- Home

- »

- Next Generation Technologies

- »

-

Generative AI In Animation Market Size, Industry Report 2033GVR Report cover

![Generative AI In Animation Market Size, Share & Trends Report]()

Generative AI In Animation Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (GANs, VAEs, Transformers), By Component (Solutions, Services), By End-use (Advertising, Movie Production, Gaming), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-327-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Generative AI In Animation Market Summary

The global generative AI in animation market size was estimated at USD 652.1 million in 2024 and is projected to reach USD 13,386.5 million by 2033, growing at a CAGR of 39.8% from 2025 to 2033. The scalability and quality improvements offered by generative AI in animation are transformative factors propelling its market growth.

Key Market Trends & Insights

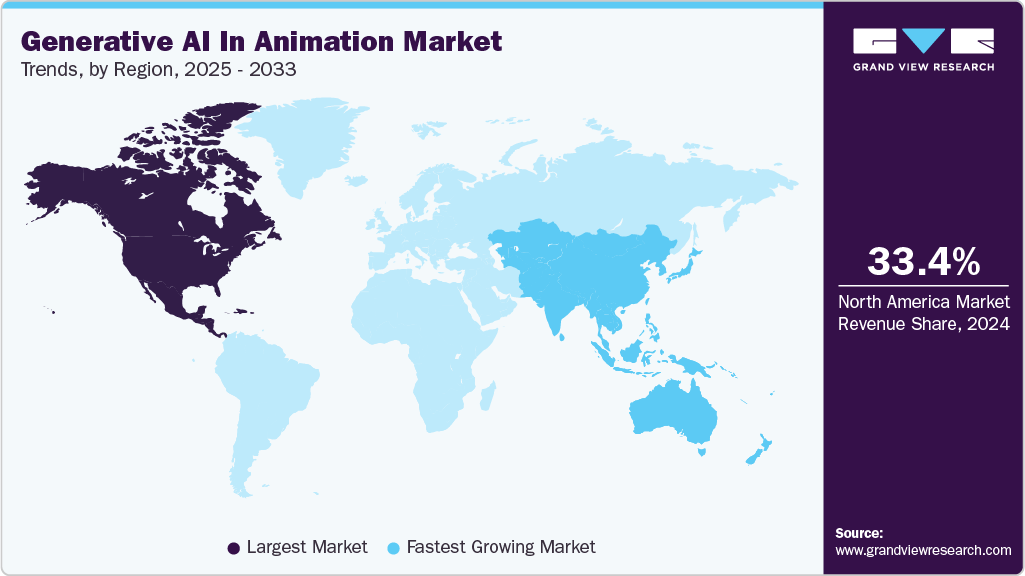

- North America dominated the global generative AI in animation market with the largest revenue share of 33.4% in 2024.

- The Generative AI in Animation market in the U.S. is expected to grow significantly over the forecast period.

- By type, the transformers segment held the highest market share of 40.9% in 2024.

- By component, the solutions segment accounted for the largest market revenue share in 2024.

- By end use, the advertising segment is anticipated to register the fastest CAGR over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 652.1 Million

- 2033 Projected Market Size: USD 13,386.5 Million

- CAGR (2025-2033): 39.8%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

By efficiently handling large workloads, from creating numerous characters to intricate scenes, AI-powered tools enable both small and large studios to meet production demands effectively. Moreover, the continuous refinement and advancement of generative AI algorithms result in animations of exceptional quality, often comparable to those crafted by human animators. This combination of scalability and quality enhancement optimizes production processes and also elevates the standard of animated content, driving widespread adoption and market expansion within the animation industry.

The growing demand for high-quality animated content, fueled by the rise of streaming platforms and online content consumption, is a key driver propelling the adoption of generative AI in the animation market. Audiences seek fresh and engaging content, so studios face pressure to produce at scale without compromising quality. Generative AI offers a solution by simplifying animation processes, enabling animators to create captivating content more efficiently. This efficiency is crucial in meeting the increasing demand for diverse and innovative animations across various platforms. Moreover, AI-powered tools empower creators to experiment with new styles and techniques, enriching the content with a wider array of offerings. Adobe Systems Incorporated, Autodesk, Inc., and NVIDIA Corporation are among the frontrunners in this pursuit. As AI progresses, it promises to transform animation, ushering in an era defined by unparalleled creativity and productivity.

NLP enables animators to provide textual descriptions or commands to AI systems, guiding them in generating animations directly from natural language inputs. This simplifies the animation process, enabling quicker iteration and exploration of ideas, which enhances efficiency and productivity. NLP enables AI systems to understand better and interpret human intentions and preferences, leading to more personalized and engaging animated content. This personalized approach is particularly beneficial in gaming, advertising, and virtual reality industries, where user engagement is crucial. NLP enhances the capabilities of Generative AI in animation, offering increasingly intuitive and efficient animation solutions. This promotes creativity and innovation, as animators can experiment with new styles and concepts that were previously not feasible or too resource-intensive. NLP facilitates seamless communication between animators and AI systems, enabling more effective collaboration and feedback. This leads to a more dynamic and iterative animation process, where creatives can refine their ideas and adapt to changing requirements.

Component Insights

The solutions segment accounted for the largest market revenue share in 2024. The solution segment dominates the generative AI animation market due to the comprehensive offerings provided by solution providers, including end-to-end services and support. These solutions typically integrate AI technologies with animation software, offering seamless workflows and simplified production processes. Animation studios and content creators prefer solutions that provide a holistic approach, covering various aspects of the animation production pipeline, from character design to scene generation and rendering. Moreover, solution providers often offer customizable options customized to the specific needs and preferences of their clients, further solidifying their dominance in the market. The expertise and experience of solution providers in implementing generative AI technologies contribute to their dominance, as clients trust their capabilities to deliver high-quality results efficiently.

The services segment is predicted to experience significant growth in the forecast period. Animation studios and content creators seek services such as consulting, training, and customization to integrate generative AI technologies into their workflows effectively. Moreover, as the complexity of animation projects grows, there is a need for services that provide technical assistance, troubleshooting, and ongoing maintenance to ensure the smooth operation of AI-powered tools. Moreover, services facilitate knowledge transfer and skill development within organizations, empowering teams to harness the full potential of generative AI for animation production. As the market matures and the adoption of generative AI increases, the demand for services is anticipated to grow further, driven by the desire for expertise and support in maximizing the benefits of AI technology in animation.

End Use Insights

The gaming segment accounted for the largest market revenue share in 2024. Gaming companies are increasingly incorporating advanced animation techniques to enhance the realism and immersion of their games, driving demand for generative AI solutions. These solutions enable gaming developers to create lifelike characters, dynamic environments, and fluid animations, elevating the gaming experience for players. Moreover, generative AI offers efficiencies in content creation, enabling gaming studios to produce high-quality animations at scale and reduce production costs. Moreover, as the gaming industry expands and diversifies, there is a growing need for innovative and visually compelling content to capture the attention of players, further fueling the adoption of generative AI in animation. Furthermore, advancements in hardware and software technologies have made generative AI more accessible to gaming developers, facilitating its integration into game development pipelines.

The advertising segment is projected to grow significantly over the forecast period. Advertisers are increasingly seeking innovative and engaging ways to capture audience attention in a crowded digital sector. Generative AI in animation offers unique opportunities to create dynamic and personalized advertising content that resonates with viewers, driving higher levels of engagement and brand recall. Moreover, advancements in AI technology have made it easier and more cost-effective for advertisers to produce high-quality animated ads on a scale and serve diverse target audiences and platforms. Moreover, as consumer preferences shift towards interactive and immersive content experiences, advertisers are increasingly turning to generative AI to create interactive advertisements and virtual experiences that drive customer engagement and brand loyalty.

Type Insights

The Transformers segment led the market and accounted for a revenue share of 40.9% in 2024. The transformer segment is experiencing growth in the generative AI animation market due to its ability to handle complex sequential data and capture long-range dependencies, which is essential for generating realistic and coherent animations. Transformers, with their self-attention mechanism, excel in understanding contextual relationships within input sequences, allowing them to produce high-quality animation outputs. This capability makes transformers particularly suited for tasks such as scene generation, character animation, and motion prediction, where context and continuity are crucial. Moreover, the versatility of transformers enables them to adapt to various animation styles and genres and serve the diverse needs of animation studios and content creators.

The GANs segment is projected to grow significantly over the forecast period. GANs are poised for growth in the generative AI animation market due to their ability to generate diverse and realistic animation content by learning from large datasets. Their adversarial training framework enables them to produce visually appealing animations with enhanced creativity and variation. GANs excel in tasks such as character design, scene generation, and animation interpolation, offering valuable tools for animation studios and content creators. Moreover, GANs' capability to generate novel content and preserve the style and aesthetics of input data makes them highly valuable for creating engaging and immersive animation experiences. As the demand for high-quality and customizable animation content increases, GANs are expected to drive innovation and advancement in generative AI animation technology.

Regional Insights

North America generative AI in animation market dominated and accounted for a 33.4% share in 2024. North America's dominance in the market is anchored in its extensive network of established animation studios, technology companies, and research institutions. These entities are at the forefront of pioneering and integrating AI technologies. With abundant resources, specialized expertise, and advanced infrastructure, they lead the industry's innovation trajectory. These organizations have the resources, expertise, and infrastructure to drive innovation and lead the market. Moreover, North America has a thriving entertainment industry, including film, television, gaming, and advertising, which are major consumers of animation services and technologies. The presence of these industries creates a strong demand for generative AI in animation, driving market growth in the region.

U.S. Generative AI in Animation Market Trends

The Generative AI in Animation market in the U.S. is expected to grow significantly over the forecast period. The growth of the market in the U.S. is propelled by the expanding adoption of AI technologies across diverse industries. As businesses across sectors recognize the transformative potential of AI, they increasingly seek innovative animation solutions powered by generative AI.

Europe Generative AI in Animation Market Trends

In Europe, the generative AI in animation market is witnessing substantial growth, propelled by the continent's diverse cultural sector. This diversity creates a demand for customized and culturally relevant animation content. Generative AI technology promotes the customization and adaptation of content to serve the specific preferences and needs of European audiences.

Asia Pacific Generative AI in Animation Trends

Asia Pacific is anticipated to register the fastest CAGR over the forecast period. The Asia Pacific region is experiencing rapid growth and adoption of generative AI in animation, driven by the increasing demand for high-quality animation content in sectors such as entertainment, gaming, advertising, and education. Emerging markets in the Asia Pacific, such as China, India, South Korea, and Japan, are emerging as key players in the global animation industry. These countries are investing heavily in AI technologies and are utilizing generative AI to produce innovative and engaging animation content.

Key Generative AI In Animation Company Insights

Some key companies in the generative AI in animation industry are Adobe, Autodesk Inc. and thefablestudio.co.

-

Adobe Inc., a leader in creative software, has been actively integrating generative AI into its animation tools through its proprietary AI engines, Adobe Firefly and Adobe Sensei. Firefly enables creators to generate backgrounds, characters, and scene elements using text prompts, enhancing workflows in tools like After Effects, Animate, and Character Animator. Adobe Sensei powers intelligent features such as auto-rigging, lip-syncing, and motion tracking, streamlining traditionally time-consuming animation tasks. The company positions its AI capabilities as tools to augment human creativity rather than replace it, focusing on ethical AI use and content authenticity.

-

thefablestudio.co. is a pioneer in generative AI for animation. The company focuses on developing AI-driven virtual beings and story-generation tools. In 2023, it introduced SHOW‑1, an AI system capable of writing, animating, voicing, and editing full episodes autonomously demonstrated with an AI-generated South Park-style episode. Building on this, Fable launched Showrunner in 2024, the world’s first AI-generated streaming platform, where users can create and share animated episodes using text prompts. The platform uses a mix of large language models, image diffusion, and neural voice synthesis to automate storytelling while allowing user customization.

Key Generative AI In Animation Companies:

The following are the leading companies in the generative AI in animation market. These companies collectively hold the largest market share and dictate industry trends.

- Adobe

- Autodesk Inc.

- DreamWorks Animation

- Google LLC

- Kartoon Studios, Inc.

- NVIDIA Corporation

- Renderforest

- ServiceNow

- thefablestudio.co

- Walt Disney Animation Studios

Recent Developments

-

In June 2025, Meta is launching a generative AI video editing feature on the Meta AI app, website, and the Edits app in the U.S. This tool allows users to transform video clips using preset AI prompts, changing locations, styles, outfits, lighting, and moods. Users can reimagine their videos as vintage comic book scenes, dreamy, cinematic moments, or even stylized video game sequences. The goal is to bring creative AI video generation and editing capabilities across Meta’s platforms.

-

In May 2025, Cartwheel launched a 3D animation AI tool suite designed to simplify and accelerate the animation process while giving creatives greater control. The tool transforms video, text, and motion libraries into production-ready 3D character animations that can be easily edited and integrated into existing workflows. Users can prototype, refine, and customize animations in any 3D format without disrupting their current pipelines. Aimed at industries such as film, anime, gaming, advertising, and social media, Cartwheel's platform reduces tedious tasks and frees up resources for more creative exploration.

-

In May 2024, Google LLC introduced AI-powered features to improve search and advertisement capabilities, including testing advertisements within Search Generative Experience and enabling advertisers to create animated ads from still images. These features enable advertisers to incorporate brand-specific fonts and colors in ads, enhancing the customization options available through Google's Performance Max platform

-

In May 2024, Autodesk acquired Wonder Dynamics, a U.S.-based AI-based video production tools provider, to integrate its cloud-based 3D animation and VFX solution with AI into established tools, aiming to simplify processes and enhance creativity. This acquisition strengthens Autodesk's strategic goal of utilizing AI to connect teams, data, and processes in the Media and entertainment industry.

-

In April 2024, Kartoon Studios, Inc. launched an AI toolkit to improve animation quality and workflow efficiency. This generative AI toolkit represents a significant advancement in animation production, harnessing AI technology to optimize workflows and elevate the quality of animated content.

Generative AI In Animation Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 916.6 million

Revenue forecast in 2033

USD 13,386.5 million

Growth rate

CAGR of 39.8% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, component, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Adobe; Autodesk Inc.; DreamWorks Animation; Google LLC; Kartoon Studios, Inc.; NVIDIA Corporation; Walt Disney Animation Studios; Renderforest; Walt Disney Animation Studios

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country; regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Generative AI In Animation Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global generative AI in animation market report based on type, component, end use, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Transformers

-

GANs

-

VAEs

-

Others

-

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Solutions

-

Services

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Televisions (Over-the-Top)

-

Advertising

-

Movie Production

-

Gaming

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global generative AI in animation market size was estimated at USD 652.1 million in 2024 and is expected to reach USD 916.6 million in 2025.

b. The global generative AI in animation market is expected to grow at a compound annual growth rate of 39.8% from 2025 to 2033 to reach USD 13,386.5 million by 2033.

b. North America dominated the generative AI in animation market with a share of 32.% in 2024. This is attributable to its strong ecosystem of leading animation studios, advanced technological infrastructure, and robust investment in AI research and development.

b. Some key players operating in the generative AI in animation market include Adobe, Autodesk Inc., Blue Sky Studios, DreamWorks Animation, Google LLC, Kartoon Studios, Inc., NVIDIA Corporation, Pixar Animation Studios, ServiceNow, Walt Disney Animation Studios.

b. Key factors that are driving the market growth include advancements in artificial intelligence, increasing adoption of cloud-based solutions, rising cybersecurity concerns, and the proliferation of Internet of Things (IoT) devices.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.