- Home

- »

- Medical Devices

- »

-

Germany Hearing Aid Retailers Market, Industry Report 2030GVR Report cover

![Germany Hearing Aid Retailers Market Size, Share & Trends Report]()

Germany Hearing Aid Retailers Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (In-the-Ear Hearing Aids, Receiver-In-the-Ear Hearing Aids), By Technology (Digital, Analog), And Segment Forecasts

- Report ID: GVR-4-68040-561-6

- Number of Report Pages: 194

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

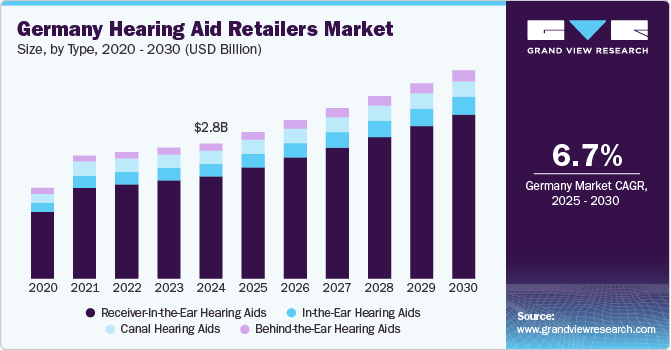

The Germany hearing aid retailers market size was estimated at USD 2.82 billion in 2024 and is expected to grow at a CAGR of 6.74% from 2025 to 2030. The growth of the hearing aid market in Germany is significantly driven by the aging population, technological advancements, and increasing awareness about hearing health. According to the Statistisches Bundesamt report, as of 2023, approximately 22% of Germany's population is 65 and older, projected to rise to 26% by 2035. This demographic shift correlates strongly with a higher prevalence of hearing loss, as nearly one-third of individuals in this age group are affected by disabling hearing loss.

The German government has promoted auditory health through various initiatives to reduce the stigma associated with hearing aids and improve access for those in need. Technological innovations have also played a crucial role; modern hearing aids now feature advanced functionalities such as Bluetooth connectivity, noise cancellation, and artificial intelligence capabilities that enhance user experience and appeal to a broader audience. In March 2024, GN Group launched The New Norm, an innovative campaign addressing the stigma surrounding hearing aids and the misperceptions associated with hearing loss. This initiative was officially launched on World Hearing Day, March 3, 2024, with the aim to change societal perceptions of hearing aids, which have often been associated with aging and disability. This campaign promotes a more positive image of hearing aids, showcasing them as essential tools for enhancing quality of life rather than symbols of impairment.

GVR Proprietary Primary Research (In-depth Interviews and Survey Findings):

(In-depth interviews (IDIs) were conducted with independent audiologists, audiologists affiliated with retail chains, and employees of manufacturer-owned retail chains. Surveys were administered to hearing aid customers, audiologists, and retailers.)Below is a detailed overview based on the primary research analysis conducted by Grand View Research regarding various aspects of hearing aids in Germany:

Customers’ Initial Point of Contact - ENT Doctors (HNO-Ärzte):

-

Most customers first discover they may need hearing aids through ENT specialists.

-

ENTs diagnose hearing issues and issue a prescription for hearing aids.

-

However, due to regulatory or ethical guidelines, ENTs cannot recommend specific audiologists. They may provide a neutral list or simply a sheet of local options.

Market Structure & Competition

-

Major Brands / Chains: The German hearing aid market is dominated by large B2C players such as:

-

Geers

-

Kind

-

Audibene

-

These well-known companies are often the default choices due to brand recognition and physical presence.

-

Independent & Online Competitors: Smaller companies or online-focused audiologists differentiate through:

-

Price competitiveness

-

Superior customer service

-

Digital visibility

-

These are attractive to savvy customers who are comfortable exploring alternatives.

Customer Behavior Insights

-

Trial-Oriented Culture: German consumers tend to try 2 or 4 different audiologists, reflecting a strong desire to compare and evaluate before committing.

-

High Trust in Medical Diagnosis: The journey typically starts with an ENT, which makes this a medical-driven purchase.

-

Independent Decision-Making: Consumers are expected to navigate the choice of an audiologist on their own, which creates room for marketing influence and online research.

-

Digital Influence is Rising: Even though the process begins offline, the decision is often finalized after online research, making SEO, SEM, and social media powerful tools.

Strategic Opportunities

-

Enhance Digital Marketing:

-

Focus on Google Ads, Facebook Ads, and SEO targeting relevant keywords like "günstige Hörgeräte", "Hörgeräte Beratung", or "Hörakustiker Vergleich".

-

-

Leverage Transparency & Trust:

-

Emphasize pricing model, customer reviews, and comparison tools.

-

Offer online consultations or home trials to appeal to convenience-seeking customers.

-

Commonly Asked Hearing Aids Features by German Consumers

Category

Details

Market Trend

Shift toward innovative, connected, and discreet technology

Customer Priority

70% prioritize Bluetooth connectivity

Desired Features

- Audio streaming

- TV and laptop connectivity

- Voice assistant integration (Siri, Google Assistant)

Emerging Innovations

Real-time language translation (e.g., Starkey supports 27 languages)

Device Type Preferences

Strong demand for small and invisible devices

Popular Models

ITE (In-the-Ear) and CIC (Completely-in-Canal) like Signia Silk

Trade-off

Smaller size = Less likely to have Bluetooth or rechargeability

Customer Compromise

Many prefer larger models to access smart features

Battery-Powered Relevance

Still relevant in global markets with less reliable access to electricity

Future Outlook

Movement toward fully connected, rechargeable hearing aids that blend medical & consumer tech

Source: Grand View Research

The industry is currently experiencing significant shifts driven by evolving market dynamics, technological advancements, and a competitive landscape that is becoming increasingly complex. Consumers are increasingly seeking premium services that enhance their overall experience with hearing aids. This includes customization options tailored to individual needs and comprehensive post-purchase care programs. For instance, Amplifon has introduced its Lifetime Aftercare program, which provides free device checks and adjustments, ensuring that users receive ongoing support throughout the lifespan of their devices.

New Revenue Streams And Business Models In Germany

Subscription Model:

Germany is facing rising inflation and decreased disposable income, prompting middle-income consumers to choose mid-tier and refurbished hearing aids as affordable options. Subscription models, like those offered by Neuroth and Iffland hören GmbH & Co. KG (starting at USD 44 per ear), provide companies with stable revenue and improved inventory management, helping them navigate economic uncertainties while catering to budget-conscious consumers.

Omni-channel Model

Adopting an omnichannel business model can boost Neuroth's market presence and efficiency by integrating online tests, fitting consultations, and mobile apps for a seamless customer experience. This approach satisfies consumer demand for flexible shopping in Germany's robust digital landscape. Centralizing inventory management will optimize stock levels and fulfillment. Similarly, Hearly.de combines online platforms and physical locations for easy product research and purchases.

Buying Group Model

Independent retailers can improve pricing and profitability by joining buying groups, enhancing their competitiveness against larger chains. This model boosts brand recognition for local businesses and allows them to offer unique products and personalized services. HÖREX Hör-Akustik eG aids independent hearing care professionals by providing purchasing power, marketing support, and training resources.

In-house Insurance Model

Rising living costs in Germany are boosting demand for mid-tier hearing aids and insurance-supported purchases. Neuroth's launch of in-house insurance aims to attract cost-sensitive customers, positioning hearing aids as essential investments. This strategy sets Neuroth apart from competitors, improves operational efficiency, and minimizes reimbursement delays. With few in-house insurance options available, Neuroth can generate new revenue from premiums and gain valuable customer insights for targeted marketing and product development.

New Market Trends Analysis

Strong Consumers Preference for Quality and Sustainability

German consumers increasingly prioritize quality and sustainability in their purchasing choices, reflecting a global trend towards responsible consumption. This emphasis is particularly strong in Germany due to cultural, economic, and regulatory influences. Growing awareness of environmental issues further drives the shift towards sustainable consumption.

Vocational Training Validation and Digitization Act

Germany's new legislation updates the Vocational Training Act to recognize digital training methods, enabling hearing aid retailers to offer flexible online training for their staff. Additionally, the government has streamlined the visa process for non-EU professionals, recognized foreign qualifications, and provided language support to promote workforce integration and diversity.

Growing Digitalization & Interconnectivity

The digitalization of health information in Germany enhances the hearing aid market by improving patient care and lowering costs. Electronic health records (EHRs) and telehealth enable retailers to access patient data for personalized fittings. This real-time information helps audiologists make better product recommendations and facilitates remote consultations, saving time and reducing costs associated with in-person visits.

Specialized Cluster Networks

Germany boasts over 30 specialized cluster networks in medical technology, fostering collaboration among manufacturers, researchers, and healthcare providers to drive innovation. These clusters provide shared facilities that enable smaller retailers to access high-quality resources, leading to enhanced product offerings and improved customer service through advanced testing equipment and training programs.

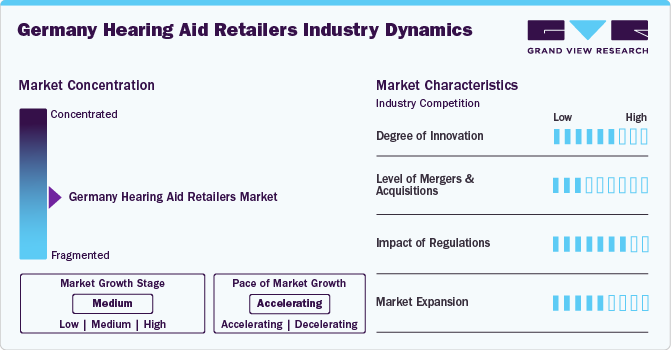

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, characteristics, and participants. The x-axis represents the level of market concentration, ranging from low to high. The y-axis represents various market characteristics, including degree of innovation, industry competition, service substitutes, and impact of regulations, level of partnerships & collaborations activities, and geographic expansion. The Germany hearing aid retailers industry is fragmented, with many local players competing for the high market share. The degree of innovation is medium, the level of merger & acquisition activities is low, the impact of regulations on the market is high, and the expansion is low.

The degree of innovation in the market is significantly high, driven by rapid technological advancements and a strong focus on user-centric design. Companies are increasingly integrating Bluetooth connectivity, artificial intelligence (AI), and rechargeable batteries into their devices, enhancing functionality and user experience. For instance, in October 2023, Vibrosonic gained attention for its innovative Hearing Contact Lens technology. This technology aims to revolutionize the way hearing aids are perceived and utilized by integrating auditory assistance directly into contact lenses. The backing from ZEISS Ventures is significant as it provides financial support, strategic guidance, and resources that can enhance the development and commercialization of this groundbreaking product.

The market saw notable consolidations as larger operators sought to expand their reach and capabilities. In May 2018, Sivantos, previously known as Siemens Audiology, and Denmark's Widex agreed to merge to form a new company valued at over USD 8.3 billion. This merger is significant in the hearing aid industry, combining two major players with extensive histories and expertise in audiology. The agreement between Sivantos and Widex marks a pivotal moment in the audiology industry, creating a powerful entity poised to innovate and compete effectively on a global scale.

The impact of regulations on the industry is high, with strict guidelines influencing device development and deployment. The regulations governing the hearing aids market in Germany have a significant impact, especially with the implementation of the Medical Device Regulation (MDR), which took full effect in 2021. This regulation replaced the previous Medical Devices Directive (MDD) and introduced stricter requirements for clinical investigations, safety assurances, and documentation processes. As a result, manufacturers like Phonak have experienced longer timelines for product approvals, with CE marking now taking up to six months instead of the one month it took previously.

The market is experiencing significant product expansion driven by technological advancements and increasing consumer demand. These innovations not only improve sound quality but also cater to users' lifestyle needs, making devices more appealing to younger demographics who may suffer from noise-induced hearing loss. Furthermore, companies are increasingly focusing on personalized solutions that address individual hearing profiles, thus enhancing customer satisfaction and driving market growth.

Type Insights

Based on type, the receiver-in-the-ear hearing aids segment held the largest revenue share of 75.96% in 2024 and is expected to grow at the fastest CAGR during the forecast period. The growth of receiver-in-the-ear (RITE) hearing aids in Germany is driven by technological advancements, an aging population, and increasing awareness about hearing health. Modern RITE hearing aids incorporate advanced features such as Bluetooth connectivity, noise reduction algorithms, and real-time sound processing capabilities that enhance user experience. These advancements improve sound quality and make these devices more user-friendly and adaptable to different listening environments. For instance, the Styletto X is a significant advancement in hearing aid technology, being recognized as the world’s first slim receiver-in-the-canal (RIC) hearing aid. This innovative device is designed to provide users with enhanced auditory experiences across various environments by utilizing acoustic motion sensors.

The behind-the-ear hearing aids segment is expected to grow at a significant CAGR during the forecast period. Increasing awareness of hearing health drives the growth of behind-the-ear (BTE) hearing aids in Germany. BTE devices are particularly popular due to their effectiveness in treating various degrees of hearing loss, especially among older people, who constitute a significant portion of the market. Integrating advanced features such as wireless connectivity and innovative technology has enhanced user experience and functionality, making these devices more appealing. Furthermore, leading manufacturers' ongoing research and development efforts are focused on creating more discreet and powerful BTE models that cater to individual user needs, further fueling market growth.

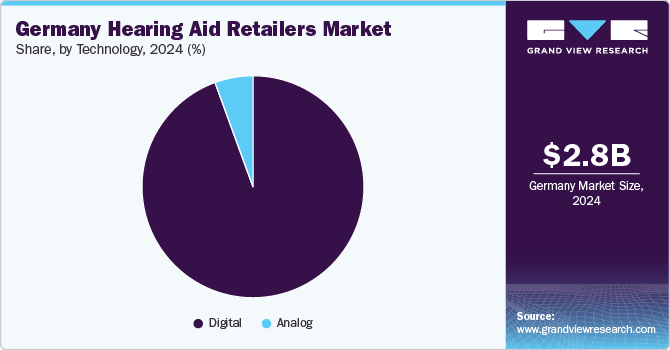

Technology Insights

Based on technology, the digital segment held the largest market share in 2024 with a market share of 94.19% and is expected to grow at the fastest CAGR during the forecast period. This rapid expansion is primarily attributed to the widespread adoption of mobile health applications (mHealth) and telehealth services, which have become essential tools for remote patient monitoring and healthcare delivery. The COVID-19 pandemic further accelerated this trend by highlighting the necessity for accessible healthcare options that minimize in-person visits. Moreover, government initiatives promoting digitalization within the healthcare sector have created an environment conducive to innovation and investment in digital health technologies.

The analog segment is expected to grow at a significant CAGR during the forecast period. Analog hearing aids continue to maintain a niche yet significant presence in the market, driven by specific demographic preferences and affordability. The aging population in Germany, which is projected to increase from 22% of individuals aged 65 and above in 2022 to 26% by 2035, plays a critical role in sustaining demand for analog hearing aids. Many elderly users prefer the straightforward functionality of analog devices over the complexity of digital options, making them attractive to those seeking basic auditory assistance without advanced technological features.

Moreover, affordability is a key driver for analog hearing aids. These devices are generally less expensive than their digital counterparts, making them accessible to consumers with limited budgets or insufficient insurance coverage. This affordability aligns with government initiatives to improve access to essential healthcare solutions for all demographics.

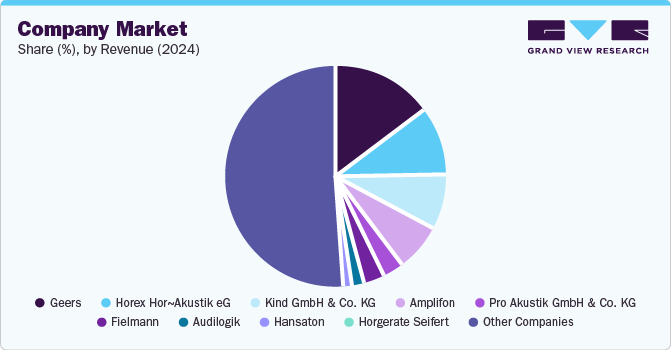

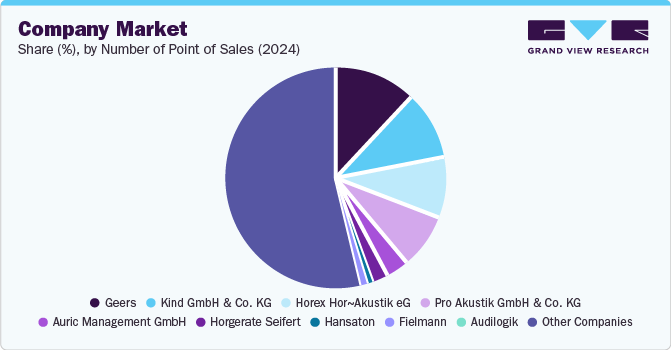

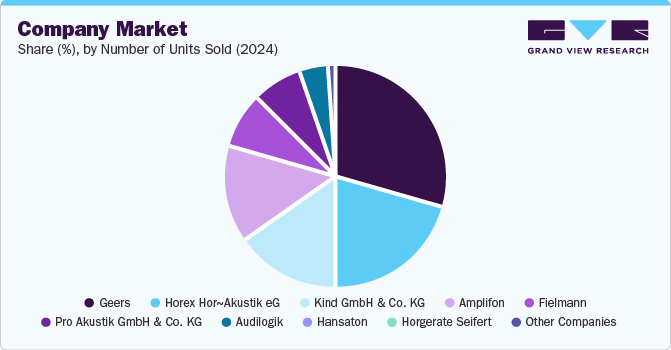

Key Companies & Market Share Insights

The market is fragmented, with the presence of multiple major players. Key players are adopting growth strategies to enhance their market presence, including collaborations and mergers & acquisitions.

Key Companies in Germany Hearing Aid Retailers Market:

- KIND GmbH & Co. KG

- GEERS

- Amplifon

- Hansaton

- Pro Akustik GmbH & Co KG.

- AUDILOGIK

- Hearly.de

- HÖREX Hör-Akustik eG

- HÖRGERÄTE SEIFERT

- Fielmann

- auric Management GmbH

Recent Developments

-

In February 2024, GN announced the expansion of the ReSound Nexia family, representing a major leap forward in hearing aid technology. With innovative features such as Bluetooth LE Audio, Auracast compatibility, superior noise management, and sustainable design practices, it sets a new standard for connectivity and user experience in the hearing aid industry.

Germany Hearing Aid Retailers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.02 billion

Revenue forecast in 2030

USD 4.18 billion

Growth rate

CAGR of 6.74% from 2025 to 2030

Actual data

2018 - 2024

Forecast data

2025 - 2030

Quantitative units

Revenue in USD million/billion, Volume in Units, and CAGR from 2025 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, technology

Country scope

Germany

Key companies profiled

KIND GmbH & Co. KG; GEERS; Amplifon; Hansaton; Pro Akustik GmbH & Co KG.; AUDILOGIK; Hearly.de; HÖREX Hör-Akustik eG; HÖRGERÄTE SEIFERT; Fielmann; Auric Management GmbH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Germany Hearing Aid Retailers Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Germany hearing aid retailers market report based on type, and technology:

-

Type Outlook (Revenue, USD Billion; 2018 - 2030)

-

In-The-Ear Hearing Aids

-

Receiver-In-The-Ear Hearing Aids

-

Behind-The-Ear Hearing Aids

-

Canal Hearing Aids

-

-

Technology Size Outlook (Revenue, USD Billion; 2018 - 2030)

-

Digital

-

Analog

-

Frequently Asked Questions About This Report

b. The Germany hearing aid retailers market size was valued at USD 2.82 billion in 2024 and is expected to reach USD 3.02 billion billion in 2025.

b. The Germany hearing aid retailers market is expected to grow at a compound annual growth rate of 6.74% from 2018 to 2030, reaching USD 4.18 billion by 2030.

b. The receiver-in-the-ear hearing aids segment held the largest revenue share of 75.96% in 2024. The growth of receiver-in-the-ear (RITE) hearing aids in Germany is driven by technological advancements, an aging population, and increasing awareness about hearing health.

b. Some key players operating in the healthcare reimbursement market include Neuroth, KIND GmbH & Co. KG, GEERS, Amplifon, Hansaton, Pro Akustik GmbH & Co KG., AUDILOGIK, Hearly.de, HÖREX Hör-Akustik eG, HÖRGERÄTE SEIFERT, Fielmann, Auric Management GmbH

b. The market's growth is significantly driven by the aging population, technological advancements, and increasing awareness about hearing health.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.