- Home

- »

- Biotechnology

- »

-

Genomics Market Size, Share, Trends, Growth Report, 2030GVR Report cover

![Genomics Market Size, Share & Trends Report]()

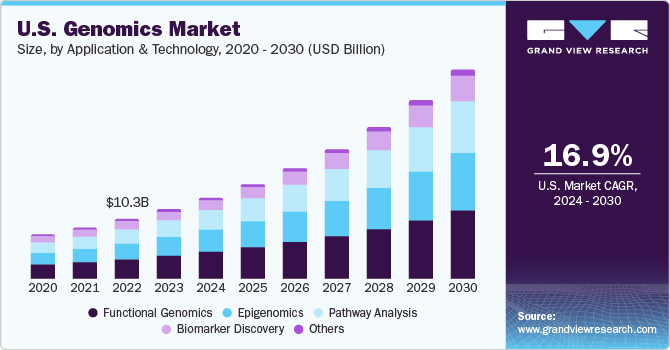

Genomics Market Size, Share & Trends Analysis Report By Application (Functional Genomics, Epigenomics, Pathway Analysis, Biomarker Discovery, Others), By Technology, By Deliverable, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-188-7

- Number of Report Pages: 200

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Genomics Market Size & Trends

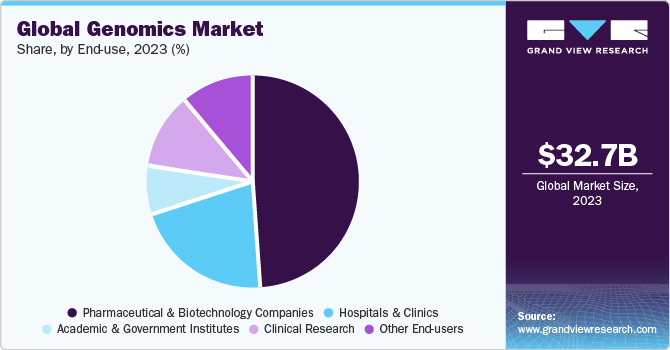

The global genomics market size was valued at USD 32.65 billion in 2023 and is projected to witness a compound annual growth rate (CAGR) of 16.5% from 2024 to 2030. The growth of genomics market is attributed to factors such as growing demand for gene therapy, personalized medicine, drug discovery, increasing cancer incidence, and a significant increase in demand for consumer genomics in recent years. Moreover, increasing number of joint ventures and partnerships amongst market players is also expected to have a positive impact on the genomics market growth. For instance, in June 2022, Illumina, Inc., and Allegheny Health Network signed a collaboration for effective evaluation of the impact of in-house Comprehensive Genomic Profiling (CGP) to leverage patient care.

The COVID-19 pandemic outbreak had posed challenges to applications of genomics technology in terms of research and therapeutics. Nevertheless, some niche applications were of great use to mankind during the pandemic situation to facilitate immediate attention for designing effective diagnostics, effective therapeutics and steps to curb the spread of COVID-19. For example, the viral genome mutational rate (~1-2 bases per month) was gauged for validity of PCR cycle was estimated to understand the efficacy of the re-purposed anti-viral treatments and thereby the vaccine development process was streamlined.

Many genomic surveillance programs were launched country wise to understand the dynamics of pandemic situation and to effective preventive measures. For instance, in December 2020, the Indian SARS-CoV-2 Genomics Consortium (INSACOG) was launched by the joint efforts of Department of Biotechnology (DBT), Ministry of Health, and ICMR with an aim to screen the genomic variations in the SARS-CoV-2 by sequencing technologies. Furthermore, country specific companies are providing consumer genomics services which is also expected to fuel the market size in coming years. One such company being Mapmygenome which is one of the pioneers in India offers DTC genomics services.

The increasing prevalence of inherited cancers is expected create a high demand for cancer genomics. The substantial understanding of human genome have targeted focus on use of various gene therapies for treatment of cancers by modern gene editing techniques such as CRISPR-Cas gene technology. For instance, in September 2022, a group of researchers at the University of California introduced the applications of precision genome editing agents for management of inherited retinal diseases (IRDs).

The development of high-throughput sequencing technologies such as Next-Generation Sequencing (NGS) and microarrays has generated massive amounts of genomic data. However, the rapid accumulation of this data from DNA sequencing and Electronic Health Records (EHRs) poses significant challenges and opportunities for the extraction of biologically or clinically relevant information. Phenome-wide association study (PheWAS) & genome-wide association study (GWAS) are helping researchers to study correlations between genotype and phenotype.

The market players are extensively working towards collaborations, expansions, acquisitions and huge capital investments to advance in research to understand rare diseases and to aid drug discovery. For instance, PacBio declares a collaboration with the Genomics England society for the utility of PacBio’s technology to detect genetic variation in unexplained rare disorders. The study is intended to re-sequence a selection of samples collected during Genomics England’s 100,000 genomes project to discover potential operational and clinical benefits of long-read sequencing for the identification of mutations associated with rare diseases.

Market Concentration & Characteristics

Market growth stage is moderate, and pace of the market growth is accelerating. The genomics market is characterized by a moderate-to-high degree of growth owing to increasing investment in R&D programs, advancements in technology, decreasing costs of sequencing, and increasing applications in various fields such as healthcare, agriculture, and personalized medicine. Furthermore, the market is also characterized by ongoing research and development activities, with companies investing in new technologies, methodologies, and applications. This included the development of cell genomics, proteomics, and advancements in bioinformatics. As per IQVIA, the number of genomes studied is predicted to increase to 52 million by 2025, bringing us new potential to treat chronic diseases and assess patient vulnerability to infections like COVID-19.

Key strategies implemented by players in genomics market are new product launches, expansion, acquisitions, partnerships, and other strategies. For instance, in January 2024, Veracyte has announced the acquisition of C2i Genomics to provide minimal residual disease capabilities to their novel diagnostic platform.

Growth of genomic data pool from research studies has helped biologists, patients, and physicians to investigate the genetic predisposition for some of the diseases. The clinical application of this data pool is expected to transform the healthcare system related to the provision of more effective, reliable, and accurate, disease management solutions. Although the clinical use of genomic data is still in the nascent stage, the industrial and healthcare communities are making efforts to successfully incorporate genetic data into clinical workflows.

The genomics market is dynamic and continues to witness constant innovation and translation of scientific knowledge to various applications. For instance, In January 2023, Prenetics Global Limited owned ACT Genomics received the U.S. FDA authorization for ACTOnco, a comprehensive genomic profiling test for solid cancers. It is beneficial for healthcare professionals to make informed clinical decisions related to professional guidelines for patients with solid cancers.

Furthermore, the use of AI-based software for understanding genomic data in various applications is another trend observed in this market and enabling cost-effective and rapid genome sequencing. Furthermore, AI speeds genomic research by automated data processing, enabling massive data integration, and allowing for faster & more accurate analysis. These benefits entice researchers, healthcare professionals, along with pharmaceutical firms, driving market expansion.

Application Insights

The functional genomics segment dominated the overall market with the largest revenue share of 32.1% in 2023. The dominance of the segment can be attributed to research studies aiming to understand a particular phenotypical expression of a given disease condition. Many gene therapies for cancers are designed on the basis of functional genomic technology. For instance, in June 2020, researchers at European Molecular Biology Laboratory (EMBL) at Heidelberg increased the scalability and precision metrics of functional genomics CRISPR/Cas9 gene-based screens through targeted single-cell RNA sequencing. Single-cell RNA sequencing gives deep insights into levels of gene expression in individual cells and can capably analyze CRISPR/Cas9 functional genomics screens.

Pathway analysis segment is predicted to emerge as the most lucrative of all by 2030. Usage of pathway analysis in developing next-generation therapeutics has emerged one of the most growing applications. Pathway-based analysis has gained more attention after the emergence of clinical genomics and personalized therapies. This is mainly because genomics and personalized therapies aid in the in-depth analysis of the ability to navigate signaling pathways and disease networks.

Deliverables Insights

The product segment dominated the market in 2023. The products used in genomics are broadly segmented into two categories—instruments or systems that are required for the synthesis and sequencing of the nucleic acid sequences and consumables & reagents.

The increase in preference for personalized medicines and decline in costs of DNA sequencing owing to the launch of NGS technology resulted in the development of novel products or systems. The genomics market is gradually becoming more competitive with new product launches. For instance, in June 2022, PerkinElmer introduced an automated benchtop system for NGS, the research-use only BioQule NGS System to automate library preparation.

The service segment is expected to register a steady CAGR by 2030. The high cost of products, the demand for expertise required for genomics, and the focus on core operations by the end user are the major factors driving the services segment. NGS-based services held a major share in the genomics services segment due to the rapid adoption of Whole Genome Sequencing (WGS) and applications of sequence databases for disorder screening and prognosis. However, data processing and interpretation, rather than data production has become the need for current development and application.

End-user Insights

The pharmaceutical and biotechnology companies segment led the market in 2023. This is attributed to the increasing demand for use of genomics in drug discovery. Moreover, the market is driven by increasing adoption of spatial genomics & transcriptomics technologies. Numerous trials are underway for novel drug discovery using underlying knowledge from genomics. For instance, in June 2022, Illumina Inc., declares that it will present seven of their abstracts regarding the key oncology research at the American Society of Clinical Oncology (ASCO) 2022 in further to an event to discuss the transformational impact of comprehensive genomic profiling in precision medicine.

The hospital and clinic segment is estimated to grow at a substantial pace during the forecast period. Several hospitals and clinics are currently offering genomic sequencing services to patients and are using this technology in the daily practice of medicine. Stanford Medicine is one such facility that provides genomic sequencing services to patients with a rare or unidentified condition that is thought to be genetic. The first hospital system to offer the general public services for genetic sequencing, analysis, and interpretation is Partners HealthCare based in the U.S. It has enrolled over 200 patients and physicians in a study funded by NIH to study the integration of whole genome sequencing in clinical medicine.

Regional Insights

North America accounted for the largest market share of 42.65% in 2023. This is attributed to the support of research institutes and pharmaceutical giants. Genomics is now an integral part of any disease research and drug discovery due to the implications of genetic expression on human health. There are emerging advancements in the region for the utility of genomics with collaborative efforts. For instance, in January 2022, Illumina, Inc. collaborated with Nashville Biosciences, LLC, (part of Vanderbilt University Medical Center at Tennesee), for drug development by using genomics and to establish a preeminent clinico-genomic resource.

Asia Pacific is estimated to be the fastest-growing segment over the forecast period due to increased demand for genomics applications in diagnostics and the growing demand for novel therapeutic drugs to fight the increased incidence of diseases in the region. Several major human genome sequencing projects are being performed, one of the most recent projects is Genome Asia 100K. Under this project, 100,000 Asian genomes would be sequenced and analyzed, which can help accelerate population-specific medical advances and precision medicine. With this project, GA 100K was expected to identify new possible therapeutic drugs and understand the biology of diseases.

India Genomics Market

Indian market is anticipated to grow at significant growth rate over the forecast period. Over the past few decades, India has become a hub for pharmaceutical and biotechnology and has gained global attention due to the presence of skilled & knowledgeable manpower and low capital investments. Owing to the presence of rich resources and a large pool of existing R&D institutions in the country, India has become one of the key areas for setting up research laboratories & manufacturing units by multinational companies. Thus, rapidly growing pharmaceutical & biotechnology industries and frequent government initiatives to boost R&D activities in the country are expected to create lucrative opportunities in India genomics market.

Key Companies & Market Share Insights

The market players operating in the genomics market are adopting product approval to increase the reach of their products in the market and improve the availability of their products & services in diverse geographical areas, along with expansion as a strategy to enhance production/research activities. In addition, several market players are acquiring smaller players to strengthen their market position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve their competencies.

Key Genomics Companies:

- Agilent Technologies

- Bio-Rad Laboratories, Inc.

- BGI Genomics

- Color Genomics, Inc.

- Danaher Corporation

- Eppendorf AG

- Eurofins Scientific

- F. Hoffmann-La Roche Ltd.

- GE Healthcare

- Illumina, Inc.

- Myriad Genetics, Inc.

- Oxford Nanopore Technologies

- Pacific Biosciences of California, Inc.

- QIAGEN N.V.

- Quest Diagnostics Incorporated

- Thermo Fisher Scientific, Inc.

- 23andMe, Inc.

Recent Development

-

In November 2023, Fabric Genomics collaborated with DNAnexus and Oxford Nanopore Technologies for deployment of CLIA/CAP labs in pediatric and neonatal ICU’s. The labs will use Oxford Nanopore’s platforms to study genetic disorders in infants.

-

in February 2023, Illumina, Inc. entered into a collaboration with African Centre of Excellence for Genomics of Infectious Diseases to start a training institute to increase genomic capabilities in African region

-

In January 2023, SOPHiA GENETIC collaborated with the Memorial Sloan Kettering Cancer Center (MSK), a U.S. Cancer Center, to offer researchers and clinicians solutions to expand analytical and testing capabilities.

-

In January 2023, Agilent Technologies, Inc. announced acquisition of Avida Biomed, a company that develops target enrichment workflows for clinical researchers utilizing NGS methods to study cancers.

-

In April 2022, QIAGEN launched the Biomedical Knowledge Base in Europe, Japan, North America, and Australia to support data science applications in biotech companies

Genomics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 37.89 billion

Revenue forecast in 2030

USD 94.86 billion

Growth rate

CAGR of 16.5% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, technology, deliverables, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand;South Korea; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Agilent Technologies; Bio-Rad Laboratories, Inc.; BGI Genomics; Color Genomics, Inc.; Danaher Corporation; Eppendorf AG; Eurofins Scientific; F. Hoffmann-La Roche Ltd.; GE Healthcare; Illumina Inc.; Myriad Genetics, Inc.; Oxford Nanopore Technologies; Pacific Biosciences of California, Inc.; QIAGEN N.V.; Quest Diagnostics Incorporated; Thermo Fisher Scientific, Inc.; 23andMe, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst's working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Genomics Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global genomics market based on application, technology, deliverables, end-use, and region:

Application & Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Functional Genomics

-

Transfection

-

Real-Time PCR

-

RNA Interference

-

Mutational Analysis

-

SNP Analysis

-

Microarray Analysis

-

-

Epigenomics

-

Bisulfite Sequencing

-

Chromatin Immunoprecipitation (ChIP & ChIP-Seq)

-

Methylated DNA Immunoprecipitation (MeDIP)

-

High-Resolution Melt (HRM)

-

Chromatin Accessibility Assays

-

Microarray Analysis

-

-

Pathway Analysis

-

Bead-Based Analysis

-

Microarray Analysis

-

Real-time PCR

-

Proteomics Tools (2-D PAGE; yeast 2-hybrid studies)

-

-

Biomarker Discovery

-

Mass Spectrometry

-

Real-time PCR

-

Microarray Analysis

-

Statistical Analysis

-

Bioinformatics

- DNA Sequencing

-

-

Others

- Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Sequencing

-

PCR

-

Flow Cytometry

-

Microarrays

-

Other technologies

-

-

Deliverables Outlook (Revenue, USD Billion, 2018 - 2030)

-

Products

-

Instruments/Systems/Software

-

Consumables & Reagents

-

-

Services

-

NGS-based Services

-

Core Genomics Services

-

Biomarker Translation Services

-

Computational Services

-

Others

-

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Clinical Research

-

Academic & Government Institutes

-

Hospitals & Clinics

-

Pharmaceutical & Biotechnology Companies

-

Other End Users

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

- Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

- Kuwait

-

-

Frequently Asked Questions About This Report

b. The global genomics market size was estimated at USD 32.65 billion in 2023 and is expected to reach USD 37.89 billion in 2024.

b. The global genomics market is expected to witness a compound annual growth rate of 16.5% from 2024 to 2030 to reach USD 94.86 billion by 2030.

b. The pharmaceutical and biotechnology companies segment accounted for the major revenue share owing to the increasing number of genetic research studies aimed at the development of efficacious drugs with fewer side effects and improving the drug discovery process.

b. Major players in the genomics market include F. Hoffmann-La Roche Ltd..; Agilent Technologies, Thermo Fisher Scientific, Inc.; Bio-Rad Laboratories, Inc.; 23andMe, Inc.; Illumina, Inc.; Myriad Genetics, Inc.; Foundation Medicine, Inc.; Danaher, Pacific Biosciences; Oxford Nanopore Technologies; and BGI.

b. Technological advancements in genetic tools, as well as molecular diagnostics, is one of the key driving force that has accelerated investment by genomic companies in the market.

Table of Contents

Chapter 1. Genomics Market: Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Market Definitions

1.2.1. Application & Technology

1.2.2. Deliverables

1.2.3. End use

1.3. Information analysis

1.4. Market formulation & data visualization

1.5. Data validation & publishing

1.6. Information Procurement

1.6.1. Primary Research

1.7. Information or Data Analysis

1.8. Market Formulation & Validation

1.9. Market Model

1.10. Objectives

Chapter 2. Genomics Market: Executive Summary

2.1. Market Snapshot

2.2. Segment Snapshot

2.3. Competitive Landscape Snapshot

Chapter 3. Genomics Market: Market Variables, Trends, & Scope

3.1. Market Segmentation and Scope

3.2. Market Lineage Outlook

3.2.1. Parent Market Outlook

3.2.2. Related/Ancillary Market Outlook

3.3. Market Dynamics

3.3.1. Market Driver Analysis

3.3.1.1. Growing integration of genomics data into clinical workflows

3.3.1.1.1. More targeted and personalized healthcare

3.3.1.1.2. Growth of newborn genetic screening programs

3.3.1.1.3. Advancements in noninvasive cancer screening

3.3.1.1.4. Military genomics

3.3.1.2. Technological advances to facilitate genomic R&D

3.3.1.2.1. Emergence of advanced genome editing techniques

3.3.1.2.2. Integration of new data streams

3.3.1.2.3. RNA biology

3.3.1.2.4. Single-cell biology

3.3.1.3. Rising adoption of DIRECT-TO-CONSUMER genomics

3.3.1.4. Success of genetic tools in agrigenomics

3.3.1.5. Increasing participation of different companies

3.3.1.6. Increase in government role and funding in genomics

3.3.2. Market Restraint Analysis

3.3.2.1. Issues regarding intellectual property protection, data management, and public policies

3.3.2.2. Dearth of Public databases and personnel knowledge on machine learning algorithms

3.4. Industry Analysis Tools

3.4.1. SWOT Analysis; By Factor (Political & Legal, Economic And Technological)

3.4.2. Porter's Five Forces Analysis

3.5. COVID-19 Impact Analysis

Chapter 4. Genomics Market: Application & Technology Business Analysis

4.1. Genomics Market: Application & Technology Market Share Analysis

4.2. Genomics Market Estimates & Forecast, By Application & Technology (USD Million)

4.3. Functional Genomics

4.3.1. Global Functional Genomics Market, 2018 - 2030 (USD Million)

4.3.2. Transfection

4.3.2.1. Global Transfection Market, 2018 - 2030 (USD Million)

4.3.3. Real-Time PCR

4.3.3.1. Global Real-Time PCR Market, 2018 - 2030 (USD Million)

4.3.4. RNA Interference

4.3.4.1. Global RNA Interference Market, 2018 - 2030 (USD Million)

4.3.5. Mutational Analysis

4.3.5.1. Global Mutational Analysis Market, 2018 - 2030 (USD Million)

4.3.6. SNP Analysis

4.3.6.1. Global SNP Analysis Market, 2018 - 2030 (USD Million)

4.3.7. Microarray Analysis

4.3.7.1. Global Microarray Analysis Market, 2018 - 2030 (USD Million)

4.4. Epigenomics

4.4.1. Global Epigenomics Market, 2018 - 2030 (USD Million)

4.4.2. Bisulfite Sequencing

4.4.2.1. Global Bisulfite Sequencing Market, 2018 - 2030 (USD Million)

4.4.3. Chromatin Immunoprecipitation (ChIP & ChIP-Seq)

4.4.3.1. Global Chromatin Immunoprecipitation (ChIP & ChIP-Seq) Market, 2018 - 2030 (USD Million)

4.4.4. Methylated DNA Immunoprecipitation (MeDIP)

4.4.4.1. Global Methylated DNA Immunoprecipitation (MeDIP) Market, 2018 - 2030 (USD Million)

4.4.5. High-Resolution Melt (HRM)

4.4.5.1. Global High-Resolution Melt (HRM) Market, 2018 - 2030 (USD Million)

4.4.6. Chromatin Accessibility Assays

4.4.6.1. Global Chromatin Accessibility Assays Market, 2018 - 2030 (USD Million)

4.4.7. Microarray Analysis

4.4.7.1. Global Microarray Analysis Market, 2018 - 2030 (USD Million)

4.5. Pathway Analysis

4.5.1. Global Pathway Analysis Market, 2018 - 2030 (USD Million)

4.5.2. Bead-Based Analysis

4.5.2.1. Global Bead-Based Analysis Market, 2018 - 2030 (USD Million)

4.5.3. Microarray Analysis

4.5.3.1. Global Microarray Analysis Market, 2018 - 2030 (USD Million)

4.5.4. Real-time PCR

4.5.4.1. Global Real-time PCR Market, 2018 - 2030 (USD Million)

4.5.5. Proteomics Tools (2-D PAGE; yeast 2-hybrid studies)

4.5.5.1. Global Proteomics Tools (2-D PAGE; yeast 2-hybrid studies) Market, 2018 - 2030 (USD Million)

4.6. Biomarker Discovery

4.6.1. Global Biomarker Discovery Market, 2018 - 2030 (USD Million)

4.6.2. Mass Spectrometry

4.6.2.1. Global Mass Spectrometry Market, 2018 - 2030 (USD Million)

4.6.3. Real-time PCR

4.6.3.1. Global Real-time PCR Market, 2018 - 2030 (USD Million)

4.6.4. Microarray Analysis

4.6.4.1. Global Microarray Analysis Market, 2018 - 2030 (USD Million)

4.6.5. Statistical Analysis

4.6.5.1. Global Statistical Analysis Market, 2018 - 2030 (USD Million)

4.6.6. Bioinformatics

4.6.6.1. Global Bioinformatics Market, 2018 - 2030 (USD Million)

4.6.7. DNA Sequencing

4.6.7.1. Global DNA Sequencing Market, 2018 - 2030 (USD Million)

4.7. Others

4.7.1. Global Others Market, 2018 - 2030 (USD Million)

Chapter 5. Genomics Market: Deliverables Business Analysis

5.1. Genomics Market: Deliverables Market Share Analysis

5.2. Genomics Market Estimates & Forecast, By Deliverables (USD Million)

5.3. Products

5.3.1. Global Products Market, 2018 - 2030 (USD Million)

5.3.2. Instruments/Systems/Software

5.3.2.1. Global Instruments/Systems/Software Market, 2018 - 2030 (USD Million)

5.3.3. Consumables & Reagents

5.3.3.1. Global Consumables & Reagents Market, 2018 - 2030 (USD Million)

5.4. Services

5.4.1. Global Services Market, 2018 - 2030 (USD Million)

5.4.2. NGS-based Services

5.4.2.1. Global NGS-based Services Market, 2018 - 2030 (USD Million)

5.4.3. Core Genomics Services

5.4.3.1. Global Core Genomics Services Market, 2018 - 2030 (USD Million)

5.4.4. Biomarker Translation Services

5.4.4.1. Global Biomarker Translation Services Market, 2018 - 2030 (USD Million)

5.4.5. Computational Services

5.4.5.1. Global Computational Services Market, 2018 - 2030 (USD Million)

5.4.6. Others

5.4.6.1. Global Others Market, 2018 - 2030 (USD Million)

Chapter 6. Genomics Market: End-use business Analysis

6.1. Genomics Market: End-use Market Share Analysis

6.2. Genomics Market Estimates & Forecast, By End-use (USD Million)

6.3. Clinical Research

6.3.1. Global Clinical Research Market, 2018 - 2030 (USD Million)

6.4. Academic & Government Institutes

6.4.1. Global Academic & Government Institutes Market, 2018 - 2030 (USD Million)

6.5. Hospitals & Clinics

6.5.1. Global Hospitals & Clinics Market, 2018 - 2030 (USD Million)

6.6. Pharmaceutical & Biotechnology Companies

6.6.1. Global Pharmaceutical & Biotechnology Companies Market, 2018 - 2030 (USD Million)

6.7. Others

6.7.1. Global Others Market, 2018 - 2030 (USD Million)

Chapter 7. Genomics Market: Regional Business Analysis

7.1. Genomics Market Share By Region, 2022 & 2030

7.2. North America

7.2.1. North America Genomics Market, 2018 - 2030 (USD Million)

7.2.2. U.S.

7.2.2.1. Key Country Dynamics

7.2.2.2. Competitive Scenario

7.2.2.3. Regulatory Framework

7.2.2.4. U.S. Genomics Market, 2018 - 2030 (USD Million)

7.2.3. Canada

7.2.3.1. Key Country Dynamics

7.2.3.2. Competitive Scenario

7.2.3.3. Regulatory Framework

7.2.3.4. Canada Genomics Market, 2018 - 2030 (USD Million)

7.3. Europe

7.3.1. Europe Genomics Market, 2018 - 2030 (USD Million)

7.3.2. UK

7.3.2.1. Key Country Dynamics

7.3.2.2. Competitive Scenario

7.3.2.3. Regulatory Framework

7.3.2.4. UK Genomics Market, 2018 - 2030 (USD Million)

7.3.3. Germany

7.3.3.1. Key Country Dynamics

7.3.3.2. Competitive Scenario

7.3.3.3. Regulatory Framework

7.3.3.4. Germany Genomics Market, 2018 - 2030 (USD Million)

7.3.4. France

7.3.4.1. Key Country Dynamics

7.3.4.2. Competitive Scenario

7.3.4.3. Regulatory Framework

7.3.4.4. France Genomics Market, 2018 - 2030 (USD Million)

7.3.5. Italy

7.3.5.1. Key Country Dynamics

7.3.5.2. Competitive Scenario

7.3.5.3. Regulatory Framework

7.3.5.4. Italy Genomics Market, 2018 - 2030 (USD Million)

7.3.6. Spain

7.3.6.1. Key Country Dynamics

7.3.6.2. Competitive Scenario

7.3.6.3. Regulatory Framework

7.3.6.4. Spain Genomics Market, 2018 - 2030 (USD Million)

7.3.7. Denmark

7.3.7.1. Key Country Dynamics

7.3.7.2. Competitive Scenario

7.3.7.3. Regulatory Framework

7.3.7.4. Denmark Genomics Market, 2018 - 2030 (USD Million)

7.3.8. Sweden

7.3.8.1. Key Country Dynamics

7.3.8.2. Competitive Scenario

7.3.8.3. Regulatory Framework

7.3.8.4. Sweden Genomics Market, 2018 - 2030 (USD Million)

7.3.9. Norway

7.3.9.1. Key Country Dynamics

7.3.9.2. Competitive Scenario

7.3.9.3. Regulatory Framework

7.3.9.4. Norway Genomics Market, 2018 - 2030 (USD Million)

7.4. Asia Pacific

7.4.1. Asia Pacific Genomics Market, 2018 - 2030 (USD Million)

7.4.2. Japan

7.4.2.1. Key Country Dynamics

7.4.2.2. Competitive Scenario

7.4.2.3. Regulatory Framework

7.4.2.4. Japan Genomics Market, 2018 - 2030 (USD Million)

7.4.3. China

7.4.3.1. Key Country Dynamics

7.4.3.2. Competitive Scenario

7.4.3.3. Regulatory Framework

7.4.3.4. China Genomics Market, 2018 - 2030 (USD Million)

7.4.4. India

7.4.4.1. Key Country Dynamics

7.4.4.2. Competitive Scenario

7.4.4.3. Regulatory Framework

7.4.4.4. India Genomics Market, 2018 - 2030 (USD Million)

7.4.5. Australia

7.4.5.1. Key Country Dynamics

7.4.5.2. Competitive Scenario

7.4.5.3. Regulatory Framework

7.4.5.4. Australia Genomics Market, 2018 - 2030 (USD Million)

7.4.6. Thailand

7.4.6.1. Key Country Dynamics

7.4.6.2. Competitive Scenario

7.4.6.3. Regulatory Framework

7.4.6.4. Thailand Genomics Market, 2018 - 2030 (USD Million)

7.4.7. South Korea

7.4.7.1. Key Country Dynamics

7.4.7.2. Competitive Scenario

7.4.7.3. Regulatory Framework

7.4.7.4. South Korea Genomics Market, 2018 - 2030 (USD Million)

7.5. Latin America

7.5.1. Latin America Genomics Market, 2018 - 2030 (USD Million)

7.5.2. Brazil

7.5.2.1. Key Country Dynamics

7.5.2.2. Competitive Scenario

7.5.2.3. Regulatory Framework

7.5.2.4. Brazil Genomics Market, 2018 - 2030 (USD Million)

7.5.3. Mexico

7.5.3.1. Key Country Dynamics

7.5.3.2. Competitive Scenario

7.5.3.3. Regulatory Framework

7.5.3.4. Mexico Genomics Market, 2018 - 2030 (USD Million)

7.5.4. Argentina

7.5.4.1. Key Country Dynamics

7.5.4.2. Competitive Scenario

7.5.4.3. Regulatory Framework

7.5.4.4. Argentina Genomics Market, 2018 - 2030 (USD Million)

7.6. MEA

7.6.1. MEA Genomics Market, 2018 - 2030 (USD Million)

7.6.2. South Africa

7.6.2.1. Key Country Dynamics

7.6.2.2. Competitive Scenario

7.6.2.3. Regulatory Framework

7.6.2.4. South Africa Genomics Market, 2018 - 2030 (USD Million)

7.6.3. Saudi Arabia

7.6.3.1. Key Country Dynamics

7.6.3.2. Competitive Scenario

7.6.3.3. Regulatory Framework

7.6.3.4. Saudi Arabia Genomics Market, 2018 - 2030 (USD Million)

7.6.4. UAE

7.6.4.1. Key Country Dynamics

7.6.4.2. Competitive Scenario

7.6.4.3. Regulatory Framework

7.6.4.4. UAE Genomics Market, 2018 - 2030 (USD Million)

7.6.5. Kuwait

7.6.5.1. Key Country Dynamics

7.6.5.2. Competitive Scenario

7.6.5.3. Regulatory Framework

7.6.5.4. Kuwait Genomics Market, 2018 - 2030 (USD Million)

Chapter 8. Competitive Landscape

8.1. Financial Performance

8.2. Participant Categorization

8.2.1. Market Leaders

8.2.1.1. Market share analysis, 2023

8.3. Participant’s Overview

8.3.1. Agilent Technologies

8.3.1.1. Overview

8.3.1.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

8.3.1.3. Technology Benchmarking

8.3.1.4. Strategic Initiatives

8.3.2. Bio-Rad Laboratories, Inc

8.3.2.1. Overview

8.3.2.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

8.3.2.3. Technology Benchmarking

8.3.2.4. Strategic Initiatives

8.3.3. BGI Genomics

8.3.3.1. Overview

8.3.3.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

8.3.3.3. Technology Benchmarking

8.3.3.4. Strategic Initiatives

8.3.4. Color Genomics, Inc

8.3.4.1. Overview

8.3.4.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

8.3.4.3. Technology Benchmarking

8.3.4.4. Strategic Initiatives

8.3.5. Danaher Corporation

8.3.5.1. Overview

8.3.5.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

8.3.5.3. Technology Benchmarking

8.3.5.4. Strategic Initiatives

8.3.6. Eppendorf AG

8.3.6.1. Overview

8.3.6.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

8.3.6.3. Technology Benchmarking

8.3.6.4. Strategic Initiatives

8.3.7. Eurofins Scientific

8.3.7.1. Overview

8.3.7.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

8.3.7.3. Technology Benchmarking

8.3.7.4. Strategic Initiatives

8.3.8. F. Hoffmann-La Roche Ltd.

8.3.8.1. Overview

8.3.8.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

8.3.8.3. Technology Benchmarking

8.3.8.4. Strategic Initiatives

8.3.9. GE Healthcare

8.3.9.1. Overview

8.3.9.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

8.3.9.3. Technology Benchmarking

8.3.9.4. Strategic Initiatives

8.3.10. Illumina, Inc.

8.3.10.1. Overview

8.3.10.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

8.3.10.3. Technology Benchmarking

8.3.10.4. Strategic Initiatives

8.3.11. Myriad Genetics, Inc

8.3.11.1. Overview

8.3.11.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

8.3.11.3. Technology Benchmarking

8.3.11.4. Strategic Initiatives

8.3.12. Oxford Nanopore Technologies

8.3.12.1. Overview

8.3.12.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

8.3.12.3. Technology Benchmarking

8.3.12.4. Strategic Initiatives

8.3.13. Pacific Biosciences of California, Inc

8.3.13.1. Overview

8.3.13.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

8.3.13.3. Technology Benchmarking

8.3.13.4. Strategic Initiatives

8.3.14. QIAGEN N.V.

8.3.14.1. Overview

8.3.14.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

8.3.14.3. Technology Benchmarking

8.3.14.4. Strategic Initiatives

8.3.15. Quest Diagnostics Incorporated

8.3.15.1. Overview

8.3.15.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

8.3.15.3. Technology Benchmarking

8.3.15.4. Strategic Initiatives

8.3.16. Thermo Fisher Scientific, Inc

8.3.16.1. Overview

8.3.16.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

8.3.16.3. Technology Benchmarking

8.3.16.4. Strategic Initiatives

8.3.17. 23andMe, Inc

8.3.17.1. Overview

8.3.17.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

8.3.17.3. Technology Benchmarking

8.3.17.4. Strategic Initiatives

8.4. Strategy Mapping

8.4.1. Expansion

8.4.2. Acquisition

8.4.3. Collaborations

8.4.4. Product/service launch

8.4.5. Partnerships

8.4.6. Others

List of Tables

Table 1 List of secondary sources

Table 2 List of abbreviations

Table 3 Global genomics market, by technology & application, 2018 - 2030 (USD Million)

Table 4 Global genomics market, by deliverables, 2018 - 2030 (USD Million)

Table 5 Global genomics market, by End-use, 2018 - 2030 (USD Million)

Table 6 Global genomics market, by region, 2018 - 2030 (USD Million)

Table 7 North America genomics market, by country, 2018 - 2030 (USD Million)

Table 8 North America genomics market, by technology & application, 2018 - 2030 (USD Million)

Table 9 North America genomics market, by deliverables, 2018 - 2030 (USD Million)

Table 10 North America genomics market, by End-use, 2018 - 2030 (USD Million)

Table 11 U.S. genomics market, by technology & application, 2018 - 2030 (USD Million)

Table 12 U.S. genomics market, by deliverables, 2018 - 2030 (USD Million)

Table 13 U.S. genomics market, by End-use, 2018 - 2030 (USD Million)

Table 14 Canada genomics market, by technology & application, 2018 - 2030 (USD Million)

Table 15 Canada genomics market, by deliverables, 2018 - 2030 (USD Million)

Table 16 Canada genomics market, by End-use, 2018 - 2030 (USD Million)

Table 17 Europe genomics market, by country, 2018 - 2030 (USD Million)

Table 18 Europe genomics market, by technology & application, 2018 - 2030 (USD Million)

Table 19 Europe genomics market, by deliverables, 2018 - 2030 (USD Million)

Table 20 Europe genomics market, by End-use, 2018 - 2030 (USD Million)

Table 21 UK genomics market, by technology & application, 2018 - 2030 (USD Million)

Table 22 UK genomics market, by deliverables, 2018 - 2030 (USD Million)

Table 23 UK genomics market, by End-use, 2018 - 2030 (USD Million)

Table 24 Germany genomics market, by technology & application, 2018 - 2030 (USD Million)

Table 25 Germany genomics market, by deliverables, 2018 - 2030 (USD Million)

Table 26 Germany genomics market, by End-use, 2018 - 2030 (USD Million)

Table 27 France genomics market, by technology & application, 2018 - 2030 (USD Million)

Table 28 France genomics market, by deliverables, 2018 - 2030 (USD Million)

Table 29 France genomics market, by End-use, 2018 - 2030 (USD Million)

Table 30 Italy genomics market, by technology & application, 2018 - 2030 (USD Million)

Table 31 Italy genomics market, by deliverables, 2018 - 2030 (USD Million)

Table 32 Italy genomics market, by End-use, 2018 - 2030 (USD Million)

Table 33 Spain genomics market, by technology & application, 2018 - 2030 (USD Million)

Table 34 Spain genomics market, by deliverables, 2018 - 2030 (USD Million)

Table 35 Spain genomics market, by End-use, 2018 - 2030 (USD Million)

Table 36 Denmark genomics market, by technology & application, 2018 - 2030 (USD Million)

Table 37 Denmark genomics market, by deliverables, 2018 - 2030 (USD Million)

Table 38 Denmark genomics market, by End-use, 2018 - 2030 (USD Million)

Table 39 Sweden genomics market, by technology & application, 2018 - 2030 (USD Million)

Table 40 Sweden genomics market, by deliverables, 2018 - 2030 (USD Million)

Table 41 Sweden genomics market, by End-use, 2018 - 2030 (USD Million)

Table 42 Norway genomics market, by technology & application, 2018 - 2030 (USD Million)

Table 43 Norway genomics market, by deliverables, 2018 - 2030 (USD Million)

Table 44 Norway genomics market, by End-use, 2018 - 2030 (USD Million)

Table 45 Asia Pacific genomics market, by country, 2018 - 2030 (USD Million)

Table 46 Asia Pacific genomics market, by technology & application, 2018 - 2030 (USD Million)

Table 47 Asia Pacific genomics market, by deliverables, 2018 - 2030 (USD Million)

Table 48 Asia Pacific genomics market, by End-use, 2018 - 2030 (USD Million)

Table 49 Japan genomics market, by technology & application, 2018 - 2030 (USD Million)

Table 50 Japan genomics market, by deliverables, 2018 - 2030 (USD Million)

Table 51 Japan genomics market, by End-use, 2018 - 2030 (USD Million)

Table 52 China genomics market, by technology & application, 2018 - 2030 (USD Million)

Table 53 China genomics market, by deliverables, 2018 - 2030 (USD Million)

Table 54 China genomics market, by End-use, 2018 - 2030 (USD Million)

Table 55 India genomics market, by technology & application, 2018 - 2030 (USD Million)

Table 56 India genomics market, by deliverables, 2018 - 2030 (USD Million)

Table 57 India genomics market, by End-use, 2018 - 2030 (USD Million)

Table 58 Australia genomics market, by technology & application, 2018 - 2030 (USD Million)

Table 59 Australia genomics market, by deliverables, 2018 - 2030 (USD Million)

Table 60 Australia genomics market, by End-use, 2018 - 2030 (USD Million)

Table 61 Thailand genomics market, by technology & application, 2018 - 2030 (USD Million)

Table 62 Thailand genomics market, by deliverables, 2018 - 2030 (USD Million)

Table 63 Thailand genomics market, by End-use, 2018 - 2030 (USD Million)

Table 64 South Korea genomics market, by technology & application, 2018 - 2030 (USD Million)

Table 65 South Korea genomics market, by deliverables, 2018 - 2030 (USD Million)

Table 66 South Korea genomics market, by End-use, 2018 - 2030 (USD Million)

Table 67 Latin America genomics market, by country, 2018 - 2030 (USD Million)

Table 68 Latin America genomics market, by technology & application, 2018 - 2030 (USD Million)

Table 69 Latin America genomics market, by deliverables, 2018 - 2030 (USD Million)

Table 70 Latin America genomics market, by End-use, 2018 - 2030 (USD Million)

Table 71 Brazil genomics market, by technology & application, 2018 - 2030 (USD Million)

Table 72 Brazil genomics market, by deliverables, 2018 - 2030 (USD Million)

Table 73 Brazil genomics market, by End-use, 2018 - 2030 (USD Million)

Table 74 Mexico genomics market, by technology & application, 2018 - 2030 (USD Million)

Table 75 Mexico genomics market, by deliverables, 2018 - 2030 (USD Million)

Table 76 Mexico genomics market, by End-use, 2018 - 2030 (USD Million)

Table 77 Argentina genomics market, by technology & application, 2018 - 2030 (USD Million)

Table 78 Argentina genomics market, by deliverables, 2018 - 2030 (USD Million)

Table 79 Argentina genomics market, by End-use, 2018 - 2030 (USD Million)

Table 80 Middle East & Africa genomics market, by country, 2018 - 2030 (USD Million)

Table 81 Middle East & Africa genomics market, by technology & application, 2018 - 2030 (USD Million)

Table 82 Middle East & Africa genomics market, by deliverables, 2018 - 2030 (USD Million)

Table 83 Middle East & Africa genomics market, by End-use, 2018 - 2030 (USD Million)

Table 84 South Africa genomics market, by technology & application, 2018 - 2030 (USD Million)

Table 85 South Africa genomics market, by deliverables, 2018 - 2030 (USD Million)

Table 86 South Africa genomics market, by End-use, 2018 - 2030 (USD Million)

Table 87 Saudi Arabia genomics market, by technology & application, 2018 - 2030 (USD Million)

Table 88 Saudi Arabia genomics market, by deliverables, 2018 - 2030 (USD Million)

Table 89 Saudi Arabia genomics market, by End-use, 2018 - 2030 (USD Million)

Table 90 UAE genomics market, by technology & application, 2018 - 2030 (USD Million)

Table 91 UAE genomics market, by deliverables, 2018 - 2030 (USD Million)

Table 92 UAE genomics market, by End-use, 2018 - 2030 (USD Million)

Table 93 Kuwait genomics market, by technology & application, 2018 - 2030 (USD Million)

Table 94 Kuwait genomics market, by deliverables, 2018 - 2030 (USD Million)

Table 95 Kuwait genomics market, by End-use, 2018 - 2030 (USD Million)

Table 96 Participant's overview

Table 97 Financial performance

Table 98 Key companies undergoing expansions

Table 99 Key companies undergoing acquisitions

Table 100 Key companies undergoing collaborations

Table 101 Key companies launching new products/services

Table 102 Key companies undertaking other strategies

List of Figures

Fig. 1 Genomics market segmentation

Fig. 2 Market research process

Fig. 3 Data triangulation techniques

Fig. 4 Primary research pattern

Fig. 5 Market research approaches

Fig. 6 Value-chain-based sizing & forecasting

Fig. 7 QFD modeling for market share assessment

Fig. 8 Market formulation & validation

Fig. 9 Market snapshot

Fig. 10 Segment snapshot

Fig. 11 Competitive landscape snapshot

Fig. 12 Parent market outlook

Fig. 13 Related/ancillary market outlook

Fig. 14 Genomics - Industry value chain analysis

Fig. 15 Genomics market driver analysis

Fig. 16 Genomics market restraint analysis

Fig. 17 Genomics market: Porter's analysis

Fig. 18 Genomics market: application & technology outlook and key takeaways

Fig. 19 Genomics market: Application & technology market share analysis, 2022 - 2030

Fig. 20 Global sequencing by Functional Genomics market, 2018 - 2030 (USD Million)

Fig. 21 Global sequencing by Real-time PCR market, 2018 - 2030 (USD Million)

Fig. 22 Global sequencing by Transfection market, 2018 - 2030 (USD Million)

Fig. 23 Global sequencing by SNP analysis market, 2018 - 2030 (USD Million)

Fig. 24 Global sequencing by Mutational analysis market, 2018 - 2030 (USD Million)

Fig. 25 Global sequencing by Microarray analysis market, 2018 - 2030 (USD Million)

Fig. 26 Global sequencing by RNA interference market, 2018 - 2030 (USD Million)

Fig. 27 Global sequencing by Epigenomics market, 2018 - 2030 (USD Million)

Fig. 28 Global sequencing by Bisulfite sequencing market, 2018 - 2030 (USD Million)

Fig. 29 Global sequencing by Microarray analysis market, 2018 - 2030 (USD Million)

Fig. 30 Global sequencing by Chromatin immunoprecipitation (ChIP & ChIP-Seq) market, 2018 - 2030 (USD Million)

Fig. 31 Global sequencing by Methylated DNA immunoprecipitation (MeDIP) market, 2018 - 2030 (USD Million)

Fig. 32 Global sequencing by High resolution melt (HRM) market, 2018 - 2030 (USD Million)

Fig. 33 Global sequencing by Chromatin accessibility assays market, 2018 - 2030 (USD Million)

Fig. 34 Global sequencing by Pathway Analysis market, 2018 - 2030 (USD Million)

Fig. 35 Global sequencing by Microarray analysis market, 2018 - 2030 (USD Million)

Fig. 36 Global sequencing by Bead-based analysis market, 2018 - 2030 (USD Million)

Fig. 37 Global sequencing by Proteomics tools (2-D PAGE; yeast 2-hybrid studies) market, 2018 - 2030 (USD Million)

Fig. 38 Global sequencing by Real-time PCR market, 2018 - 2030 (USD Million)

Fig. 39 Global sequencing by Biomarker Discovery market, 2018 - 2030 (USD Million)

Fig. 40 Global sequencing by DNA sequencing market, 2018 - 2030 (USD Million)

Fig. 41 Global sequencing by Microarray analysis market, 2018 - 2030 (USD Million)

Fig. 42 Global sequencing by Real-time PCR market, 2018 - 2030 (USD Million)

Fig. 43 Global sequencing by Mass spectrometry market, 2018 - 2030 (USD Million)

Fig. 44 Global sequencing by Statistical analysis market, 2018 - 2030 (USD Million)

Fig. 45 Global sequencing by Bioinformatics market, 2018 - 2030 (USD Million)

Fig. 46 Global sequencing by Products market, 2018 - 2030 (USD Million)

Fig. 47 Global sequencing by Services market, 2018 - 2030 (USD Million)

Fig. 48 Global sequencing by Instruments/Systems/Softwares market, 2018 - 2030 (USD Million)

Fig. 49 Global sequencing by Consumables & Reagents market, 2018 - 2030 (USD Million)

Fig. 50 Global sequencing by NGS-based Services market, 2018 - 2030 (USD Million)

Fig. 51 Global sequencing by Core Genomics Services market, 2018 - 2030 (USD Million)

Fig. 52 Global sequencing by Biomarker Translation Services market, 2018 - 2030 (USD Million)

Fig. 53 Global sequencing by Computational Services market, 2018 - 2030 (USD Million)

Fig. 54 Global sequencing by Others market, 2018 - 2030 (USD Million)

Fig. 55 Global sequencing by Pharmaceutical and Biotechnology Companies market, 2018 - 2030 (USD Million)

Fig. 56 Global sequencing by Hospitals and Clinics market, 2018 - 2030 (USD Million)

Fig. 57 Global sequencing by Academic and Government Institutes market, 2018 - 2030 (USD Million)

Fig. 58 Global sequencing by Clinical Research market, 2018 - 2030 (USD Million)

Fig. 59 Global sequencing by Other End-uses market, 2018 - 2030 (USD Million)

Fig. 60 Regional marketplace: Key takeaways

Fig. 61 Regional marketplace: Key takeaways

Fig. 62 North America genomics market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 63 U.S. key country dynamics

Fig. 64 U.S. genomics market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 65 Canada key country dynamics

Fig. 66 Canada genomics market, 2018 - 2030 (USD Million)

Fig. 67 Europe genomics market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 68 UK key country dynamics

Fig. 69 UK genomics market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 70 Germany key country dynamics

Fig. 71 Germany genomics market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 72 France key country dynamics

Fig. 73 France genomics market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 74 Italy key country dynamics

Fig. 75 Italy genomics market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 76 Spain key country dynamics

Fig. 77 Spain genomics market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 78 Denmark key country dynamics

Fig. 79 Denmark genomics market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 80 Sweden key country dynamics

Fig. 81 Sweden genomics market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 82 Norway key country dynamics

Fig. 83 Norway genomics market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 84 Asia-Pacific genomics market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 85 Japan key country dynamics

Fig. 86 Japan genomics market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 87 China key country dynamics

Fig. 88 China genomics market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 89 India key country dynamics

Fig. 90 India genomics market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 91 Australia key country dynamics

Fig. 92 Australia genomics market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 93 Thailand key country dynamics

Fig. 94 Thailand genomics market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 95 South Korea key country dynamics

Fig. 96 South Korea genomics market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 97 Latin America genomics market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 98 Brazil key country dynamics

Fig. 99 Brazil genomics market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 100 Mexico key country dynamics

Fig. 101 Mexico genomics market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 102 Argentina key country dynamics

Fig. 103 Argentina genomics market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 104 MEA genomics market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 105 South Africa key country dynamics

Fig. 106 South Africa genomics market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 107 Saudi Arabia key country dynamics

Fig. 108 Saudi Arabia genomics market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 109 UAE key country dynamics

Fig. 110 UAE genomics market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 111 Kuwait key country dynamics

Fig. 112 Kuwait genomics market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 113 Key company categorization

Fig. 114 Company market positioning

Fig. 115 Market participant categorization

Fig. 116 Strategy frameworkWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Application Outlook (Revenue, USD Billion, 2018 - 2030)

- Functional Genomics

- Transfection

- Real-Time PCR

- RNA Interference

- Mutational Analysis

- SNP Analysis

- Microarray Analysis

- Epigenomics

- Bisulfite Sequencing

- Chromatin Immunoprecipitation (ChIP & ChIP-Seq)

- Methylated DNA Immunoprecipitation (MeDIP)

- High-Resolution Melt (HRM)

- Chromatin Accessibility Assays

- Microarray Analysis

- Pathway Analysis

- Bead-Based Analysis

- Microarray Analysis

- Real-time PCR

- Proteomics Tools (2-D PAGE; yeast 2-hybrid studies)

- Biomarker Discovery

- Mass Spectrometry

- Real-time PCR

- Microarray Analysis

- Statistical Analysis

- Bioinformatics

- DNA Sequencing

- Others

- Functional Genomics

- By Technology Outlook (Revenue, USD Million, 2018 - 2030)

- Sequencing

- PCR

- Flow Cytometry

- Microarray

- Other Technology

- By Deliverables Outlook (Revenue, USD Million, 2018 - 2030)

- Products

- Instruments/Systems/Software

- Consumables & Reagents

- Services

- NGS-based Services

- Core Genomics Services

- Biomarker Translation Services

- Computational Services

- Others

- Products

- By End-User Outlook (Revenue, USD Million, 2018 - 2030)

- Clinical Research

- Academic & Government Institutes

- Hospitals & Clinics

- Pharmaceutical & Biotechnology Companies

- Other End Users

- Genomics Market: Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- North America Genomics Market, Application

- Functional Genomics

- Transfection

- Real Time PCR

- RNA Interference

- Mutational Analysis

- SNP Analysis

- Microarray Analysis

- Epigenomics

- Bisulfite Sequencing

- Chromatin Immunoprecipitation (ChIP & ChIP-Seq)

- Methylated DNA Immunoprecipitation (MeDIP)

- High Resolution Melt (HRM)

- Chromatin Accessibility Assays

- Microarray Analysis

- Pathway Analysis

- Bead-Based Analysis

- Microarray Analysis

- Real-time PCR

- Proteomics tools (2-D PAGE; yeast 2-hybrid studies)

- Biomarker Discovery

- Mass Spectrometry

- Real-time PCR

- Microarray Analysis

- Statistical Analysis

- Bioinformatics

- DNA Sequencing

- Others

- Functional Genomics

- North America Genomics Market, Technology

- Sequencing

- PCR

- Flow Cytometry

- Microarray

- Other Technology

- North America Genomics Market, Deliverables

- Products

- Instruments/Systems/Softwares

- Consumables & Reagents

- Services

- Core Genomics Services

- NGS-based Services

- Biomarker Translational Services

- Computational Services

- Others

- Products

- North America Genomics Market, By End-use

- Clinical Research

- Academic and Government Institutes

- Hospitals and Clinics

- Pharmaceutical and Biotechnology Companies

- Other Genomics Market, By End-users

- U.S.

- U.S. Genomics Market, Application

- Functional Genomics

- Transfection

- Real Time PCR

- RNA Interference

- Mutational Analysis

- SNP Analysis

- Microarray Analysis

- Epigenomics

- Bisulfite Sequencing

- Chromatin Immunoprecipitation (ChIP & ChIP-Seq)

- Methylated DNA Immunoprecipitation (MeDIP)

- High Resolution Melt (HRM)

- Chromatin Accessibility Assays

- Microarray Analysis

- Pathway Analysis

- Bead-Based Analysis

- Microarray Analysis

- Real-time PCR

- Proteomics tools (2-D PAGE; yeast 2-hybrid studies)

- Biomarker Discovery

- Mass Spectrometry

- Real-time PCR

- Microarray Analysis

- Statistical Analysis

- Bioinformatics

- DNA Sequencing

- Others

- Functional Genomics

- U.S. Genomics Market, Technology

- Sequencing

- PCR

- Flow Cytometry

- Microarray

- Other Technology

- US Genomics Market, Deliverables

- Products

- Instruments/Systems/Softwares

- Consumables & Reagents

- Services

- Core Genomics Services

- NGS-based Services

- Biomarker Translational Services

- Computational Services

- Others

- Products

- US Genomics Market, By End-use

- Clinical Research

- Academic and Government Institutes

- Hospitals and Clinics

- Pharmaceutical and Biotechnology Companies

- Other Genomics Market, By End-users

- U.S. Genomics Market, Application

- Canada

- Canada Genomics Market, Application

- Functional Genomics

- Transfection

- Real Time PCR

- RNA Interference

- Mutational Analysis

- SNP Analysis

- Microarray Analysis

- Epigenomics

- Bisulfite Sequencing

- Chromatin Immunoprecipitation (ChIP & ChIP-Seq)

- Methylated DNA Immunoprecipitation (MeDIP)

- High Resolution Melt (HRM)

- Chromatin Accessibility Assays

- Microarray Analysis

- Pathway Analysis

- Bead-Based Analysis

- Microarray Analysis

- Real-time PCR

- Proteomics tools (2-D PAGE; yeast 2-hybrid studies)

- Biomarker Discovery

- Mass Spectrometry

- Real-time PCR

- Microarray Analysis

- Statistical Analysis

- Bioinformatics

- DNA Sequencing

- Others

- Functional Genomics

- Canada Genomics Market, Technology

- Sequencing

- PCR

- Flow Cytometry

- Microarray

- Other Technology

- Canada Genomics Market, Deliverables

- Products

- Instruments/Systems/Softwares

- Consumables & Reagents

- Services

- Core Genomics Services

- NGS-based Services

- Biomarker Translational Services

- Computational Services

- Others

- Products

- Canada Genomics Market, By End-use

- Clinical Research

- Academic and Government Institutes

- Hospitals and Clinics

- Pharmaceutical and Biotechnology Companies

- Other Genomics Market, By End-users

- Canada Genomics Market, Application

- North America Genomics Market, Application

- Europe

- Europe Genomics Market, Application

- Functional Genomics

- Transfection

- Real Time PCR

- RNA Interference

- Mutational Analysis

- SNP Analysis

- Microarray Analysis

- Epigenomics

- Bisulfite Sequencing

- Chromatin Immunoprecipitation (ChIP & ChIP-Seq)

- Methylated DNA Immunoprecipitation (MeDIP)

- High Resolution Melt (HRM)

- Chromatin Accessibility Assays

- Microarray Analysis

- Pathway Analysis

- Bead-Based Analysis

- Microarray Analysis

- Real-time PCR

- Proteomics tools (2-D PAGE; yeast 2-hybrid studies)

- Biomarker Discovery

- Mass Spectrometry

- Real-time PCR

- Microarray Analysis

- Statistical Analysis

- Bioinformatics

- DNA Sequencing

- Others

- Functional Genomics

- Europe Genomics Market, Technology

- Sequencing

- PCR

- Flow Cytometry

- Microarray

- Other Technology

- Europe Genomics Market, Deliverables

- Product

- Instruments/Systems/Softwares

- Consumables & Reagents

- Services

- Core Genomics Services

- NGS-based Services

- Biomarker Translational Services

- Computational Services

- Others

- Product

- Europe Genomics Market, By End-use

- Clinical Research

- Academic and Government Institutes

- Hospitals and Clinics

- Pharmaceutical and Biotechnology Companies

- Other Genomics Market, By End-users

- UK

- UK Genomics Market, Application

- Functional Genomics

- Transfection

- Real Time PCR

- RNA Interference

- Mutational Analysis

- SNP Analysis

- Microarray Analysis

- Epigenomics

- Bisulfite Sequencing

- Chromatin Immunoprecipitation (ChIP & ChIP-Seq)

- Methylated DNA Immunoprecipitation (MeDIP)

- High Resolution Melt (HRM)

- Chromatin Accessibility Assays

- Microarray Analysis

- Pathway Analysis

- Bead-Based Analysis

- Microarray Analysis

- Real-time PCR

- Proteomics tools (2-D PAGE; yeast 2-hybrid studies)

- Biomarker Discovery

- Mass Spectrometry

- Real-time PCR

- Microarray Analysis

- Statistical Analysis

- Bioinformatics

- DNA Sequencing

- Others

- Functional Genomics

- UK Genomics Market, Technology

- Sequencing

- PCR

- Flow Cytometry

- Microarray

- Other Technology

- UK Genomics Market, Deliverables

- Products

- Instruments/Systems/Softwares

- Consumables & Reagents

- Services

- Core Genomics Services

- NGS-based Services

- Biomarker Translational Services

- Computational Services

- Others

- Products

- UK Genomics Market, By End-use

- Clinical Research

- Academic and Government Institutes

- Hospitals and Clinics

- Pharmaceutical and Biotechnology Companies

- Other Genomics Market, By End-users

- UK Genomics Market, Application

- Germany

- Germany Genomics Market, Application

- Functional Genomics

- Transfection

- Real Time PCR

- RNA Interference

- Mutational Analysis

- SNP Analysis

- Microarray Analysis

- Epigenomics

- Bisulfite Sequencing

- Chromatin Immunoprecipitation (ChIP & ChIP-Seq)

- Methylated DNA Immunoprecipitation (MeDIP)

- High Resolution Melt (HRM)

- Chromatin Accessibility Assays

- Microarray Analysis

- Pathway Analysis

- Bead-Based Analysis

- Microarray Analysis

- Real-time PCR

- Proteomics tools (2-D PAGE; yeast 2-hybrid studies)

- Biomarker Discovery

- Mass Spectrometry

- Real-time PCR

- Microarray Analysis

- Statistical Analysis

- Bioinformatics

- DNA Sequencing

- Others

- Functional Genomics

- Germany Genomics Market, Technology

- Sequencing

- PCR

- Flow Cytometry

- Microarray

- Other Technology

- Germany Genomics Market, Deliverables

- Products

- Instruments/Systems/Softwares

- Consumables & Reagents

- Services

- Core Genomics Services

- NGS-based Services

- Biomarker Translational Services

- Computational Services

- Others

- Products

- Germany Genomics Market, By End-use

- Clinical Research

- Academic and Government Institutes

- Hospitals and Clinics

- Pharmaceutical and Biotechnology Companies

- Other Genomics Market, By End-users

- Germany Genomics Market, Application

- France

- France Genomics Market, Application

- Functional Genomics

- Transfection

- Real Time PCR

- RNA Interference

- Mutational Analysis

- SNP Analysis

- Microarray Analysis

- Epigenomics

- Bisulfite Sequencing

- Chromatin Immunoprecipitation (ChIP & ChIP-Seq)

- Methylated DNA Immunoprecipitation (MeDIP)

- High Resolution Melt (HRM)

- Chromatin Accessibility Assays

- Microarray Analysis

- Pathway Analysis

- Bead-Based Analysis

- Microarray Analysis

- Real-time PCR

- Proteomics tools (2-D PAGE; yeast 2-hybrid studies)

- Biomarker Discovery

- Mass Spectrometry

- Real-time PCR

- Microarray Analysis

- Statistical Analysis

- Bioinformatics

- DNA Sequencing

- Others

- Functional Genomics

- France Genomics Market, Technology

- Sequencing

- PCR

- Flow Cytometry

- Microarray

- Other Technology

- France Genomics Market, Deliverables

- Products

- Instruments/Systems/Softwares

- Consumables & Reagents

- Services

- Core Genomics Services

- NGS-based Services

- Biomarker Translational Services

- Computational Services

- Others

- Products

- France Genomics Market, By End-use

- Clinical Research

- Academic and Government Institutes

- Hospitals and Clinics

- Pharmaceutical and Biotechnology Companies

- Other Genomics Market, By End-users

- France Genomics Market, Application

- Italy

- Italy Genomics Market, Application

- Functional Genomics

- Transfection

- Real Time PCR

- RNA Interference

- Mutational Analysis

- SNP Analysis

- Microarray Analysis

- Epigenomics

- Bisulfite Sequencing

- Chromatin Immunoprecipitation (ChIP & ChIP-Seq)

- Methylated DNA Immunoprecipitation (MeDIP)

- High Resolution Melt (HRM)

- Chromatin Accessibility Assays

- Microarray Analysis

- Pathway Analysis

- Bead-Based Analysis

- Microarray Analysis

- Real-time PCR

- Proteomics tools (2-D PAGE; yeast 2-hybrid studies)

- Biomarker Discovery

- Mass Spectrometry

- Real-time PCR

- Microarray Analysis

- Statistical Analysis

- Bioinformatics

- DNA Sequencing

- Others

- Functional Genomics

- Italy Genomics Market, Technology

- Sequencing

- PCR

- Flow Cytometry

- Microarray

- Other Technology

- Italy Genomics Market, Deliverables

- Products

- Instruments/Systems/Softwares

- Consumables & Reagents

- Services

- Core Genomics Services

- NGS-based Services

- Biomarker Translational Services

- Computational Services

- Others

- Products

- Italy Genomics Market, By End-use

- Clinical Research

- Academic and Government Institutes

- Hospitals and Clinics

- Pharmaceutical and Biotechnology Companies

- Other Genomics Market, By End-users

- Italy Genomics Market, Application

- Spain

- Spain Genomics Market, Application

- Functional Genomics

- Transfection

- Real Time PCR

- RNA Interference

- Mutational Analysis

- SNP Analysis

- Microarray Analysis

- Epigenomics

- Bisulfite Sequencing

- Chromatin Immunoprecipitation (ChIP & ChIP-Seq)

- Methylated DNA Immunoprecipitation (MeDIP)

- High Resolution Melt (HRM)

- Chromatin Accessibility Assays

- Microarray Analysis

- Pathway Analysis

- Bead-Based Analysis

- Microarray Analysis

- Real-time PCR

- Proteomics tools (2-D PAGE; yeast 2-hybrid studies)

- Biomarker Discovery

- Mass Spectrometry

- Real-time PCR

- Microarray Analysis

- Statistical Analysis

- Bioinformatics

- DNA Sequencing

- Others

- Functional Genomics

- Spain Genomics Market, Technology

- Sequencing

- PCR

- Flow Cytometry

- Microarray

- Other Technology

- Spain Genomics Market, Deliverables

- Products

- Instruments/Systems/Softwares

- Consumables & Reagents

- Services

- Core Genomics Services

- NGS-based Services

- Biomarker Translational Services

- Computational Services

- Others

- Products

- Spain Genomics Market, By End-use

- Clinical Research

- Academic and Government Institutes

- Hospitals and Clinics

- Pharmaceutical and Biotechnology Companies

- Other Genomics Market, By End-users

- Spain Genomics Market, Application

- Sweden

- Sweden Genomics Market, Application

- Functional Genomics

- Transfection

- Real Time PCR

- RNA Interference

- Mutational Analysis

- SNP Analysis

- Microarray Analysis

- Epigenomics

- Bisulfite Sequencing

- Chromatin Immunoprecipitation (ChIP & ChIP-Seq)

- Methylated DNA Immunoprecipitation (MeDIP)

- High Resolution Melt (HRM)

- Chromatin Accessibility Assays

- Microarray Analysis

- Pathway Analysis

- Bead-Based Analysis

- Microarray Analysis

- Real-time PCR

- Proteomics tools (2-D PAGE; yeast 2-hybrid studies)

- Biomarker Discovery

- Mass Spectrometry

- Real-time PCR

- Microarray Analysis

- Statistical Analysis

- Bioinformatics

- DNA Sequencing

- Others

- Functional Genomics

- Sweden Genomics Market, Technology

- Sequencing

- PCR

- Flow Cytometry

- Microarray

- Other Technology

- Sweden Genomics Market, Deliverables

- Products

- Instruments/Systems/Softwares

- Consumables & Reagents

- Services

- Core Genomics Services

- NGS-based Services

- Biomarker Translational Services

- Computational Services

- Others

- Products

- Sweden Genomics Market, By End-use

- Clinical Research

- Academic and Government Institutes

- Hospitals and Clinics

- Pharmaceutical and Biotechnology Companies

- Other Genomics Market, By End-users

- Sweden Genomics Market, Application

- Norway

- Norway Genomics Market, Application

- Functional Genomics

- Transfection

- Real Time PCR

- RNA Interference

- Mutational Analysis

- SNP Analysis

- Microarray Analysis

- Epigenomics

- Bisulfite Sequencing

- Chromatin Immunoprecipitation (ChIP & ChIP-Seq)

- Methylated DNA Immunoprecipitation (MeDIP)

- High Resolution Melt (HRM)

- Chromatin Accessibility Assays

- Microarray Analysis

- Pathway Analysis

- Bead-Based Analysis

- Microarray Analysis

- Real-time PCR

- Proteomics tools (2-D PAGE; yeast 2-hybrid studies)

- Biomarker Discovery

- Mass Spectrometry

- Real-time PCR

- Microarray Analysis

- Statistical Analysis

- Bioinformatics

- DNA Sequencing

- Others

- Functional Genomics

- Norway Genomics Market, Technology

- Sequencing

- PCR

- Flow Cytometry

- Microarray

- Other Technology

- Norway Genomics Market, Deliverables

- Products

- Instruments/Systems/Softwares

- Consumables & Reagents

- Services

- Core Genomics Services

- NGS-based Services

- Biomarker Translational Services

- Computational Services

- Others

- Products

- Norway Genomics Market, By End-use

- Clinical Research

- Academic and Government Institutes

- Hospitals and Clinics

- Pharmaceutical and Biotechnology Companies

- Other Genomics Market, By End-users

- Norway Genomics Market, Application

- Denmark

- Denmark Genomics Market, Application

- Functional Genomics

- Transfection

- Real Time PCR

- RNA Interference

- Mutational Analysis

- SNP Analysis

- Microarray Analysis

- Epigenomics

- Bisulfite Sequencing

- Chromatin Immunoprecipitation (ChIP & ChIP-Seq)

- Methylated DNA Immunoprecipitation (MeDIP)

- High Resolution Melt (HRM)

- Chromatin Accessibility Assays

- Microarray Analysis

- Pathway Analysis

- Bead-Based Analysis

- Microarray Analysis

- Real-time PCR

- Proteomics tools (2-D PAGE; yeast 2-hybrid studies)

- Biomarker Discovery

- Mass Spectrometry

- Real-time PCR

- Microarray Analysis

- Statistical Analysis

- Bioinformatics

- DNA Sequencing

- Others

- Functional Genomics

- Denmark Genomics Market, Technology

- Sequencing

- PCR

- Flow Cytometry

- Microarray

- Other Technology

- Denmark Genomics Market, Deliverables

- Products

- Instruments/Systems/Softwares

- Consumables & Reagents

- Services

- Core Genomics Services

- NGS-based Services

- Biomarker Translational Services

- Computational Services

- Others

- Products

- Denmark Genomics Market, By End-use

- Clinical Research

- Academic and Government Institutes

- Hospitals and Clinics

- Pharmaceutical and Biotechnology Companies

- Other Genomics Market, By End-users

- Denmark Genomics Market, Application

- Europe Genomics Market, Application

- Asia Pacific

- Asia Pacific Genomics Market, Application

- Functional Genomics

- Transfection

- Real Time PCR

- RNA Interference

- Mutational Analysis

- SNP Analysis

- Microarray Analysis

- Epigenomics

- Bisulfite Sequencing

- Chromatin Immunoprecipitation (ChIP & ChIP-Seq)

- Methylated DNA Immunoprecipitation (MeDIP)

- High Resolution Melt (HRM)

- Chromatin Accessibility Assays

- Microarray Analysis

- Pathway Analysis

- Bead-Based Analysis

- Microarray Analysis

- Real-time PCR

- Proteomics tools (2-D PAGE; yeast 2-hybrid studies)

- Biomarker Discovery

- Mass Spectrometry

- Real-time PCR

- Microarray Analysis

- Statistical Analysis

- Bioinformatics

- DNA Sequencing

- Others

- Functional Genomics

- Asia Pacific Genomics Market, Technology

- Sequencing

- PCR

- Flow Cytometry

- Microarray

- Other Technology

- Asia Pacific Genomics Market, Deliverables

- Product

- Instruments/Systems/Softwares

- Consumables & Reagents

- Services

- Core Genomics Services

- NGS-based Services

- Biomarker Translational Services

- Computational Services

- Others

- Product

- Asia Pacific Genomics Market, By End-use

- Clinical Research

- Academic and Government Institutes

- Hospitals and Clinics

- Pharmaceutical and Biotechnology Companies

- Other Genomics Market, By End-users

- Japan

- Japan Genomics Market, Application

- Functional Genomics

- Transfection

- Real Time PCR

- RNA Interference

- Mutational Analysis

- SNP Analysis

- Microarray Analysis

- Epigenomics

- Bisulfite Sequencing

- Chromatin Immunoprecipitation (ChIP & ChIP-Seq)

- Methylated DNA Immunoprecipitation (MeDIP)

- High Resolution Melt (HRM)

- Chromatin Accessibility Assays

- Microarray Analysis

- Pathway Analysis

- Bead-Based Analysis

- Microarray Analysis

- Real-time PCR

- Proteomics tools (2-D PAGE; yeast 2-hybrid studies)

- Biomarker Discovery

- Mass Spectrometry

- Real-time PCR

- Microarray Analysis

- Statistical Analysis

- Bioinformatics

- DNA Sequencing

- Others

- Functional Genomics

- Japan Genomics Market, Technology

- Sequencing

- PCR

- Flow Cytometry

- Microarray

- Other Technology

- Japan Genomics Market, Deliverables

- Products

- Instruments/Systems/Softwares

- Consumables & Reagents

- Services

- Core Genomics Services

- NGS-based Services

- Biomarker Translational Services

- Computational Services

- Others

- Products

- Japan Genomics Market, By End-use

- Clinical Research

- Academic and Government Institutes

- Hospitals and Clinics

- Pharmaceutical and Biotechnology Companies

- Other Genomics Market, By End-users

- Japan Genomics Market, Application

- China

- China Genomics Market, Application

- Functional Genomics

- Transfection

- Real Time PCR

- RNA Interference

- Mutational Analysis

- SNP Analysis

- Microarray Analysis

- Epigenomics

- Bisulfite Sequencing

- Chromatin Immunoprecipitation (ChIP & ChIP-Seq)

- Methylated DNA Immunoprecipitation (MeDIP)

- High Resolution Melt (HRM)

- Chromatin Accessibility Assays

- Microarray Analysis

- Pathway Analysis

- Bead-Based Analysis

- Microarray Analysis

- Real-time PCR

- Proteomics tools (2-D PAGE; yeast 2-hybrid studies)

- Biomarker Discovery

- Mass Spectrometry

- Real-time PCR

- Microarray Analysis

- Statistical Analysis

- Bioinformatics