- Home

- »

- Advanced Interior Materials

- »

-

GCC Ceramic Tiles Market Size, Share, Growth Report, 2030GVR Report cover

![GCC Ceramic Tiles Market Size, Share & Trends Report]()

GCC Ceramic Tiles Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Glazed Ceramic Tiles, Porcelain), By Application, By End-use (Residential, Commercial), By Country, And Segment Forecasts

- Report ID: GVR-4-68039-611-1

- Number of Report Pages: 104

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

GCC Ceramic Tiles Market Size & Trends

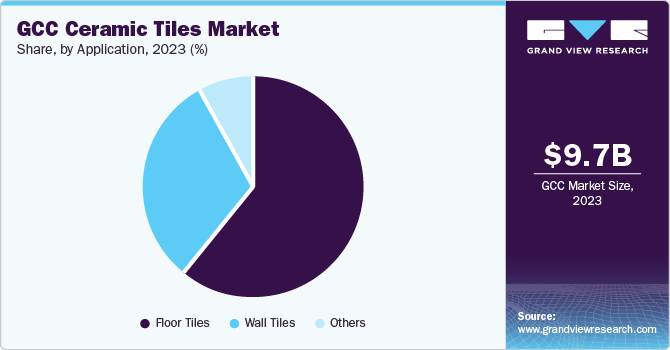

The global GCC ceramic tiles market size was valued at USD 9.68 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 7.3% from 2024 to 2030. The market’s growth can be attributed to the surging construction expenditure by the GCC countries such as Saudi Arabia, the UAE, Bahrain, and Kuwait. The demand for ceramic tiles is also projected to grow in this region at a significant rate during the forecast period owing to their durability, rigidity, and ease of maintenance. Moreover, the easy availability and installation in a wide range of colors, textures, and dimensions are anticipated to increase their popularity in wall and flooring applications.

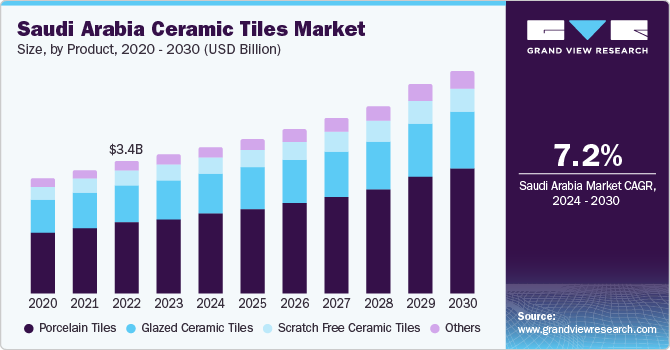

Saudi Arabia is expected to account for a significant share of the market owing to continued investment by the government in infrastructure projects worth USD 180 billion per year between 2015 and 2019. According to a study by Alpen Capital, the growing efforts of the Saudi government to improve tourism in the country are expected to propel construction activities in the hospitality and retail industries. This is projected to impact the market in the country positively.

Ceramic tiles are becoming more popular in the building sector, particularly for bathroom and kitchen flooring and wall applications. The necessity to address present building difficulties and future novel structural designs is driving up demand for ceramic tiles in this industry. Currently, construction issues include significant infrastructural degradation, leading to the material life of many concrete structures being exhausted.

The ceramic tiles industry is a complex network of economic agents, including the supply relationship that interlinks and overlaps with collaborative ones. In the integrated value chain, the central position lies with the ceramic tile manufacturers that supply themselves with advanced technologies and raw materials. These manufacturers are also collaborating with several service organizations, such as graphic studios, to help develop new graphics for the production of higher-quality tiles.

Technological advancements have enabled tile producers to avoid traditional surface finishes such as gloss and matte. The producers have successfully imitated natural wood and velvet's surface finish and texture. Innovations by ceramic wall tiles manufacturers to create an illusion of the touch & look of fabric are expected to draw consumer attention.

The market for ceramic tiles could be more organized to a greater extent as numerous domestic players are operating across GCC. Many small-scale players manufacture and distribute ceramic tile products and cater to wall and flooring applications. These players prefer the supply of ceramic tile directly to the end market by avoiding the distribution channel and, thus, negatively, hence the value chain.

Market Concentration & Characteristics

Market growth stage is medium, and pace of the market growth is accelerating. Technological advancements have enabled tile producers to break away from traditional surface finishes such as gloss and matte. The producers have been successful in imitating the surface finish and texture of natural wood and that of velvet. In addition, advancements in inkjet technology and digital printing technology have provided further opportunities for manufacturers to replicate the color and tone of stones and wood.

The ceramic tiles market in GCC is regulated by many bodies, including ISO and SASO. The bodies have levied various regulations and standards related to the manufacturing and quality of the product. Furthermore, the market has several substitutes for ceramic tiles, such as glass tiles and rubber tiles. The abundant availability of glass and rubber, coupled with their decorative application, is expected to increase their demand and production, thereby hampering the market growth.

Product Insights

Porcelain tiles dominated GCC ceramic tiles market in 2023 by accounting for a share of 54.5% in terms of revenue. Impermeable porcelain tiles' resistance to bacteria and mold contributes to their long-term value in floor-covering applications. In addition, porcelain is stain and chemical-resistant. The growing usage of sustainable building materials in the GCC region will likely boost demand for porcelain tiles, as is its ecologically friendly manufacturing method.

Glazed ceramic tiles are expected to be the fastest-growing segment over the forecast period of 2024 to 2030. The protective layer applied on glazed ceramic tiles makes them stain-resistant and naturally resistant to high humidity conditions. As a result, these are increasingly considered suitable for wet areas, such as kitchens, bathrooms, and laundry rooms, which, in turn, are expected to influence the market growth positively.

Glazed tiles are used for special and heavy-duty applications and highly stressed usage conditions such as landscapes, pathways, parking spaces, and shop floors. In addition, they are used for special applications such as high-traffic areas, staircase solutions, swimming pools, and external wall cladding.

Application Insights

In 2023, floor tiles accounted for the largest market volume share of 58.6%. The growth of this market segment can be attributed to technological advancements in the development of these tiles. For instance, digital printing processes are used for designing ceramic floor tiles using printers that enable high-resolution, nanometer-grade, and multi-layered printing on flat, curved, or textured surfaces.

The production of floor tiles using micro-crystal technology has several advantages, such as lower production cost, excellent aesthetic appeal, corrosion & chemical resistance, acid resistance, and glossy surface. In addition, these tiles offer slip resistance and anti-bacterial properties. Microcrystal floor tiles are durable and mostly preferred owing to their extra-smooth finish and clear texture. Thus, the development of advanced products is expected to enhance the utility and aesthetics of the building, thereby driving the demand for the product over the forecast period.

The wall tiles are growing fastest in terms of revenue at a CAGR of 7.3% over the forecast period. These products are a more cost-effective and long-lasting alternative to traditional stone materials in various residential and non-residential structures. Furthermore, rising consumer preferences for personalization and customization by using 3D printing technology will likely open up new opportunities in the ceramic tiles market.

End-use Insights

The use of ceramic tiles in residential segment is expected to grow at a fastest CAGR of 7.4% over the forecast period. The growth of this market segment can be attributed to the rising number of single-family houses in emerging economies such as Qatar and Kuwait of the region and the increasing disposable income of consumers. The flooring tiles are available in various shades and patterns. As such, they are ideal for creating patterns resembling natural stone and wood.

Apartments, residential buildings, tiny houses, and complexes comprise the residential end-use category. Ceramic tiles are preferred in residential applications due to their higher durability, low cost, and resistance to stain, filth, and shock. The flooring is available in a wide range of patterns and hues, making it an ideal option for creating designs that resemble genuine stone and wood.

The adoption of ceramic tiles in commercial industries such as healthcare, office, institution, retail, and other commercial areas is increasing owing to the product's anti-bacterial, anti-slip, and water resistance properties. In addition, designers and architects' rising preference for ceramic tiles-based floorings is expected to boost their demand in the commercial end-use segment over the forecast period.

Rising demand for highly durable and cost-efficient ceramic tiles-based floorings for high-traffic commercial and industrial sectors will drive segment growth over the forecast period. The development of new products and hassle-free installation techniques have considerably gone segment growth in recent years.

Country Insights

Saudi Arabia was the largest market in 2023, with a revenue share of 36.5%, owing to the government's significant investment in developing many infrastructure projects like railways, electricity production, sewerage treatment, and water treatment. Various government projects to create houses for the country's growing population will likely stimulate the ceramic tiles market.

Bahrain is expected to witness the fastest growth over the forecast period owing to increasing expenditure by the government, as per the Vision 2030 program, for the development of infrastructure projects and commercial complexes. The construction of low-price houses by the government in partnership with private players for the low- and middle-income populations is expected to drive the demand for ceramic tiles.

The demand for ceramic tiles in Oman is expected to be driven by high investments by the government in partnership with private players toward the development of the non-oil sector in the country as per the five-year plans. The construction of several government-funded housing projects over the past few years to provide cheap housing for the low-income population in the country is expected to create growth avenues in the market.

Key Companies & Market Share Insights

Some of the key players operating in the market include RAK CERAMICS, Porcelanosa Dubai, Arabian Tile Company Limited, and Saudi Ceramics.

-

RAK CERAMICS is headquartered in Ras Al Khaimah, UAE. The company is primarily engaged in the manufacturing and marketing of different types of tiles including ceramic floor tiles, ceramic wall tiles, and vitrified tiles. The company’s other major business segments include bathroom and kitchen, and megaslabs.

-

Saudi Ceramics is primarily engaged in the manufacturing of ceramic and porcelain walls and floor tiles. It operates its business through various business segments including tiles, bathware, fittings and accessories, water heaters, and sanitary wares. The company has an annual production capacity of 64 square meters of ceramic and porcelain tiles.

-

FORSAN CERAMICS, niceramics, and Riyadh Ceramics are some of the emerging market participants in the GCC ceramic tiles market.

-

FORSAN CERAMICS is organized into two business units, namely design and sanitary ware. It is specialized in the manufacturing of ceramic tiles, porcelain tiles, and sanitary ware collections. The company has a production capacity of 15 million square meters of ceramic tiles, 8 million square meters of porcelain, and 1.45 million square meters of sanitary wares.

- Riyadh Ceramics is primarily engaged in the manufacturing of ceramic wall & floor tiles and porcelain wall & floor tiles. Its ceramic tiles are produced at its clay product and manufacturing unit present in Dammam. The company’s ceramic tiles are used for wall and floor coverings in residential, retail, and industrial projects.

Key GCC Ceramic Tiles Companies:

- RAK Ceramics

- Porcelanosa Dubai

- Al Jawadah Ceramics

- Forsan Ceramics

- Al Anwar Ceramic Tiles Co. SAO

- Al Maha Ceramics

- Al Khaleej Ceramics

- Saudi Ceramics

- Niceramics

- Arabian Tile Company Ltd.

- FUTURE CERAMICS

- Riyadh Ceramics

- ARABIAN CERAMICS

- Porcellan

Recent Developments

-

In January 2023, Saudi Ceramic Company announced that construction of the new porcelain tiles factory with a capacity of 8.25 million square meters in Saudi Arabia had been 40% completed. The overall structure is set to be completed by 2024 for the plant's trial and commercial production.

-

In November 2021, ELIE SAAB partnered with RAK Ceramics to launch a bathroom and surface collection in downtown Dubai. ELIE SAAB is a Lebanese fashion designer, and in collaboration with RAK Ceramics, it launched five elegant collections of luxury ceramic tiles. This includes Liquid Metal, Royal, Glamour, Travertinum, and Soft Lux.

GCC Ceramic Tiles Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 10.29 billion

Revenue forecast in 2030

USD 15.74 billion

Growth rate

CAGR of 7.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

January 2024

Quantitative units

Volume in million square meters, revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, country

Regional scope

GCC (Gulf Cooperation Council)

Country scope

UAE; Saudi Arabia; Bahrain; Kuwait; Oman; Qatar

Key companies profiled

RAK CERAMICS; Porcelanosa Dubai; Al Jawadah Ceramics; FORSAN CERAMICS; Al Anwar Ceramic Tiles Co. SAOG; Al Maha Ceramics; Al Khaleej Ceramics; Saudi Ceramics; Niceramics; Arabian Tile Company Ltd.; FUTURE CERAMICS; Riyadh Ceramics; ARABIAN CERAMICS; Porcellan

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global GCC Ceramic Tiles Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the GCC ceramic tiles market report based on product, application, end-use, and country:

-

Product Outlook (Volume, Million Square Meters; Revenue, USD Billion, 2018 - 2030)

-

Glazed Ceramic Tiles

-

Porcelain Tiles

-

Scratch Free Ceramic Tiles

-

Others

-

-

Application Outlook (Volume, Million Square Meters; Revenue, USD Billion, 2018 - 2030)

-

Wall Tiles

-

Floor Tiles

-

Others

-

-

End-use Outlook (Volume, Million Square Meters; Revenue, USD Billion, 2018 - 2030)

-

Residential

-

Commercial

-

-

Country Outlook (Volume, Million Square Meters; Revenue, USD Billion, 2018 - 2030)

-

GCC

-

Saudi Arabia

-

UAE

-

Kuwait

-

Bahrain

-

Oman

-

Qatar

-

-

Frequently Asked Questions About This Report

b. The GCC ceramic tiles market size was estimated at USD 9.68 billion in 2023 and is expected to reach USD 10.29 billion in 2024.

b. The GCC ceramic tiles market is expected to grow at a compound annual growth rate of 7.3% from 2024 to 2030 to reach USD 15.74 billion by 2030.

b. The porcelain segment dominated the GCC ceramic tiles market with a share of 51.6% in 2023 owing to features such as mold and bacteria resistance imparting long-term value to floor covering.

b. Some of the key players operating in the GCC ceramic tiles market include RAK Ceramics, Porcelanosa Dubai, Al Jawadah Ceramics, Forsan Ceramics, Al Anwar Ceramic Tiles Co. SAOG, Al Maha Ceramics.

b. The key factor which is driving GCC ceramic tiles market is surging construction expenditure by the GCC countries such as Saudi Arabia, the UAE, Bahrain, and Kuwait.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.