These turbines use less fuel to produce the same amount of energy and eliminate transmission and distribution losses. Combined cycle turbines are known to be extremely efficient, allowing systems to achieve efficiencies of 60 to 80 percent. Strict regulations for coal plants, low gas prices, and integration of increasing amounts of renewable energy are driving the shift to combined cycle gas turbine technology.

CCPPs complement solar and wind power as they can start and stop at a rapid pace, enabling them to compensate for changes in renewable energy power. Government initiatives pushing the use of sustainable fuels for electricity generation and reducing GHG emissions are expected to advance the demand for natural gas-fired power plants over their coal-fired counterparts. Additionally, the industry growth is poised to be driven by reducing gas prices and the discovery of shale gas reserves during the projection period.

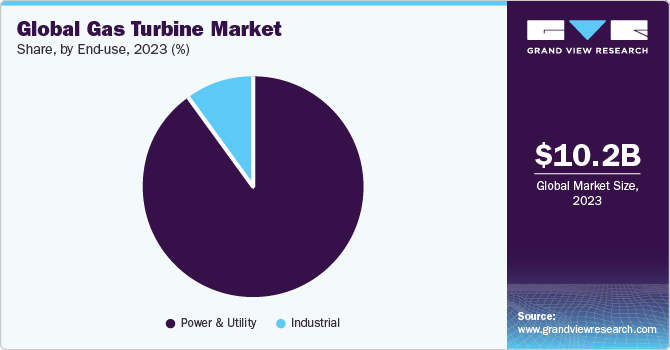

End-use Insights

The power & utility segment accounted for the largest revenue share of approximately 90.0% in 2023. Increased demand for power generation is being driven by the expansion in population and urbanization around the world, which is boosting the use of gas turbines in the power and utility sectors. Another important driver includes the focus on establishing an environment-friendly form of power generation. The product demand in the power & utility end-use segment is anticipated to progress at a significant growth rate over the forecast period; however, key competitors are still skeptical regarding the growing product demand in the power generation segment.

Volatility in prices of natural gas may hinder the market growth in this segment. Heavy industries, specialty chemical production, glass & cement manufacture, pharmaceutical, and sugar mills are all part of the industrial segment. Due to strict pollution regulations, gas turbines are witnessing growing demand in the industrial sector. Low natural gas prices are also boosting product demand in industrial settings. Demand is mostly driven by past increases in industrial activity around the world.

Regional Insights

Asia Pacific led the market with the highest revenue share of 37.21% in 2023, spearheaded by economies such as Indonesia, China, Thailand, Japan, and India. Asia Pacific is also anticipated to advance at the fastest CAGR during the forecast period. The region's electricity requirements are driven by rapid urbanization and the fast-emerging middle-class population. The presence of developing economies, such as India and China, as well as the availability of economical raw materials and labor, encourage multinational businesses to expand their regional operations. North America is also expected to advance at a noticeable CAGR through 2030, led by the U.S., Canada, and Mexico.

The demand for gas turbines in North America is primarily driven by shale gas reserves and technological development in extraction & mining technology, which are consistently lowering the operational cost of gas extraction. Furthermore, this region has witnessed large-scale commissioning of gas-based power. Oil and gas companies have been able to generate shale gas on a commercial scale because of technological breakthroughs in completion procedures like multistage hydraulic fracturing and drilling techniques like horizontal wellbores.

Saudi Arabia is a major gas turbine end-consumer in the Middle East and Africa region. This has resulted in a large number of gas turbine providers in the country, all of whom are seeking to increase their market share. Gas turbines are supplied by major OEMs, such as Siemens Energy, General Electric, and Mitsubishi Power, Ltd., throughout the country.

Key Companies & Market Share Insights

The market is consolidated by a few major companies, which account for a dominating industry share. Companies practice several strategic initiatives, such as joint ventures, mergers & acquisitions, partnerships, and new product offerings, to enhance their foothold in the market. For instance, in February 2023, General Electric and Aksa Power Generation signed a contract for the supply of two highly efficient GE 6F.03 gas turbines for a new CHP power plant in the Kyzylorda region of Kazakhstan. GE will also provide maintenance services to help in the long-term availability and reliable operation of equipment.

Key Gas Turbine Companies:

- Ansaldo Energia

- Bharat Heavy Electricals Ltd.

- Centrax Gas Turbines

- General Electric

- Kawasaki Heavy Industries, Ltd.

- MAN Energy Solutions

- Mitsubishi Power, Ltd.

- OPRA Turbines

- Siemens Energy

- Solar Turbines Inc.

Gas Turbine Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 11.02 billion

Revenue forecast in 2030

USD 13.98 billion

Growth rate

CAGR of 4.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report Updated

November 2023

Quantitative units

Volume in MW, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume and revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Technology, capacity, end-use, region

Regional Scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; South Korea; India; Australia; Brazil; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

Ansaldo Energia; Bharat Heavy Electricals Ltd.; Centrax Gas Turbines; General Electric; Kawasaki Heavy Industries, Ltd.; MAN Energy Solutions; Mitsubishi Power, Ltd.; OPRA Turbines; Siemens Energy; Solar Turbines Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Gas Turbine Market Report Segmentation

This report forecasts volume and revenue growth and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global gas turbine market report based on technology, capacity, end-use, and region:

-

Technology Outlook (Volume, MW; Revenue, USD Million, 2018 - 2030)

-

Open Cycle

-

Combined Cycle

-

-

Capacity Outlook (Volume, MW; Revenue, USD Million, 2018 - 2030)

-

≤200 MW

-

>200 MW

-

-

End-use Outlook (Volume, MW; Revenue, USD Million, 2018 - 2030)

-

Power & Utility

-

Industrial

-

-

Regional Outlook (Volume, MW; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Power & Utility was the largest end-use segment in the gas turbine market accounting for over 90.28% of the total value in 2023 owing to the deployment of a number of large-capacity power projects.

b. Some key players operating in the gas turbine market include Siemens Energy, Mitsubishi Power, Ltd., and Kawasaki Heavy Industries, Ltd.

b. The global gas turbine market size was estimated at 10.19 billion in 2023 and is expected to reach USD 11.02 billion in 2024.

b. The global gas turbine market is expected to witness a compound annual growth rate of 4.0% from 2024 to 2030 to reach USD 13.98 billion by 2030.

b. The >200 MW capacity segment led the global gas turbine market in 2023, accounting for the highest revenue share of more than 73.0%.

b. The combined cycle technology segment dominated the global gas turbine market and accounted for the largest revenue share of over 88.0% in 2023.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."