- Home

- »

- Homecare & Decor

- »

-

Germany Sauna Market Size & Share, Industry Report, 2033GVR Report cover

![Germany Sauna Market Size, Share & Trends Report]()

Germany Sauna Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Traditional Sauna, Infrared Sauna, Electric Sauna, Steam Saunas/Rooms), By Application (Residential, Commercial), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-661-3

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Germany Sauna Market Summary

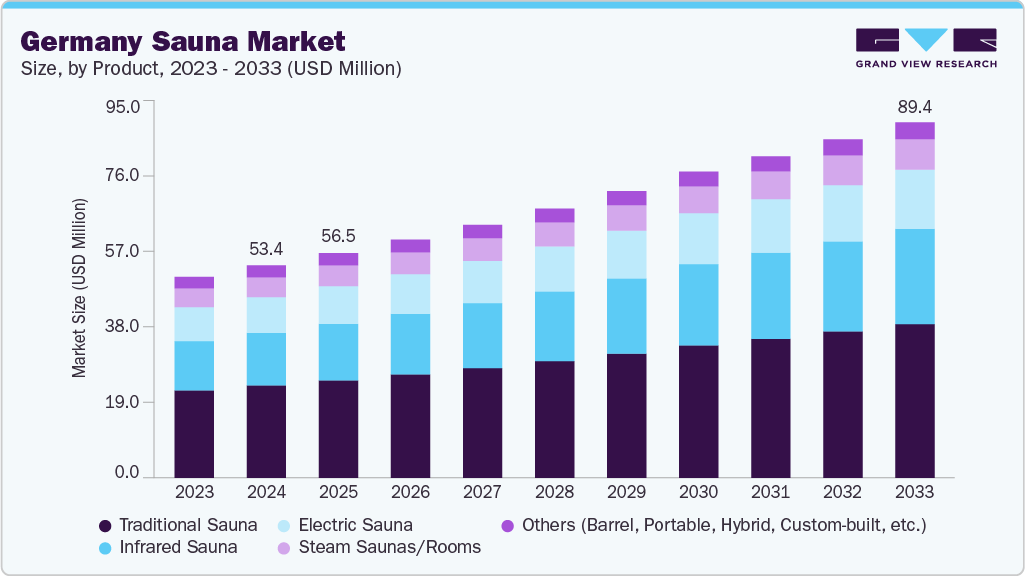

The Germany sauna market size was estimated at USD 53.4 million in 2024 and is projected to reach USD 89.4 million by 2033, growing at a CAGR of 5.9% from 2025 to 2033. As Germany’s population increasingly prioritizes wellness, preventive health, and sustainable living, saunas have emerged as essential components of modern lifestyles rather than simply traditional leisure activities.

Key Market Trends & Insights

- Northern Germany held 31.60% of the revenue of the Germany sauna market in 2024.

- The sauna industry in Western Germany is expected to grow steadily over the forecast period.

- By product, traditional saunas segment held the highest market share of 43.48% in 2024.

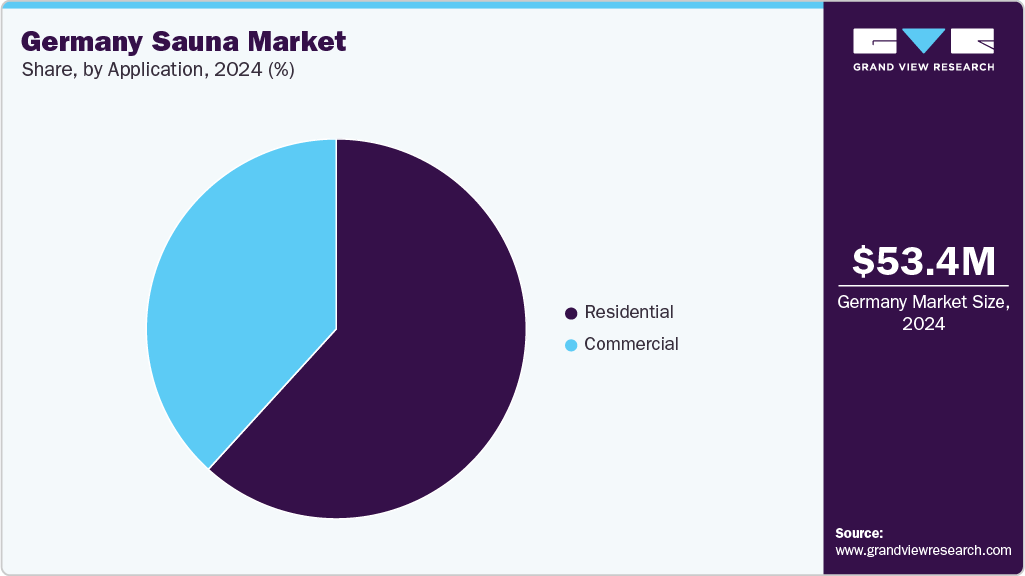

- By application, residential saunas segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 53.4 Million

- 2033 Projected Market Size: USD 89.4 Million

- CAGR (2025-2033): 5.9%

Interest in sauna use is broadening across age groups and social segments, fueled by a desire for stress relief, immune support, and holistic well-being. This shift has created significant momentum in the German sauna market, where wellness tourism, residential installations, and innovative sauna concepts are all driving robust growth.Government initiatives and regulatory frameworks have significantly supported this sector’s expansion. Germany’s Federal Ministry for Economic Affairs and Climate Action (BMWK) emphasizes sustainable building standards, which encourage wellness infrastructure such as energy-efficient saunas in both commercial and residential projects. In addition, spa tourism is a strategic priority in state-level tourism plans, with regions such as Baden-Württemberg, Bavaria, and North Rhine-Westphalia promoting themselves as wellness hubs. Municipal investments in modern spa complexes, such as Therme Erding in Bavaria and Carolus Thermen in Aachen, further strengthen consumer confidence in sauna-based wellness offerings.

From the consumer side, data from the German Sauna Association and the German Hotel and Restaurant Association (DEHOGA) indicate that over 30 million Germans visit a sauna at least once per year, reflecting growing demand for wellness and relaxation experiences. Domestic interest in private sauna installations has been on the rise, with manufacturers such as KLAFS and EOS Sauna reporting significant growth in residential projects as consumers invest in personal wellness spaces. Moreover, saunas are increasingly integral to premium fitness clubs and wellness resorts, offering innovative experiences such as panoramic sauna views, themed Aufguss (infusion) ceremonies, and bio-saunas. According to the German Sauna Association, the popularity of sauna visits has grown in both urban areas and traditional spa regions, fueled by the public’s rising interest in physical and mental well-being.

Manufacturers are innovating rapidly to meet consumer expectations, developing compact, energy-efficient sauna cabins suitable for urban apartments, and customizable options featuring smart controls, chromotherapy, and integrated sound systems. Sustainability is a significant driver, with companies using FSC-certified wood, low-emission heating systems, and energy-saving technology. In the commercial sector, wellness centers are differentiating with specialty saunas, such as salt saunas, herbal steam baths, and infrared cabins, to attract diverse clientele and boost revenue.

Ownership and access models are also evolving. Instead of solely purchasing private sauna cabins, many Germans are opting for flexible wellness subscriptions or pay-per-use models in urban spas and premium gyms. In cities such as Berlin, Munich, and Hamburg, memberships offering access to diverse sauna landscapes and multi-sensory wellness zones are increasingly popular among professionals and fitness enthusiasts seeking relaxation without the upfront cost of ownership.

Marketing and brand positioning have adapted to highlight saunas as part of broader physical and mental health narratives. Influencers, spa-focused social media campaigns, and digital experiences showcase saunas as essential for stress relief, immunity, and quality of life. Mobile apps and wellness platforms let users book sauna sessions, discover themed Aufguss events, and track health metrics, deepening engagement and brand loyalty. These digital tools are particularly popular with urban millennials and health-conscious consumers who see sauna use as an integral aspect of modern wellness lifestyles.

Consumer Insights

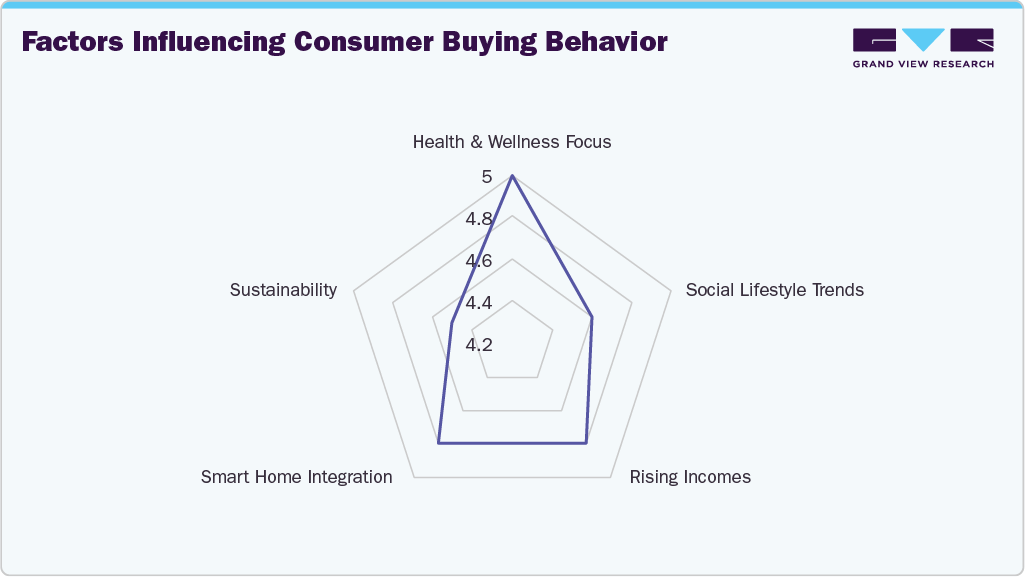

Consumers increasingly see saunas not just as wellness spaces but as essential tools for stress relief, holistic health, and personal time-outs from fast-paced routines. Users value the calming atmosphere and the mental reset saunas provide, leading to growing interest in home sauna installations to replicate spa-like experiences privately. Avoiding busy public facilities and maintaining personalized hygiene standards are additional motivations driving home sauna purchases.

Functionality and ease of use are decisive for buying decisions. Consumers often seek digital controls, precise temperature regulation, and energy-efficient operation. Features such as programmable sessions, aromatherapy diffusers, and integrated lighting scenarios enhance appeal, especially among those who want tailored wellness rituals. Consumers appreciate designs that integrate seamlessly into living spaces, including compact models for apartments and outdoor saunas for gardens or terraces.

Lifestyle fit drives demand for diverse sauna types from traditional Finnish saunas prized for intense heat and ritualistic experience, to infrared cabins favored for gentle, therapeutic warmth and lower energy consumption. Families gravitate toward models with safety features, spacious benches, and child-friendly designs. At the same time, wellness enthusiasts look for innovative materials, elegant aesthetics, and multi-sensory options such as sound systems or chromotherapy lights.

Urban buyers often prioritize compact saunas with quick heat-up times, minimal power usage, and stylish design suited for modern interiors. Meanwhile, rural and suburban consumers tend to invest in larger units, valuing robust construction, higher seating capacity, and custom finishes for private wellness spaces. Sustainability plays a growing role, with buyers attracted to eco-friendly woods, low-emission heaters, and brands committed to responsible manufacturing.

Consumers are increasingly driven by a heightened focus on health and wellness, a trend that strongly shapes their sauna purchasing behavior. Many view sauna bathing not only as a leisure activity but as a preventive health measure supporting stress relief, improved circulation, and immune system benefits. This health-conscious mindset has spurred demand for saunas with features such as infrared technology for muscle relaxation or steam functions tailored to respiratory well-being. In response, manufacturers and wellness facilities are offering customizable sauna experiences, integrating options such as chromotherapy lights, aroma infusions, and smart controls that enable personalized wellness routines.

Consumers are attentive to sustainable materials, energy-efficient heating systems, and products with eco-certifications. This eco-awareness aligns with broader German values around sustainability and cost-saving, especially given rising energy prices. As a result, sauna producers emphasize eco-friendly wood sourcing, insulation innovations, and low-energy consumption heaters. Sauna businesses and public spas also promote “green” operational practices, helping reassure customers that their wellness rituals align with environmental responsibility.

Product Insights

Traditional saunas accounted for a revenue share of 43.48% in the year 2024 in the Germany sauna industry. These saunas, known for their dry heat and high-temperature steam created by pouring water on heated stones, align closely with the country’s longstanding spa and thermal bathing traditions. Many users associate them with authentic relaxation, detoxification, and circulatory health benefits, making them a preferred choice over modern infrared or hybrid alternatives. In addition, the presence of traditional saunas in public wellness centers, hotels, and private homes reinforces their popularity, especially among older consumers who value familiar routines and proven health practices.

The demand for infrared saunas is projected to grow at a CAGR of 6.8% over the forecast period of 2025 to 2033. As busy lifestyles leave many people seeking convenient ways to relax and recover, infrared saunas appeal because they require shorter sessions and heat up quickly, saving both time and energy. The market is also benefiting from increasing interest in beauty and skin health, as infrared heat is promoted to improve circulation and support skin rejuvenation. In addition, the availability of sleek, modern designs and portable models makes these saunas attractive for residential use, while competitive pricing and broader distribution through online retail channels are making them more accessible to a wider audience.

Application Insights

Residential saunas accounted for a revenue share of 61.76% in the year 2024 in the Germany sauna industry. As consumers increasingly prioritize health, stress relief, and personal space, many are choosing to invest in home saunas rather than relying solely on public facilities. The COVID-19 pandemic further accelerated this trend, creating lasting preferences for in-home wellness setups where people can enjoy privacy, hygiene, and flexibility in use. Moreover, advancements in compact and energy-efficient sauna designs have made it easier for homeowners, even in urban areas with limited space, to install saunas without major renovations.

The sauna demand at commercial establishments is projected to grow at a CAGR of 6.4% over the forecast period of 2025 to 2033. As consumers increasingly prioritize mental health and stress relief, businesses such as wellness centers, boutique spas, and luxury gyms are investing in saunas to diversify their services and stand out in a competitive market. Commercial establishments also recognize saunas as valuable revenue drivers, whether through entry fees, premium memberships, or wellness packages. With growing interest in sustainable design and modern aesthetics, businesses are opting for contemporary sauna models that appeal to style-conscious clients, further fueling market expansion.

Country Insights

The Northern Germany sauna industry held 31.60% of revenue in 2024, due to a strong culture of wellness tourism and a high concentration of spa resorts and wellness centers in coastal and scenic regions. Popular destinations along the North Sea and Baltic Sea attract visitors seeking relaxation and health benefits, with saunas often featured as key amenities in hotels, thermal baths, and wellness retreats. The region also benefits from a large urban population in cities such as Hamburg and Bremen, where residents increasingly invest in home saunas for personal well-being and stress relief.

The Western Germany sauna industry is projected to grow at a CAGR of 6.5% from 2025 to 2033. Cities such as Cologne, Düsseldorf, and Frankfurt are seeing increased interest in premium health and leisure experiences, prompting both individuals and businesses to invest in modern sauna facilities. The region’s thriving hospitality and fitness sectors are expanding their wellness offerings to attract customers seeking relaxation and holistic health benefits. In addition, growing awareness about stress management and preventive health care is motivating consumers to incorporate saunas into their routines.

Key Germany Sauna Company Insights

The Germany sauna market is shaped by a mix of established manufacturers and innovative new entrants that are adapting to shifting consumer lifestyles and wellness trends. Leading companies focus on craftsmanship, energy efficiency, and user-centric design, offering products that blend traditional sauna culture with modern convenience and technology. These players expand their market reach through collaborations with wellness resorts, fitness centers, home improvement retailers, and digital sales platforms, ensuring broad customer access across residential and commercial sectors. In response to increasing demand for personalized and sustainable wellness solutions, key brands are also introducing specialized products such as infrared, hybrid, and compact home saunas. Agile production methods and strategic partnerships further enable them to serve both the premium and affordable segments, positioning them well in Germany’s growing wellness and health-focused economy.

Key Germany Sauna Companies:

- Harvia Group

- KLAFS GmbH

- SAUNATEC

- TyloHelo Group

- Sauna360 Inc. (Masco Corporation)

- HUUM

- Syracuse Sauna King

- Effegibi

- Nordic Sauna

- Saunacore

Recent Developments

-

In April 2025, HUUM and SAWO teamed up to enhance their presence in the European sauna market: HUUM will distribute SAWO’s premium sauna heaters, steam generators, wood‑burning and design heaters, sauna accessories (like doors, handles, buckets, and ladles), and infrared products across Europe. This partnership blends HUUM’s innovative Nordic flair, such as Wi‑Fi-enabled heater controls, with SAWO’s extensive range, offering sauna enthusiasts a broader selection of high-end, seamlessly integrated solutions.

-

In May 2024, KLAFS unveiled its new Taras outdoor sauna, a luxury, fully customizable wellness retreat designed for both private homes and spa facilities. With 23 layout options, including glass panels, wooden or metallic exteriors, it seamlessly adapts to diverse outdoor settings. Prefabricated for same-day installation, Taras features plush, free‑floating loungers, wood-panel interiors (spruce, ash, Thermowood), and triple-glazed insulation to maintain comfort in all weather. Its integrated atmospheric lighting and high-end insulation ensure an immersive experience, while delivery as a complete unit streamlines setup.

Germany Sauna Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 56.5 million

Revenue forecast in 2033

USD 89.4 million

Growth rate

CAGR of 5.9% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, country

Regional scope

Southern Germany; Western Germany; Northern Germany; Eastern Germany

Country scope

Germany

Key companies profiled

Harvia Group; KLAFS GmbH; SAUNATEC; TyloHelo Group; Sauna360 Inc. (Masco Corporation); HUUM; Syracuse Sauna King; Effegibi; Nordic Sauna; Saunacore

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Germany Sauna Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the Germany sauna market on the basis of product, application, and country:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Traditional Sauna

-

Infrared Sauna

-

Electric Sauna

-

Steam Saunas/Rooms

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Residential

-

Commercial

-

-

Country Outlook (Revenue, USD Million, 2021 - 2033)

-

Germany

-

Southern Germany

-

Bavaria (Bayern)

-

Baden-Württemberg

-

-

Western Germany

-

North Rhine-Westphalia (Nordrhein-Westfalen)

-

Hesse (Hessen)

-

Rhineland-Palatinate (Rheinland-Pfalz)

-

Saarland

-

-

Northern Germany

-

Lower Saxony (Niedersachsen)

-

Schleswig-Holstein

-

Hamburg

-

Bremen

-

Mecklenburg-Vorpommern

-

-

Eastern Germany

-

Berlin

-

Brandenburg

-

Saxony (Sachsen)

-

Saxony-Anhalt (Sachsen-Anhalt)

-

Thuringia (Thüringen)

-

-

-

Frequently Asked Questions About This Report

b. The Germany sauna market was estimated at USD 53.4 million in 2024 and is expected to reach USD 56.50 million in 2025.

b. The Germany sauna market is expected to grow at a compound annual growth rate of 5.9% from 2024 to 2030 to reach USD 89.4 million by 2033.

b. Traditional saunas accounted for a revenue share of 43.48% in the year 2024, due to their strong cultural roots and preference for classic high-heat steam experiences. Many consumers value the traditional sauna ritual for relaxation, social connection, and its perceived health benefits.

b. Some of the key players in the Germany sauna market include Harvia Group, KLAFS GmbH, SAUNATEC, TyloHelo Group, Sauna360 Inc. (Masco Corporation), HUUM, Syracuse Sauna King, Effegibi, Nordic Sauna, Saunacore

b. Key factors driving the growth of the Germany sauna market are rising health awareness and the popularity of wellness routines that promote relaxation and detoxification. Expanding spa facilities and modern home sauna options are making these experiences more accessible to a wider audience.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.