- Home

- »

- Power Generation & Storage

- »

-

Generator Paralleling Switchgear Market Size Report, 2030GVR Report cover

![Generator Paralleling Switchgear Market Size, Share & Trends Report]()

Generator Paralleling Switchgear Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Open Transition System, Closed Transition System), By Application (Prime Power, Standby Power, Peak Shaving), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-435-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

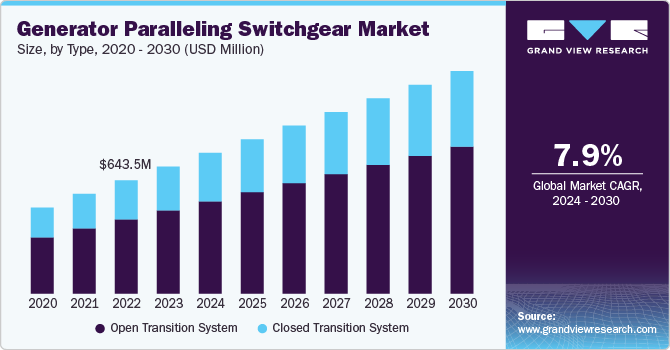

The global generator paralleling switchgear market size was estimated at USD 721.09 million in 2023 and expected to grow at a CAGR of 7.95% from 2024 to 2030. The rising emphasis on energy efficiency and sustainability by various countries including the U.S., the UK, Germany, India, and China is fueling the market growth.

A growing trend in the generator paralleling switchgear market is the shift towards modular and scalable solutions. Businesses and infrastructure projects increasingly seek switchgear systems that can be easily expanded or reconfigured as their power needs change. Modular switchgear allows for incremental upgrades and adjustments without overhauling the entire system, which offers greater flexibility and cost-efficiency. This trend reflects the need for adaptable power solutions in dynamic environments, where future growth and changes in energy demands are anticipated.

Drivers, Opportunities & Restraints

With global focus shifting towards reducing carbon footprints and optimizing energy use due to the looming threat of climate change spurred by increased global warming, businesses are investing in technologies that not only improve power reliability but also enhance energy efficiency. Generator paralleling switchgear helps balance load and ensuring that generators operate at peak efficiency, which supports broader sustainability goals and regulatory requirements for reduced energy consumption and emissions.

The expansion of data centers presents a valuable opportunity for the generator paralleling switchgear market. As the digital economy grows, data centers require robust and reliable power solutions to handle massive data processing and storage demands. Generator paralleling switchgear is crucial in ensuring these facilities have uninterrupted power and can manage multiple backup generators efficiently. This increasing demand for data center infrastructure drives the need for advanced paralleling switchgear solutions that can guarantee operational continuity and power quality.

Despite its potential, the generator paralleling switchgear market faces challenges that could hinder its growth. A significant restraint for the growth is the complexity and cost of installation and maintenance. Advanced paralleling systems often involve sophisticated technology and require specialized knowledge for setup and upkeep. This complexity can deter smaller organizations or those with limited technical resources from adopting such systems. The high initial investment and ongoing maintenance costs can be a barrier, particularly in regions where budget constraints and technical expertise are limiting factors.

Type Insights

The open transition system segment led the market with the largest revenue share of 65.55% in 2023, which can be attributed to the need for cost-effective and straightforward power transfer solutions. Open transition systems, also known as "break-before-make" systems, offer a simple and reliable way to switch between power sources without requiring complex controls or equipment. This simplicity and lower cost make it an attractive option for facilities that need reliable but less intricate power management, especially in applications where a brief power interruption during the switch is acceptable.

The closed transition system segment is expected to grow at a significant CAGR over the forecast period. The demand for seamless power transfer with no interruption is driving the need for the segment. Closed transition systems, or "make-before-break" systems, allow for a smooth transition between power sources, which is crucial for operations that cannot tolerate any downtime or power blips. This uninterrupted switching capability is increasingly valued in critical applications, such as hospitals and data centers, where continuous power is essential for maintaining operations and avoiding potential disruptions.

Application Insights

The standby power segment dominated the market with the largest revenue share of 45.20% in 2023, owing to the rising need for reliable backup power to ensure operational continuity during main power outages. Standby power systems are essential for facilities that must maintain operations during power failures, such as emergency services or essential infrastructure. Paralleling switchgear in these setups ensures that multiple backup generators can work together efficiently to provide a seamless transition and reliable power when the main supply fails.

The prime power segment is expected to grow at a significant CAGR over the forecast period, spurred by the requirement for continuous and stable power supply in areas without reliable utility access. Prime power systems are designed to provide the primary source of power for extended periods, often in remote or off-grid locations. Paralleling switchgear enables multiple generators to operate in tandem, balancing the load and ensuring consistent power output, which is crucial for industries such as mining, construction, or remote communities.

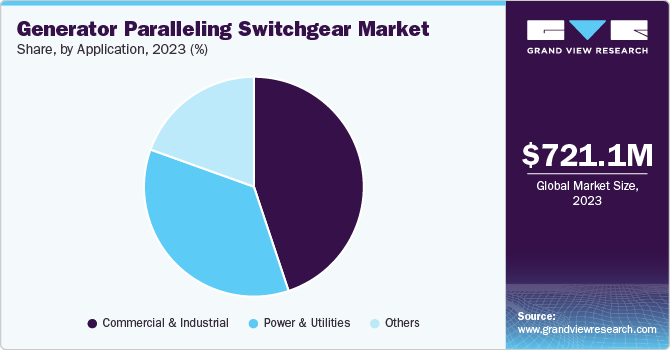

End Use Insights

The commercial & industrial segment dominated the market with the largest revenue share of 44.88% in 2023, driven by the increasing need for reliable and uninterrupted power supply, especially in regions with frequent grid instability or power outages. Industries such as manufacturing, data centers, and hospitals require continuous power to avoid disruptions that could lead to significant operational and financial losses. Additionally, the rise of renewable energy sources and microgrids necessitates advanced control and synchronization solutions to manage multiple power sources efficiently. Recent trends in automation and smart infrastructure also push the adoption of modern paralleling switchgear that integrates seamlessly with intelligent energy management systems, enhancing operational efficiency and resilience.

In the power & utilities segment, the adoption of generator paralleling switchgear is driven by the growing need for grid stability, particularly with the integration of renewable energy sources like wind and solar. As these sources are intermittent, utilities require reliable backup systems to maintain grid stability and prevent blackouts. The increasing emphasis on decentralization of power generation, with microgrids and distributed energy resources (DERs), also fuels the demand for advanced switchgear solutions that can synchronize and control multiple generators effectively. Additionally, the modernization of aging infrastructure, coupled with stringent regulations to ensure energy reliability and efficiency, propels investments in high-performance paralleling switchgear. Recent instances of extreme weather events, which have stressed the importance of resilient power infrastructure, further underscore the need for these systems.

Regional Insights

North America dominated the global generator paralleling switchgear market and accounted for largest revenue share of 30.10% in 2023, owing to the ongoing initiatives to modernize the aging power grid infrastructure. With growing investments in smart grid technology and the need to integrate renewable energy sources, there is a rising demand for advanced switchgear that can effectively manage and synchronize multiple power generation sources. The push for greater energy resilience, especially in response to frequent natural disasters like hurricanes and wildfires, further accelerates the adoption of these systems.

The robust growth of the industrial and commercial sectors in North America, particularly in areas like manufacturing, healthcare, and data centers, also fuels demand for reliable backup power solutions. These industries require uninterrupted power to maintain operations, driving the need for sophisticated generator paralleling switchgear that ensures continuous power supply during outages or grid instability. The increasing adoption of automation and smart technologies in these sectors further supports the market growth.

U.S. Generator Paralleling Switchgear Market Trends

In the U.S., the frequent occurrence of natural disasters such as hurricanes, wildfires, and severe storms has heightened the focus on building resilient power infrastructure. A generator paralleling switchgear plays a critical role in ensuring uninterrupted power supply during emergencies, making it a key component in disaster preparedness strategies across various sectors. The increasing investment in emergency power systems, particularly in vulnerable regions, drives the demand for these solutions.

Europe Generator Paralleling Switchgear Market Trends

In Europe, the transition to renewable energy is a significant driver for the generator paralleling switchgear market. As countries in the region strive to meet their carbon reduction targets, there is an increasing reliance on wind, solar, and other renewable energy sources. However, the intermittent nature of these sources requires reliable backup systems to ensure grid stability. A generator paralleling switchgear is essential in managing the synchronization of various power sources, making it a critical component in Europe's renewable energy infrastructure. Recent policies and investments aimed at achieving energy transition goals further stimulate demand for these systems.

Asia Pacific Generator Paralleling Switchgear Market Trends

The Asia Pacific region is experiencing rapid industrialization and urbanization, leading to increased demand for reliable and stable power supply. Countries like China, India, and Southeast Asian nations are investing heavily in infrastructure development, including the expansion of industrial zones and urban centers. This surge in construction and industrial activities drives the need for generator paralleling switchgear, which ensures continuous power supply to support these developments. Additionally, the region's growing focus on energy efficiency and sustainability, coupled with the integration of renewable energy sources, further supports market growth.

Key Generator Paralleling Switchgear Company Insights

The market is highly competitive, with several key players dominating the landscape. The market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their products.

Key Generator Paralleling Switchgear Companies:

The following are the leading companies in the generator paralleling switchgear market. These companies collectively hold the largest market share and dictate industry trends.

- General Electric

- Caterpillar

- Cummins Inc.

- Regal Rexnord Corporation

- Kohler Co.

- Schneider Electric SE

- ABB

- KDM Steel

- Hertzman (Hangzhou) Power Technology Co.,Ltd.

- INDUSTRIAL ELECTRIC MFG

Recent Developments

-

In December 2023, Pioneer Power Solutions, Inc. announced the receival of four new orders valuing more than USD 10.0 million. This order includes a significant amount of paralleling switchgear for a U.S.-based natural gas distributor, which is to be delivered by 2025.

-

In October 2020, Cummins introduced two new Digital Master Controls (DMC), named DMC6000 and DMC2000, enhancing their PowerCommand generator paralleling switchgear offerings. These products are designed to provide integrated power control solutions for various applications, including critical sectors like hospitals and data centers.

Generator Paralleling Switchgear Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 798.65 million

Revenue forecast in 2030

USD 1,264.00 million

Growth rate

CAGR of 7.95% from 2024 to 2030

Historical data

2018 - 2022

Base year

2023

Forecast period

2024 - 2030

Quantitative units

Volume in KV, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; The Netherlands; Denmark; China; India; Japan; South Korea; Indonesia; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

General Electric; Caterpillar; Cummins Inc.; Regal Rexnord Corporation; Kohler Co.; Schneider Electric SE; ABB; KDM Steel; Hertzman(Hangzhou) Power Technology Co., Ltd.; INDUSTRIAL ELECTRIC MFG

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Generator Paralleling Switchgear Market Report Segmentation

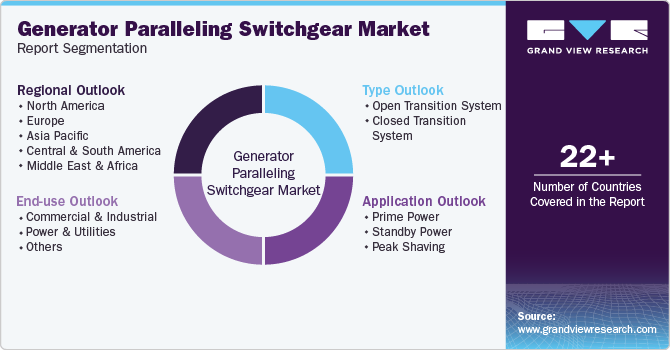

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented global generator paralleling switchgear market report based on type, application, end-use, and region:

-

Type Outlook (Volume, KV; Revenue, USD Million, 2018 - 2030)

-

Open Transition System

-

Closed Transition System

-

-

Application Outlook (Volume, KV; Revenue, USD Million, 2018 - 2030)

-

Prime Power

-

Standby Power

-

Peak Shaving

-

-

End Use Outlook (Volume, KV; Revenue, USD Million, 2018 - 2030)

-

Commercial & Industrial

-

Power & Utilities

-

Others

-

-

Regional Outlook (Volume, KV; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

The Netherlands

-

Denmark

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Indonesia

-

Thailand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global generator paralleling switchgear market size was valued at USD 721.09 million in 2023 and is expected to reach USD 798.65 million in 2024.

b. The global generator paralleling switchgear market is expected to grow at a CAGR of 7.95% from 2024 to 2030, reaching USD 1264.00 million by 2030.

b. Based on type, the Open Transition System segment led the market with the largest revenue share of 65.55% in 2023, which can be attributed to the need for cost-effective and straightforward power transfer solutions.

b. Key players operating in the generator paralleling switchgear market include General Electric; Caterpillar; Cummins Inc., Regal Rexnord Corporation; Kohler Co.; Schneider Electric SE; and ABB; among others

b. The rising emphasis on energy efficiency and sustainability by various countries, including the U.S., UK, Germany, India, China, and others, fuels the generator paralleling switchgear market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.