- Home

- »

- Nutraceuticals & Functional Foods

- »

-

GCC Liquid Dietary Supplements Market Size Report, 2030GVR Report cover

![GCC Liquid Dietary Supplements Market Size, Share & Trends Report]()

GCC Liquid Dietary Supplements Market (2025 - 2030) Size, Share & Trends Analysis Report By Ingredients (Vitamins, Botanicals), By Type, By Application, By End User, By Distribution Channel, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-657-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

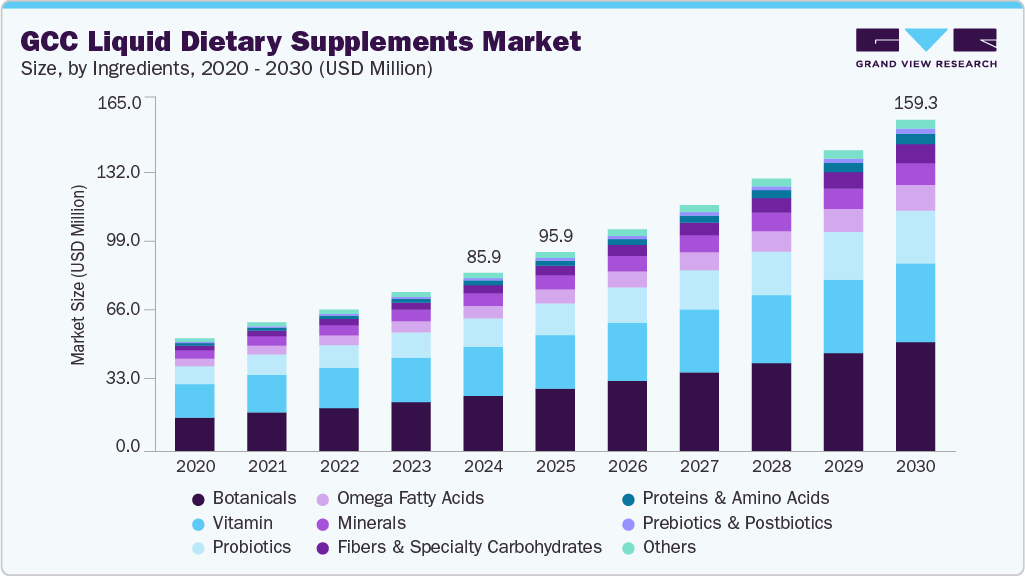

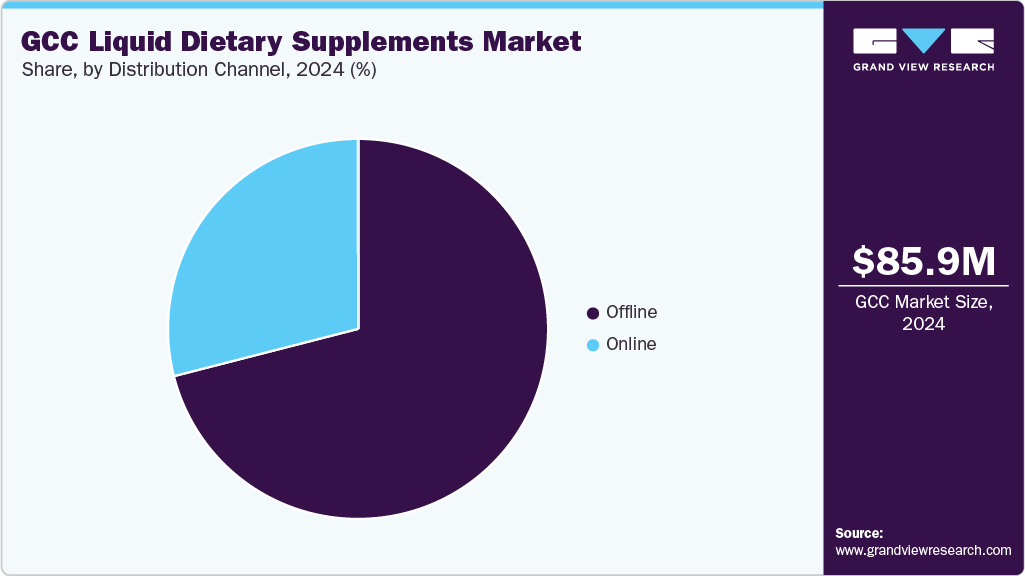

The GCC liquid dietary supplements market size was estimated at USD 85.9 million in 2024 and is projected to grow at a CAGR of 10.7% from 2025 to 2030. The growth of the market can be attributed to rising health consciousness and growing consumption of preventive healthcare among people, prevalence of lifestyle-related diseases, expansion of e-commerce platforms, and rising economic growth and disposable income in the region.

Increasing awareness about maintaining a healthy lifestyle in the GCC region drives market growth. People in the area increasingly engage in fitness activities to maintain a healthy lifestyle. For instance, in October 2024, the UAE launched the eighth edition of the Dubai Fitness Challenge (DFC), attracting a record 2,735,158 participants, witnessing a 14% increase from 2023. The challenge spanned 30 days and promoted daily exercise through free fitness villages, community events, and accessible programs, and driving city-wide engagement across Dubai while reinforcing the UAE’s commitment to public health. Such increasing health consciousness has forced people across the region to seek products that support their overall well-being. Liquid dietary supplements offers a convenient way for consumers to meet their nutritional needs, leading to a surge in demand for these products.

Consumer Insights

The rise in low-quality and counterfeit health products has made GCC consumers increasingly cautious about the supplements they purchase. The consumers in the region prioritize brands with strong reputations and prefer to buy products that are certified by regulatory bodies and are in line with stringent guidelines. This focus on quality assurance is crucial across sensitive categories including prenatal and infant nutrition, where safety and efficacy are essential. Furthermore, endorsements and recommendations by physicians and pharmacists bolster consumer trust and drive preference for prescribed liquid dietary supplements.

Consumers in the GCC significantly rely on online resources, such as social media platforms, health blogs, and customer reviews, powered by high smartphone usage and extensive internet access to research and choose their choice of liquid dietary supplements. While making a purchase, consumers evaluate brand trustworthiness, compare products, and confirm ingredient claims based on the digital interaction and customers’ feedback. Influencer endorsements and peer recommendations also influence the purchasing decisions, particularly for younger, tech-savvy customers who value community feedback and authenticity while making decisions about their health and wellbeing.

Ingredients Insights

The botanicals segment dominated the GCC liquid dietary supplements market and accounted for revenue share of 31.2% in 2024. Consumers across the GCC are increasingly shifting toward plant-based and herbal supplements due to rising awareness of the side effects of synthetic ingredients. Botanical ingredients such as turmeric, ginseng, and ashwagandha are increasingly gaining popularity for their perceived safety and long-term health benefits, especially in managing stress, immunity, and digestion. Additionally, regulatory bodies in the GCC are streamlining approvals processes and safety standards for herbal and botanical-based supplements. With governments promoting preventive healthcare and wellness, the regulatory push toward more natural product adoption and encourages manufacturers to introduce botanical-based liquid formulations.

The proteins & amino acids segment is expected to witness the fastest with a CAGR of 15.6% during the forecast period. Consumers in the GCC are increasingly turning to easy-to-consume, easily digested alternatives compared to traditional supplements or protein powders. Liquid forms of amino acids and proteins are digested more quickly. They are less taxing and easier on the digestive system for people with gastrointestinal sensitivities or those recovering from sickness. This has heightened their popularity among active and general well-being consumers. In addition, the food & beverage companies in the region are also increasing their production capacities to meet the increasing demand for protein and amino acid supplements in the region. For instance, in July 2024, Agthia Group PJSC opened a new protein plant facility in Jeddah, Saudi Arabia to align with Saudi Vision 2030 and expand its MENA presence. The strategic expansion was intended to respond to the growing demand for Agthia's protein brands, increase local production, and improve market presence both online and offline within the Kingdom. These factors are collectively contributing to the growth of the proteins & amino acids segment.

Type Insights

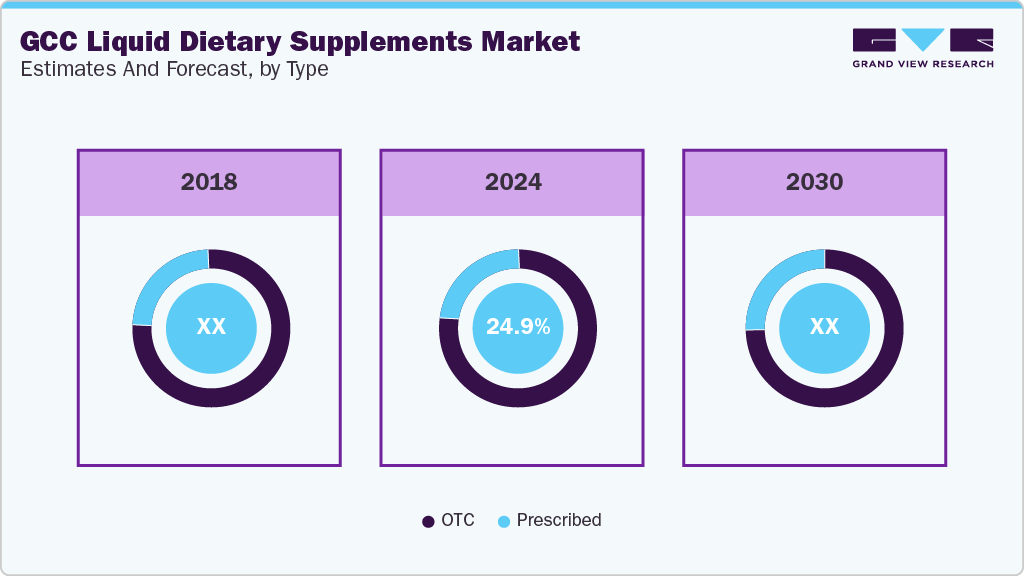

The OTC segment accounted for the largest revenue share of the market in 2024, owing to the rising self-care and wellness trends in the region driven by the rapid urbanization and a growing middle-class population. According to World Bank Data, of 2023, in Oman and the UAE, nearly 88.0% of the total population lived in urban areas, and in Saudi Arabia, approximately 85.0% of the total population lived in urban areas. This has led to increased disposable income and higher healthcare spending. As a result, consumers in the region are more willing to invest in OTC products for self-care and preventive healthcare. OTC liquid supplements, majorly those supporting immunity, energy, digestion, and general wellness, are easily accessible through pharmacies, supermarkets, and e-commerce platforms, enabling consumers to manage minor deficiencies without clinical intervention.

The prescribed liquid dietary supplements are expected to grow at the fastest CAGR from 2025 to 2030. The growth of government-funded screening programs for cancer, cardiovascular diseases, and diabetes is contributing to the growth of the prescribed liquid dietary supplements segment in GCC. For instance, in May 2025, Abu Dhabi’s Public Health Centre and Ma’an authority launched a joint fundraising initiative to provide free early screening for cancer, diabetes, and cardiovascular diseases to basic health insurance holders. Targeting adults aged 40-75, the program aimed to improve early detection, reduce complications, and uplift public health standards across the Abu Dhabi emirate in the UAE. Early detection initiatives require targeted supplementation to support patient health during treatment and recovery. As a result, prescribed supplements are increasingly recommended by healthcare professionals to manage nutritional needs in diagnosed patients.

Application Insights

The bone & joint health segment accounted for the largest revenue share in the market in 2024 owing to the various national fitness initiatives, including Saudi Vision 2030 and the UAE’s National Sports Strategy, which has increased physical activity and sports participation across all age groups in the region. The third Abu Dhabi Sports and Physical Activity Survey, an annual survey by the Department of Community Development (DCD) in partnership with the Abu Dhabi Sports Council and Statistics Centre, revealed increased physical activity. The research showed an increase in youth participation, with the number of children and teenagers involved in at least an hour of daily physical activity increasing from 11.0 to 12.5%. Further, during 2024, Abu Dhabi had 145 sporting and community activities, which saw the number of individuals engaging in such activities rise by 33.0% to 481,300 from 362,000 in 2023. This increasing sports culture has boosted the occurrence of joint strain and minor orthopedic treatments, which has led to high demand for liquid dietary supplements for their role in maintaining flexibility, preventing inflammation, and supporting post-exercise recovery, mainly among active adults and amateur athletes.

The prenatal health sector is expected to expand substantially throughout the forecast period, fueled by the growing awareness about the importance of prenatal nutrition. Growing awareness helps to encourage expecting mothers to include supplements rich in folic acid, iron, calcium, and DHA. Liquid supplements are preferred for ease of consumption and faster nutrient absorption, particularly for women experiencing morning sickness or nausea. Additionally, the easy availability of prenatal liquid supplements across pharmacies and online platforms has boosted the growth of the segment. Targeted marketing in combination with medical practitioners’ recommendations also improves purchasing behavior among pregnant women across urban and rural areas in the GCC.

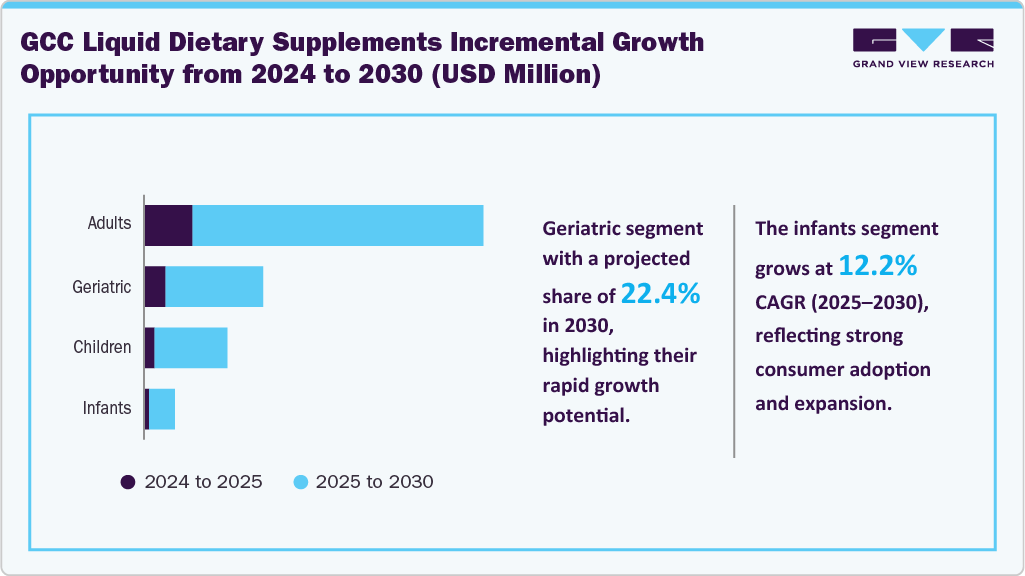

End User Insights

The adults segment accounted for the largest revenue share in the market. Adults in the GCC are increasingly affected by lifestyle-related conditions such as obesity, diabetes, hypertension, and stress. According to Mercer Talent Enterprise, a UAE-based tech human capital company, in GCC, over 65.0% of employees reported increased stress level at work in 2022 and over 45.0% of employees stated that their workload increased in the past 12 months. These issues have accelerated interest in liquid supplements aimed at managing energy levels, immunity, heart health, and metabolism. Liquid forms are particularly favored by working professionals for their ease of consumption and quick absorption.

The infants sector is expected to expand with the fastest growth rate during the forecast period. National health strategies across the GCC countries, particularly in the UAE and Saudi Arabia, include initiatives to reduce childhood malnutrition and support early development. For instance, in August 2023, the Abu Dhabi Public Health Centre (ADPHC) launched a campaign for the Maternal and Child Health program in partnership with Maternity and Children Hospitals in Abu Dhabi to increase awareness about the public health of pregnant women and children in the region. These programs include pediatric supplement recommendations encouraging parents to adopt supplements for vitamin D, multivitamins, or iron for infants as part of preventive healthcare. Additionally, healthcare professionals in the region are increasingly prescribing liquid dietary supplements for infants due to their ease of consumption compared to tablets or powders. This is particularly common for addressing common deficiencies, such as vitamin D or iron in newborns and toddlers, boosting product adoption across pharmacies and hospitals.

Distribution Channel Insights

The offline distribution segment held the largest revenue share of the market in 2024 owing to the high presence of pharmacies and health stores in the region. For instance, in the first quarter of 2024, Dubai Health Authority (DHA) licensed over 45 new pharmacies marking high healthcare infrastructure growth in the city. This makes pharmacies, supermarkets and specialty stores a key buying locations for liquid dietary supplements. Consumers trust these physical outlets for product authenticity, sales advice from on-site representatives, and immediate availability, supporting steady offline sales. Physicians and pharmacists in clinics and hospitals often recommend liquid supplements, encouraging direct purchases from offline channels. Such professional endorsement strengthens consumer confidence and drives demand within traditional retail environments.

The online distribution segment is projected to experience significant growth from 2025 to 2030. The proliferation of internet penetration and smartphone usage in the GCC is driving the growth of online retail platforms. Consumers increasingly prefer purchasing liquid dietary supplements online owing to their convenience, availability of wide product variety, competitive pricing, and doorstep delivery, especially amid busy urban lifestyles. Additionally, online platforms use targeted digital marketing, customer reviews, and personalized recommendations, enhancing consumer engagement and trust. These features help educate consumers about product benefits and increase impulse buying, driving growth in the online distribution of liquid supplements.

Country Insights

Saudi Arabia held the largest revenue share of the market in 2024 owing to the strong government healthcare initiatives and Vision 2030. The country’s Vision 2030 strategy emphasizes upgrading the healthcare industry, encouraging wellness, preventive care, and healthier lifestyles. Under the country’s vision strategy, the government is expected to invest over USD 65 billion in healthcare infrastructure and uplift private sector participation in the healthcare sector to 65%. This high healthcare investment in infrastructure and public health awareness campaigns contributes to the adoption of liquid dietary supplements as a complement to traditional medicine.

The UAE is expected to grow significantly during the forecast period. The country has a large, increasing expatriate population with different health priorities and preferences. As of 2025, over 85% of the country’s population is expatriate. This diverse demographic creates a demand for a wide range of liquid dietary supplements catering to different nutritional requirements, including immunity boosters and digestive aids. Manufacturers and retailers take advantage of this diversity by offering products that cater to global tastes and health trends.

Key GCC Liquid Dietary Supplements Company Insights

Some of the key companies operating in GCC Liquid dietary supplements industry include Nestle Health Science S.A. Bayer AG, GSK plc, Herbalife Nutrition Ltd., and others.

-

Nestle Health Science has expanded its presence in the GCC by introducing clinically backed, condition-specific liquid supplements specifically for targeting malnutrition, diabetes, and digestive health through partnerships with local hospitals and pharmacies. The company uses its medical nutrition portfolio and develops formulations to cater to the local dietary needs and regulatory standards.

-

In the GCC, Abbott focuses on prescription driven growth for its liquid supplements by collaborating healthcare professionals and institutions. It promotes its key brands, including Ensure and PediaSure, through clinical trials, CME programs, and partnerships with government-backed health screenings in the region.

Key GCC Liquid Dietary Supplements Companies:

- Abbott Laboratories

- Amway Corporation

- Bayer Aktiengesellschaft (Bayer AG)

- Dabur International Limited

- General Nutrition Centers, Inc. (GNC)

- GlaxoSmithKline plc (GSK)

- Herbalife Nutrition Ltd.

- Nestle Health Science S.A.

- NOW Health Group, Inc. (NOW Foods)

- The Juice Plus+ Company

Recent Developments

-

In June 2025, GROUNDED launched its clean-label protein milkshakes in 35 Grandiose stores across the UAE. Available in milk chocolate and mint choc flavors, each shake offered 20g of plant protein, made with real ingredients and no additives, and featured sustainable, fully recyclable FSC-certified paperboard packaging.

-

In February 2025, iPRO launched its healthy hydration beverages in Saudi Arabia through a strategic collaboration with Al Rabie Saudi Foods Company. Using Al Rabie's distribution network of over 21,000 sales points, iPRO Hydrate products have became widely accessible, making an expansion into the UAE's health-focused beverage market.

-

In February 2025, Revive Collagen, a UK-based supplement brand, launched in over 100 Supercare stores and online across the UAE, marking a key milestone in its global expansion. The company partnered with GMG to tap into rising consumer demand for natural, result-driven collagen supplements within the region’s growing health and beauty market.

GCC Liquid Dietary Supplements Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 95.87 million

Revenue forecast in 2030

USD 159.3 million

Growth rate

CAGR of 10.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Ingredients, type, application, end user, distribution channel, and country

Country scope

Saudi Arabia, UAE, Bahrain, Kuwait, Oman, Qatar

Key companies profiled

Abbott Laboratories, Amway Corporation, Bayer Aktiengesellschaft (Bayer AG), Dabur International Limited, General Nutrition Centers, Inc. (GNC), GlaxoSmithKline plc (GSK), Herbalife Nutrition Ltd., Nestlé Health Science S.A., NOW Health Group, Inc. (NOW Foods), and The Juice Plus+ Company.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

GCC Liquid Dietary Supplements Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the GCC liquid dietary supplements market report based on ingredients, type, application, end user, distribution channel, and country:

-

Ingredients Outlook (Revenue, USD Million, 2018 - 2030)

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

OTC

-

Prescribed

-

-

End User Outlook (Revenue, USD Million, 2018 - 2030)

-

Adults

-

Millennials

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen X

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen Z

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Boomers

-

Male

-

Female

-

-

-

Geriatric

-

Children

-

Infants

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Hypermarkets/Supermarkets

-

Pharmacies

-

Specialty Stores

-

Practitioner

-

Others

-

-

Online

-

Amazon

-

Other Online Retail Stores

-

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Saudi Arabia

-

UAE

-

Bahrain

-

Kuwait

-

Oman

-

Qatar

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.