- Home

- »

- Medical Devices

- »

-

Minimally Invasive Surgical Instruments Market Report, 2030GVR Report cover

![Minimally Invasive Surgical Instruments Market Size, Share & Trends Report]()

Minimally Invasive Surgical Instruments Market (2024 - 2030) Size, Share & Trends Analysis Report By Device (Handheld Instruments, Inflation Devices), By Application (Cardiac, Gastrointestinal), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-609-7

- Number of Report Pages: 114

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Minimally Invasive Surgical Instruments Market Summary

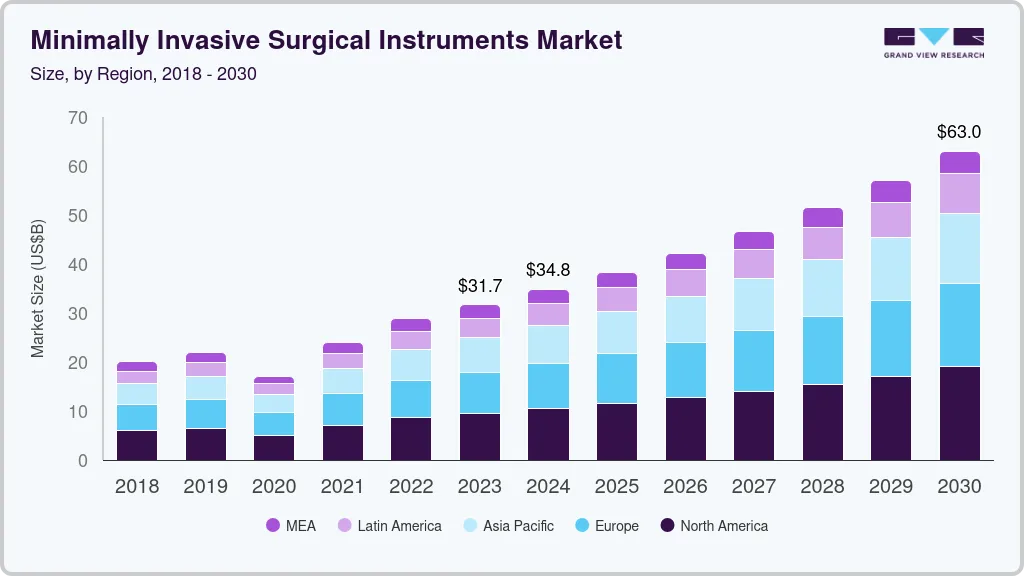

The global minimally invasive surgical instruments market size was estimated at USD 31,650.6 million in 2023 and is projected to reach USD 63,045.5 million by 2030, growing at a CAGR of 10.3% from 2024 to 2030. Surgical robots have revolutionized the field of minimally invasive surgeries (MIS) and their acceptance by the surgeons is rising globally.

Key Market Trends & Insights

- North America dominated the market with a share of 29.9% in 2023.

- By end-use, the hospitals segment captured the largest revenue share of 68.8% in 2023.

- By device, the handheld instruments segment led the market with a revenue share of 22.1% in 2033.

- By application, orthopedics was the largest application segment in 2023 and accounted for a revenue share of 23.6%.

Market Size & Forecast

- 2023 Market Size: USD 31,650.6 Million

- 2030 Projected Market Size: USD 63,045.5 Million

- CAGR (2024-2030): 10.3%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

The cost of MIS procedures is significantly less than in-patient and conventional open surgeries with equal outcomes resulting in a significant increase in value for the patient as well as insurance providers.

This trend is likely to continue in the coming years. Increasing number of new product launches and a growing number of product approvals by several market players for gaining a larger market share are anticipated to create robust growth opportunities for the industry. For instance, in December 2022, Abbott announced the launch of Navitor, an advanced transcatheter aortic valve implantation system. The device has wide application scope in the management of aortic stenosis.

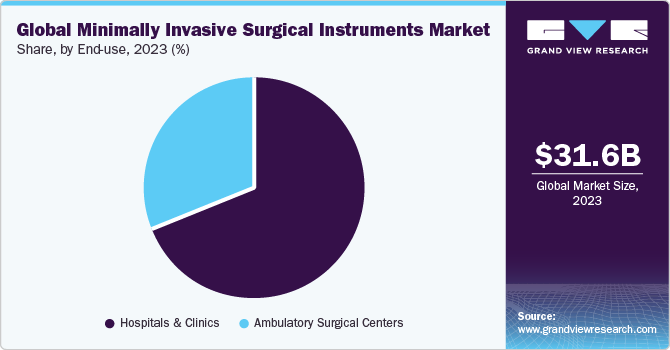

End-use Insights

Based on end-use, the global market is further segmented into hospitals and ambulatory surgical centers (ASCs). The hospitals end-use segment captured the largest revenue share of 68.8% in 2023 owing to an increase in the prevalence of chronic disorders among the elderly population, which led to a rise in the number of hospital admissions for the treatment of chronic ailments.

The ASCs end-use segment is anticipated to witness the fastest growth rate from 2024 to 2030. As per Becker's ASC review published in 2019, there are more than 5,480 Medicare-certified ambulatory surgery centers in the U.S. Thus, the availability of reimbursement policies for ambulatory surgical procedures is also one of the major factors driving segment growth.

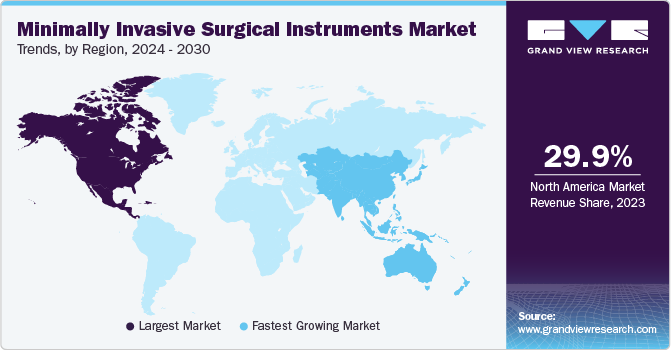

Regional Insights

North America dominated the market with a share of 29.9% in 2023 due to the presence of well-established healthcare infrastructure, favorable government reimbursement policies, and high prevalence of chronic diseases. Asia Pacific is expected to witness the fastest CAGR of 10.8% from 2024 to 2030 owing to improving healthcare infrastructure and increasing government initiatives. Moreover, economic development in countries, such as India and Japan, are expected to contribute to regional market growth.

The presence of a large population pool with low per capita income in this region led to high demand for affordable treatment options. Many multinational companies are planning to invest in developing countries, such as India and China, to strengthen their positions in the overall market. Thus, increasing number of partnerships and strategic alliances is creating lucrative growth opportunities in the regional market.

Market Dynamics Insights

The benefits of MIS procedures in healthcare include minimized patient trauma & discomfort, lower risk of infection, and quicker procedure & recuperation periods, which usually result in reduced healthcare expenditures. The necessity to undertake highly skilled activities utilizing specialized tools with limited visibility along with ranges of motion, on the other hand, introduced higher levels of experience for the surgical team, ranging from endoscopic surgeons & robotic procedure specialists to interventional radiologists. Endoscopic cameras, visualization scanners, nonmagnetic monitoring, specialized devices & catheters, contrast injectors, and pricey robotic systems are examples of support equipment.

Furthermore, minimally invasive surgeries offer numerous benefits compared to open surgery techniques, which is anticipated to fuel market growth. Minimally invasive surgeries offer several advantages including faster recovery time, smaller incisions, reduced scarring & pain, increased accuracy, and shorter hospital stays. Procedures, such as radiofrequency (RF) ablation and laser ablation, are minimally invasive. The rising demand for minimally invasive surgery is expected to aid market growth during the forecast period. Moreover, as the number of newly diagnosed cancer cases decreased considerably during the COVID-19 pandemic, due to fewer screening initiatives undertaken by concerned authorities, there was a significant decline in minimally invasive surgeries in 2020.

The market is constantly transforming based on innovative advancements, especially in the fields of cardiac, orthopedic, ophthalmic, neurological, and oral surgical procedures. The consistent technological advancements in this field offer higher-quality instruments that grant the surgeons to perform surgical interventions effectively without sacrificing patient safety. Improved product designs offer accuracy and level of control in the operating room. As compared to other chronic disorders, the prevalence of heart disorders is increasing worldwide due to lack of physical activity, increased cases of obesity & smoking, poor nutrition, family history, etc.

Other risk factors include diabetes, hypertension, or hyperlipidemia. According to the CDC, about 20.1 million adults aged 20 years and older had coronary artery disease in 2020. People aged 60 years and above are at a high risk of cardiovascular, orthopedic, and neurological diseases. Thus, an increase in the geriatric population is expected to boost the demand for surgical equipment. In addition, a rise in the number of road accidents is another key factor leading to the demand for surgical instruments. Furthermore, an increasing volume of orthopedic surgeries across the globe is leading to a rise in the demand for MIS instruments.

For instance, as per the American Academy of Orthopedic Surgeons, primary hip surgeries (32.7%) and primary knee surgeries (54.4%) were most performed in 2019. Thus, growing prevalence of targeted diseases will create growth opportunities for industry players. Technological advancements in MIS instruments to offer accuracy, portability, and cost-effectiveness are among the factors prompting market players to constantly improve & launch advanced devices. The introduction of novel MIS products is anticipated to boost market growth. Development of novel MIS instruments allowed complex procedures to be performed, which were earlier considered unsuitable for minimally invasive techniques.

New product launches and growing number of product approvals by key companies will create numerous growth opportunities in future. For instance, in December 2020, Abbott launched minimally invasive heart valve repair device, to treat mitral regurgitation, in India. In December 2022, Abbott announced the launch of minimally invasive devices, TAVI, for heart valve treatment, across India.

Device Insights

Based on device, the market is segmented into handheld instruments, cutter instruments, monitoring & visualization devices, inflation devices, guiding devices, electrosurgical devices, and auxiliary devices. In 2023, the handheld instruments segment led the market with a revenue share of 22.1%. Handheld instruments reduce the damage to extraneous tissues, thereby speeding up patient recovery while reducing discomfort & other adverse effects. Most MIS handheld instruments are single-use products.

In addition, handheld devices allow easier access at the time of surgery with instrument triangulation, hence minimizing the risk of potential mistakes. These benefits of handheld instruments are predicted to significantly increase their demand. Furthermore, many companies are launching various handheld instruments, thereby creating strong market position. For instance, in September 2022, Zimmer Biomet announced an agreement with Associates of Surgical Planning to commercialize its mixed reality navigation system, which is FDA approved, for hip replacement.

Application Insights

Based on application, the market is classified into cardiac, gastrointestinal, orthopedic, dental, cosmetic, vascular, thoracic, gynecological, urological, and others. Orthopedics was the largest application segment in 2023 and accounted for a revenue share of 23.6%. Minimally invasive surgery is typically utilized in knee and hip replacement procedures. Hospitals and surgeons prefer surgical procedures that have fewer operative and postoperative complications, as well as reduced hospitalization periods. On the other hand, patients seek surgical treatments that reduce trauma and facilitate speedy recovery.

Rising incidence of stomach cancer, obesity, and type 2 diabetes mellitus is the key factor anticipated to drive the demand for gastrointestinal surgeries. The mortality rate due to stomach cancer is the highest in several countries. On the other hand, obesity is becoming a major health concern with over 400,000 people suffering from morbid obesity. Surgical intervention helps reduce the morbidity and mortality associated with morbid obesity. It also helps improve the quality of life. Thus, demand for gastrointestinal surgery is expected to increase significantly over the forecast period.

Key Companies & Market Share Insights

Most market players have strong collaborations with manufacturers and suppliers to ensure uninterrupted global supply. Many companies are involved in strategic partnerships and mergers & acquisitions as their global strategies. For instance, in February 2023, Encision Inc. signed a Proof of Concept Services Agreement with Vicarious Surgical Inc. The Vicarious surgical robot design plans to boost precision, control, and visualization of instruments in robotic-assisted minimally invasive surgery. Also, in November 2022, New View Surgical, Inc. announced the closure of USD 12.1M Series to fund the commercialization of VisionPort System.

Key Minimally Invasive Surgical Instruments Companies:

- Medtronic

- Siemens Healthineer AG

- Ethicon, Inc. (Johnson & Johnson)

- Depuy Synthes

- GE Healthcare

- Abbott Laboratories

- Intutive Surgical, Inc.

- Nuvasive, Inc.

- Zimmer Biomet

Minimally Invasive Surgical Instruments Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 34.81 billion

Revenue forecast in 2030

USD 63.0 billion

Growth rate

CAGR of 10.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

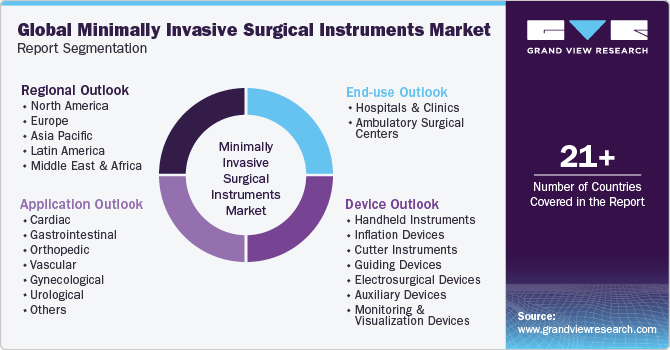

Segments covered

Device, end-use, application, region

Regional Scope

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway China; Japan; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Medtronic; Siemens; Healthineer AG; Ethicon, Inc. (Johnson & Johnson); Depuy Synthes; GE Healthcare; Abbott Laboratories; Intutive Surgical, Inc.; Nuvasive, Inc.; Zimmer Biomet

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Global Minimally Invasive Surgical Instruments Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global minimally invasive surgical instruments market report on the basis of device, application, end-use, and region:

-

Device Outlook (Revenue, USD Million, 2018 - 2030)

-

Handheld Instruments

-

Inflation Devices

-

Cutter Instruments

-

Guiding Devices

-

Electrosurgical Devices

-

Auxiliary Devices

-

Monitoring & Visualization Devices

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiac

-

Gastrointestinal

-

Orthopedic

-

Vascular

-

Gynecological

-

Urological

-

Thoracic

-

Cosmetic

-

Dental

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Ambulatory Surgical Centers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global minimally invasive surgical instruments market size was estimated at USD 31.65 billion in 2023 and is expected to reach USD 34.81 billion in 2024.

b. The global minimally invasive surgical instruments market is expected to grow at a compound annual growth rate of 10.4% from 2024 to 2030 to reach USD 63.0 billion by 2030.

b. North America dominated the minimally invasive surgical instruments market with a share of 29.9% in 2023. This is attributable to the high rate of accidental injuries and the large geriatric population.

b. Some key players operating in the minimally invasive surgical instruments market include Medtronic, Stryker, Smith & Nephew, Abbott, NuVasive, Inc., CONMED, Zimmer Biomet, Intuitive Surgical, Inc.

b. Key factors driving the minimally invasive surgical instruments market growth include cost-effectiveness of the procedure, improved adoption among geriatric patients, and reduction in recovery time.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.