- Home

- »

- Advanced Interior Materials

- »

-

Refractories Market Size And Share, Industry Report, 2033GVR Report cover

![Refractories Market Size, Share & Trends Report]()

Refractories Market (2026 - 2033) Size, Share & Trends Analysis Report By End Use (Iron & Steel, Cement & Lime, Glass & Ceramics, Non-Ferrous Metals), By Region (North America, Europe, APAC, Latin America, MEA), And Segment Forecasts

- Report ID: GVR-4-68040-141-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Refractories Market Summary

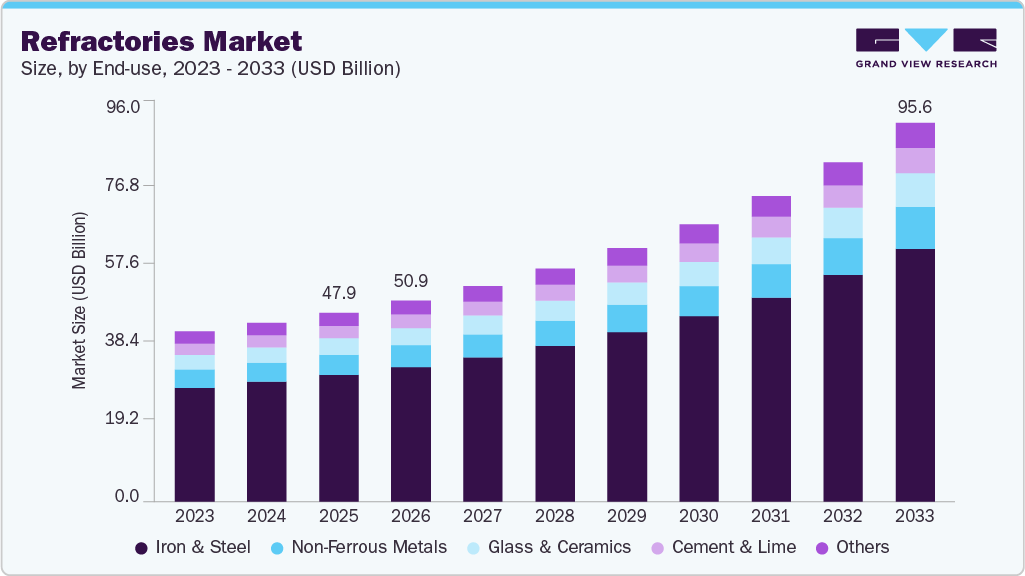

The global refractories market size was estimated at USD 47.88 billion in 2025 and is projected to reach USD 95.96 billion by 2033, growing at a CAGR of 9.5% from 2026 to 2033. Crude steel manufacturing through basic oxygen furnaces (BOF), electric arc furnaces (EAF), and induction furnaces (IF) requires high volumes of shaped and unshaped refractories to withstand extreme temperatures and chemical wear.

Key Market Trends & Insights

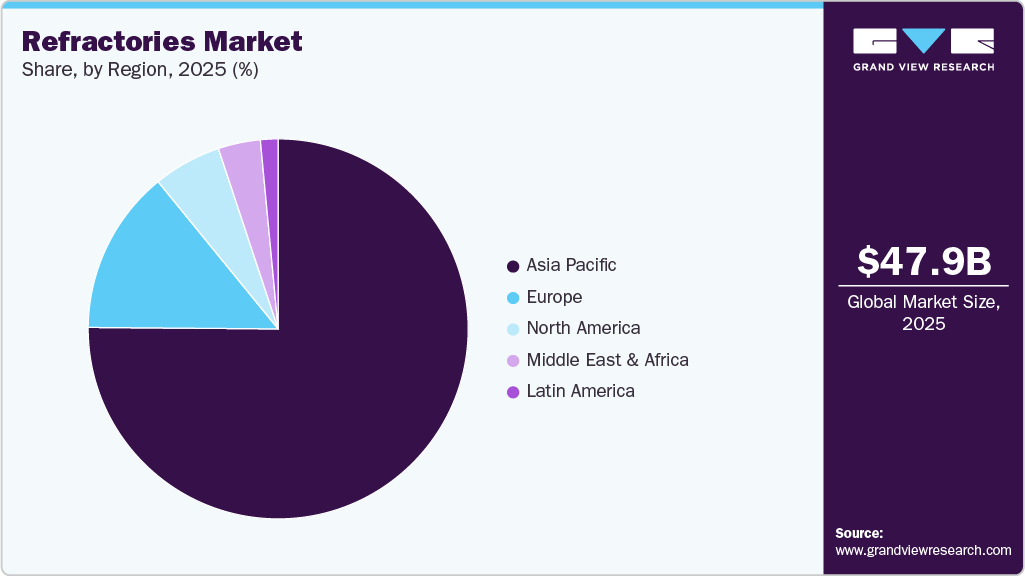

- Asia Pacific dominated the refractories market with the largest revenue share of over 75% in 2025.

- By end use, iron & steel segment accounted for the largest market revenue share of 67.0% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 47.88 Billion

- 2033 Projected Market Size: USD 95.96 Billion

- CAGR (2026-2033): 9.5%

- Asia Pacific: Largest market in 2025

- Europe: Fastest growing market

As countries such as India, China, and Vietnam ramp up infrastructure and construction projects, steel demand and, thus, refractories continue to rise. Additionally, green steel initiatives in Europe and Asia encourage investments in new EAF setups, further strengthening refractory consumption.Cement kilns operate at temperatures exceeding 1400°C, demanding consistent refractory lining replacement. Rapid urbanization and population growth in the Asia Pacific and Africa are fueling the construction of roads, bridges, residential, and commercial buildings, which translates to higher cement output. Moreover, capacity expansion plans by major cement producers in countries like India, Indonesia, and Nigeria are boosting demand for basic and non-basic refractories.

Rising demand from the non-ferrous metals industry is also contributing to market growth. Copper, aluminum, zinc, and nickel smelters require specialized refractory linings to handle chemically aggressive slags and high thermal loads. As energy transition efforts accelerate, demand for these metals in EV batteries, wind turbines, and solar panels increases. This is pushing companies in regions such as Latin America, Africa, and Australia to invest in expanding and upgrading their smelting facilities, driving consistent refractory usage.

The growing role of refractories in waste-to-energy (WTE), glass, and petrochemical industries is enhancing market diversity. Incineration plants and biomass-based energy units rely on refractory linings to prevent structural degradation. Similarly, glass furnaces and chemical reactors are lined with high-grade refractories to ensure operational efficiency and reduce maintenance downtimes. Rising environmental awareness and stricter waste disposal norms increase investments in these sectors, reinforcing long-term refractory demand.

Lastly, technological advancements and product innovation are reshaping the market. Manufacturers focus on high-performance monolithic refractories, castables, and precast shapes that offer better energy efficiency and longer service life. Demand for recyclable, low-carbon, and energy-efficient materials also influences product design, especially in Europe and North America. Digitalization in refractory monitoring and predictive maintenance further supports their adoption in advanced industrial operations, making the sector more resilient and future-ready.

Drivers, Opportunities & Restraints

Rising focus on industrial automation and process optimization creates fresh momentum for the refractory market. Automated steel, cement, and non-metal production systems require refractory products with improved thermal shock resistance and predictable performance under varying load cycles. In addition, government-backed infrastructure schemes such as China's Belt and Road Initiative and the Middle East's Vision 2030 programs foster long-term capital investments in refineries, power plants, and industrial complexes that rely on refractory linings for durability and safety.

Emerging economies in Southeast Asia and Sub-Saharan Africa present untapped potential for refractory manufacturers. Local production capacities remain limited, offering opportunities for international players to establish manufacturing bases or strategic partnerships. Moreover, the circular economy trend is opening up a niche for sustainable refractory solutions, including recycled aggregates and spent refractory recovery systems. Companies that invest in closed-loop systems and environmentally compliant products are well-positioned to benefit from tightening emission standards and growing stakeholder scrutiny around ESG practices.

Volatility in raw material prices poses a significant restraint for the refractories market. Key inputs such as bauxite, magnesia, and graphite heavily rely on China for supply, making global pricing vulnerable to export restrictions and environmental crackdowns. Furthermore, refractory production is energy-intensive and carbon-emitting, leading to growing regulatory pressures, especially in Europe and North America.

End Use Insights

Iron & steel held the revenue share of over 67% in 2025. The iron and steel sector continues to be the cornerstone of refractory consumption thanks to its extensive thermal and chemical demands. In the first half of 2025, global crude steel production reached 934.3 million tonnes. This sustained high volume of crude steel output drives consistent demand for refractory materials used in blast furnaces, basic oxygen furnaces, electric arc furnaces, and continuous casting moulds. As producers strive to reduce downtime and extend the service life of linings, investments in refractory optimization and replacement cycles remain robust.

The glass and ceramics segment is witnessing steady growth within the refractories market due to rising demand from construction, packaging, and consumer goods industries. In glass manufacturing, refractory materials are crucial for lining furnaces, regenerators, and forehearths under extreme thermal and chemical conditions. Growing global glass production, driven by expanding urbanization, infrastructure projects, and increasing consumption of flat glass and container glass, has necessitated consistent investments in high-performance refractories to ensure process stability, longer furnace life, and energy efficiency. The push toward electric and hybrid glass furnaces for decarbonization further encourages the adoption of advanced fused cast and insulating refractory products.

Regional Insights

Asia Pacific accounted for the largest market revenue share of over 75% in 2025. The expanding steel and cement industries across countries such as China, India, Japan, and Southeast Asian nations primarily drive the growth of the refractory market in the Asia Pacific. As the region experiences a rise in urbanization and infrastructure development, the demand for crude steel and clinker production continues to surge. Basic oxygen furnaces, electric arc furnaces, and rotary kilns rely heavily on various shaped and unshaped refractories for efficient operation and thermal resistance. Moreover, government-backed infrastructure programs and private sector investments in transport, housing, and energy sectors are creating sustained consumption of refractories.

North America Refractories Market Trends

Refractory market in the North America is growing due to the resurgence of domestic steel production and ongoing investments in EAF installations. The U.S. and Canada are witnessing a revival in manufacturing and infrastructure sectors, supported by policy incentives like the Inflation Reduction Act and the Bipartisan Infrastructure Law. These measures stimulate demand for refractory materials in steelmaking, cement, and non-ferrous metals industries. In particular, the shift from blast furnaces to EAFs drives the need for high-performance, thermal shock-resistant refractories tailored for intermittent operations.

U.S. Refractories Market Trends

In the U.S., the localization of critical mineral processing and battery manufacturing supply chains proliferates the market. Federal initiatives such as the CHIPS and Science Act and the Defense Production Act supporting domestic mining, metal refining, and advanced manufacturing are raising refractory demand in lithium, nickel, and cobalt processing facilities. These operations require highly resistant refractory linings for smelters, roasters, and thermal treatment units that withstand corrosive environments and extreme temperatures. This trend reflects a shift toward strategic independence in materials essential for clean energy technologies.

Europe Refractories Market Trends

The refractories market in Europe is anticipated to register the fastest CAGR over the forecast period. The market is experiencing growth due to the accelerated push toward green steel production and carbon-neutral manufacturing. Leading producers in Germany, Sweden, and Austria are investing heavily in hydrogen-based DRI and EAF technologies as part of their decarbonization strategies. These transitions require new refractory formulations that withstand higher oxidation environments and frequent thermal cycling. The European Union’s stringent environmental regulations and carbon pricing mechanisms are compelling industries to modernize kilns, ladles, and furnaces with more durable and energy-efficient refractory linings.

Latin America Refractories Market Trends

In Latin America, the refractory market is advancing steadily due to the expansion of the regional steel industry, particularly in Brazil, Mexico, and Argentina. Growing investments in electric arc furnace-based production and modernization of blast furnaces are increasing the need for robust refractory linings in ladles, converters, and casting units. Local steel producers are focusing on improving operational efficiency and furnace life cycles, which is driving the adoption of shaped and unshaped refractories with higher resistance to corrosion and thermal shock. In addition, the recycling of spent refractories is gaining momentum across steel mills as companies look to cut costs and comply with sustainability goals.

Middle East & Africa Refractories Market Trends

Growing investments in steel production, non-ferrous metallurgy, and cement manufacturing drive the Middle East and Africa refractory market. Countries such as Saudi Arabia, the UAE, Egypt, and South Africa are expanding their industrial output to support large-scale infrastructure and construction projects. This has increased the demand for refractories in electric arc furnaces, rotary kilns, and ladle refining units. As part of broader economic diversification plans, regional governments are encouraging the development of domestic steel and mining industries, which directly support refractory consumption in smelting, refining, and casting processes.

Key Refractories Company Insights

Some of the key players operating in the market include RHI Magnesita, Imerys, and other.

-

RHI Magnesita is a global leader in refractory products and solutions, headquartered in Austria and operating in more than 120 countries. The company has a fully integrated supply chain that includes raw material mining, manufacturing, engineering, installation, and recycling. It serves various industries, such as steel, cement, glass, non-ferrous metals, and energy. RHI Magnesita is known for its innovation in high-temperature materials and digital solutions that help clients monitor refractory performance and predict wear in real time.

-

Imerys is a France-based multinational company focused on industrial minerals used across various applications, including refractories. While it previously operated a major refractory division through its High Temperature Solutions (HTS) business, Imerys divested this segment in 2023. That business now operates under Calderys, an independent global player in refractories. Before the divestiture, Imerys was known for integrating mining, mineral processing, and customized refractory formulations, particularly for steel, cement, and foundry applications.

Key Refractories Companies:

The following are the leading companies in the refractories market. These companies collectively hold the largest market share and dictate industry trends.

- Chosun Refractories Co., Ltd.

- CoorsTek Inc.

- HarbisonWalker International

- Imerys

- Krosaki Harima

- Morgan Advanced Materials

- RHI Magnesita

- Saint-Gobain SEFPRO

- Shinagawa Refractories

- Vesuvius

Recent Development

-

In October 2024, Shinagawa Refractories Co., Ltd. announced the acquisition of Gouda Refractories Group B.V., a prominent Netherlands-based refractory manufacturer. This acquisition marks a key step in advancing Shinagawa’s Vision 2030 and aligns with its 6th Mid-Term Management Plan by expanding its footprint across the EMEA region. It enables Shinagawa to enter new end-use markets, including non-ferrous metals, petrochemicals, and waste-to-energy.

Refractories Market Report Scope

Report Attribute

Details

Market definition

Scope includes apparent consumption of refractories in different end uses such as steel, cement, etc.

Market size value in 2026

USD 50.90 billion

Revenue forecast in 2033

USD 95.96 billion

Growth rate

CAGR of 9.5% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative Units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2026 to 2033

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

End use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; Russia; UK; China; India; Japan; South Korea; Brazil; South Africa

Key companies profiled

Chosun Refractories Co., Ltd.; CoorsTek Inc.; HarbisonWalker International; Imerys; Krosaki Harima; Morgan Advanced Materials; RHI Magnesita; Saint-Gobain SEFPRO; Shinagawa Refractories; Vesuvius

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Refractories Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global refractories market report based on end use and region.

-

End Use Outlook (Revenue, USD Million; Volume, Kilotons; 2021 - 2033)

-

Iron & Steel

-

Cement & Lime

-

Glass & Ceramics

-

Non-Ferrous Metals

-

Others

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilotons; 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Russia

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

South Korea

-

Brazil

-

-

Middle East & Africa

-

Saudi Africa

-

-

Frequently Asked Questions About This Report

b. The global refractories market size was estimated at USD 47.88 billion in 2025 and is expected to reach USD 50.90 billion in 2026.

b. The global refractories market is expected to grow at a compound annual growth rate of 9.5% from 2026 to 2033 to reach USD 95.96 billion by 2033.

b. The iron & steel segment dominated the market with a revenue share of over 67% in 2025.

b. Some of the key players of the global refractories market are Chosun Refractories Co., Ltd., CoorsTek Inc., HarbisonWalker International, Imerys, Krosaki Harima, Morgan Advanced Materials, RHI Magnesita, Saint-Gobain SEFPRO, Shinagawa Refractories, Vesuvius, and others.

b. The rising demand from the steel, cement, and glass industries drives the global refractories market's growth. Increasing infrastructure development and industrialization across emerging economies further support this growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.