- Home

- »

- Next Generation Technologies

- »

-

Geospatial Analytics Market Size And Share Report, 2030GVR Report cover

![Geospatial Analytics Market Size, Share & Trends Report]()

Geospatial Analytics Market Size, Share & Trends Analysis Report By Component, By Type, By Application (Surveying, Medicine & Public Safety), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-358-4

- Number of Report Pages: 142

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Geospatial Analytics Market Size & Trends

The global geospatial analytics market size was valued at USD 85.77 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 12.6% from 2023 to 2030. Geospatial analytics refers to the collection and manipulation of data based on location. It uses multiple technological tools, including Global Positioning Systems (GPS), Geographic Information Systems (GIS), georeferencing, metadata, and remote sensing to provide accurate modeling, trend analysis, and predictions. These analytics also filter out relevant and useful data from irrelevant data sets.

Geospatial analysis applies various analytical techniques, such as statistical analysis, to analyze geographical and spatial data. It also uses software solutions capable of processing spatial data, rendering maps, and applying analytical methods to geographic or terrestrial datasets with the help of GIS and geomatics. Besides, geospatial information systems can be easily integrated into an organization’s enterprise information systems. These advantages are the major driving factors for the geospatial analytics market growth.

However, key restraining factors hampering the market growth include high acquisition costs and operational concerns such as a lack of skilled human resources, the limited presence of open standards and interoperability mechanisms, and integration issues between GIS and Environmental Resources Management (ERM) systems. Although the overall cost of geospatial analytics solutions has drastically declined over the last decade, owing to the increased availability of open-source tools and plunging hardware costs, it remains a major cause of concern for Small and Medium Scale Enterprises (SMEs).

Geospatial analytics was initially developed to tackle challenges faced by the environmental and life sciences industries, focusing on ecology, epidemiology, and geology. Over the years, the technology has been widely adopted to cater to many different industries, including government and defense, utilities, public safety, healthcare, and natural resources. It also finds major applications in Climate Change Adaptation (CCA) and Disaster Risk Reduction and Management (DRRM).

At the same time, advancements in geospatial technology have also increased the volume of the data collected and the frequency of data collection, and analyzing the large volumes of data being generated is becoming a major concern for organizations. AI and ML are helping organizations analyze these large volumes of geospatial data and gain valuable insights to undertake an actionable approach and make informed business decisions. Similarly, advances in AI allow geospatial analytics solutions and service providers to offer cloud-based geospatial analytics solutions capable of providing on-demand analytics to run large and complex datasets to connected devices. These innovations facilitate integrating information systems with hybrid cloud computing environments.

The increased adoption of big data analytics, cloud computing, IoT, AI, and other business intelligence tools is driving the growth of geospatial analytics. Additionally, the abundant availability of remote sensing satellites, high-speed internet, communication network infrastructure, and widespread adoption of UAV technology to gather geospatial data are expected to further contribute to the market growth.

Moreover, technological developments in augmented reality will likely foster market growth as augmented reality uses 3D platforms and GIS information to provide virtual information. The advancements in AI and big data have enabled providers of geospatial analytics solutions and services to offer on-demand analytics of large and complex datasets. These advancements have also enabled the integration of information systems with a hybrid cloud computing environment.

Further, market vendors focus on product development to increase their customer base. For instance, in June 2019, Hexagon’s geospatial division launched Luciad V2019 at its digital solutions conference named HxGN LIVE 2019. The solution enables smart cities, organizations, and nations to leverage real-time location intelligence to drive real-time decision-making.

The introduction of smart city initiatives has boosted the demand for innovative technologies in developing economies across the globe. Geospatial analytics plays a major role in analyzing the migration of the population and in smart city planning. Moreover, the leading organizations prefer geospatial analytics solutions for determining strategies, future investments, and expansion programs to be implemented.

While the rising adoption of geospatial technologies coupled with the introduction of other supporting technologies, such as cloud services and embedded sensors, and the growing popularity of social media are making it difficult to analyze and map the data, the introduction of big data analytics is enhancing the data handling capabilities by processing large volumes of data in the shortest possible time durations. As a result, the demand for geospatial analytics solutions and big data capabilities is anticipated to increase over the forecast period.

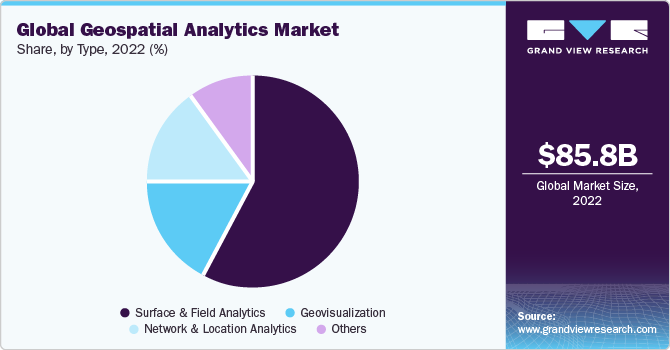

Type Insights

The surface & field analytics segment accounted for the largest revenue share of 58.3% in 2022 owing to its wide adoption by government and private companies for infrastructure development projects, determining water flow, and designing and constructing drainage systems. This geospatial analytics service is also used in agriculture to analyze topsoil erosion.

The network & location analytics segment is estimated to register the fastest CAGR of 13.7% over the forecast period owing to its increased use to optimize marketing strategies and develop and deliver highly customized promotional content. Location is a vital component of geospatial analytics. The technology helps enhance data analytics' functionality, utility, and relevance. It also can analyze and organize a large amount of data in real-time to derive decisive business insights.

Additionally, it allows visualizing, understanding, and interpreting data to reveal relationships, trends, and patterns through globes, maps, charts, and reports for marketing activities. It is crucial for any company looking to expand its operations, explore new markets, and achieve customer satisfaction.

Regional Insights

North America dominated the market and accounted for the largest revenue share of 33.9% in 2022, owing to the wide presence of key industry players offering geospatial analytics software and solutions in the region. Major players operating in the region include DigitalGlobe (U.S.), Alteryx, Inc. (U.S.), Harris Corporation (U.S.), Trimble Navigation Ltd. (U.S.), Pitney Bowes (U.S.), ESRI (U.S.), and Google LLC (U.S.).

The factors influencing North America's market growth is the increased adoption of emerging technologies such as Big Data analysis, cloud computing, IoT, AI, and other business intelligence tools. In addition, the high number of available remote sensing satellites, availability of high-speed internet and communication network infrastructure, and widespread adoption of UAV technology to capture geospatial data are expected to further contribute to the market growth.

The U.S. is the leader in geospatial data infrastructure and the first to develop GPS technology, which is widely used globally. With the Wide Area Augmentation System (WAAS), satellite-based augmentation system, and an efficient geodetic infrastructure, the U.S. sets an example for its counterparts regarding governance mechanisms and data infrastructure. Other countries are highly dependent on U.S. technologies, which has boosted the growth of the market in the country.

The U.S. and Canada have dedicated geospatial domain startup creation and support programs such as Startup VISA Canada. These national innovation programs attract global innovators and bring new talent into the market space to help gather, understand, and implement geospatial data. Owing to these factors, North America is expected to continue leading the market over the forecast period.

Asia Pacific is expected to expand at the fastest CAGR of 17.6% during the forecast period. Owing to the growing demand in China, India, and Japan. The increase in demand in China is mainly attributed to its rapid industrialization and growth of the infrastructure and logistics sectors. These countries extensively use analytics solutions for disaster control, environment monitoring, and forest management. Moreover, there has been a significant rise in the region's adoption of geospatial analytics by government and public safety agencies.

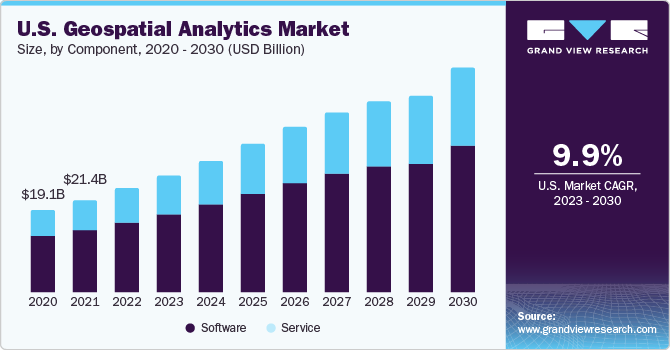

Component Insights

The software segment accounted for the largest revenue share of 66.1% in 2022, owing to companies' increasing adoption of software solutions for acquiring location-based Business Intelligence (BI) for informed decision-making. In addition, there has been a significant rise in the adoption of analytics software for environment monitoring, forest management, and traffic monitoring. Moreover, the development of 4-dimensional GIS software bodes well for the growth of the software segment.

The services segment is expected to expand at the fastest CAGR of 13.4% during the forecast period. It can be attributed to the increasing requirement of installation, training, and support services to support the increasing deployment of software and solutions. Government agencies and public safety organizations are deploying analytics to monitor natural resources infrastructure projects, detect cross-border infiltration, and offer enhanced safety and security to vehicles. In addition, companies are also offering Geospatial Analytics-as-a-Service. For instance, the IBM Cloud Geospatial Analytics service enables users to accurately monitor the locations of moving mobile devices in real time. These factors are further anticipated to increase service demand over the forecast period.

Application Insights

The surveying segment held the largest revenue share of 21.3% in 2022 and is expected to expand at the fastest CAGR of 14.2% over the forecast period, owing to its wide-scale agriculture and natural resource monitoring adoption. However, the military intelligence segment is expected to emerge as the fastest-growing segment over the forecast period. It is attributed to the increasing number of remote sensing satellites globally for border patrolling, which demands geospatial analytics.

Remote sensing is used for land surveying and in most of the earth's science disciplines, including hydrology, ecology, meteorology, oceanography, glaciology, and geology. Apart from the commercial, economic, planning, and humanitarian applications, remote sensing is also used for military intelligence purposes by countries with the most powerful military capabilities, such as the U.S., North Atlantic Treaty Organization (NATO), Russia, Japan, Israel, China, and India.

Moreover, organizations such as the National Emergency Management Agency (NEMA) use geospatial analytics to improve disaster response and preparedness as the technology helps devise effective disaster management strategies through proper disaster visualization, deployment of rescue teams, and planning of post-disaster activities such as reconstruction and rehabilitation.

Key Companies & Market Share Insights

Numerous companies focus on growth strategies such as new product launches, enhancements, agreements, partnerships, and collaborations. For instance, in June 2023, the U.S.-based Yale University launched a new center for geospatial solutions. The Center for Geospatial Solutions (YCGS) aims to provide enhanced geospatial research support for its students and faculty and upgrade its training, research, and engagement infrastructure in the geospatial field.

Key Geospatial Analytics Companies:

- Alteryx, Inc.

- Bentley Systems Incorporated

- ESRI

- Fugro N.V.

- General Electric Company

- Google LLC

- Foursquare

- Trimble

- Maxar Technologies Inc.

- SAP SE

Recent Developments

-

In May 2023, Google launched Google Geospatial Creator, a powerful tool that allows users to create immersive AR experiences that are both accurate and visually stunning. It is powered by Photorealistic 3D Tiles and ARCore from Google Maps Platform and can be used with Unity or Adobe Aero. Geospatial Creator provides a 3D view of the world, allowing users to place their digital content in the real world, similar to Google Earth and Google Street View.

-

In April 2023, Hexagon AB launched the HxGN AgrOn Control Room. It is a mobile app that allows managers and directors of agricultural companies to monitor all field operations in real time. It helps managers identify and address problems quickly, saving time and money. Additionally, the app can help to improve safety by providing managers with a way to monitor the location and status of field workers.

-

In December 2022, ESRI India announced the availability of Indo ArcGIS offerings on Indian public clouds and services to provide better management, collecting, forecasting, and analyzing location-based data.

-

In May 2022, Trimble announced the launch of the Trimble R12i GNSS receiver, which has a powerful tilt adjustment feature. It enables land surveyors to concentrate on the task and finish it more quickly and precisely.

-

In May 2021, Foursquare purchased Unfolded, a US-based provider of location-based services. This US-based firm provides location-based services and goods, including data enrichment analytics and geographic data visualization. With this acquisition, Foursquare aims to provide its users access to various first and third-party data sets and integrate them with the geographical characteristics.

-

In January 2021, ESRI, a U.S.-based geospatial image analytics solutions provider, introduced the ArcGIS platform. ArcGIS Platform by ESRI operates on a cloud consumption paradigm. App developers generally use this technology to figure out how to include location capabilities in their apps, business operations, and goods. It aids in making geospatial technologies accessible.

Geospatial Analytics Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 98.93 billion

Revenue forecast in 2030

USD 226.53 billion

Growth rate

CAGR of 12.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

November

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

Alteryx, Inc.; Bentley Systems Incorporated; ESRI; Fugro N.V.; General Electric Company; Google LLC; Foursquare; Trimble; Maxar Technologies; SAP SE

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

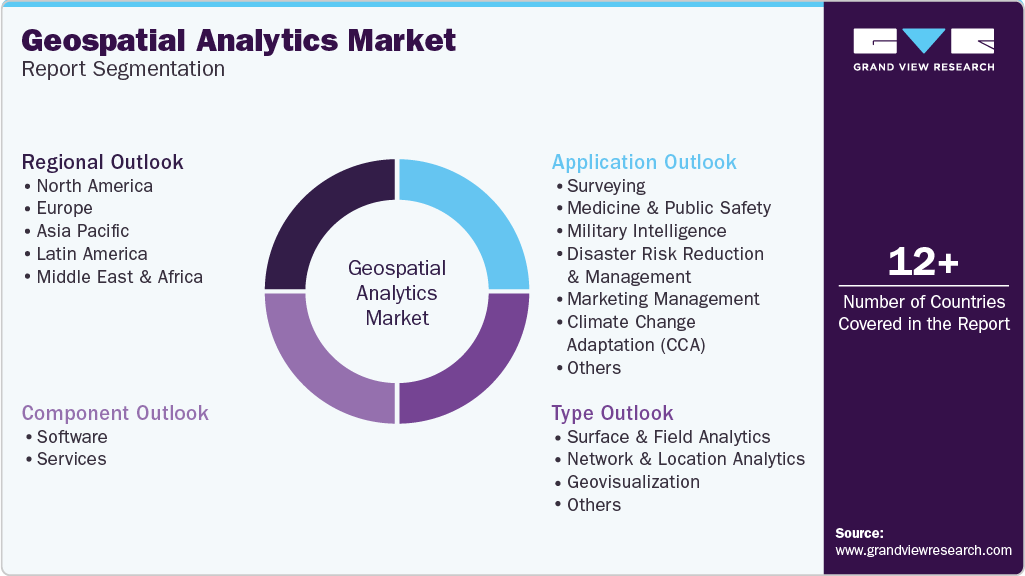

Global Geospatial Analytics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global geospatial analyticsmarket report based on component, type, application, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Service

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Surface & Field Analytics

-

Network & Location Analytics

-

Geovisualization

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Surveying

-

Medicine & Public Safety

-

Military Intelligence

-

Disaster Risk Reduction & Management

-

Marketing Management

-

Climate Change Adaption (CCA)

-

Urban Planning

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global geospatial analytics market size was estimated at USD 85.77 billion in 2022 and is expected to reach USD 98.93 billion in 2023.

b. The global geospatial analytics market is expected to grow at a compound annual growth rate of 12.6% from 2023 to 2030 to reach USD 226.53 billion by 2030.

b. North America dominated the geospatial analytics market with a share of 33.90% in 2022. This is attributable to increased adoption of emerging technologies such as big data analysis, cloud computing, IoT, AI, and other business intelligence tools.

b. Some key players operating in the geospatial analytics market include Alteryx, Inc., Bentley Systems Incorporated, ESRI, Fugro N.V., General Electric Company, Google LLC, Foursquare, Trimble, Maxar Technologies Inc., and SAP SE.

b. Key factors that are driving the market growth include increasing digital transformation, infrastructure development, increasing requirements for precision agriculture, environmental monitoring, and improved defense and security.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."