- Home

- »

- Green Building Materials

- »

-

Glass Curtain Wall Market Size, Share, Industry Report, 2030GVR Report cover

![Glass Curtain Wall Market Size, Share & Trends Report]()

Glass Curtain Wall Market (2025 - 2030) Size, Share & Trends Analysis Report By System Type (Unitized, Stick), By End-use (Commercial, Public, Residential), By Region (North America, Europe, Asia Pacific, CSA, & MEA), And Segment Forecasts

- Report ID: GVR-4-68038-906-7

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Glass Curtain Wall Market Summary

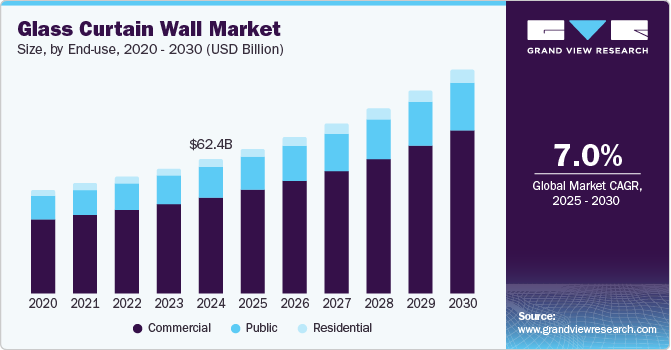

The global glass curtain wall market size was estimated at USD 62.4 billion in 2024 and is projected to reach USD 104.2 billion by 2030, growing at a CAGR of 7.0% from 2025 to 2030. The rising demand for energy-efficient buildings is a significant growth driver of the glass curtain wall industry.

Key Market Trends & Insights

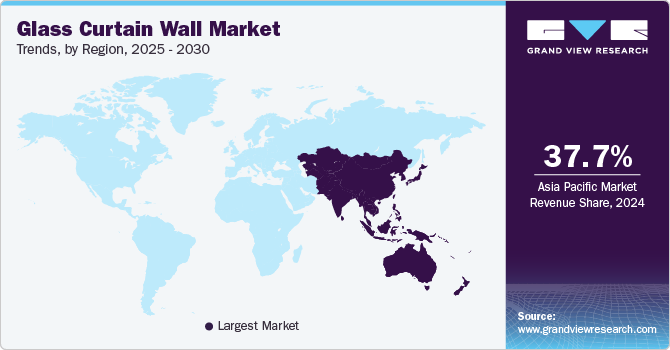

- Asia Pacific dominated the glass curtain wall industry and accounted for the largest revenue share of about 37.7% in 2024.

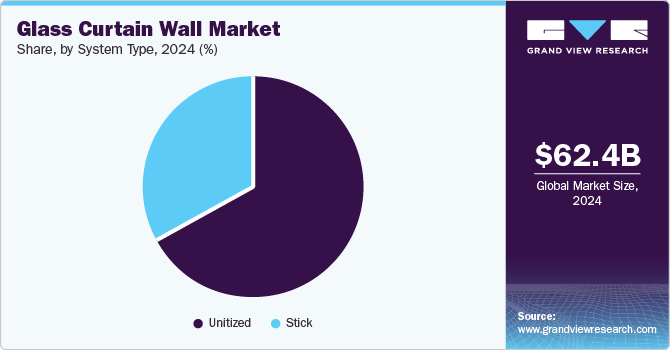

- By system type, the unitized segment led the glass curtain wall industry and accounted for the largest revenue share of 66.9% in 2024.

- By end-use, the commercial segment dominated the market and accounted for the largest revenue share of 71.6% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 62.4 Billion

- 2030 Projected Market Size: USD 104.2 Billion

- CAGR (2025-2030): 7.0%

- Asia Pacific: Largest market in 2024

With stringent regulations and growing awareness of sustainability, governments and businesses worldwide are increasingly adopting glass curtain walls with advanced insulation properties. These systems help optimize energy consumption by reducing heat gain in summer and heat loss in winter, leading to lower heating, ventilation, and air conditioning (HVAC) costs. The integration of double-glazed and low-emissivity (Low-E) glass further enhances energy efficiency, making glass curtain walls a preferred choice for modern construction projects.Rapid urbanization and infrastructural development are also driving the growth of the market. Expanding commercial and residential construction activities, particularly in emerging economies, are increasing the demand for aesthetic and functional building facades. High-rise buildings and smart city projects incorporate glass curtain walls to achieve a contemporary architectural appearance while ensuring structural strength and durability. Additionally, the rising trend of green buildings has led to an increased preference for glass curtain walls, which contribute to natural lighting and improved indoor air quality.

Technological advancements in glass processing and curtain wall systems are another major market driver. Innovations such as photovoltaic (PV) glass, dynamic glazing, and self-cleaning glass enhance the performance and functionality of curtain walls. These advancements not only improve the aesthetic appeal of buildings but also contribute to sustainability by reducing reliance on artificial lighting and energy-intensive maintenance. Moreover, the development of lightweight and high-strength glass materials has expanded the applicability of curtain wall systems, making them more viable for a diverse range of architectural designs.

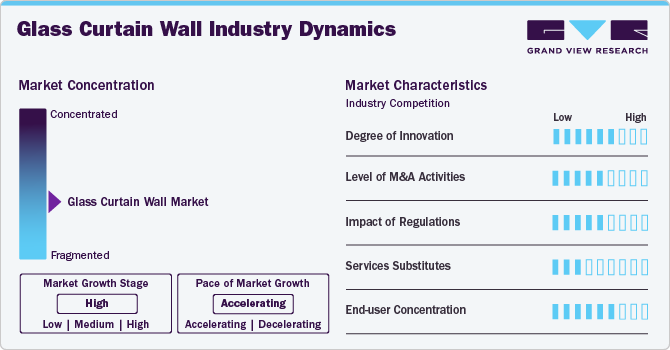

Market Concentration & Characteristics

The glass curtain wall market exhibits a moderate to high market concentration, with several key players such as AGC Inc., Guardian Glass, and Saint-Gobain holding significant market shares. The market is characterized by a high degree of innovation, particularly in energy-efficient glazing technologies, smart glass integration, and advanced coatings for thermal insulation and solar control. Regulatory frameworks, such as stringent building energy codes and green building certifications (e.g., LEED, BREEAM), play a pivotal role in shaping product development and adoption. These regulations drive manufacturers to enhance thermal performance, safety standards, and environmental sustainability, leading to the widespread adoption of double- and triple-glazed curtain wall systems.

The presence of service substitutes in the market remains limited, as alternatives like traditional masonry facades or aluminum cladding lack the aesthetic appeal and energy efficiency advantages offered by glass curtain walls. However, hybrid facades incorporating glass with other materials present a minor competitive threat. The end user concentration is notable within the commercial and institutional sectors, including corporate offices, retail centers, and healthcare facilities, where aesthetics, natural lighting, and energy savings are prioritized. The residential sector, though a smaller segment, is gaining traction due to increasing adoption in luxury high-rise buildings. Overall, the market's growth is influenced by regulatory compliance, technological advancements, and shifting preferences toward sustainable and visually appealing building solutions.

System Type Insights

The unitized segment led the glass curtain wall industry and accounted for the largest revenue share of 66.9% in 2024, driven by its superior efficiency, faster installation process, and enhanced structural performance. Unlike stick-built systems, unitized curtain walls are pre-assembled in controlled factory environments, ensuring higher precision and quality. This pre-fabrication significantly reduces on-site labor costs and construction time, making it an ideal choice for large-scale commercial and high-rise buildings.

The stick segment is expected to grow at a significant CAGR of 5.9% over the forecast period, driven by its cost-effectiveness, flexibility in design, and ease of installation. This system allows for on-site assembly, making it an ideal choice for projects requiring customization and adaptability to complex architectural structures. Additionally, the growing demand for energy-efficient buildings has driven the adoption of stick curtain walls, as they can accommodate high-performance glazing solutions, such as Low-E glass and double-glazed panels, enhancing thermal insulation and reducing energy consumption.

End-use Insights

The commercial segment dominated the market and accounted for the largest revenue share of 71.6% in 2024, driven by the increasing construction of modern office buildings, shopping malls, hotels, and commercial complexes worldwide. The rising emphasis on sustainable architecture and energy-efficient buildings has fueled the adoption of glass curtain walls, as they enhance natural lighting, reduce energy consumption, and improve thermal insulation. Additionally, the growing demand for aesthetically appealing and technologically advanced facades has driven investments in high-performance glazing solutions, particularly in urban areas with high-rise developments.

Residential segment is expected to grow at the fastest CAGR of 7.6% over the forecast period, driven by the increasing demand for luxury high-rise apartments, condominiums, and smart homes, where glass curtain walls enhance aesthetics, energy efficiency, and natural lighting. Urbanization trends, particularly in rapidly developing regions such as Asia-Pacific and the Middle East, have fueled large-scale residential construction projects, further propelling market demand.

Regional Insights

North America glass curtain wall market is driven by advancements in energy-efficient glazing, stringent building codes, and increasing demand for sustainable construction materials. Regulatory frameworks, such as the U.S. Department of Energy (DOE) guidelines and LEED (Leadership in Energy and Environmental Design) certification requirements, are pushing the adoption of high-performance glass curtain walls with enhanced thermal insulation and solar control properties. Additionally, the growing emphasis on net-zero energy buildings (NZEBs) is encouraging developers to integrate advanced curtain wall solutions that reduce energy consumption while maintaining aesthetic appeal.

U.S. Glass Curtain Wall Market Trends

The U.S. glass curtain wall industry is driven by increasing demand for energy-efficient buildings, as developers and property owners seek solutions to reduce energy consumption and meet stringent energy codes. Glass curtain walls with advanced glazing technologies, such as low-emissivity (Low-E) coatings and dynamic glass, enhance thermal insulation and minimize heat transfer, aligning with sustainability goals. Additionally, the growth of green building certifications such as LEED (Leadership in Energy and Environmental Design) and BREEAM (Building Research Establishment Environmental Assessment Method) has encouraged architects and builders to incorporate high-performance curtain wall systems that improve overall building energy efficiency and sustainability credentials.

Asia Pacific Glass Curtain Wall Market Trends

Asia Pacific dominated the glass curtain wall industry and accounted for the largest revenue share of about 37.7% in 2024, driven by rapid urbanization and the expansion of commercial infrastructure. Increasing investments in high-rise buildings, smart cities, and corporate office spaces across major economies such as China, India, and Japan are fostering demand for aesthetically appealing and energy-efficient façade solutions. The region's booming construction sector, supported by favorable government policies and foreign direct investments, further propels market growth. Additionally, rising disposable incomes and an increasing focus on sustainable architecture are encouraging developers to adopt glass curtain walls for their modern designs, daylight optimization, and thermal insulation benefits.

The China glass curtain wall market is driven by Technological advancements in smart glass and energy-efficient coatings, enabling superior insulation, solar control, and dynamic light regulation, which align with China’s sustainability goals. The growth of prefabrication and modular construction has further boosted the market, as developers seek efficient and cost-effective solutions that reduce labor costs and construction timelines. Additionally, rising foreign investments and the presence of global players have contributed to the market’s competitiveness, leading to increased innovation and product differentiation. The demand for high-rise buildings and skyscrapers, particularly in cities like Shanghai, Beijing, and Shenzhen, has fueled the adoption of glass curtain walls, given their ability to provide structural efficiency, daylight optimization, and aesthetic appeal.

Europe Glass Curtain Wall Market Trends

The Europe glass curtain wall industry is driven expansion of the commercial real estate sector, with increasing investments in office spaces, retail complexes, and hotels driving the need for high-performance building envelopes. Moreover, advancements in manufacturing technologies, including automation and prefabrication, have streamlined production processes, making high-quality glass curtain wall systems more cost-effective and accessible. The rising trend of high-rise construction in Europe, driven by space constraints and urban densification, has also contributed to the increased adoption of curtain wall systems, which provide structural efficiency and modern aesthetics.

The Germany curtain wall market is expected to grow during the forecast period. The rise in renovation and retrofitting projects across Germany’s aging building stock has increased the replacement demand for modern glass curtain wall systems with enhanced insulation and durability. The government’s incentives and funding for energy-efficient building upgrades, including subsidies for sustainable construction materials, further boost market adoption. Lastly, advancements in prefabricated and modular curtain wall systems have enhanced installation efficiency and reduced construction time, making them a preferred choice for developers seeking cost-effective and sustainable façade solutions.

Latin America Glass Curtain Wall Market Trends

The Latin America glass curtain wall industry is driven by rise in commercial construction activities, particularly in major urban centers such as São Paulo, Mexico City, and Buenos Aires. The expansion of corporate offices, shopping malls, and high-rise buildings has significantly boosted demand for glass curtain walls due to their aesthetic appeal and ability to enhance natural lighting. Additionally, urbanization and infrastructure development initiatives by governments and private investors have spurred large-scale construction projects, further supporting the market's growth.

Middle East & Africa Glass Curtain Wall Market Trends

The hospitality and tourism industry is a major growth driver for the Middle East & Africa glass curtain wall industry, as luxury hotels, resorts, and shopping malls increasingly incorporate glass curtain walls to enhance their visual appeal. Additionally, advancements in glass technology, including low-emissivity (Low-E) coatings and dynamic glass, have improved the efficiency and durability of curtain wall systems, making them more attractive to developers. The availability of high-quality raw materials and increased manufacturing capabilities within the region has also supported market growth, reducing dependency on imports. Finally, government-backed infrastructure projects, such as airport expansions, cultural centers, and commercial hubs, further drive the demand for glass curtain walls as part of contemporary architectural trends in the Middle East & Africa.

Key Glass Curtain Wall Company Insights

Some of the key players operating in market include Kawneer and Asahi Glass

-

Kawneer is a manufacturer of architectural aluminum systems, specializing in high-performance façade solutions. Kawneer’s product offerings in the glass curtain wall market include unitized and stick-built curtain wall systems, designed for high-rise buildings, retail spaces, and modern office structures. The company provides thermally efficient curtain wall solutions, such as 1600 Wall System and AA Series, which offer superior structural performance and design flexibility.

-

Asahi Glass (AGC Inc.) is a global leader in glass manufacturing, serving industries such as automotive, construction, and electronics. AGC’s product range includes Low-E glass, solar control glass, and laminated safety glass, which are widely used in curtain wall applications.

Nippon Sheet Glass, Schott AG are some of the emerging market participants in the glass curtain wall market.

-

Nippon Sheet Glass (NSG Group) is a major player in the glass industry, offering cutting-edge solutions for architectural, automotive, and technical glass applications. NSG’s curtain wall glass offerings include Pilkington Optiwhite, Pilkington Suncool, and Pilkington Activ self-cleaning glass, designed to enhance building sustainability and aesthetic appeal.

-

Schott AG is a German multinational specializing in high-tech glass and ceramics for various industries, including architecture, healthcare, and electronics. Schott’s architectural glass portfolio includes high-performance laminated glass, anti-reflective glass, and dynamic glazing solutions tailored for curtain wall systems. Its Schott Pyran fire-rated glass provides superior fire protection while maintaining transparency and aesthetic appeal.

Key Glass Curtain Wall Companies:

The following are the leading companies in the glass curtain wall market. These companies collectively hold the largest market share and dictate industry trends.

- Kawneer

- Asahi Glass

- Nippon Sheet Glass

- Schott AG

- China Glass Holdings Limited

- Vitro

- Apogee Enterprises Inc.

Recent Developments

-

In February 2020, Gualini Spa revealed its progress on the expansion of Orio al Serio Airport, Italy’s third-busiest airport by passenger volume. As part of the project, the company is responsible for supplying and installing the external glazed facades using a stick curtain wall system, ensuring the structure meets the required performance standards.

Glass Curtain Wall Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 67.2 billion

Revenue forecast in 2030

USD 104.2 billion

Growth rate

CAGR of 7.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

System type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; China; India; Japan; South Korea; Brazil; Saudi Arabia; UAE

Key companies profiled

Kawneer; Asahi Glass; Nippon Sheet Glass; Schott AG; China Glass Holdings Limited; Vitro; Apogee Enterprises Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Glass Curtain Wall Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global glass curtain wall market report based on system type, end-use and region:

-

System Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Unitized

-

Stick

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Public

-

Residential

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global glass curtain wall market size was estimated at USD 62.4 billion in 2024 and is expected to reach USD 67.2 billion in 2025.

b. The glass curtain wall market is expected to grow at a compound annual growth rate of 7.0% from 2025 to 2030 to reach USD 104.2 billion by 2030.

b. Based on end-use, the commercial segment dominated the market and accounted for the largest revenue share of 71.6% in 2024, driven by the increasing construction of modern office buildings, shopping malls, hotels, and commercial complexes worldwide.

b. Some of the key players operating in the glass curtain wall market include Kawneer, Asahi Glass, Nippon Sheet Glass, Schott AG, China Glass Holdings Limited, Vitro, and Apogee Enterprises Inc.

b. The key factors that are driving the glass curtain wall market include growing demand for commercial spaces such as offices, malls, among others, and the rising adoption of green building standards across the world.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.