- Home

- »

- Specialty Polymers

- »

-

GCC Specialty Chemicals Market Size Report, 2020-2027GVR Report cover

![GCC Specialty Chemicals Market Size, Share & Trends Report]()

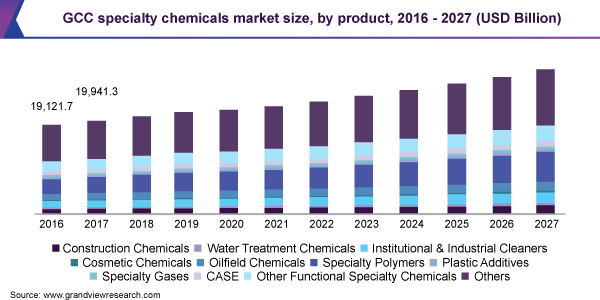

GCC Specialty Chemicals Market Size, Share & Trends Analysis Report By Product (Construction Chemicals, Industrial & Institutional Cleaners, Oilfield Chemicals, Specialty Polymers), And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68038-722-3

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Specialty & Chemicals

Report Overview

The GCC specialty chemicals market size was estimated to be more than USD 21.8 billion in 2019 and is expected to expand at a compound annual growth rate (CAGR) of more than 4.5% between 2020 and 2027. Growing investments in construction, oil and gas, and the automotive sector is likely to be the primary market growth driver. Grand construction projects in line across the GCC countries such as smart city projects including NEOM are likely to fuel the product demand in the near future. In terms of product type, specialty polymers, oil field chemicals, construction chemicals, industrial and institutional cleaners are expected to collectively hold the majority revenue share in the market. Saudi Arabia and UAE with significant proven reserves of oil and major upcoming construction projects are anticipated to pose significant opportunities for growth to the market in the near future.

Rising focus of the governments across GCC region on economic diversification in order to reduce their reliance on oil revenue is expected to create ample opportunities for other segments including personal care and cosmetics, industrial and institutional cleaners, textile chemicals, and food additives.

The demand for specialty chemicals is expected to grow at a steady pace owing to the expanding oil and gas and building and construction sectors in the region. These are some of the prominent end-users of the products and therefore, their growth is expected to drive the demand and the GCC specialty chemicals market in the forthcoming years.

Specialty chemicals are used in oil and gas sector for performance enhancement and improvement in production efficiency. Demulsifiers and corrosion inhibitors are some of the dominant product categories used in oil and gas end-use. Furthermore, the significant refining capacity of the GCC countries is likely to add on to the demand for oilfield chemicals.

Product Insights

The others segment held the largest share of around 40% in 2019 and is anticipated to continue holding the leading revenue share over the forecast period. The rapid growth of construction industry, driven by the intensive oil and gas investments, upcoming infrastructural projects, urban development, and utility is expected to create noteworthy demand for construction and building chemicals. According to the Global Infrastructure Hub, in the last five years (2014 to 19) the UAE recorded a total private infrastructure investment of more than USD 9,600 million.

Expanding population along with increasing rate of urbanization has driven the demand for automobiles. In addition, the expanding consumer base expected to translate into higher demand for vehicles and automotive parts. Furthermore, favorable tax structure, excluding special consumption tax, luxury tax, and value-added tax, coupled with fuel availability at competitive prices has resulted in a relatively inexpensive and increased purchasing of cars. Recent allowance of women driving in Saudi Arabia is likely to add to the car fleet size on road. These factors are expected to project a positive scenario for specialty chemicals from polymers, catalysts and CASE in the near future.

The global energy market faces a high degree of uncertainty on account of the COVID-19 outbreak and related containment measures taken. The plunge in demand for oil, tumbling oil prices, decrease in rig count, and investments in oil and gas sector are expected to leave the industry broken and have been a crucial challenge faced by oil and gas manufacturers of GCC. The price war between Saudi Arabia and Russia, after the OPEC supply pact fell apart, led to a significant decline in oil prices. The further fall in U.S. crude oil prices to minus USD 37 on April 20, 2020, which was the biggest fall in the history, owing to lack of inventories to store excess oil is further anticipated to have a negative impact on the economies of GCC countries, which is expected to restrain the market growth.

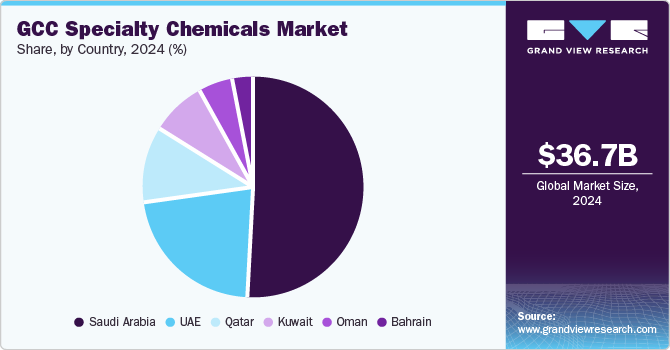

Country Insights

Saudi Arabia holds a prominent share of oil reserves in the whole of GCC and 17.2% of the global share in 2019. This projects several opportunities for growth to the specialty chemicals from the oil & gas industry of the country. Besides these, the country also projects opportunities from other industries including automotive, personal care and cosmetics, and electrical & electronics among others after the launch of Vision 2030, which aims at diversifying the country’s economy. A grand automotive cluster under development in the Jubail city of Saudi Arabia is likely to boost the demand for specialty chemicals from automotive and transportation. Under Vision 2030, the implementation of certain reforms such as energy price reform, VAT, and expat levy are likely to boost the country’s economy and propel market growth.

The introduction of megaprojects and the execution of Private Sector Stimulus Package (PSSP) are expected to have a positive impact on the country’s industries in 2020. Building and construction is one of the outperforming sectors of Saudi Arabia that witnessed growth of 1.3%, 4.9% and 4.6% y-o-y growth in the first three quarters of 2019.

Some of the megaprojects of building and construction include the USD 500 billion NEOM project, for the development of new smart city in the northwest region of the country. This is likely to create several opportunities for specialty chemicals in the near future, as they are reported to be more environment-friendly, cost-effective, and high-performing. Further, the world’s largest pipeline project worth USD 1.1 billion of Saudi Arabia is expected to increase the demand for specialty coatings, polymers, specialty functional, and specialty construction chemicals among others.

The growth of specialty chemicals market in other GCC countries namely UAE, Bahrain, Kuwait, Oman, and Qatar is mainly driven by the expansion of oil and gas, construction and automotive industries. Compared to all GCC countries, UAE has the most diversified economy and thus projects lucrative opportunities in terms of application across varied end uses. These opportunities are boosted further by the future construction projects in line, Jumeirah Garden City, Al Maktoum International Airport, and Dubai Creek Harbour to name a few.

Technological advancements and recent developments such as the discovery of the Khalij al-Bahrain field in Bahrain and the application of advanced recovery techniques for increasing natural gas production in Oman are likely to create the demand in the near future. In terms of economic diversification, infrastructure development is one of the prime focus in Bahrain, which will drive the demand for specialty construction chemicals.

Key Companies & Market Share Insights

Increasing number of joint ventures or associations with international companies, business integration, long-term agreements and production expansion are some of the key developmental steps among the market players. Through partnership or joint-venture route, several international construction companies are entering into the market. Numerous new construction projects lined up in GCC have increased the competition as well as opened up new opportunities for domestic as well as international construction companies. These opportunities include economical energy resources and ease of doing business amongst others. Further, new FDI norms allowing international companies have a dominant share of ownership is likely to attract several other players.

The market has witnessed acquisitions by manufacturers/ distributors/ end users in attempts to achieve higher benefits from integrated business operations or to increase regional penetration. Long-term agreements are expected to help players sustain business operations for a longer duration and mark their positions in the market. Further, it is likely to ensure interrupted supply and reduce vulnerability to price fluctuations. With the rising popularity of specialty chemicals in different end-uses, manufacturers’ interests into the market have increased. New specialty chemical manufacturing facilities are opening up in the region and driving the market expansion. Some of the prominent players operating in the GCC specialty chemicals market are:

-

Arkema Chemicals Saudi Arabia

-

EVONIK GULF FZE

-

Fayfa Chemical Factory (L.L.C.)

-

Halliburton

-

Horizon Chemicals

-

Huntsman (UAE) FZE

-

Professional Specialty Chemicals Factory (Ahmad Al Amoudi Group)

-

SABIC

-

Sadara Chemical Company

-

Sika Group

-

Tricom LLC

GCC Specialty Chemicals Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 22.3 Billion

Revenue forecast in 2027

USD 31.0 Billion

Growth Rate

CAGR of 4.5% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Revenue in USD Million and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, country

Regional scope

GCC

Country scope

Saudi Arabia; UAE; Kuwait; Oman; Qatar; Bahrain

Key companies profiled

Horizon Chemicals; Professional Specialty Chemicals Factory (Ahmad Al Amoudi Group); SABIC; Sika Group; EVONIK GULF FZE; Huntsman (UAE) FZE; Arkema Chemicals Saudi Arabia; Halliburton; Sadara Chemical Company; Fayfa Chemical Factory (L.L.C.); Tricom LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the GCC specialty chemicals market report on the basis of product and country:

-

Product Outlook (Revenue, USD Million, 2016 - 2027)

-

Specialty Polymers

-

Specialty Gases

-

Institutional & Industrial Cleaners

-

Electronic Chemicals

-

Rubber Processing Chemicals

-

Flavors & Fragrances

-

Construction Chemicals

-

Food & Feed Additives

-

Cosmetic Chemicals

-

Oilfield Chemicals

-

Mining Chemicals

-

Pharmaceutical & Nutraceutical Additives

-

Plastic Additives

-

Printing Inks

-

CASE (Coatings, Adhesives, Sealants & Elastomers)

-

Specialty Pulp & Paper Chemicals

-

Specialty Textile Chemicals

-

Catalysts

-

Water Treatment Chemicals

-

Corrosion Inhibitors

-

Flame Retardants

-

Others

-

-

Country Outlook (Revenue, USD Million, 2016 - 2027)

-

Saudi Arabia

-

UAE

-

Kuwait

-

Oman

-

Qatar

-

Bahrain

-

Frequently Asked Questions About This Report

b. The global GCC specialty chemicals market size was estimated at USD 21.8 billion in 2019 and is expected to reach USD 22.3 billion in 2020.

b. The global GCC specialty chemicals market is expected to grow at a compound annual growth rate of 4.5% from 2020 to 2027 to reach USD 31 billion by 2027.

b. Saudi Arabia dominated the GCC Specialty Chemicals market with a share of 70.5% in 2019. This is attributable to grand automotive cluster under development in the Jubail city of Saudi Arabia is likely to boost the demand of specialty chemicals from automotive and transportation. Under Vision 2030.

b. Some key players operating in the GCC Specialty Chemicals market include Horizon Chemicals, Professional Specialty Chemicals Factory (Ahmad Al Amoudi Group), SABIC, Sika Group, EVONIK GULF FZE, Huntsman (UAE) FZE, Arkema Chemicals Saudi Arabia, Halliburton, Sadara Chemical Company, Fayfa Chemical Factory (L.L.C.), and Tricom LLC.

b. Key factors that are driving the market growth include increasing investments in construction, oil & gas, and automotive sector coupled with government focus towards economic diversification for reducing their reliance on oil revenue is expected to create ample opportunities for other segments including personal care & cosmetics, industrial & institutional cleaners, textile chemicals and food additives among others.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."