- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Insect Protein Market Size, Share And Growth Report, 2030GVR Report cover

![Insect Protein Market Size, Share & Trends Report]()

Insect Protein Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Coleoptera, Lepidoptera, Hymenoptera, Orthoptera, Hemiptera, Diptera), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-157-3

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Insect Protein Market Summary

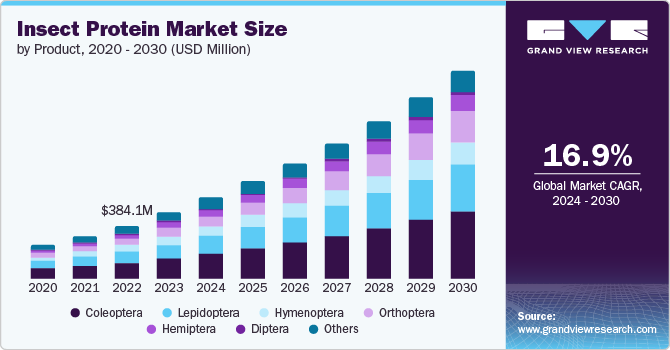

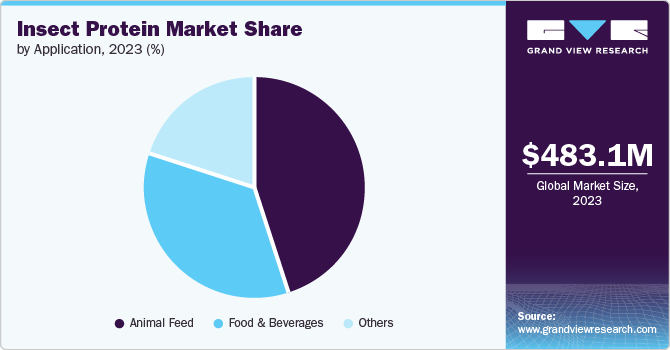

The insect protein market size was estimated at USD 483.1 million in 2023 and is projected to reach USD 1.51 billion by 2030, growing at a CAGR of 16.9% from 2024 to 2030. This growth is attributed to increasing awareness of sustainable and eco-friendly protein alternatives, driven by environmental concerns and a push for reducing carbon footprints in food production.

Key Market Trends & Insights

- The insect protein market in North America is expected to grow at a CAGR of 16.0% from 2024 to 2030.

- The U.S. insect protein market is expected to grow at a CAGR of 15.9% from 2024 to 2030.

- By product, in 2023, the coleoptera segment held a revenue share of more than 30% in the global market.

- By application, the food and beverage segment is expected to grow at a CAGR of 18.5% from 2024 to 2030.

Market Size & Forecast

- 2023 Market Size: USD 483.1 Million

- 2030 Projected Market Size: USD 1.51 Billion

- CAGR (2024-2030): 16.9%

- Europe: Largest market in 2023

In addition, advancements in regulatory frameworks and technological innovations are facilitating the incorporation of insect proteins in various applications, including animal feed, pet food, and human nutrition. The surge in insect protein demand is primarily driven by the growing demand for sustainable protein sources as traditional animal farming faces scrutiny over its environmental impact.

Insect farming requires significantly less land, water, and feed than conventional livestock, making it a highly efficient alternative. Consumers increasingly seek eco-friendly and nutritionally rich protein options, pushing companies to innovate. For example, Protix, a leading European company, specializes in producing insect-based ingredients for animal feed and human consumption, emphasizing sustainability and reducing carbon emissions. Furthermore, governments and regulatory bodies are starting to acknowledge the potential of insect proteins, with regions like the European Union approving certain insect species for human consumption, thus presenting new market growth opportunities.

Despite its promising potential, the market faces several significant challenges that could hinder its growth. One of the foremost obstacles is consumer acceptance. In many Western cultures, the idea of consuming insects is still met with skepticism and cultural aversion, which slows the adoption of insect-based products.

Industry Dynamics

The market growth stage is high, and the pace of the market is accelerating. Technological advancements and product innovation are crucial in propelling the market forward, enhancing production efficiency and product quality. Innovations in automation and biotechnology are revolutionizing how insects are farmed and processed.

Companies like Ynsect are at the forefront, utilizing vertical farming and AI to optimize breeding, feeding, and harvesting processes. This approach increases yield and ensures consistency in protein content and quality.

Regulatory support is crucial for insect protein products like Diptera-based protein products. Governments and international bodies are working on setting standards and regulations to ensure the safety and quality of insect-derived proteins. These regulatory frameworks are expected to boost consumer acceptance and trust in Diptera-based products.

Despite its rising potential as a sustainable and nutritious food source, the market faces significant competition from several established and emerging protein substitutes. Traditional protein sources like soy and pea proteins dominate the plant-based protein sector due to their well-established supply chains, consumer familiarity, and broader acceptance. Other innovative protein sources, such as algae and fungi-based proteins, are also gaining traction due to their scalability and nutritional benefits. These alternatives pose a competitive challenge by appealing to health-conscious and environmentally aware consumers who might otherwise be potential adopters of insect protein.

Product Insights

In 2023, the Coleoptera segment held a revenue share of more than 30% in the global market. Coleoptera, commonly known as beetles, are emerging as a promising source of insect protein. Beetle larvae, particularly mealworms, are rich in protein and essential nutrients, making them a highly nutritious food source. The environmental benefits of beetle farming, such as low greenhouse gas emissions and minimal land use, are significant drivers for their adoption. As the global population grows and the demand for sustainable protein sources increases, Coleoptera-based protein is gaining traction in the food industry.

The orthoptera segment is projected to grow at a CAGR of 19.8% from 2024 to 2030. Orthoptera, which includes grasshoppers and crickets, is rapidly gaining traction as a high-protein, sustainable food source. Known for their high protein content and nutritional benefits, these insects provide a complete amino acid profile, making them an excellent alternative to traditional animal proteins. The ease of farming and low environmental impact contribute to their growing popularity.

Application Insights

Animal feed is one of the prominent applications of insect proteins. The demand for insect protein in animal feed is projected to account for more than 40% of the global revenue in 2023. This significant demand is mainly due to the rising need for sustainable and nutrient-rich alternatives to traditional feed sources like soy and fishmeal. Insect proteins, especially from species like black soldier flies and mealworms, offer high-quality amino acids and essential nutrients, making them ideal for aquaculture, poultry, and pet food industries. In addition, insect protein production is environmentally friendly, utilizing organic waste and requiring less land and water, which aligns with the growing emphasis on sustainability in agriculture.

The food and beverage segment is expected to grow at a CAGR of 18.5% from 2024 to 2030. As traditional protein sources face scrutiny over their environmental impact, insect proteins are emerging as a viable alternative due to their high nutritional value and significantly lower ecological footprint. Brands like Chapul and EXO lead the charge in integrating insect proteins into mainstream products, offering protein bars and powders made from crickets.

Regional Insights

The insect protein market in North America is expected to grow at a CAGR of 16.0% from 2024 to 2030. North American food giants are investing in insect ingredient production. For instance, in partnership with Protix, Tyson Foods is addressing sustainability challenges in animal protein production while capitalizing on the rising demand for alternative protein sources. This partnership facilitates the efficient utilization of animal waste and positions both companies to meet increasing consumer and industry demands for sustainable solutions.

U.S. Insect Protein Market Trends

The U.S. insect protein market is expected to grow at a CAGR of 15.9% from 2024 to 2030. This robust growth is primarily driven by increasing recognition of insects as a sustainable protein source for animal feed and pet food industries. Major U.S.-based companies like Tyson Foods have invested in insect protein production, focusing initially on pet food and animal feed applications rather than direct human consumption.

Europe Insect Protein Market Trends

The insect protein market in Europe accounted for the largest revenue share of over 36.81% in 2023 and is expected to grow at a CAGR of 16.8% from 2024 to 2030. The regulatory support, coupled with increasing consumer awareness of sustainability and health benefits associated with insect protein, is expected to propel demand and innovation within the regional market, positioning it as a leader in sustainable protein solutions. The European Union’s approval in 2021 to use insect protein in feed for chickens and pigs, which is already permitted for farmed fish, has further catalyzed market expansion by fostering regulatory acceptance and encouraging adoption across agricultural sectors.

Key Insect Protein Company Insights

The market is moderately fragmented. Key market participants, such as AgriProtein and Ynsect, are scaling up their operations to meet the demand for insect proteins, offering innovative solutions that reduce the ecological footprint of animal feed production. Key players like Protix, Ynsect, and Enterra are pioneering advancements in farming technologies and expanding production capacities to meet growing demand. Protix, based in the Netherlands, collaborates with partners like Tyson Foods to scale operations and develop sustainable insect-based feed solutions. Enterra, based in Canada, specializes in transforming organic waste into insect-based protein and oils, catering to agricultural and aquaculture industries. These companies drive innovation through research, partnerships, and regulatory advancements, positioning themselves at the forefront of market competition.

Key Insect Protein Companies:

The following are the leading companies in the insect protein market. These companies collectively hold the largest market share and dictate industry trends.

- Ynsect

- Protix

- AgriProtein

- EnviroFlight

- Hexafly

- Innovafeed

- Beta Hatch

- Entomo Farms

- Entobel

- nextProtein

Recent Developments

-

In October 2023, Tyson Foods, a leading U.S. meat producer, announced an investment in Protix, a Netherlands-based company specializing in insect ingredients. This partnership includes establishing a U.S. factory utilizing animal waste to cultivate black soldier flies. These insects are processed into feed for pets, poultry, and fish. However, Tyson Foods clarified that their efforts primarily focus on using insect protein as an ingredient rather than directly for human consumption

-

In 2023, Innovafeed launched a new brand to leverage insects' potential in aquaculture and monogastric nutrition. Their new product line includes insect oil tailored for aquaculture and insect protein designed for monogastric animals, expanding their portfolio to address sustainable protein needs across different animal farming sectors

Insect Protein Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 591.6 million

Revenue forecast in 2030

USD 1.51 billion

Growth rate

CAGR of 16.9% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, volume in metric tons, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; Italy; UK; China; Japan; India; Australia & New Zealand; Brazil; South Africa

Key companies profiled

Ynsect; Protix; AgriProtein; EnviroFlight; Hexafly; Innovafeed; Beta Hatch; Entomo Farms; Entobel; nextProtein

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Insect Protein Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the insect protein market report based on product, application, and region:

-

Product Outlook (Volume, Metric Tons; Revenue, USD Million, 2018 - 2030)

-

Coleoptera

-

Lepidoptera

-

Hymenoptera

-

Orthoptera

-

Hemiptera

-

Diptera

-

Others

-

-

Application Outlook (Volume, Metric Tons; Revenue, USD Million, 2018 - 2030)

-

Food & Beverages

-

Animal Feed

-

Others

-

-

Regional Outlook (Volume, Metric Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global insect protein market size was estimated at USD 483.1 million in 2023 and is expected to reach USD 591.6 million in 2024.

b. The global insect protein market is expected to grow at a compound annual growth rate of 16.9% from 2024 to 2030 to reach USD 1.51 billion by 2030.

b. Europe held a significant share of 36.8% of the overall market revenue in 2023 due to increasing regulatory support and rising consumer awareness of the sustainability benefits of insect protein.

b. Some of the key players operating in the insect protein market include Ynsect, Protix, AgriProtein, EnviroFlight, Hexafly, Innovafeed, Beta Hatch, Entomo Farms, Entobel, and nextProtein.

b. Key factors that are driving the demand for increasing awareness of sustainable and eco-friendly protein alternatives, advancements in regulatory frameworks, and technological innovations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.