- Home

- »

- Consumer F&B

- »

-

GCC Nutraceuticals Market Size, Industry Report, 2033GVR Report cover

![GCC Nutraceuticals Market Size, Share & Trends Report]()

GCC Nutraceuticals Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Nutraceuticals, Functional Food, Functional Beverages, Infant Formula), By Application, By Distribution Channel, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-796-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

GCC Nutraceuticals Market Summary

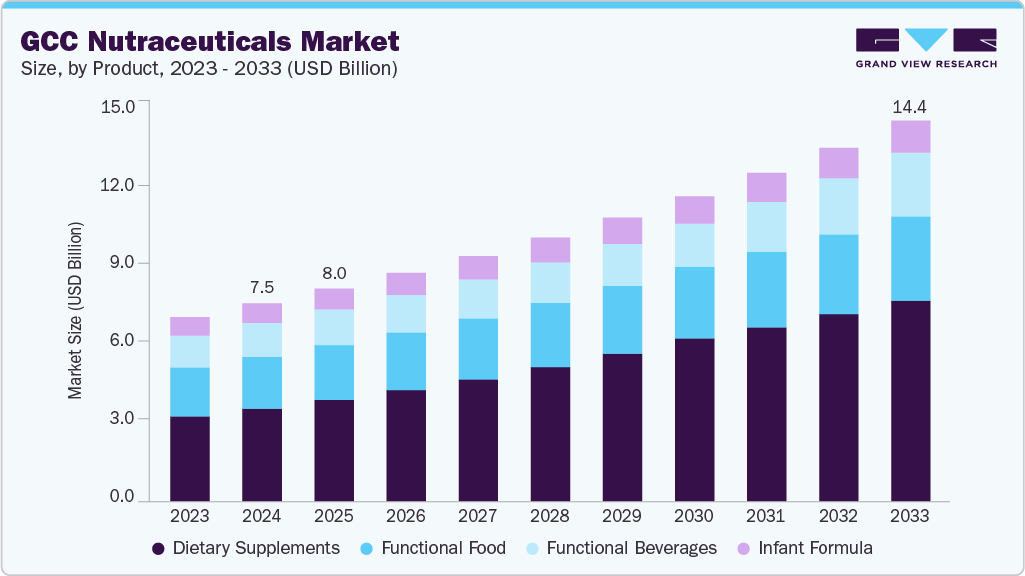

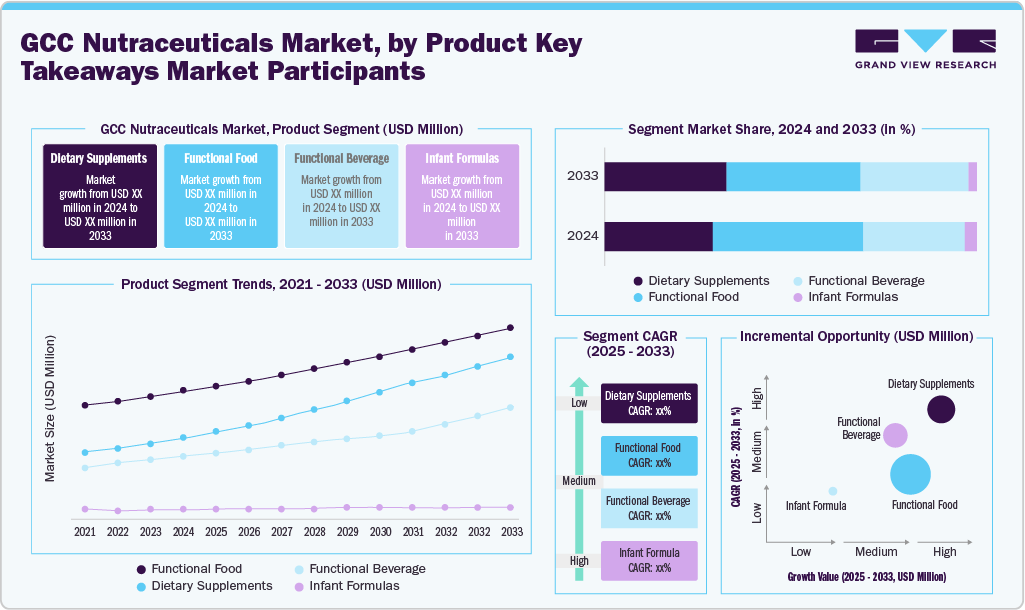

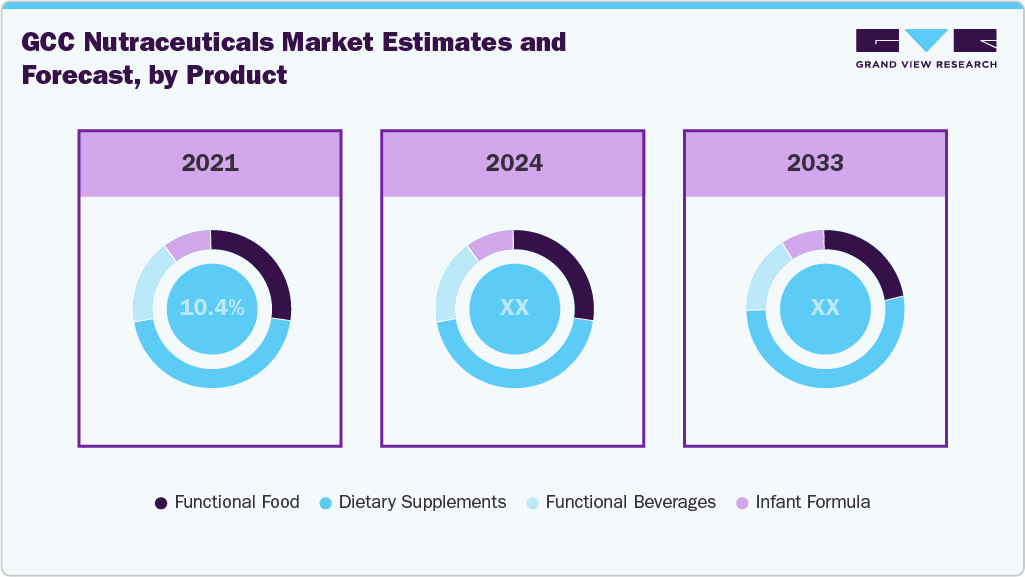

The GCC nutraceuticals market size was estimated at USD 7.47 billion in 2024 and is projected to reach USD 14.36 Billion by 2033, growing at a CAGR of 7.5% from 2025 to 2033. The growth of the nutraceuticals market in the GCC is driven by rising consumption of products that support immunity, digestion, energy, and mental well-being.

Key Market Trends & Insights

- By product, the dietary supplement segment held the highest market share of 46.9% in 2024.

- Based on product, the dietary supplements segment is expected to grow at a CAGR of 8.9% from 2025 to 2033.

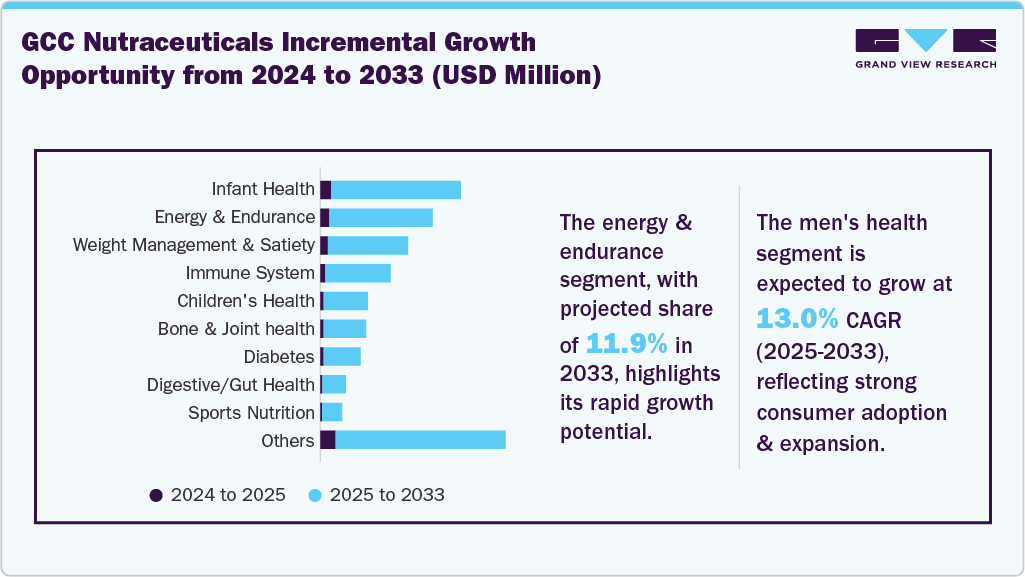

- Based on application, weight management & satiety held the highest market share of 16.6% in 2024.

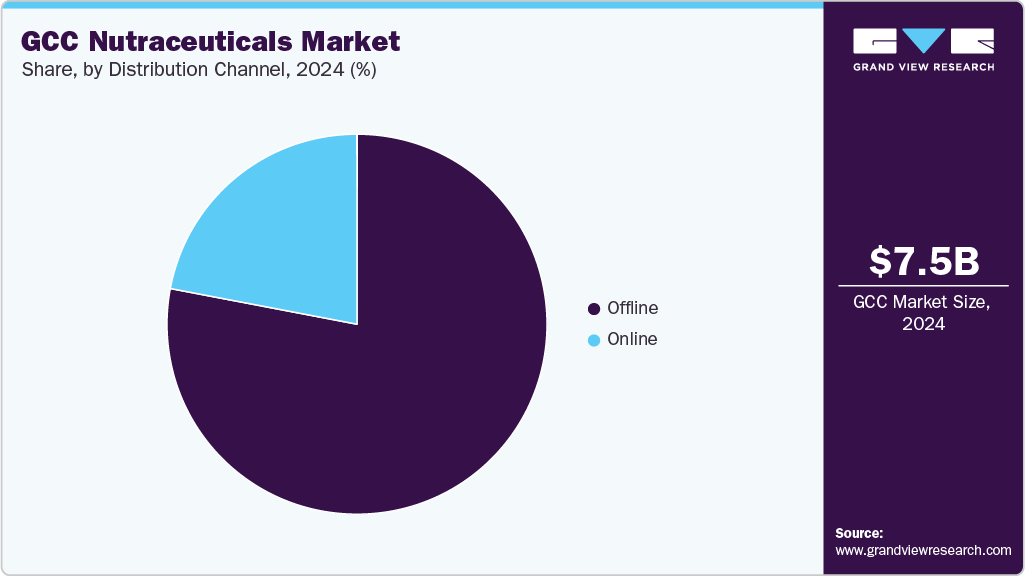

- By distribution channel, the offline segment held the highest market share of 78.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 7.47 Billion

- 2033 Projected Market Size: USD 14.36 Billion

- CAGR (2025-2033): 7.5%

The growing inclination of the people in this region toward maintaining good health is favoring the demand for clear labeling, natural ingredients, and eco-friendly packaging, as buyers want to know exactly what they consume.

The expansion of e-commerce makes it easier for urban consumers to access a wide range of health products online. Governments also support local production through new policies, helping reduce import dependency. Lifestyle-related disorders such as diabetes, cardiovascular diseases, obesity, and gastrointestinal issues are becoming common in GCC regions, leading to a shift from treatment-based approaches to preventive healthcare. Nutraceuticals, including dietary supplements, functional foods, and fortified beverages, are increasingly adopted across GCC countries to address nutritional deficiencies and enhance immune health. While challenges such as inconsistent regulations and income disparities persist, these countries progressively incorporate nutraceuticals into their healthcare systems. Adopting herbal and plant-based products is especially prominent, reflecting strong cultural traditions and long-standing reliance on natural remedies.

In the GCC region, the use of nutraceuticals is deeply rooted in cultural and religious traditions. Ingredients such as black seed, dates, honey, and ginger are widely trusted for their natural healing properties and spiritual significance. People often prefer herbal and plant-based remedies, viewing them as safer and more aligned with traditional values. Religious beliefs also shape consumption habits, with practices such as fasting influencing the use of supplements. The GCC nutraceuticals market has significant growth potential over the coming years, driven by consumer demand and evolving healthcare priorities.

Consumer Insights

Most nutraceutical users in the GCC region fall within the 15-64 age group, with strong engagement from millennials and Gen Z, who are highly focused on immunity, physical appearance, fitness, and mental well-being. The younger demographic is especially inclined toward vitamins, proteins, probiotics, and herbal blends that address energy, skin, sleep, and mood. The elderly population (65+) is increasingly turning to nutraceuticals to manage chronic conditions such as cardiovascular issues, arthritis, and age-related immunity decline. The urban population, particularly the middle and upper-income segments, shows higher usage rates because of better access, awareness, and disposable income. Though tablets and capsules are the most preferred formats, interest in powders and gummies is also increasing, especially among youth. Women are identified as proactive consumers, especially in the beauty, bone health, and weight management categories.

Consumers are seeking natural, science-backed solutions that support immunity, digestion, and overall well-being, with a strong shift toward habit-forming and personalized wellness. The GCC nutraceuticals industry is witnessing robust growth driven by a strong preference for essential supplements such as Vitamin D, Vitamin C, Omega-3, collagen, and multivitamins, which dominate consumer demand across the region. This trend is further amplified by the increasing adoption of digital health platforms that offer smart supplement tracking, making health management more personalized and accessible. Consumers also show a rising inclination toward locally produced, halal-certified, and clinically validated products, reflecting a growing emphasis on trust, transparency, and cultural alignment. Moreover, the market is shaped by the expanding fitness culture, a shift toward clean-label formulations, and the growing appeal of personalized nutrition solutions tailored to individual health goals.

Product Insights

The dietary supplement segment dominated the market and accounted for 46.9% in 2024, driven by rising interest in healthy aging, higher spending on preventive health, government wellness initiatives, and the rise of tech-enabled platforms. In addition, chronic disease prevalence, aging population, and a shift toward proactive self-care are boosting demand for high-quality, science-backed dietary supplements in the GCC. Urbanization and lifestyle diseases are pushing consumers in the UAE to seek natural, health-focused products, particularly in areas such as weight management, diabetic care, heart health, and beauty. For instance, Global Edge introduced three new global brands specializing in natural plant-based nutrition, healthy aging, and dietary supplements at the Arab Health 2025 event. This move aligns with the UAE’s vision to advance healthcare and cater to the surging demand for natural and effective healthcare solutions. With high per capita income and growing interest in organic products, the region presents strong opportunities for supplement and wellness product expansion.

The functional beverages segment is projected to record the second-fastest CAGR over the forecast period. The GCC region is witnessing diverse expansion of functional beverages, from performance coffees and date-sweetened colas to organic matcha and convenient wellness drinks, showcasing health, sustainability, convenience, and innovation. In May 2025, Beforeyouspeak Coffee, an Australian health and wellness brand, launched its functional coffee range in the UAE. The blends include ingredients such as MCTs, ginseng, turmeric, and collagen, formulated to support energy, beauty, and wellbeing.

Application Insights

The weight management & satiety segment dominated the market with a significant share in 2024. The rapid economic growth, sedentary lifestyles, high-calorie diets, and extreme heat have led to high obesity rates in the GCC region. The region continues to struggle with obesity and related diseases due to cultural norms and restricted physical activity (especially among women). In 2025, Abu Dhabi's Department of Health and Abu Dhabi Public Health Centre launched the region’s first Personalized Weight Management Program. Targeting overweight and obese members from age 18 and above, the program combines digital monitoring, tailored clinical support, and a unique reimbursement model to promote sustainable weight loss and reduce the risks of chronic diseases. It aims to shift focus from weight to overall quality of life and health longevity, offering personalized, science-based solutions and continuous engagement to enhance long-term well-being.

The men's health segment is expected to record the fastest CAGR over the forecast period, with rising lifestyle-related conditions, such as obesity and diabetes, and shifting cultural attitudes toward male wellness. The young urban population with strong purchasing power is increasingly seeking targeted solutions for fitness, vitality, mental wellbeing, and personal grooming, driving demand for specialized supplements, functional foods, and digital health services. For instance, Better, the UAE's first men's wellness startup, has launched in Dubai, offering customized subscription-based treatments for men’s physical and sexual health, including biotin hair loss gummies and generic Viagra mints. The company plans to expand into Saudi Arabia and across the GCC, positioning itself as a discreet, accessible solution for men’s wellness needs.

Distribution Channel Insights

The offline distribution segment dominated the GCC nutraceuticals industry in 2024, driven by the strong presence of pharmacy chains, consumer trust in personal health consultations, and the rising demand for preventive solutions related to lifestyle diseases such as diabetes, obesity, and bone degeneration. The region’s regulatory support for functional foods and supplements and increasing shelf space for wellness products in hypermarkets and pharmacies, has further enhanced sales through the offline channel. In February 2025, Aster Pharmacy launched its largest GCC store, Trio, in Riyadh, Saudi Arabia, in partnership with Abdul Mohsen Al Hokair Group. The 711 square meter flagship store introduced a drive-through concept and offers over 13,000 health, wellness, beauty, and lifestyle products, including in-house brands, skincare analysis, and home healthcare devices.

The online segment is anticipated to record the fastest CAGR from 2025 to 2033. A strong online retail ecosystem, combined with rising demand for wellness products and AI-enhanced diagnostics, has paved the way for digital-first offerings.

Country Insights

Saudi Arabia dominated the GCC nutraceuticals industry in 2024, due to health-conscious consumer behavior, rising prevalence of chronic diseases, and strong government support for preventive healthcare. Increasing demand for immunity-boosting, weight management, and energy-enhancing products has pushed functional foods and dietary supplements into the mainstream. Consumers actively seek organic, plant-based, and halal-certified alternatives, reflecting a shift toward cleaner, natural nutrition. Consumers also seek low-sugar, vitamin-rich drinks with functional benefits such as faster hydration, immune support, and clean labels free from artificial ingredients and caffeine.

The United Arab Emirates is anticipated to experience the fastest CAGR from 2025 to 2033. Government initiatives and a diverse, affluent population with increasing interest in holistic and clean-label nutrition fuel market growth.

Key GCC Nutraceuticals Company Insights

Some key players in the GCC nutraceuticals industry include Nestlé, Danone, Yakult Honsha Co., Ltd., and others.

- Bayer operates across the GCC region through its Consumer Health division, offering a range of OTC and nutraceutical products, including Berocca, Redoxon, and Supradyn, which support energy, immunity, and general wellness. With regional headquarters in Dubai, Bayer is active in both pharmacy and retail channels across the UAE, Saudi Arabia, and Qatar, and engages in awareness campaigns focused on preventive health and lifestyle-related supplementation.

Key GCC Nutraceuticals Companies:

- Nestlé

- Danone

- Yakult Honsha Co., Ltd.

- Bayer AG

Recent Developments

- In June 2024, ZeroHarm Sciences, India’s clean-label nutraceutical company, announced plans to enter the GCC market with a new line of plant‑based, nanotechnology‑enhanced nutraceuticals.

GCC Nutraceuticals Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.03 Billion

Revenue forecast in 2033

USD 14.36 Billion

Growth rate

CAGR of 7.5% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, distribution channel, country

Key companies profiled

Nestlé S.A., Yakult Honsha Co., Ltd., Bayer AG, Danone

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

GCC Nutraceuticals Market Report Segmentation

This report forecasts revenue growth at the regional and country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the GCC nutraceuticals market report based on product, application, distribution channel, and country:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Nutraceuticals

-

Tablets

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Capsules

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Soft Gels

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Powders

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Gummies

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Liquid

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Others

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

-

Others

-

-

Functional Food

-

Vegetable and Seed Oil

-

Sweet Biscuits, Snack Bars and Fruit Snacks

-

Dairy

-

Baby Food

-

Breakfast Cereals

-

Others

-

-

Functional Beverages

-

Energy drink

-

Sports drink

-

Others (Functional dairy based beverages, kombucha, kefir, probiotic drinks, and functional water)

-

-

Infant Formula

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Allergy & Intolerance

-

Healthy Ageing

-

Bone & Joint health

-

Cancer Prevention

-

Children's Health

-

Cognitive Health

-

Diabetes

-

Digestive / Gut Health

-

Energy & Endurance

-

Eye Health

-

Heart Health

-

Immune System

-

Infant Health

-

Inflammation

-

Maternal Health

-

Men's Health

-

Nutricosmetics

-

Oral care

-

Personalized Nutrition

-

Post Pregnancy Health

-

Sexual Health

-

Skin Health

-

Sports Nutrition

-

Weight Management & Satiety

-

Women's Health

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Offline

-

Supermarkets & Hypermarkets

-

Pharmacies

-

Specialty Stores

-

Practitioner

-

Grocery Stores

-

Others

-

-

Online

-

Amazon

-

Other Online Retail Stores

-

-

-

Country Outlook (Revenue, USD Million, 2021 - 2033)

-

GCC

-

Saudi Arabia

-

United Arab Emirates

-

Bahrain

-

Kuwait

-

Oman

-

Qatar

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.