- Home

- »

- Nutraceuticals & Functional Foods

- »

-

GCC Protein Ingredients Market Size, Industry Report, 2033GVR Report cover

![GCC Protein Ingredients Market Size, Share & Trends Report]()

GCC Protein Ingredients Market (2025 - 2033) Size, Share & Trends Analysis Report By Product Type (Plant Protein, Animal/Dairy Protein, Microbe-based Protein, and Insect Protein), By Application (Food & Beverages, Animal Feed, and Others), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-776-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

GCC Protein Ingredients Market Summary

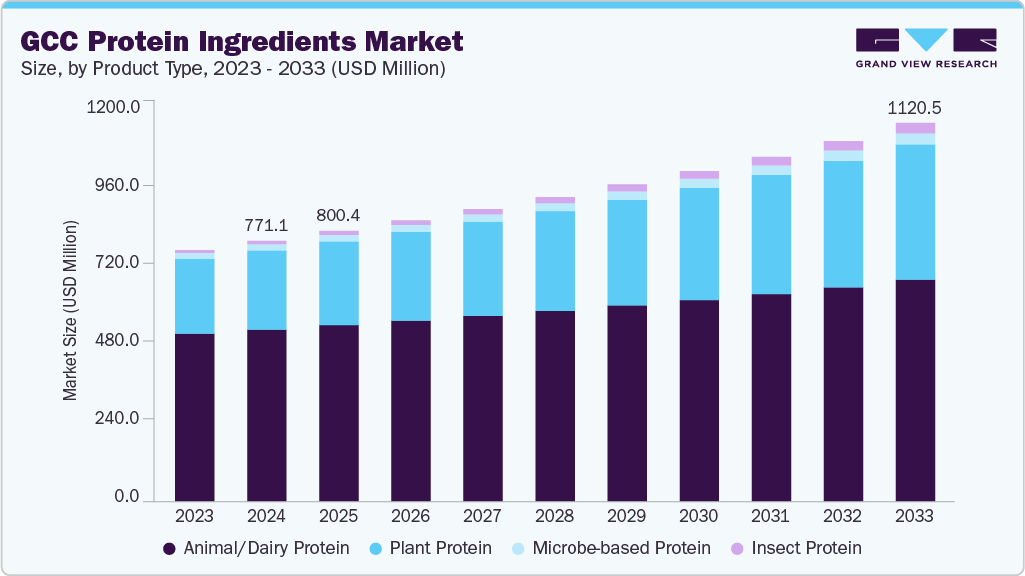

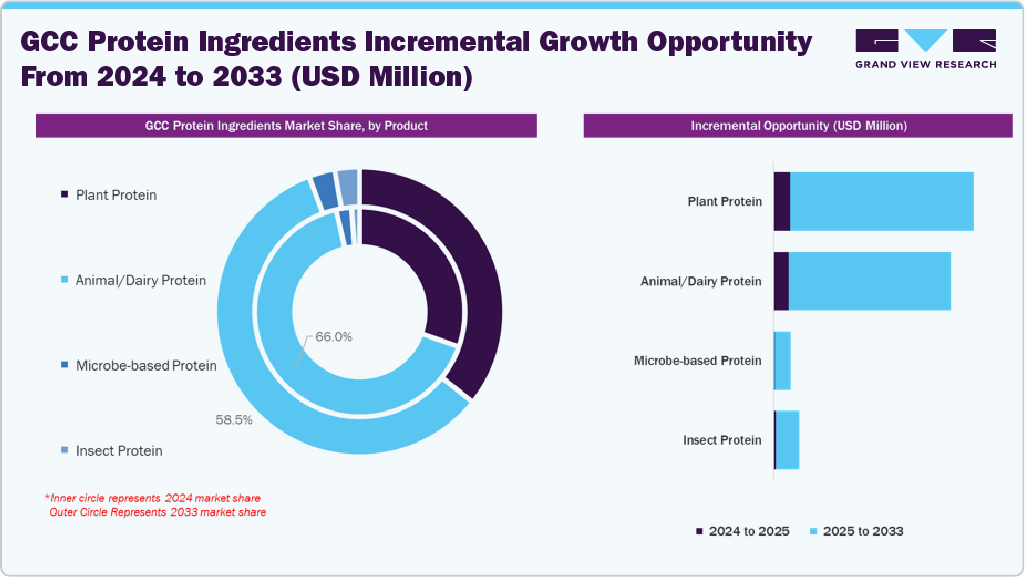

The GCC protein ingredients market size was estimated at USD 771.1 million in 2024 and is projected to reach USD 1,120.5 million by 2033, growing at a CAGR of 4.3% from 2025 to 2033. This growth is driven by shifting consumer preferences and the increasing prevalence of sedentary lifestyle-related illnesses.

Key Market Trends & Insights

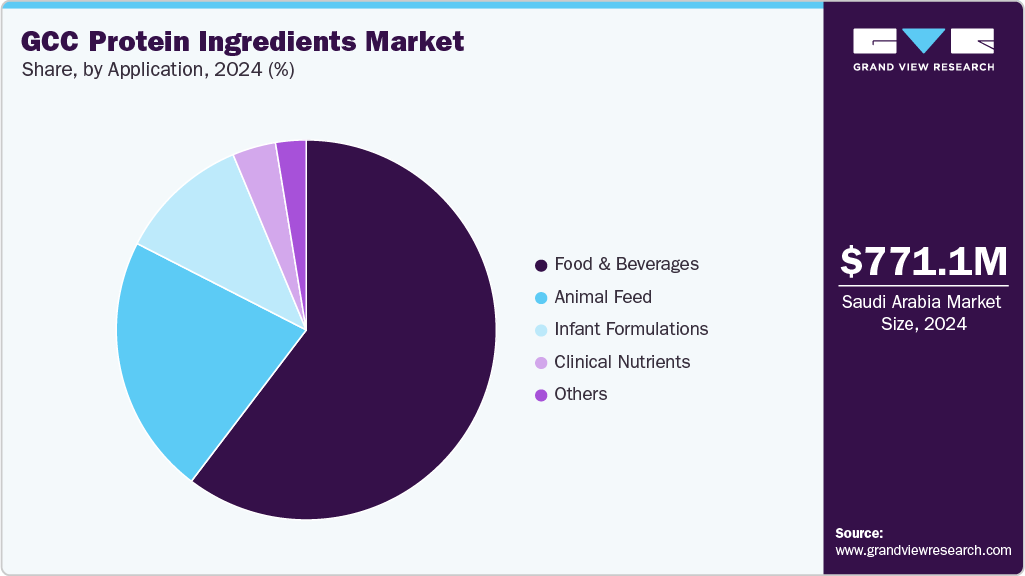

- Saudi Arabia dominated the GCC protein ingredients market with a share of 40.1% in 2024.

- By product type, the animal/dairy protein segment held the largest market share in 2024.

- By application, the food & beverages segment is expected to grow at the fastest CAGR of 4.7% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 771.1 Million

- 2033 Projected Market Size: USD 1,120.5 Million

- CAGR (2025-2033): 4.3%

Furthermore, the rising interest in healthy living is boosting the demand for functional foods with essential protein ingredients and nutrients crucial for maintaining health. The demand for GCC protein ingredients is rising due to consumers' growing preference for plant-based products, which are perceived as healthier alternatives to animal-based options. This trend is expected to encourage protein ingredient manufacturers to develop various food products derived from soy and wheat, further boosting demand.

The market is expanding as more people become aware of health and wellness and participate in sports, fitness, and lifestyle activities. In addition, consumers are increasingly opting for products that are less processed, contain fewer artificial additives, are non-GMO, sustainably sourced, and halal certified. This shift is expected to enhance consumer preference for products containing certain ingredients. The growing popularity of these products among health-conscious individuals is anticipated to drive overall growth in the protein ingredients market.

Product Type Insights

The animal/dairy protein segment held the largest share in 2024. The growth of this segment is driven by the rise in the demand for sports nutrition, clinical nutrition, and fortified food products. Various animal/dairy protein products include milk protein concentrates/isolates, whey protein concentrates, whey protein hydrolysates, gelatin, casein, and collagen peptides. Moreover, several product launches with enhanced nutritional profiles by major players in collaboration with global brands in the protein ingredient market are expected to fuel the overall market growth. For instance, in October 2022, Change Foods, a food tech company, partnered with KEZAD GROUP with the support of the Ministry of Economy of the UAE under the NextGen FDI initiative, to establish a commercial manufacturing plant in Abu Dhabi by the end of 2025 for the production of animal-free milk protein (casein).

The insect protein segment is expected to grow at the fastest CAGR of 13.3% from 2025 to 2033, owing to rising awareness of maintaining health and the benefits of nutrition and fortified food among consumers. This is expected to create high demand for cleaner, higher-protein, and various micronutrients. Moreover, these tiny creatures offer different health benefits, including essential amino acids, mainly in manufacturing protein bars, energy drinks, and pet food. In addition, a rise in the initiatives by the GCC government to support food waste management, alternative proteins, and sustainable agriculture is further attributed to boost the growth of the insect protein segment countrywide over the forecast period.

Application Insights

The food & beverages segment held the largest market share of 60.4% in 2024 and is expected to grow at the fastest CAGR from 2025 to 2033. This growth is driven by high consumption of dietary supplements, bakery & confectionery, sports nutrition products, and non-dairy beverage alternatives across GCC countries. However, consumers are shifting toward convenient, healthy products supporting active lifestyles and wellness goals. Protein ingredients, such as plant-based, dairy, and animal sources, are widely incorporated in products such as shakes, yogurts, protein bars, and baked snacks. Major companies operating in food and beverage products across GCC countries focus on expanding their portfolio by incorporating protein-based products. For instance, in August 2025, Baladna, a dairy and juice company, announced financials for the first half of 2025 and reported around 229% increase in net profit compared to the previous year. The growth was experienced through product innovation and introducing 25 new products under product categories such as Greek yogurt drinks, protein shakes, laban, flavored milk, yoghurt, and juices.

The animal feed segment is expected to grow at the second-fastest CAGR over the forecast period, owing to the growing expansion of aquaculture and poultry sectors, especially across Saudi Arabia and the UAE. These countries are investing heavily in aquaculture projects, which help improve food security and reduce their reliability on seafood imports. Moreover, companies such as Circa Biotech are expanding their facilities to convert food waste into insect-based animal feed protein, showing industrial-scale momentum. For instance, in May 2024, at the Food Innovation Conference 2024 in Dubai, Circa Biotech Ltd. highlighted advancements in scaling insect protein production in the UAE, underlining its strategic importance for the broader GCC protein ingredients market. The company uses the black soldier fly (BSF), which feeds on food waste, to upcycle food waste into high-protein animal and aquaculture feed, a model aligned with the region’s food security, sustainability, and circular economy objectives.

Country Insights

Saudi Arabia Protein Ingredients Market Trends

Saudi Arabia held the largest share of 40.0% in the GCC protein ingredients market in 2024. The market is driven by rising consumer demand for protein ingredients, with a growing focus on health and wellness. The market in Saudi Arabia is dominated by animal-based proteins, which are mainly consumed in the form of whey protein concentrates and milk protein concentrates/isolates. This has further resulted in various joint ventures to produce protein. In November 2022, Calysseo, a JV between Adisseo and Calysta, announced its plan to build an alternative protein facility along with a fermenter having a capacity of 100,000 metric tons in Saudi Arabia to produce Calysta’s novel protein ingredients in partnership with Food Carvan. The facility is expected to be operational by the end of 2026.

UAE Protein Ingredients Market Trends

The UAE protein ingredients market is expected to grow at the fastest CAGR from 2025 to 2033. More people are shifting toward high-protein diets to maintain fitness, build muscle, and manage weight, with obesity, diabetes, and lifestyle-related diseases on the rise. The rising health concerns are reflected in the growing demand for protein powders, protein shakes, and functional food, especially among the health-conscious millennial and Gen-Z populations.

Key GCC Protein Ingredients Company Insights

Some key players in the GCC protein ingredients market include ADM, Arla Foods amba, and NZMP.

-

ADM is a player in the agricultural processing and nutrition sector, offering plant-based proteins such as soy, pea, and wheat proteins. The company is focused on innovation, advanced processing solutions, and clean-label solutions to improve the taste, texture, and functions of protein ingredients used across various applications, such as beverages, bakeries, meat substitutes, and dairy alternatives.

Key GCC Protein Ingredients Companies:

- ADM

- DuPont

- Arla Foods amba

- NZMP

Recent Developments

-

In September 2025, Arla Foods launched its protein pudding in Saudi Arabia. This is a high-protein snack with no added sugar and helps satisfy people with a sweet tooth.

-

In August 2024, NUOS, a Swiss alternative protein producer, announced a partnership with Abu Dhabi Growth Fund to establish an advanced facility for producing alternative protein at scale.

GCC Protein Ingredients Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 800.4 million

Revenue forecast in 2033

USD 1,120.5 million

Growth rate

CAGR of 4.3% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD Million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, application

Key companies profiled

ADM, DuPont, Arla Foods amba, NZMP

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global GCC Protein Ingredients Market Report Segmentation

This report forecasts revenue growth at the regional and country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the GCC protein ingredients market report based on product type, and application:

-

Product Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Plant Protein

-

Cereals

-

Wheat

-

Wheat Protein Concentrates

-

Wheat Protein Isolates

-

Textured Wheat Protein

-

Hydrolyzed Wheat Protein

-

HMEC/HMMA Wheat Protein

-

-

Rice

-

Rice Protein Isolates

-

Rice Protein Concentrates

-

Hydrolyzed Rice Protein

-

Others

-

-

Oats

-

Oat Protein Concentrates

-

Oat Protein Isolates

-

Hydrolyzed Oat Protein

-

Others

-

-

-

Legumes

-

Soy

-

Soy Protein Concentrates

-

Soy Protein Isolates

-

Textured Soy Protein

-

Hydrolyzed Soy Protein

-

HMEC/HMMA Soy Protein

-

-

Pea

-

Pea Protein Concentrates

-

Pea Protein Isolates

-

Textured Pea Protein

-

Hydrolyzed Pea Protein

-

HMEC/HMMA Pea Protein

-

-

Lupine

-

Chickpea

-

Others

-

-

Roots

-

Potato

-

Potato Protein Concentrate

-

Potato Protein Isolate

-

-

Maca

-

Others

-

-

Ancient Grains

-

Hemp

-

Quinoa

-

Sorghum

-

Amaranth

-

Chia

-

Others

-

-

Nuts & Seeds

-

Canola

-

Almond

-

Flaxseeds

-

Others

-

-

-

Animal/Dairy Protein

-

Egg Protein

-

Milk Protein Concentrates/Isolates

-

Whey Protein Concentrates

-

Whey Protein Hydrolysates

-

Whey Protein Isolates

-

Gelatin

-

Casein/Caseinates

-

Collagen Peptides

-

-

Microbe-based Protein

-

Algae

-

Bacteria

-

Yeast

-

Fungi

-

-

Insect Protein

-

Coleoptera

-

Lepidoptera

-

Hymenoptera

-

Orthoptera

-

Hemiptera

-

Diptera

-

Others

-

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Food & Beverages

-

Bakery & Confectionary

-

Beverages (Non-Dairy Alternatives)

-

Breakfast Cereals

-

Dairy Alternatives

-

Beverages

-

Cheese

-

Snacks

-

Others

-

-

Dietary Supplements/Weight Management

-

Meat Alternatives & Extenders

-

Poultry

-

Beef

-

Pork

-

Others

-

-

Snacks (Non-Dairy Alternatives)

-

Sports Nutrition

-

Others

-

-

Infant Formulations

-

Clinical Nutrients

-

Animal Feed

-

Others

-

-

Country Outlook (Revenue, USD Million, 2021 - 2033)

-

Saudi Arabia

-

UAE

-

Bahrain

-

Kuwait

-

Oman

-

Qatar

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.