- Home

- »

- Next Generation Technologies

- »

-

Geospatial Analytics Market Size, Industry Report, 2030GVR Report cover

![Geospatial Analytics Market Size, Share & Trends Report]()

Geospatial Analytics Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Software, Services), By Type, By Application (Surveying, Medicine & Public Safety), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-358-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Geospatial Analytics Market Summary

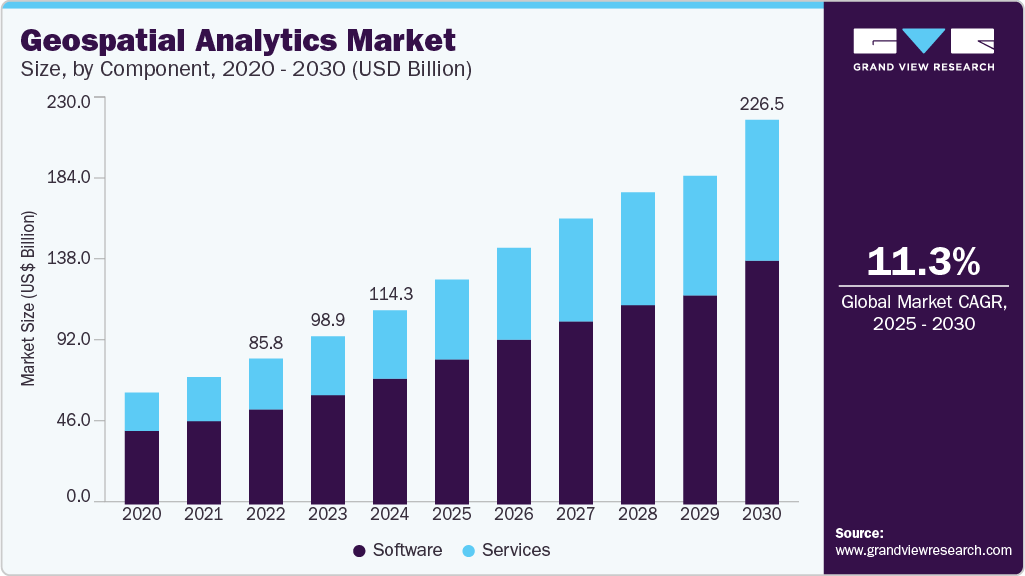

The global geospatial analytics market size was estimated at USD 114.32 billion in 2024 and is projected to reach USD 226.53 billion by 2030, growing at a CAGR of 11.3% from 2025 to 2030, driven by the increasing adoption of location-based services across various industries, including retail, transportation, and logistics. Businesses are leveraging geospatial data to optimize supply chains, enhance customer targeting, and improve operational efficiency.

Key Market Trends & Insights

- The geospatial analytics market in North America held the largest share of over 34.0% in 2024.

- The geospatial analytics market in the U.S. is expected to grow significantly at a CAGR of 8.9% from 2025 to 2030.

- By component, the software segment dominated the market and accounted for the revenue share of over 64.0% in 2024.

- By type, the surface & field analytics segment dominated the market and accounted for the revenue share of over 56.0% in 2024.

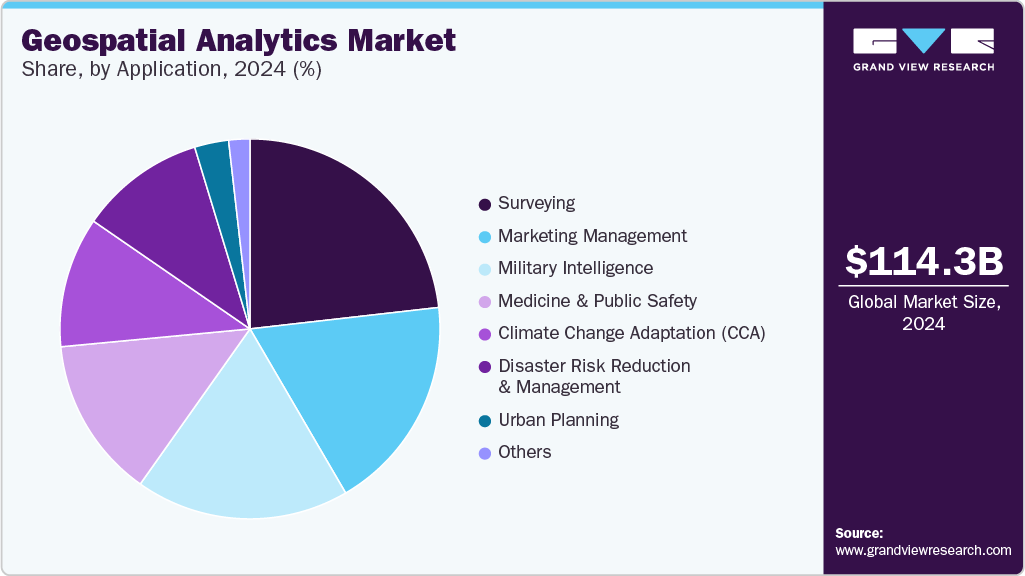

- By application, the surveying segment dominated the market and accounted for the revenue share of over 23.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 114.32 Billion

- 2030 Projected Market Size: USD 226.53 Billion

- CAGR (2025-2030): 11.3%

- North America: Largest market in 2024

The rise of smart cities and urban planning initiatives has further accelerated demand, as governments and municipalities utilize geospatial analytics to manage infrastructure, monitor environmental changes, and improve public safety. The integration of geospatial analytics with artificial intelligence (AI) and big data technologies is also contributing to the growth of geospatial analytics industry. By combining spatial data with machine learning algorithms, organizations can gain deeper insights and make more accurate predictions. This is particularly valuable in industries such as agriculture for precision farming, defense for surveillance and threat detection, and disaster management for early warning systems and impact assessment. The ability to analyze vast volumes of satellite imagery, sensor data, and geotagged information in real time is revolutionizing decision-making processes.

Moreover, government policies and investments are propelling market growth. Many national governments are investing in smart city initiatives, infrastructure development, and environmental monitoring programs, all of which rely heavily on geospatial data. These initiatives require sophisticated mapping and spatial analysis tools to plan and execute large-scale projects effectively. For instance, Singapore’s Smart Nation 2.0 (2024-2025) leverages geospatial analytics for hyper-accurate urban planning, real-time IoT-driven city management, and AI-powered decision-making. Singapore integrates 3D digital twins, satellite imagery, and LiDAR mapping to optimize traffic, disaster response, and sustainability. The initiative boosts the geospatial analytics market by driving demand for precision data, cloud-based spatial platforms, and AI-enhanced location intelligence.

Component Insights

The software segment dominated the market and accounted for the revenue share of over 64.0% in 2024, driven by the growth of cloud computing and SaaS-based delivery models. Cloud-based geospatial analytics solutions offer scalable storage, seamless integration with enterprise systems, and remote accessibility-benefiting businesses with globally distributed teams that require real-time data sharing. These features are driving adoption among SMEs and large enterprises alike.

The services segment is anticipated to grow at a CAGR of 12.1% during the forecast period, driven by the increasing complexity of geospatial data and the rising demand for end-to-end solutions across industries. As organizations increasingly invest in geospatial tools, the need for specialized services, such as consulting, integration, maintenance, and training, has expanded significantly.

Type Insights

The surface & field analytics segment dominated the market and accounted for the revenue share of over 56.0% in 2024. The segment growth is driven by the increasing adoption of precision agriculture technologies, where surface and field analytics play a critical role in monitoring soil health, crop performance, irrigation patterns, and pest detection. Farmers and agribusinesses rely on geospatial data captured through drones, satellite imagery, and sensors to gain real-time insights, reduce waste, and improve yield forecasts. The shift toward sustainable farming practices and food security is further accelerating demand for this type of analysis.

The network & location analytics segment is expected to grow at a significant CAGR over the forecast period due to the rise of location-based services (LBS) in sectors such as retail, transportation, telecommunications, and urban planning. Businesses are leveraging location analytics to understand customer behavior, foot traffic, and regional preferences, enabling targeted marketing, site selection, and personalized services. The proliferation of smartphones and internet of things (IoT) devices has made it easier to collect and analyze real-time location data, further accelerating the demand for such solutions.

Application Insights

The surveying segment dominated the market and accounted for the revenue share of over 23.0% in 2024, driven by the adoption of advanced technologies like drones, LiDAR, and mobile mapping systems, which are also transforming the surveying segment. These tools significantly reduce the time and manpower needed to conduct large-scale land surveys while increasing accuracy and efficiency. They are especially valuable in difficult terrains and remote locations, where traditional survey methods are costly or impractical. In addition, the growth of renewable energy projects-including wind farms and solar installations, has driven the need for precise land and site assessments. Surveying data is crucial for evaluating terrain suitability, aligning installations, and minimizing environmental impact.

The disaster risk reduction & management segment is expected to grow at a significant CAGR over the forecast period due to the growing need for early warning systems and real-time monitoring. Geospatial analytics enables authorities to track weather patterns, water levels, seismic activity, and vegetation health through satellite imagery, remote sensing, and sensor networks. This data supports the development of predictive models and risk maps that help identify vulnerable areas and issue timely alerts, thereby minimizing the loss of lives and property. Moreover, the segment is also growing due to increased investment in national and local disaster management frameworks, especially in disaster-prone regions such as Southeast Asia, the Caribbean, and parts of Africa.

Regional Insights

The geospatial analytics market in North America held a significant share of over 34.0% in 2024, driven by the strong government investments in defense, smart cities, and autonomous vehicles. The U.S. and Canada are adopting AI-powered geospatial intelligence for border security, precision agriculture, and 5G-enabled urban planning. The rise of cloud-based geospatial platforms (e.g., Google Earth Engine, Esri ArcGIS) and increasing demand from logistics and retail sectors further propel growth.

U.S. Geospatial Analytics Industry Trends

The geospatial analytics market in the U.S. is expected to grow significantly at a CAGR of 8.9% from 2025 to 2030 driven by the military and aerospace applications, including NASA’s Earth observation programs and Department of Defense (DoD) geospatial AI initiatives. Commercial adoption is surging in autonomous drones, real-time traffic management, and climate risk modeling, driven by tech giants like Microsoft and IBM integrating spatial analytics into AI solutions.

Europe Geospatial Analytics Industry Trends

The geospatial analytics market in Europe is anticipated to register a considerable growth from 2025 to 2030, due to the strict environmental regulations and smart city projects, such as the EU’s Copernicus Earth observation program. Countries like Germany and France use geospatial data for renewable energy planning, carbon footprint tracking, and precision farming. The expansion of autonomous shipping and port logistics also contributes to market demand.

The UK geospatial analytics market is expected to grow rapidly in the coming years, owing to national security and disaster resilience, leveraging geospatial analytics for flood prediction, crime mapping, and infrastructure monitoring. The Ordnance Survey’s digital twin projects and private-sector adoption in telematics and insurance risk assessment drive growth. Brexit has also increased demand for customs and trade route optimization using spatial data.

The geospatial analytics market in Germany held a substantial market share in 2024, owing to Industry 4.0 and autonomous mobility, with geospatial analytics optimizing supply chain logistics and smart factory operations. The country’s push for sustainable urban development (e.g., energy-efficient buildings) and precision agriculture (via satellite-based soil monitoring) further boosts the market.

Asia Pacific Geospatial Analytics Industry Trends

Asia Pacific is expected to register the fastest CAGR of 16.0% from 2025 to 2030, due to rapid urbanization and government-led geospatial infrastructure projects. Countries like India and Australia invest in land-use planning, disaster management, and transportation analytics, while startups drive innovation in location-based services (LBS) and IoT integration.

The Japan geospatial analytics market is expected to grow rapidly in the coming years driven by aging infrastructure management and robotics, using geospatial analytics for earthquake resilience, automated construction, and drone-based delivery systems. The government’s Society 5.0 initiative promotes AI-geospatial fusion for smart healthcare and autonomous public transport.

The geospatial analytics market in China held a substantial market share in 2024, due to state-backed surveillance and smart city megaprojects, utilizing BeiDou satellite navigation and AI-powered urban monitoring. The Belt and Road Initiative (BRI) relies on geospatial analytics for cross-border logistics, while precision agriculture and pollution control applications see heavy investment.

Key Geospatial Analytics Company Insights

Key players operating in the geospatial analytics industry are Esri, Google, Trimble Inc., SAP SE, BENTLEY SYSTEMS, INCORPORATED, Fugro. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In April 2025, BENTLEY SYSTEMS, INCORPORATED announced a collaboration with Google to enhance infrastructure management using advanced asset analytics. This initiative integrates Google's Imagery Insights, powered by Google Street View, Vertex AI, and Blyncsy, to enable rapid detection and assessment of roadway conditions. The new capabilities aim to support transportation departments and their engineering partners in monitoring and evaluating transportation infrastructure more efficiently by identifying problem areas and tracking asset condition changes over time.

-

In February 2025, Esri introduced the Content Store for ArcGIS, a web application designed to simplify the acquisition and integration of commercial satellite imagery. Developed in collaboration with SkyWatch, the app provides users with seamless access to high-resolution imagery from top providers, including Maxar. By consolidating services that previously required dealing with multiple vendors and manual data handling, the Content Store enhances efficiency and streamlines the imagery procurement process for organizations.

-

In February 2025, Fugro announced the acquisition of EOMAP GmbH & Co. KG, a German firm specializing in satellite-based mapping and monitoring of marine and freshwater environments. This strategic move enhances Fugro's capabilities by incorporating Earth Observation technology into its existing mapping solutions, marking a significant step in the company's efforts to strengthen its presence in the global water sector.

Key Geospatial Analytics Companies:

The following are the leading companies in the geospatial analytics market. These companies collectively hold the largest market share and dictate industry trends.

- Alteryx

- Autodesk

- BENTLEY SYSTEMS, INCORPORATED

- ESRI

- Foursquare

- Fugro

- GE Vernova

- Hexagon AB

- Mapbox

- Maxar Technologies

- SAP SE

- Trimble Inc.

Geospatial Analytics Market Report Scope

Report Attribute

Details

Market size in 2025

USD 132.39 billion

Revenue forecast in 2030

USD 226.53 billion

Growth rate

CAGR of 11.3% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report enterprise size

Revenue forecast, company share, competitive landscape, growth factors, and trends

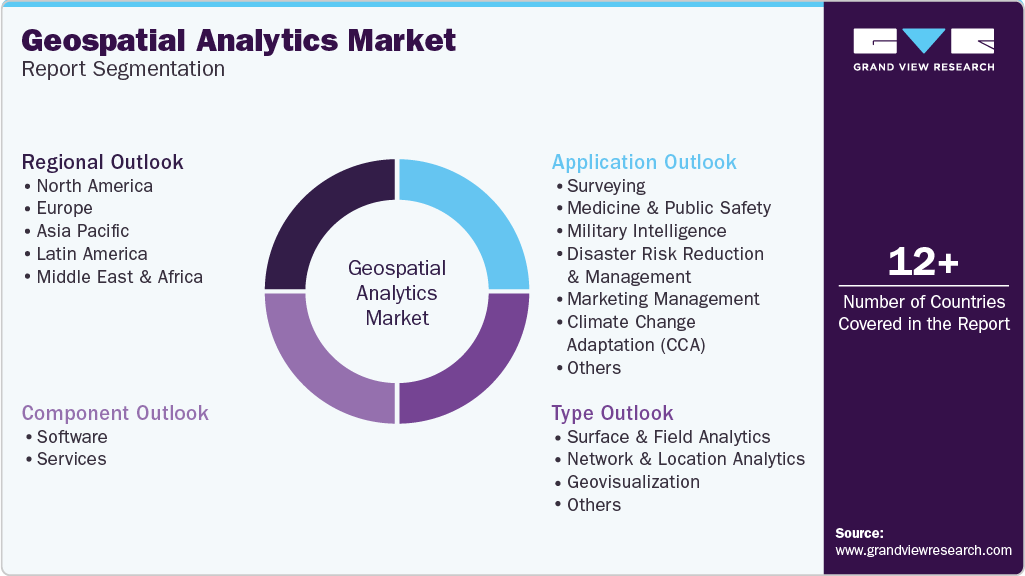

Segments covered

Component, type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; and South Africa

Key companies profiled

Alteryx; Autodesk; BENTLEY SYSTEMS, INCORPORATED; ESRI; Foursquare; Fugro; GE Vernova; Google; Hexagon AB; Mapbox; Maxar Technologies; SAP SE; Trimble Inc.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Geospatial Analytics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the geospatial analytics market report based on component, type, application, and region.

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Software

-

Services

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Surface & Field Analytics

-

Network & Location Analytics

-

Geovisualization

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Surveying

-

Medicine & Public Safety

-

Military Intelligence

-

Disaster Risk Reduction & Management

-

Marketing Management

-

Climate Change Adaptation (CCA)

-

Urban Planning

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global geospatial analytics market size was estimated at USD 114.32 billion in 2024 and is expected to reach USD 132.39 billion in 2025.

b. The global geospatial analytics market is expected to grow at a compound annual growth rate of 11.3% from 2025 to 2030 to reach USD 226.53 billion by 2030.

b. North America dominated the geospatial analytics market with a share of 34.2% in 2024. This is attributable to the strong government investments in defense, smart cities, and autonomous vehicles. The rise of cloud-based geospatial platforms and increasing demand from logistics and retail sectors further propel growth.

b. Some key players operating in the geospatial analytics market include Alteryx, Autodesk, BENTLEY SYSTEMS, INCORPORATED, ESRI, Foursquare, Fugro, GE Vernova, Google, Hexagon AB, Trimble Inc., Mapbox, Maxar Technologies, SAP SE

b. Key factors driving market growth include the increasing adoption of location-based services across various industries, including retail, transportation, and logistics. Businesses are leveraging geospatial data to optimize supply chains, enhance customer targeting, and improve operational efficiency.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.