- Home

- »

- Advanced Interior Materials

- »

-

Andalusite Market Size, Share, Growth Analysis Report, 2030GVR Report cover

![Andalusite Market Size, Share & Trends Report]()

Andalusite Market (2023 - 2030) Size, Share & Trends Analysis Report By Application (Refractories, Foundry, Kiln Furniture, Others), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-925-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Andalusite Market Size & Trends

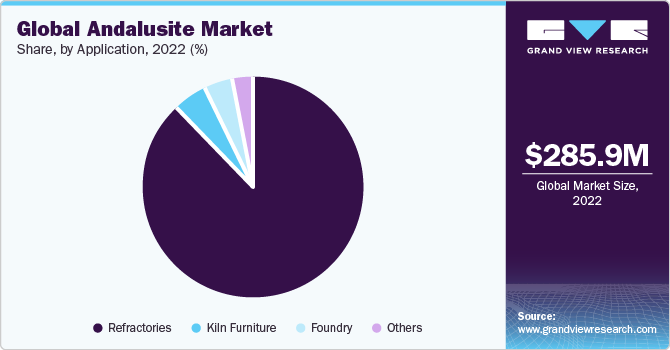

The global andalusite market size was valued at USD 285.9 million in 2022 and is anticipated to expand at a compound annual growth rate (CAGR) of 4.5% from 2023 to 2030. Increasing demand for refractories in the steel industry is expected to remain a key driving factor over the forecast period, as andalusite is mostly used in refractory production. The phenomenal properties of andalusite such as volume stability, high thermal shock, low porosity, and high chemical and creep resistance, along with the high level of purity, make it suitable for use in the manufacturing of refractories. Refractories are largely used in blast furnaces during the production of steel, owing to properties such as the ability to withstand high temperatures and thermal conductivity.

Growing demand for steel in various end-use industries such as construction is anticipated to increase the utilization of refractories in the coming years. The strong growth of the construction industry owing to the increasing population and rapid urbanization is likely to propel global steel consumption, which is anticipated to augment refractory production over the forecast period. Rising demand for cast metal products from the automotive industry is expected to drive foundry industry growth which, in turn, will propel the market, as andalusite is an important component in foundry sand.

According to the Foundry Informatics Centre, global casting production increased by nearly 5.3% from 2017 to 2018, which is likely to augment the demand for andalusite over the coming years. However, market growth is anticipated to be hindered by the supply-demand imbalance. Andalusite’s production is limited as commercial deposits are concentrated in South Africa, Turkey, and Peru, which is insufficient in meeting consumer demand. This factor can result in consumers readily switching to alternatives such as bauxite, owing to their abundant availability.

Application Insights

The refractories segment held the dominant revenue share of 88.3% in 2022. Andalusite is used in the linings of kilns and boilers to protect equipment from high temperatures. Refractory products provide resistance against corrosion, abrasion, and any other type of attack. Refractory materials form a significant portion of the overall manufacturing segment, as finished products of the refractory market are used in various industries, including construction and automotive.

For example, the manufacturing of a car weighing 1.3 tons can require up to 10 kilograms of refractories in the form of bricks and mixes. Hence, the increasing production of vehicles is anticipated to augment the demand for products such as steel, glass, aluminum, copper, and plastics, which, in turn, is expected to propel the demand for refractories.

The foundry segment is anticipated to register the highest CAGR of 4.9% over the forecast period. Andalusite as foundry sand is suitable for the production of patterns, molds, and cores. Considering its anti-veining properties such as low thermal expansion, heat resistance, and high refractoriness, it is preferred for the heavy casting of iron and steel alloys. Besides, it also helps in minimizing issues related to sand sintering, sand-washing, and metal penetration.

The kiln furniture segment is anticipated to witness a CAGR of 4.4% over the forecast period, owing to the growing demand for kilns from the ceramics and automotive industries. Andalusite shapes are used in making kiln furniture, such as saggars and shelves that are used in investment castings, thermal processing, and glass. A benefit of using andalusite over other minerals is that it can be used in its raw form, while certain minerals such as kyanite need to be calcined for high-temperature applications.

Regional Insights

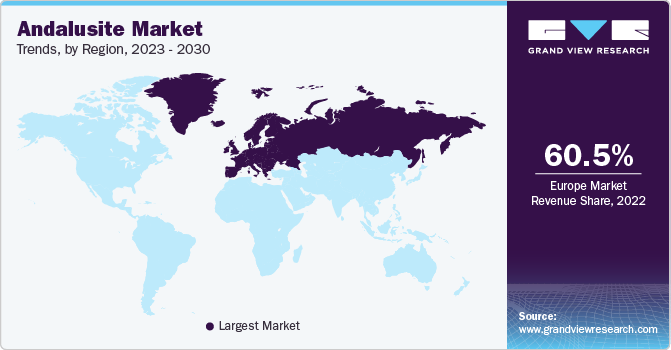

Europe dominated the market and accounted for a revenue share of 60.5% in 2022, owing to the growth of the construction industry in which refractories are used for producing cement. On the other hand, the Asia Pacific region is expected to expand at a CAGR of 4.5% during the forecast period. The Asia Pacific market is dominated by China owing to the increasing production of refractories in the country. It produced nearly 23 million tons of refractories in 2017, which are majorly consumed by the steel industry.

The growing demand for steel in China is anticipated to augment the growth of the andalusite market over the coming years. A substantial demand for andalusite in the country also comes from the foundry industry. In 2018, China increased its foundry casting production by 2 million tons to reach a total production of 49.4 million tons, owing to the increasing demand from the manufacturing sector.

In March 2022, the Indian government approved the Ministry of Mines' proposal to amend the Second Schedule of the Mines and Minerals (Development and Regulation) Act, 1957. This amendment aims to specify the royalty rates for andalusite, potash, glauconite, platinum group of metals (PGM), emerald, sillimanite, and molybdenum. Notably, the royalty rates for sillimanite, kyanite, and andalusite have been maintained at the existing level. The amendment is expected to promote import substitution for various crucial minerals, thus conserving foreign exchange reserves. Moreover, it will reduce the country's mineral reliance on foreign sources by encouraging local production.

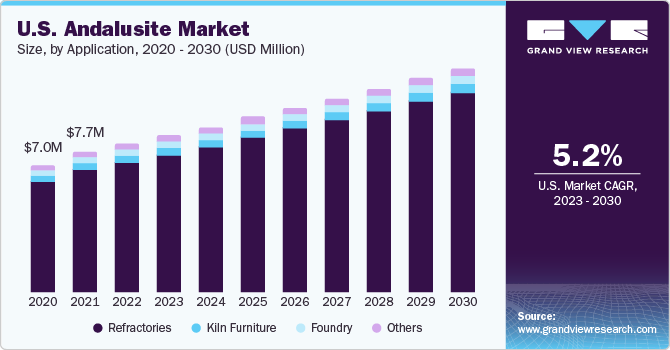

In North America, the market is driven by the growing steel and foundry industries. Positive development in the production of lightweight vehicles in Mexico and high investments by original equipment manufacturers (OEMs) in the U.S. are anticipated to boost the demand for metal casting in the region. In 2018, major automakers in the region announced a combined investment of USD 4.8 billion in capacity expansions, new product launches, and construction of new facilities, which is expected to increase the consumption of andalusite over the coming years.

In the Middle East and Africa, South Africa is the largest producer and exporter of andalusite, with the USGS stating that the country produced 200,000 tons of the product in 2018. Increasing production of steel in the Middle East and Africa is propelling the consumption of refractories, thus resulting in an increased demand for andalusite. According to the World Steel Association, in 2022, crude steel production reached 44.0 million tons in the Middle East.

Key Companies & Market Share Insights

Producers are largely focusing on the innovation and development of new grades of andalusite to serve various applications. In January 2021, Andalusite Resources (Pty) Ltd., a significant contributor to global andalusite production based in South Africa, announced the approval of ARM Andalusite (Pty) Ltd. as its new investor and owner. Andalusite Resources entered into business rescue proceedings in mid-2019 after having faced financial difficulties. However, it was expected that the company would successfully emerge from its business rescue status and undergo a transfer of ownership.

In another market development, in July 2018, Resco Products constructed a new R&D facility in Greensboro, North Carolina, which was aimed at launching various grades of andalusite and improving product performance.

Key Andalusite Companies:

- Andalucita S.A.

- Imerys S.A.

- LKAB Minerals

- Latin Resources

- Resco Products

- Shijiazhuang Mining

- Keyhan Payesh Alvand

Andalusite Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 301.3 million

Revenue forecast in 2030

USD 409.3 million

Growth rate

CAGR of 4.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; Turkey; Russia; China; India; Australia; Brazil; South Africa

Key companies profiled

Andalucita S.A.; Imerys S.A.; LKAB Minerals; Latin Resources; Resco Products; Shijiazhuang Mining; Keyhan Payesh Alvand

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Andalusite Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global andalusite market report based on application and region:

-

Application Outlook (Revenue, USD Million; Volume, Kilo Tons, 2018 - 2030)

-

Refractories

-

Foundry

-

Kiln Furniture

-

Others

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilo Tons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Turkey

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global andalusite market size was estimated at USD 285.9 million in 2022 and is expected to reach USD 301.2 million in 2023.

b. The global andalusite market is expected to grow at a compound annual growth rate (CAGR) of 4.5% from 2023 to 2030 to reach USD 409.3 million by 2030.

b. Refractory was the largest segment in 2022 with a market revenue share of 87.0%. Growing usage of refractories in industries such as glass, non-ferrous metals, paper & pulp, cement, etc. is anticipated to augment segment growth over the forecast period.

b. Some of the key vendors of the global andalusite market are Imerys Refractory Minerals, Andalusite Resources, Andalusia S.A., and Resco Products.

b. Increasing demand for refractories in the steel industry is expected to remain a key driving factor over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.