Grain Mill Products Market Size & Trends

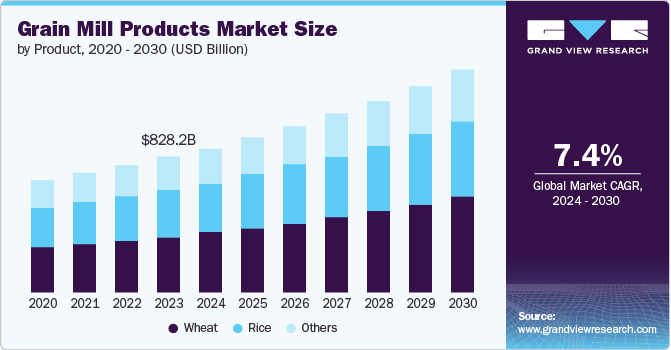

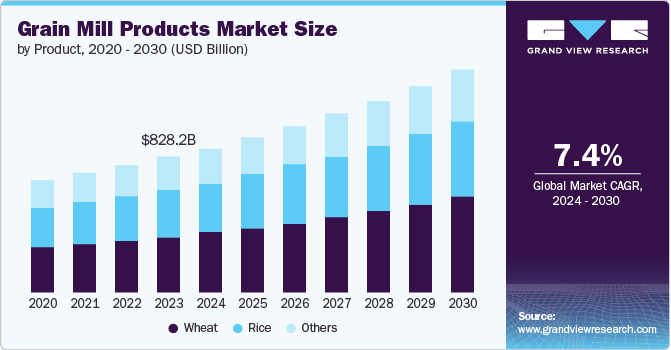

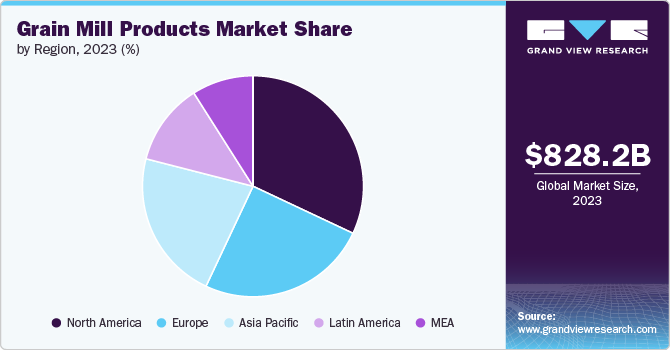

The global grain mill products market size was valued at USD 828.17 billion in 2023 and is projected to grow at a CAGR of 7.4% from 2024 to 2030. The growth is attributed to the rise in global population and disposable income, which leads to an increased need for processed grain products. The growing demand for convenient, quick meals, driven by a fast-paced modern lifestyle, significantly influences the grain milling industry.

The grain mill products market is driven by factors such as the rising consumption of bakery and confectionery products and the increasing use of various types of flour in the fast food industry. The growing demand for nutritious and healthy food and natural and organic food products is anticipated to grow the Grain Mill Products Market further. Additionally, the heavy reliance of the food service industry, such as cafes and fast food restaurants, on grain-based products in developing regions such as Asia Pacific and Middle East nations is further propelling market growth.

Technological advancements and research & development in the grain mill industry positively influence the market. Advancements in milling techniques are resulting in increased production and enhanced operational effectiveness. Moreover, developing new grain mixes formulated explicitly for dietary requirements, like low-carb, gluten-free, and organic alternatives, further drives market expansion.

Product Insights

The wheat segment accounted for the largest revenue share of 41.4% in 2023. The significance of wheat within the global grain mills market is recognized and attributed to many critical factors. Foremost is wheat's position as a staple food across the globe. Its widespread popularity is particularly noticeable in Asian countries such as India and China, where substantial wheat consumption significantly propels the demand for this grain. Besides its common use in producing flour for bread, bakery items, and pasta, wheat demonstrates remarkable versatility. It finds applications in producing breweries like ale and beer, is a key ingredient in energy bars, and plays a vital role in animal feed production. Additionally, a pronounced shift in consumer preferences towards organic and health-focused products has increased demand for organic wheat flour. This shift highlights the evolving consumer trends and reinforces wheat's pivotal role in the grain mills market.

The rice segment is expected to register a significant CAGR during the forecast period. Rice serves as a dietary staple for a massive portion of the world's population and is the main factor of segment expected growth. The increasing health concerns and the rising demand for gluten-free diets are driving the expansion of rice products. The nutritional advantages of sourced rice increase the popularity of rice flour products among different food and drink producers. Rice flour is used in various bakery and confectionery, sweet and savory snacks, drinks, and baby food.

Regional Insights

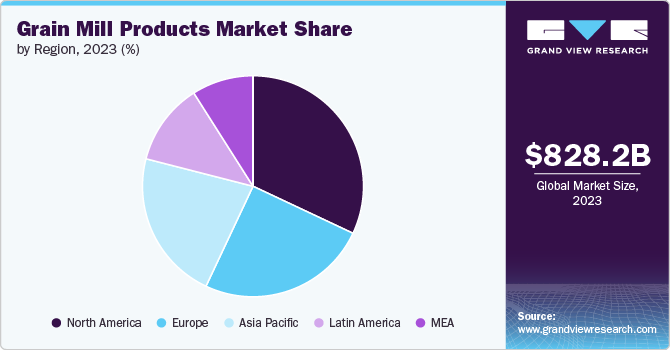

North America grain mill products accounted for a revenue share of 31.6% in 2023. North America has a large and affluent consumer base with a high demand for processed grain products. The region's demand for flour, cornmeal, and other milled grains remains high due to the popularity of convenient meals, bakery products, and ready-to-eat options. Moreover, the region has leading industry giants such as Ardent Mills and Conagra Brands, Inc. in North America, encouraging innovation and technological progress in grain milling, which results in improved efficiency and product quality.

U.S. Grain Mill Products Market Trends

The U.S. grain mill products market dominated the North American market due to its large population and high disposable income, which led to a strong demand for convenient and processed grain-based goods. The high demand for fast food, baked goods, and pre-packaged meals requires flour, cornmeal, and other milled grains. Furthermore, the U.S. is a hub for innovation in the grain milling industry, leading to more efficient milling processes, improved product quality, and a wider variety of grain-based options, ensuring further growth of the country's grain mill products market.

Europe Grain Mill Products Market Trends

Europe's grain mill products market is anticipated to witness significant growth. Europe has a tradition of consuming bread and baked goods, leading to a consistent need for wheat flour, an essential product of grain mills. The region's rapid urbanization and fast-paced lifestyles increased demand for quick and easy food choices, driving the market growth.

The UK grain mill products market is expected to grow rapidly in the coming years. Grain mills are essential for providing the flour and grains needed to make breakfast cereals, pastries, and other convenient food products, ensuring a stable demand for grain mill products. Grain mills in the UK market appeal to health-conscious and environmentally conscious consumers using domestic wheat and eco-friendly methods, potentially opening up new growth opportunities.

Asia Pacific Grain Mill Products Market Trends

Asia Pacific grain mill products market is anticipated to witness significant growth. The region has a growing population, especially in nations such as China and India. The economic growth in the region leads to high disposable incomes, allowing consumers to explore a wider variety of grain-based products. The demand for pastries, ready-to-eat meals, and refined cereals such as wheat flour is rising. Moreover, the desire for convenient, ready-made food has increased due to urbanization and busier lifestyles. As numerous Asian countries prioritize domestic production, there is rising investment in advanced grain milling technologies, which is expected to drive the demand for grain mill products in the region.

China's grain mill products market held a substantial market share in 2023 owing to the massive population and regular grain demand. The country's economic growth allows consumers to diversify their grain consumption. Furthermore, the Chinese government's focus on ensuring food security is driving investments in advanced grain milling technologies.

Key Grain Mill Products Company Insights

Some of the key companies in the grain mill products market include Ardent Mills, Conagra Brands, Inc., Oy Karl Fazer Ab., King Arthur Flour, Goodman Fielder, and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, partnerships, product launch, business expansion, and others.

-

Ardent Mills is the premier flour mill and ingredient company. It specializes in flour, pulses, quinoa, organic, and gluten-free products, promoting emerging nutrition and innovation in plant-based ingredients.

-

Conagra Brands, Inc. provides flour, ingredients, baking mixes, recipe books, and baked goods. The company primarily sells flour and other baking ingredients directly to customers. Later, it established itself as a retail space in Norwich, which features a bakery, cafe, store, and baking school.

Key Grain Mill Products Companies:

The following are the leading companies in the grain mill products market. These companies collectively hold the largest market share and dictate industry trends.

- Ardent Mills

- Conagra Brands, Inc.

- Oy Karl Fazer Ab

- King Arthur Flour

- Goodman Fielder.

- Grain Millers, Inc.

- ADM

- Hodgson Mill

- Cargill, Incorporated

- General Mills Inc.

Recent Developments

-

In April 2024, King Arthur Baking Company launched a new Regeneratively-Grown Climate Blend Flour, aiming to source all its flour from regeneratively-grown wheat by 2030. This initiative focused on enhancing soil health through sustainable farming practices, which could lead to lower grain production with significantly higher profits, thus promoting both environmental sustainability and economic viability for farmers. The fresh whole-wheat mixture has more fiber and tastes exactly like the original.

-

In June 2023, Ardent Mills introduced Egg Replacement Powder and Ancient Grains Flour blend. The company created these products to help customers take advantage of new market opportunities, meet changing consumer desires for high-quality ingredients and delicious flavor, and address supply chain obstacles.

Grain Mill Products Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 883.83 billion

|

|

Revenue forecast in 2030

|

USD 1,353.72 billion

|

|

Growth Rate

|

CAGR of 7.4% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Quantitative units

|

Revenue in USD million and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Product, region

|

|

Regional scope

|

North America, Europe, Asia Pacific, Latin America, MEA

|

|

Country scope

|

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Australia, Brazil and UAE

|

|

Key companies profiled

|

Ardent Mills.; Conagra Brands, Inc.; Oy Karl Fazer Ab.; King Arthur Flour; Goodman Fielder.; Grain Millers, Inc.; ADM; Hodgson Mill; Cargill, Incorporated.; General Mills Inc.

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Global Grain Mill Products Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the grain mill products market report based on product and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)