- Home

- »

- Biotechnology

- »

-

Gene Synthesis (Research-use) Market Size Report, 2033GVR Report cover

![Gene Synthesis (Research-use) Market Size, Share & Trends Report]()

Gene Synthesis (Research-use) Market (2025 - 2033) Size, Share & Trends Analysis Report By Method (Solid-phase Synthesis, Chip-based Synthesis), By Service (Antibody DNA Synthesis), By Application, By End Use, By Research Phase, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-114-3

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Gene Synthesis (Research-use) Market Summary

The global gene synthesis (research-use) market size was estimated at USD 2.09 billion in 2024 and is projected to reach USD 8.39 billion by 2033, growing at a CAGR of 16.8% from 2025 to 2033. The surging investment by players in the synthetic biology field and supportive government laws & rules are expected to propel market growth.

Key Market Trends & Insights

- North America gene synthesis (research-use) market held the largest share of 36.80% of the global market in 2024.

- The gene synthesis (research-use) industry in the U.S. is expected to grow significantly over the forecast period.

- By method, the PCR-based g segment held the largest market share in 2024.

- By services, the antibody DNA synthesis segment dominated with the market share of 61.48% in 2024.

- By application, the gene & cell therapy development segment held the largest market share of 58.27% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.09 Billion

- 2033 Projected Market Size: USD 8.39 Billion

- CAGR (2025-2033): 16.8%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Moreover, technological advances in gene synthesis procedures & techniques are also boosting the service demand over the forecast period. For instance, in April 2022, GenScript, a provider of life science research tools and services, announced the launch of the most advanced semiconductor chip for DNA synthesis in the field. This chip provides the highest throughput.

Technological Advancements Driving Faster and Cost-Efficient Gene Synthesis

Advancements in synthetic biology technologies are significantly transforming the gene synthesis (research-use) landscape, enabling faster, more accurate, and cost-efficient DNA synthesis processes. Continuous improvements in automation, error correction, and next-generation sequencing (NGS) integration have enhanced the precision and scalability of synthetic gene construction. These developments have substantially reduced turnaround times, allowing researchers to design and synthesize complex gene sequences within shorter timeframes. Moreover, the integration of AI-driven design tools and cloud-based bioinformatics platforms has streamlined workflow efficiency, further accelerated research timelines and reducing costs associated with manual interventions.

The adoption of high-throughput synthesis platforms and enzymatic DNA assembly methods has further strengthened production capabilities, enabling large-scale synthesis of genes for various research applications, including genomics, synthetic biology, and protein engineering. These technological innovations have not only improved synthesis accuracy but have also minimized contamination risks and material wastage. As a result, research institutions and biotechnology companies are increasingly leveraging these advancements to support pre-clinical studies, target validation, and the development of advanced therapeutic candidates such as mRNA vaccines and gene therapies.

Furthermore, ongoing R&D efforts aimed at enhancing the efficiency and affordability of gene synthesis technologies are expected to drive market expansion over the forecast period. The growing collaboration between academic institutions, private companies, and government research agencies is fostering the development of next-generation synthesis platforms capable of producing longer DNA fragments with higher fidelity. As the demand for customized genetic constructs continues to rise across applications in synthetic biology, diagnostics, and precision medicine, advancements in synthetic biology technologies are likely to remain a key driver supporting sustainable growth in the global gene synthesis (research-use) market.

Rising Research Investments and Expanding Applications in Biotechnology

The increasing investment in biotechnology and life sciences research is a major driver of the gene synthesis (research-use) market. Governments and private organizations across both developed and emerging economies are allocating significant funding to genomic research, synthetic biology, and precision medicine initiatives. These investments are accelerating innovation in gene design, molecular diagnostics, and therapeutic development, fostering the adoption of gene synthesis technologies in academic, pharmaceutical, and biotech research.

Moreover, the expanding application scope of gene synthesis in areas such as vaccine development, enzyme engineering, and genetic circuit design is fueling market demand. The ability to rapidly generate tailored gene sequences is enabling researchers to explore novel biological pathways and develop targeted interventions for various diseases. As biotechnology research continues to evolve, increasing R&D expenditure and the diversification of gene synthesis applications are expected to remain key growth drivers for the global market.

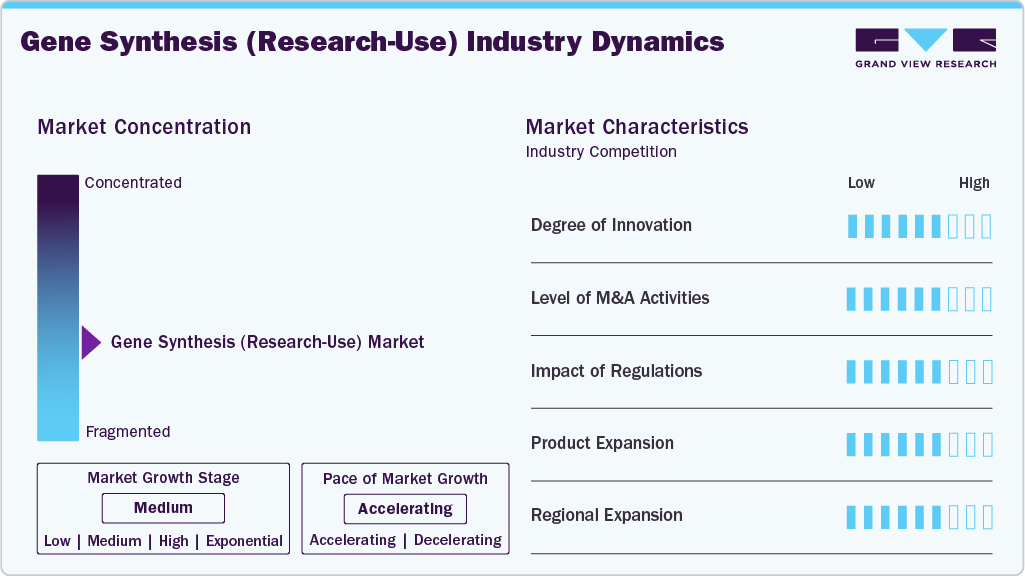

Market Concentration & Characteristics

The gene synthesis (research-use) industry exhibits a high level of innovation, driven by continuous advancements in automation, AI-assisted gene design, and error-correction technologies. Ongoing R&D efforts aimed at improving synthesis accuracy, scalability, and turnaround time are further enhancing the industry’s capability to support cutting-edge research in genomics, synthetic biology, and precision medicine.

The gene synthesis (research-use) industry reflects moderate M&A activities, primarily driven by companies seeking to expand their technological capabilities, global footprint, and service portfolios. Strategic acquisitions are focused on integrating advanced synthesis platforms, strengthening bioinformatics expertise, and enhancing end-to-end research solutions to meet growing demand across biotechnology, pharmaceutical, and academic research sectors.

Regulations play a crucial role in the gene synthesis (research-use) industry by biosafety, ethical compliance, and the responsible use of synthetic genetic materials. They establish standards for sequence screening, data security, and material handling to prevent misuse and maintain research integrity. In addition, regulatory frameworks promote transparency and support international collaboration in synthetic biology research.

Product expansion in the gene synthesis (research-use) industry is driven by growing demand for customized DNA constructs, advancements in synthesis technologies, and the increasing adoption of synthetic genes across diverse research applications. Companies are continuously broadening their portfolios by introducing high-throughput synthesis services, gene fragments, and optimized vectors to cater to evolving academic and industrial research needs.

Regional expansion in the gene synthesis (research-use) industry is driven by increasing globalization of biotechnology research, rising investments in emerging markets, and the establishment of advanced research infrastructure across developing regions. Companies are expanding their presence through strategic partnerships, local collaborations, and the setup of regional facilities to enhance service accessibility and meet growing global research demand.

Method Insights

PCR-based enzyme synthesis method segment held the largest revenue share of 36.97% in 2024 and is anticipated to grow at the fastest CAGR over the forecast period. The growth of the segment is attributed to the growing adoption of gene synthesis and the limitations involved in the chemical synthesis process. Moreover, the demand for alternative DNA synthesis options has been increasing with the growing applications of synthetic biology in various domains.

The solid-phase synthesis segment is also witnessing considerable growth, driven by ongoing advancements in solid-phase technologies and their expanding applications across various research fields. It can be utilized to create modified & canonical polymers of nucleic acids, especially DNA or RNA. Such factors are expected to drive the segment’s growth over the forecast period.

Services Insights

The antibody DNA synthesis segment maintained a dominant share in 2024, accounting for 61.48 % in terms of revenue. The enormous revenue share of the segment is owing to the effectiveness and efficiency of gene synthesis for the development and production of antibodies. In addition, the presence of advanced technologies for gene synthesis supports market growth. Many participants are offering services for antibody DNA synthesis. These players include Synbio GENEWIZ and GenScript.

The viral DNA synthesis segment is expected to grow at the fastest CAGR of 19.7% during 2025-2033. Several viral DNA synthesis services applications are expected to drive the segment over the forecast period. The significant growth of the segment is due to its ability to construct viral DNA in the lab without relying on an existing virus sample and synthesizing viral genomes helps in understanding gene functions.

Application Insights

The gene & cell therapy development segment held the largest revenue share of 58.27% in 2024, and it is expected to exhibit the fastest CAGR over the forecast period. The growth of the segment can be attributed to various factors, including a number of initiatives undertaken by biotechnology companies to promote gene and cell therapy and the increasing adoption of cell & gene therapies.

The vaccine development segment is anticipated to register a significant CAGR over the forecast period. This growth is driven by the rising demand for synthetic genes in rapid vaccine design, increasing R&D investments in mRNA and DNA-based vaccines, and the growing focus on preparedness for emerging infectious diseases. Moreover, advancements in gene synthesis technologies enabling high-throughput and error-free DNA assembly are further supporting market expansion in this segment. Such factors are expected to drive the segment’s growth over the forecast period.

Research Phase Insights

The clinical segment accounted for the largest revenue share of 76.35% in 2024, and is anticipated to demonstrate the fastest CAGR of 18.0% over the forecast period. The segment's growth is attributed to the increasing number of gene and cell therapy and the rise in clinical trials for advanced therapy. Moreover, gene synthesis plays a crucial role in advancing clinical research by transforming diagnostics and therapeutics.

The pre-clinical is anticipated to register a significant CAGR over the forecast period in the research phase segment. This growth is attributed to the increasing adoption of synthetic genes for early-stage drug discovery, target validation, and toxicology studies. Rising investments by biotechnology and pharmaceutical companies in pre-clinical R&D, coupled with the growing demand for customized gene constructs to accelerate candidate screening, are further driving the segment’s expansion. Such factors are expected to drive the segment’s growth over the forecast period.

End Use Insights

The academic & government research institutions segment dominated the market with a revenue share of 42.13% in 2024. This dominance of these institutions was due to the active engagement of these institutions in research to study model organisms using gene synthesis. The increased flexibility and automation in gene synthesis techniques have made it easier for research laboratories to adopt this technology. Moreover, the presence of universities and research institutions that conduct research activities on synthetic biology & gene synthesis is expected to support the segment growth.

The contract research organization segment is anticipated to register the fastest CAGR of 19.1% from 2025 to 2033. The rising outsourcing practices and the increasing number of biotechnology companies support the segment’s growth. In addition, the growth of the segment is driven by the expansion of services by many contract research organizations, including GenScript and Eurofins.

Regional Insights

North America gene synthesis (research-use) market dominated the respective global market with a share of 36.80% in 2024. A number of major and well-established market participants operate in the region and the development of synthetic biology field in the region propel the market growth. Several key market participants operating in North America include GenScript, Azenta, Inc. (GENEWIZ), Boster Biological Technology, Twist Bioscience, ProteoGenix, Inc, Biomatik, and ProMab Biotechnologies, Inc.

U.S Gene Synthesis (Research-use) Market Trends

The U.S. gene synthesis (research-use) market is highly competitive owing to the presence of market players in the region focus on geographic expansion, technological advancements, and new product launches. For instance, in November 2021, GenScript, a major player in the gene synthesis market, introduced a highly automated gene synthesis center in New Jersey a city in the U.S. This new facility can provide production support to the customers of the U.S. in case of uncertain scenarios, such as pandemics and changes in trade and customs regulations. Such strategies implemented by key players can drive market growth in the region over the forecast period.

Europe Gene Synthesis (Research-use) Market Trends

The Europe gene synthesis (research-use) industry is witnessing steady growth, driven by the rising adoption of synthetic biology tools in academic and commercial research, expanding biotechnology infrastructure, and increasing government funding for genomics and molecular biology studies. Moreover, growing collaborations between research institutes and gene synthesis service providers, along with advancements in automation and error correction technologies, are further accelerating market development across the region.

The UK gene synthesis (research-use) market is well-established, driven by a strong biotechnology ecosystem, advanced research infrastructure, and significant government funding for genomics and life sciences. Continuous innovations in synthetic biology and the presence of leading academic and commercial research institutions further strengthen the country’s market position.

Gene synthesis (research-use) market in Germany is growing, supported by robust investments in biotechnology and genomics research, along with strong collaborations between academia and industry. The country’s advanced laboratory infrastructure and focus on innovation in synthetic biology further contribute to market expansion.

Asia Pacific Gene Synthesis (Research-use) Market Trends

Asia Pacific is expected to showcase the fastest CAGR of 18.2% from 2025 to 2033. The growth of the region is expected due to the growing interest in research activities for synthetic biology and the development of therapeutics. Moreover, major players in the market are focusing on countries in this region. For instance, GenScript, a company in life science research services and tools, expanded its services in Singapore in February 2023. The facility in Singapore aims to provide gene synthesis services with 24-hour technical support for researchers. These factors are anticipated to propel the market demand over the forecast period.

The China gene synthesis (research-use) market is growing rapidly. This is attributed to substantial government funding for biotechnology research, the presence of a large number of gene synthesis service providers and expanding applications in synthetic biology and precision medicine. Additionally, advancements in automation and cost-effective synthesis technologies are further propelling market growth.

Gene synthesis (research-use) market in Japan is growing, owing to the country’s strong focus on genomics research, increasing investments in synthetic biology, and advancements in automation and DNA synthesis technologies. In addition, supportive government initiatives and collaborations between academic institutions and biotechnology companies are further driving market expansion.

MEA Gene Synthesis (Research-use) Market Trends

The Middle East and Africa (MEA) gene synthesis (research-use) industry is emerging, driven by the growing focus on biotechnology and life sciences research, increasing government initiatives to build genomic research capacity, and rising academic collaborations with global institutions. Additionally, expanding investments in healthcare innovation and the gradual establishment of molecular biology laboratories across key countries are supporting the region’s market growth.

The Kuwait gene synthesis (research-use) market is emerging, driven by growing investments in biotechnology research, increasing focus on healthcare innovation, and government initiatives to strengthen scientific research infrastructure. Additionally, collaborations with international research organizations are supporting the development of molecular biology capabilities in the country.

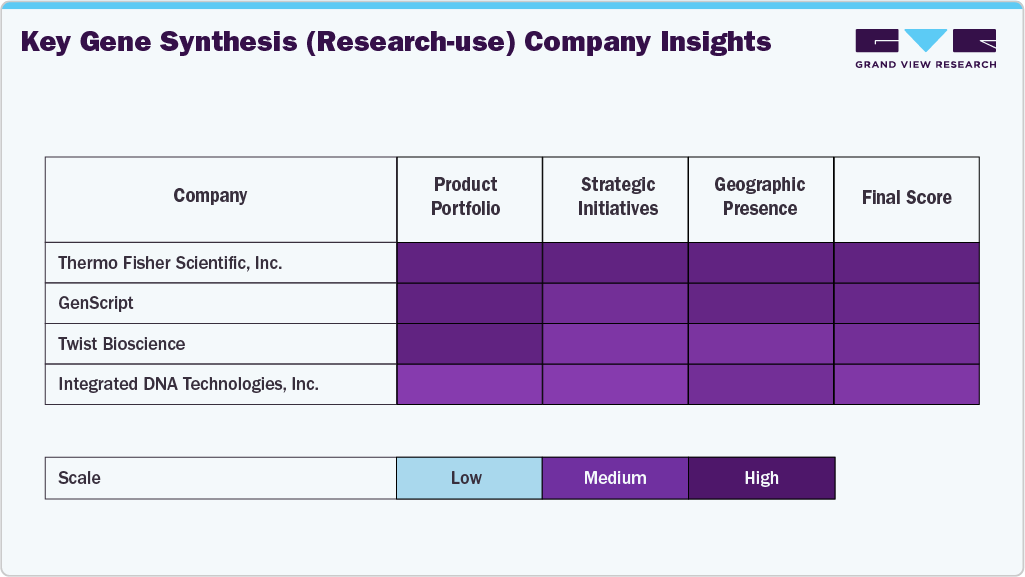

Key Gene Synthesis (Research-use) Company Insights

The gene synthesis (research-use) industry is characterized by the presence of several established players and emerging biotechnology firms actively contributing to market growth through technological innovation and product diversification. Leading companies such as Thermo Fisher Scientific Inc., GenScript Biotech Corporation, Twist Bioscience Corporation, Integrated DNA Technologies (IDT), and Bioneer Corporation dominate the global market owing to their advanced synthesis platforms, broad service offerings, and strong distribution networks. These companies continue to focus on enhancing synthesis accuracy, reducing turnaround time, and expanding their research-use-only product portfolios to strengthen their market position.

Strategic initiatives such as partnerships, mergers and acquisitions (M&A), and regional expansions are common among key market participants. For instance, major players are acquiring smaller firms with specialized expertise in gene editing, oligonucleotide synthesis, or bioinformatics to enhance technological capabilities and accelerate innovation. Collaborations with research institutions and academic laboratories are also on the rise, enabling companies to co-develop advanced gene synthesis tools tailored to specific research applications such as synthetic biology, molecular diagnostics, and vaccine development.

Emerging players are gaining traction by offering cost-effective synthesis solutions and leveraging automation and AI-based platforms to cater to growing demand from small and mid-sized research organizations. This has intensified market competition and encouraged established firms to invest further in R&D and digital transformation. Moreover, several companies are expanding their footprint in high-growth regions such as Asia-Pacific, the Middle East, and Eastern Europe, capitalizing on increasing government funding for genomics and biotechnology research.

Overall, the competitive landscape of the gene synthesis (research-use) market is evolving toward greater innovation, collaboration, and global accessibility. Market leaders are expected to retain dominance through continuous technological advancements and service expansion, while new entrants are likely to capture niche segments through agility and specialization. As research demand for synthetic genes continues to rise, the industry is poised for sustained growth supported by innovation-led strategies and strategic market consolidation.

Key Gene Synthesis (Research-use) Companies:

The following are the leading companies in the gene synthesis (research-use) market. These companies collectively hold the largest market share and dictate industry trends.

- GenScript

- Azenta, Inc. (GENEWIZ)

- Boster Biological Technology

- Twist Bioscience

- ProteoGenix

- Biomatik

- ProMab Biotechnologies, Inc.

- Thermo Fisher Scientific, Inc.

- Integrated DNA Technologies, Inc. (Danaher)

- OriGene Technologies, Inc.

Gene Synthesis (Research-Use) Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.42 billion

Revenue forecast in 2033

USD 8.39 billion

Growth rate

CAGR of 16.8% from 2025 to 2033

Historical data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Method, service, application, research phase, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

GenScript; Azenta, Inc. (GENEWIZ); Boster Biological Technology; Twist Bioscience; ProteoGenix, Inc; Biomatik; ProMab Biotechnologies, Inc.; Thermo Fisher Scientific, Inc.; Integrated DNA Technologies, Inc. (Danaher); OriGene Technologies, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Gene Synthesis (Research-Use) Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, grand view research has segmented the global gene synthesis (research-use) market report based on method, service, application, research phase, end use, and region.

-

Method Outlook (Revenue, USD Million, 2021 - 2033)

-

Solid-phase Synthesis

-

Chip-based Synthesis

-

PCR-based Enzyme Synthesis

-

-

Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Antibody DNA Synthesis

-

Viral DNA Synthesis

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Gene & Cell Therapy Development

-

Vaccine Development

-

Others

-

-

Research Phase Outlook (Revenue, USD Million, 2021 - 2033)

-

Pre-clinical

-

Clinical

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Biotechnology and pharmaceutical companies

-

Academic and government research institutes

-

Contract research organizations

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global gene synthesis (research-use) market size was estimated at USD 2.09 billion in 2024 and is expected to reach USD 2.42 billion in 2025.

b. The global gene synthesis (research-use) market is expected to grow at a compound annual growth rate of 16.81% from 2025 to 2033 to reach USD 8.39 billion by 2033.

b. North America dominated the gene synthesis (research-use) market with a share of 36.80% in 2024. This is attributable to well-established healthcare infrastructure and a large number of end users within the region

b. Some key players operating in the gene synthesis (research-use) market include GenScript; Azenta, Inc. (GENEWIZ); Boster Biological Technology; Twist Bioscience; ProteoGenix, Inc; Biomatik; ProMab Biotechnologies, Inc.; Thermo Fisher Scientific, Inc.; Integrated DNA Technologies, Inc. (Danaher); OriGene Technologies, Inc.

b. Key factors that are driving the market growth include rising investment in synthetic biology market along with advent of enzymatic DNA synthesis process

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.