- Home

- »

- Automotive & Transportation

- »

-

Road Haulage Market Size, Share & Trends Report, 2030GVR Report cover

![Road Haulage Market Size, Share & Trends Report]()

Road Haulage Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Domestic Road Haulage, International Road Haulage), By Vehicle, By Application, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-739-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Road Haulage Market Size & Trends

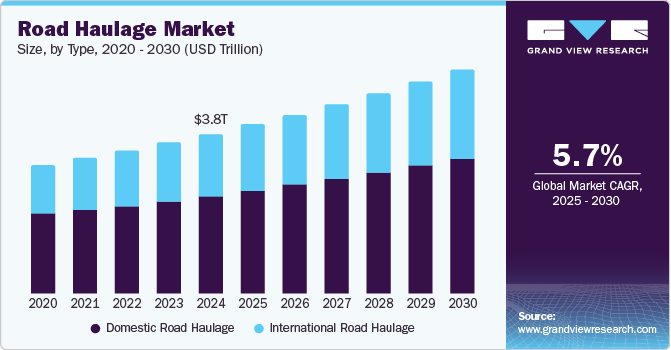

The global road haulage market size was valued at USD 3,833.97 billion in 2024 and is projected to grow at a CAGR of 5.7% from 2025 to 2030. A substantial increase in truck production globally and promising expansion of the e-commerce sector have supplemented the growing freight demand from major industries, including retail and manufacturing. Trucks are considered highly flexible, cost-efficient, and the responsive mode of freight transport that distributors generally prefer for moving various types of goods, further enabling industry advancements.

Additionally, technological developments and innovations such as integrated supply chains, vehicle-to-vehicle (V2V) communication, autonomous driving, and remote diagnostics have helped transform the logistics industry, fueling substantial demand for road haulage services worldwide. Road transport ensures more direct oversight of cargo as it moves from one point to another. This empowers drivers to take immediate action to address issues such as improper road conditions, inclement weather, and potential delays, offering increased control over the transportation process.

The rapid growth of the e-commerce sector has highlighted the need for timely parcel deliveries to consumers. The industry’s strong expansion has resulted in the emergence of service requirements such as express deliveries, leading to the development of a new class of logistics operators. Customers expect fast and reliable delivery of their orders and road haulage offers an efficient way to meet the demand for next-day, same-day, or two-day delivery. Moreover, the ability to reach both urban and rural areas conveniently means that companies can expand their service area to accommodate the rising e-commerce demand. Road haulage also serves as a major enabler for other industries by providing transportation for raw materials, finished goods, and consumer products, facilitating the smooth functioning of supply chains. This mode of freight transport is also highly scalable, allowing businesses to ship products ranging from small parcels to large containers. By consolidating goods in larger shipments, companies can reduce the cost per unit of transportation compared to air or rail.

The market is expected to witness new avenues for growth during the forecast period due to the introduction of various innovations in the global automotive industry. For instance, using modern GPS and telematics systems, businesses and customers can track shipments in real time, thus improving customer service and allowing for better planning, as well as reducing uncertainty in delivery times. Real-time tracking, automated updates, and customer portals mean that both businesses and consumers have greater access to information, enabling proactive management of logistics. Platooning is another recent development that has been stated to improve fuel economy, reduce air drag, and enhance vehicle capacity on highways. It further helps in smoothening traffic conditions by reducing the number of times that trucks are required to stop and start. The logistics industry is also looking towards green innovations in this segment as a means to comply with government norms regarding emissions and improve vehicle efficiency. For instance, road haulage companies are introducing electric trucks, hybrid vehicles, and alternative fuel options such as natural gas-powered vehicles, to reduce carbon emissions. Through the use of route optimization software, fuel-efficient vehicles, and better logistical practices, domestic road haulage can contribute to reducing fuel consumption and carbon footprints, especially for shorter routes or regional deliveries.

Type Insights

The domestic road haulage segment accounted for the largest revenue share of 61.1% in the global market in 2024. Increasing economic development in emerging nations and improvements in transportation infrastructure have driven the demand for moving goods through roadways between states and cities. Domestic deliveries are more economical when compared to international deliveries and do not require large amounts of paperwork, which appeals to trucking and logistics companies looking to maintain simplicity in their operations. Domestic road haulage is often the quickest option for delivering goods within a country, especially when distances are not very long, compared to rail or sea transport. This is crucial for industries that demand time-sensitive delivery of products such as food and pharmaceuticals or high-demand consumer goods. Companies are investing in introducing eco-friendly fleets that adhere to emission regulations across different regions, which is further expected to positively drive market expansion.

The international road haulage segment is expected to advance at the fastest CAGR from 2025 to 2030. Increasing frequency of cross-border goods movement and the establishment of dedicated highways and roadways has made it easier for companies to incorporate international freight movement in their operations. International road haulage can handle a wide variety of cargo, including bulk goods, perishable items, consumer products, and specialized freight such as hazardous materials or temperature-sensitive goods. Unlike other transport modes such as sea or rail, which depend on fixed routes and infrastructure, road haulage can access diverse destinations, including remote locations or cities without direct rail or port access, offering extensive coverage across multiple countries. Relaxation in taxation & import duties and the introduction of flexible cost structures by transportation service providers further aid segment demand. For certain regions, such as Europe and North America, road haulage can be more economical than air or sea transport, especially across distances that do not justify the high costs and long transit times of shipping by air or sea.

Vehicle Insights

The heavy commercial vehicles segment accounted for a dominant revenue share in the global market in 2024. This can be attributed to a steady rise in the long-distance transportation of a several types of goods and a notable increase in production of large commercial vehicles and trucks. Road haulage forms an important part of global supply chains, particularly in industries such as manufacturing, automotive, and consumer goods. With the noticeable growth in worldwide trade activities, there is an urgent need for vehicles that can transport bulk materials, machinery, and other products across continents or countries. Furthermore, expansion of third-party logistics providers and increasing complexity of freight services, such as refrigerated or temperature sensitive transport, has factored in the rising popularity of specialized large vehicles. For instance, the transportation of perishable goods requires temperature-controlled systems in vehicles, which have witnessed a substantial demand in recent years.

The light commercial vehicles segment is anticipated to advance at the fastest CAGR during the forecast period. The demand for such vehicles has witnessed a noticeable growth, owing to the increased frequency of movement of smaller goods, regional transport, and the expansion of the last-mile delivery sector. The sharp growth witnessed by the e-commerce industry, particularly over the past decade, has presented the need for efficient delivery services in suburban and urban areas. Light vehicles are ideal in this respect as they can efficiently navigate busy streets, roads, and residential locations. Logistics firms are increasingly balancing their fleet structures by including both larger trucks for long-distance movement and smaller vehicles for local and regional distribution. These vehicles have also become very popular in urban settings where governments and regulatory bodies have implemented stringent norms regarding emissions, leading to the use of their electric variants.

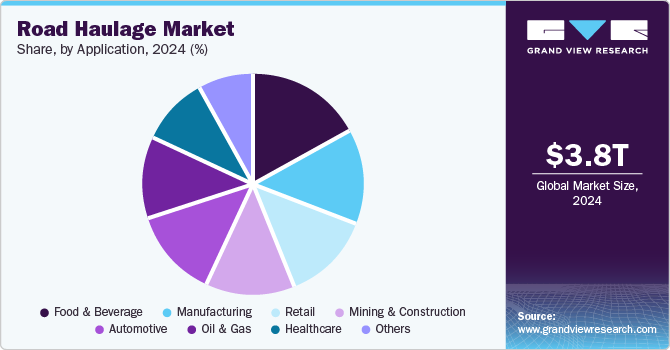

Application Insights

The food & beverage segment accounted for a leading revenue share in the global market in 2024 and is further expected to maintain its position in the coming years. As the global population grows and income levels rise, particularly in emerging economies, there is a significant increase in food consumption. This drives substantial demand for road transport to distribute food products that meet the needs of urban populations and remote areas. The increased trading of food and beverage products globally has highlighted the importance of cross-border shipments between countries. Globalization of food trade and regional trade agreements have further aided the provision of efficient and reliable food & beverage logistics, particularly road transport, to move products across borders. According to a report by Eurostat published in July 2024, in the road freight transport sector of the European Union, food products, beverages, and tobacco emerged as the dominant segment, accounting for 308 billion ton-kilometers. This highlights the increasing emphasis being put on the movement of food items both regionally and internationally. As most of these products are perishable or get spoilt after a certain period, logistics companies are integrating latest technologies in temperature control and refrigeration in their fleets, driving segment growth.

The manufacturing segment is anticipated to advance at the fastest CAGR from 2025 to 2030, owing to the increasing pace of manufacturing activities globally and the need to transport heavy equipment and machinery across different regions. Establishment of cross-border trade agreements between countries has further eased the movement of such components, necessitating the presence of reliable and sturdy trucking fleets that can conveniently carry heavy objects. Manufacturing generally occurs in regional hubs and finished products need to be distributed quickly within specific regions or globally. Road haulage provides the required door-to-door service that facilitates seamless delivery to warehouses, distribution centers, and retail outlets. Furthermore, the adoption of Just-in-Time (JIT) inventory systems by manufacturers, where parts and materials are delivered exactly when needed, creates a significant demand for fast and reliable road haulage. Manufacturers require transport services that can operate with high precision, providing timely delivery and reducing inventory costs.

Regional Insights

The North American market for road haulage accounted for the second-largest revenue share in 2024. The presence of a dense and well-maintained road transport network in the region and strong market competition between freight and logistics service providers have ensured steady industry growth. Trade between the U.S., Canada, and Mexico, often referred to as North American trade, depends heavily on road transport. Cross-border trade is facilitated by agreements such as the United States-Mexico-Canada Agreement (USMCA) that entered into effect in July 2020, which has streamlined cross-border logistics. The U.S. is Canada's largest trading partner, while Mexico is an important supplier of raw materials and manufactured goods to the U.S., requiring extensive road transport for movement across the U.S.-Mexico border. The strengthening e-commerce infrastructure in the region presents further growth opportunities to road haulage service providers and aids in regional market expansion.

Asia Pacific Road Haulage Market Trends

Asia Pacific accounted for the largest revenue share of 47.0% in the global road haulage market in 2024, on account of economic expansion, evolving supply chain requirements, and large-scale infrastructural developments in the region. Many countries in Asia Pacific, such as China, India, Indonesia, and Vietnam, are experiencing strong economic growth, which is driving demand for goods transportation. There has been a substantial expansion of regional industries and a subsequent increase in production capacities, driving the requirement for efficient logistics and transportation services. Moreover, the rise of megacities and urban areas has driven the popularity of last-mile delivery services, which rely heavily on road haulage to move goods from warehouses or distribution centers to retailers and consumers.

China accounts for a dominant revenue share in the regional market, aided by the extensive industrialization in the economy and the well-established road infrastructure that has made it convenient to move goods and services seamlessly. According to data from World Bank, the country has emerged as the leading manufacturing economy globally in 2024, accounting for around 32.0% of the global manufacturing output. The presence of a large workforce, low labor costs, cheap rate of raw materials, and high production quality have made the country a leader across several segments such as machinery, electronics, and textiles. Thus, a sharp rise in production and exports has boosted the adoption of road haulage services, as it plays an important role in ensuring the timely delivery of manufactured goods. The booming e-commerce industry has further necessitated the presence of freight and last-mile deliveries in the economy, driving market growth.

Europe Road Haulage Market Trends

Europe is anticipated to advance at the second-fastest CAGR during the forecast period, owing to the presence of highly industrialized economies such as Germany, France, and the UK and technological innovations in the logistics industry. The region has witnessed good economic recovery and growth in the post-pandemic period, particularly in western European countries, leading to increased production and consumer demand. The European Union's (EU) single market enables free movement of goods across borders, leading to higher cross-border transportation volumes between the 27 member states. Road haulage is a preferred option for moving goods within the region due to its flexibility and shorter transit times compared to other modes of transport. Additionally, the presence of various regulations regarding road freight transports have compelled manufacturers and service providers to modify their solutions. For instance, all commercial vehicles weighing over 3.5 tons in the EU are required to use a digital tachograph to monitor and record the driver’s working hours, speed, and distance traveled.

Germany accounted for the largest revenue share in the regional road haulage market in 2024, on account of the presence of an extensive network of highways and expressways and the widespread adoption of trucking solutions as an effective medium of goods movement. According to a report by Upply published in April 2023, road freight transport (RFT) accounts for almost 75% of the total goods transported via land in the country, with this share expected to further increase in the future. This trend is expected to maintain a substantial demand for road haulage services in Germany. Trucking and logistics companies are increasingly focusing on innovations such as energy-efficient vehicles and autonomous trucks to increase driver comfort, adhere to environment regulations, and improve efficiency in the transportation process.

Key Road Haulage Company Insights

Some of the major companies involved in the global road haulage market include AM Cargo, LKW WALTER, and Monarch Transport, among others.

-

AM Cargo is a logistics and transportation company offering a wide range of services to address requirements in both domestic and international shipping. The company specializes in providing air cargo, sea freight, road transport, and supply chain solutions for various industries, including e-commerce, automotive, retail, manufacturing, and pharmaceuticals. AM Cargo possesses a fleet of 36 trucks of its own and indirectly employs over 100 transporters, who regularly provide inland container transport services, national and international transport, and delivery/collection of merchandise.

-

LKW Walter is a major European provider of transport and logistics services, specializing in road freight, international transport, and supply chain solutions. The company is well-known for its extensive network, comprehensive logistics solutions, and sustainability objectives. In the road transport segment, it offers capabilities and features such as intelligent transport planning software, environment-friendly trucks, advanced telematics systems, and round and triangular trips. LKW Walter serves customers across a broad range of industries, including automotive, manufacturing, food and beverage, retail, and consumer goods. Besides Europe, the company operates in markets such as Central Asia, North Africa, Middle East, and the Caucasus region.

Key Road Haulage Companies:

The following are the leading companies in the road haulage market. These companies collectively hold the largest market share and dictate industry trends.

- CONCOR

- AM Cargo

- Gosselin

- Kindersley Transport Ltd.

- LKW WALTER

- Manitoulin Transport Inc.

- Monarch Transport

- SLH Transport, LLC

- UK Haulier

- Woodside Logistics Group

Recent Developments

-

In February 2024, LKW WALTER launched the eCMR solution with the aim to replace paper-based processes with a completely digital alternative. As part of this development, the company stated that QR codes already present on its KRONE trailers in operation across Europe would provide access to the eCMR by scanning with a smartphone or similar devices. Access would also be granted to the vehicle documents of the trailer and the LKW WALTER driver application. This is expected to enable both customers and carriers to have access to each individual transport’s information in real-time, ensuring supply chain transparency and efficiency.

-

In August 2023, Gosselin Moving announced the acquisition of Frey & Klein Internationale Spedition GmbH, along with its newly built warehouse in Hunsrück, Germany. The acquisition forms part of Gosselin's long-term strategy to further insource its hauling activities in Europe, as well as boost its customer base in Germany. Frey & Klein has a notable fleet size designed for long-distance transportation, with approximately 14 trucks with trailers and several smaller vehicles.

Road Haulage Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4,071.68 billion

Revenue forecast in 2030

USD 5,374.59 billion

Growth rate

CAGR of 5.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, vehicle, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; China; Japan; India; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

CONCOR; AM Cargo; Gosselin; Kindersley Transport Ltd.; LKW WALTER; Manitoulin Transport Inc.; Monarch Transport; SLH Transport, LLC; UK Haulier; Woodside Logistics Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

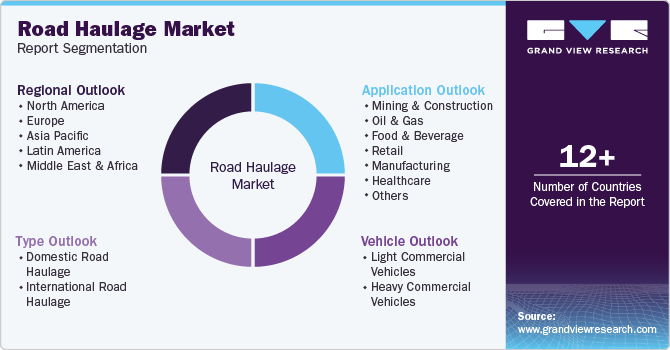

Global Road Haulage Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the road haulage market report based on type, vehicle, application, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Domestic Road Haulage

-

International Road Haulage

-

-

Vehicle Outlook (Revenue, USD Billion, 2018 - 2030)

-

Light Commercial Vehicles

-

Heavy Commercial Vehicles

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Mining & Construction

-

Oil & Gas

-

Food & Beverage

-

Retail

-

Manufacturing

-

Healthcare

-

Automotive

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.