- Home

- »

- Electronic Devices

- »

-

Street Lighting Market Size, Share & Trends Report, 2030GVR Report cover

![Street Lighting Market Size, Share & Trends Report]()

Street Lighting Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Traditional Lighting, LED Lighting), By Application (Highways, Roadways), By Region (North America, Asia Pacific), And Segment Forecasts

- Report ID: GVR-4-68040-450-3

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Street Lighting Market Summary

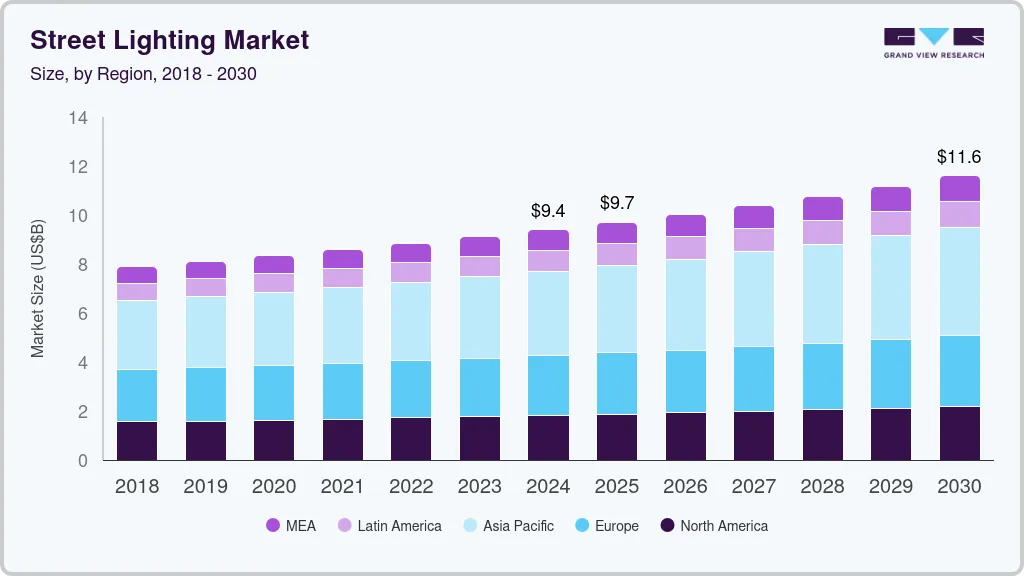

The global street lighting market size was estimated at USD 9.10 billion in 2023 and is projected to reach USD 11.60 billion by 2030, growing at a CAGR of 3.6% from 2024 to 2030. The growing urbanization and infrastructure development projects drive the market's growth.

Key Market Trends & Insights

- The street lighting market in Asia Pacific dominated the market in 2023 and accounted for a 36.5% share of the overall market.

- By type, the LED lighting segment dominated the market in 2023 and accounted for a 79.7% share of global revenue.

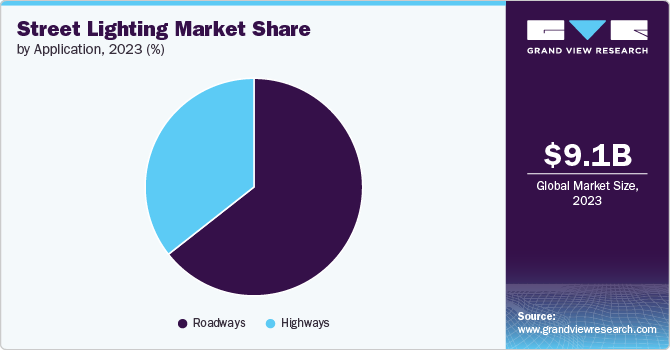

- By application, the roadways segment dominated the market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 9.10 Billion

- 2030 Projected Market Size: USD 11.60 Billion

- CAGR (2024-2030): 3.6%

- Asia Pacific: Largest market in 2023

As the global population increasingly moves toward urban areas, cities are expanding, and new urban zones are being developed. This rapid urbanization creates a heightened demand for infrastructure that supports safe and functional public spaces, with street lighting playing a vital role in this process. Street lighting ensures visibility and safety in urban environments, particularly during nighttime. As cities grow, the need for extensive, reliable street lighting networks becomes more pressing. New residential areas, commercial zones, and public spaces require well-planned lighting systems to enhance security, facilitate transportation, and promote social and economic activities after dark.Moreover, the growing emphasis on energy efficiency and sustainability is significantly boosting the adoption of LED street lighting. Traditional streetlights, such as high-pressure sodium lamps, are being replaced by energy-efficient LED lights, which consume less power and have a longer lifespan. This shift is driven by the need to reduce energy consumption, lower carbon emissions, and decrease municipal operational costs. Additionally, government incentives and regulations promoting green technologies accelerate the transition to LED street lighting.

Many cities and towns are undertaking retrofit and modernization projects to replace outdated street lighting infrastructure with new, energy-efficient, smart lighting systems. These projects are often driven by the need to reduce operational costs, improve lighting quality, and comply with new energy regulations. The growing trend of upgrading existing street lighting systems creates significant opportunities for market players, especially in developed regions with well-established infrastructure that need modernization.

The street lighting market is subject to various regulatory frameworks, which can vary widely across regions. A lack of standardized regulations and guidelines for deploying street lighting systems, especially smart lighting, can create confusion and slow adoption. Additionally, obtaining approvals and navigating through bureaucratic hurdles can be time-consuming, leading to delays in project implementation. These regulatory challenges can deter investments and hinder the market's overall growth.

Type Insights

The LED lighting segment dominated the market in 2023 and accounted for a 79.7% share of global revenue. The energy efficiency offered by LED lighting drives the segment's growth. LED lights consume significantly less electricity than traditional lighting technologies such as high-pressure sodium (HPS) or metal halide lamps. This reduction in energy consumption leads to substantial cost savings on electricity bills for municipalities and other stakeholders responsible for public lighting.

The traditional lighting segment is projected to grow significantly from 2024 to 2030. The extensive existing infrastructure drives the market's growth. Many cities and towns worldwide have long-established networks of streetlights based on older technologies such as HPS or Metal Halide lamps. Upgrading to modern systems such as LEDs can be expensive and logistically challenging, leading municipalities to maintain and replace existing traditional lighting fixtures rather than undertake costly overhauls. This entrenched infrastructure supports the ongoing demand for traditional lighting components and maintenance services.

Application Insights

The roadways segment dominated the market in 2023. The increasing focus on smart city initiatives drives the market's growth. Smart cities aim to improve the quality of urban life through the integration of technology into infrastructure and services. Street lighting is a critical component of smart city projects, as it not only provides illumination but also serves as a platform for other smart technologies, such as traffic management systems, environmental sensors, and public safety networks.

The highways segment is projected to grow significantly from 2024 to 2030. Street lighting's crucial role in enhancing road safety drives the market's growth. Well-lit highways significantly reduce the likelihood of accidents, especially during nighttime or low-visibility conditions. Adequate lighting helps drivers perceive road conditions, obstacles, and other vehicles more clearly, improving reaction times and reducing the risk of collisions.

Regional Insights

North America street lighting market held a significant share in 2023. Government initiatives and regulations in North America play a crucial role in driving the growth of the street lighting market. Many cities and states have implemented energy efficiency standards and sustainability goals that encourage the adoption of energy-efficient street lighting solutions, thus driving market growth.

U.S. Street Lighting Market Trends

The street lighting market in the U.S.is expected to grow at a significant CAGR from 2024 to 2030. The ongoing need for infrastructure upgrades and modernization in the U.S. drives the market's growth. Many existing street lighting systems in U.S. cities and towns need to be updated, often relying on traditional high-pressure sodium (HPS) or metal halide lamps that are less efficient and more costly to maintain. There is a strong push to replace these aging systems with modern, energy-efficient solutions like LEDs.

Europe Street Lighting Market Trends

The street lighting market in Europe is expected to witness notable growth from 2024 to 2030. Improving public safety and enhancing the quality of life in urban areas drives market growth in Europe. Effective street lighting contributes to safer public spaces by reducing crime and accidents. Enhanced lighting also improves the overall attractiveness of urban areas, making them more appealing for residents and visitors.

Asia Pacific Street Lighting Market Trends

The street lighting market in Asia Pacific dominated the market in 2023 and accounted for a 36.5% share of the overall market. Rapid urbanization and infrastructure development drive the market's growth. As cities expand and new urban areas are developed, the demand for street lighting solutions grows correspondingly. Rapid urbanization leads to the creation of new residential, commercial, and industrial zones, all of which require effective street lighting to ensure safety and functionality.

Key Street Lighting Company Insights

The companies are focusing on numerous strategic initiatives, including new product development, agreements, and partnerships & collaborations to gain a competitive advantage over their rivals.

For instance, in September 2024, Crompton Greaves Consumer Electricals Limited completed an LED street lighting project for the National Highways Authority of India (NHAI) in Bengaluru. This initiative involved installing energy-efficient LED street lights along key roadways, significantly enhancing visibility and safety for motorists and pedestrians. The project aligns with the government's push for sustainable infrastructure and aims to reduce energy consumption while improving the quality of urban lighting.

Key Street Lighting Companies:

The following are the leading companies in the street lighting market. These companies collectively hold the largest market share and dictate industry trends.

- Acuity Brands

- ams-OSRAM AG

- Signify Holding

- Cree Lighting USA LLC

- Zumtobel Group

- Cooper Lighting LLC

- Hubbell

- Schréder

- Thorn

- Itron Inc.

Street Lighting Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 9.39 billion

Revenue forecast in 2030

USD 11.60 billion

Growth rate

CAGR of 3.6% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Acuity Brands; ams-OSRAM AG; Signify Holding; Cree Lighting USA LLC; Zumtobel Group; Cooper Lighting LLC; Hubbell; Schréder; Thorn; Itron Inc.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Street Lighting Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global street lighting market report based on type, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Traditional Lighting

-

LED Lighting

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Highways

-

Roadways

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Kingdom of Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global street lighting market size was estimated at USD 9.10 billion in 2023 and is expected to reach USD 9.39 billion in 2024.

b. The global street lighting market is expected to grow at a compound annual growth rate of 3.6% from 2024 to 2030 to reach USD 11.60 billion by 2030.

b. Asia Pacific dominated the street lighting market with a share of 36.5% in 2023. Rapid urbanization and infrastructure development drive the regional market's growth.

b. Some key players operating in the street lighting market include Acuity Brands; ams-OSRAM AG; Signify Holding; Cree Lighting USA LLC; Zumtobel Group; Cooper Lighting LLC; Hubbell; Schréder; Thorn; and Itron Inc.

b. Key factors that are driving the market growth include the growing urbanization and infrastructure development projects and growing emphasis on energy efficiency and sustainability.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.