- Home

- »

- Alcohol & Tobacco

- »

-

Grain Alcohol Market Size & Share, Industry Report, 2030GVR Report cover

![Grain Alcohol Market Size, Share & Trends Report]()

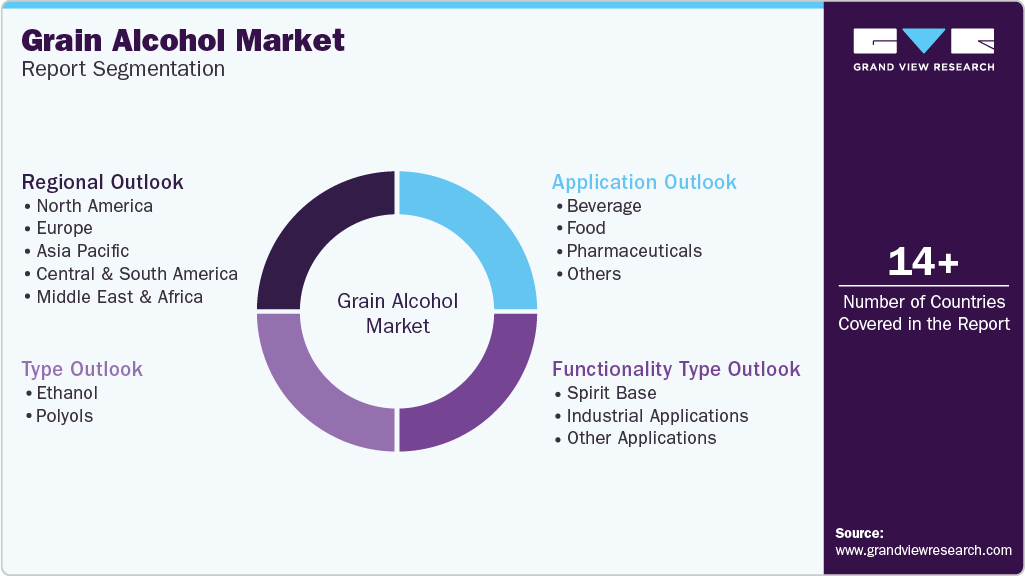

Grain Alcohol Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Ethanol, Polyols), By Functionality (Spirit Base, Industrial Applications), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-582-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Grain Alcohol Market Summary

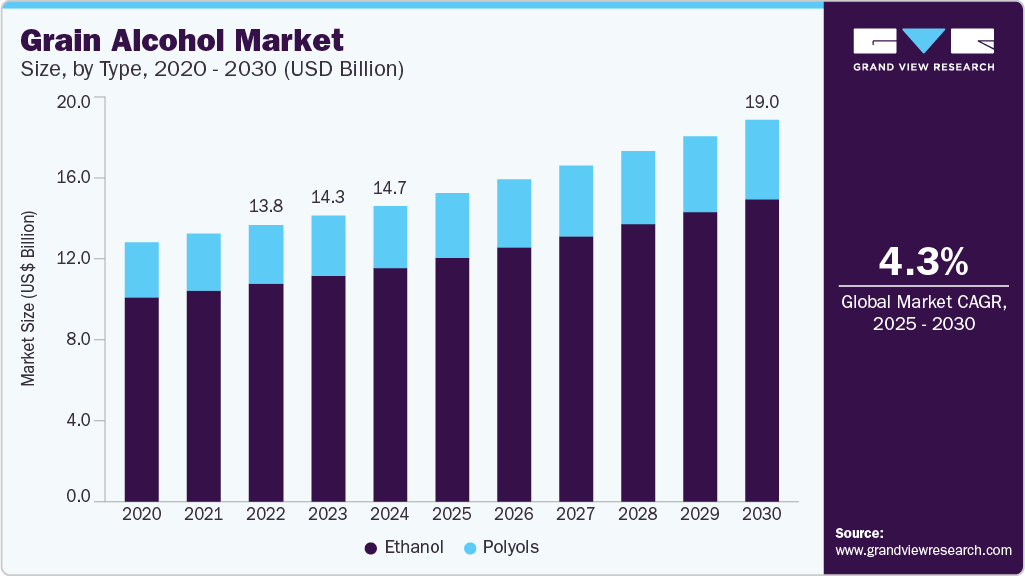

The global grain alcohol market size was valued at USD 14.7 billion in 2024 and is projected to reach USD 19.01 billion by 2030, growing at a CAGR of 4.3% from 2025 to 2030. The market is experiencing robust growth due to socioeconomic, cultural, and industry-specific factors.

Key Market Trends & Insights

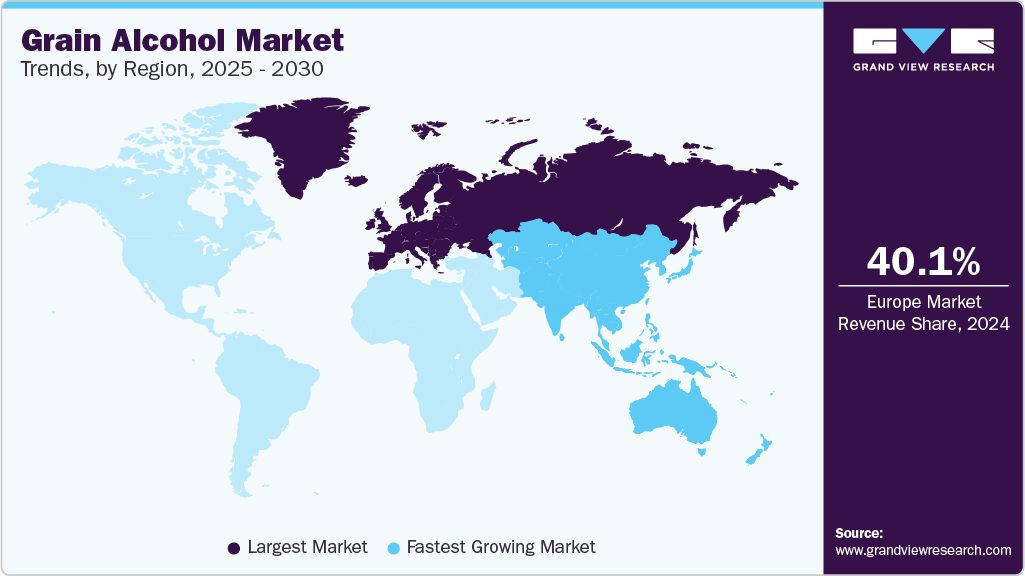

- Europe grain alcohol market held the largest revenue share of 40.08% in 2024

- Based on type, ethanol segment accounted for market revenue of USD 11.65 billion in 2024.

- Based on application, the beverage segment expected to exceed USD 10 billion in 2030.

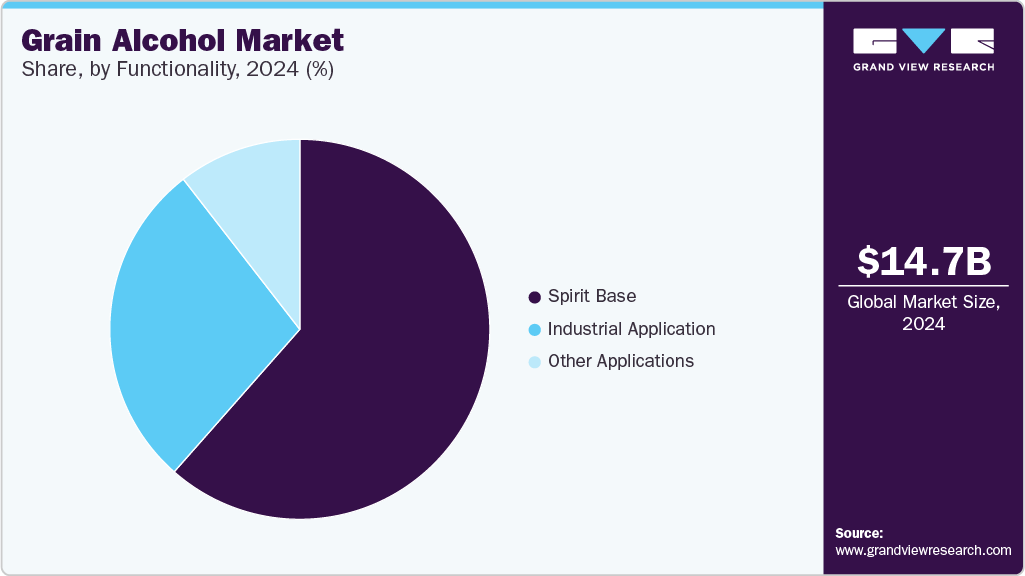

- Based on functionality, spirit base segment accounted for over 60% of the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 14.7 Billion

- 2030 Projected Market Size: USD 19.01 Billion

- CAGR (2025-2030): 4.3%

- Europe: Largest market in 2024

One of the primary drivers is the increasing global consumption of alcoholic beverages, which is closely linked to rising disposable incomes and urbanization. As more people move to urban areas and adopt modern lifestyles, there is a greater tendency to consume alcohol, including grain-based spirits. This trend is especially pronounced in developing regions outside Europe and the US, where rapid urbanization and westernization fuel demand for grain alcohol products.

Another significant factor is consumers' evolving preferences toward premium and high-quality alcoholic beverages. The market has seen a surge in demand for craft and artisanal spirits, including specialty and barrel-aged grain alcohols. The craft distillery movement has gained momentum, with consumers seeking unique flavors, local ingredients, and terroir-driven spirits. This shift is supported by innovation in flavored and infused grain alcohol products, which cater to a diverse and discerning customer base.

The food processing industry and the health and personal care sectors also contribute to the growth of the grain alcohol industry. Grain alcohol is widely used in various food products and personal care formulations, driving demand beyond traditional beverage applications. The increased use of grain alcohol in these industries, particularly in developed economies, has significantly boosted market growth in recent years.

Additionally, the rising popularity of beer and craft beer production has had a notable impact on the market. Breweries, especially those producing craft and local beers, are major consumers of grain alcohol derived from barley and other grains. The global increase in beer production and the growing demand for unique and locally produced brews are expected to stimulate the market further in the coming years.

Emerging markets in Asia Pacific, Latin America, the Middle East, and Africa present substantial expansion opportunities. As the middle class grows and affluence increases in these areas, demand for alcoholic beverages and products containing grain alcohol rises correspondingly. Market participants actively pursue strategies to enter and expand in these regions, recognizing the potential for significant business growth.

Sustainability and regulatory trends are shaping the future of the grain alcohol industry. There is a growing emphasis on organic and sustainable grain sourcing and the use of grain alcohol in industrial and pharmaceutical applications, such as ethanol for biofuel. Regulatory policies supporting ethanol-blended fuels and environmentally friendly production practices are further propelling market expansion. These trends, combined with the ongoing innovation and diversification of product offerings, are expected to sustain the market's growth trajectory in the years ahead.

Type Insights

Ethanol was the most prominent grain alcohol and accounted for market revenue of USD 11.65 billion in 2024. The growth of ethanol, or grain alcohol, is primarily driven by its expanding use in the energy and beverage sectors. Governments worldwide are increasingly adopting regulations to reduce greenhouse gas emissions, leading to a surge in demand for ethanol-based fuels due to their high octane rating and lower emissions than traditional gasoline. This regulatory push, particularly in significant economies, has positioned ethanol as a preferred biofuel additive, significantly boosting the market.

In the beverage industry, rising global consumption of alcoholic beverages, especially in developing countries with growing disposable incomes and urbanization, has been a key factor. Ethanol, derived from grains such as corn, wheat, and barley, is a fundamental ingredient in spirits like whiskey, vodka, and rum. The trend toward premium and craft spirits has increased demand for high-quality ethanol, as consumers seek unique flavors and artisanal products. This shift is also supported by innovation in flavored and infused alcoholic beverages, which rely on ethanol or grain alcohol as a neutral base.

Additionally, the versatility of ethanol grain alcohol extends its growth into other industries such as pharmaceuticals, personal care, and food processing, where it is used as a solvent and ingredient. The combination of expanding applications, technological advancements in production, and evolving consumer preferences for premium, sustainable, and innovative products is expected to sustain the robust growth of ethanol and grain alcohol in the coming years.

Application Insights

The beverage industry was the largest application for grain alcohol, with the market expected to exceed USD 10 billion in 2030. Grain alcohol is a key ingredient of the beverage industry, serving as the essential base for various distilled spirits, including vodka, gin, whiskey, rum, and liqueurs. Its defining characteristics, purity, neutral taste, and versatility, allow beverage manufacturers to craft both traditional and innovative products. For vodka and gin, grain alcohol provides a clean, unobtrusive canvas highlighting botanical infusions and subtle flavor notes. In whiskey and other aged spirits, it forms the backbone upon which complex flavors develop during maturation. The beverage industry also utilizes grain alcohol to produce ready-to-drink cocktails and bitters and as a fortifying agent in wines and aperitifs. Its adaptability makes it indispensable for large-scale producers and craft distilleries, enabling the creation of mass-market and niche, artisanal offerings.

The demand for grain alcohol in the beverage sector is skyrocketing due to several converging trends. Rising global incomes and urbanization have led to increased alcohol consumption, particularly in emerging markets where Western lifestyles and social drinking are becoming more prevalent. Consumers also strongly prefer premium, craft, and artisanal spirits, driving the expansion of small-batch distilleries and innovative beverage brands. The popularity of cocktail culture and flavored spirits has further fueled demand, as grain alcohol’s neutral profile is ideal for infusions and flavor experimentation. Additionally, the globalization of beverage markets and the expansion of distribution networks have made high-quality spirits more accessible to a broader audience, amplifying the need for grain alcohol as a core ingredient.

In the food industry, grain alcohol is valued for its multifunctional properties and is crucial in food processing and product development. It is commonly used as a preservative, helping extend perishable goods' shelf life by inhibiting microbial growth. Grain alcohol also acts as an effective solvent and carrier for flavors, extracts, and colorants, allowing manufacturers to create concentrated flavorings such as vanilla extract and herbal tinctures. Its ability to dissolve both water-soluble and fat-soluble compounds makes it ideal for extracting and stabilizing flavors in confectionery, baked goods, sauces, and marinades. Additionally, grain alcohol is used as a glazing and coating agent, providing shine and preserving the texture of candies and baked products.

Functionality Insights

Spirit base was the most predominant use if grain alcohol and accounted for over 60% of the market in 2024. The growth of grain alcohol as a spirit base is primarily driven by the rising global demand for alcoholic beverages, particularly spirits such as vodka, gin, and whiskey, which rely on grain alcohol for their production. This trend is fueled by increasing disposable incomes, urbanization, and shifting consumer preferences toward premium, craft, and artisanal spirits. The expansion of the craft distillery sector and innovation in flavored and infused spirits have further boosted demand, as grain alcohol provides a neutral and versatile base for a wide range of products. Additionally, the cultural significance of spirits in many regions and the popularity of cocktail culture and ready-to-drink beverages continue to propel the use of grain alcohol in this segment.

In industrial applications, grain alcohol is experiencing growing demand due to its effectiveness as a solvent and its role in producing pharmaceuticals, cosmetics, and household products. The surge in demand for sanitizers and disinfectants, especially during global health crises, has significantly increased the use of grain alcohol in the pharmaceutical and healthcare sectors. Moreover, its use as a biofuel additive-ethanol is being promoted by government policies aimed at reducing carbon emissions and encouraging the adoption of renewable energy sources. The combination of regulatory support for ethanol-blended fuels and the versatility of grain alcohol in various industrial processes is driving robust growth in this area.

Beyond beverages and industrial uses, grain alcohol is increasingly utilized in food processing as a preservative, flavor carrier, and solvent for colorants and extracts. The rising consumption of processed and convenience foods, driven by changing lifestyles and the demand for longer shelf life, has led to greater use of grain alcohol in food applications. Additionally, the personal care and cosmetics industries value grain alcohol for its purity and ability to stabilize formulations. The overall growth in these sectors, coupled with ongoing product innovation and expanding grain alcohol applications into emerging markets, continues to support rising demand in these diverse functional areas.

Regional Insights

The North America grain alcohol market was valued at USD 3.92 billion in 2024. The growth of the grain alcohol market in North America is fueled by several key factors, including the region's strong demand for both alcoholic beverages and ethanol-based fuels. The United States, in particular, has a well-established culture of spirit and beer consumption, with a robust craft distillery and brewery sector driving innovation in flavored, barrel-aged, and specialty grain alcohol products. Additionally, North America is a major producer and consumer of ethanol as a biofuel, supported by government regulations to reduce greenhouse gas emissions and promote renewable energy sources. The convergence of these trends- rising demand for premium spirits, expansion of craft alcohol, and regulatory support for ethanol- continues to propel the grain alcohol market in North America.

U.S. Grain Alcohol Market Trends

The U.S. grain alcohol market is expected to exceed USD 4.15 billion by 2030 and grow at a CAGR of 4.4% from 2025 to 2030. In the United States, the grain alcohol market benefits from a combination of traditional and emerging drivers. The country’s large and diverse alcoholic beverage market, with a growing preference for craft, artisanal, and ready-to-drink (RTD) cocktails, supports ongoing demand for high-quality grain alcohol. The U.S. is also the world’s leading producer of corn-based ethanol, with federal and state policies incentivizing the use of ethanol as a fuel additive. This dual demand from both the beverage and fuel sectors, along with ongoing product innovation and consumer interest in organic and sustainable alcohol options, underpins the strong growth trajectory of grain alcohol in the U.S.

Europe Grain Alcohol Market Trends

Europe grain alcohol market held the largest revenue share of 40.08% in 2024, driven by its deep-rooted traditions in spirits and beer production, high per capita alcohol consumption, and a mature food and beverage industry. The region’s growth is further supported by the popularity of craft and local spirits, innovation in flavored and terroir-driven alcohol products, and the expansion of the cocktail culture. Eastern and Southeastern European countries are experiencing robust growth due to rising disposable incomes and evolving consumer preferences. Additionally, Europe’s regulatory environment and focus on sustainable and organic grain sourcing contribute to the continued expansion of the grain alcohol market in the region.

Asia Pacific Grain Alcohol Market Trends

The Asia Pacific grain alcohol market is expected to grow at a CAGR of 4.9% from 2025 to 2030. Asia Pacific is the fastest-growing region for grain alcohol consumption, propelled by rapid economic development, urbanization, and increasing affluence among the middle class. Countries such as China, India, Malaysia, and Indonesia are witnessing a surge in demand for both alcoholic beverages and processed foods, both of which utilize grain alcohol extensively. Changing lifestyles, a growing youth population, and the rising popularity of Western-style spirits and cocktails drive market growth. The region also presents significant opportunities for expansion in both beverage and industrial applications, as manufacturers respond to evolving consumer tastes and increasing regulatory support for ethanol as a biofuel.

Key Grain Alcohol Company Insights

The competitive landscape of the grain alcohol market is characterized by the presence of several major global players who dominate production, innovation, and distribution across key regions. Leading companies include Archer-Daniels-Midland Company (ADM) and Cargill Inc. from the United States, Wilmar Group from Singapore, Roquette Frères from France, and Merck Group from Germany. These firms leverage their extensive production capacities, integrated supply chains, and strong research and development capabilities to maintain market leadership. Other significant players include MGP Ingredients, Cristalco SAS, Manildra Group, Glacial Grain Spirits LLC, Wuliangye Yibin Co., Diageo plc, and Pernod Ricard SA, which contribute to a competitive yet collaborative market environment focused on innovation and quality enhancement.

Key Grain Alcohol Companies:

The following are the leading companies in the grain alcohol market. These companies collectively hold the largest market share and dictate industry trends.

- Archer-Daniels-Midland Company (ADM)

- Cargill Inc.

- Kweichow Moutai Co. Ltd.

- Roquette Frères SA

- MGP Ingredients Inc.

- Cristalco SAS

- Wilmar International Limited

- Manildra USA

- Glacial Grain Spirits LLC

- Wuliangye Yibin Co.

- Diageo plc

- Pernod Ricard SA

- ChemCeed LLC

- Greenfield Global Inc.

Grain Alcohol Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 15.38 billion

Revenue forecast in 2030

USD 19.01 billion

Growth rate

CAGR of 4.3% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, functionality, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; UAE

Key companies profiled

Archer-Daniels-Midland Company (ADM); Cargill Inc.; Kweichow Moutai Co. Ltd.; Roquette Frères SA; MGP Ingredients Inc.; Cristalco SAS; Wilmar International Limited; Manildra USA; Glacial Grain Spirits LLC; Wuliangye Yibin Co.; Diageo plc; Pernod Ricard SA; ChemCeed LLC; Greenfield Global Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Grain Alcohol Market Report Segmentation

This report forecasts revenue growth globally, regionally, and country-wide and analyzes the latest industry trends and opportunities in each sub-segment from 2018 to 2030. Grand View Research has segmented the global grain alcohol market report by type, functionality, application, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Ethanol

-

Polyols

-

-

Functionality Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Spirit Base

-

Industrial Applications

-

Other Applications

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Beverage

-

Food

-

Pharmaceuticals

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global grain alcohol market was valued at USD 14.75 billion in 2024 and is expected to reach USD 15.38 billion in 2025.

b. The global grain alcohol market is expected to grow at a CAGR of 4.3% from 2025 to 2030 to reach USD 19.01 billion by 2030.

b. Beverage industry was the largest application for grain alcohol with market expected to exceed USD 10 billion in 2030. Grain alcohol is a key ingredient of the beverage industry, serving as the essential base for various distilled spirits, including vodka, gin, whiskey, rum, and liqueurs. Its defining characteristics, purity, neutral taste, and versatility, allow beverage manufacturers to craft both traditional and innovative products. For vodka and gin, grain alcohol provides a clean, unobtrusive canvas highlighting botanical infusions and subtle flavor notes. In whiskey and other aged spirits, it forms the backbone upon which complex flavors develop during maturation. The beverage industry also utilizes grain alcohol to produce ready-to-drink cocktails and bitters and as a fortifying agent in wines and aperitifs. Its adaptability makes it indispensable for large-scale producers and craft distilleries, enabling the creation of mass-market and niche, artisanal offerings.

b. Some key players operating in the market include Archer-Daniels-Midland Company (ADM); Cargill Inc.; Kweichow Moutai Co. Ltd.; Roquette Frères SA; MGP Ingredients Inc.; Cristalco SAS; Wilmar International Limited; Manildra USA; Glacial Grain Spirits LLC; Wuliangye Yibin Co.; Diageo plc; Pernod Ricard SA; ChemCeed LLC; Greenfield Global Inc.

b. The grain alcohol market is experiencing robust growth due to socioeconomic, cultural, and industry-specific factors. One of the primary drivers is the increasing global consumption of alcoholic beverages, which is closely linked to rising disposable incomes and urbanization. As more people move to urban areas and adopt modern lifestyles, there is a greater tendency to consume alcohol, including grain-based spirits. This trend is especially pronounced in developing regions outside Europe and the US, where rapid urbanization and westernization fuel demand for grain alcohol products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.