- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Graphene Coating Market Size, Share, Industry Report, 2030GVR Report cover

![Graphene Coating Market Size, Share & Trend Report]()

Graphene Coating Market (2025 - 2030) Size, Share & Trend Analysis Report By Product (Solvent Based, Water Based), By End-use (Electronics, Automotive, Medical), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-502-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Graphene Coating Market Summary

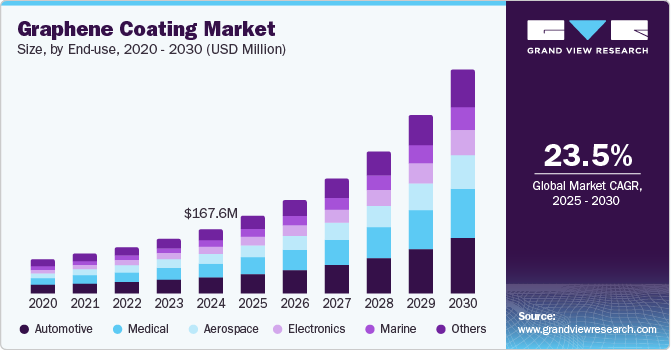

The global polyamide market size was estimated at USD 167.62 million in 2024 and is projected to reach USD 578.1 million by 2030, growing at a CAGR of 23.5% from 2025 to 2030. The global graphene coating industry is witnessing robust growth, driven by the unique properties of graphene that position it as a transformative material across a wide range of industries.

Key Market Trends & Insights

- North America dominated the global polyamide market with the largest revenue share of 43.0% in 2024.

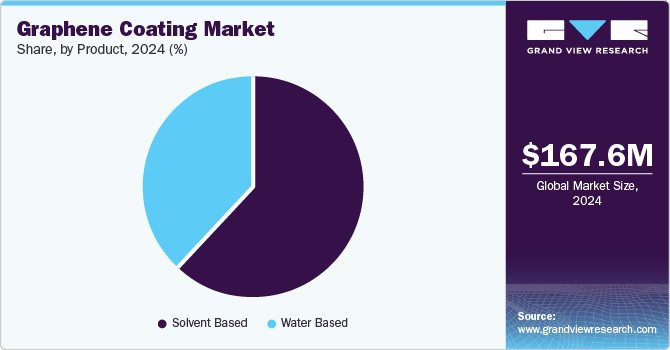

- By product, the solvent based segment led the market, holding the largest revenue share of 62.3% in 2024.

- By end use, the electronics segment held the dominant position in the market and accounted for the leading revenue share of 11.3% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 167.62 Million

- 2030 Projected Market Size: USD 578.1 Million

- CAGR (2025-2030): 23.5%

- North America: Largest market in 2024

Graphene coatings exhibit exceptional conductivity, corrosion resistance, mechanical strength, and thermal management, rendering them highly desirable for applications in sectors such as electronics, automotive, aerospace, and renewable energy. The increasing demand for advanced materials that enhance product performance and durability is a primary factor propelling market expansion.

In the electronics sector, the growing need for lightweight, high-performance devices has significantly increased the adoption of graphene coatings. These coatings enhance the efficiency of components such as circuit boards, sensors, and displays, while also providing superior heat dissipation, making them indispensable in the development of next-generation devices. Similarly, the automotive industry is leveraging graphene coatings for their ability to reduce weight, improve fuel efficiency, and offer enhanced protection against wear and corrosion.

The renewable energy sector represents another critical growth avenue for graphene coatings. The global emphasis on sustainable energy solutions has driven the utilization of graphene to enhance the performance and longevity of solar panels, wind turbines, and energy storage systems, including batteries and supercapacitors. Graphene’s contribution to improving energy efficiency and extending the operational lifespan of these systems underscores its importance in the transition to clean energy technologies.

Drivers, Opportunities & Restraints

The global graphene coating market’s growth is driven by the exceptional properties of graphene, such as high electrical conductivity, thermal stability, and mechanical strength, which make it an ideal material for a wide range of applications. Industries such as electronics, automotive, aerospace, and construction are increasingly adopting graphene coatings to enhance performance, durability, and efficiency. The rising demand for lightweight and corrosion-resistant materials in automotive and aerospace sectors is a significant driver, as graphene coatings improve fuel efficiency and reduce maintenance costs. Additionally, the growing emphasis on sustainable and eco-friendly solutions across industries aligns with graphene coatings, which enable reduced material usage and lower environmental impact.

The market offers immense opportunities for growth, particularly in the development of next-generation technologies. Innovations in energy storage systems, including batteries and supercapacitors, present a promising avenue, with graphene coatings playing a critical role in enhancing energy density and charge-discharge cycles. The rapid expansion of renewable energy projects globally, including solar and wind energy, is creating demand for advanced materials that can improve efficiency and longevity, where graphene coatings are well-suited. Emerging economies in Asia Pacific, Latin America, and the Middle East offer untapped potential, as industrialization and urbanization drive the need for advanced coatings in infrastructure and manufacturing.

Despite its vast potential, the graphene coating industry faces certain challenges. The high cost of graphene production and coating processes can limit widespread adoption, particularly in price-sensitive industries. Technical challenges related to the scalability and uniform application of graphene coatings also hinder market growth. Furthermore, limited awareness and understanding of graphene’s benefits among end users can restrict its adoption in traditional sectors. Regulatory hurdles and the need for standardized testing methods to validate graphene coating performance further add to the barriers faced by manufacturers in the global market. Addressing these challenges will be essential to unlocking the full potential of graphene coatings.

Product Insights

The solvent based segment accounted for the largest revenue share of 62.3% in 2024. The growing focus on industrial efficiency and sustainability has propelled the adoption of solvent-based graphene coatings. These coatings provide a reliable solution for enhancing the lifespan of equipment and infrastructure, reducing maintenance costs and downtime. In industries like construction and energy, where durability and performance are critical, solvent-based graphene coatings are increasingly being used to protect surfaces exposed to extreme environments.

Water based segment is anticipated to grow significantly at a CAGR of 18.2% over the forecast period, driven by its eco-friendly nature and compliance with stringent environmental regulations. As industries worldwide prioritize sustainability, the demand for water-based coatings, which emit significantly lower levels of volatile organic compounds (VOCs), is increasing.

End-use Insights

The electronics segment dominated the market with a market share of 11.3% in 2024. Shift toward sustainable manufacturing practices is critical driver, as electronics manufacturers strive to minimize waste and improve product life cycles. Graphene coatings, being lightweight and eco-friendly, align with these sustainability goals, further driving their adoption in the electronics segment.

The marine sector is anticipated to register the fastest CAGR of 24.0% over the forecast period, driven by the exceptional properties of graphene, such as high corrosion resistance, hydrophobicity, and superior thermal and mechanical strength. These attributes make graphene coatings highly desirable for protecting marine vessels, offshore structures, and equipment exposed to harsh marine environments. The rising need to enhance the durability and lifespan of ships and reduce maintenance costs fuels the adoption of graphene coatings.

Regional Insights

The North America graphene coating industry is driven by strong advancements in technology and innovation, supported by significant investments in research and development. The region's well-established aerospace and automotive industries are key contributors to the market, as graphene coatings are increasingly utilized to enhance corrosion resistance, reduce weight, and improve energy efficiency. The growing demand for durable and lightweight materials in these industries is a major driver, with graphene coatings offering solutions that meet stringent performance requirements.

U.S. Graphene Coating Market Trends

The technological advancements in nanotechnology and material science are also contributing to the growth of the market for graphene coatings in the U.S. Research and development activities by both academic institutions and private companies are advancing the commercialization of graphene-based products, making them more cost-effective and easier to apply.

Asia Pacific Graphene Coating Market Trends

Asia Pacific is anticipated to experience significant growth due to primary robust industrialization and technological advancements occurring across countries like China, Japan, South Korea, and India. These nations are at the forefront of manufacturing, electronics, and automotive industries, which increasingly rely on graphene coatings for their superior properties. In particular, the automotive sector in Asia Pacific is embracing graphene coatings to enhance fuel efficiency, reduce vehicle weight, and improve performance, all of which are vital to meet stringent environmental regulations and growing consumer demand for more sustainable vehicles.

Europe Graphene Coating Market Trends

The Europe graphene coating industry is expected to experience rapid growth. One of the primary drivers is the region’s commitment to sustainability and environmental goals. European countries, particularly those in the European Union, are focused on reducing carbon footprints and improving energy efficiency, which aligns with the benefits of graphene coatings. Graphene’s ability to enhance the durability, efficiency, and lifespan of products, while reducing environmental impact, makes it highly attractive in industries such as automotive, construction, and renewable energy. For example, in the automotive sector, graphene coatings are used to reduce weight and improve fuel efficiency, helping manufacturers meet stringent emissions standards.

Latin America Graphene Coating Market Trends

The support for technological innovation in Latin America, driven by both government and private sector investments, is playing a role in boosting the graphene coating industry’s growth. Research and development initiatives focused on advanced materials are gaining momentum, with many countries in the region supporting technological hubs and partnerships with academic institutions. This growing interest in graphene’s potential is paving the way for more commercial applications and the development of cost-effective graphene coating solutions across industries.

Middle East & Africa Graphene Coating Market Trends

The Middle East and Africa graphene coating industry is expected to grow significantly over the forecast period. The Middle East, in particular, is experiencing significant investments in mega infrastructure projects, such as smart cities, airports, and large-scale buildings, where the demand for durable and high-performance materials is essential. Graphene coatings are being adopted in these sectors for their superior properties, such as corrosion resistance and enhanced durability, which are crucial for extending the lifespan of structures, especially in harsh environmental conditions like those in desert climates. This makes graphene coatings an attractive solution for the construction and building materials market in the region.

Key Graphene Coating Company Insights

Some of the key players operating in the market include Nanoxplore Inc.; Telga Group; and Directa Plus S.p.A

-

Nanoxplore Inc. is engaged in the manufacturing and distribution of graphene powder for use in various industrial markets. It offers customized and standard graphene-enhanced plastics and composites products for targeted industries such as transportation & automotive, energy storage & batteries, tires & rubbers, paints & coatings, electronic enclosure, and consumer packaging.

-

Talga Group is involved in the development of advanced materials, technology, and green graphite battery anode products that will contribute to a sustainable future.

Key Graphene Coating Companies:

The following are the leading companies in the graphene coating market. These companies collectively hold the largest market share and dictate industry trends.

- Applied Graphene Materials

- 2D Carbon Graphene Material Co., Ltd.

- Thomas Swan & Co. Ltd.

- Graphene Laboratories, Inc.

- Graphensic AB

- GRAPHENE SQUARE INC

- AMO GmbH

- Talga Group

- ACS Material

- BGT Materials Limited, Ltd.

- CVD Equipment Corporation

- Directa Plus S.p.A.

- Grafoid Inc.

- Graphenea

- NanoXplore Inc.

- HAYDALE GRAPHENE INDUSTRIES PLC

- Zentek Ltd.

Graphene Coating Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 200.9 million

Revenue forecast in 2030

USD 578.1 million

Growth rate

CAGR of 23.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; China; Japan; India; Brazil, Argentina; Saudi Arabia; South Africa

Key companies profiled

Applied Graphene Materials; 2D Carbon Graphene Material Co., Ltd.; Thomas Swan & Co. Ltd.; Graphene Laboratories, Inc.; Graphensic AB; GRAPHENE SQUARE INC; AMO GmbH; Talga Group; ACS Material; BGT Materials Limited, Ltd.; CVD Equipment Corporation; Directa Plus S.p.A.; Grafoid Inc.; Graphenea; NanoXplore Inc.; HAYDALE GRAPHENE INDUSTRIES PLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Graphene Coating Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global graphene coating market report based on product, end-use, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Solvent Based

-

Water Based

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Electronics

-

Automotive

-

Medical

-

Marine

-

Aerospace

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Some key players operating in graphene coatings market include Applied Graphene Materials; 2D Carbon Graphene Material Co., Ltd.; Thomas Swan & Co. Ltd.; Graphene Laboratories, Inc.; Graphensic AB; GRAPHENE SQUARE INC; AMO GmbH; Talga Group; ACS Material; BGT Materials Limited, Ltd.; CVD Equipment Corporation; Directa Plus S.p.A.; Grafoid Inc; Graphenea; NanoXplore Inc.; HAYDALE and GRAPHENE INDUSTRIES PLC

b. Key factors that are driving the market growth include the growing need for lightweight, high-performance devices has significantly increased the adoption of graphene coatings. These coatings enhance the efficiency of components such as circuit boards, sensors, and displays, while also providing superior heat dissipation, making them indispensable in the development of next-generation devices.

b. The global graphene coatings market size was estimated at USD 167.62 million in 2024 and is expected to reach USD 200.9 million in 2025.

b. The global graphene coatings market is expected to grow at a compound annual growth rate of 23.5% from 2025 to 2030 to reach USD 578.1 million by 2030.

b. The solvent-based segment dominated the graphene coatings market, with a revenue share of 62.3% in 2024. The growing focus on industrial efficiency and sustainability has propelled the adoption of solvent-based graphene coatings. These coatings provide a reliable solution for enhancing the lifespan of equipment and infrastructure and reducing maintenance costs and downtime.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.